USOIL GROWTH AHEAD|

✅CRUDE OIL broke the key

Structure level of 69.50$

While trading in an local uptrend

Which makes me bullish biased

And I think that after the retest of the broken level is complete

A rebound and bullish continuation will follow

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Oil

Oil Trap Activated – Limit Orders Set for the Big Score💥🛢️Crude Oil Vault Breach Plan – DCA Heist Begins!🧨💰

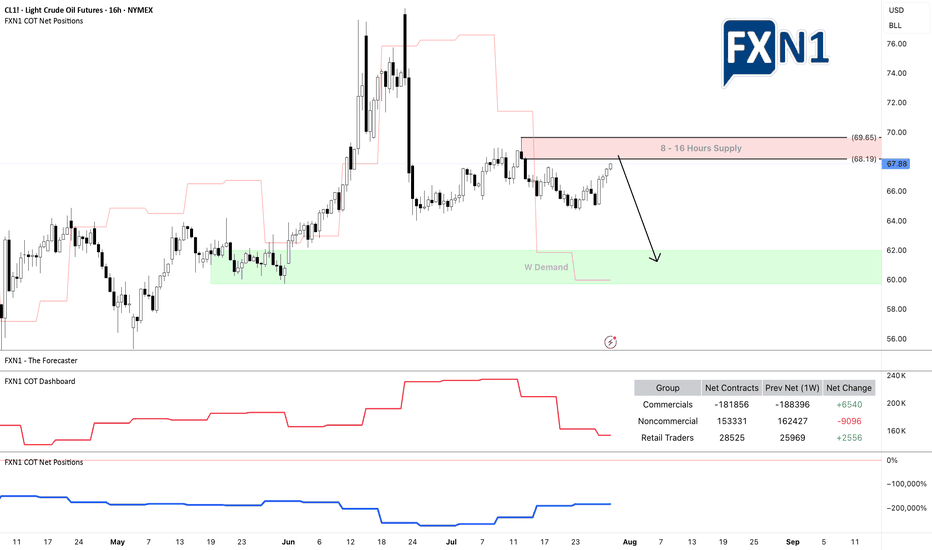

🚨Asset: CL1!

📈Bias: BULLISH RAID MODE ON

🎯Target: $74.50

🛡️Stop Loss: $67.50

🔑Entry: ANY LEVEL – Thief stacking limit orders like layers of gold bars 💼⚖️ (DCA Mode Activated)

🕵️♂️Thief Trader is not chasing, we're ambushing 🧠 — scaling in smart with multiple limit traps. The crew never FOMOs, we trap the market 🎯.

💣This is a layered loot plan, not for weak hands. Watch how we load up quietly while market sleeps 😴, then hit hard when the vault cracks open 🔐.

Support this heist by smashing that ❤️LIKE button

💬 Comment your plans below & join the real thief squad

🤝 Together we rob the market — LEGALLY & LOGICALLY

#ThiefTrader #OilHeist #CL1 #BullishTrap #DCA #CrudeOilStrategy #SmartMoneyPlay #MarketRobbery #TeamLoot #NoRetailPanic

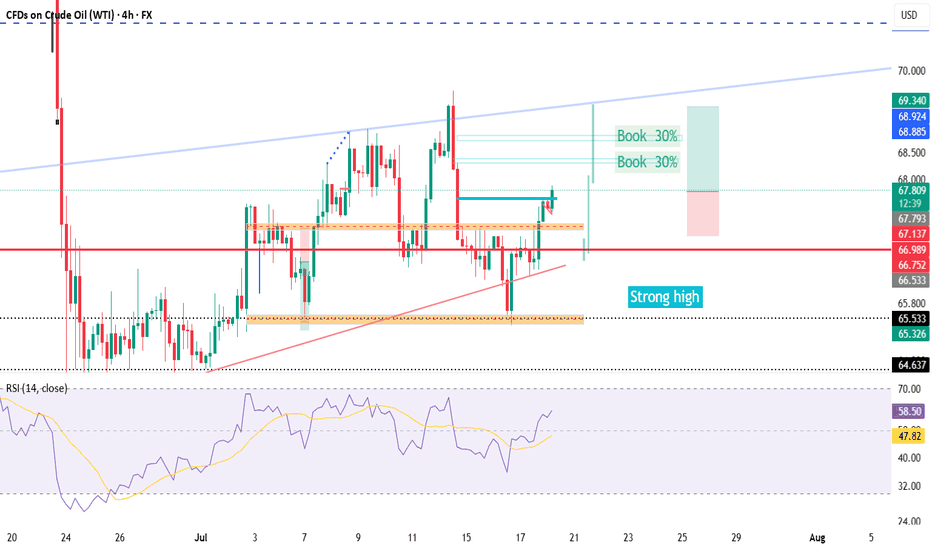

WTI remains supported on Russia sanctions threatIt is worth keeping an eye on the energy markets, given the recent bounce from a key support area around $65.00. With WTI moving back above the 200-day average at $68.00, this is an additional bullish sign from a technical standpoint. This level is now the first support to watch, followed by $67.00 and then that $65.00 key level.

Resistance comes in at $70.00 followed by $72.80.

From a macro point of view, President Trump’s decision to bring forward the deadline for Russia to agree to a ceasefire has ever so slightly heightened the prospect of secondary sanctions being imposed on foreign purchasers of Russian crude — namely China, India, and Turkey. There is a risk we could see a spike in oil prices, if fears of Russian supply being curtailed, intensifies. At the same time, fears about demand have receded with the announcement of a few trade deals by the US and recent economic data from Europe and the US both showing mild strength.

