Oil Prices Up as Trump Delays EU Tariffs (Temporary Relief?) The global oil market, a sensitive barometer of economic health and geopolitical stability, registered a slight uptick in prices following the news that the Trump administration would extend the deadline for imposing new tariffs on a range of European Union goods. This minor rally, however, comes against a backdrop of a broader downtrend that has characterized the oil markets since mid-January. The persistent downward pressure has been largely attributed to the chilling effect of existing and threatened tariffs, not just between the US and the EU, but on a global scale, which have cast a long shadow over the outlook for global energy demand.

To understand the significance of this deadline extension and its nuanced impact on oil prices, it's crucial to first appreciate the environment in which it occurred. For several months, the dominant narrative surrounding oil has been one of demand-side anxiety. President Trump's "America First" trade policy, which has seen the imposition of sweeping tariffs on goods from various countries, most notably China, and the persistent threat of more to come against allies like the European Union, has injected a significant dose of uncertainty into the global economic system.

Tariffs, at their core, are taxes on imported goods. Their imposition typically leads to a cascade of negative economic consequences. Businesses that rely on imported components face higher input costs, which can either be absorbed, thereby reducing profit margins, or passed on to consumers in the form of higher prices. Higher consumer prices can dampen spending, a key driver of economic growth. Furthermore, the uncertainty created by an unpredictable trade policy environment often leads businesses to postpone investment decisions and hiring, further stagnating economic activity.

This economic slowdown, or even the fear of it, directly translates into weaker demand for oil. Manufacturing activity, a significant consumer of energy, tends to decline. Global shipping and freight, which rely heavily on bunker fuel and diesel, slow down as trade volumes shrink. Consumer demand for gasoline and jet fuel can also wane if economic hardship leads to reduced travel and leisure activities. The retaliatory measures often taken by targeted nations – imposing their own tariffs on US goods – only serve to exacerbate this negative feedback loop, creating a tit-for-tat escalation that further erodes business confidence and global trade flows.

It is this overarching concern about a tariff-induced global economic slowdown that has been weighing heavily on oil prices since the middle of January. Market participants, from large institutional investors to commodity traders, have been pricing in the potential for significantly reduced oil consumption in the months and years ahead if these trade disputes were to escalate or become entrenched. Every new tariff announcement or threat has typically sent ripples of concern through the market, often pushing oil prices lower.

Against this gloomy backdrop, the news of an extension to the tariff deadline on EU goods, while not a resolution, acts as a momentary pause button on further immediate escalation. It offers a temporary reprieve, a brief window where the worst-case scenario of new, damaging tariffs being instantly applied is averted. This is likely why oil prices "edged higher."

The market's reaction can be interpreted in several ways. Firstly, it reflects a slight easing of immediate downside risk to the European economy. The EU is a massive economic bloc and a significant consumer of oil. The imposition of new US tariffs on key European goods, such as automobiles or luxury products, would undoubtedly have a detrimental impact on European industries, potentially tipping already fragile economies closer to recession. An extension of the deadline pushes this immediate threat further down the road, offering a sliver of hope that a negotiated solution might yet be found, or at least that the economic pain is deferred. This deferral, however slight, can lead to a marginal upward revision of short-term oil demand expectations from the region.

Secondly, the extension can be seen as a signal, however faint, that dialogue and negotiation are still possible. In the fraught world of international trade diplomacy, any indication that parties are willing to continue talking rather than immediately resorting to punitive measures can be interpreted positively by markets. It reduces, fractionally, the "uncertainty premium" that has been built into asset prices, including oil.

However, it is crucial to temper any optimism. The fact that oil only "edged higher" rather than surged indicates the market's deep-seated caution. An extension is not a cancellation. The underlying threat of tariffs remains very much on the table. The fundamental disagreements that led to the tariff threats in the first place have not been resolved. Therefore, while the immediate pressure point has been alleviated, the chronic condition of trade uncertainty persists.

The oil market is acutely aware that this extension could simply be a tactical move, buying time for political reasons without altering the fundamental trajectory of trade policy. If, at the end of the extended period, no agreement is reached and tariffs are indeed imposed, the negative impact on oil demand expectations would likely resurface with renewed force. The market is therefore likely to adopt a "wait and see" approach, with traders hesitant to make significant bullish bets based solely on a deadline postponement.

Furthermore, the US-EU trade dynamic is just one piece of a larger global puzzle. The ongoing trade tensions with China, for instance, continue to be a major drag on global growth projections and, by extension, oil demand. Progress, or lack thereof, on that front often has a more substantial impact on oil prices than developments in the US-EU relationship, given the sheer scale of US-China trade and China's role as the world's largest oil importer.

