GBPUSD stay longThe British pound continues to trade well above the 1.2900 level against the US dollar, following the renewed bullish sentiment towards the upcoming UK election result. Going forward, the GBPUSD pair remains a strong buy on dips back towards the 1.2840 level. At present, the 1.2880 level may be the nearest area of support GBPUSD bulls will attempt to enter if a pullback occurs.

• The GBPUSD pair is bullish while trading above the 1.2840 level, key resistance is found at the 1.3000 and 1.3100 levels.

• If the GBPUSD pair trades below the 1.2940 level, key support is found at the 1.2880 and 1.2840 levels.

Octafx

USDJPY upside failureThe US dollar has come back under pressure against the Japanese yen currency after suffering a heavy technical rejection around the 109.00 level. The balance of power is with sellers while price trades below the rising trendline on the daily time frame. Overall, a break below the 108.20 support level exposes the USDJPY pair to further losses towards the 107.50 level.

• The USDJPY pair is only bullish while trading above the 108.68 level, key resistance is found at the 109.00 and 109.40 levels.

• The USDJPY pair is only bearish while trading below the 108.68 level, key technical support is found at the 108.20 and 107.50 levels.

BTCUSD $8,500 keyBitcoin is attempting to move away from critical technical support as the recent bearish momentum in the cryptocurrency is starting to fade. The BTCUSD pair will need to rally towards the $9,800 level in order to confirm that a medium-term price floor has been established. Traders should note that a sustained loss of the $8,500 support level could lead to a strong decline towards the $7,900 level.

• The BTCUSD pair is only bullish while trading above the $9,250 level, key resistance is located at the $9,600 and $9,800 levels.

• If the BTCUSD pair trades under the $9,250 level, sellers may test towards the $8,400 and $7,900 support levels.

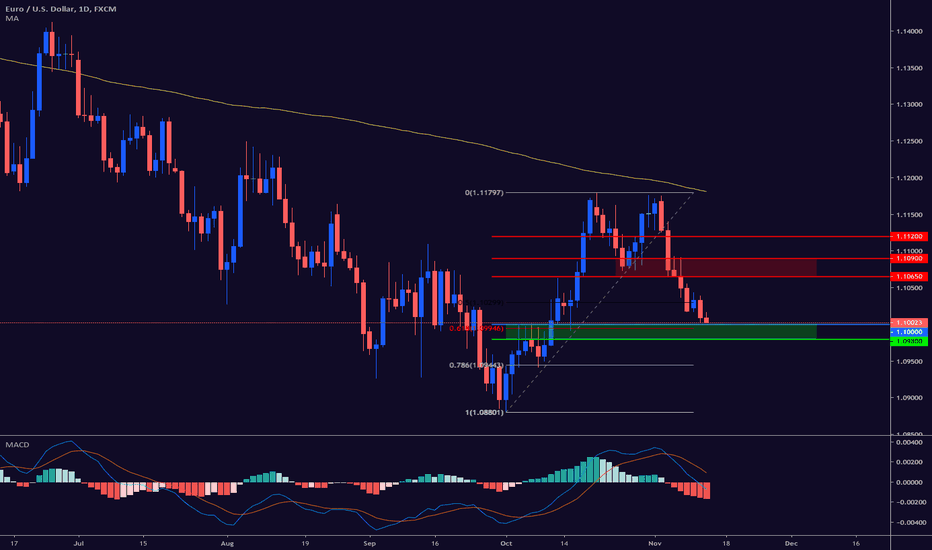

EURUSD major week aheadThe euro is holding above key technical support against the US dollar after performing a bullish breakout above the 1.1045 level last week. The EURUSD pair faces a pivotal trading week ahead and could challenge the 1.1120 level if bulls can force a breakout above the 1.1080 level. The overall medium-term upside objective of the EURUSD pair is found at the 1.1360 level.