By Fawad Razaqzada, market analyst with FOREX.com.

Crude oil: Sell around 70.20, target 65.00-64.00Crude Oil Market Analysis:

Yesterday's crude oil market was very strong, with buying driving the market higher. The daily chart ultimately closed with a clear bullish candlestick. Buying on the daily chart is testing the resistance level between 70.00 and 70.60. After two consecutive days of bullish closes, and with clear bullish candlesticks, I predict another surge today. Let's look at the daily chart. The daily chart shows a significant rebound after a significant drop. Today, focus on selling opportunities between 70.00 and 70.60. A break of this level will change the overall selling trend. The strategy remains to sell high and be bearish.

Fundamental Analysis:

Today, focus on the ADP employment data and the EIA crude oil inventory data. The key news will be the interest rate results during the US trading session, along with speeches.

Trading Recommendations:

Crude oil: Sell around 70.20, target 65.00-64.00

Crude oil starts to rise, are you ready?

💡Message Strategy

Oil prices continued their upward trend amid rising geopolitical risks. US President Trump recently issued a tough statement, demanding Russia end the conflict with Ukraine within 10 to 12 days or face secondary sanctions.

Fears that Russian crude oil exports might be disrupted pushed Brent crude oil prices close to $70 per barrel, marking their largest single-day gain in two weeks at 2.3%. Meanwhile, US West Texas Intermediate (WTI) crude oil prices also remained stable around $67.

The intertwined uncertainties of geopolitics and trade policy have complicated market sentiment. Besides the situation between Russia and Ukraine, investors are closely watching the August 1st trade policy deadline set by the United States and the upcoming OPEC+ meeting in early August, which will determine its September crude oil production increase plan.

The industry generally expects that despite tight crude oil inventories in some parts of the world and strong peak season consumption in the Northern Hemisphere, if OPEC+ continues to increase production, oversupply pressure will gradually emerge by the end of the year.

📊Technical aspects

From a technical perspective, the daily chart of US crude oil (WTI) shows a modest upward trend. The current price is trading steadily above its 100-day moving average, indicating continued bullish momentum.

The Relative Strength Index (RSI) remains between 55 and 60, remaining within overbought territory, suggesting further upside potential. A successful break above the key resistance level of $68.50 would open up opportunities towards $70.

💰Strategy Package

Long Position:66.50-67.00,SL:65.50,Target:68.50-69.00

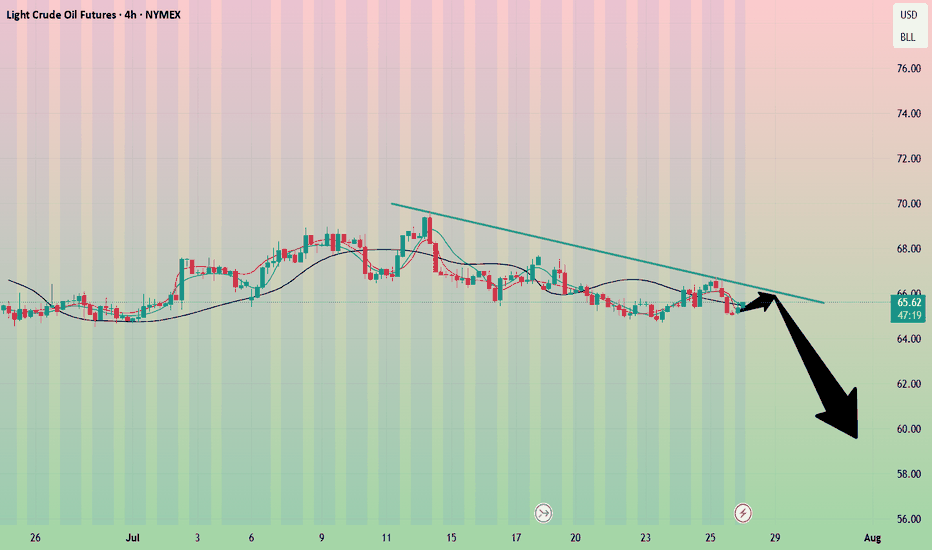

Crude Oil Spikes - Russia / Ukraine / USA sanction? Concerns about the possibility of tighter global oil supplies are supporting crude prices after President Trump warned of "secondary sanctions" if Russia fails to reach a ceasefire in Ukraine within 10 to 12 days.

These sanctions have absolutely burned the shorts in oil and can cause a 3 bar surge on the daily chart if crude breaks this channel.

Keep you eye on the daily 200 MA...if it holds above we should push higher on crude.

FOMC RATE DECISION TOMORROW - Tune into our live stream.

Oil Market Sentiment Shifts After Trump’s Urgent Warning, but...On June 23, 2025, at 9:35 AM, President Donald J. Trump issued a stark warning via social media:

"EVERYONE, KEEP OIL PRICES DOWN. I’M WATCHING! YOU’RE PLAYING RIGHT INTO THE HANDS OF THE ENEMY. DON’T DO IT!"

Since his post, oil prices experienced a notable bullish impulse. From both fundamental and technical perspectives, the market is now approaching a 16-hour supply zone, which could serve as a potential resistance area.

Additionally, I’ve observed a divergence in trader positioning: non-commercial traders increased their short positions significantly last week, while retail traders remain long. This divergence between price action and non-commercial positions suggests a possible shift in momentum, and I am currently eyeing a short setup.

As always, I encourage traders to conduct their own analysis. The trader featured below operates on the D1 timeframe and focuses on scalping, which can be useful for short-term entries.

Stay cautious and keep an eye on how the market reacts near the identified supply zone.

