Oilprice

Oil : April Could Be the Worst Month in Three and a Half YearsOil Prices: April Could Be the Worst Month in Three and a Half Years

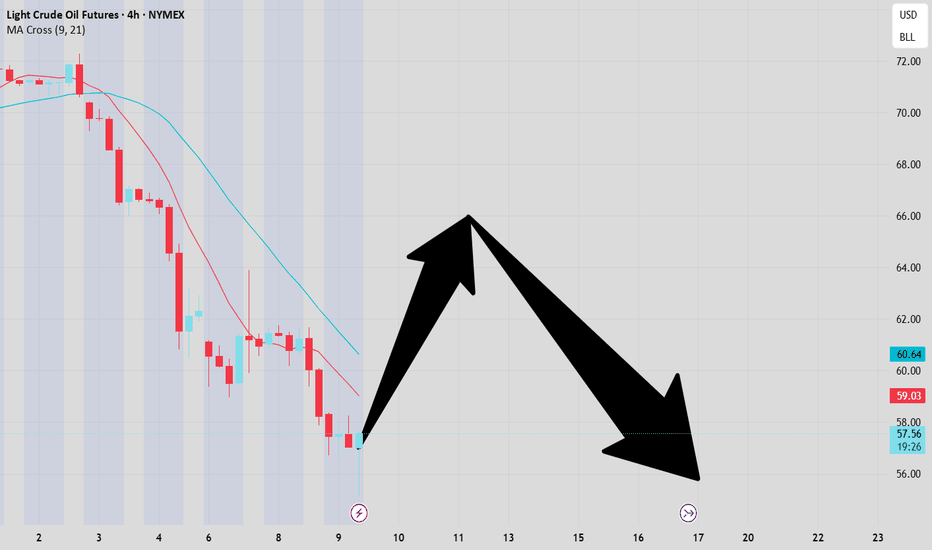

As the XTI/USD chart shows:

→ at the beginning of April, WTI crude was trading above $71 per barrel;

→ this morning, on the last day of the month, the price has fallen below $60.

The overall decline may reach 16% — the worst monthly performance since November 2021.

Why Is Oil Falling?

The primary driver behind the sharp drop in oil prices earlier this month was the introduction of new US tariffs, particularly targeting China and the EU. This raised concerns that a potential global trade war could slow economic growth and, in turn, reduce global oil demand.

According to a Reuters poll, the tariffs imposed by Trump have made a global recession in 2025 a realistic risk.

In addition, growing attention is being paid to OPEC+ and its plans to increase oil production. The next meeting is scheduled for 5 May.

Technical Analysis of the XTI/USD Chart

Oil price fluctuations in 2025 have formed a descending channel (highlighted in red), with lower highs and lower lows reflecting continued bearish sentiment.

Bulls may hope for support to emerge around the $58.85 level, as:

→ this has acted as support before (as indicated by arrows);

→ this level aligns with the lower boundary of a local upward trend (shown in blue), which formed after news broke that Trump had postponed the implementation of some tariffs — triggering a sharp rebound in oil prices from the 9 April low.

Nevertheless, the broader structure remains bearish: the rise towards point C appears to be a corrective recovery following the impulse drop from A to B. Given the potential impact of upcoming news — including statements from the White House and OPEC+ decisions — a bearish breakout below the blue channel cannot be ruled out.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crude oil---sell near 63.00, target 60.00-58.00Crude oil market analysis:

The recent crude oil daily line has also begun to decline. Yesterday, the daily line closed negative, and the selling began to decline. Today's idea is to consider selling opportunities near the rebound of 63.00. Crude oil continues to be bearish. No matter the fundamentals or technical aspects, there is no sign of bullishness. Today, crude oil is expected to fluctuate and fall. Don't chase the rebound. We are considering it. In addition, crude oil will also close the monthly line. Pay attention to its monthly line.

Fundamental analysis:

This week is a data week. Starting from Wednesday, big data will be released one by one. In addition, continue to pay attention to the situation of the US dollar and the changes in tariff policies.

Operation suggestions:

Crude oil---sell near 63.00, target 60.00-58.00

Crude oil------sell near 64.30, target 60.00-58.00Crude oil market analysis:

Crude oil has been fluctuating recently. Today, we focus on the rhythm and range of its fluctuations. The suppression near 65.30 is successful. The selling trend is downward. Let's sell on the rebound today. Pay attention to the suppression near 64.00. There is still room for selling. The recent data and tariff war on crude oil have not had a big impact on it, so it has been hovering.

