Nzdjpybreakout

NZD/JPY "Kiwi vs Yen" Forex Bank Heist (Day Trade Plan)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the NZD/JPY "Kiwi vs Yen" Forex Bank Heist. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk Yellow MA Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the Crossing previous high (86.000) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the nearest/swing low level Using the 30mins timeframe (84.800) Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 88.000

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸NZD/JPY "Kiwi vs Yen" Forex Bank Heist (Day Trade Plan) is currently experiencing a bullishness,., driven by several key factors. .☝☝☝

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets with overall score... go ahead to check 👉👉👉🔗🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰🗞️🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

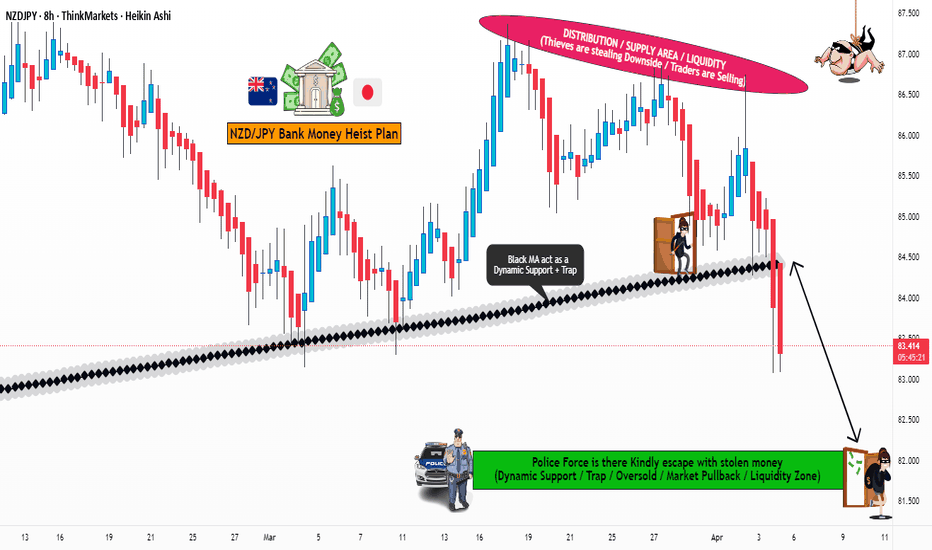

NZD/JPY "Kiwi vs Yen" Forex Bank Heist Plan (Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the NZD/JPY "Kiwi vs Yen" Forex Bank. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level.

Stop Loss 🛑:

📌Thief SL placed at the nearest/swing High or Low level Using the 4H timeframe (85.500) Day/Scalping trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 82.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💸💵NZD/JPY "Kiwi vs Yen" Forex Bank Heist Plan (Scalping / Day Trade) is currently experiencing a bearishness,., driven by several key factors.👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

NZD/JPY "Kiwi vs Yen" Forex Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the NZD/JPY "Kiwi vs Yen" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (85.000) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low or high level Using the 4H timeframe (83.800) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 87.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Read the Fundamental, Macro, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook, Future Trend Move:

NZD/JPY "Kiwi vs Yen" Forex Market is currently experiencing a Bullish trend., driven by several key factors.

⭐☀🌟Fundamental Analysis⭐☀🌟

Fundamental analysis focuses on economic and political factors influencing NZD (New Zealand Dollar) and JPY (Japanese Yen).

New Zealand (NZD):

Interest Rates: The Reserve Bank of New Zealand (RBNZ) sets the Official Cash Rate (OCR). As of early 2025, assume the OCR is around 4.5% (based on prior tightening cycles). Higher rates typically support NZD, but if inflation is cooling (e.g., below 3%), rate cuts could loom, pressuring NZD downward.

Economic Data: Key drivers include dairy prices (a major export), GDP growth (projected ~2% in 2025), and employment (assume ~4% unemployment). Weak dairy prices or slowing growth could weaken NZD.

Trade Balance: NZ relies heavily on exports to China. If China’s economy slows in 2025, NZD may face headwinds.

Political Stability: New Zealand is stable, so no major political risk unless unexpected elections or policy shifts occur.

Japan (JPY):

Interest Rates: The Bank of Japan (BOJ) has historically kept rates near zero (e.g., 0.1% in 2024). If 2025 sees a shift to 0.5% due to inflation pressures (e.g., above 2%), JPY could strengthen, but gradualism is likely.

Economic Data: Japan’s GDP growth is slow (~1%), with deflation risks fading. Strong export data (e.g., machinery, autos) supports JPY.