✅ Please share your thoughts about CL1! in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

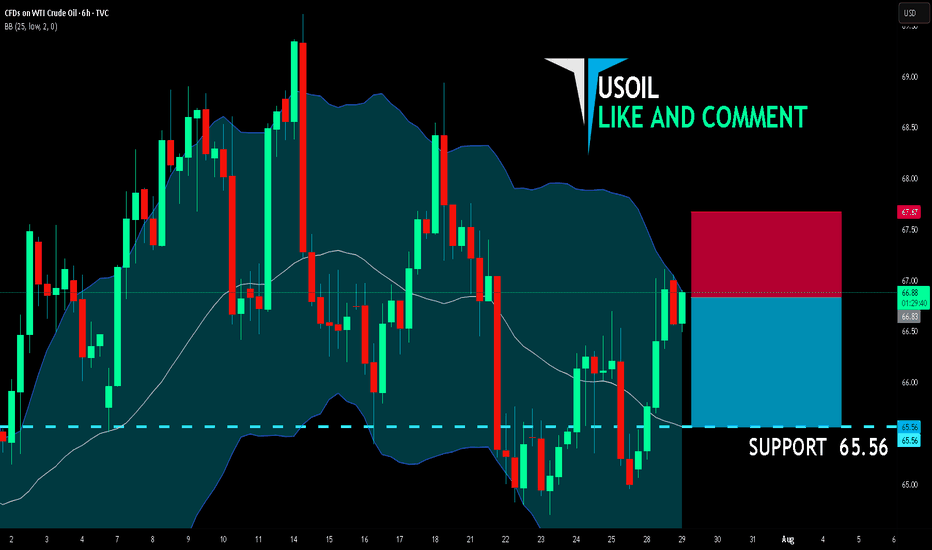

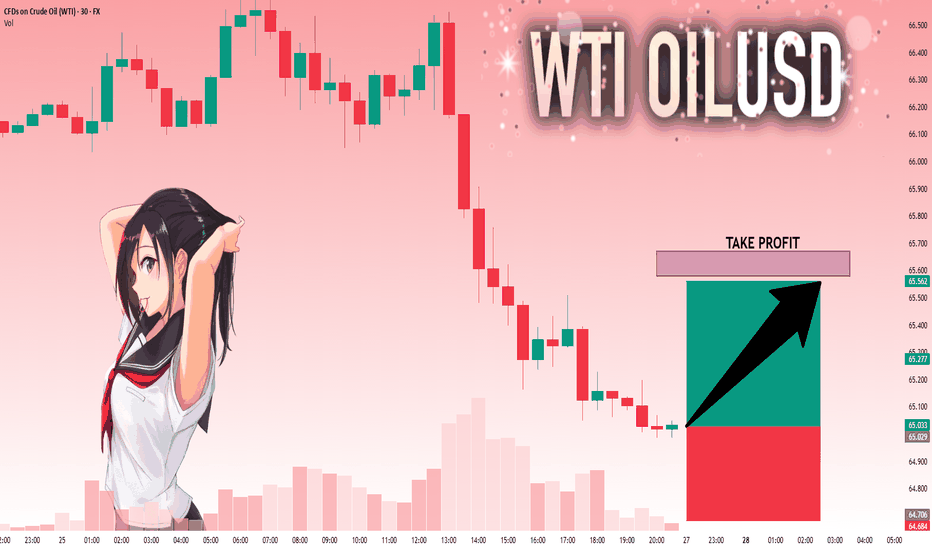

USOIL BEST PLACE TO SELL FROM|SHORT

USOIL SIGNAL

Trade Direction: short

Entry Level: 66.83

Target Level: 65.56

Stop Loss: 67.67

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 6h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

