"Trap or Opportunity? NZD/JPY Smart Pullback Play?"💼🎯 NZD/JPY – The Kiwi Vault Breakout | Thief Trading Style Forex Blueprint 🔓📈

🌟Hola! Hello! Ola! Bonjour! Hallo! Marhaba, Global Market Raiders!🌍✨

Welcome to the Thief Trading Style – where smart traders strategize, strike, and secure the bag. This is not your regular trade idea... this is a market infiltration plan – a tactical move on the NZD/JPY pair, aka the Kiwi vs Yen Battle Zone.

🎯 Plan Overview – Operation: Kiwi Vault Breakout

Using a mix of technical heatmaps, smart money concepts, and macro insight, this chart outlines a bold plan for Long Position scalpers and swing tacticians.

💹 The current trend shows signs of bullish momentum, with price eyeing the upper yellow zone – a known resistance pocket where liquidity pools and trap setups often play out.

📈 Entry Strategy – The Gate Is Open

Buy Limit zones:

☑️ Watch the 15/30 min timeframe for pullbacks to nearest swing low/high.

☑️ Ideal for scalpers & swing traders aiming for precise entries.

🧠 “Enter like a shadow, exit like thunder.”

🛑 Stop Loss – Secure Your Capital

Place SL at:

☑️ Recent swing low/high (Based on 4H structure – approx. 87.200)

☑️ Adjust according to your lot size, capital exposure, and position count

Remember, SL is not fear — it's discipline.

🎯 Target – Precision Exit

🎯 TP Zone: 88.900

⚠️ Optional: Exit earlier based on reaction to key levels, or trail your stop to lock gains.

💡 "Profit isn't greed, it's your reward for precision."

⚡Trader Roles – Choose Your Mode

👀 Scalpers:

Only trade the long bias. No short-circuiting the plan.

Use trailing stops to guard gains and surf the momentum waves.

📈 Swing Traders:

You’re in for a full ride — ride the wave till the next institutional block.

Stay patient, and let price develop before jumping in.

🔍 Analysis Backdrop – What’s Fueling the Move?

The bullish push is backed by:

🔸 Positive fundamental & macro signals

🔸 Institutional positioning (check COT Reports)

🔸 Intermarket correlation strength

🔸 Market sentiment score

📊 Want full breakdowns? Dive into COT, Macro Reports, Quant Flow & more → 🔗🔗🔗 Klick

📰 Risk Reminder – News Volatility Warning

🚨 Avoid new entries during major data releases

🔒 Protect open positions with trailing SLs

⚙️ Manage risk – trading is about probability, not certainty

💬 Final Words – Boost the Blueprint

💥Hit “Like” if you vibe with this strategy and support the community of tactical traders.

This plan is designed to bring clarity, structure, and a bit of swagger to your chart screen.

See you in the next setup – stay sharp, stay stealthy. 💼🧠💪

Disclaimer:

This idea is for educational purposes only and not investment advice. Please evaluate your own risk tolerance and market understanding before entering any trades.

Nzdjpytechnicalanalysis

NZD/JPY "Kiwi vs Yen" Forex Bank Heist (Day Trade Plan)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the NZD/JPY "Kiwi vs Yen" Forex Bank Heist. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk Yellow MA Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the Crossing previous high (86.000) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the nearest/swing low level Using the 30mins timeframe (84.800) Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 88.000

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸NZD/JPY "Kiwi vs Yen" Forex Bank Heist (Day Trade Plan) is currently experiencing a bullishness,., driven by several key factors. .☝☝☝

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets with overall score... go ahead to check 👉👉👉🔗🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰🗞️🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