Crude oil market analysis:

Crude oil has been fluctuating recently. Today, we focus on the rhythm and range of its fluctuations. The suppression near 65.30 is successful. The selling trend is downward. Let's sell on the rebound today. Pay attention to the suppression near 64.00. There is still room for selling. The recent data and tariff war on crude oil have not had a big impact on it, so it has been hovering.

Operational suggestions

Crude oil------sell near 64.30, target 60.00-58.00

Crude oil---sell near 64.00, target 63.00-62.00Crude oil market analysis:

Recently, crude oil has been running up. Yesterday, the daily line had a technical retracement under the pressure of 65.00. Today, we are still bearish. Let's continue to sell when it rebounds. There is still a lot of room for crude oil to fall. Today's crude oil rebounded near 64.00 and sold. If it breaks below 60.00, it will open up a new space for a big drop. The recent data and fundamentals of crude oil are suppressing it. Buy today and expect a big rebound.

Operational suggestions:

Crude oil---sell near 64.00, target 63.00-62.00

Market Analysis: WTI Crude Oil Rebounds in TandemMarket Analysis: WTI Crude Oil Rebounds in Tandem

WTI Crude oil prices climbed higher above $60.00 and might extend gains.

Important Takeaways for WTI Crude Oil Price Analysis Today

- WTI Crude oil prices started a recovery wave above the $60.00 and $61.50 resistance levels.

- There was a break below a connecting bullish trend line with support at $63.00 on the hourly chart of XTI/USD at FXOpen.

Oil Price Technical Analysis

On the hourly chart of WTI Crude Oil at FXOpen, the price started a recovery wave from $58.40 against the US Dollar. The price gained bullish momentum after it broke the $60.00 resistance and the 50-hour simple moving average.

The bulls pushed the price above the $61.50 and $62.00 resistance levels. The recent high was formed at $64.20 and the price started a downside correction. There was a minor move below the 23.6% Fib retracement level of the upward move from the $59.87 swing low to the $64.18 high.

There was a break below a connecting bullish trend line with support at $63.00. The RSI is now below the 50 level. Immediate support on the downside is near the $62.0 zone or the 50% Fib retracement level of the upward move from the $59.87 swing low to the $64.18 high.

The next major support on the WTI crude oil chart is near the $61.50 zone, below which the price could test the $59.90 level. If there is a downside break, the price might decline toward $58.40. Any more losses may perhaps open the doors for a move toward the $56.20 support zone.

If the price climbs higher again, it could face resistance near $64.20. The next major resistance is near the $65.00 level. Any more gains might send the price toward the $68.50 level.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crude oil---sell near 63.90, target 60.00-58.00Crude oil market analysis:

The recent crude oil has been delivered. The new contract is relatively strong at present. Yesterday's daily line closed with a positive line. In the short-term bottom shock, we are still bearish on crude oil today. We continue to sell. The large pattern suppresses around 65.30. The daily moving average suppresses around 65.700, which means that buying needs to break this position to reverse. Today's crude oil is suppressed at 63.90.

Operational suggestions:

Crude oil---sell near 63.90, target 60.00-58.00

Crude oil---sell near 62.00, target 60.00-59.00Crude oil market analysis:

The crude oil pattern shows that it is starting to hover at the bottom. Continue to sell when it rebounds. If the 65.30 position is not broken, you can stick to the bearish idea. The recent tariffs and fundamentals of crude oil make it difficult to rise, and the previously announced inventory data has also increased a lot. Crude oil rebounds to 62.00 today and can be sold. If it breaks, the next selling position is around 63.80.

Fundamental analysis:

There are not many data this week, but there are still many fundamentals. Note that the market will rest on Friday this week, which is Good Friday.

Operation suggestions:

Crude oil---sell near 62.00, target 60.00-59.00

Crude oil-----sell near 61.00, target 69.00-67.00Crude oil market analysis:

Tariffs have been increased again, and crude oil continues to fall sharply. It is difficult to change the short-term selling of crude oil. In addition, data and fundamentals all suppress it. Today's crude oil can continue to find selling opportunities. The crude oil pattern shows that the possibility of a big rebound is small. We pay attention to the suppression position of its moving average, which has dropped to around 61.80. This position is also the high point of yesterday's rebound. Today's idea will rely on this position to sell it. The first suppression of crude oil is around 59.30, and the strong pressure is 61.80.