The slight rise in oil prices also needs to be seen in the context of other market-moving factors. Supply-side dynamics, such as OPEC+ production decisions, geopolitical events in major oil-producing regions like the Middle East, and fluctuations in US shale output, constantly interact with demand-side sentiment. A deadline extension on EU tariffs might provide a small boost, but it can be easily overshadowed by a surprise inventory build, an unexpected increase in OPEC production, or signs of weakening economic data from other major economies.

In conclusion, the decision by the Trump administration to extend the tariff deadline on EU goods offered a moment of temporary relief to an oil market that has been under duress from trade war anxieties. This relief manifested as a marginal increase in oil prices, reflecting a slight reduction in immediate perceived risk to global economic activity and oil demand, particularly from Europe. However, this should not be mistaken for a fundamental shift in market sentiment or a resolution to the underlying trade disputes. The threat of tariffs remains, and the broader concerns about a global economic slowdown fueled by protectionist policies continue to loom large. The oil market's cautious reaction underscores the prevailing uncertainty, suggesting that while this extension provides a brief breathing space, the path ahead for oil prices will continue to be heavily influenced by the unpredictable currents of international trade policy.

Oilforecast

Crude oil---sell near 61.50, target 61.00-60.00Crude oil market analysis:

Yesterday's crude oil still did not rise. After the daily line was adjusted, the buying and selling game became more obvious. Today, it rebounded and continued to sell. Syria's thawing restrictions have helped to support the continuation of crude oil selling. In addition, the ceasefire between Russia and Ukraine also suppressed crude oil. In the long run, crude oil is unlikely to rise again. Today, pay attention to the short position opportunity of 62.70.

Fundamental analysis:

Recently, there are many fundamentals, but relatively few data, which has a great impact on the market. The Sino-US trade negotiations, the Russian-Ukrainian negotiations, and the India-Pakistan ceasefire have all affected the market.

Operation suggestions:

Crude oil---sell near 61.50, target 61.00-60.00

Crude oil------sell near 65.00, target 63.00-62.00Crude oil market analysis:

Gold has been moving recently, and crude oil has also moved with it. Yesterday's crude oil daily line closed with a big positive, and is currently testing the big pass near 65.00 on the weekly line. If this position is broken, we will be bullish on the long-term trend of crude oil. Today's crude oil idea is to rebound in the short term, and the general trend is bearish. Consider selling when it approaches 65.00 for the first time. 61.30 is the buying and receiving position. Pay attention to the inventory changes of crude oil later.

Operational suggestions:

Crude oil------sell near 65.00, target 63.00-62.00

USOIL UPDATEHello friends

Given the recent growth in oil prices, it is natural for the price to correct. Now we have obtained the most important price support areas for you and we have also specified the target. If you are willing to enter the transaction, be sure to observe capital management.

*Trade safely with us*

Oil - Short Term Sell Trade Update!!!Hi Traders, on April 17th I shared this idea "Oil - Looking To Sell Pullbacks In The Short Term"

I expected to see bearish continuation until the two Fibonacci resistance zones hold. You can read the full post using the link above.

Price moved lower as per the plan here!!!

Price respected the first Fibonacci resistance zone, created a false break of it and moved lower as expected!!!

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

-------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Short on Oil/Back to 57$ SOONI believe we can continue the retest of previous major support level at 65-66$ and fibonacci 0.618. This major support will be flipped to resistance in my opinion. We can see a significant sell-off back towards the 57$ area and below from this location.

I will be looking to enter a short trade from the 0.618 region/66$ if there is a rejection.

My mid-term/end-of-year prediction for US OIL is between 45-50$ and possibly lower.

If you believe in the fundamentals and idea of this setup, feel free to follow and use it.

Not financial advice.

Crude oil------sell near 61.60, target 60.00-58.00Crude oil market analysis:

Crude oil has also started to fluctuate recently. Yesterday's daily line finally began to decline. Crude oil is bearish in both the big and small trends. Continue to sell when it rebounds to the moving average. The crude oil pattern is still weak on the daily line. The current suppression position has begun to move down. Crude oil 61.68 is an opportunity to sell. The daily moving average has begun to rush down. Don't intercept it.

Fundamental analysis

Today, we will start to pay attention to the ADP data, as well as PCE data and EIA crude oil inventory data.

Operation suggestions

Crude oil------sell near 61.60, target 60.00-58.00

Oil - Short Term Sell Trade Update!!!Hi Traders, on April 17th I shared this idea "Oil - Looking To Sell Pullbacks In The Short Term"

I expected to see bearish continuation until the two Fibonacci resistance zones hold. You can read the full post using the link above.

The price is currently holding in the first Fibonacci resistance zone.

