NZDUSD to continue in the upward move?NZDUSD - 24h expiry

There is no indication that the rally is coming to an end.

Although we remain bullish overall, a correction is possible with plenty of room to move lower without impacting the trend higher.

Risk/Reward would be poor to call a buy from current levels.

A move through 0.6025 will confirm the bullish momentum.

The measured move target is 0.6075.

We look to Buy at 0.5950 (stop at 0.5900)

Our profit targets will be 0.6050 and 0.6075

Resistance: 0.6025 / 0.6050 / 0.6075

Support: 0.6000 / 0.5950 / 0.5925

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

NZDUSD

NZD-USD Will Fall! Sell!

Hello,Traders!

NZD-USD has retested a

Horizontal resistance level

Of 0.6036 so we are

Locally bearish biased

And from the resistance we

We will be expecting a

Local bearish correction

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Bearish reversal off overlap resistance?The Kiwi (NZD/USD) is rising towards the pivot and could reverse to the pullback support.

Pivot: 0.5987

1st Support: 0.5831

1st Resistance: 0.6125

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Weekly FOREX Forecast: Buy EUR, GBP, AUD, NZD vs USDThis is the FOREX outlook for the week of April 21 - 25th.

In this video, we will analyze the following FX markets:

USD Index

EUR

GBP

AUD

NZD

CAD

CHF

JPY

Not a lot of movement last week, as price traded in a small range. May see more of the same this coming week, as there are no major news events planned. The USD is still weak, and there may be opportunities to buy against it in the EUR, GBP, AID, NZD, CAD, CHF, AND JPY.

Wait for good confirmation before taking valid buy setups!

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

GBPAUD NULLISH OR BEARISH DETAILED ANALYSIS GBPAUD is currently trading around the 2.0850 level, hovering just above a strong confluence support zone as seen on the 12H chart. Price action has formed a bullish symmetrical triangle pattern following a strong impulsive rally earlier this month. This compression near a major demand zone signals a potential bullish breakout as price builds pressure right above the support base. The 2.0700–2.0600 region has historically acted as a key level, now reinforcing itself as solid structure support.

Technically, this setup is clean and aligned with classic continuation pattern behavior. We had a strong rally leading into the triangle, and the market has been respecting both the lower support boundary and declining resistance trendline. The recent candles show signs of rejection from the lower bounds of the wedge, adding to the bullish sentiment. A confirmed breakout above 2.0900 could trigger a fresh wave of upside momentum targeting the 2.1300–2.1600 zone in the coming sessions.

Fundamentally, GBP remains supported by stronger-than-expected inflation data and ongoing hawkish tones from the Bank of England. Markets are dialing back expectations of near-term rate cuts, giving the pound further upside traction. Meanwhile, AUD is weakening amid soft Chinese economic data, increasing risk aversion, and fading demand for commodities. Australia’s labor market also showed signs of cooling, reducing the RBA’s tightening pressure and putting the Aussie on the back foot.

This is a high-probability swing setup gaining traction on TradingView due to the combination of strong technical formation and macro divergence. With the pattern maturing above support and a clear bullish structure, GBPAUD is offering an attractive risk-to-reward scenario for bulls eyeing continuation into Q2. Patience on the breakout confirmation will be key, but the bias remains clearly bullish from both a chart and economic perspective.

NZD-USD Free Signal! Buy!

Hello,Trades!

NZD-USD made a bullish

Breakout of the key horizontal

Level around 0.5920 then

Made a pullback to retest

The new support so we are

Bullish biased which means

We can enter a long trade

On Monday with the Take

Profit of 0.5968 and the

Stop Loss of 0.5893

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZDUSD Trading Opportunity! SELL!

My dear friends,

Please, find my technical outlook for NZDUSD below:

The price is coiling around a solid key level - 0.5971

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 0.5847

Safe Stop Loss - 0.6013

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

NZD_USD WILL KEEP GROWING|LONG|

✅NZD_USD is trading in an

Uptrend and the pair made a

Strong bullish breakout of the

Key horizontal level of 0.5927

Which is a support now and the

Breakout is confirmed so we

Will be expecting a further

Bullish continuation

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZDUSD: Will Start Falling! Here is Why:

Remember that we can not, and should not impose our will on the market but rather listen to its whims and make profit by following it. And thus shall be done today on the NZDUSD pair which is likely to be pushed down by the bears so we will sell!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

SHORT ON NZD/USDPrice is in a overall uptrend but has started its pullback phase from the high.

Got a choc (change of character) to the downside as well as equal highs/ double top forming.

Dollar news just came out positive and there is a good chance this pair could fall 200-300 pips by the end of the week.

NZDUSD Discretionary Analysis: Bounce at 0.59Hello traders.

NZDUSD has potential for me. I'm expecting the momentum to continue, and I've got my eye on that 0.59 level to get involved. That's where I'll be looking for a setup.