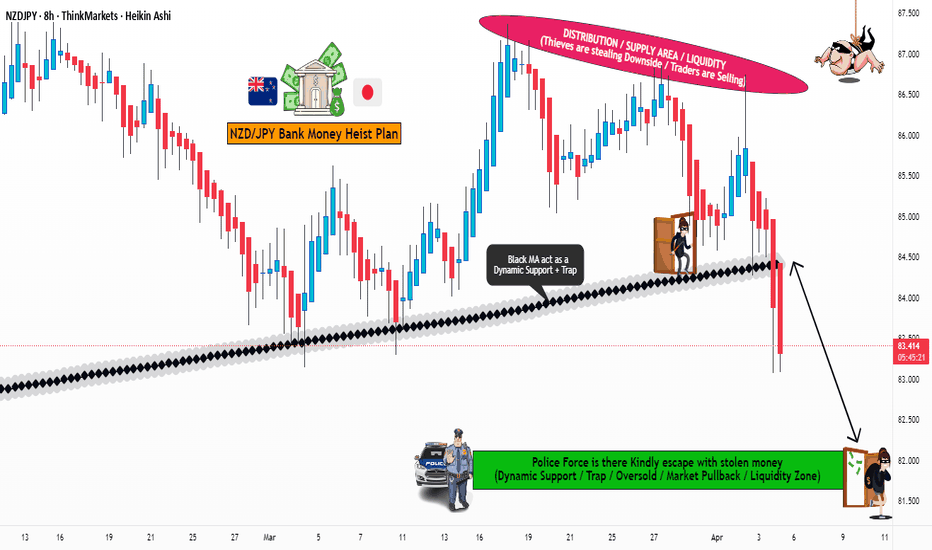

NZD/JPY "Kiwi vs Yen" Forex Bank Heist Plan (Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the NZD/JPY "Kiwi vs Yen" Forex Bank. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level.

Stop Loss 🛑:

📌Thief SL placed at the nearest/swing High or Low level Using the 4H timeframe (85.500) Day/Scalping trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 82.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💸💵NZD/JPY "Kiwi vs Yen" Forex Bank Heist Plan (Scalping / Day Trade) is currently experiencing a bearishness,., driven by several key factors.👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

NZD/JPY "Kiwi vs Yen" Forex Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the NZD/JPY "Kiwi vs Yen" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (85.000) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low or high level Using the 4H timeframe (83.800) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 87.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Read the Fundamental, Macro, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook, Future Trend Move:

NZD/JPY "Kiwi vs Yen" Forex Market is currently experiencing a Bullish trend., driven by several key factors.

⭐☀🌟Fundamental Analysis⭐☀🌟

Fundamental analysis focuses on economic and political factors influencing NZD (New Zealand Dollar) and JPY (Japanese Yen).

New Zealand (NZD):

Interest Rates: The Reserve Bank of New Zealand (RBNZ) sets the Official Cash Rate (OCR). As of early 2025, assume the OCR is around 4.5% (based on prior tightening cycles). Higher rates typically support NZD, but if inflation is cooling (e.g., below 3%), rate cuts could loom, pressuring NZD downward.

Economic Data: Key drivers include dairy prices (a major export), GDP growth (projected ~2% in 2025), and employment (assume ~4% unemployment). Weak dairy prices or slowing growth could weaken NZD.

Trade Balance: NZ relies heavily on exports to China. If China’s economy slows in 2025, NZD may face headwinds.

Political Stability: New Zealand is stable, so no major political risk unless unexpected elections or policy shifts occur.

Japan (JPY):

Interest Rates: The Bank of Japan (BOJ) has historically kept rates near zero (e.g., 0.1% in 2024). If 2025 sees a shift to 0.5% due to inflation pressures (e.g., above 2%), JPY could strengthen, but gradualism is likely.

Economic Data: Japan’s GDP growth is slow (~1%), with deflation risks fading. Strong export data (e.g., machinery, autos) supports JPY.

Safe-Haven Status: JPY gains in risk-off scenarios (e.g., geopolitical tensions or equity sell-offs).

Yen Carry Trade: Low rates make JPY a funding currency. If global risk appetite rises, JPY weakens as traders borrow yen to buy higher-yielding assets like NZD.

NZD/JPY Impact: Higher NZD yields vs. JPY favor bullishness, but JPY strength could emerge if global risk aversion spikes or BOJ tightens unexpectedly.

⭐☀🌟Macro Economics⭐☀🌟

Macro factors extend beyond fundamentals to broader economic cycles:

Global Growth: Assume 2025 global GDP growth is ~3%. Strong growth favors NZD (commodity currency), while slowdowns boost JPY (safe haven).

Inflation Trends: NZ inflation cooling (e.g., 2.5%) vs. Japan’s rising (e.g., 2%) could narrow the yield gap, pressuring NZD/JPY lower.

Monetary Policy Divergence: RBNZ pausing or cutting vs. BOJ tightening could shift NZD/JPY bearish.