Safe-Haven Status: JPY gains in risk-off scenarios (e.g., geopolitical tensions or equity sell-offs).

Yen Carry Trade: Low rates make JPY a funding currency. If global risk appetite rises, JPY weakens as traders borrow yen to buy higher-yielding assets like NZD.

NZD/JPY Impact: Higher NZD yields vs. JPY favor bullishness, but JPY strength could emerge if global risk aversion spikes or BOJ tightens unexpectedly.

⭐☀🌟Macro Economics⭐☀🌟

Macro factors extend beyond fundamentals to broader economic cycles:

Global Growth: Assume 2025 global GDP growth is ~3%. Strong growth favors NZD (commodity currency), while slowdowns boost JPY (safe haven).

Inflation Trends: NZ inflation cooling (e.g., 2.5%) vs. Japan’s rising (e.g., 2%) could narrow the yield gap, pressuring NZD/JPY lower.

Monetary Policy Divergence: RBNZ pausing or cutting vs. BOJ tightening could shift NZD/JPY bearish.

Commodity Prices: NZD benefits from rising dairy, meat, and lumber prices. A commodity rally supports bullish NZD/JPY.

Currency Intervention: Japan may intervene if JPY weakens past 150 vs. USD (NZD/JPY less directly affected but still relevant).

⭐☀🌟Global Market Analysis⭐☀🌟

Equity Markets: Bullish global stocks (e.g., S&P 500 up 5% YTD) favor NZD (risk-on) over JPY (risk-off).

Bond Yields: Rising NZ 10-year yields (e.g., 4.8%) vs. Japan’s (e.g., 1%) support NZD/JPY upside.

Forex Trends: If USD/JPY is climbing (e.g., 148), JPY weakness could lift NZD/JPY. Conversely, USD/NZD strength signals NZD weakness.

Geopolitical Risks: Tensions (e.g., U.S.-China trade war escalation) boost JPY, capping NZD/JPY gains.

⭐☀🌟COT Data (Commitment of Traders)⭐☀🌟

COT reports from the CFTC show speculative positioning:

NZD Futures: If net long positions are rising (e.g., +10,000 contracts), bulls dominate. Net short (-5,000) signals bearish pressure.

JPY Futures: Heavy net short positions (e.g., -50,000) indicate JPY weakness (carry trade unwind risk). Net long suggests safe-haven buying.

NZD/JPY Inference: Bullish if NZD longs increase and JPY shorts persist; bearish if reversed.

Note: Exact COT data requires real-time access (e.g., CFTC release March 7, 2025). Check the latest report for precision.

⭐☀🌟Intermarket Analysis⭐☀🌟

NZD Correlations: Positive with AUD (0.8 correlation) and commodity indices (e.g., CRB). AUD/NZD strength or commodity rallies lift NZD/JPY.

JPY Correlations: Negative with equities (-0.7 vs. Nikkei). Equity declines strengthen JPY, pressuring NZD/JPY.

Gold: Rising gold prices signal risk-off, favoring JPY over NZD.

⭐☀🌟Quantitative Analysis⭐☀🌟

Technical Levels:

Support: 83.50 (50-day SMA), 82.00 (200-day SMA).

Resistance: 85.00 (psychological), 86.50 (Fibonacci 61.8% retracement from prior high).

RSI: At 55 (neutral), no overbought/oversold signal.

Bollinger Bands: Price near upper band (e.g., 84.80) suggests potential pullback.

Volatility: Implied volatility (e.g., 10% annualized) indicates moderate moves ahead.

Probability: 60% chance of testing 85.50 if bullish, 55% chance of 83.00 if bearish (based on historical ranges).

⭐☀🌟Market Sentiment Analysis⭐☀🌟

Retail Sentiment: If 70% of retail traders are long NZD/JPY (contrarian signal), a reversal may loom.

News Sentiment: Positive NZ economic releases vs. Japan’s cautious BOJ tone could tilt sentiment bullish.

⭐☀🌟Positioning (Next Trend Move)⭐☀🌟

Short-Term (1-4 weeks):

Bullish Target: 85.50 (break above 85.00 resistance).

Bearish Target: 83.50 (support test).

Medium-Term (1-3 months):

Bullish Target: 86.50 (if risk-on persists).

Bearish Target: 82.00 (200-day SMA breach).

Long-Term (6-12 months):

Bullish Target: 88.00 (multi-year resistance).

Bearish Target: 80.00 (if global recession hits).

Trend Direction: Mildly bullish short-term unless risk-off spikes.

