ODFL: The Buy Signal Traders Can’t IgnoreThe Turning Point for Old Dominion Freight Line – What’s Next?

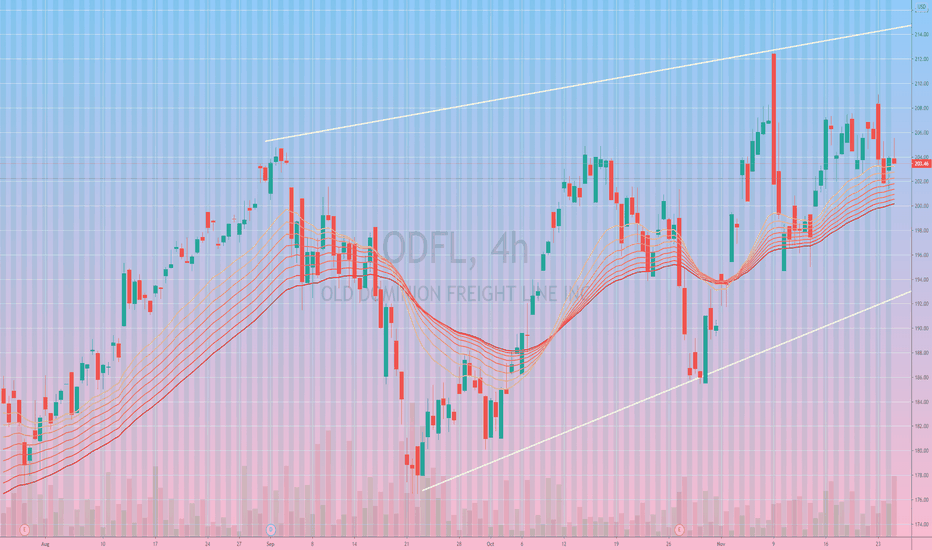

Old Dominion Freight Line (NASDAQ: ODFL) is at a critical inflection point, sitting at $185.47 after a notable -20.49% decline from its absolute high of $233.26 back in November 2024. The stock has hovered near key support at $184.03, teasing traders with potential buy setups.

But here’s where it gets interesting: a surge in buy volume has appeared, with an Increased Buy Volumes pattern confirming accumulation at these levels. RSI14 is at 40.98, signaling the stock is near oversold territory, while MFI60 has dipped to 34.98, indicating liquidity inflows are building.

Could this be the final shakeout before a rally? With the 50-day moving average still above at $189.07, traders are eyeing a possible breakout above $189.05 resistance for confirmation. The question now is—will bulls take control, or is another leg down coming? Stay tuned.

ODFL Roadmap: Following the Smart Money Trail

Navigating the recent price action of Old Dominion Freight Line (NASDAQ: ODFL) is like following breadcrumbs left by institutional traders. Let’s break down the key patterns that defined the last trading sessions and see which signals were spot on and which ones misfired.

January 27: Increased Sell Volumes – The Heavy Drop Begins

ODFL opened at $195.08 but quickly lost ground, closing at $194.72. The pattern suggested a strong selling wave, and the next few sessions confirmed this as prices slid further down.

January 28: Sell Volumes Max – Bears Tighten Grip

A classic sell continuation setup—ODFL tanked from $191.78 to $189.70, confirming the downtrend. This was a clean sell-off with no signs of reversal, reinforcing the bearish dominance.

January 29: Increased Sell Volumes – Exhaustion Near?

Closing at $185.80, ODFL was testing key support. With RSI dipping into oversold territory, traders started watching for a bounce, but sellers weren’t done yet.

January 30 (Early Session): VSA Sell Pattern – False Hope?

A VSA Manipulation Sell Pattern appeared, hinting at another downward move. However, by the next session, things took an unexpected turn…

January 30 (Later Session): VSA Buy Pattern – Smart Money Steps In

Here’s where the tide turned. ODFL bounced from $183.83 to $185.81, signaling that big buyers were stepping back in. The trigger point aligned, confirming a bullish reversal attempt.