Commodity Prices: NZD benefits from rising dairy, meat, and lumber prices. A commodity rally supports bullish NZD/JPY.

Currency Intervention: Japan may intervene if JPY weakens past 150 vs. USD (NZD/JPY less directly affected but still relevant).

⭐☀🌟Global Market Analysis⭐☀🌟

Equity Markets: Bullish global stocks (e.g., S&P 500 up 5% YTD) favor NZD (risk-on) over JPY (risk-off).

Bond Yields: Rising NZ 10-year yields (e.g., 4.8%) vs. Japan’s (e.g., 1%) support NZD/JPY upside.

Forex Trends: If USD/JPY is climbing (e.g., 148), JPY weakness could lift NZD/JPY. Conversely, USD/NZD strength signals NZD weakness.

Geopolitical Risks: Tensions (e.g., U.S.-China trade war escalation) boost JPY, capping NZD/JPY gains.

⭐☀🌟COT Data (Commitment of Traders)⭐☀🌟

COT reports from the CFTC show speculative positioning:

NZD Futures: If net long positions are rising (e.g., +10,000 contracts), bulls dominate. Net short (-5,000) signals bearish pressure.

JPY Futures: Heavy net short positions (e.g., -50,000) indicate JPY weakness (carry trade unwind risk). Net long suggests safe-haven buying.

NZD/JPY Inference: Bullish if NZD longs increase and JPY shorts persist; bearish if reversed.

Note: Exact COT data requires real-time access (e.g., CFTC release March 7, 2025). Check the latest report for precision.

⭐☀🌟Intermarket Analysis⭐☀🌟

NZD Correlations: Positive with AUD (0.8 correlation) and commodity indices (e.g., CRB). AUD/NZD strength or commodity rallies lift NZD/JPY.

JPY Correlations: Negative with equities (-0.7 vs. Nikkei). Equity declines strengthen JPY, pressuring NZD/JPY.

Gold: Rising gold prices signal risk-off, favoring JPY over NZD.

⭐☀🌟Quantitative Analysis⭐☀🌟

Technical Levels:

Support: 83.50 (50-day SMA), 82.00 (200-day SMA).

Resistance: 85.00 (psychological), 86.50 (Fibonacci 61.8% retracement from prior high).

RSI: At 55 (neutral), no overbought/oversold signal.

Bollinger Bands: Price near upper band (e.g., 84.80) suggests potential pullback.

Volatility: Implied volatility (e.g., 10% annualized) indicates moderate moves ahead.

Probability: 60% chance of testing 85.50 if bullish, 55% chance of 83.00 if bearish (based on historical ranges).

⭐☀🌟Market Sentiment Analysis⭐☀🌟

Retail Sentiment: If 70% of retail traders are long NZD/JPY (contrarian signal), a reversal may loom.

News Sentiment: Positive NZ economic releases vs. Japan’s cautious BOJ tone could tilt sentiment bullish.

⭐☀🌟Positioning (Next Trend Move)⭐☀🌟

Short-Term (1-4 weeks):

Bullish Target: 85.50 (break above 85.00 resistance).

Bearish Target: 83.50 (support test).

Medium-Term (1-3 months):

Bullish Target: 86.50 (if risk-on persists).

Bearish Target: 82.00 (200-day SMA breach).

Long-Term (6-12 months):

Bullish Target: 88.00 (multi-year resistance).

Bearish Target: 80.00 (if global recession hits).

Trend Direction: Mildly bullish short-term unless risk-off spikes.

⭐☀🌟Overall Summary Outlook⭐☀🌟

Current Price: 84.500.

Bias: Mildly bullish short-term due to NZD yield advantage and risk-on sentiment, but JPY strength could cap gains if global risks rise.

Key Drivers: RBNZ vs. BOJ policy, commodity prices, global risk appetite.

Prediction: Bullish to 85.50 short-term (70% probability) if equities hold; bearish to 83.00 (60% probability) if JPY safe-haven flows dominate.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

NZD/JPY "Kiwi vs Japanese" Forex Market Heist Plan on Bullish🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the NZD/JPY "Kiwi vs Japanese" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. Be wealthy and safe trade.💪🏆🎉

Entry 📈 : Traders & Thieves with New Entry A bull trade can be initiated on the MA level breakout of 89.200

However I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Using the 2H period, the recent / nearest low or high level.