Discretionary Trading: Where Experience Becomes the Edge

Discretionary trading is all about making decisions based on what you see, what you feel, and what you've learned through experience. Unlike systematic strategies that rely on fixed rules or algorithms, discretionary traders use their judgment to read the market in real time. It's a skill that can't be rushed, because it's built on screen time, pattern recognition, and the ability to stay calm under pressure.

There's no shortcut here. You need to see enough market conditions, wins, and losses to build that intuition—the kind that tells you when to pull the trigger or sit on your hands. Charts might look the same, but context changes everything, and that's something only experience can teach you.

At the end of the day, discretionary trading is an art, refined over time, sharpened through mistakes, and driven by instinct. It's not for everyone, but for those who've put in the work, it can be a powerful way to trade.

NZDUSD H1 I Bearish Drop Based on the H1 chart, the price is rising toward our sell entry level at 0.5925, a pullback resistance that aligns with the 61.8 Fibo retracement.

Our take profit is set at 0.5855, an overlap support.

The stop loss is set at 0.5970, above the 127.2% Fibo extension.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

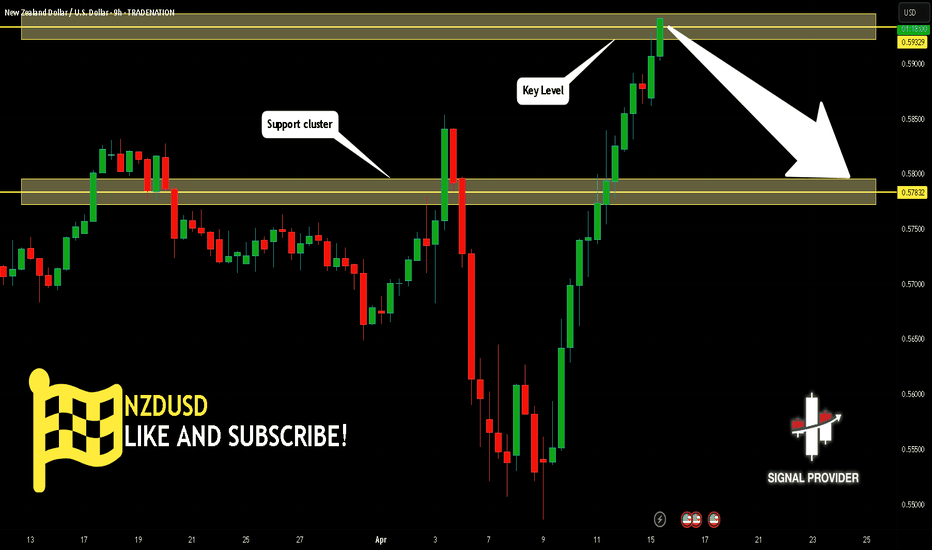

NZDUSD Will Go Lower! Short!

Here is our detailed technical review for NZDUSD.

Time Frame: 9h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is trading around a solid horizontal structure 0.593.

The above observations make me that the market will inevitably achieve 0.578 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

NZDUSD: Short Signal with Entry/SL/TP

NZDUSD

- Classic bearish setup

- Our team expects bearish continuation

SUGGESTED TRADE:

Swing Trade

Short NZDUSD

Entry Point - 0.5918

Stop Loss - 0.5991

Take Profit - 0.5782

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

NZD/USD Broke The Res , Good Chance To Buy To Get 200 Pips !Here is my NZD/USD Long Setup , we have a daily closure above the res and also it`s a very good support and we can trust it , we can enter a buy trade if the price go back to retest the broken res , and if we have a good bullish price action then we can enter a buy trade and targeting 200 pips .

This Is An Educational + Analytic Content That Will Teach Why And How To Enter A Trade

Make Sure You Watch The Price Action Closely In Each Analysis As This Is A Very Important Part Of Our Method

Disclaimer : This Analysis Can Change At Anytime Without Notice And It Is Only For The Purpose Of Assisting Traders To Make Independent Investments Decisions.

Kiwi H1 | Falling toward an overlap supportThe Kiwi (NZD/USD) is falling towards an overlap support and could potentially bounce off this level to climb higher.

Buy entry is at 0.5840 which is an overlap support that aligns close to the 23.6% Fibonacci retracement.

Stop loss is at 0.5770 which is a level that lies underneath a swing-low support.

Take profit is at 0.5922 which is a swing-high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

FXAN & Heikin Ashi Trade IdeaOANDA:NZDUSD

In this video, I’ll be sharing my analysis of NZDUSD, using FXAN's proprietary algo indicators with my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

NZD/USD Approaches 0.5900 – Critical Test for Bulls Ahe🧭 Overview:

The NZD/USD pair showed notable bullish strength on Monday, April 14, 2025, opening at 0.5830, hitting a high of 0.5900, and closing near 0.5885. This upward movement marks a potential shift in sentiment after a prolonged period of consolidation, driven by a weaker U.S. dollar and increased risk appetite among investors.