January 30 (Final Hours): Increased Buy Volumes – Reversal Lock

By the close of the day, the pattern was clear—smart money was back. The stock held gains at $186.70, locking in a higher low and confirming the buy-side control.

What’s Next?

With ODFL showing signs of accumulation, all eyes are on the $189.05 resistance. A breakout could confirm a new uptrend, while failure to hold above $184 might signal another leg down. Either way, momentum is shifting, and traders better be ready.

Technical & Price Action Analysis

📌 Key Support & Resistance Levels to Watch

When it comes to ODFL, levels matter—they act as magnets for price action. If support fails, it flips into resistance, trapping late buyers. If resistance gets crushed, it opens the door for a strong breakout. Let’s map out the battlefield:

🔹 Support Levels (Buyers' Last Stand)

184.03 – Holding above this keeps bulls in play. If it breaks, expect deeper retracement.

181.54 – A soft landing zone, but if it folds, we’re looking at a bigger flush.

172.74 – This is where things get real. Losing this means sellers have full control.

172.00 – Right above the danger zone—break below and it’s game over for bulls.

170.08 – The last line of defense before things spiral downward.

🔸 Resistance Levels (Ceilings to Break)

189.05 – First major checkpoint. If bulls can’t clear it, expect heavy rejection.

192.18 – If this cracks, momentum shifts, and buyers take the wheel.

196.57 – The decision point. Holding above confirms a trend reversal.

206.66 – Bulls dream of this level; a breakout here ignites FOMO.

212.25 – Long-term resistance, break above and it’s clear skies.

🚨 Powerful Resistance – Where the Big Players Step In

171.48 – If price collapses below, expect major distribution.

163.31 – The “no man's land.” Bulls don’t want to see this level tested.

118.93 – If we ever touch this, pack it up—ODFL is in serious trouble.

Trading Strategies Using Rays: The Path of Least Resistance

The Rays from the Beginning of Movement framework allows us to anticipate ODFL’s price action not by predicting static levels, but by tracking how price interacts with dynamic Fibonacci-based rays. These rays, layered with VSA analysis, define market structure and let us ride high-probability setups as price moves from one ray to the next.

📌 Key Concept: We don’t blindly enter at fixed levels. Instead, we wait for interaction with rays, confirmation from VSA volume shifts, and alignment with Moving Averages, which serve as dynamic resistance/support zones.

🚀 Optimistic Scenario: Bulls Take Control

If ODFL holds support and buyers step in at key VSA interaction points, we can expect a steady climb up the ray structure.

Entry Zone: $184.03 - $185.47 (VSA confirmation needed)

First Target: $189.05 (Initial breakout test)

Second Target: $192.18 (Momentum build-up)

Third Target: $196.57 (Trend confirmation)

💡 Bullish Momentum Factor: Price reclaiming MA50 ($189.07) and flipping it into support would be a game-changer. If this aligns with a VSA Buy Volume spike, expect acceleration.

🔻 Pessimistic Scenario: Sellers Keep Control

If resistance holds and ODFL fails to reclaim higher rays, bears will drag price to lower support zones.

Entry Zone: $189.05 - $192.18 (Failure to break)

First Target: $184.03 (Breakdown confirmation)

Second Target: $181.54 (Bearish continuation)

Third Target: $172.74 (Capitulation zone)

💡 Bearish Breakdown Factor: If MA50 ($189.07) & MA100 ($189.42) reject price with a VSA Sell Volume spike, it’s an early warning of a deeper move.

🔥 Possible Trade Setups

Long from $184.03 → $189.05 (VSA buy confirmation at support)

Breakout Long from $189.05 → $196.57 (Momentum above MA50)

Short from $189.05 → $184.03 (Failure to hold resistance)

Breakdown Short from $181.54 → $172.74 (Bearish cascade setup)

These setups will only activate after interaction with the rays, ensuring trades align with market structure and smart money flow. The next move starts from the next ray, so trade what’s in front of you! 🚀

Trading Strategies Using Rays: The Path of Least Resistance

The Rays from the Beginning of Movement framework allows us to anticipate ODFL’s price action not by predicting static levels, but by tracking how price interacts with dynamic Fibonacci-based rays. These rays, layered with VSA analysis, define market structure and let us ride high-probability setups as price moves from one ray to the next.

