NZDCHF is in the Bearish Side due to Bearish TrendHello Traders

In This Chart NZDCHF HOURLY Forex Forecast By FOREX PLANET

today NZDCHF analysis 👆

🟢This Chart includes_ (NZDCHF market update)

🟢What is The Next Opportunity on NZDCHF Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Chart

Nzdchfanalysis

NZDCHF is in the Bearish Side due to Bearish TrendHello Traders

In This Chart NZDCHF HOURLY Forex Forecast By FOREX PLANET

today NZDCHF analysis 👆

🟢This Chart includes_ (NZDCHF market update)

🟢What is The Next Opportunity on NZDCHF Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Chart

NZDCHF – Waiting for a Reaction at Key LevelWe’re waiting for price to reach our marked zone.

✅ Short is the primary scenario — but only with a valid bearish signal.

❗️If the zone breaks and price confirms above, we’ll look to buy after a proper pullback and signal.

We don’t predict — we prepare.

The market decides, we just follow with structure and discipline.

NZD/CHF Heist Blueprint: Snag the Kiwi vs. Franc Profits!Ultimate NZD/CHF Heist Plan: Snag the Kiwi vs. Franc Loot! 🚀💰

🌍 Greetings, Wealth Raiders! Hola! Ciao! Bonjour! 🌟

Fellow money chasers and market bandits, 🤑💸 let’s dive into the NZD/CHF "Kiwi vs. Franc" Forex heist with our 🔥Thief Trading Style🔥, blending sharp technicals and solid fundamentals. Follow the charted strategy for a long entry, aiming to cash out near the high-risk ATR zone. Watch out for overbought signals, consolidation, or a trend reversal trap where bearish robbers lurk. 🏴☠️💪 Seize your profits and treat yourself—you’ve earned it! 🎉

Entry 📈

The vault’s open wide! 🏦 Grab the bullish loot at the current price—the heist is live! For precision, set Buy Limit orders on a 15 or 30-minute timeframe, targeting a retest of the nearest high or low.

Stop Loss 🛑

📍 Place your Thief SL at the recent swing low on a 4H timeframe for day trades.

📍 Adjust SL based on your risk tolerance, lot size, and number of orders.

Target 🎯

Aim for 0.50400 or slip out early to secure your loot! 💰

Scalpers, Listen Up! 👀

Stick to long-side scalps. Got big capital? Jump in now! Smaller stacks? Join swing traders for the robbery. Use a trailing SL to lock in your gains. 🧲💵

NZD/CHF Market Intel 📊

The Kiwi vs. Franc is riding a bullish wave, fueled by key drivers. Dig into the fundamentals, macro trends, COT reports, sentiment, intermarket analysis, and future targets for the full scoop. 🔗👇

⚠️ Trading Alert: News & Position Safety 📰

News drops can shake the market! To protect your loot:

Skip new trades during news releases.

Use trailing stops to secure profits and limit losses. 🚫

Join the Heist! 💥

Support our robbery plan—hit the Boost Button! 🚀 Let’s stack cash with ease using the Thief Trading Style. 💪🤝 Stay sharp for the next heist plan, bandits! 🤑🐱👤🎉

NZD/CHF Potential Bullish Reversal SetupNZD/CHF Potential Bullish Reversal Setup 🔄📈

📊 Chart Analysis:

The chart shows a potential bullish reversal for NZD/CHF, supported by technical patterns and key levels:

🧠 Key Technical Highlights:

🔹 Double Bottom Formation (🟠 Circles)

A clear double bottom pattern can be seen around the 0.48300 support zone, signaling potential reversal from the downtrend.

🔹 Strong Support Zone 📉

Price bounced from a historically respected support zone (~0.48200–0.48400), which held several times in the past (marked with green arrows).

🔹 Downtrend Breakout 🔺

A short-term bearish channel has been broken to the upside, indicating potential bullish pressure.

🔹 Target Zone 🎯

Immediate bullish target is around 0.49265, aligning with previous resistance.

🔹 Resistance Area (🔵 Boxes)

Next significant resistance lies at 0.49400–0.49800, which may act as the next hurdle if price breaks the 0.49265 level.

✅ Conclusion:

As long as price holds above 0.48400, bulls may aim for the 0.49265 🎯 target. A breakout above that level can open the path to higher resistances.

