NZD/USD "KIWI HEIST" – BEARISH BANK ROBBERY!🦹♂️ NZD/USD "THE KIWI HEIST" – BEARISH BANK ROBBERY PLAN! 🚨💰

(Thief Trading Style – Short Entry Strategy for Maximum Loot!)

🎯 MASTER TRADING HEIST BLUEPRINT

🔥 Thief’s Technical & Fundamental Analysis Confirms:

NZD/USD is OVERBOUGHT + TREND REVERSAL!

Police (Bulls) set a TRAP near the Red Zone (Support) – Time to ESCAPE with profits before they catch us!

✔ Entry Point (Bearish Loot Grab):

*"The vault is UNLOCKED! Swipe SHORT anywhere – but for SAFER HEIST, use Sell Limit orders (15m/30m pullbacks). Pro Thieves use DCA/Layering for max gains!"*

✔ Stop Loss (Escape Route):

"SL at nearest 4H Swing High (0.60400). Adjust based on YOUR risk tolerance & loot size!"

✔ Target 🎯 (Profit Escape):

0.58900 (or exit earlier if cops (bulls) show up!)

⚠️ THIEF’S WARNING – NEWS & RISK MANAGEMENT

📢 High-Impact News = VOLATILITY TRAP!

Avoid new trades during news releases.

Trailing SL = Lock profits & evade market cops!

💥 SCALPERS & SWING THIEVES – QUICK NOTES:

Scalpers: Only quick LONG scalp plays (use Trailing SL!).

Swing Thieves: Hold for the BIG BEARISH LOOT! 🏦

📉 WHY NZD/USD IS BEARISH? (Thief’s Intel Report)

Overbought + Trend Reversal Signals!

Bulls (Police) losing strength at Resistance!

For FULL Intel (Fundamentals, COT Report, Sentiment, etc.) – Klickk 🔗!

🚀 BOOST THIS HEIST! (Like & Share for More Loot Plans!)

💖 "Hit 👍 BOOST to strengthen our THIEF SQUAD! More heists = More profits!"

📌 DISCLAIMER (Stay Safe, Thieves!):

This is NOT financial advice. Trade at your own risk & manage positions wisely!

🤑 NEXT HEIST COMING SOON… STAY TUNED! 🎭

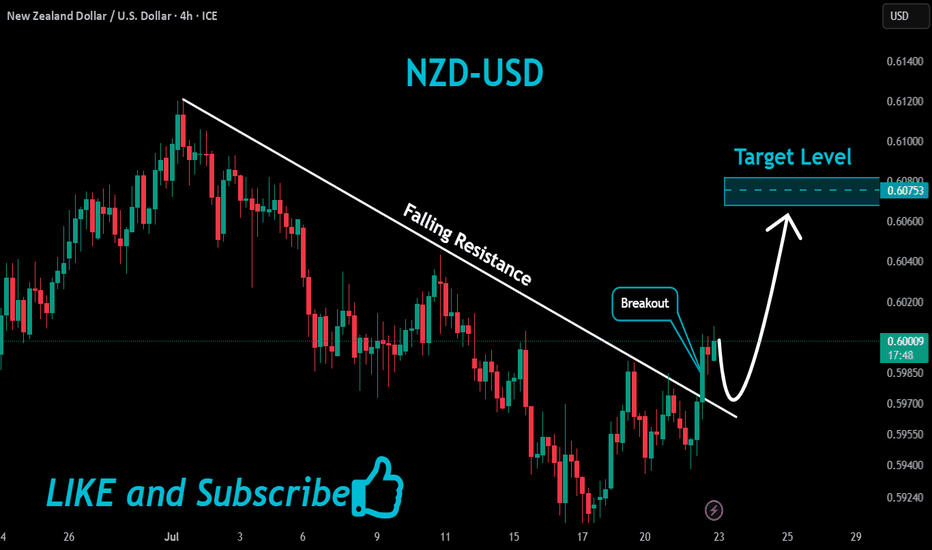

Nzdusdbreakout

NZDUSD Massive Bullish Breakout!

