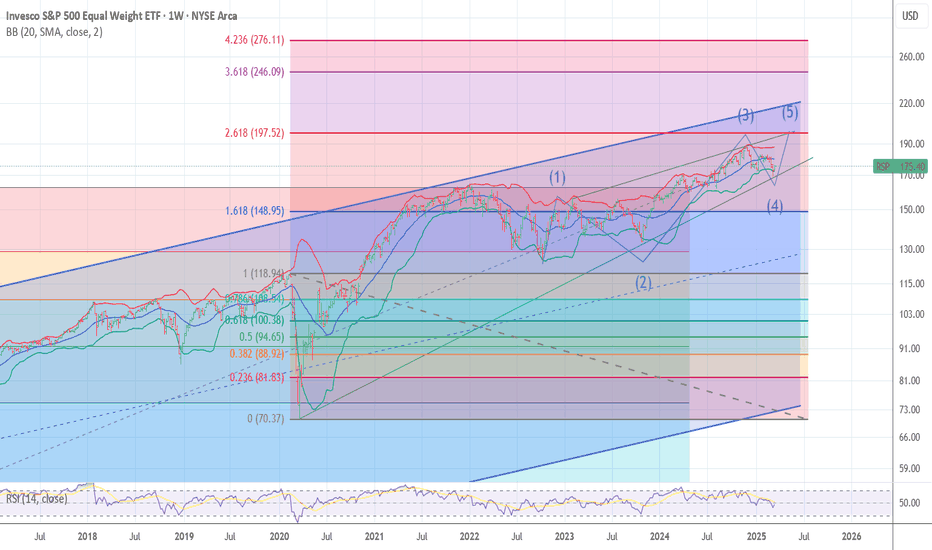

RSP and WHY I AM BULLISH STILL197/199 target The chart posted is the sp 500 equal weighted RSP has dropped to a trend line dated back to march 23 2020 . I have three clean points and all are major . Elliot Wave calls for a final 5th wave to end this advance in the area of 198 plus or minus 1.25 Fib relationship and PUT /CALL as well as most of my spiral and cycles point to the final advance to a Bull market top is now setup . BULL MARKETS TOP ON GOOD NEWS > Best of trades WAVETIMER

OEX

NEW RECORD HIGH Coming 26 td from today The wave structure I was so bearish on Has made it to the support targets the crash cycle based on data back to 1902 is all Crash cycles have been 8 to 12 TD today is day 9 I have moved to a 90 long knowing that the cycle has at most 2 days and is into the 5 /6 spiral cycle lows inan event due by 3/8 to 3/13 focus 3/10 .I can now state that the chart posted could be counted as an expanding triangle in what is now labeled wave 4 I am looking for a sharp 26 td rally to mark the top from 3/10the week .SP 100 should see 3055 min to as high 3150 in a blowoff wave . Best of trades WAVETIMER

OEX 100 FINAL LEG TARGET 3273 March 13th week The chart posted is the blue chips SP 100 OEX .It is my View that All markets are that of fractals patterns the have a clear movement of math in a repeating Sequence . March 13th week if I am correct and we are into an OEX HIGH near 3273 we would be hitting the long term channel as well as my 1.4 to 3.4 % Breach of the monthly Bollinger band signal as well . I would then generate My Signal for the Major Top to End the bull move from march 9 2009 . I have posted the forecast for 2025 calling for a min drop of 20 % plus as I did in the bed8th forecast 2021 calling for a decline of mIn 20 plus . Well spirals as well as the Math and Bullish Sentiment models call a last wave up in what should be a blowoff ?? in a narrow but it is a new Paradigm !! The MIN decline in this signal has been 21.9 The avg has been 38% and the longest has been over 50 % . If we see a sharp drop over the next 3 td and we drop to 618 target 2886 plus or minus 4 I will move to a 120% long in the money Calls in SPY and QQQ . Best of Trades WAVETIMER After this top I will turn as Bearish as I did January 10th 2020 and dec 2021

I have now moved to an 80 % long PUTS in SPY and QQQ and SMHBased on the chart posted the OEX 100 is at a crossroad I can count this Two ways first the bullish count we are ending a wave 1 up of 5 of 5 in the blowoff wave and we would see an small abc decline toa .382 then I would cover Or if we break the .50 % pullback would would look for a sharp washout to the a minor new low .But if we break above 2951 then we are in the 5 wave up to two target 3045 alt 3147

IF you are Bearish SP 500 Your EARLY The chart posted is That of High yield Market ETF HYG we have just finished of the correct in this sector and should see Liquidity coming back into assets One Last Gasp This should raise mags qqq and spy toa new record high as most other indexes struggle to rally back to .618 best of trades WAVETIMER

S&P 100 versus all the rest S&P 500 and also Russell 2000S&P 100 versus all the rest S&P 500 and also Russell 2000... Note that in the previous cycle 2003-2007 was a value cycle so the S&P 100 big cap names were underperform the broad market, growth cycles are mostly a concentrated big cap names phenomenon.