USOIL: Long Trade with Entry/SL/TP

USOIL

- Classic bullish formation

- Our team expects growth

SUGGESTED TRADE:

Swing Trade

Buy USOIL

Entry Level - 62.27

Sl - 60.60

Tp - 65.58

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Oil

Crude OIL CRASH - OPEC & Trump - Recession Catalyst#Recession is here, Markets are bleeding.

Crude #Oil is the kicker.

I shorted TVC:USOIL on Friday.

Hunting on this trade for a while now.

Very #Bearish outlook on #WTI.

MARKETSCOM:OIL Weekly

#FundamentalAnalysis

- #OPEC+ Output Hike (411K bpd)

- #Trump #Tariffs & #TradeWar

I'm looking at a #CrudeOIL #MarketCrash, similar to the #Covid era, when NYMEX:CL1! went in minus on #Nymex #Futures.

TVC:USOIL & my BIG SHORT

#Trading EASYMARKETS:OILUSD via CFDs with #Leverage.

Executed my #Sell Position on #WTI at $64.

* DYOR before, it's not a financial advice, I just share.

#TechnicalAnalysis

- #ElliottWave Impulse Cycle a (white)

- #Correction in Primary ABC (red)

- #LeadingDiagonal in Primary A (red)

- #Descending Triangle in Primary B (red)

Why will BLACKBULL:WTI Crash?

#Bearish Primary C (red) has started.

#Break-out below the Triangle Flat Line.

Important Note:

The #Bearish #Impulse will continue lower.

After the short-lived pull-back, Sellers will dominate.

$63-64 Range is the Entry.

MARKETSCOM:OIL Daily

TVC:USOIL #Short #TradeSignal

- Entry @ $63-64 Range

- SL @ $73

- TP1 @ $40

- TP2 @ $30

- TP3 @ $20

Stay in the green and many pips ahead!

Richard (Wave Jedi)

USOIL Will Move Higher! Buy!

Here is our detailed technical review for USOIL.

Time Frame: 6h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a significant support area 62.526.

The underlined horizontal cluster clearly indicates a highly probable bullish movement with target 65.043 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

USOIL BEST PLACE TO BUY FROM|LONG

USOIL SIGNAL

Trade Direction: long

Entry Level: 62.31

Target Level: 71.18

Stop Loss: 56.40

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Analysis of oil prices in the next six months to one yearThe oil chart indicates that prices are likely to see lower numbers. The United States may intend to take a series of actions to keep oil prices down in order to alleviate some inflationary pressure, which could stem from the trade war and also from military conflicts involving the U.S.

From the chart, it can be inferred that in the medium term, prices might fluctuate between $55 and $69, but there is also the possibility of a correction down to around $43. This would benefit industrialized countries that consume oil, helping their economies become somewhat more resilient to the impending stagflationary shock worldwide.

XTI/USD "WTI LIGHT CRUDE OIL" Energy Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XTI/USD "WTI LIGHT CRUDE OIL" Energy market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Buy above (68.00) then make your move - Bullish profits await!"

however I advise to placing the Buy Stop Orders above the breakout Level (or) placing the Buy limit orders within a 15 or 30 minute timeframe, Entry from the most Recent or Swing low or high level should be in retest.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 4H timeframe (66.00) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

🏴☠️Primary Target - 71.00 (or) Escape Before the Target

🏴☠️Secondary Target - 74.00 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

🛢️ XTI/USD "WTI LIGHT CRUDE OIL" Energy Market is currently experiencing a neutral trend (high chance to bullishness),., driven by several key factors.

📰🗞️Read the Fundamental, Macro Economics, COT Report, Seasonal Factors, Intermarket Analysis, Inventory and Storage Analysis, Sentimental Outlook, Future trend predict.