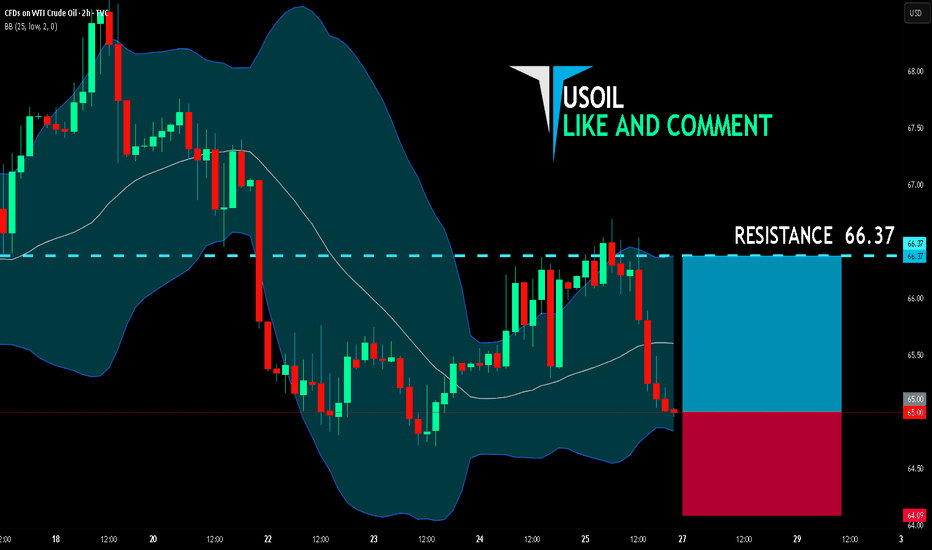

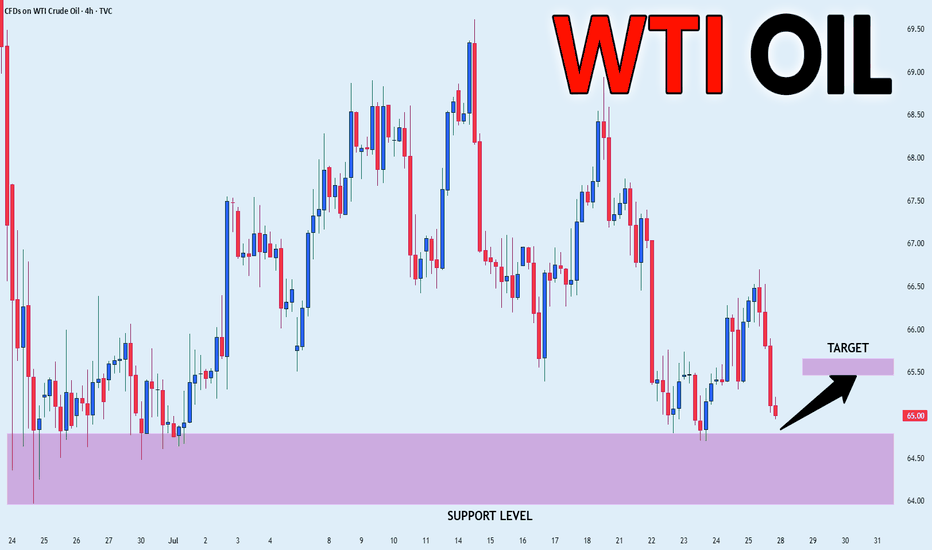

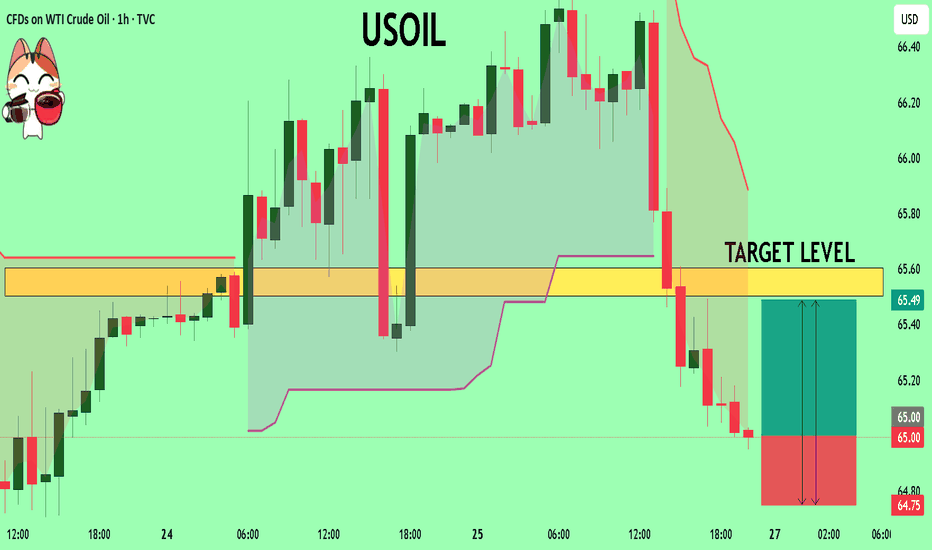

USOIL LONG FROM SUPPORT

USOIL SIGNAL

Trade Direction: long

Entry Level: 65.00

Target Level: 66.37

Stop Loss: 64.09

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 2h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Crude oil-----sell near 67.50, target 65.00-64.00Crude oil market analysis:

The idea of crude oil today is still bearish. Xiaoyang predicts that it will rebound first and then continue to fall. Consider selling near 67.50 if it rebounds. Crude oil is basically weak if it does not stand above 70.00. Crude oil is a repair market after a big drop. In theory, it will continue to fall after the repair. In addition, pay attention to crude oil inventory data later.

Operation suggestions:

Crude oil-----sell near 67.50, target 65.00-64.00

WTI(20250729)Today's AnalysisMarket news:

After gold prices soared to an all-time high of more than $3,500 an ounce in April, the latest report from the Commodity Futures Trading Commission (CFTC) showed that fund managers have increased their bullish bets to the highest level in 16 weeks.

Technical analysis:

Today's buy and sell boundaries:

66.09

Support and resistance levels:

68.13

67.37

66.87

65.30

64.80

64.04

Trading strategy:

If the price breaks through 66.87, consider buying, the first target price is 67.37

If the price breaks through 66.09, consider selling, the first target price is 65.30

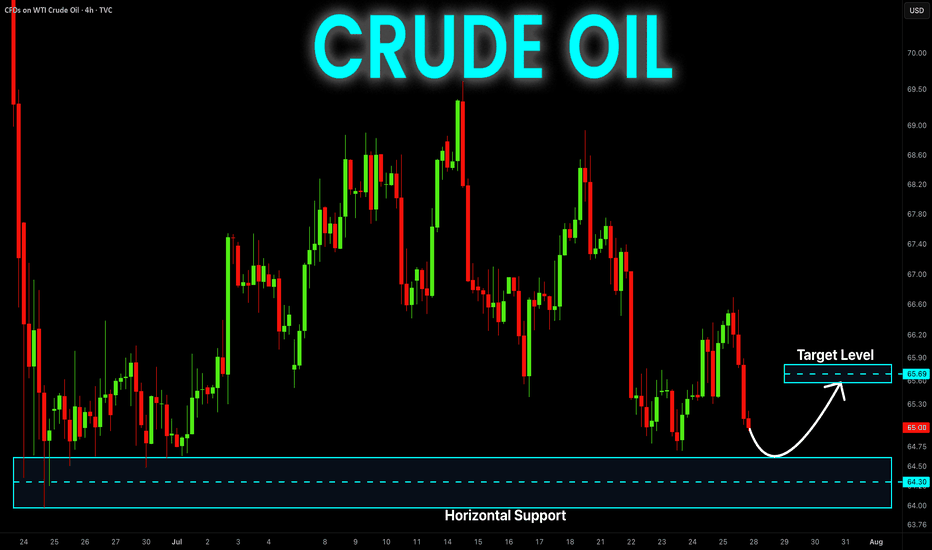

CRUDE OIL Bullish Continuation! Buy!