Goal 🎯: 90.200 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Fundamental & Macro Outlook 📰🗞️

Based on the fundamental & macro analysis, I would expecting a bullish outlook for NZD/JPY "Kiwi vs Japanese" Forex Market

Fundamental Analysis

1. Interest Rate Differential: The Reserve Bank of New Zealand (RBNZ) has maintained a hawkish tone, while the Bank of Japan (BoJ) remains dovish. This interest rate differential can make NZD/JPY more attractive to investors.

2. Inflation Rates: New Zealand's inflation rates have been relatively high, while Japan's inflation rates remain low. Higher inflation in New Zealand can lead to higher interest rates, making NZD/JPY more attractive.

3. Economic Growth: New Zealand's economic growth has been steady, while Japan's economy has shown signs of improvement. A stronger Japanese economy can lead to a weaker NZD/JPY.

4. Trade Balance: New Zealand's trade balance has been in deficit, while Japan's trade balance has been in surplus. A worsening trade balance in New Zealand can lead to a weaker NZD/JPY.

Macroeconomic Analysis

1. Global Risk Appetite: NZD/JPY is considered a risk pair, meaning it performs well when global risk appetite is high. A decrease in global risk appetite can lead to a weaker NZD/JPY.

2. Central Bank Policies: The BoJ's monetary policy remains more dovish than the RBNZ's. A more dovish BoJ can lead to a weaker JPY, making NZD/JPY more attractive.

3. Geopolitical Tensions: Geopolitical tensions, particularly between the US and North Korea, can lead to a safe-haven flow into JPY, weakening NZD/JPY.

4. Commodity Prices: New Zealand is a major exporter of commodities, so higher commodity prices can lead to a stronger NZD, making NZD/JPY more attractive.

Upcoming Economic Events

1. RBNZ Monetary Policy Statement (February 22): A hawkish tone from the RBNZ can lead to a stronger NZD and a bullish NZD/JPY.

2. BoJ Monetary Policy Meeting (March 10): A dovish tone from the BoJ can lead to a weaker JPY and a bullish NZD/JPY.

3. New Zealand GDP (March 16): A strong GDP reading can lead to a stronger NZD and a bullish NZD/JPY.

Conclusion

Based on the analysis above, the outlook for NZD/JPY is slightly bullish. The interest rate differential, inflation rates, and commodity prices are all supportive of a stronger NZD. However, geopolitical tensions and a potential safe-haven flow into JPY can lead to a weaker NZD/JPY.

Market Sentiment Indicators

1. FX Sentiment Index: 54% of traders are long on NZD/JPY, while 46% are short. (Source: FXStreet)

2. Retail Trader Sentiment: 60% of retail traders are long on NZD/JPY, while 40% are short. (Source: IG Client Sentiment)

3. Speculative Positions: The latest CFTC data shows that speculative positions are net long on NZD/JPY. (Source: CFTC)

Market Sentiment Analysis

The market sentiment indicators suggest that the majority of traders are bullish on NZD/JPY. This could be due to the interest rate differential between New Zealand and Japan, as well as the recent strength in commodity prices.

However, it's essential to note that market sentiment can be a contrarian indicator. If the majority of traders are long on NZD/JPY, it may indicate that the market is due for a correction.

Disclaimer---Sentiment & Fundamental analysis is subjective and based on publicly available data. It should not be considered as investment advice. Trading forex involves risk, and you could lose some or all of your investment. Always do your own research and consider multiple sources before making a trade.

Trading Alert⚠️ : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

NZD/JPY "Kiwi-Yen" Bank Money Heist Plan on Bearish SideOla! Ola! My Dear Robbers / Money Makers & Losers, 🤑💰

This is our master plan to Heist NZD/JPY "Kiwi-Yen" Bank based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Short entry. Our target is Near the Green Zone that is High risk Dangerous level, market is oversold / Consolidation / Trend Reversal / Trap at the level Bullish Robbers / Traders gain the strength. Be safe and be careful and Be rich 💰.

Entry 👇 📉: Can be taken Anywhere, What I suggest you to Place Sell Limit Orders in 15mins Timeframe, Recent / Nearest High Point.