Before start the heist plan read it.👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

XTI/USD "WTI Crude Oil" Energy Market Heist Plan (Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XTI/USD "WTI Light Crude Oil" Energy Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk ATR Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (71.000) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low level Using the 1H timeframe (68.500) Day / scalping trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 73.500 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

🛢🔥XTI/USD "WTI Light Crude Oil" Energy Market Heist Plan (Day/Scalping Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Inventory and Storage Analysis, Seasonal Factors, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

XTI/USD "WTI Crude Oil" Energy Market Heist Plan (Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XTI/USD "WTI Light Crude Oil" Energy Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Yellow MA Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

Stop Loss 🛑:

Thief SL placed at the recent/swing low level Using the 1H timeframe (68.00) Day / scalping trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 70.90 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

🛢🔥XTI/USD "WTI Light Crude Oil" Energy Market Heist Plan (Day/Scalping Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Inventory and Storage Analysis, Seasonal Factors, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

USOILSPOT "WTI CRUDE OIL" Energy Market Heist Plan (Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USOILSPOT "WTI CRUDE OIL" Energy market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Buy above (68.000) then make your move - Bullish profits await!"

however I advise to placing the Buy Stop Orders above the breakout Level (or) placing the Buy limit orders within a 15 or 30 minute timeframe, Entry from the most Recent or Swing low or high level should be in retest.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 30mins timeframe (66.00) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

🏴☠️Primary Target - 70.000 (or) Escape Before the Target

🏴☠️Secondary Target - 72.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

🛢️ USOILSPOT "WTI CRUDE OIL" Energy Market Heist Plan (Day Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Read the Fundamental, Macro Economics, COT Report, Seasonal Factors, Intermarket Analysis, Inventory and Storage Analysis, Sentimental Outlook, Future trend predict.

Before start the heist plan read it.👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

WTI , road map on high time frame

"Hello traders, focusing on WTI on high time frames, this analysis is based on the liquidity concept. Observing the chart, the price has surpassed the $69 level, which was significant for institutional orders. Consequently, I anticipate a decline towards lower prices. In my view, the next potential level could be around $64."

If you have any specific questions or require further assistance with your message, feel free to let me know!

Oil in a multi-week declining triangle patternPYTH:USOILSPOT

Oil has been in a multi-week declining triangle pattern, lasting over 2 years so far, which will eventually break to the downside. When it does, the price target should be around $35 USD. Which is calculated subtracting the width of the triangle from the base of the triangle.

When? Probably when we have a stock market crash, which could be soon. Fundamentally speaking, a global recession should reduce global demand for crude oil. Also, a resolution of the Ukraine-Rusia conflict should increase global supply of crude oil.

Good luck to you

Agape ATP's $24 Billion Breakthrough! In a market landscape clouded by macroeconomic uncertainty and weakening sentiment, Agape ATP Corporation (NASDAQ: ATPC) has emerged as a countercyclical outlier with its recent announcement of two landmark Sales and Purchase Agreements (SPAs) worth approximately USD 24 billion. Signed with Swiss One Oil & Gas AG, these agreements mark a bold step forward for ATPC, setting the stage for an ambitious entry into the refined fuels distribution market on a global scale.

The SPAs follow a successful Initial Corporate Purchase Order (ICPO) completed in February 2025, which served as a proving ground for initial trial shipments. Under the terms of the agreements, ATPC will initially supply 200,000 metric tonnes of EN590 10PPM diesel and 2 million barrels of Jet Fuel A1 in March 2025. Following successful execution of this validation phase, the contracts are structured to scale rapidly to weekly deliveries of 500,000 metric tonnes of diesel and 2 million barrels of Jet Fuel A1 — an exponential increase that underscores the strategic ambition of both parties.

All deliveries will be conducted using Free on Board (FOB) procedures at major international ports, with product quality certified by SGS or equivalent agencies in accordance with ASTM/IP standards. This not only enhances transparency and credibility but also signals ATPC's commitment to international compliance and operational rigour.