HI,Traders !

#NZDUSD is trading in a strong

Uptrend and the price just

Made a massive bullish

Breakout of the falling

Resistance line and the

Breakout is confirmed

So after a potential pullback

We will be expecting a

Further bullish continuation !

Comment and subscribe to help us grow !

Is This the Next Big Heist? Thief Trader Eyes NZD/USD Long SetupThief Trader’s NZD/USD Heist Plan – Long Setup in Play!

🌍 **Hello Global Wealth Warriors!**

Hello, Bonjour, Ciao, Salut, Guten Tag, Ola!

📢 **Fellow Profit Pirates & Market Mavericks**, it’s time to set sail again! Get ready to loot the forex seas with our latest **Thief Trader Strategy** targeting the **NZD/USD (The Kiwi)** pair.

---

🔎 **Trade Overview**

💥 Setup: Long Entry Plan – Executing our cunning blueprint with Thief Trading's sharp technical & fundamental intel**.

🎯 Target: 0.62300 (or exit just before for safety).

⚠️ Danger Zone: Watch for traps at the RED Zone Level – signs of overbought conditions, consolidation, trend flips & bearish setups.

---

🟢 **Entry Signal** – *The Heist Begins!*

📈 **Primary Entry**:

> Breakout above **MA Line (0.60300)** = Bullish move → *Place a Buy Stop above ATR Line*

📉 **Pullback Option**:

> *Buy Limit* at recent swing low/high on **15 or 30-min TF**.

📌 **Pro Tip**:

Set an **Alert** on your chart to catch the breakout live. Timing is everything!

---

🛑 **Stop Loss – The Getaway Plan**

📍 **SL Recommendation**:

> Recent swing low on the **4H chart (0.59400)** for day/swing trades.

> 🎯 Customize your SL based on risk, lot size, and total orders.

---

🔐 **Scalpers vs. Swingers**

👀 **Scalpers**: Focus ONLY on long-side plays.

💰 Got deep pockets? Dive in.

😎 Otherwise, swing traders – this is your golden moment. Trail your SL to protect profits.

🌐 **Market Pulse** – Momentum Watch

📊 Kiwi is navigating a **MA Resistance Zone**, but bullish bias remains due to:

* **Fundamentals**

* **Macro Insights**

* **COT Reports**

* **Sentiment & Intermarket Trends**

* **Quant Analysis + Overall Score**

📎 Check the linkks for detailed breakdown.

📰 **News Warning!**

⚠️ Major releases ahead?

* Pause entries.

* Protect trades with **trailing SLs**.

---

🚨 **Join the Next Heist with Thief Trading!**

💥 Smash that **Boost** or **Like** to join our profit squad.

With **Thief Trader Style**, we dominate the markets DAILY.

Your support fuels our mission. ❤️💼

---

💸 Stay ready for the next move, money-makers.

🎯 Eyes on the chart – timing is profit.

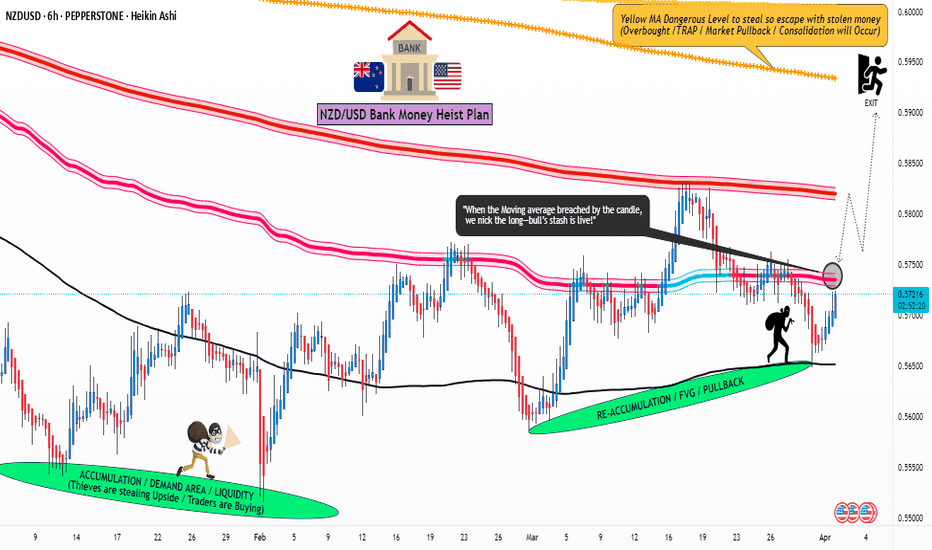

NZD/USD "The Kiwi" Forex Bank Money Heist (Bullish)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the NZD/USD "The Kiwi" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk Yellow MA Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the Nearest / Swing low level Using the 1D timeframe (0.58400) Day trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 0.60800

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸NZD/USD "The Kiwi" Forex Money Heist Plan is currently experiencing a bullishness,., driven by several key factors. .☝☝☝

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets with overall score... go ahead to check👉👉👉🔗🔗🌎🌏🗺

⚠️Trading Alert : News Releases and Position Management 📰🗞️🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

NZD/USD "The Kiwi" Forex Bank Money Heist (Short Term Plan)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the NZD/USD "The Kiwi" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry and short entry. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 :

"The loot's within reach! Wait for the breakout, then grab your share - whether you're a Bullish thief or a Bearish bandit!"

🏁Buy entry above 0.60300

🏁Sell Entry below 0.58990

📌However, I recommended to place buy stop for bullish side and sell stop for bearish side.

Stop Loss 🛑:

🚩Thief SL placed at 0.59000 for Bullish Trade

🚩Thief SL placed at 0.60000 for Bearish Trade

Using the 30mins period, the recent / swing low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

🏴☠️Bullish Robbers TP 0.61500 (or) Escape Before the Target

🏴☠️Bearish Robbers TP 0.57500 (or) Escape Before the Target

💰💵💸NZD/USD "The Kiwi" Forex Market Heist Plan is currently experiencing a neutral trend,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets with overall score... go ahead to check👉👉👉🔗🔗🌎🌏🗺

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

NZDUSD potential 50 pip drop? NZDUSD 4h crossed the previous liquidity zone with strong false breakout giving a high probability for the price to form a potential inverted head & shoulder and may continue to drop to 0.5308 which may lead a 50 pip drop with market open as the market is in strong down trend.

A possible sell trade setup with market open is highly probable!

NZDUSD..SHORTPrice is nearing a critical level around .

** No setup, no trade. **

For me, a solid plan always comes before any prediction.

*****If the zone is broken and confirmed with a retest, I’ll adjust my plan accordingly for a possible reverse trade.

For detailed entry points, trade management, and high-probability setups, follow the channel:

ForexCSP

#NZDUSD:DXY Gaining Its Strength Back, Is it end for the Bulls? The OANDA:NZDUSD DXY index shows a change in price character and momentum, indicating a possible price reversal for the shorter term. This aligns with our fundamental analysis, as there’s a likelihood of a China-US trade deal that could significantly influence the demand for the DXY.

There are two possible selling entries, allowing you to choose between a riskier or safer approach. Alongside these entries, we’ve set targets accordingly to your chosen entry.

Good luck and trade safely!

Thank you for your unwavering support! 😊

If you’d like to contribute, here are a few ways you can help us:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_

❤️🚀

NZD/USD "The Kiwi" Forex Bank Heist Plan (Swing/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the NZD/USD "The Kiwi" Forex Bank. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Yellow MA Zone. It's Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout then make your move at (0.57500) - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) after the MA breakout Place buy limit orders within a 15 or 30 minute timeframe most NEAREST (or) SWING low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📌Thief SL placed at the nearest/swing low or high level Using the 6H timeframe (0.56500) Day/Swing trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 0.59400 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💵💰NZD/USD "The Kiwi" Forex Bank Heist Plan (Swing / Day Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.... go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

NZD/USD "The Kiwi" Forex Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the NZD/USD "The Kiwi" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at 0.56300 (swing Trade Basis) Using the 4H period, the recent / nearest low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 0.58650 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

NZD/USD "The Kiwi" Forex Market market is currently experiencing a bullish trend,., driven by several key factors.

💫Fundamental Analysis

New Zealand Economic Trends: New Zealand's economy is expected to grow at a moderate pace in 2025, driven by consumer spending and business investment.

US Economic Trends: The US economy is expected to grow at a slower pace in 2025, driven by declining business investment and government spending.

Monetary Policy: The Reserve Bank of New Zealand is expected to maintain low interest rates in 2025, while the Federal Reserve is expected to maintain low interest rates in 2025.

Trade Policies: The US-New Zealand trade relationship is expected to remain stable, with no major changes in trade policies anticipated.

💫Macro Economics

Global GDP Growth: The World Bank forecasts global GDP growth to accelerate to 3.4% in 2025, up from 3.2% in 2024.

Inflation Rate: Global inflation is expected to rise to 3.8% in 2025, driven by increasing demand and supply chain disruptions.

Interest Rates: Central banks are expected to maintain low interest rates in 2025, supporting currency markets.

Unemployment Rate: The global unemployment rate is expected to decline to 5.4% in 2025, driven by job growth in emerging markets.

💫COT Data

Net Long Positions: Institutional traders have increased their net long positions in NZD/USD to 55%.

COT Ratio: The COT ratio has risen to 2.1, indicating a bullish trend.

Open Interest: Open interest in NZD/USD futures has increased by 12% over the past month, indicating growing investor interest.

💫Sentimental Outlook

Institutional Sentiment: 60% bullish, 40% bearish

Retail Sentiment: 55% bullish, 45% bearish

Market Mood: The overall market mood is bullish, with a sentiment score of +25.

💫Technical Analysis

Moving Averages: 50-period SMA: 0.5684, 200-period SMA: 0.5594.

Relative Strength Index (RSI): 4-hour chart: 54.21, daily chart: 51.14.

Bollinger Bands: 4-hour chart: 0.57280 (upper band), 0.5624 (lower band).

💫Market Overview

Current Price: 0.57280

Daily Change: 0.08%

Weekly Change: 1.40%

💫Next Move Prediction

Bullish Move: Potential upside to 0.5850-0.5950.

Key Support Levels: 0.5684, 0.5594.

Key Resistance Levels: 0.5850, 0.5950.

💫Overall Outlook

The overall outlook for NZD/USD is bullish, driven by a combination of fundamental, technical, and sentimental factors. The expected increase in New Zealand's interest rates, bullish market sentiment, and growing investor interest are all supporting the bullish trend. However, investors should remain cautious of potential downside risks, including changes in global trade policies and unexpected economic data releases.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

NZD/USD "The Kiwi" Forex Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the NZD/USD "The Kiwi" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (0.63300) then make your move - Bullish profits await!"

however I advise placing Buy Stop Orders above the breakout MA or Place Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at the recent / nearest low level Using the 4H timeframe (0.56500) swing trade basis

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 0.64400 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

NZD/USD "The Kiwi" Forex Market market is currently experiencing a bullish trend,., driven by several key factors.

🔴Fundamental Analysis:

The NZD/USD pair is currently trading at 0.5677, with a 0.04% increase. The pair's upward movement is driven by weaker US PMI data, which has dragged the Greenback lower against the New Zealand Dollar. The Reserve Bank of New Zealand is expected to cut its 4.25% cash rate by 50bps at its upcoming meeting, which could impact the pair's movement.

🟣Macroeconomic Analysis:

The global economic trends are influencing the NZD/USD pair. The US inflation rate is at 2.90%, while New Zealand's inflation rate is at 2.20%. The interest rate difference between the two countries is also affecting the pair, with the US Fed Funds Interest Rate at 4.50% and the New Zealand Interest Rate at 4.25%.

🔵COT Report:

The latest COT report shows that speculative traders have increased their long positions in the NZD/USD pair, indicating a bullish sentiment.

🟠Sentimental Market Analysis:

The market sentiment for the NZD/USD pair is currently bullish, with 60% of investors expecting the price to increase in the next week. The social media sentiment is also bullish, with 55% of tweets and posts expressing a positive sentiment towards the pair.

🟢Aggregate Sentiment:

Bullish: 62%

Neutral: 26%

Bearish: 12%

🟡Positioning Analysis:

Institutional investors have increased their investment in the NZD/USD pair, indicating a growing interest in the pair. Retail investors are also optimistic about the pair, with 70% of investors expecting the price to increase in the next week.

⚫Overall Outlook:

Based on the analysis, the overall outlook for the NZD/USD pair is bullish, with a potential price increase of 5% in the next week. However, the market is subject to volatility, and investors should exercise caution when making investment decisions.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

NZD/USD "The Kiwi Dollar" Forex Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the NZD/USD "The Kiwi Dollar" Forex Market market. Please adhere to the strategy I've outlined in the chart, which emphasizes long & Short entry. 👀 Be wealthy and safe trade 💪🏆🎉

Entry 📈 :

"The loot's within reach! Wait for the breakout, then grab your share - whether you're a Bullish thief or a Bearish bandit!"

Buy entry above 0.56500

Sell Entry below 0.55300

Stop Loss 🛑:

Thief SL placed at 0.55600 (swing Trade) for Bullish Trade

Thief SL placed at 0.56200 (swing Trade) for Bearish Trade

Using the 4H period, the recent / nearest low or high level.

SL is based on your risk of the trade, lot size and how many orders you have to take.

Target 🎯:

-Bullish Robbers TP 0.58750 (or) Escape Before the Target

-Bearish Robbers TP 0.54000 (or) Escape Before the Target

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

The NZD/USD "The Kiwi Dollar" Forex Market market is currently experiencing a Neutral trend (slightly Bearishness),., driven by several key factors.

🟢Fundamental Analysis:

The NZD/USD pair is currently experiencing modest recovery gains below mid-0.5600s, with upside seeming limited

The Reserve Bank of New Zealand's (RBNZ) prospect for more rate cuts could further weigh on the NZD

🔴Macro Economics:

New Zealand's GDP growth rate and inflation data will be crucial in determining the NZD/USD's direction.

The US economy's growth rate, inflation, and employment data will also impact the pair.

🔵COT Report:

Unfortunately, I couldn't find the latest COT report data for NZD/USD. However, I can suggest checking the official CFTC website or reliable financial websites for the latest reports.

🟡Market Sentiment:

The market sentiment for NZD/USD is currently bearish, with 60% of traders holding short positions.

Investors are cautious due to the prospect of more RBNZ rate cuts and global economic uncertainty.

🟣Institutional and Retail Banks Positioning:

Institutional investors are bearish on NZD/USD, citing the prospect of more RBNZ rate cuts and global economic uncertainty.

Retail traders are also bearish, with some expecting a price decline due to weak economic data and others expecting a price increase due to strong technical indicators.

⚪Overall Outlook:

The NZD/USD pair is expected to move bearish in the short term,

Bullish sentiment: 30%

Bearish sentiment: 70%

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤗

nzdusd buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

NZD/USD "The Kiwi" Forex Market Heist Plan on Bearish🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the NZD/USD "The Kiwi" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 👀 So Be Careful, wealthy and safe trade.💪🏆🎉

Entry 📉 : You can enter a Bearish trade at any point.

however I advise placing sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest high level should be in retest.

Stop Loss 🛑: Using the 4H period, the recent / nearest high level.

Goal 🎯: 0.55300

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Based on the fundamental analysis 📰 🗞️ I would conclude that the NZD/USD (New Zealand Dollar/US Dollar) pair is: Bearish

Reasons:

Interest rate differential: The Reserve Bank of New Zealand's (RBNZ) interest rate (2.50%) is lower than the Federal Reserve's (Fed) interest rate (4.50%), making the NZD less attractive to investors.

Economic growth: New Zealand's GDP growth (1.5%) is slower than the US GDP growth (2.1%), which could lead to a stronger USD.

Trade balance: New Zealand's trade deficit (NZD 1.1 billion) is larger than the US trade deficit (USD 50 billion), which could put downward pressure on the NZD.

Commodity prices: New Zealand's economy is heavily reliant on commodity exports, and a decline in commodity prices could negatively impact the NZD.

However, it's essential to consider the following risks:

Global economic slowdown: A slowdown in global economic growth, particularly in China and the US, could negatively impact the USD and support the NZD.

RBNZ's monetary policy: The RBNZ's dovish stance and potential interest rate cuts could support the NZD.

US-China trade tensions: Escalating trade tensions between the US and China could lead to a decline in the USD and support the NZD.

Bearish Scenario:

Stronger US economic data, such as GDP growth and inflation, supports the USD

Decline in commodity prices, particularly dairy and meat, supports the USD

Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

nzdusd buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

NZD/USD "Kiwi-US Dollar" Bank Money Heist Plan on Bullish SideHallo! My Dear Robbers / Money Makers & Losers, 🤑 💰

This is our master plan to Heist EUR/JPY "YUPPY" Bank based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal / Trap at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Entry 📈 : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Swing Low Point

Stop Loss 🛑 : Recent Swing Low using 2h timeframe

Attention for Scalpers : If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss 🚫🚏. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

#NZDUSD: On the Way to Yearly High! EURNZD

Price rejected at the major key level at 0.6360, where it had been rejected six times previously, showing a strong hold at that level. Since the price has dropped, we are now expecting a bullish reversal at 0.60. A great entry at that level can get you 700 pips in the long term.

Good luck!

NZD/USD "Kiwi" Bank Money Heist Plan on Bearish SideHola ola My Dear,

Robbers / Money Makers & Losers,

This is our master plan to Heist NZD/USD "Kiwi" Bank based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Short entry. Our target is Green Zone that is High risk Dangerous level, market is oversold / Consolidation / Trend Reversal / Trap at the level Bullish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Note: If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money.

Entry : Can be taken Anywhere, What I suggest you to Place Sell Limit Orders in 15mins Timeframe Recent / Nearest Swing High

Stop Loss : Recent Swing High using 2hrs timeframe

Warning : Fundamental Analysis comes against our robbery plan. our plan will be ruined smash the Stop Loss. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style

The NZDUSD price forecast update June 30thThe NZD/USD pair is trading around 0.60914. The price is currently below both the 100-period and 200-period moving averages, indicating a bearish trend.

There is a significant support zone around 0.60313 to 0.59926. This zone had previously acted as a support but has been broken and retested, indicating a potential shift to resistance. Immediate resistance is around 0.60824, just above the current price.

The price has recently broken through a significant support level (around 0.60824) and retested it, suggesting a potential continuation of the downtrend.

Summary: Right Now it indicates a bearish trend with the price trading below key moving averages and having recently broken a critical support level. Traders should look for selling opportunities on rallies to resistance levels, with potential downside targets near the descending support line around 0.59000. Always ensure proper risk management with stop-loss orders above key resistance levels.

What do you think ? Let me know in the comments

SIGNAL:

SELL: 0.60944 - 0.61085

STOP: 0.61168

TAKE PROFIT: 0.60295

TAKE PROFIT: 0.59948

NOTE: Trade at your own risk. Thank you