📌 Key Concept: We don’t blindly enter at fixed levels. Instead, we wait for interaction with rays, confirmation from VSA volume shifts, and alignment with Moving Averages, which serve as dynamic resistance/support zones.

🚀 Optimistic Scenario: Bulls Take Control

If ODFL holds support and buyers step in at key VSA interaction points, we can expect a steady climb up the ray structure.

Entry Zone: $184.03 - $185.47 (VSA confirmation needed)

First Target: $189.05 (Initial breakout test)

Second Target: $192.18 (Momentum build-up)

Third Target: $196.57 (Trend confirmation)

💡 Bullish Momentum Factor: Price reclaiming MA50 ($189.07) and flipping it into support would be a game-changer. If this aligns with a VSA Buy Volume spike, expect acceleration.

🔻 Pessimistic Scenario: Sellers Keep Control

If resistance holds and ODFL fails to reclaim higher rays, bears will drag price to lower support zones.

Entry Zone: $189.05 - $192.18 (Failure to break)

First Target: $184.03 (Breakdown confirmation)

Second Target: $181.54 (Bearish continuation)

Third Target: $172.74 (Capitulation zone)

💡 Bearish Breakdown Factor: If MA50 ($189.07) & MA100 ($189.42) reject price with a VSA Sell Volume spike, it’s an early warning of a deeper move.

🔥 Possible Trade Setups

Long from $184.03 → $189.05 (VSA buy confirmation at support)

Breakout Long from $189.05 → $196.57 (Momentum above MA50)

Short from $189.05 → $184.03 (Failure to hold resistance)

Breakdown Short from $181.54 → $172.74 (Bearish cascade setup)

These setups will only activate after interaction with the rays, ensuring trades align with market structure and smart money flow. The next move starts from the next ray, so trade what’s in front of you! 🚀

ODFL

Transportation leader $SAIA is near ATHSaia provides less-than-truckload, non-asset truckload, expedited and logistics services across the U.S. is ranked #1 in its industry by IBD

While the sector ETF AMEX:XTN is down, stocks like NASDAQ:SAIA , NYSE:XPO and NASDAQ:ODFL are all near new highs

The price is in its second base formation close of breaking out above $439.50

I'll leave a stop buy just above this point.

ODFL WCA - Cup and HandleCompany: Old Dominion Freight Line, Inc.

Ticker: ODFL

Exchange: NASDAQ

Sector: Industrials

Introduction:

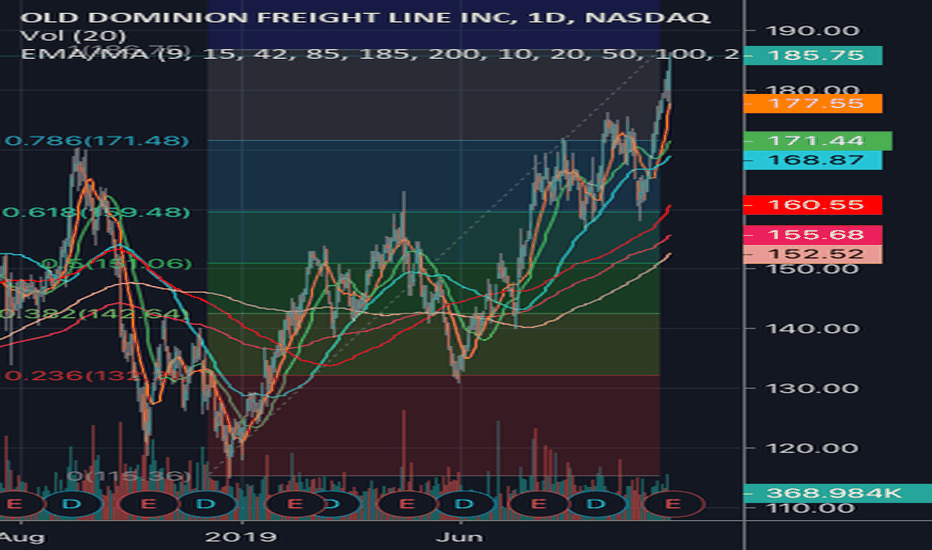

Today we are studying Old Dominion Freight Line, Inc. (ODFL) listed on the NASDAQ, a well-regarded player in the industrials sector. The weekly chart is indicating a possible bullish continuation based on a classic Cup and Handle pattern that has been forming over the past 608 days.