Until both the Fibonacci resistance zones hold my bearish view still remains.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

-------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Crude oil---sell near 63.00, target 60.00-58.00Crude oil market analysis:

The recent crude oil daily line has also begun to decline. Yesterday, the daily line closed negative, and the selling began to decline. Today's idea is to consider selling opportunities near the rebound of 63.00. Crude oil continues to be bearish. No matter the fundamentals or technical aspects, there is no sign of bullishness. Today, crude oil is expected to fluctuate and fall. Don't chase the rebound. We are considering it. In addition, crude oil will also close the monthly line. Pay attention to its monthly line.

Fundamental analysis:

This week is a data week. Starting from Wednesday, big data will be released one by one. In addition, continue to pay attention to the situation of the US dollar and the changes in tariff policies.

Operation suggestions:

Crude oil---sell near 63.00, target 60.00-58.00

Crude oil------sell near 64.30, target 60.00-58.00Crude oil market analysis:

Crude oil has been fluctuating recently. Today, we focus on the rhythm and range of its fluctuations. The suppression near 65.30 is successful. The selling trend is downward. Let's sell on the rebound today. Pay attention to the suppression near 64.00. There is still room for selling. The recent data and tariff war on crude oil have not had a big impact on it, so it has been hovering.

Crude oil market analysis:

Crude oil has been fluctuating recently. Today, we focus on the rhythm and range of its fluctuations. The suppression near 65.30 is successful. The selling trend is downward. Let's sell on the rebound today. Pay attention to the suppression near 64.00. There is still room for selling. The recent data and tariff war on crude oil have not had a big impact on it, so it has been hovering.

Operational suggestions

Crude oil------sell near 64.30, target 60.00-58.00

Crude Oil Tests Critical Support Level at $65.10FenzoFx—Crude Oil is consolidating below the $65.10 resistance, trading around $64.30. The price remains above the 50-period SMA on the 4-hour chart, confirming a bullish trend. However, the Stochastic Oscillator crossing above 20 signals overbought conditions, suggesting a potential pullback.

If oil stays below $65.10, a bearish wave could follow, targeting $62.31 and then $61.75.

Bullish Scenario: A close and stabilization above $65.10 could trigger the uptrend, targeting $67.60.

>>> No Deposit Bonus

>>> %100 Deposit Bonus

>>> Forex Analysis Contest

All at FenzoFx Decentralized Forex Broker

Crude Oil Stabilizes Above Key Fibonacci LevelFenzoFx—Crude Oil is consolidating after testing $63.9 resistance, trading near $62.23, supported by the 50.0% Fibonacci retracement.

While the bullish trend persists above the 50-period simple moving average, the Stochastic Oscillator shows an oversold condition, hinting at a rebound.

A bullish wave may target $64.00 if Oil holds above $62.00. However, if it dips below this level, momentum could extend down to $60.77, near the 78.6% Fibonacci retracement.

>>> No Deposit Bonus

>>> %100 Deposit Bonus

>>> Forex Analysis Contest

All at FenzoFx Decentralized Forex Broker

Crude oil---sell near 63.90, target 60.00-58.00Crude oil market analysis:

The recent crude oil has been delivered. The new contract is relatively strong at present. Yesterday's daily line closed with a positive line. In the short-term bottom shock, we are still bearish on crude oil today. We continue to sell. The large pattern suppresses around 65.30. The daily moving average suppresses around 65.700, which means that buying needs to break this position to reverse. Today's crude oil is suppressed at 63.90.

Operational suggestions:

Crude oil---sell near 63.90, target 60.00-58.00

Oil - Looking To Sell Pullbacks In The Short TermH4 - Strong bearish move.

No opposite signs.

Currently it looks like a pullback is happening.

Expecting bearish continuation until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Crude Oil AnalysisFenzoFx—Crude Oil started a bullish wave from $55.15, trading at around $62.20. Momentum slowed near $63.90 resistance.

The Stochastic Oscillator indicates short-term overpricing as Crude Oil remains below $63.90, keeping the bearish trend intact. Price may dip toward $58.90 support, with further pressure potentially driving it to $55.15.

If Crude Oil surpasses $63.90, the bearish outlook invalidates, targeting $65.10 resistance.

>>> No Deposit Bonus

>>> %100 Deposit Bonus

>>> Forex Analysis Contest

All at F enzo F x Decentralized Forex Broker

Crude oil---sell near 64.00, target 62.00-60.00Crude oil market analysis:

Crude oil has been falling recently. Under the pressure of tariffs, the decline of crude oil is very large. In addition, the previously released crude oil inventory data also shows its weakness. The weekly line closed with a cross star, and the lower shadow is very long. The possibility of a unilateral decline in crude oil this week is small, and the possibility of fluctuations is greater. The position of 65.30 is its suppression. Look for selling opportunities in the Asian session of 63.50-65.30 today. The other 58.00 of crude oil is support.

Operational suggestions:

Crude oil---sell near 64.00, target 62.00-60.00

Crude Oil Found Support: What's Next?FenzoFx—Crude oil tested the $58.9 level as support and bounced back from it. The primary trend is bearish; therefore, it will likely resume if the price closes and stabilizes below this support.