What makes this deal truly transformative is the sheer scale of the undertaking. If executed to full potential, weekly deliveries of 2 million barrels of jet fuel would translate into an annual supply of roughly 104 million barrels — equivalent to around 2% of total annual U.S. jet fuel consumption. Such volume would position ATPC as a serious contender within the global energy trade ecosystem, shifting its profile from a relatively obscure player to a recognisable force in refined fuel logistics and supply.

The structural staging of the agreement — trial, validation, then full-scale execution — reveals a commercially astute strategy. It reduces upfront risk and capital exposure while providing room for operational ramp-up and systems optimisation. However, the magnitude of the weekly delivery requirements suggests that ATPC must urgently enhance its logistical capabilities, secure dependable supply sources, and establish robust quality assurance and compliance frameworks.

From a financial standpoint, the implications are staggering. The USD 24 billion value of the agreements stands in stark contrast to ATPC's current market capitalisation of just USD 5.17 million — a disconnect representing a multiple of over 4,600 times. While such disparity is not uncommon in early-stage high-growth stories, it highlights the importance of scrutinising the company’s readiness to scale operationally and financially.

Under FOB terms, ATPC will bear the cost of acquiring and transporting the fuel to the port of loading, thereby requiring significant working capital. Timely financing and cash flow management will be paramount, especially as delivery volume scales. Questions surrounding margin structure, procurement reliability, and commodity price hedging strategies will need to be addressed to fully appreciate the risk-return profile of this venture.

Yet, amid broader market softness and investor caution, ATPC’s bold strategic execution stands out. If the company successfully navigates the complex logistics, financial demands, and operational scale-up, this agreement has the potential to redefine its financial trajectory and long-term shareholder value.

In an era where execution is everything, Agape ATP’s audacious move could very well prove prescient. Investors will be watching closely — not just for signs of progress, but for proof of delivery.

Article inspired by Stock Titan.

Today analysis for Nasdaq, Oil, and GoldNasdaq

The Nasdaq closed sharply lower due to the aftermath of tariff impositions. Following a significant gap-down, the index broke below the lower Bollinger Band, intensifying selling pressure. Yesterday’s bearish candlestick confirmed a sell signal, leading to an expanded third wave of selling. The index has now reached the previous support zone near 18,500, with additional volatility expected due to today’s Non-Farm Payrolls (NFP) report and Fed Chair Powell’s speech.

On the monthly chart, the Nasdaq is forming a lower shadow around the 20-month moving average. Given the sharp decline, if further selling occurs, oversold conditions may trigger a strong rebound, making it risky to chase shorts at this stage. The 240-minute chart also shows a sell signal, with heavy selling pressure continuing. However, this is a risky zone to enter new short positions, so it's advisable to monitor short-term price movements before making a move.

Regardless of whether you take long or short positions, due to high volatility, make sure to set stop-loss levels and adjust leverage to a manageable risk level.

Additionally, the VIX surged, forming a large bullish candle and reaching its March 11 high. With the VIX in an uptrend and a buy signal appearing, further volatility expansion is likely. However, since it has reached a key resistance zone, a short-term pullback in the VIX could allow for a Nasdaq rebound. For the VIX to break above its previous high, a period of consolidation may be necessary. Given the strong buying momentum on both the weekly and monthly charts, this should be taken into consideration when forming a trading strategy.

Crude Oil

Crude oil plunged following the OPEC meeting, where supply increases became a key issue. While oversupply concerns are a factor, the economic slowdown fears from tariffs have also played a major role in the decline. Previously, $68 was considered a strong support level, but oil collapsed from $72 in a steep decline. The final key support lies around $66.

On the daily chart, the MACD and signal line are converging near the zero line, suggesting that once a new wave begins, it could lead to a strong trend movement. Depending on today's session and Monday’s market, oil could see an aggressive breakout in either direction. Current candlestick patterns indicate that the weekly chart remains bearish, meaning holding long positions over the weekend carries significant risk.

The 240-minute chart also confirms a strong sell signal, with MACD plummeting. Oil may form a temporary sideways range near the $66 support, but if this level breaks, selling pressure could intensify. Ensure you manage stop-loss risks carefully in case of further downside.

