Nice R:R4 50% long setup for oilHey everyone,

after a patient play out of short seen below, finally a long setup popped up on me.

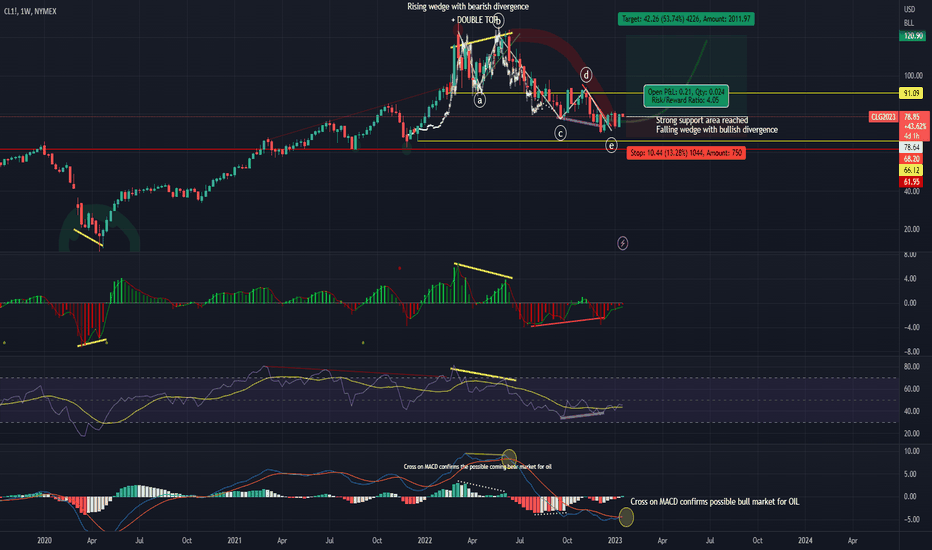

I see a finished EW correction topped out by falling wedge formation with bullish divergence on indicators.

Markets turning bullish and with Bitcoin and cryptocurrencies , I´m adding in bag some oil longs.

This is very nice and conservative Risk:Reward 4 ratio setup

Entry: 78-80 USD

SL: 68 USD

TP1: 100 USD

TP2: 120 UD

Chachain

KEYWORDS

Oil , CL1! , R:R, money management, risk, reward, technique, style, trading, bitcoin , bitcointrading, profitable trading, profittrading, profit trading, secret, divergence, bull divergence, bear divergence, divergencetrading, divergence trading, trading strategy, how to trade bitcoin , bitcoin trades, bitcoin trading, make profit, take profit, trading strategy, trading technique, successful, successful trader, successful technique, successful strategy, successful secret, how to trade, trend analysis, technical analysis , indicators, rsi , relative strenght index, let it rain, successful life, easy strategy, easy trading, easy technique, make money, crypto investing, investing, crypto, cryptocurrency, cryptocurrencies, mentoring, money, chartart, beyond

Oillongtrade

OIL... New lows after the oil war has ended??Another Trading Snack!

Using my weekly chart I’ve formed this oil trading bias for some time. That and I deeply respect the EW 5 wave patterns on longer time charts. Let me explain...

Yes that’s right! I suggest that new lows could come in price action on the WTI even though the oil war had come to an end as some pundits were reporting in the news.

I have always suspected the price action was due to Covad 19 and the global economic slow down due to a large part brought on by politicians of the day and their policies. I’m not arguing those political policies as being good or bad ideas. I’m observing that due to a large part because of those policies the globes economical state has been the cause of the slowing in oil demand. This in my view has produced the kind of price action we have now.

The odds are in favor in setting a new oil price low, then a meaningful bounce off new lows. All the while with current monetary policies the globe over inflation is coming— and if or when inflation comes, oil price action will rip higher from current depreciation like current prices.

My tactic and strategy is to start buying oil, maybe still today I’ll dip my toe in, but my targeted price to a buying zone is $13-18 on the WTI.

If I step in today towards the markets NY close I’ll be within or just under $1.00 of the 2020 lows and very close to the 2004 lows as well.

As always, you either make dust or you eat dust in trading.

All the best in your trades.

Note: this is just my trading idea! It is NOT trading advice! Trade your own plan and using your own risk tolerances.