Fundamental analysis:

The tariff war continues to affect the market, and buying and selling have begun a big game. We will pay attention to CPI later, and there will be crude oil inventory data today.

Operation suggestions:

Crude oil-----sell near 61.00, target 69.00-67.00

Crude oil-----sell near 63.70, target 62.00-60.00Crude oil market analysis:

We continue to be bearish on crude oil today, and continue to sell on rebounds. The position of 63.80, which was pulled up last night, is today's major suppression position. This position is a selling opportunity. Crude oil has not broken the previous low point, but it will have a big bottom shock and a big repair after the data is over. Today's crude oil will wait for the opportunity to sell. In addition, the recent data on crude oil also suppresses it. Crude oil has not effectively stood on the major pressure before, and the short-term rebound is just a rebound. The weekly trend is still bearish.

Fundamental analysis:

The US tariffs on the world are still brewing, which has also led to a sharp drop in global stock markets, and the market is not optimistic about expectations. Later this week, we will focus on the heavyweight CPI data.

Operation suggestions:

Crude oil-----sell near 63.70, target 62.00-60.00

Crude oil-----buy near 68.90, target 69.90-72.00Crude oil market analysis:

Yesterday's crude oil daily line showed continuous tombstones, which was suppressed near 72.00. Today's idea is to continue to look at the rebound in the short term and pay attention to the support near 68.70. This position is a buy rebound. We will wait for opportunities in the Asian session. Crude oil has begun to move on a weekly trend. We need to pay attention to this week's closing to determine whether it will start a weekly trend in the future.

Fundamental analysis:

Trump's midnight tariffs caused the market to tremble again. In addition, ADP rose sharply, with a result of 155,000 people, 80,000 people in advance, and 115,000 people expected. The bulls still pulled up under such a big negative situation.

Operation suggestions:

Crude oil-----buy near 68.90, target 69.90-72.00

USOil Sell 70.000Crude oil has been fluctuating and rising recently, reaching a three-week high. From a fundamental perspective:

Supply: The United States has intensified its energy sanctions against Iran. Attacks on Saudi facilities have affected their performance. The OPEC+ will gradually lift the voluntary production cuts starting from April and may increase production for the second time in May. The 30-day ceasefire agreement between Russia and Ukraine has not been effectively implemented in substance. However, recently, the United States, Russia, and Ukraine have reached some consensus on Black Sea navigation and the protection of energy facilities.

Inventory: According to API data, for the week ending March 25, U.S. crude oil inventories dropped significantly by nearly 9 million barrels. However, commercial crude oil inventories have been increasing continuously for several weeks, and the overall inventory remains at a high level.

Geopolitics: The U.S. airstrikes against the Houthi armed group in Yemen and Israel's military operations in the Gaza Strip have heightened concerns about the disruption of crude oil supplies in the Middle East. The United States' continuous strengthening of sanctions against Iran and Venezuela also includes a plan to impose a 25% tariff on countries importing Venezuelan crude oil.

Production Increase Pressure: The daily supply increments of non-OPEC countries (such as the United States and Brazil) far exceed the global demand growth rate, which has long-term downward pressure on the oil price center.

💎💎💎 USOIL 💎💎💎

🎁 Sell@70.000 - 70.200

🎁 TP 68.5 68.0 67.5

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates

Crude oil ------ Buy around 68.60, target 70.00-70.60Crude oil market analysis:

Today's crude oil can be sold at short positions of 70.20-70.60, and the buying position is around 68.60. It is strong in the short term. We need to pay attention to the situation when it stands above 70.00. If the daily line stands above it, we need to pay attention to the new buying opportunities later, and the big drop will come to an end. However, the long-term trend of crude oil is still selling. In addition, with the increase in inventory data, the price of crude oil is unlikely to rise much.

Operation suggestion:

Crude oil ------ Buy around 68.60, target 70.00-70.60

OIL Today's strategyIn the medium term, because the lower edge of the channel has been broken, the short force is relatively dominant, and crude oil may face certain downward pressure.

However, today's crude oil prices are affected by tightening expectations on the supply side, geopolitics and other factors, and the short-term trend is strong, and there is a certain upward momentum on the technical side. Investors need to pay close attention to the breakout of key support and resistance levels.