Gold

Gold declined, reacting to fluctuations in the U.S. dollar's value. The price failed to hold above $3,200 and dropped below the 5-day moving average. Gold has been in a one-way trend, so a bullish approach remains valid unless it breaks below the 10-day MA. However, it has now entered a range-bound phase, and MACD on the daily chart is nearing the signal line, suggesting potential downside risks. The MACD failed to break its February highs, increasing the likelihood of divergence, which could trigger a strong correction if selling intensifies. With rising market volatility and today's NFP release, further wild swings in gold prices are expected.

The 240-minute chart has shown a sell signal, leading to a sharp decline. However, the price has found support near a key resistance-turned-support zone. Since the MACD and signal line remain above the zero line, gold may continue trading within a range in the short term. On shorter timeframes, candlestick volatility is high, so reducing leverage and widening stop ranges would be a prudent strategy.

During periods of extreme market volatility, technical analysis may become less effective, as market sentiment often overrides chart patterns. As always, trade only within your manageable volatility range. The market is always open, so even if you incur losses, there will always be opportunities to recover. Manage risk wisely, and best of luck with your trades today!

If you like my analysis, please follow me and give it a boost!

For additional strategies for today, check out my profile. Thank you!

WTI / OIL PoV - Break Point 65$ / 62$ / 47$ LONG The price of oil has recently undergone a significant retracement, dropping to its lowest levels in the last three months. This decline has been influenced by several factors, including trade tariff policies and decisions made by OPEC+.

In March 2025, the price of Brent crude fell below $70, touching a low of $69.76, its lowest since September. In New York, West Texas Intermediate (WTI) lost 1.64%, reaching $67.24. New tariffs imposed by the Trump administration on imports from Canada and Mexico have fueled uncertainty about international trade, raising concerns that global economic slowdown might cause oil demand to fall behind supply.

Additionally, OPEC+ decided to increase production by 138,000 barrels per day in April, with the goal of reaching a production level of 2.2 million barrels per day by 2026. This decision contributed to an oversupply that could negatively affect prices, especially if economic growth slows.

Trade tariffs have had a direct impact on the oil market. In February 2025, China imposed a 10% tariff on U.S. crude oil in response to U.S. tariffs, contributing to the drop in oil prices to their lowest levels of the year. Additionally, U.S. crude oil inventories increased beyond expectations, indicating further weakness in demand.

Geopolitical tensions, such as the U.S. proposals to take control of Gaza and the intention to strengthen sanctions on Iran, have added further uncertainty to the market, affecting consumer and investor confidence.

Regarding the price levels you’ve identified for potential purchases, it's important to note that the oil market is influenced by a combination of geopolitical, economic, and supply factors. The support levels at $65, $62, and $57 that you've pointed out may represent significant technical levels, but it’s crucial to monitor geopolitical developments and trade policies that can affect price volatility. It is advisable to consult up-to-date sources and market analysis before making investment decisions.

Hellena | Oil (4H): SHORT to support area 65.268.We need to talk about one important nuance. Many people ask “Hellena, you say you can't buy oil, but it's going up. Well, it is, yes. But all my data and wave markings suggest that the price will soon start a downward movement. There are major changes in geopolitics and I am not in a position to stop them. I just set a stoploss and wait for the trade that will bring me profit.

Now coming to the forecast, I think that the downward movement will start soon, but before it, the price may rise quite high, maybe even to the area of 74.000.

But the main direction is the support area of 65.268.

There are 2 possible ways to enter the trade:

1) Entry at market price.

2) Limit pending sell orders if the price starts an upward movement to the area of 74.484.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

USOIL:Continue to move downwardAfter U.S. President Donald Trump announced tariffs and the OPEC+ decided to increase oil production, concerns about the demand outlook intensified, leading to a significant decline in crude oil prices on Thursday.