📌 Bullish Bias maintained above support zone — monitor for volume confirmation and retest strength.

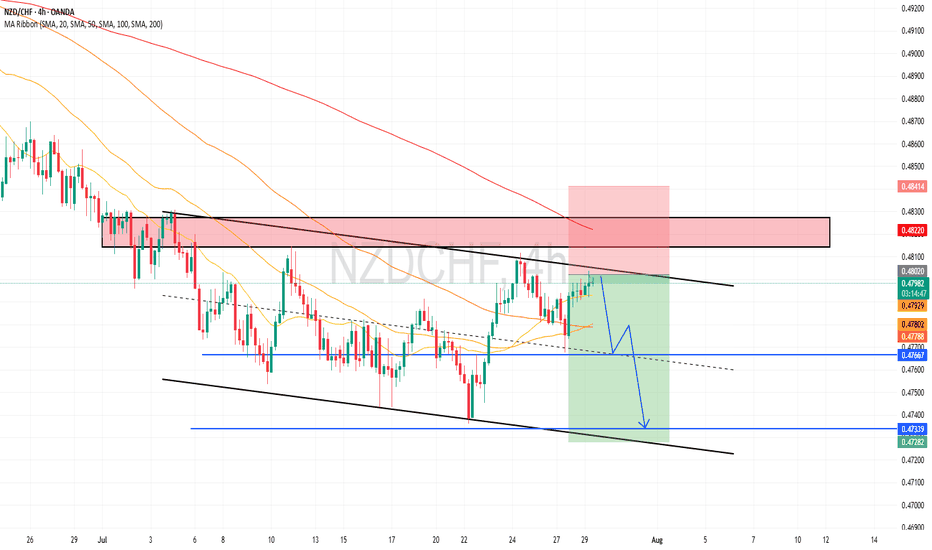

NZDCHF Analysis – “Kiwi Faces Uphill Battle Against Safe-Haven FNZDCHF Price has formed a bearish pennant / triangle after a strong drop from the highs around 0.4960.

Rejection seen from the trendline resistance at ~0.4900, suggesting limited bullish momentum.

Bearish targets are mapped to:

0.4847 (first support)

0.4819 (deeper bearish target)

Two bearish scenarios drawn, both suggesting downside pressure is likely if support breaks.

Structure Bias: Bearish as long as below ~0.4905

📊 Current Bias: Bearish

🧩 Key Fundamentals Driving NZDCHF

NZD Side (Mixed to Weak):

RBNZ held rates at 5.50%, but no additional hawkish surprises. Kiwi is underperforming against safe-havens despite resilience.

Mixed Chinese influence: Some recent recovery in China’s retail/consumption data (e.g., 618 festival) but not strong enough to fuel Kiwi strength.

Risk sentiment: Global geopolitical tensions (Israel-Iran, Ukraine) are pressuring high-beta currencies like NZD.

CHF Side (Strengthening):

Swiss Franc bid on risk-off: CHF is strengthening as a safe-haven due to escalating geopolitical concerns and volatile global markets.

SNB not cutting yet: Recent SNB assessment indicates gradual, patient stance. The central bank may ease later in 2025, but no urgency.

European proximity flows: CHF benefits from proximity to EU and low volatility in domestic economy.

⚠️ Risks That May Reverse the Trend

Surprise RBNZ hawkish speech or inflation spike

Risk-on reversal boosting NZD

Unexpected SNB rate cut or dovish surprise

🗓️ Key News to Watch

🇳🇿 NZ Trade Balance and inflation expectations

🇨🇭 Swiss inflation data and SNB commentary

Global sentiment drivers: Middle East headlines, equity volatility

🏁 Which Asset May Lead?

NZDCHF may lag behind NZDJPY or AUDCHF in volatility but offers a cleaner risk-off signal. If CHF strength and Kiwi weakness persist, this pair can trend with limited noise.

NZD/CHF Technical Outlook – Bullish Reversal in Play! 📅 Chart Date: May 26, 2025

💱 Pair: NZD/CHF

📈 Current Price: 0.49246

📏 Indicators Used:

🔵 200 EMA: 0.50959

🔴 50 EMA: 0.49424

📍 Key Technical Levels:

🟣 Reversal Point (Support Zone): 0.4880 – 0.4930

This zone has shown consistent buying interest. The price recently bounced off this level, indicating strong bullish sentiment forming here.