• The EURUSD pair is only bearish while trading below the 1.1045 level, key support is found at the 1.1020 and 1.0980 levels.

• The EURUSD pair is only bullish while trading above the 1.1045 level, key resistance is found at the 1.1080 and 1.1170 levels.

GBPUSD 1.2840 keyThe British pound is holding firm against the greenback in early week trading, with the pair appearing to have a medium-term floor in place around the 1.2770 level. Going forward, GBPUSD buyers could rally price towards the 1.3100 level if buyers can continue to defend the 1.2840 support level. A sustained breakout above the 1.2930 level should be the trigger for a technical test of the 1.3000 level.

• The GBPUSD pair is bullish while trading above the 1.2840 level, key resistance is found at the 1.2930 and 1.3000 levels.

• If the GBPUSD pair trades below the 1.2840 level, key support is found at the 1.2770 and 1.2710 levels.

ETHUSD bullish biasEthereum is performing fairly well despite the recent heavy losses seen across the broader cryptocurrency market this week. Continued gains above the $180.00 level are now needed to challenge towards the top of the ETHUSD pair’s short-term trading range. Crypto market sentiment is still weak at present, although the altcoin space appears to be performing better than Bitcoin at present.

• If the ETHUSD pair trades above the $180.00 level, key resistance is found at the $200.00 and $250.00 levels.

• If the ETHUSD pair trades below the $180.00 level, key support is found at the $170.00 and $155.00 levels.

GBPUSD wedge playThe British pound is still holding onto its weekly gains against the US dollar, with the pair currently creating bullish higher highs. The four-hour time frame shows that the pair is trapped inside a wedge pattern, with the bottom of the wedge located under the 1.2840 level. A breakout above the 1.2910 level is currently needed for bulls to break free from the neutral pattern.

• If the GBPUSD pair trades above the 1.2880 level, key resistance is found at the 1.2910 and 1.2940 levels.

• If the GBPUSD pair trades below the 1.2880 level, key support is found at the 1.2840 and 1.2770 levels.

USDJPY trendline breakThe US dollar is still trading on the defensive against the Japanese yen currency as the pair continues to fall back from the 109.00 resistance are. Major trendline support for the USDJPY pair has now been broken and is currently located at around the pivotal 108.60 level. Going forward, the USDJPY pair could fall towards the 107.50 level if the 108.20 support level is broken.

• The USDJPY pair is only bullish while trading above the 108.90 level, key resistance is found at the 109.60 and 110.00 levels.

• The USDJPY pair is only bearish while trading below the 108.90 level, key technical support is found at the 108.20 and 107.50 levels.

BTCUSD $9,250 neededBitcoin is still under downside pressure on Thursday as buyers struggle to secure the cryptocurrency back above the $9,000 resistance level. A bullish daily price close above the $9,250 resistance level is needed to stabilize the BTCUSD pair in the short-term. Overall, the BTCUSD pair still has a strong chance of moving back towards its current monthly trading higher if the $8,500 support level holds.

• The BTCUSD pair is only bullish while trading above the $9,250 level, key resistance is located at the $9,400 and $9,800 levels.

• If the BTCUSD pair trades under the $9,250 level, sellers may test towards the $8,700 and $8,500 support levels.

EURUSD bulls failingThe euro currency is still trapped around the 1.1000 level against the US dollar, with bulls repeatedly failing to move the pair away from key technical support. A strong recovery above the 1.1045 level would increase the chances of a potential bounce towards the 1.1120 resistance level. Traders should cautious toward extreme EURUSD sellers if a breakdown below the 1.0980 support level happens.

• The EURUSD pair is only bearish while trading below the 1.1045 level, key support is found at the 1.1000 and 1.0980 levels.

• The EURUSD pair is only bullish while trading above the 1.1045 level, key resistance is found at the 1.1065 and 1.1120 levels.

USDJPY testing lowerThe US dollar is trading lower against the Japanese yen currency after a technical break below the 108.90 support level. Further intraday losses towards the 108.20 level remain possible while the USDJPY pair trades below the important 108.90 level. Overall, sustained gains above the 109.30 level are needed to encourage a technical test of the 110.00 resistance level.

• The USDJPY pair is only bullish while trading above the 108.90 level, key resistance is found at the 109.60 and 110.00 levels.

• The USDJPY pair is only bearish while trading below the 108.90 level, key technical support is found at the 108.60 and 108.20 levels.

ETHUSD holding supportEthereum is under downside pressure alongside the broader cryptocurrency market on Wednesday, although the second-largest cryptocurrency continues to hold the $180.00 level. The ETHUSD pair still stands a respectable chance of recovering towards the $250.00. Overall, a strong upside rally in the BTCUSD pair would be highly advantageous to the ETHUSD pair right now.

• If the ETHUSD pair trades above the $180.00 level, key resistance is found at the $200.00 and $250.00 levels.

• If the ETHUSD pair trades below the $180.00 level, key support is found at the $170.00 and $155.00 levels.

EURUSD 1.1045 neededThe euro has managed a marginal recovery from the 1.1000 level against the US dollar, following a technical battle in this area on Tuesday. EURUSD bulls need to advance the pair above the 1.1042 level to confirm that a short-term price floor is now in place. Overall, traders will start to turn bullish towards the EURUSD pair on an intraday basis if the 1.1065 resistance level is overcome.

• The EURUSD pair is only bearish while trading below the 1.1065 level, key support is found at the 1.1000 and 1.0980 levels.

• The EURUSD pair is only bullish while trading above the 1.1065 level, key resistance is found at the 1.1090 and 1.1120 levels.

GBPUSD inflation dayThe British pound is holding firm against the US dollar currency, with the pair trading around the important 1.2850 level ahead of key inflation data from the UK and US economies today. The GBPUSD pair ideally needs to firm above the 1.2880 level to secure further gains towards the 1.2940 resistance level. Overall, GBPUSD bulls who are not already long from the 1.2770 area may be awaiting for a meaningful technical pullback.

• If the GBPUSD pair trades above the 1.2880 level, key resistance is found at the 1.2940 and 1.3000 levels.

• If the GBPUSD pair trades below the 1.2880 level, key support is found at the 1.2770 and 1.2710 levels.

GBPUSD 1.2880 keyThe British pound has performed a sharp reversal from the 1.2770 level against the US dollar after the chances British PM Boris Johnson securing a majority Parliament victory increased. Continued strength above the 1.2880 level is now needed to secure an important technical test of the 1.2940 resistance level. Overall, the GBPUSD pair could have formed an important technical bottom during its recent decline to 1.2770.

• If the GBPUSD pair trades above the 1.2880 level, key resistance is found at the 1.2940 and 1.3000 levels.

• If the GBPUSD pair trades below the 1.2880 level, key support is found at the 1.2850 and 1.2810 levels.

EURUSD bulls need to reclaim 1.1065The euro currency has managed to bounce from the 1.1010 technical area against the US dollar, although upside momentum is currently lacking. EURUSD bulls need to force an intraday recovery above the 1.1065 level to secure a test of the 1.1120 resistance level this week. Overall, sustained weakness below the 1.1020 level should be considered bearish for the EURUSD pair.

• The EURUSD pair is only bearish while trading below the 1.1065 level, key support is found at the 1.1010 and 1.0980 levels.

• The EURUSD pair is only bullish while trading above the 1.1065 level, key resistance is found at the 1.1090 and 1.1120 levels.

LTCUSD $57.00 key supportLitecoin remains trapped around the $60.00 level as almost the entire cryptocurrency market comes under bearish selling pressure. LTCUSD bulls need to defend the $57.00 level to avoid further downside in the pair towards the $50.00 level. Overall, the LTCUSD pair still has a chance of achieving its near-term target of $90.00, while trading above the $57.00 support level.

• If the LTCUSD pair trades below the $57.00 level, key support is found at the $50.00 and $46.50 levels.

• If the LTCUSD pair trades above the $57.00 level, key resistance is found at the $68.00 and $90.00 levels.

BTCUSD $8,700 keyBitcoin is attempting to recover in early week trade after the number one cryptocurrency came under heavy bearish pressure last Friday. BTCUSD bulls need to defend the $8,700 support level this week to avoid further loses towards the $8,400 technical region. Overall, traders that are bullish towards Bitcoin will attempt to force a recovery towards the $9,800 level.

• The BTCUSD pair is only bullish while trading above the $8,900 level, key resistance is located at the $9,600 and $10,000 levels.

• If the BTCUSD pair trades under the $8,900 level, sellers may test towards the $8,700 and $8,400 support levels.

EURUSD 1.1000 very importantThe euro currency is drifting lower in early week trade against the US dollar, with the pair so far failing to attract a meaningful bid. The 1.1000 level is huge for the EURUSD this week, with bulls needing to step in from this key area to avoid a steep decline towards the 1.0930 area. Overall, watch out for a strong bullish counter-move to occur if the EURUSD pair starts to firm above the 1.1060 level.

• The EURUSD pair is only bearish while trading below the 1.1090 level, key support is found at the 1.1000 and 1.0980 levels.

• The EURUSD pair is only bullish while trading above the 1.1090 level, key resistance is found at the 1.1110 and 1.1150 levels.

GBPUSD awaiting dataThe British pound is under threat against the US dollar on Monday as traders await a slew of high-impacting data from the UK economy this morning. Worse than expected UK data could sink the GBPUSD pair lower towards the 1.2740 support area. Overall, traders have few reasons to be bullish towards the GBPUSD pair this week unless the 1.2940 level is successfully overcome.

• If the GBPUSD pair trades above the 1.2850 level, key resistance is found at the 1.2890 and 1.2940 levels.

• If the GBPUSD pair trades below the 1.2850 level, key support is found at the 1.2740 and 1.2710 levels.

ETHUSD $180.00 still keyEthereum has pulled back from the $190.00 resistance level after buyers failed to performed a breakout above the $200.00 resistance level. Despite the recent move lower, the ETHUSD pair still has a bullish intraday bias while trading above the $180.00 level. Overall, the ETHUSD pair still has the potential to trade towards the $250.00 level while trading above the $180.00 support level.

• If the ETHUSD pair trades above the $180.00 level, key resistance is found at the $200.00 and $250.00 levels.

• If the ETHUSD pair trades below the $180.00 level, key support is found at the $170.00 and $155.00 levels.

GBPUSD bears in controlThe British pound is under heavy downside pressure against the US dollar after the recent dovish Bank of England meeting heightened technical selling. The GBPUSD pair risks falling towards the 1.2740 level, although the 1.2710 level is the main support area. Overall, selling any rallies towards the 1.2850 resistance level is the preferred intraday strategy when trading the GBPUSD pair.

• If the GBPUSD pair trades below the 1.2850 level, key support is found at the 1.2740 and 1.2710 levels.

• If the GBPUSD pair trades above the 1.2850 level, key resistance is found at the 1.2890 and 1.2925 levels.

USDJPY 110.00 still possibleThe US dollar is increasingly bullish against the Japanese yen currency, following a sharp bounce from the pivotal 108.60 support level. The USDJPY pair is likely to test towards the 110.00 level if the 109.60 resistance level is overcome later today. Overall, an even stronger rally towards the 110.80 level is still possible, as the USDJPY pair continues to exhibit bullish price action.

• The USDJPY pair is only bullish while trading above the 108.60 level, key resistance is found at the 109.60 and 110.00 levels.

• The USDJPY pair is only bearish while trading below the 108.60 level, key technical support is found at the 108.20 and 107.90 levels