Stop Loss 🛑: Recent Swing High using 2H timeframe

Attention for Scalpers : Focus to scalp only on Short side, If you've got a money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss 🚫🚏. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

💖Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

NZD/JPY Daily setupThe NZD/JPY pair has fallen by 920 pips over the past 15 days. Such a significant and sustained decline is unlikely to continue indefinitely without a corrective pullback. Currently, the price has halted its downward momentum and is beginning to reverse near my key area of interest.

Key Confluences:

The pair is rebounding off a descending trend line that has been in place since November 2023.

It is also bouncing off an ascending trend line that has been in place since August 2023.

The price is reacting to the 0.786 Fibonacci retracement level.

It is rejecting the significant psychological level of 90.000.

Market Structure

The JPY basket has reached a resistance level and is starting to decline.

These factors suggest a potential reversal or correction in the NZD/JPY pair.

NZD/JPY 4hr TF

Has currently closed on the 4 hour TF nicely I expect NZD/JPY to start having an healthy pull back.

JPY Basket weekly TF

Is currently reacting off my area of interest I expect price to start moving lower.

JPY Basket Daily TF

JPY Basket 4hr TF

NZDJPY I Strong bearish divergence indicating potential shortWelcome back! Let me know your thoughts in the comments!

** NZDJPY Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!

NZDJPY - DAILY TECHNICAL BIAS WITH FUNDAMENTAL BIAS

By now MARKET RISK is ON. Also, since NZD RATES are high, we expect NZDJPY to go UP again. We look forward to the future behavior of NZDJPY. The reason is because the interest rate of NZD is higher compared to JPY. NZD CPI DATA is also very high. LABOR DATA is also very POSITIVE for NZD. JPY may be somewhat WEAK in the next few days.

However, NZDJPY should be slightly BUY with upcoming JPY WEAKNESS.

Anyway, if the PRICE falls back on the NZDJPY MAIN SUPPORT LINE, you can BUY if the MARKET RISK ON continues. And 87.00 LEVEL can be BUY temporarily. Earlier NZDJPY was SELL due to strong JPY and MARKET SENTIMENT is RISK OFF.

Anyway, after that, you can definitely SELL at the 80.00 LEVEL. For that, MARKET RISK should be ON. STOCK UP, VIX DOWN, JPY WEAK.

NZDJPY - DAILY TECHNICAL BIAS WITH FUNDAMENTAL BIAS#NZDJPY

By now MARKET RISK is ON. Also, since NZD RATES are high, we expect NZDJPY to go UP again. We look forward to the future behavior of NZDJPY. The reason is because the interest rate of NZD is higher compared to JPY. NZD CPI DATA is also very high. LABOR DATA is also very POSITIVE for NZD. JPY may be somewhat WEAK in the next few days.

However, NZDJPY should be slightly BUY with upcoming JPY WEAKNESS.

Anyway, if the PRICE falls back on the NZDJPY MAIN SUPPORT LINE, it is possible to BUY if the MARKET RISK ON continues. And 81.79 LEVEL can be SELL temporarily. Earlier NZDJPY was SELL due to strong JPY and MARKET SENTIMENT is RISK OFF.

Anyway, after that, you can definitely BUY at 88.10 LEVEL. For that, MARKET RISK should be ON. STOCK UP, VIX DOWN, JPY

NZDJPY - DAILY TECHNICAL BIAS WITH FUNDAMENTAL BIAS#NZDJPY

By now MARKET RISK is ON. Also, since NZD RATES are high, we expect NZDJPY to go UP again. We look forward to the future behavior of NZDJPY. The reason is because the interest rate of NZD is higher compared to JPY. NZD CPI DATA is also very high.

Either way, NZDJPY should be slightly BUY with JPY WEAKNESS.

Anyway, the PRICE can SELL again on the NZDJPY MAIN SUPPORT, if the MARKET RISK ON continues, to the 88.50 LEVEL. Earlier NZDJPY was SELL due to strong JPY and MARKET SENTIMENT is RISK OFF. After that, you can definitely buy at the 88.50 level. For that, MARKET RISK should be ON. STOCK UP, VIX DOWN, JPY WEAK. Besides, the USD should be WEAK. If the MAIN STRUCTURE is broken, it can be SELL at 79.56 LEVEL.