Hello,Traders!

CRUDE OIL made a rebound

From the support just as

I predicted and the price

Went further still and broke

The key horizontal level

Of 66.50$ and the breakout

Is confirmed so we are

Bullish biased and we will be

Expecting a further bullish

Move up!

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

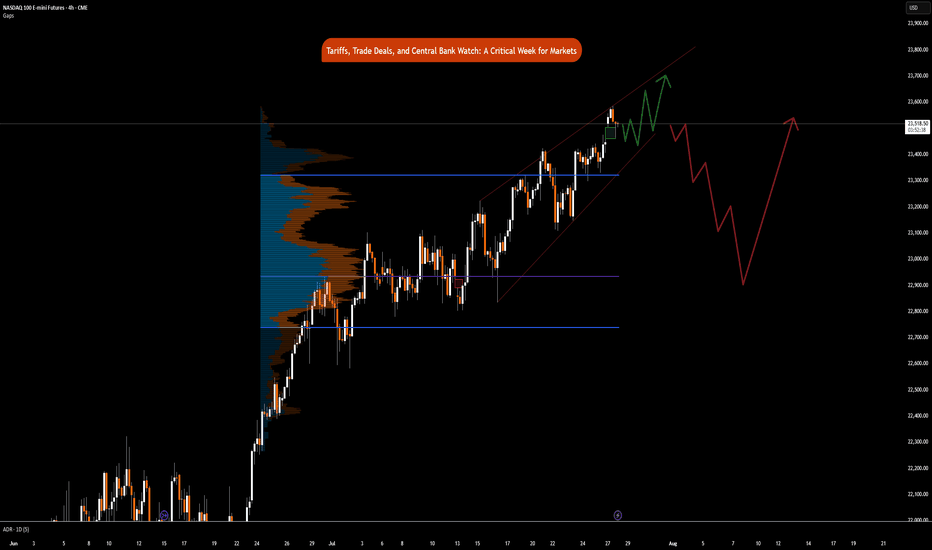

Tariffs, Trade Deals, & Central Bank Watch: Key Week in MarketsCME_MINI:NQ1! CME_MINI:ES1! CME_MINI:MNQ1! COMEX:GC1! CME_MINI:MES1! NYMEX:CL1!

This is a significant week in terms of macroeconomic headlines, key data releases, central bank decisions, and major trade policy developments. We get numbers for growth, inflation and decision and insights into monetary policy. Combining this with ongoing trade policy developments, we have a key week which may shape how the rest of the year unfolds.

Below is a consolidated summary of the latest trade negotiations, scheduled economic releases, and policy outlooks.

US - EU Trade Deal:

• US–EU Tariffs: The US will impose a 15% tariff on most EU goods, including cars, semiconductors, and pharmaceuticals, but retain a 50% tariff on steel and aluminium with a new quota system.

• Exemptions: Zero-for-zero tariffs agreed for agriculture, aircraft parts, and chemicals; aircraft exports are temporarily exempt.

• EU Commitments: The EU will invest $600 billion in the US and purchase $750 billion in US energy, mainly LNG.

• Agriculture: The EU will lower tariffs on many US agricultural goods, though not comprehensively.

• Political Reactions: EU leaders are mixed, Germany and the Netherlands praised the deal, France called it unbalanced, and Hungary viewed it unfavorably.

• The deal is not final until it is ratified by all EU national parliaments and the EU Parliament.

China Talks: US and China expected to extend their trade truce by 90 days. US-China meeting expected in Stockholm on Monday and Tuesday. Trump to freeze export controls to secure a deal. A group of US executives will visit China for trade discussions, organized by the US-China Business Council.

South Korea Trade Talks: Korea proposes a shipbuilding partnership with the US and is preparing a trade package.

UK–US Relations: PM Starmer and Trump to meet in Scotland to discuss the UK–US trade deal implementation, Middle East ceasefire, and pressure on Russia.

Thus far, the US has announced trade deals with the UK, Vietnam, Philippines, Indonesia, Japan and The EU. Trade delegations are working to finalize deals with China, Mexico, Canada

Key Economic Data Releases:

Monday: Treasury refunding financing estimates.

Supply: 2-Year and 5-Year Note Auction, 3 & 6-Month Bill Auction

Tuesday: US Advance Goods Trade Balance, Wholesale Inventories Advance, CB Consumer Confidence, JOLTS Job Opening (Jun), Atlanta Fed GDPNow, Australian CPI Q2

Supply: 7-Year Note Auction

Wednesday: German GDP Q2, EUR GDP Q2, US ADP Non-farm Employment, US GDP Q2, Crude Oil Inventories, Chinese Manufacturing PMI

Canada: BoC Interest Rate Decision, Rate Statement, Monterey Policy Report, BoC Press Conference

US: Fed Interest Rate Decision,FOMC Statement, Fed Press Conference.

Japan: BoJ Interest Rate Decision, Monetary Policy Statement

Thursday: EU Unemployment (Jun), US PCE & Core PCE Price Index (Jun)

Japan: BoJ Press Conference

Friday: EU CPI, US NFP, Unemployment Rate, Average Hourly Earnings, ISM Manufacturing PMI, Michigan 1-Year & 5-Year Inflation Expectations.

