NZDJPY price action forming a top?NZDJPY - 24h expiry

Trading has been mixed and volatile.

Price action looks to be forming a top.

We look for a temporary move higher.

Preferred trade is to sell into rallies.

Bespoke resistance is located at 88.45.

We look to Sell at 88.45 (stop at 88.65)

Our profit targets will be 87.65 and 87.50

Resistance: 88.50 / 88.65 / 88.90

Support: 87.90 / 87.60 / 87.20

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Nzdjpyshort

NZDJPY to find sellers at market price?NZDJPY - 24h expiry

Trading has been mixed and volatile.

Price action looks to be forming a top.

We look for a temporary move higher.

Preferred trade is to sell into rallies.

Bespoke resistance is located at 87.80.

We look to Sell at 87.80 (stop at 88.00)

Our profit targets will be 87.00 and 86.85

Resistance: 87.80 / 88.00 / 88.25

Support: 87.20 / 87.00 / 86.75

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

NZD/JPY - Triangle Breakout (23.06.2025)The NZD/JPY Pair on the H1 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Triangle Breakout Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 86.35

2nd Support – 86.00

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

nzdjpy sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

NZDJPY to find sellers at previous resistance?NZDJPY - 24h expiry

Trading has been mixed and volatile. Price action looks to be forming a top. We look for a temporary move higher. Preferred trade is to sell into rallies. Bespoke resistance is located at 86.50.

We look to Sell at 86.50 (stop at 86.75)

Our profit targets will be 85.50 and 85.25

Resistance: 86.30 / 86.70 / 87.00

Support: 85.50 / 85.20 / 84.80

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

NZDJPY to continue in the downward move?NZDJPY - 24h expiry

The medium term bias remains bearish.

Short term RSI is moving higher.

We look for a temporary move higher.

Preferred trade is to sell into rallies.

Bespoke resistance is located at 85.25.

We look to Sell at 85.25 (stop at 85.55)

Our profit targets will be 84.20 and 84.00

Resistance: 85.25 / 85.70 / 86.10

Support: 84.60 / 84.20 / 84.00

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

NZD/JPY Breaks Wedge Structure – Bearish Setup Targets 82.42NZD/JPY has broken down from a rising wedge and failed to reclaim upper support, now acting as resistance. The structure is cleanly bearish on the 4H chart, with rejection near 85.60 and a confirmed lower high. Weak New Zealand data and rising safe-haven demand for JPY add weight to this technical setup. Price looks poised to extend toward 82.42 and possibly 80.99 if momentum builds. Bearish bias is valid unless price closes above 87.17.

🔍 Technical Analysis

Chart Pattern: Rising wedge → broken → retest failed

Bear Flag: Forming below wedge base, suggesting further downside

Resistance Area: 85.60–87.17

Bearish Structure:

Lower highs and bearish candle formations

Price unable to reclaim former support trendline

Support Targets:

First TP: 84.00 – minor support, fib confluence

Second TP: 82.42 – March swing low

Final TP: 81.00 zone – next fib cluster

🌍 Macro Fundamentals

🇳🇿 New Zealand Dollar (NZD)

Retail Sales missed: 0.0% vs 0.9% forecast → consumer sector is slowing

Core Retail Sales weak: 0.7% vs 1.4%

Dairy auction (GDT Index) down -0.9% → key export underperforming

Implication: Risk of slower growth → RBNZ may shift toward neutral/dovish stance

🇯🇵 Japanese Yen (JPY)

JPY supported by risk-off flows due to:

U.S. credit downgrade

Iran-US nuclear tension

Declining global PMI forecasts

Yen strengthens as traders seek safe havens despite BoJ’s dovish baseline

🎯 Trade Plan

Bias: Bearish

Entry Zone: 85.50–85.60 (confirmation area)

Targets:

TP1: 84.00

TP2: 82.42

TP3: 81.00

Stop Loss: Above 87.17 (invalidates wedge breakdown)

⚠️ What to Watch

China sentiment or surprise stimulus (may support NZD)

Sharp equity rallies (could reduce JPY demand short-term)

If NZD/JPY closes above 86.00, reduce position or stay out

🧭 Conclusion

NZD/JPY has rolled over from a broken rising wedge, now forming a clean bearish continuation structure. Weak NZ data and macro risk flows into JPY favor downside extension. This setup offers clear levels, defined risk, and macro alignment — ideal for disciplined short entries.

NZDJPY to find sellers at previous resistance?NZDJPY - 24h expiry

Price action looks to be forming a top.

Short term RSI is moving higher.

We look for a temporary move higher.

Preferred trade is to sell into rallies.

Bespoke resistance is located at 86.35.

We look to Sell at 86.35 (stop at 86.65)

Our profit targets will be 85.30 and 85.00

Resistance: 86.30 / 86.80 / 87.20

Support: 85.30 / 85.00 / 84.50

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

NZDJPY to find sellers at current resistance?NZDJPY - 24h expiry

The primary trend remains bearish.

The rally has posted a correction count on the daily chart.

Price action looks to be forming a top.