NZDJPY - DAILY TECHNICAL BIAS WITH FUNDAMENTAL BIAS#NZDJPY

NZDJPY should be slightly SELL because the MARKET RISK is off now. Also, since NZD RATES are high, we expect NZDJPY to go UP again. We look forward to the future behavior of NZDJPY. The reason is because the interest rate of NZD is higher compared to JPY.

Either way, NZDJPY should be LONG TERM DOWN.

Anyway, the PRICE can go down again on the NZDJPY MAIN SUPPORT, if the MARKET RISK OFF continues, to the 83.58 LEVEL. Earlier NZDJPY was SELL due to strong JPY and MARKET SENTIMENT is RISK OFF. After that, you can definitely BUY at 88.59 LEVEL. For that, MARKET RISK should be ON. STOCK UP, VIX DOWN, JPY WEAK. Besides, the USD should be WEAK. nzdjpy

NZDJPY - DAILY TECHNICAL BIAS WITH FUNDAMENTAL BIAS#NZDJPY

NZDJPY was slightly UP due to MARKET RISK ON the previous day. But now we see that MARKET RISK is ON. We expect further NZDJPY UP.

Anyway, NZDJPY BREAKED THE DOWNSIDE TRENDLINE and moved up. That PRICE can fall back on that TREND LINE. Maybe the PRICE will go down to the 86.20 LEVEL again and that PRICE LEVEL can become SUPPORT. After that, if MARKET RISK continues to be ON, you can definitely BUY at 87.61 LEVEL. For that, MARKET RISK should be ON.

To BUY NZDJPY, VIX must be DOWN and SNP500 must be UP. And COMMODITIES should definitely be UP. We are waiting for the change in the above mentioned MARKETS.

NZDJPY - DAILY TECHNICAL BIAS WITH FUNDAMENTAL BIAS#NZDJPY

NZDJPY was slightly DOWN due to MARKET RISK OFF the previous day. But now we see that MARKET RISK is ON. We expect NZDJPY to go UP again.

Anyway, the NZDJPY DOWNSIDE TRENDLINE is BREAKING UP again. That PRICE can fall back on that TREND LINE. After that, if MARKET RISK continues to be ON, you can definitely BUY at 86.88 LEVEL. For that, MARKET RISK should be ON.

To BUY NZDJPY, VIX must be DOWN and SNP500 must be UP. And COMMODITIES should definitely be UP. We are waiting for the change in the above mentioned MARKETS.

NZDJPY - DAILY TECHNICAL BIAS WITH FUNDAMENTAL BIAS Currently the NZDJPY is going down a bit due to the MARKET RISK OFF. We expect NZDJPY to be UP again.

Somehow that PRICE can fall back on the NZDJPY MAIN TRENDLINE. Then if you BREAK the DOWNSIDE TREND LINE you can definitely buy BUY for 86.88 LEVEL. It must be MARKET RISK ON.

But we can sell NZDJPY up to 81.51 according to STRUCTURE. The reason for this is the idea that the existing MARKET SENTIMENT in the OVERALL MARKET will be RISK OFF in the coming days. We must pay attention to the MARKET SENTIMENT.

NZDJPY - DAILY TECHNICAL BIAS WITH FUNDAMENTAL BIAS- NZD FEATURE The NZD FEATURE currently stands at 0.6348 LEVEL. JPY FEATURE is a bit UP now compared to the previous days. The JPY FEATURE has become a bit STRONG with RISK OFF in the previous days. It could be further JPY UP. Stay tuned for the VIX INDEX. Currently VIX is getting a bit UP at the moment. NZDJPY prices are moving below DYNAMIC LEVELS. Also created an ALT.BAT PATTERN in NZDJPY.

- NZDJPY Price may be slightly lower before UP up to 86.88 LEVEL according to MARKET STRUCTURE. Then the NZDJPY price can be DOWN. It may be up to 81.51 LEVEL. So look at the REACTION of STOCKS MARKETS, VIX, SNP500 MARKETS

NZDJPY - DAILY TECHNICAL BIAS WITH FUNDAMENTAL BIAS- NZD FEATURE The NZD FEATURE currently stands at 0.6431 LEVEL. JPY FEATURE is getting a bit UPA now compared to yesterday. The JPY FEATURE has become a bit STRONG with RISK OFF in the previous days. It could be further JPY UP. Stay tuned for the VIX INDEX. Currently VIX is getting a bit UP at the moment. NZDJPY prices are moving higher than DYNAMIC LEVELS. Also an ALT.BAT PATTERN is being created in NZDJPY.