It is also a busy earnings week. See here for a complete earnings schedule .

Markets are interpreting trade deals as positive news thus far. The dollar is strengthening.

As we previously mentioned, we anticipate no rate cuts this year as economic data proves to be resilient and inflation largely under control. WSJ also posted an article stating that most tariffs costs are being absorbed by companies due to weaker pricing power. We previously wrote about this on our blog: “ In our analysis, the inflation impact of tariffs may not show up until Q4 2025 or early 2026, as tariff threats are mostly used as a lever to negotiate deals. While effective tariff rates have increased, as Trump reshapes how tariffs are viewed, cost pass-through to consumers will be limited in Q3 2025, as companies’ front-loaded inventory helps mitigate the risks of increased tariff exposure.

So, what we have is an interesting development shaping up where, while inflation may rise and remain sticky, it is yet to be seen whether slowing consumer spending will weaken enough to the point where companies must start offering discounts, which would nullify the tariff risk to the end consumer and result in companies absorbing all tariffs. This scenario will see reduced earnings margins leading into the last quarter and early 2026. However, it will materially reduce risks of higher inflation.”

In our view, the US dollar has a higher probability to rally in the short-term i.e., Q3 as markets re-align FX rate differentials. Bond yields stabilize, Equities continue pushing higher, while Gold retraces as previously mentioned. This in our view, is what investors and participants refer to as the Goldilocks scenario. If this plays out as expected we anticipate continued strength with AI, tech, energy and defense sectors outperforming into mid- 2026.

Institutional View: Morgan Stanley

Morgan Stanley also sees no rate cuts in 2025, despite market pricing for two 25 bps cuts. They forecast more aggressive cuts in 2026 due to:

• Tariff-related inflation emerging before labor market deterioration

• Slowing US growth, as fiscal support fades

• Impact of tighter immigration policy and global trade realignment

That said, MS continues to cite longer-term risks to the dollar, including:

• Twin deficits (fiscal + current account)

• Ongoing debate around USD’s safe haven status

• USD hedging activity picking up by international investors

• Strained credibility of the Fed due to tension between Fed Chair and the US Administration

How Fed policy evolves in Q4 2025 and Q1 2026 will depend heavily on the incoming Fed Chair nominee, who is expected to replace Jerome Powell in May 2026. This nomination could significantly influence future policy direction around growth and inflation targets.

Market Analysis: Oil Prices Ease – Market Awaits Fresh CatalystMarket Analysis: Oil Prices Ease – Market Awaits Fresh Catalyst

WTI crude oil is also down and remains at risk of more losses below $64.60.

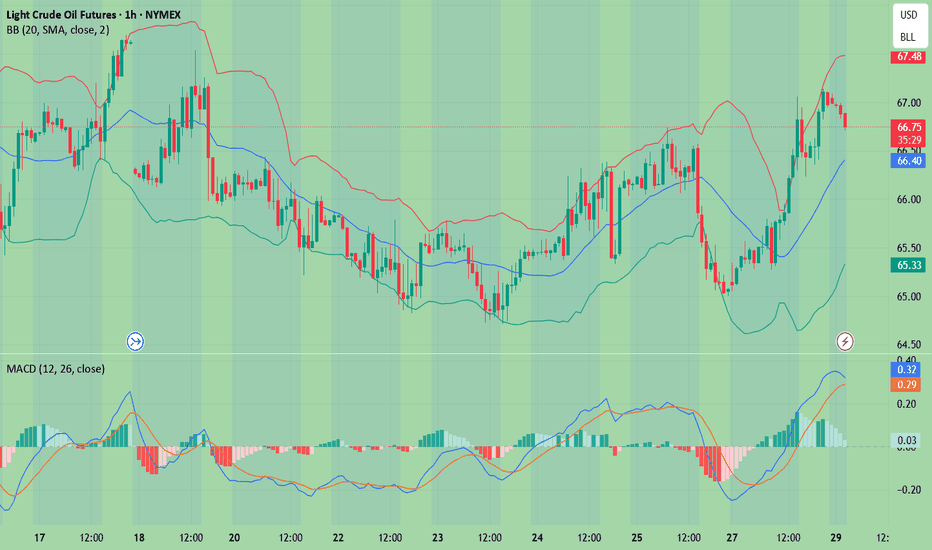

Important Takeaways for WTI Crude Oil Price Analysis Today

- WTI crude oil price continued to decline below the $66.00 support zone.

- It traded below a connecting bullish trend line with support at $65.60 on the hourly chart of XTI/USD at FXOpen.

WTI Crude Oil Price Technical Analysis

On the hourly chart of WTI crude oil at FXOpen, the price struggled to continue higher above $67.50. The price formed a short-term top and started a fresh decline below $66.00.

There was a steady decline below the $65.80 pivot level. The bears even pushed the price below $65.00 and the 50-hour simple moving average. The price traded below a connecting bullish trend line with support at $65.60.

Finally, the price tested the $64.75 zone. The recent swing low was formed near $64.73, and the price is now consolidating losses. On the upside, immediate resistance is near the $65.60 zone. It is close to the 50% Fib retracement level of the downward move from the $66.42 swing high to the $64.73 low.

The main resistance is $65.80. A clear move above it could send the price towards $66.40. The next key resistance is near $67.50. If the price climbs further higher, it could face resistance near $70.00. Any more gains might send the price towards the $72.00 level.