🟪 Resistance Zone: 0.5080 – 0.5160

This area has previously capped upside movement. It's aligned near the 200 EMA – a significant dynamic resistance.

📈 Bullish Setup Active! 🐂

The price action shows a strong bullish reaction off the reversal zone.

There's a potential higher low forming, indicating a trend reversal.

The price is currently reclaiming the 50 EMA – a bullish sign when followed by strong candles.

If momentum continues, we could see a target retest of the resistance zone around 0.51+ 🔝

⚠️ Watch Out:

A rejection from the 50 EMA may lead to another dip toward the support zone.

Bearish confirmation only below 0.4880 with strong volume 🔻

📌 Conclusion:

This chart suggests a bullish momentum building up in NZD/CHF. As long as price holds above the reversal zone, we can expect a push toward the resistance area. A break above 0.5160 would confirm a medium-term trend reversal. 📈🔥

💡 Traders Tip: Consider entries above 0.4945 with SL below 0.4880 and TP around 0.5080–0.5160. 🎯

NZDCHF short: trend continuationMain trend – bearish.

Pull back to nearest s/r level at 0.49850 has been completed.

A lower high has now been formed.

Price is below the 200dma.

We are in all time low territory, so I will be targeting the 0.4700 round number and then evaluate again.

This is not a trade recommendation; it’s merely my own analysis. Trading carries a high level of risk, so only trade with money you can afford to lose and carefully manage your capital and risk. If you like my idea, please give a “boost” and follow me to get even more. Please comment and share your thoughts too!!

It’s not whether you are right or wrong, but how much money you make when you are right and how much you lose when you are wrong – George Soros

NZDCHF Bullish Outlook – Wedge Breakout Setup in PlayAscending Structure: Price action has been respecting a series of higher lows, supported by an ascending trendline – a key indicator of bullish pressure.

Bullish Flag/Wedge Formation: The current price is consolidating inside a rising wedge, typically seen as a continuation pattern in bullish trends, especially when preceded by a strong rally.

Breakout Zone: A breakout above the wedge resistance (~0.4915–0.4930) opens the path to retest the recent high at 0.4953, and further to 0.4985 resistance.

Volume & Momentum: If confirmed by bullish momentum or strong candle close above the wedge, it validates further upside.

Key Levels:

Support: 0.4870 (trendline base), 0.4800 (invalidates setup)

Immediate Resistance: 0.4930

Targets:

TP1: 0.4953

TP2: 0.4985 (measured move from wedge)

✅ Confluence for Bullish Setup:

Price respecting higher low structure.

Bullish consolidation wedge near previous highs.

Clean upside path if price breaks above 0.4930.

⚠️ Invalidation:

If price breaks below 0.4870, this would invalidate the bullish structure and could suggest a retest of 0.4800, making the current setup a potential bull trap.

NZDCHF m15 BuyHello everyone.

There's a perfect buy opportunity on NZDCHF right now.

You can even set your RRR to 1:4, but those who prefer a shorter target can close at RRR 1:2.

I expect the pair to reach the 0.49225 level during the day.

Wishing everyone profitable trades!

🔔 I post detailed trade ideas and daily market analysis like this every day on my TradingView profile.

👉 Follow me to get notified and read the full breakdowns.

#NZDCHF: Will Price Continue The Bearish Trend? If we analyse the trading history of NZDCHF, the overall trend has been bearish. The CHF has consistently dominated the NZD, and this trend is expected to continue. The price has dropped significantly, and since the last two weeks, it has filled the gap area. In the future, we anticipate the price moving towards 0.40.

Wishing you good luck and safe trading!

Thanks for your support! 😊

If you want to help us out, here are a few things you can do:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_

❤️🚀

NZDCHF Reversal Builds as Trade Data Surprises Bulls Eye 0.5078NZDCHF has formed a clear inverse head & shoulders pattern on the 4H chart, with price currently hovering above the neckline at 0.4840. The technical breakout remains valid, with bullish targets at:

TP1: 0.4993

TP2: 0.5078

SL: Below 0.4740

🧠 Fundamental Update – NZ Trade Balance (Apr 21):

Latest Data:

Actual: +80M

Forecast: +510M

Previous: +510M

✅ Still positive, but below expectations

⚠️ Weaker-than-expected trade surplus may weigh on NZD short-term

Combined With Recent CPI Data (Apr 16):

Inflation rose to 2.5% YoY, higher than forecast but still within the RBNZ's target band

Most price pressures are seen as temporary (fuel, education)

RBNZ cut OCR to 3.5% in April and has left the door open to further cuts

Markets still fully price in a rate cut on May 28, with a projected floor of 2.75% by October

🌏 Global Context:

Trade tensions and slowing global growth (esp. from U.S. tariff risk) are driving demand for safe havens like CHF

ANZ economists have revised forecasts for additional RBNZ easing to 2.5%, citing weak global sentiment

🧭 Interpretation for NZDCHF:

Short-term:

✅ Positive technical structure

✅ Net trade surplus supports slight NZD demand

⚠️ Trade miss and dovish RBNZ tone keep bullish momentum cautious

Medium-term:

⚠️ Macro headwinds + expected RBNZ cut may limit upside

⚠️ Potential pullbacks if rate-cut sentiment strengthens into May

💡 Final Trade Strategy:

Bullish bias valid above 0.4840, but watch for volatility

Profit-taking recommended at 0.4993

Be cautious near 0.5078, especially before the May 28 RBNZ meeting

A close below 0.4740 would invalidate the bullish setup

NZDCHF market outlookFX:NZDCHF

NZDCHF has came back and reached above its neck level of the QM pattern the second time, also having several demand zones reached and respected, pushing price upwards and forming a compression. We can keep an eye out on this pair and make decisions when it reaches the resistance zone once again. There are two possible scenarios that could happen, if it’s able to break above the resistance zone and close bullish candles, we can look for long opportunities and buy it to resistance 2 which is at 0.49630. If there is a strong rejection from resistance, we can then look for pullback and enter on shorts.

However, due to the fact that NZDCHF is still very bearish on the H4 and Daily timeframes, our bias should be bearish and prioritize selling opportunities. On sell trades, we may be able to hold the position longer and target different take profit levels.

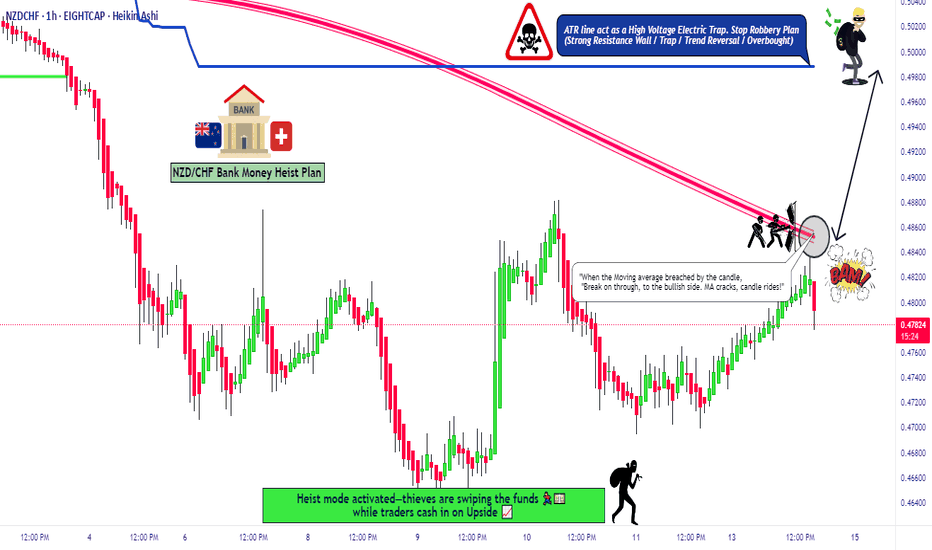

NZD/CHF "Kiwi-Franc" Forex Bank Heist Plan (Scalping/Day Trade)6 hours ago

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the NZD/CHF "Kiwi vs Franc" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk ATR Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (0.48700) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 30mins timeframe (0.47600) Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 0.49900 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸NZD/CHF "Kiwi vs Franc" Forex Market Heist Plan (Scalping/Day) is currently experiencing a bullishness,., driven by several key factors. 👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets and Overall outlook score..., go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

NZD/CHF Ready To Go Down Hard , Don`t Miss 250 Pips !Here is my chart on NZD/CHF And it`s very clear short setup after this amazing bearish closure below my second support , so i think this pair will go down hard for the next days and weeks , let`s sell this pair and see what will happen !

This Is An Educational + Analytic Content That Will Teach Why And How To Enter A Trade

Make Sure You Watch The Price Action Closely In Each Analysis As This Is A Very Important Part Of Our Method

Disclaimer : This Analysis Can Change At Anytime Without Notice And It Is Only For The Purpose Of Assisting Traders To Make Independent Investments Decisions.

NZDCHF is in the Bearish Side Hello Traders

In This Chart NZDCHF HOURLY Forex Forecast By FOREX PLANET

today NZDCHF analysis 👆

🟢This Chart includes_ (NZDCHF market update)

🟢What is The Next Opportunity on NZDCHF Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Chart

NZDCHF - Weekly Forecast - Technical Analysis & Trading IdeasMidterm forecast:

While the price is above the support 0.49439, beginning of uptrend is expected.

We make sure when the resistance at 0.52680 breaks.

If the support at 0.49439 is broken, the short-term forecast -beginning of uptrend- will be invalid.

OANDA:NZDCHF

Technical analysis:

A peak is formed in daily chart at 0.51845 on 02/20/2025, so more losses to support(s) 0.49950 and minimum to Major Support (0.49439) is expected.

Take Profits:

0.51043

0.51780

0.52680

0.53798

0.55094

0.56221

0.56728

0.57630

0.58900

0.60187

0.65051

__________________________________________________________________

❤️ If you find this helpful and want more FREE forecasts in TradingView,

. . . . . . . . Hit the 'BOOST' button 👍

. . . . . . . . . . . Drop some feedback in the comments below! (e.g., What did you find most useful? How can we improve?)

🙏 Your support is appreciated!

Now, it's your turn!

Be sure to leave a comment; let us know how you see this opportunity and forecast.

Have a successful week,

ForecastCity Support Team

NZD/CHF "Kiwi vs Swissy" Forex Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the ˗ˏˋ ★ ˎˊ˗GBP/JPY "The Beast" ˗ˏˋ ★ ˎˊ˗ Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (0.50100) then make your move - Bearish profits await!" however I advise placing Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at (0.50700) swing Trade Basis Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 0.49400 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook:

NZD/CHF "Kiwi vs Swissy" Forex Market is currently experiencing a Bearish trend in short term, driven by several key factors.

🔰Fundamental Analysis

Fundamental analysis examines the economic indicators of New Zealand and Switzerland, which directly influence the NZD/CHF pair.

🔰New Zealand Economic Indicators:

GDP growth is forecasted at around 1-2% for 2025, reflecting a moderate recovery New Zealand GDP Growth Forecast. Recent data shows a contraction of 1% in Q3 2024, indicating challenges Monthly Economic Review.

Inflation rate is stable at 2.2% as of the latest data, within the Reserve Bank of New Zealand's (RBNZ) target range New Zealand Inflation Rate.

Interest rates are around 3.75-4%, with recent cuts signaling a dovish stance to support the economy New Zealand Interest Rate.

Trade balance shows a deficit, with recent figures at NZD 219 million surplus in December 2024, but annual trends indicate ongoing deficits New Zealand Balance of Trade.

Major exports include dairy products, meat, logs, and wood, while imports are dominated by petroleum and machinery, making NZD sensitive to commodity price fluctuations.

🔰Switzerland Economic Indicators:

GDP growth is projected at 1.3-1.5% for 2025, with a recent quarterly expansion of 0.4% in Q3 2024 Switzerland GDP Growth Rate.

Inflation is forecasted at 1.1-1.4% for 2025, currently at 0.4% in January 2025, reflecting low inflationary pressure Switzerland Inflation Rate.

Interest rates are at 0.50%, with potential for further cuts, as indicated by the Swiss National Bank (SNB) Switzerland Interest Rate.

Switzerland maintains a trade surplus, with January 2025 surplus at CHF 4029.15 million, driven by exports like pharmaceuticals and watches Switzerland Balance of Trade.

The interest rate differential, with New Zealand's rates higher, could attract capital to NZD, but Switzerland's stable economy and surplus may support CHF.