⭐☀🌟Overall Summary Outlook⭐☀🌟

Current Price: 84.500.

Bias: Mildly bullish short-term due to NZD yield advantage and risk-on sentiment, but JPY strength could cap gains if global risks rise.

Key Drivers: RBNZ vs. BOJ policy, commodity prices, global risk appetite.

Prediction: Bullish to 85.50 short-term (70% probability) if equities hold; bearish to 83.00 (60% probability) if JPY safe-haven flows dominate.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

NZD/JPY "Kiwi vs Japanese" Forex Market Heist Plan on Bullish🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the NZD/JPY "Kiwi vs Japanese" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. Be wealthy and safe trade.💪🏆🎉

Entry 📈 : Traders & Thieves with New Entry A bull trade can be initiated on the MA level breakout of 89.200

However I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Using the 2H period, the recent / nearest low or high level.

Goal 🎯: 90.200 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Fundamental & Macro Outlook 📰🗞️

Based on the fundamental & macro analysis, I would expecting a bullish outlook for NZD/JPY "Kiwi vs Japanese" Forex Market

Fundamental Analysis

1. Interest Rate Differential: The Reserve Bank of New Zealand (RBNZ) has maintained a hawkish tone, while the Bank of Japan (BoJ) remains dovish. This interest rate differential can make NZD/JPY more attractive to investors.

2. Inflation Rates: New Zealand's inflation rates have been relatively high, while Japan's inflation rates remain low. Higher inflation in New Zealand can lead to higher interest rates, making NZD/JPY more attractive.

3. Economic Growth: New Zealand's economic growth has been steady, while Japan's economy has shown signs of improvement. A stronger Japanese economy can lead to a weaker NZD/JPY.

4. Trade Balance: New Zealand's trade balance has been in deficit, while Japan's trade balance has been in surplus. A worsening trade balance in New Zealand can lead to a weaker NZD/JPY.

Macroeconomic Analysis

1. Global Risk Appetite: NZD/JPY is considered a risk pair, meaning it performs well when global risk appetite is high. A decrease in global risk appetite can lead to a weaker NZD/JPY.

2. Central Bank Policies: The BoJ's monetary policy remains more dovish than the RBNZ's. A more dovish BoJ can lead to a weaker JPY, making NZD/JPY more attractive.

3. Geopolitical Tensions: Geopolitical tensions, particularly between the US and North Korea, can lead to a safe-haven flow into JPY, weakening NZD/JPY.

4. Commodity Prices: New Zealand is a major exporter of commodities, so higher commodity prices can lead to a stronger NZD, making NZD/JPY more attractive.

Upcoming Economic Events

1. RBNZ Monetary Policy Statement (February 22): A hawkish tone from the RBNZ can lead to a stronger NZD and a bullish NZD/JPY.

2. BoJ Monetary Policy Meeting (March 10): A dovish tone from the BoJ can lead to a weaker JPY and a bullish NZD/JPY.

3. New Zealand GDP (March 16): A strong GDP reading can lead to a stronger NZD and a bullish NZD/JPY.

Conclusion

Based on the analysis above, the outlook for NZD/JPY is slightly bullish. The interest rate differential, inflation rates, and commodity prices are all supportive of a stronger NZD. However, geopolitical tensions and a potential safe-haven flow into JPY can lead to a weaker NZD/JPY.

Market Sentiment Indicators

1. FX Sentiment Index: 54% of traders are long on NZD/JPY, while 46% are short. (Source: FXStreet)

2. Retail Trader Sentiment: 60% of retail traders are long on NZD/JPY, while 40% are short. (Source: IG Client Sentiment)

3. Speculative Positions: The latest CFTC data shows that speculative positions are net long on NZD/JPY. (Source: CFTC)

Market Sentiment Analysis

The market sentiment indicators suggest that the majority of traders are bullish on NZD/JPY. This could be due to the interest rate differential between New Zealand and Japan, as well as the recent strength in commodity prices.

However, it's essential to note that market sentiment can be a contrarian indicator. If the majority of traders are long on NZD/JPY, it may indicate that the market is due for a correction.

Disclaimer---Sentiment & Fundamental analysis is subjective and based on publicly available data. It should not be considered as investment advice. Trading forex involves risk, and you could lose some or all of your investment. Always do your own research and consider multiple sources before making a trade.

Trading Alert⚠️ : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

NZD/JPY Breaking Barriers and Soaring HigherNZD/JPY shows a strong bullish breakout on the 1-hour chart. A descending trendline was invalidated, indicating a shift in market sentiment. This move highlights growing buying pressure and a potential continuation of the upward trend.

