Oil

USOIL Analysis of TodayThe global economic situation has a significant impact on the demand for crude oil.

During periods of economic prosperity, industrial production and transportation activities are frequent, leading to an increase in the demand for crude oil, which in turn drives up the price of USOIL.

For example, during the period of rapid development of emerging economies, the demand for energy was robust. When there is an economic recession, the demand decreases, and the price may drop. Just like after the global financial crisis in 2008, the demand for crude oil plummeted sharply, and the price also crashed accordingly. In terms of supply, the changes in production output of major oil-producing countries are of vital importance.

The adjustment of production capacity and production disruptions in major oil-producing countries such as the United States, Saudi Arabia, and Russia will all affect the global crude oil supply. For instance, the development of the shale oil industry in the United States has significantly increased the country's crude oil production, having a major impact on the global crude oil market supply pattern.

🎁 Buy@66.90 - 67.00

🎁 SL 66.80

🎁 TP 67.15 - 67.20

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad

If you also aspire to achieve financial freedom,Follow the link below to get my daily strategy updates

USOIL:The latest trading strategyThe price of WTI crude oil futures has risen slightly, and the market is currently in the process of bottom - building.

The price briefly broke through last week's high of $67.94, reaching an intraday high of $68.37 before pulling back. The market remains in a "sell - on - rally" mode.

After the higher opening, there is a probability that the crude oil price will stabilize at a lower level. For the subsequent trading strategy, short - selling is worth considering.

USOIL Trading Strategy:

Sell@67.7-68.3

TP:66-65

USOIL Will Go Higher From Support! Long!

Please, check our technical outlook for USOIL.

Time Frame: 12h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a key horizontal level 67.592.

Considering the today's price action, probabilities will be high to see a movement to 71.123.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

USOIL Market Outlook – Key Levels and Scenarios📌 Market Structure

🔹 Key Support Zone (~64.50 - 65.30 USD)

The price has tested this area multiple times, highlighted by the red dashed line at the bottom.

A pronounced lower wick suggests a possible exhaustion of bearish pressure.

🔹 Intermediate Resistance (~68.20 - 70.00 USD)

The price has reacted to this zone, which appears to be a former support turned resistance.

Caution is needed for potential rejections in this range.

🔹 Liquidity and Wider Supply Zone (~75.00 - 80.00 USD)

This area, marked with red/purple gradients, represents a selling zone with a high concentration of orders.

The price could be drawn to this level if the bullish phase continues.

📉 Bearish Scenario

Failure to break above 68.20 - 70.00 USD could lead to a retest of 64.50 - 65.30 USD.

A breakdown below this level could open the way toward 62.40 - 60.00 USD.

📈 Bullish Scenario

A weekly close above 68.20 - 70.00 USD could trigger a recovery toward 75.00 - 77.00 USD.

A breakout above 80.00 USD would invalidate the long-term bearish structure.

🔎 Conclusion:

The price is currently at a critical stage around 68 USD, with potential for a pullback.

Monitoring the reaction between 65.30 - 68.20 USD will be key in determining the next direction.

Volume and macroeconomic factors (OPEC, oil inventories, Fed policies) will be crucial in confirming the trend.

Bearish Structure & Gap Fill Target📊 Crude Oil Market Analysis – Bearish Structure & Gap Fill Target 🚨

📉 Crude oil is showing a bearish candle structure, indicating potential downside.

🔄 Bearish Outlook:

✅ Key Target: Price could drop to $67.31 to fill the gap.

✅ Bearish Confirmation: As long as price remains below the bearish candle formations, the trend stays bearish.

✅ Reversal Trigger: A breakout above the bearish candle structure would invalidate the bearish setup.

📌 Until a breakout occurs, the trend remains bearish! Watch price action closely.

WTI increased slightly and decreased rapidly, downtrend TVC:USOIL prices rose slightly by about 1% in Asian trading on Monday before falling sharply, largely due to the continued US military crackdown on Houthi militias.

US Pete Hegseth said on Sunday that the US military will continue to fight the Houthis until they stop attacking international shipping lanes. The US has previously conducted airstrikes in Yemen, causing casualties among Houthi fighters.

The Houthis have hinted that they could take stronger retaliatory actions, adding to market concerns that the situation in the Red Sea will continue to escalate.

While geopolitical tensions pushed oil prices higher, concerns about global economic growth limited gains.

Goldman Sachs analysts have lowered their oil price forecasts based on the following points:

• The Trump administration’s new tariffs on Mexico and Canada could restrict global trade and lead to lower-than-previously expected US economic growth.

• The slowdown in economic growth will lead to lower oil demand, and Goldman Sachs expects oil demand growth in the coming months to be lower than previously estimated by the market.

• OPEC+ supply could exceed expectations, and while the market is currently focused on the situation in the Middle East, overall supply remains relatively abundant.

• The market expects signs of a slowdown in the US economy to keep oil prices under pressure in the long term, although geopolitical factors could still support prices in the short term. In addition, the market is paying attention to the Federal Reserve's interest rate meeting on March 18-19. The market expects the Fed to keep interest rates unchanged while continuing to assess the impact of the Trump administration's policies on the economy. If the economic outlook continues to deteriorate, the possibility of the Federal Reserve adjusting its policy this year cannot be ruled out.

WTI Crude Oil Technical Outlook Analysis TVC:USOIL

On the daily chart, WTI crude oil is temporarily in the accumulation phase but with the current position and structure, the downtrend is still dominant with the short-term trend being noticed by the price channel, the medium-term by the price channel and the nearest pressure from the EMA21.

The recovery momentum of WTI crude oil is also limited by the 0.50% Fibonacci extension level, and as long as crude oil fails to move above the EMA21 and break above the price channel, it still has a main bearish outlook.

In the short term, the downside target is around $65, the low since September 10, 2024, followed by the 0.786% Fibonacci extension. Notable positions for the WTI crude oil downside trend will be listed again as follows.

Support: $66.63 – $65.33

Resistance: $67.85 – $68.52 – $69.07

#USOIL/WTI 1 DAYUSOIL/WTI (1D Timeframe) Analysis

Market Structure:

The price is currently trading near a key support level, which has previously acted as a strong demand zone. Buyers may step in at this level, leading to a potential reversal or bounce.

Forecast:

A buy opportunity is expected if the price holds above the support level and shows signs of bullish momentum. Confirmation through price action, such as bullish candlestick patterns or increased volume, can strengthen the trade setup.

Key Levels to Watch:

- Entry Zone: Consider buying near the support level if the price confirms a bounce.

- Risk Management:

- Stop Loss: Placed below the support level to manage downside risk.

- Take Profit: Target resistance levels or previous swing highs for potential gains.

Market Sentiment:

If the support level holds, the market sentiment may shift towards the upside, leading to a potential bullish move. However, a breakdown below support could indicate further weakness, requiring reassessment.

#202511 - priceactiontds - weekly update - wti crude oil futuresGood Evening and I hope you are well.

comment: Weekly chart. First green week after 7 consecutive bear weeks. Astonishing eh. Weak bull bar anyhow and sideways is more likely than anything above 70, for now at least. We have now seen higher highs but the 2024-04 highs were not broken and market failed below 80. So the multi-year contraction is still valid. Same for the downside. Lows were not broken for now and bears would need to get below the 2024-09 low to make new ones.

current market cycle: trading range

key levels: 65 - 70

bull case: Bulls have nothing. Still. They need a daily close above 70 to start having arguments again. For now they just stopped new lows after 7 weeks and any bounce is likely to get sold again. Daily 20ema at 68.4 is their next target and above that they could try for 70. Since we made higher lows and lower highs last week, we are obviously in a triangle, which could break on Monday.

Invalidation is below 64.

bear case: Bears needed to take profits and reduce risk at these lows that were previous support. For now I see the chance of another leg down as very low so I don’t have many arguments for the bears. If we close strongly below 65, it opens up 64, then 62 but we have so many previous lows (support) down here, it’s just not a good short trade.

Invalidation is above 71.

short term: Neutral again. No shorts for me down here. Want to see either 70 or 63 next week.

medium-long term - Update from 2025-02-23: Bear trend is getting weaker but I still see this going sideways around 70 instead of a range expansion.

current swing trade: None

chart update: Minor adjustments to the trend lines.

WTI - Weekly Forecast - Technical Analysis & Trading IdeasMidterm forecast:

While the price is above the support 64.000, resumption of uptrend is expected.

We make sure when the resistance at 79.361 breaks.

If the support at 64.000 is broken, the short-term forecast -resumption of uptrend- will be invalid.

TVC:USOIL BLACKBULL:WTI

Technical analysis:

A peak is formed in daily chart at 79.355 on 01/15/2025, so more losses to support(s) 64.900 and minimum to Major Support (64.000) is expected.

Take Profits:

68.354

70.182

72.434

74.449

77.410

79.361

83.961

87.000

93.882

100.802

109.192

126.350

__________________________________________________________________

❤️ If you find this helpful and want more FREE forecasts in TradingView,

. . . . . . . . Hit the 'BOOST' button 👍

. . . . . . . . . . . Drop some feedback in the comments below! (e.g., What did you find most useful? How can we improve?)

🙏 Your support is appreciated!

Now, it's your turn!

Be sure to leave a comment; let us know how you see this opportunity and forecast.

Have a successful week,

ForecastCity Support Team

BRIEFING Week #11 : Are we done ? (nope)Here's your weekly update ! Brought to you each weekend with years of track-record history..

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil

USOIL latest analysis of profitable trading signalsDuring the US trading session on Thursday, US crude oil fell in a narrow range and is currently trading around $67.13 per barrel, holding most of the gains in the previous two trading days. Previously, oil prices had rebounded for two consecutive trading days. The latest monthly report released by the Organization of Petroleum Exporting Countries (OPEC) on Wednesday showed that the organization maintained its forecast for global oil demand growth in 2025 and 2026, which is expected to increase by 1.45 million barrels per day and 1.43 million barrels per day respectively. The current crude oil market is supported by factors such as the decline in US inflation and the recovery of market sentiment in the short term, and prices have rebounded.

Analysis: From the daily chart level, the medium-term trend of crude oil remains in a wide upward channel, and oil prices gradually fall back to the lower edge of the channel. There have been many cases where one trading day swallowed up all the gains in the previous week, and the short-selling forces are more dominant. The medium-term trend of crude oil maintains a range of oscillations and downward, and the lower edge of the channel has been broken. It is expected that the medium-term decline of crude oil will start soon. The short-term trend of crude oil (1H) continues to consolidate at a low level, and the oil price gradually tests from the bottom of the range to the upper edge of the range, with the range range between 68.80-65.20. The short-term objective trend direction is oscillating rhythm. It is expected that the trend of crude oil will be resisted at the upper edge of the range during the day, and the probability of falling back downward is high. On the whole, He Bosheng recommends that the operation strategy of crude oil today is mainly to rebound high and to step on lows as a supplement. The short-term focus on the upper resistance of 68.3-68.8 and the short-term focus on the lower support of 66.0-65.5. FX:USOIL FOREXCOM:USOIL TVC:USOIL

WTI Oil H4 | Rising into an overlap resistanceWTI oil (USOIL) is rising towards an overlap resistance and could potentially reverse off this level to drop lower.

Sell entry is at 68.46 which is an overlap resistance that aligns with the 38.2% Fibonacci retracement.

Stop loss is at 70.70 which is a level that sits above the 61.8% Fibonacci retracement and a multi-swing-high resistance.

Take profit is at 65.20 which is a multi-swing-low support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

WTI OIL Massive 4-year Support hit. Bullish reversal ahead??WTI Oil (USOIL) hit on last week's 1W candle the 1M MA100 (red trend-line), a massive long-term Support level that has been holding since the week of April 26 2021, i.e. almost 4 years.

At the same time, the price entered the 2-year Support Zone, which has produced all major Bullish Phases (green Rectangles) during this time span. The last one got rejected twice on the 1W MA200 (orange trend-line).

Given the fact that this most recent rejection formed the current 2-month Bearish Phase (red Rectangle), which even based on 1W RSI terms, is similar to all previous Bearish Phases that found Support on the 2-year Support Zone, we have a massive long-term Support Cluster in front of us.

Naturally, until the 1W MA200 breaks, that should be the first Target of any buy attempts. As a result, we expect $80.00 to be tested by June 2025 the earliest.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USOIL BEST PLACE TO BUY FROM|LONG

USOIL SIGNAL

Trade Direction: long

Entry Level: 66.90

Target Level: 73.40

Stop Loss: 62.52

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

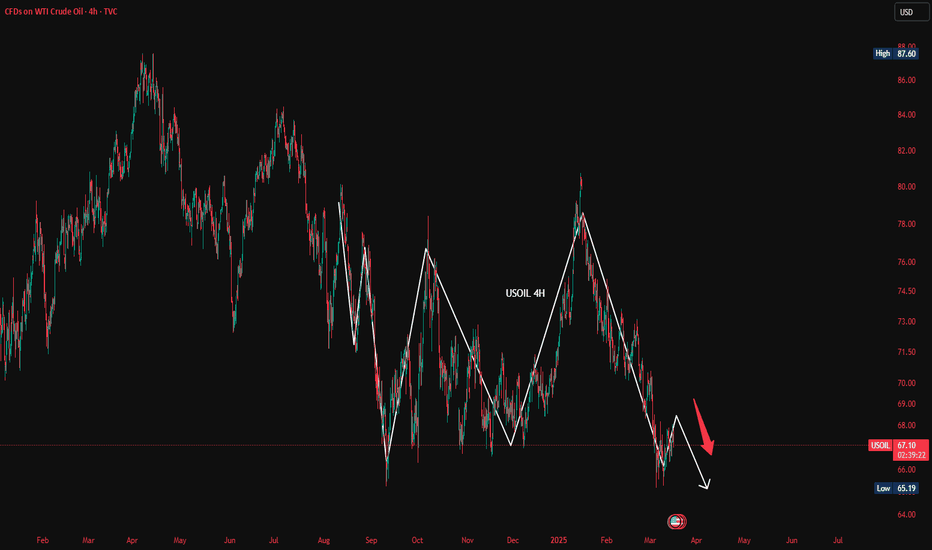

WTI Crude Oil Analysis: Is the Downtrend Still in Play?Welcome back, guys! 👋 I'm Skeptic , and today we’re diving into a quick analysis of WTI Crude Oil (WTI) . Let’s break it down.

📉 4-Hour Time Frame Analysis

In the 4-hour time frame, WTI has shown a very strong corrective move, and despite trying to hold the support zone PRZ, it even failed to maintain it, suggesting a potential downtrend. Now, we have an opportunity to focus more on our short setups, but we’ll need to manage the risk as well.

🔮 Short Setup

For short positions, a break below the 4-hour support at 65.183 would be a good trigger to enter a short position. Place the stop loss just above the broken PRZ, around 67.024 , and keep an eye on price action as a sharp movement down could follow. If the support breaks, we’re likely to see a continuation towards the next support level, so the move could be pretty sharp, but make sure your stop loss is tight to manage risk effectively.

💡 Long Setup

For the long setup, we’ll wait for a potential fake breakout below the support and then look for a return above 67.024 . If we break above the resistance at 67.639 , we’ll look for a possible long continuation. However, since the current trend is bearish, we’ll reduce our risk and wait for confirmation from the 4-hour or daily time frames before entering.

Let me know your thoughts and ideas on WTI! 💬 Drop any questions in the comments, and I’ll be happy to discuss them. Let’s grow together, not alone! 🔥

OIL / WTI PoV - LONGThe analysis of the current oil price highlights the $65/66 range as a critical level for a potential rally. After a period of consolidation and corrections in recent weeks, oil seems to have found strong support around these levels, with prices oscillating between $65 and $66 per barrel. These levels represent an important liquidity zone, as in the past, the price has found support here, suggesting that there could be an opportunity for a bullish rebound if the price manages to remain stable above this threshold.

A rally above the $65/66 level could be supported by several fundamental factors, including improved demand prospects, a reduction in global inventories, and potential policies from OPEC. If demand for oil increases, especially with economic recoveries in certain regions or a rise in industrial production globally, there could be further support for prices. Additionally, OPEC+'s stance in the production-limiting agreement and potential supply cuts could keep the market tight, pushing prices higher.

Geopolitical dynamics also play a significant role in determining the direction of oil. Any tensions or disruptions in supply from key producing countries, such as those in the Middle East, could serve as catalysts for further price increases. Another factor that could support prices is the depreciation of the dollar, which typically benefits oil, as the commodity is priced in dollars.

However, if the price fails to maintain stability above the $65/66 level, we might see a new correction phase, with prices possibly retreating to lower levels. A move away from these levels could mark the beginning of a new bearish phase, with the risk of prices sliding back towards $60 per barrel or even lower if demand weakens or if there are supply excesses in the market.

In summary, the $65/66 level is crucial for the price of oil. Maintaining or closing above these levels could pave the way for a rally, while failure to do so could lead to further price weakening. With OPEC+ policies playing a key role in balancing the market, the next few months will be critical in determining the future direction of oil prices.