Immediate support is near the $64.60 level. The next major support on the WTI crude oil chart is near $63.20. If there is a downside break, the price might decline towards $60.00. Any more losses may perhaps open the doors for a move toward the $55.00 support zone.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

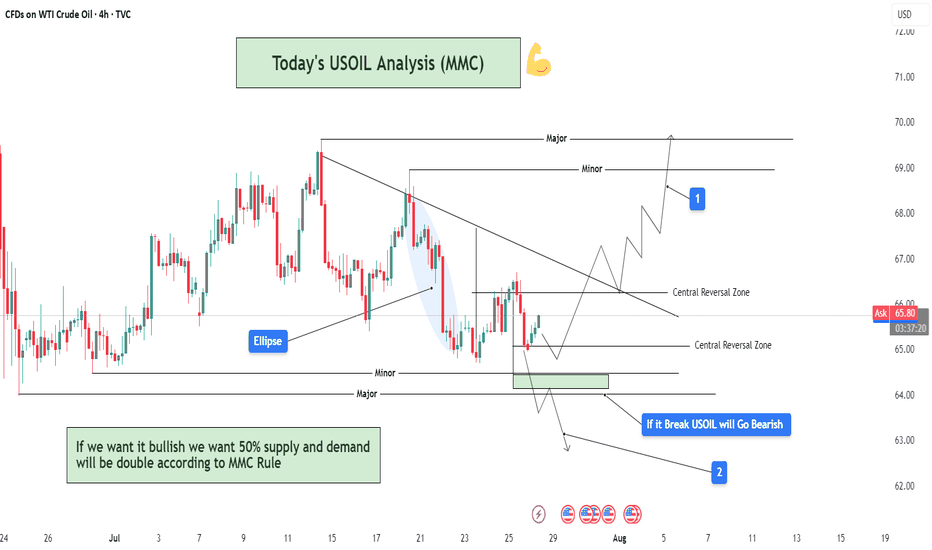

USOIL Analysis : MMC Bullish Setup Building on USOIL – Target🧠 Introduction & Trade Philosophy

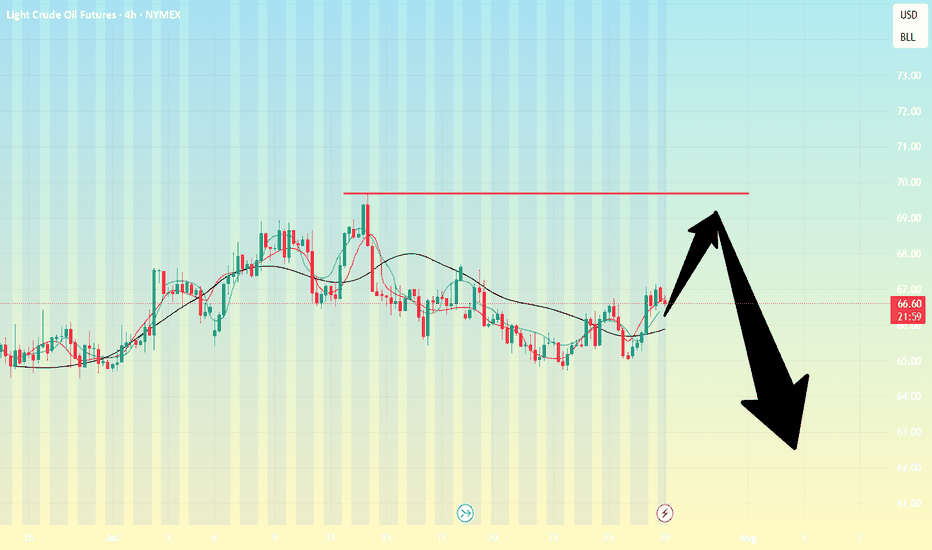

In today’s 4H USOIL chart analysis, we are at a critical decision-making zone, where price action is preparing to make a major move in either direction, based on the response to a central demand zone. We are applying the MMC Rule, which emphasizes mirroring supply-demand behavior and validating market moves through structural confirmation.

The current price structure presents a classic MMC scenario, where price must either confirm a bullish double demand reaction or invalidate the setup by breaking the key zone and moving bearish.

📍 Chart Structure Explained

🔷 1. Central Reversal Zones (CRZs)

There are two CRZs highlighted:

The upper CRZ around 65.90–66.20, where price was previously rejected.

The lower CRZ, where price is currently consolidating, is around 64.80–65.50.

These zones are liquidity-rich areas where big players react—either by absorbing positions or driving directional moves.

🟢 2. Bullish Scenario – MMC Rule In Play (Path 1)

"If we want it bullish, we want 50% supply and demand will be double according to MMC Rule"

According to MMC, a bullish move must be confirmed by a strong reaction from demand, showing double the pressure of the last bearish move. Here's how that plays out:

Price respects the lower CRZ, bouncing near the 65.00 mark.

If this bounce gains momentum and breaks above the trendline resistance, the first target is the minor resistance at $69.00, followed by the major resistance zone near $70.50–$71.00.

A retest of broken structure, followed by bullish continuation, is expected. This is marked with the white zigzag projection labeled as “1” on the chart.

Watch for a clear higher high formation, which would indicate a shift in structure and validate bullish momentum.

🔻 3. Bearish Scenario – Breakdown Confirmation (Path 2)

"If it breaks, USOIL will go bearish"

If price fails to hold the current demand and closes below $64.80–64.50, it signals that demand has been absorbed, and MMC reversal has failed. In that case:

A clean breakdown below the demand zone will confirm bearish control.

The next downside target becomes $62.00, as labeled “2” on the chart.

The downward move is likely to follow a steep path as marked with the sharp downward trendline extension, especially if supported by volume and news catalysts.