If this scenario unfolds, the next bearish target could be the $55.15 support level.

>>> Win $160.0 prize every week by joining FenzoFx contest.

Crude oil-----sell near 63.70, target 62.00-60.00Crude oil market analysis:

We continue to be bearish on crude oil today, and continue to sell on rebounds. The position of 63.80, which was pulled up last night, is today's major suppression position. This position is a selling opportunity. Crude oil has not broken the previous low point, but it will have a big bottom shock and a big repair after the data is over. Today's crude oil will wait for the opportunity to sell. In addition, the recent data on crude oil also suppresses it. Crude oil has not effectively stood on the major pressure before, and the short-term rebound is just a rebound. The weekly trend is still bearish.

Fundamental analysis:

The US tariffs on the world are still brewing, which has also led to a sharp drop in global stock markets, and the market is not optimistic about expectations. Later this week, we will focus on the heavyweight CPI data.

Operation suggestions:

Crude oil-----sell near 63.70, target 62.00-60.00

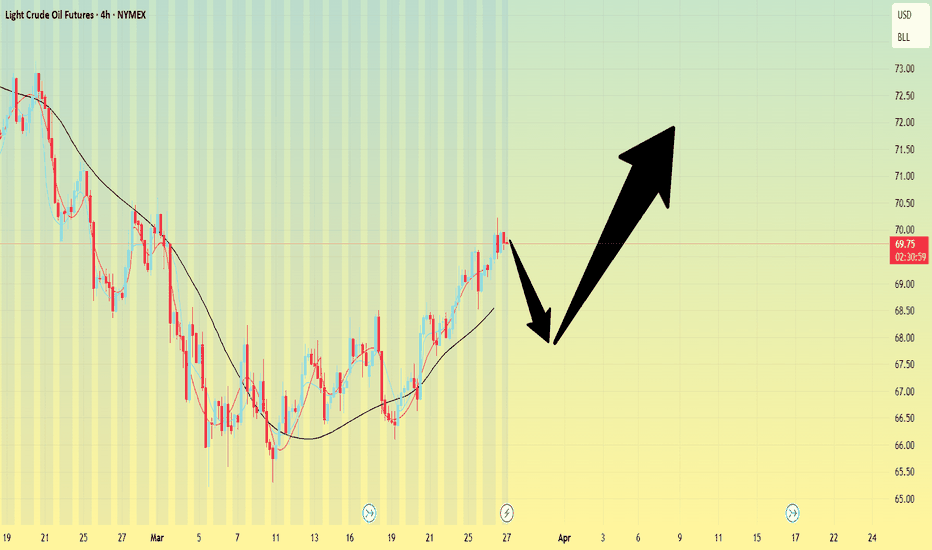

Crude oil-----buy near 68.90, target 69.90-72.00Crude oil market analysis:

Yesterday's crude oil daily line showed continuous tombstones, which was suppressed near 72.00. Today's idea is to continue to look at the rebound in the short term and pay attention to the support near 68.70. This position is a buy rebound. We will wait for opportunities in the Asian session. Crude oil has begun to move on a weekly trend. We need to pay attention to this week's closing to determine whether it will start a weekly trend in the future.

Fundamental analysis:

Trump's midnight tariffs caused the market to tremble again. In addition, ADP rose sharply, with a result of 155,000 people, 80,000 people in advance, and 115,000 people expected. The bulls still pulled up under such a big negative situation.

Operation suggestions:

Crude oil-----buy near 68.90, target 69.90-72.00

Oil - Short Term Buy Idea Update!!!Hi Traders, on March 25th I shared this "Oil - Expecting Retraces and Further Continuation Higher"

I expected to see retraces and further continuation higher. You can read the full post using the link above.

The bullish move delivered as expected!!!

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

-------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Oil - Expecting The Price To Bounce Higher FurtherH1 - Price has created series of higher highs, higher lows structure

Strong bullish momentum

Higher highs based on the moving averages of the MACD indicator

Expecting retraces and further continuation higher until the two strong support zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Crude oil-----buy around 69.00, target 69.90-70.90Crude oil market analysis:

Crude oil has not been so strong for a long time. The K-line has uploaded the daily moving average, and the bulls have begun to rush up. The current suppression position is 70.00-70.60. Yesterday, the highest peak was 70.22. Today's idea is to follow the short-term buying, buy at a low price to see its moving average rebound, and the daily moving average is also starting to attack. We don’t speculate whether this wave of upward rush will change the trend of the daily line, but we can be sure that the short-term is bullish. Today’s idea is to buy directly around 69.00.

Fundamental analysis:

Although there is no big data this week, the US tariffs still cause huge market fluctuations in terms of fundamentals.

Operation suggestions:

Crude oil-----buy around 69.00, target 69.90-70.90