- Currently the OVERALL MARKET is showing RISK OFF. STOCKS is currently RED showing a RISK OFF SENTIMENT. And the VOLATILITY is getting a bit UP. Also COMMODITIES show a DOWN SIDE BIAS today. Currently the MARKET has a RISK OFF SENTIMENT. Therefore, in the future, all NZD CAD AUD currencies may be slightly lower compared to JPY CHF and USD currencies.

- NZDJPY price may be slightly UP before DOWN to 89.79 LEVEL according to MARKET STRUCTURE. Then the NZDJPY price can be DOWN. It may be down to 78.51 LEVEL. So look at the REACTION of STOCKS MARKETS, VIX, SNP500 MARKETS.

NZDJPY - DAILY TECHNICAL BIAS WITH FUNDAMENTAL BIAS- NZD FEATURE The NZD FEATURE currently stands at 0.6452 LEVEL. JPY FEATURE is down a bit now compared to yesterday. JPY FEATURE was a bit DOWN with RISK ON in the previous days. There will be more JPY DOWN. Stay tuned for the VIX INDEX. Currently VIX is getting a bit DOWN. NZDJPY prices are moving higher than DYNAMIC LEVELS. Also an ALT.BAT PATTERN is being created in NZDJPY.

- Currently the OVERALL MARKET is showing RISK OFF. STOCKS is currently RED showing a RISK OFF SENTIMENT. And the VOLATILITY is getting a bit UP. Also COMMODITIES show a MIXED BIAS today. Currently the MARKET has a RISK OFF SENTIMENT. Therefore, in the future, all NZD CAD AUD currencies may be slightly lower compared to JPY CHF and USD currencies.

- NZDJPY price may be slightly higher before DOWN to 86.88 LEVEL according to MARKET STRUCTURE. Then the NZDJPY price can be DOWN. It may be down to 82.49 LEVEL. So look at the REACTION of STOCKS MARKETS, VIX, SNP500 MARKETS.

NZDJPY - DAILY TECHNICAL BIAS WITH FUNDAMENTAL BIAS- NZD FEATURE The NZD FEATURE currently stands at 0.6497 LEVEL. JPY FEATURE is down a bit now compared to yesterday. JPY FEATURE was a bit DOWN with RISK ON in the previous days. Stay tuned for the VIX INDEX. Currently VIX is getting a bit DOWN. NZDJPY prices are moving higher than DYNAMIC LEVELS.

- Currently the OVERALL MARKET is showing RISK OFF. STOCKS is currently RED showing a RISK OFF SENTIMENT. And the VOLATILITY is getting a bit UP. Also COMMODITIES show a MIXED BIAS today. Currently the MARKET has a RISK OFF SENTIMENT. Therefore, in the future, all NZD CAD AUD currencies may be slightly lower compared to JPY CHF and USD currencies.

- NZDJPY price may be slightly UP before DOWN to 86.46 LEVEL according to MARKET STRUCTURE. Then the NZDJPY price can be DOWN. It may be down to 78.51 LEVEL. So look at the REACTION of STOCKS MARKETS, VIX, SNP500 MARKETS.

NZDJPY - Will BE MARKET RISK ON?

- NZD FEATURE The NZD FEATURE currently stands at 0.6547 LEVEL. JPY FEATURE is getting a bit DOWN right now. JPY FEATURE was a bit DOWN with RISK ON in the previous days. Stay tuned for the VIX INDEX. Currently VIX is getting somewhat DOWN. The NZDJPY price is ready to move higher than the DYNAMIC LEVELS.

- Currently the OVERALL MARKET is showing RISK ON. STOCKS is currently GREEN showing a RISK ON SENTIMENT. Also the VOLATILITY is getting a bit DOWN. Also COMMODITIES show a UP SIDE BIAS today. Currently the market has a RISK ON SENTIMENT. Therefore, in the future, all NZD CAD AUD currencies may be UP compared to JPY CHF currencies.

- NZDJPY price may be slightly UP before DOWN to 86.46 LEVEL according to MARKET STRUCTURE. Then the NZDJPY price can be DOWN. It may be down to 78.51 LEVEL. So look at the REACTION of STOCKS MARKETS, VIX, SNP500 MARKETS.