The short-term trend of crude oil has dropped sharply, with all the gains since mid-March being given back. The oil price has touched a low near 66. The moving average system diverges downward, and objectively, the short-term trend direction is downward. The bearish momentum is abundant. It is expected that after a minor adjustment at a low level in the intraday trading, the short-term trend of crude oil will mainly continue to move downward.

Trading Strategy:

buy@67.5-68

TP:66-65.5

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

WTI Oil H4 | Potential bearish breakoutWTI oil (USOIL) is falling towards a potential breakout level and it could drop lower from here.

Sell entry is at 66.44 which is a potential breakout level.

Stop loss is at 67.40 which is a level that sits above a pullback resistance.

Take profit is at 65.20 which is a multi-swing-low support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

USOIL LONG SIGNAL|

✅CRUDE OIL fell down sharply

And will soon retest a key wide

Support area around 66.00$

So I think that the pair will make a rebound

Therefore we will be able to enter

A long trade with the TP of 68.20$

And the SL of 65.17$

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

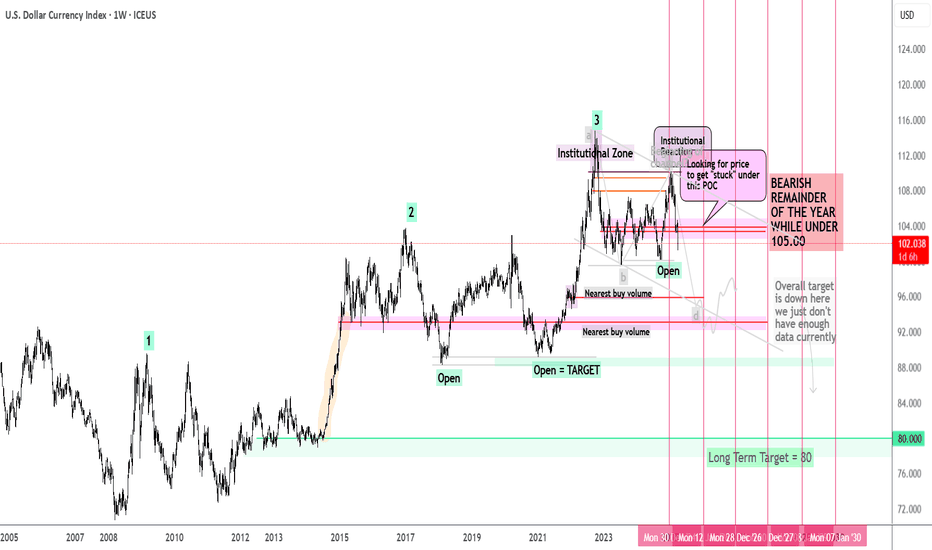

DXY to 80? ...Tariffs the First Domino in a Multi-Year Collapse?This is a pure technical walkthrough of the U.S. Dollar Index—no fluff, no indicators, no fundamentals. Just market structure, smart money, and liquidity concepts.

Back on January 14th , I posted about a potential 20%+ drop in the DXY — you can view it here . This video builds on that thesis and walks you through the full technical story from 1986 to today , including accumulation cycles, yearly trap zones, and my long-term target of 80. Am I crazy? Maybe. Let's see if I can convince you to be crazy too 😜

There is a video breakdown above, and a written breakdown below.

Here are timestamps if you want to jump around the video:

00:00 – The Case for $80: Not as Crazy as It Sounds

02:30 – The 0.786 Curse: Why the Dollar Keeps Faking Out

06:15 – How Smart Money Really Moves: The 4-Phase Playbook

12:30 – The Trap Is Set: Yearly Highs as Liquidity Bait

20:00 – Inside the Mind of the Market: 2010–2025 Unpacked

25:00 – The Bear Channel No One’s Talking About

36:00 – The First Domino: Is the Dollar’s Slide Just Beginning?

👇 If you're a visual learner, scroll down—each chart tells part of the story.

Chart: Monthly View – Three Highs, .786 Retraces, and Trendline Breaks

History doesn’t repeat, but it sure rhymes.