Cup and Handle Pattern:

The Cup and Handle is a bullish continuation or reversal pattern that mimics a teacup with a handle on the right side. It's defined by a rounded bottom, followed by a minor pullback that forms the handle.

Analysis:

The previous trend for ODFL was in an upward direction, which was interrupted by a consolidation phase that manifested as a Cup and Handle pattern, potentially indicating continuation of the bullish trend. The so-called "lip" or the horizontal resistance of the pattern is at 374.41.

The price is significantly above the 200-day exponential moving average (EMA), reinforcing the bullish sentiment. Notably, two weekly candles have successfully closed above the resistance level.

Conclusion:

In light of the successful close of the candles above the resistance, a long position might be considered. In the event of a successful bullish continuation, the price target is projected to be at 515.51, which corresponds to a potential rise of around 30%.

Remember, this analysis should be part of a broader market research and risk management strategy and is not direct trading advice.

If you found this analysis helpful, please consider liking, sharing, and following for more insights. Wishing you profitable trading!

Best regards,

Karim Subhieh

Disclaimer: This analysis is for educational purposes only and is not financial advice. Always conduct your own research and consult with a financial advisor before making investment decisions.

These stocks confirm the bottom has not happened yetMonday will determine where we are. I have three theories for now. Most importantly I am not yet convinced the near-term bottom is in because other stocks that have followed the market pretty well have not finished their wave 5 bottoms which would have them notch lows lower than their wave 3 bottoms from June.

The S&P 500 index ended its last long bull run with a top on January 4, 2022. It ended Primary wave 1 with a firm bottom on February 24, 2022 (this is the sell-off on the first day of Russia-Ukraine conflict). Primary wave 2 topped on March 29, 2022. Primary wave 3 bottomed on June 17, 2022. Primary wave 4 topped on August 16, 2022, while nearly touching the top trendline which began on January 4 and ran to March 29.Multiple stocks, especially those in the NASDAQ began the bear market earlier in the fourth quarter of 2021.

Amazon ( AMZN ) is one of these stocks. The stock had an all-time high July 13, 2021; however, this was likely a wave 3 top from the prior waves instead of the beginning of its own bear market. This was confirmed when Amazon’s lows in May and June 2022 flashed wave 3 signals instead of cementing a wave 5 base and market bottom. Therefore, Amazon began its decline with a top on November 19, 2021. It finished wave 1on March 8, 2022, wave 2 on March 29, 2022, wave 3 on May 24, 2022, wave 4 on August 16, 2022. Amazon began its waves early but achieved market reversals for waves 2 and 4 while bottoming with the market around June 17. If unsure about the index, this stock can also hold clues as it is yet to drop below its wave 3 bottom.

Next stock is Target ( TGT ). The stock presented the wave 3 peak from its last bull run on August 11, 2021; however, it achieved an all-time high on November 15, 2021. This is where I believe its bear market began. Wave 1 ended February 24, 2022, wave 2 on April 21, 2022, wave 3 on June 30, 2022, and wave 4 on August 16, 2022. This stock matched the wave 1 and 4 reversals while forming a bottom, just not its final on June 17 as well. This stock is trending well with the market. Like AMZN, it is yet to go below its wave 3 bottom and therefore I believe more declines are to come.