📈 Current Market Structure:

The pair broke above the consolidation range and is now trading near a key resistance zone around the 200-day moving average. The recent bullish candle indicates strong buyer momentum, suggesting that a medium-term trend reversal may be underway.

🔹 Key Resistance Levels:

0.5900: Psychological level and the 200-day SMA. A daily close above this may confirm a shift in long-term trend.

0.5955: A former swing high, acting as the next resistance for bulls.

0.6000 – 0.6040: Major resistance zone. A breakout here could confirm full bullish reversal and open room for extended gains.

🔸 Key Support Levels:

0.5823: Recent swing low and intraday support. Holding above this level maintains short-term bullish bias.

0.5760: Intermediate support. A break below this could expose the pair to deeper corrections.

0.5700: Major support level, aligning with previous structure lows from February 2024.

Source: DailyFX, Investing.com

📐 Price Action Patterns:

Recent bullish candles have broken key resistance within a sideways range, indicating increased demand for the kiwi dollar. The breakout above 0.5850 confirms momentum, while the lack of overbought signals on RSI and MACD crossover further support the continuation of the move. However, price faces a major test at the 0.5900 area.

🔮 Potential Scenarios:

✅ Bullish Scenario:

If NZD/USD maintains above 0.5823 and successfully breaks above 0.5900, the pair could extend gains toward 0.5955 and 0.6000. This scenario may be supported by weaker U.S. dollar sentiment and stabilization in global risk sentiment.

❌ Bearish Scenario:

If the pair fails to hold above 0.5823, it may decline toward 0.5760. A break below this level opens the door to test 0.5700, which would invalidate the current bullish breakout structure.

📌 Conclusion:

NZD/USD is showing signs of bullish recovery, supported by a breakout above consolidation and increased technical momentum. The area around 0.5900 will be critical — a successful close above it could mark the beginning of a new bullish phase. Traders should watch price action closely near this resistance zone and adjust strategies accordingly.

🗓️ Note: This analysis is based on market data available as of April 14, 2025. Always follow up with the latest price action and news events before making trading decisions.

NZDUSD INTRADAY bullish continuation supported at 0.5715NZDUSD maintains a bullish bias, supported by the prevailing upward trend. Recent intraday movement indicates a corrective pullback toward a key consolidation zone, offering a potential setup for trend continuation.

Key Support Level: 0.5715 – previous consolidation range and pivotal support

Upside Targets:

0.5946 – initial resistance

0.6000 and 0.6070 – extended bullish targets on higher timeframes

A bullish reversal from 0.5715 would suggest continuation of the uptrend, confirming buying momentum.

However, a decisive break and daily close below 0.5715 would invalidate the bullish structure, opening the door for further retracement toward 0.5650, with additional support at 0.5590 and 0.5500.

Conclusion

NZDUSD remains bullish above 0.5715. A bounce from this level supports further gains. Traders should watch for confirmation signals before positioning for the next move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

NZD/USD SELLERS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

We are now examining the NZD/USD pair and we can see that the pair is going up locally while also being in a uptrend on the 1W TF. But there is also a powerful signal from the BB upper band being nearby, indicating that the pair is overbought so we can go short from the resistance line above and a target at 0.576 level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Market Analysis: NZD/USD Gains Pace, Bulls Are Back?Market Analysis: NZD/USD Gains Pace, Bulls Are Back?

NZD/USD is also rising and might aim for more gains above 0.5850.

Important Takeaways for NZD USD Analysis Today

- NZD/USD is consolidating gains above the 0.5765 zone.

- There is a key bullish trend line forming with support at 0.5825 on the hourly chart of NZD/USD at FXOpen.

NZD/USD Technical Analysis

On the hourly chart of NZD/USD on FXOpen, the pair started a steady increase from the 0.5515 zone. The New Zealand Dollar broke the 0.5670 resistance to start the recent increase against the US Dollar.

The pair settled above 0.5765 and the 50-hour simple moving average. It tested the 0.5850 zone and is currently consolidating gains. The pair corrected lower below the 0.5840 level. However, the bulls are active above the 0.5825 level.

The NZD/USD chart suggests that the RSI is stable above 50. On the upside, the pair might struggle near 0.5850. The next major resistance is near the 0.5880 level.

A clear move above the 0.5880 level might even push the pair toward the 0.5920 level. Any more gains might clear the path for a move toward the 0.6000 resistance zone in the coming days.

On the downside, immediate support is near the 0.5825 level. There is also a key bullish trend line forming with support at 0.5825. The first key support is near the 0.5765 level. The next major support is near the 0.5670 level and the 50% Fib retracement level of the upward move from the 0.5485 swing low to the 0.5853 high.

If there is a downside break below the 0.5670 support, the pair might slide toward the 0.5570 support. Any more losses could lead NZD/USD in a bearish zone to 0.5515.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

What I'm expecting on the new week open..This is basically what my gut is telling me that is going to happen on Monday's open based on technical factors thought by ICT and my own spin on it.

TLDW; It looks like we are just going to start going up with very little retracement at the start of the week.

- R2F Trading