🔰Macroeconomics

Macroeconomics encompasses broader economic factors influencing the pair:

New Zealand's economy is commodity-driven, with dairy and meat exports critical. Recent declines in commodity prices, forecasted at 5% in 2025 Commodity Forecast, could weaken NZD.

Switzerland's economy, with a strong financial sector and safe-haven status, benefits from global uncertainty, potentially strengthening CHF during risk-off periods.

Both countries face global trade dynamics, with New Zealand's deficit and Switzerland's surplus affecting currency valuation.

🔰Global Market Analysis

Global economic conditions play a significant role in currency movements:

Global GDP growth is projected at 3.3% for 2025, according to the IMF, with mixed regional performances World Economic Outlook.

Commodity prices are expected to decline, negatively impacting NZD due to New Zealand's export reliance Commodity Markets Outlook.

Stock markets show mixed performance, with international stocks outperforming U.S. markets in early 2025, potentially affecting risk-sensitive currencies like NZD Global Stock Market Performance.

Bond yields are stable, with U.S. 10-year Treasury yields above 4.5%, influencing global currency flows Global Economic Outlook.

🔰COT Data and Positioning

COT data provides insights into large trader positions, though direct NZD/CHF data is limited, requiring analysis of NZD/USD and USD/CHF:

For NZD/USD, non-commercial traders are assumed net long, suggesting bullish sentiment on NZD NZD COT Data.

For USD/CHF, net short positioning (long CHF) indicates bearish USD sentiment, supporting CHF CHF COT Data.

Positioning suggests a complex dynamic, with NZD strengthening against USD but CHF also gaining, potentially leading to downward pressure on NZD/CHF if CHF strengthens more.

Trader sentiment, with 91% long positions recently, contrasts with price movements, creating a bearish indicator Forex Sentiment NZDCHF.

🔰Intermarket Analysis

Intermarket relationships influence currency valuation:

NZD is highly correlated with commodity prices, particularly dairy and meat. With a forecasted 5% decline in 2025, NZD faces downward pressure Commodity Price Forecast.

CHF, as a safe-haven currency, strengthens during global risk-off periods, with recent stock market volatility supporting its value Global Market Outlook.

Bond yields and equity market performance suggest CHF may benefit from risk aversion, while NZD suffers from commodity weakness.

🔰Quantitative Analysis

Technical analysis provides insights into price trends:

At 0.50300, NZD/CHF is below key moving averages (e.g., 50-day and 200-day), indicating a downtrend NZD CHF Technical Analysis.

RSI (Relative Strength Index) suggests potential oversold conditions, with values around 30, hinting at possible reversals, but current momentum leans bearish TradingView Analysis.

Support levels are near 0.5000, with resistance at 0.5100, based on recent charts NZD/CHF Technical Analyses.

🔰Market Sentimental Analysis

Market sentiment reflects trader positioning and expectations:

Recent data shows 91% of traders long on NZD/CHF, with an average price of 0.5250, contrasting with a downward price movement, creating a bearish indicator Forex Sentiment NZDCHF.

COT data and retail sentiment suggest mixed views, with institutional traders showing caution, potentially aligning with bearish technical signals.

🔰Next Trend Move and Overall Outlook

Combining all factors, the next trend move for NZD/CHF is likely downward:

Declining commodity prices and New Zealand's trade deficit weigh on NZD.

CHF's safe-haven status and lower interest rates support its strength, especially in uncertain global conditions.

Technical indicators and sentiment align with a bearish outlook, with the pair expected to test lower support levels.

The overall summary outlook is bearish, with NZD/CHF likely to decline further in 2025, though higher New Zealand interest rates provide some counterbalance. Real-time market feeds up to March 4, 2025, confirm this trend, with future predictions leaning toward continued bearish movement.

🔰Table: Summary of Key Economic Indicators

Indicator New Zealand (2025 Forecast) Switzerland (2025 Forecast)

GDP Growth 1-2% 1.3-1.5%

Inflation Rate 2.2% 1.1-1.4%

Interest Rate 3.75-4% 0.5% (potential cuts)

Trade Balance Deficit Surplus

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

NZDCHF - Short from bearish OB !!Hello traders!

‼️ This is my perspective on NZDCHF.

Technical analysis: Here we are in a bearish market structure from 4H timeframe perspective, so I look for a short. My point of interest is imbalance filled + rejection from bearish OB.

Like, comment and subscribe to be in touch with my content!