Next is Lowes ( LOW ) which is in a slightly different ending position but yet to drop below it’s wave 3 bottom. The Lowes bear market began on December 13, 2021. Wave 1 ended with the market on February 24. Wave 2 ended on March 21. Wave 3 ended on June 22, while achieving a near bottom with the market on June 17. Wave 4 ended on August 17 which is one day behind the market. For now it appears it may be further along in its final wave 5 down, but it is still 12 points above the wave 3 low. The trendlines have not been as helpful from a technical standpoint for this bear market.

Rockwell Automation ( NYSE:ROK ) is another stock moving with the market, however, the trend lines are not producing points of resistance. Wave 1 began December 16, 2021 and ended with the market on February 24, 2022. Wave 2 ended with the market on March 29, 2022. Wave 3 ended days after the market on June 22, 2022. Wave 4 ended with the market on August 16. This stock has tracked very tightly with the index, and if this remains true I currently have ROK around Minor wave 2 in Intermediate wave 5. This is more apparent than the current movement in the index, however, it can be used to indicate what lies ahead for the market.

Old Dominion ( ODFL ) is next with the bear market beginning December 7, 2021. Wave 1 ended with the market on February 24, 2022, wave 2 on March 18, wave 3 ended on May 19, but did find another market low on June 17 with the market. Wave 4 ended on August 11 and the stock is currently around Intermediate wave 5 preparing for its final bottom.

Another high volume darling with earnings this week is Apple ( AAPL ). It began the bear market with the index on January 4, 2022. Wave 1 ended slightly later on March 14, but it also shared a major bottom on February 24 with the market. Wave 2 ended on March 30, wave 3 ended June 16, 2022, and wave 4 ended on August 17. The last three reversals for Apple occurred one day after the market, so this is something to consider moving forward. A drop to the wave 3 bottom requires a minimum 20 point loss from Friday’s close. This stock has quite a bit of ground to lose and the stock trends up prior to earnings. An earnings call bomb is the quickest way for Apple to retake the June lows.

The S&P 500 has gone below the Primary wave 3 bottom so technically it does not have to go lower than it did on October 13. I am using the stocks mentioned here to determine when the index has bottomed as I do not believe it has occurred yet. Tomorrow will be big for the index. The current chart has us possibly still in Intermediate wave 4, and it would likely be near the Minor C wave. The trendlines for SPX have held well and there is not much before that line is met. This only leaves room for the near-term top to happen no later than tomorrow. For this entire analysis to hold true, we should have an overall down week. Big earnings start coming out by mid-week to include some of the stocks mentioned here. I will map out the sub waves once I know where we are in Intermediate wave 5. Earliest models would have Intermediate 5 lasting 11 days IF we ended Minor wave 2 on Friday. If we are not in Intermediate wave 5 yet, the length could be around 15 days long.

Upcoming catalysts besides earnings are the Fed the first week in November and the U.S. elections the second week of November.

ODFL.NAS_Bearish Pullback Trade_ShortENTRY: 268.72

SL: 291.45

TP1: 256.98

TP2: 246.65

- ADX>20

- Daily RS -ve

- Daily FFI +ve

- Weekly RS -ve

- Weekly FFI -ve

- Short-term downtrending stock.

- EMAs are aligned.

- Stoch RSI still above overbought area and waiting for it to cross down 70.

- Price pulled back to 20EMA and seems to reject support turn resistance area and monthly CPR since 20 Apr 2022.

- Entry based on initial >3% bounce from 10/20EMA.

- Would like a better closing.

ODFL LONG SETUPMarket just finished 1-5 Elliot Wave Theory Upwards and is on it's way to complete ABC Correction to the opposite direction, we are expecting market to bounce at 235 zone because it is 38.2% fib zone, and an institutional candle zone, after the bounce we are expecting price to reach our target which is at B point of an ABC correction.

Entry: 235

Invalidation: 222

Target: 329

ODFL Sure Looks ToppyI'm calling a top here. Super over-extended. P/E is bonkers for a trucking company. Expecting this to cool down very soon. Forming a hanging man candle at the top of the trend resistance today..

Not the popular thing to do.

Near Term price target of $255-$250

Medium Term price target of $235-$230.

(Opinion Only)