OIL Today's strategy

buy@67.5-68

tp:69-69.5

We share various trading signals every day with over 90% accuracy

Fans who follow us can get high rewards every day

If you want stable income, you can contact me

Crude oil-----sell near 69.00, target 67.00-66.00Crude oil market analysis:

Recently, crude oil has been hovering at the bottom. There are short-term stabilization signals, but it is basically difficult to turn around if you don't buy at 70.00. Today's idea is still bearish. Crude oil is sold regardless of weekly or short-term. Today's idea is still to sell at a high price and bearish. Crude oil pays attention to the inventory data later.

Operational suggestions:

Crude oil-----sell near 69.00, target 67.00-66.00

OIL Today's strategyIn the short term, there is a simultaneous advance of the long positions in crude oil. The price has tested the vicinity of $68.5 several times but encountered resistance. Moreover, after reaching around $65.2 at the lower level, it rebounded rapidly. The market still needs further testing. In the short term, it is advisable to sell high and buy low within the range of $68.5 to $65.2.

OIL Today's strategy

sell@67.5-67.9

buy:65.7-66.2

If you don't know how to do it, you can refer to my transaction.

Crude Oil Prices: Double-Edged Sword for Indian Marketers

The global crude oil market, a volatile beast, dictates the energy landscape for nations worldwide.1 For India, a nation heavily reliant on oil imports, the fluctuations in crude oil prices carry significant implications.2 While a dip in crude oil prices might seem like a welcome relief, especially for consumers, it presents a complex and often challenging scenario for oil marketing companies (OMCs) operating within the Indian market. This seemingly beneficial drop in prices acts as a double-edged sword, bringing with it a unique set of complexities that stem from market dynamics, government policies, and the intrinsic characteristics of the oil and gas sector.3

The initial and seemingly positive impact of lower crude oil prices is the potential for reduced import costs.4 For a country like India, where a substantial portion of its energy needs are met through imports, this can lead to a decrease in the overall expenditure on crude oil. This reduction can, in turn, alleviate pressure on the nation's current account deficit and theoretically translate to lower fuel prices for consumers. However, this potential benefit is often overshadowed by the ever-present threat of government intervention through excise duty hikes.

Governments, seeking to bolster their revenue, often capitalize on falling crude oil prices by increasing excise duties on petrol and diesel.5 This strategic move allows them to capture a significant portion of the savings that would otherwise be passed on to consumers. For OMCs, this translates to a reduction in the potential for increased margins. While they still benefit from reduced raw material expenses, the extent of the gain is substantially diminished. This delicate dance between market forces and government policies creates a complex environment for OMCs to navigate.

Furthermore, the expectation of price cuts for end consumers becomes a significant challenge for OMCs. Consumers naturally anticipate a corresponding reduction in fuel prices when crude oil prices decline. However, OMCs must carefully balance this expectation with the need to maintain their financial health. Rapid and substantial price cuts can strain their profitability, especially when coupled with excise duty adjustments. This balancing act requires a delicate approach, as OMCs must ensure their financial stability while remaining responsive to consumer demands.

Beyond the immediate impact on OMCs, lower crude oil prices pose a significant challenge to the upstream oil and gas sector. Upstream companies, involved in exploration and production, are directly affected by the decline in realized prices for their crude oil. This can lead to reduced profitability, delayed or cancelled investment projects, and even financial distress for some companies. The economic viability of many oil and gas fields is contingent on a certain price threshold. When prices fall below this level, production becomes less attractive, potentially hindering future energy security.

The impact on the gas sector is particularly noteworthy. Natural gas economics are often intertwined with crude oil prices, with gas prices sometimes linked to oil price benchmarks.6 A decline in crude oil prices can thus indirectly affect gas prices, making gas production and distribution less profitable. This can have broader implications for the energy sector, as natural gas is increasingly seen as a cleaner alternative to other fossil fuels.7 Reduced investment in gas infrastructure and production can hinder the transition towards a more sustainable energy mix.

Moreover, the volatility associated with fluctuating crude oil prices creates uncertainty for OMCs and the entire energy sector.8 Long-term planning and investment decisions become more difficult when the market is subject to rapid and unpredictable price swings. This uncertainty can deter investment in new projects and hinder the development of a stable and reliable energy supply. This volatility necessitates a robust and adaptable strategy for OMCs to navigate the unpredictable market.