🔄 Mirror Concept Highlight – Ellipse Area

The ellipse shape on the chart marks a previous compression zone followed by a breakout. This area represents an imbalance in supply that led to a sell-off. The MMC principle suggests the market tends to mirror these zones—if that was previous supply, and the current demand zone mirrors its positioning and structure, we can anticipate a similar reaction, but to the upside.

This is where the "50% double reaction" rule comes in—demand needs to show twice the strength to overcome the previous sell-side pressure.

🔧 Technical Levels Summary

Zone Type Price Range Notes

Major Resistance 70.50 – 71.00 Final target if bullish scenario plays out

Minor Resistance 68.80 – 69.20 First bullish checkpoint

Upper CRZ 65.90 – 66.20 Key structure to break for bulls

Lower CRZ (Support) 64.80 – 65.50 Demand base for bullish setup

Bearish Target Zone 62.00 – 61.80 Projected zone if support breaks

🧭 Trader’s Mindset & Risk Notes (MMC Style)

Wait for clear confirmation and price behavior near the CRZs before entering.

Use trendline breaks, candlestick confirmation, and volume to validate direction.

Avoid guessing the direction—let price tell the story.

Stick to MMC rules: No confirmation, no position.

✅ Bullish Criteria Checklist:

✔️ Price respects lower CRZ

✔️ Breakout above trendline

✔️ Closes above $66.20

✔️ Higher highs + strong bullish candles

✔️ MMC Double Demand Reaction Confirmed

❌ Bearish Breakdown Triggers:

❌ Breaks below $64.50

❌ Weak bounce + lower highs

❌ Volume increases on downside

❌ Clean breakdown structure

🚀 Trade Plan & Outlook

We’re now at a critical zone where market sentiment will soon be clear. Based on your MMC analysis, the bias remains bullish as long as price holds above $64.80. Be patient and let the setup complete with structure confirmation.

This is not just a technical play—it's a psychological zone, where institutional traders also make decisions. Follow the MMC logic and react with confirmation.

Crude oil-----sell near 67.00, target 65.00-63.00Crude oil market direction:

The recent daily crude oil line has been hovering, and it feels like it is falling or not falling. The daily crude oil line is still bearish. Let's continue to sell it on the rebound. For crude oil today, we focus on the suppression of 67.00. Consider selling it at this rebound position. The daily crude oil line needs to break the 64.00 position to see real selling force, otherwise it is a repair shock with a very small amplitude.

Fundamental analysis:

The latest news is that the United States and the European Union have reached a 15% tariff agreement, which overall supports the US dollar and suppresses gold. In addition, this week, pay attention to ADP employment data, non-agricultural employment data, and the Federal Reserve's interest rate decision and speech.

Operation suggestions:

Crude oil-----sell near 67.00, target 65.00-63.00

CRUDE OIL REBOUND AHEAD|LONG|

✅CRUDE OIL is going down now

But a strong support level is ahead at 64.69$

Thus I am expecting a rebound

And a move up towards the target of 65.50$

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

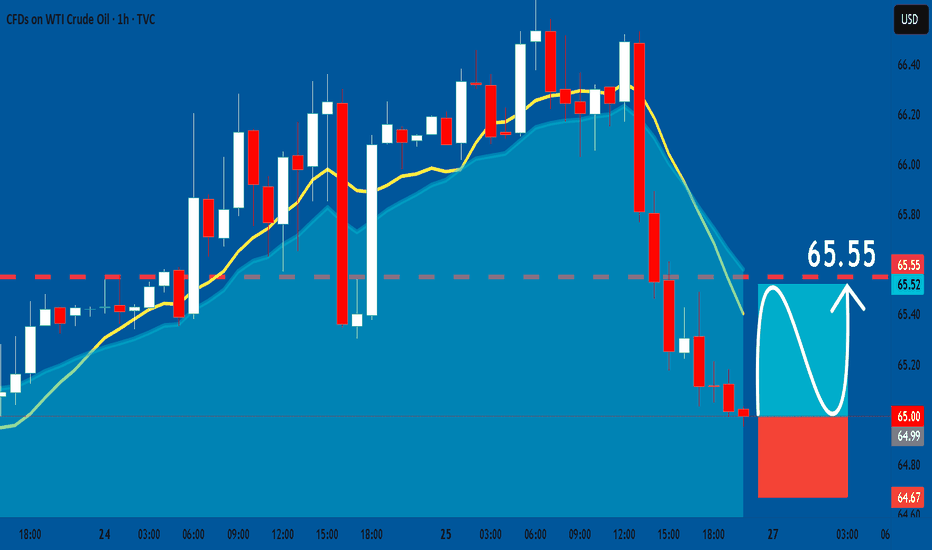

USOIL: Long Trade with Entry/SL/TP

USOIL

- Classic bullish setup

- Our team expects bullish continuation

SUGGESTED TRADE:

Swing Trade

Long USOIL

Entry Point - 65.00

Stop Loss - 64.67

Take Profit - 65.55

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

CRUDE OIL Risky Long! Buy!

Hello,Traders!

CRUDE OIL will soon hit

A horizontal support

Of 64.50$ and as it is

A strong level we will be

Expecting a local bullish

Rebound on Monday

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USOIL: Next Move Is Up! Long!

My dear friends,

Today we will analyse USOIL together☺️

The market is at an inflection zone and price has now reached an area around 65.029 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move up so we can enter on confirmation, and target the next key level of 65.579.Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

USOIL My Opinion! BUY!

My dear friends,

Please, find my technical outlook for USOIL below:

The instrument tests an important psychological level 65.00

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 65.50

Recommended Stop Loss - 64.75

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK