OIL: THE CHART THAT COULD TIP THE WORLDWTI Crude just bounced hard off the $65 channel support, tagging resistance at $76 — and what happens next isn’t just about price. It’s about power.

Zoom into this chart:

We're sitting at a directional pivot with two possible outcomes:

1️⃣ If this was a truncated 5th wave, the structure is complete. Any further war escalation could be the catalyst for oil to break resistance — dragging down risk assets, including CRYPTOCAP:BTC and equities.

2️⃣ If wave 5 isn’t done, we’ll likely see one more sharp leg down before oil launches. Either way, this is a high-stakes Elliott Wave setup with global macro consequences.

Chart with FIB Levels:

You'll see the wave I’ve marked (3) is messy, and on lower timeframes, that may hint at a truncated move worth watching.

Why this matters:

Over 20% of global oil flows through the Strait of Hormuz, a critical chokepoint controlled by Iran. If conflict escalates, that line gets squeezed… and oil price explodes.

Price to watch:

$76 resistance.

If oil breaks, the markets will react fast.

If it fails, we might get one more correction and maybe some relief from the sideways pain we’ve seen across risk assets.

Remember the COVID Crash?

Oil literally went below zero in April 2020. That wasn't just a chart anomaly, it was a global demand collapse. Traders were paying to get rid of oil because there was nowhere to store it. That moment marked a generational low, and what followed was a powerful multi-year 5 wave up.

Now look where we are:

That same COVID low helped form the base of the current Elliott Wave structure. The fact we’re back testing levels that once sparked global panic is no coincidence.

If you’ve been here before, you’ll see the signs. The charts always leave traces. And if this is the end of wave 5, it could be the start of a whole new macro move.

TLDR:

Stop trading headlines.

Trade the structure.

This chart is telling us everything.

Oilcrude

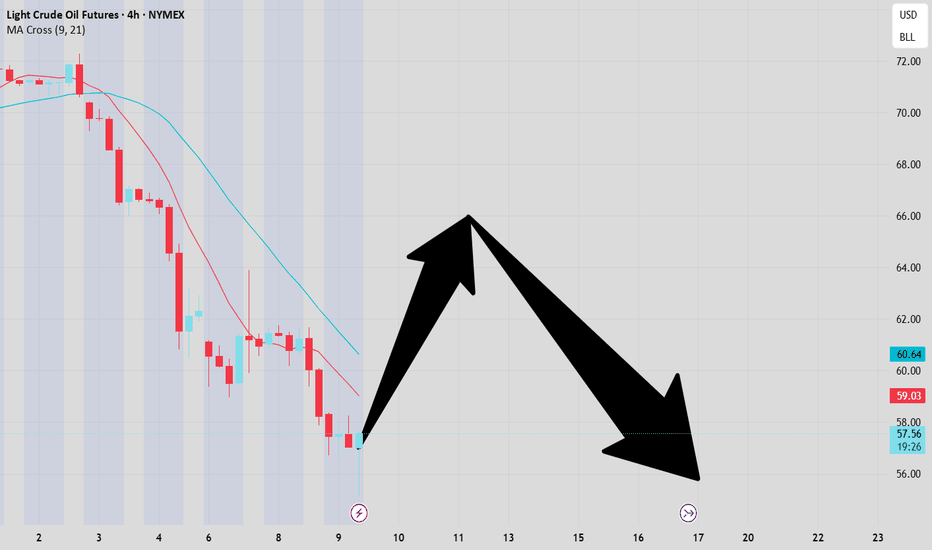

Oil - Short Term Sell Trade Update!!!Hi Traders, on April 17th I shared this idea "Oil - Looking To Sell Pullbacks In The Short Term"

I expected to see bearish continuation until the two Fibonacci resistance zones hold. You can read the full post using the link above.

Price moved lower as per the plan here!!!

Price respected the first Fibonacci resistance zone, created a false break of it and moved lower as expected!!!

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

-------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

"UK Oil Spot/ BRENT" Energy Market Heist Plan (Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "UK Oil Spot/ BRENT" Energy Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk GREEN Zone. It's a Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level for Pullback Entries.

Stop Loss 🛑:

📌Thief SL placed at the nearest/swing High or Low level Using the 4H timeframe (67.500) Day/Swing trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 60.000 (or) Escape Before the Target

💰💵💸"UK Oil Spot/ BRENT" Energy Market Heist Plan (Scalping/Day Trade) is currently experiencing a Bearish trend.., driven by several key factors.👇👇👇

📰🗞️Read the Fundamental, Macro Economics, COT Report, Seasonal Factors, Intermarket Analysis, Inventory and Storage Analysis, Sentimental Outlook, Future trend predict.

Before start the heist plan read it. go ahead to check 👉👉👉🔗🔗🌎🌏🗺

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Crude oil-----Buy near 65.00, target 62.30-60.00Crude oil market analysis:

Recently, crude oil has also fluctuated greatly due to the influence of fundamentals. It started to rise rapidly yesterday, and the daily line closed with a standard big hammer candle pattern. Today, we rely on the 65.20 position to buy. We can also consider buying when it falls back to a small support. Today's crude oil trend is bearish, and short-term buying and selling are both possible. The current fundamentals have basically not changed the selling of crude oil. In addition, there will be EIA crude oil inventory data tonight. Today's crude oil is expected to fluctuate greatly. Consider selling it when it rebounds to 65.00 in the Asian session.

Fundamental analysis:

Tariffs are the biggest fundamentals in the near future, and the market impact is relatively large. Today we focus on CPI data and crude oil inventory data.

Operation suggestions:

Crude oil-----Buy near 65.00, target 62.30-60.00

Crude oil-----sell near 61.00, target 69.00-67.00Crude oil market analysis:

Tariffs have been increased again, and crude oil continues to fall sharply. It is difficult to change the short-term selling of crude oil. In addition, data and fundamentals all suppress it. Today's crude oil can continue to find selling opportunities. The crude oil pattern shows that the possibility of a big rebound is small. We pay attention to the suppression position of its moving average, which has dropped to around 61.80. This position is also the high point of yesterday's rebound. Today's idea will rely on this position to sell it. The first suppression of crude oil is around 59.30, and the strong pressure is 61.80.

Fundamental analysis:

The tariff war continues to affect the market, and buying and selling have begun a big game. We will pay attention to CPI later, and there will be crude oil inventory data today.

Operation suggestions:

Crude oil-----sell near 61.00, target 69.00-67.00

Crude oil---Buy near 70.60, target 71.90-76.00Crude oil market analysis:

Today's crude oil is still bought at a low price, and short-term bulls have started. Yesterday, gold fell in the US market, but did not fall in the Asian market, but repaired at a high level. The strong support of the daily line has reached 70.00, and the small support is 70.50. Today's idea is to find buying opportunities above 71.50. The daily moving average of crude oil is lined up, and there is still a lot of room for growth.

Fundamental analysis:

This week is a data week. Today, pay attention to the ADP employment data, which is the pre-agricultural data.

Operation suggestions:

Crude oil---Buy near 70.60, target 71.90-76.00

Crude oil pays attention to short-term adjustments

Crude oil currently continues to maintain a good oscillatory upward trend along the short-term moving average on the weekly trend. It also maintains a good oscillatory upward trend on the daily trend. Although it has gone out of a slight rise and fall, the strong technical form is still the same.

Nothing has changed. There is a certain degree of divergence in the 4-hour trend. The K-line has begun to gradually break through the short-term moving average. There may be a certain degree of adjustment in the short-term trend.

Crude oil hits new highs, if it falls back, you can go long

At present, due to the intensification of international geopolitical conflicts, market supply concerns have once again heated up. At the same time, manufacturing data in the United States and China have rebounded, and demand-side expectations have increased. The dual benefits on both sides of supply and demand have stimulated the rebound of crude oil. Technically, the continuous positive closing continues to test the upper pressure level. .

In terms of operation, we will focus on the pressure level near 85, and the gradually moving upward support near 82. We will support the bullish trend by stepping back, but do not consider aggressive pursuit of the increase.

Crude oil is short around 84.4, stop loss is 85.2, target is below 82.6

Go long near 82.3, stop loss 81.5, target above 84

Ideas are for reference only. Profit and loss are at your own risk. Investment is risky. Please be cautious when entering the market.

Crude oil pressure is obvious, bulls are cautious

U.S. crude oil inventories continue to rise, and short-term demand concerns have also increased. However, as expectations for U.S. interest rate cuts have increased, the loose atmosphere has given crude oil some support. At the same time, short-term supply-side pressure has increased as geopolitical conflicts intensify.

Crude oil also stretched again after repeated repetitions. Technically, longs and shorts closed alternately. The top still focused on the pressure around 84, but did not chase the rise too much.

Crude oil is focusing on support near 80, how to trade today?

The short-term trend of crude oil (1H) fluctuated and hit new lows, testing the 80 support. The moving average system is arranged in a short position, and the short-term objective trend is downward. Oil prices hit around 80.70, forming a certain recurrence, and their upward strength is relatively weak. It is expected that crude oil will remain volatile in the short term during the day.

Trading strategy: 81.60 short, stop loss: 81.90, target 80.60.Trading strategies are for reference only

USOIL is gettick stuck between $68 and $75Geopolitics in the Red Sea

Tensions in the Red Sea continue to rise, with Iran issuing yet another warning to the U.S. and its allies before expanding the war in the rich-oil-producing region. The warning follows the deployment of an Iranian warship in the Red Sea after the withdrawal of the USS Gerald R. Ford supercarrier from the waters earlier this month. In addition to that, it follows an increasing number of attacks from Houthi rebels on commercial and military ships sailing through this popular trade route, which caused major shipping companies to reroute their ships around the Cape of Good Hope, adding additional cost and time to the shipping. To make things worse, in the past few days, there were multiple reports of attacks from Somalian vessels on commercial ships in other parts of the Middle East. Furthermore, there were reports of over 100 attacks on the U.S. forces in Syria and Iraq since mid-October 2023. To sum up these developments, the situation in the region is deteriorating at a fast pace, and the potential eruption of a broader conflict continues to pose a significant threat to falling oil prices.

Technical analysis

Since the start of the year, the USOIL has been mainly trending sideways. The loss of bearish momentum is reflected in a low value of ADX and flattening of RSI, Stochastic, and MACD on the daily chart; the flattening can also be observed on the weekly chart. As a result, we expect the USOIL to keep oscillating between $68 and $75 in the very short term. However, our price target of $65 per barrel stays unchanged.

Illustration 1.01

Illustration 1.01 shows the daily chart of USOIL and simple support/resistance levels derived from peaks and troughs.

Technical analysis

Daily time frame = Neutral

Weekly time frame = Bearish (turning neutral)

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not be a basis for taking any trade action by an individual investor or any other entity. Your own due diligence is highly advised before entering a trade.

USOIL Crude Oil WTI Price Prediction for Winter The potential for an increase in oil prices looms as supply disruptions in Libya unfold. Additionally, heightened tensions in the Middle East, fueled by another attack on a container ship in the Red Sea and explosions in Iran, contribute to the uncertainty. Shipping giants temporarily halted Red Sea shipments last month due to attacks by Houthi rebels, who were influenced by the conflict between Hamas and Israel.

On a recent Wednesday, the Yemeni militant group, supported by Iran, claimed responsibility for targeting a container ship en route to Israel.

Concurrently, OPEC announced its members' commitment to unity and cohesion within the organization, emphasizing their dedication to shared objectives.

Adding to the complex landscape, last month saw Angola, a member of OPEC for 16 years, decide to exit the cartel due to disputes over quotas. In light of these developments, my forecast for oil prices is set at $80 by March 2024.

The U.S. reveals a trick up its sleeveA few weeks ago, we expressed our bewilderment at the U.S. administration and its handling of the oil stockpiles. Despite oil plummeting below $70 during the summer, officials did not take the initiative to refill the Strategic Petroleum Reserves (also canceling plans to buy oil in July 2023), prompting us to speculate about what trick the administration could have up its sleeve. Finally, last week, we might have discovered exactly what it was when news erupted that the United States lifted some of the sanctions on Venezuela, allowing it to produce and export oil to its chosen markets for the next six months without limitation.

While Venezuela’s oil production is only about 800,000 barrels per day, the news announcement is still quite a big thing as it will enable U.S. entities to buy crude oil and help alleviate rising crude oil prices (especially if the country ramps up production in the coming months and the global economy continues to slow down - presuming no broad conflict will affect oil supply in the Middle East).

Now, on the topic of technicals, we are paying close attention to the Sloping Support/Resistance. If the price breaks back above the resistance (and holds the ground), it will be bullish. However, a failure will raise our skepticism about more upside. In addition to that, we are watching MACD, RSI, and Stochastic on the daily chart. To support a bearish case, we would want to see all of them continue declining. Contrarily, to support a bullish case, we would like to see MACD reversing and breaking above the midpoint.

Illustration 1.01

Illustration 1.01 shows the daily chart of USOIL and a simple setup with bullish prospects above the sloping support/resistance and bearish prospects below it.

Illustration 1.02

Illustration 1.02 displays the daily chart of MACD. The yellow arrow indicates a bearish breakout below the midpoint. If MACD fails to rebound back into the bullish area above zero, it will raise the odds for a continuation lower.

Illustration 1.03

Illustration 1.03 shows the daily chart of USOIL and simple moving averages. The yellow arrow indicates an impending bearish crossover between the 20-day SMA and the 50-day SMA. If successful, it will bolster a bearish case.

Technical analysis

Daily time frame = Bearish (with weak trend)

Weekly time frame = Slightly bearish

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not be a basis for taking any trade action by an individual investor. Therefore, your own due diligence is highly advised before entering a trade.

OIL LONGRisk 0.5%

TP1 = 1:2 RR

Disclaimer:

The contents in this Idea are intended for information purpose only and do not constitute investment recommendation or advice. Nor are they used to promote any specific products or services. They serve as an integral part of a case study to demonstrate fundamental concepts in risk management under given market scenarios. A full version of the disclaimer is available in our profile description.

7 Dimension Analysis For OIL😇7 Dimension Analysis

Analysis Time Frame: Daily

1️⃣ Price Structure: Sideways to Bullish

🟢 Structure Initial Behavior: Choch Bearish

🟢 Move: Corrective

🟢 Inducement: Done

🟢 Pull Back Count: 1st

1st OB mitigated

Extreme OB unmitigated

Touch count 4, breakout from the range

2️⃣ Pattern

🟢TREND LINES: Act as Support

🟢CHART PATTERNS:

Flag: Signaling Continuation

Triple Bottom: Indicates a potential move to the long side

Rectangle Breakout: Confirms bullish sentiment

Fakeout: Strong demand signals after the breakout

CIP: Holding at rectangle resistance, now acting as support

Buildup: Bullish momentum after the rectangle breakout

🟢 CANDLE PATTERNS:

Record Session Count: 7 buy candles, transitioning to sideways during buildup

Change in Guard: Noted at the end of the record session count

Momentum (Engulfing): Indicates potential bullish continuation

Engulfing: Classic bullish pattern at the bottom

Good Momentum: Observed at rectangle breakout

Narrow Range 4: Bullish breakout during the buildup phase

Inside Bar: Current candle forming, confirmation needed at closing

Todays Open High: Sustained for 4 hours

3️⃣ Volumes

4️⃣ Momentum RSI:

🟢 Zone: Superbullish yet

🟢 Range Shift: Sideways to Bullish

🟢 Divergence: Hidden 5-candle divergence indicates loss of momentum

5️⃣ Volatility Bollinger Bands:

Middle Band S/R: Strong support

Squeez: 60 candles in range, poised for a breakout inside the bulls

Squeez Breakout, Outside Upper Band: Bulls showing strength

Headfake: Price closed outside the lower band multiple times but quickly bounced back

M Pattern: 2nd leg forming, potential small correction toward middle band support

Open with Gap and Equal High: May indicate a correction

6️⃣ Strength ADX:

Main line under 20 shows overall consolidation, but bulls have some power

7️⃣ Sentiment ROC:

Rate of change for oil is in demand compared to all other commodities according to available data

✔️ Entry Time Frame: H1

✅ Entry TF Structure: Bullish

☑️ Current Move: Impulsive, waiting for a valid high after corrective move

✔ Support Resistance Base: Hourly trendline and wick OB area acting as strong support

☑️ Candles Behavior: (to be monitored after correction)

☑️ FIB Trigger Event: Not yet

☑️ Trend Line Breakout: Not yet

☑️ Final Comments: Awaiting correction completion before considering buy position

💡 Decision: Buy

🚀 Entry: 75

✋ Stop Loss: 73.5

🎯 Take Profit: 81.54

😊 Risk to Reward Ratio: 1:5

🕛 Expected Duration: 15 days

USOIL:i think it will fall

Hi traders, I think crude oil is going to go down, what do you think?

$76 was our tp point yesterday, and now we can see from the 4-hour chart that there has been no breakthrough here, and it is also a pressure level at present.

So the trading strategy is: short near 76, tp75-74.6

If you agree with my point of view, welcome to pay attention

BLACKBULL:USOIL.F FX:USOILSPOT TVC:USOIL

Oil moves up with US inflation and China boosting economyIt's worth noting that oil prices early on Wednesday extended the substantial gains from Tuesday, which were driven by brighter inflation figures from the United States and evidence that China taking steps to boost its economic growth.

I hope this information is helpful. Please let me know if you have any questions in your comments.