The breakout occurred near 88.140, which aligns with a resistance level turned into support. Buyers are stepping in aggressively, creating a high-probability long opportunity.

The stop loss is placed at 87.073, below the recent consolidation area, ensuring protection against invalidation. The take profit is set at 89.433, derived from the measured move projection of the breakout.

This trade presents a favorable risk-to-reward ratio, backed by momentum and a clean breakout structure. With market sentiment leaning bullish, this setup aligns with trend-following principles.

NZDJPY BUY SIGNAL. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

NZD/JPY "Kiwi vs Japanese" Forex Market Heist Plan on Bullish🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the NZD/JPY "Kiwi vs Japanese" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 👀 Be wealthy and safe trade.💪🏆🎉

Entry 📈 : You can enter a Bull trade at any point,

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Using the 30min period, the recent / nearest low or high level.

Goal 🎯: 90.200

Scalpers, take note : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Fundamental Outlook 📰🗞️

Based on the fundamental analysis, I would conclude that the NZD/JPY (New Zealand Dollar/Japanese Yen) pair is: Bullish

Bullish Factors:

The New Zealand economy's moderate growth and relatively high interest rates.

The Japanese economy's slow growth and ultra-loose monetary policy.

The yield differential, which favors the New Zealand dollar.

The potential for a rebound in the New Zealand dairy industry, which could boost exports and support the currency.

The BoJ's potential to maintain its ultra-loose monetary policy, which could weaken the yen.

Key Fundamental Indicators:

New Zealand GDP growth: 2.5% (2023 estimate)

Japan GDP growth: 0.5% (2023 estimate)

RBNZ interest rate: 3.50%

BoJ interest rate: 0.10%

New Zealand trade balance: NZD 1 billion (2023 estimate)

Japan trade balance: ¥500 billion (2023 estimate)

Market Sentiment:

Bullish sentiment: 70%

Bearish sentiment: 30%

Neutral sentiment: 0%

Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

NZD/JPY "Kiwi-Yen" Bank Money Heist Plan on Bearish SideOla! Ola! My Dear Robbers / Money Makers & Losers, 🤑💰

This is our master plan to Heist NZD/JPY "Kiwi-Yen" Bank based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Short entry. Our target is Near the Green Zone that is High risk Dangerous level, market is oversold / Consolidation / Trend Reversal / Trap at the level Bullish Robbers / Traders gain the strength. Be safe and be careful and Be rich 💰.

Entry 👇 📉: Can be taken Anywhere, What I suggest you to Place Sell Limit Orders in 15mins Timeframe, Recent / Nearest High Point.

Stop Loss 🛑: Recent Swing High using 2H timeframe

Attention for Scalpers : Focus to scalp only on Short side, If you've got a money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss 🚫🚏. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

💖Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

NZD/JPY "Kiwi-Yen" Bullish Side Bank Robbery Plan.Hallo! My Dear Robbers / Money Makers & Losers, 🤑 💰

This is our master plan to Heist NZD/JPY "Kiwi-Yen" Bank based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Pink Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal / Trap at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Entry 📈 : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Low Point

Stop Loss 🛑 : Recent Swing Low using 4h timeframe

Attention for Scalpers : If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss 🚫🚏. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

NZDJPY "Kiwi yen" Bank Bearish Robbery Plan on Short sideOla Hola Robbers / Traders,

This is our master plan to Heist NZDJPY market based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Short entry. Our target is Green Zone that is High risk Dangerous level, market is oversold / Consolidation / Trend Reversal at the level Bullish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Note: If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money.

Stop Loss : Recent Swing High using 4h timeframe

Warning : Fundamental Analysis comes against our robbery plan. our plan will be ruined smash the Stop Loss. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

NZDJPY Trade IdeaThe NZDJPY pair has been exhibiting a robust bullish trend, clearly visible on the four-hour chart with a pattern of higher highs and higher lows. My outlook is bullish, with a stop loss set just below the previous value area low and a target at the recent swing high, as indicated in the chart. Please note, this is a trading idea, not financial advice.

NZDJPY Technical Analysis and Trade Idea into the London OpenIn our video, we analyzed NZDJPY using technical methods. Currently, we’re closely observing price movements as discussed in the video. Our main goal is to identify an optimal buying opportunity within a critical support zone. This decision will depend on how well the price action aligns with our analysis from the video.