Preferred trade is to sell into rallies.

Bespoke resistance is located at 85.95.

We look to Sell at 85.95 (stop at 86.20)

Our profit targets will be 85.05 and 84.85

Resistance: 86.10 / 86.40 / 86.70

Support: 85.30 / 85.00 / 84.80

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

NZDJPY 39-Year Trap – 5149 Pips Short Setup!This chart showcases a massive 39-year consolidation range in NZDJPY, spanning from 1986 to 2025, with no confirmed breakout or breakdown throughout this entire period. The pair remains range-bound, signaling long-term indecision.

Currently, we are preparing for short-side trades based on a key technical clue:

The latest monthly candle wicked above resistance, sweeping liquidity before closing lower — a classic liquidity grab or false breakout setup, indicating a potential reversal within the range.

Trade Plan:

Entry 1: 89.364

Entry 2 (Add more lots if price rises): 93.351

Stop Loss for both entries: 95.967

Our targets remain:

Take Profit 1: 70.220

Take Profit 2: 42.516

This setup is aiming for a 5,149 pip move (~55% drop), aligned with the historical range-bound behavior.

NZDJPY to find sellers at previous resistance?NZDJPY - 24h expiry

The primary trend remains bearish.

The rally is close to a correction count on the daily chart.

We look for a temporary move higher.

Preferred trade is to sell into rallies.

Bespoke resistance is located at 84.95.

We look to Sell at 84.95 (stop at 85.25)

Our profit targets will be 83.75 and 83.50

Resistance: 85.00 / 85.50 / 86.20

Support: 84.10 / 83.70 / 83.20

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

NZDJPY to continue in the sequence of lower highs?NZDJPY - 24h expiry

The primary trend remains bearish.

The rally is close to a correction count on the daily chart.

The RSI is trending lower.

Bearish divergence is expected to cap gains.

Bespoke resistance is located at 84.50.

Preferred trade is to sell into rallies.

We look to Sell at 84.50 (stop at 85.15)

Our profit targets will be 81.90 and 81.50

Resistance: 85.00 / 85.50 / 86.30

Support: 83.20 / 82.25 / 81.85

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

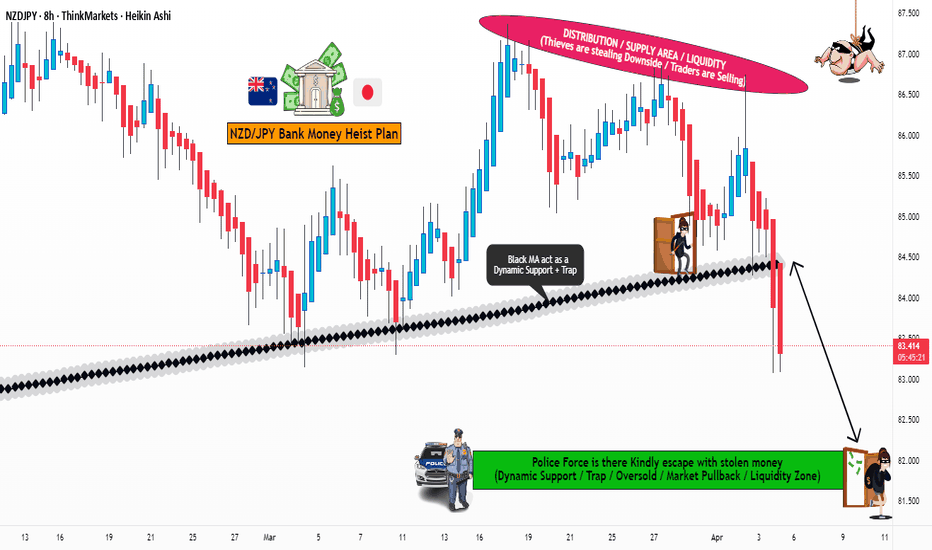

NZD/JPY "Kiwi vs Yen" Forex Bank Heist Plan (Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the NZD/JPY "Kiwi vs Yen" Forex Bank. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level.

Stop Loss 🛑:

📌Thief SL placed at the nearest/swing High or Low level Using the 4H timeframe (85.500) Day/Scalping trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 82.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💸💵NZD/JPY "Kiwi vs Yen" Forex Bank Heist Plan (Scalping / Day Trade) is currently experiencing a bearishness,., driven by several key factors.👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

NZDJPY Approaching Key Resistance — Potential Sell SetupOANDA:NZDJPY is approaching a key resistance zone, a level where sellers have consistently stepped in, leading to notable bearish reversals in the past. This area is marked by strong selling pressure, increasing the likelihood of a bearish move if sellers regain control.

The current price action suggests that if the pair confirms resistance through signals like bearish engulfing candles, long upper wicks, or increased selling volume, we could see a downward move toward 86.100, which represents a logical target based on previous price behavior and market structure.

However, if the price breaks above this zone and sustains, the bearish outlook may be invalidated, opening the door for further upside.

Just my take on support and resistance zones—not financial advice. Always confirm your setups and trade with solid risk management.

Best of luck!