Each major DXY rally has formed a sequence of three swing highs right after a break of trendline structure. In both instances, price retraced to the .786 level on the yearly closes—an often overlooked fib level that institutional players respect.

We’re now sitting at a high again. You’ll notice price has already reversed from that zone. That doesn’t guarantee a collapse, but when we line it up with other confluences (next charts), the probability of a deeper markdown becomes hard to ignore.

I'd also like to note that all of the highlighted moves, are 2-3 year trend runs. Which means if we are bearish, this could be the exact start of a 2-3 bear market.

Market Phases Since 1986

This chart illustrates how DXY has moved through repeating cycles of:

🟡 Accumulation: Smart money building positions quietly.

🔵 Markup: Price accelerates with buy orders + media hype.

🟣 Distribution: Smart money sells to latecomers.

🔴 Markdown: Public panic → smart money reloads.

If we are indeed entering another markdown phase, this would align perfectly with the pattern seen over the past 40 years.

You’ll also notice the "Point of Control" (POC) zones—volume-based magnets that price often returns to. These spots often act as the origin of the move, and as such, they make for strong targets and areas of interest.

Liquidity Zones and Stop Loss Traps

This is where it gets juicy.

The majority of breakout traders placed long entries at the blue lines—above swing highs, thinking resistance was broken. But what’s under those highs? Stop loss clusters.

Institutions use these areas as liquidity harvests.

Several key levels are marked as “OPEN” in this chart, meaning price has yet to return to sweep those orders. That’s why I’m expecting price to begin seeking out that liquidity over the coming months.

There's also an imbalance gap (thin price action) around the 85–86 zone. If price falls into that trap door, there’s nothing to stop it until the 80s.

The 2025 Outlook

Here’s how I’m approaching this year:

✅ Bearish bias under 105

🎯 Targets at 100, 95, and 90

🚪 Trap door under 86 if volume is thin

Price is currently stuck under the recent point of control and showing signs of distribution. If that level continues to hold as resistance, we could see a multi-leg push downward, with the 100 and 95 zones acting as check-in points.

If we break under the 90s and enter the imbalance zone, 80 becomes more than just possible—it becomes probable.

🗣️ Let’s Sharpen Together

Do you see this unfolding the same way?

Do you disagree with the 80 target?

Drop a comment with your view or share your own markup—this is why we trade!

Stay safe,

⚠️ Risk Disclaimer

This post is for educational purposes only and reflects my personal analysis and opinions. It is not financial advice. Trading involves significant risk and may not be suitable for all investors. Always do your own research, manage your risk appropriately, and never trade money you can’t afford to lose.

EDUCATION: The $5 Drop: How Trump’s Tariffs Sent Oil TumblingOil markets don’t move in a vacuum. Politics, trade wars, and global economic shifts all play a role in price action. Case in point: the recent $5 drop in oil prices following Trump’s latest tariff announcement.

What Happened?

Markets reacted swiftly to Trump’s renewed push for tariffs, targeting key trading partners. The result? A ripple effect that sent oil prices tumbling as traders anticipated lower global demand. The logic is simple—higher tariffs slow trade, slowing trade weakens economies, and weaker economies use less oil.

Why It Matters to Traders

For traders, this kind of volatility is both an opportunity and a risk. Sharp price drops like this shake out weak hands while rewarding those who position themselves with clear strategies. If you trade crude oil, understanding the macro picture—beyond just supply and demand—can make or break your positions.

The Next Move

Is this just a knee-jerk reaction, or the start of a larger trend? Smart traders are watching key levels, tracking institutional order flow, and looking for confirmation before making their next move.

How do you react when headlines move the market? Do you panic, or do you position yourself with a plan? Drop a comment and let’s talk strategy.

USOIL BULLS ARE STRONG HERE|LONG

USOIL SIGNAL

Trade Direction: long

Entry Level: 69.37

Target Level: 70.64

Stop Loss: 68.53

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 2h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