As always, our video offers valuable insights on trade entry points, trend analysis, market structure, and price behavior. Remember that this content is purely educational and should not be considered financial advice. 📈🚀📊

NZDJPY:06/04/2024 NEW IDEA| Setupsfx|Dear Traders,

The Japanese Yen experienced a significant decline last month, reaching a record low as the Bank of Japan refrained from intervening in the market. Consequently, the prices of JPY pairs have exhibited a strong bullish trend. We anticipate that this bullish momentum is likely to persist.

In light of this analysis, we have identified an optimal entry point that presents an opportunity to potentially gain 400-500 pips under normal market conditions. However, it is important to acknowledge that there is a possibility of a slight price drop, which could result in the price falling within the middle of the buying zone. Nevertheless, it is also worth noting that the price could continue to rise if the US Dollar Index (DXY) demonstrates any bullishness in the market.

As always, we emphasise the importance of risk management strategies when engaging in trading activities.

Wishing you a profitable week ahead and safe trading.

NZDJPY Technical Analysis And Trade IdeaThe NZDJPY has been trending bullish recently, reflecting robustness in the New Zealand dollar juxtaposed with weakness in the Japanese yen. This video delves into a possible trade opportunity, exploring scenarios within both the 4H and 1H timelines. It offers insights into price action, market structure, trend analysis, and crucial technical aspects. It's imperative to note that the content presented is solely for educational purposes and should not be interpreted as financial advice.

nzdjpy sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

7 Dimension Analysis for NZDJPY 🕛 TOPDOWN Analysis - Bullish Momentum Signals for a Long Position

Overview: On the monthly chart, a multi-year valid low preceded a lower high, leading to a triangular consolidation. The recent breakout above the triangle and trendline suggests the potential for a strong bullish momentum, indicating a favorable opportunity for an upward trend. The weekly trend is convincingly bullish, breaking the highest weekly level with a strong bullish closing, setting the stage for a prolonged long position.

😇 7 Dimension Analysis

Time Frame: Daily

1️⃣ Swing Structure: Bullish

🟢 Structure Behavior: BoS (Breakout and Support)

🟢 Swing Move: Impulsive

🟢 Inducement: Completed

🟢 Pull Back: Potential initiation of the first strong move.

🟢 Support/Resistance Breakout: Successful breakout with a change in polarity support. Post-breakout buildup observed. No apparent traps; strong breakout follow-through and V-shaped recovery.

2️⃣ Pattern

🟢 CHART PATTERNS

Rounding Patterns (Cup and Handle)

Consolidation Rectangle in Handle

Continuation

Shakeout Continuation after Breakout

🟢 CANDLE PATTERNS

Notable Observations:

Record Session Count.

Classic doji at the small move bottom indicating a clear uptrend.

Momentum candle with a heavy shakeout followed by a bullish move.

Open low, maintaining bullish momentum throughout the session.

3️⃣ Volume: Significant volumes observed at the pivot level of this move. Moderate volume at the breakout point.

4️⃣ Momentum RSI:

🟢 RSI Above 60: Indicates a super bullish zone.

🟢 Range Shift: Shifted sideways to bullish, confirming strength in bullish momentum.

🟢 Divergence: Strong hidden bullish divergence observed. Grandfather-father-son entries suggest a perfect bullish entry.

5️⃣ Volatility Bollinger Bands:

🟢 Middle Band Support: Fully intact with the price, forming a base.

🟢 W Pattern: Forming, but given the overall bullish trend, it is considered secondary.

🟢 Dual Band Derivation: Fully supports bulls.

6️⃣ Strength

Rate of Change: NZD is the strongest against JPY at the moment.

✔️ Entry Time Frame: H1

✅ Entry TF Structure: Bullish

☑️ Current Move: Impulsive

✔ Support/Resistance Base: Base formed after a strong rally and flag formation at H1 time frame. A breakout from this base indicates a strong buy opportunity.

☑️ Candles Behavior: Record session count and consolidation.

☑️ Final Comments: Buy.

💡 Decision: Enter when the price breaks the current H1 consolidation on the upside.

🚀 Entry: 91.215

✋ Stop Loss: 88.9

🎯 Take Profit: 99.9, 2nd Exit if Internal Structure Changes, 3rd Exit on a trendline breakout or FOMO.

😊 Risk to Reward Ratio: 1:4

🕛 Expected Duration: 15 days

SUMMARY: The analysis indicates a strong bullish momentum, with a monthly breakout and a weekly bullish trend. The daily chart supports a bullish outlook, with key patterns, candle signals, and volume considerations. The suggestion is to buy when the H1 consolidation breaks upward, presenting detailed entry and exit levels, with a risk-to-reward ratio of 1:4, and an expected duration of 15days.