From a macroeconomic perspective, while lower crude prices can potentially stimulate economic activity by reducing fuel costs for businesses and consumers, the potential for reduced government revenue due to lower oil prices (if excise duties are not increased) must be considered. In a country like India, where government revenue is crucial for funding infrastructure projects and social programs, a significant decline in oil-related revenue can have far-reaching consequences. This highlights the need for a balanced approach to fiscal policy, ensuring that government revenue remains stable while providing relief to consumers.

The challenges posed by lower crude oil prices highlight the need for a balanced and nuanced approach to energy policy. Governments must strike a delicate balance between providing relief to consumers, maintaining fiscal stability, and supporting the long-term health of the oil and gas sector. This requires careful consideration of excise duty adjustments, pricing mechanisms, and investment incentives. A coherent and forward-looking energy policy is essential to navigate the complexities of the global crude oil market and ensure the nation's energy security.

In conclusion, while lower crude oil prices may appear to be a boon, they present a complex set of challenges for OMCs and the broader Indian oil and gas sector. The potential for excise duty hikes, concerns about price cuts, and the impact on upstream realisations and gas economics create a double-edged sword scenario. Navigating this complex landscape requires careful policy decisions and a comprehensive understanding of the intricate dynamics of the global energy market. OMCs must remain adaptable and resilient, while governments must implement policies that balance consumer needs with fiscal stability and long-term energy security.

Oil weekly chart with buy and sell levelsOil weekly cahrt with both buy and sell levels

High probability of some high impact news this week be carful

For a buy am looking at entering at 70.20 , expecting 72.00 and 73.40 next.

On the sell side looking at entering at 69.30 expecting 68.80 and 68.30 levels .

1 hour chart i like the buy side this week but of course wait for conformation.

Check out my other charts below

Why I Believe Brent Crude Oil is Headed to $125 by 2026www.tradingview.com 1. Supply Constraints: Geopolitics & Trade Wars

One of the biggest drivers of higher oil prices is geopolitical instability and trade policy shifts. We're already seeing major disruptions that could tighten supply further:

Middle East Tensions – The ongoing conflicts in the Red Sea, Iran, and Israel continue to create uncertainty. Attacks on shipping routes and production facilities raise the cost of transporting oil and increase the risk of supply disruptions.

Russia-Ukraine War – With Russian oil facing sanctions and restrictions, global supply chains have had to adjust, making energy markets more fragile.

OPEC+ Output Cuts – OPEC has repeatedly restricted production to keep prices elevated, and there’s no indication they’ll reverse course anytime soon.

U.S.-China Trade War & Tariffs – With Trump leading in the 2024 election polls, there’s a growing possibility that tariffs on China will return. If this happens, energy trade flows could be further disrupted, and retaliatory tariffs could add to price pressures.

Strategic Petroleum Reserve (SPR) Depletion – The U.S. used a huge portion of its SPR to lower oil prices in 2022-2023, but refilling those reserves will create additional demand, pushing prices even higher.

With these factors at play, supply is becoming more constrained, making it easier for prices to rise with even small increases in demand.

2. Demand Boom: AI, Bitcoin Mining, and Agriculture

While supply is tightening, demand for energy is skyrocketing in unexpected ways.

AI Data Centers & Industrial Demand

AI computing is extremely energy-intensive, and as companies like Microsoft, Google, and Amazon continue to expand cloud computing infrastructure, demand for electricity is surging.

Many data centers still rely on fossil fuels for backup power and cooling systems, meaning oil and gas usage will continue to increase.

Bitcoin (BTC) Mining

Bitcoin mining requires massive amounts of electricity, and as BTC prices rise, mining activity expands in energy-dependent regions.

With the 2024 BTC halving, miners will have to run at full efficiency, which translates to higher global energy consumption.

Agriculture & Food Production

The world’s growing population and extreme weather events (like El Niño) are driving higher food production needs.

Fertilizer production, transportation, and machinery all require oil, meaning agricultural commodities are directly contributing to higher energy demand.

Together, these factors suggest that demand for oil is only going to increase, making it harder for supply to keep up.

3. Oil Price vs. Stock Market: The $100 Warning Zone

Historically, when oil prices get too high, the stock market struggles. Some key examples:

2008 Recession: Oil peaked at $147 per barrel, right before the financial crisis.

2018 Market Drop: When oil hit $80+, stocks sold off sharply.

2022 Inflation Shock: Oil reached $120+, leading to Fed rate hikes and market turmoil.

Why $100+ Oil is a Warning Sign for Stocks

Higher oil prices = higher inflation. This forces central banks like the Federal Reserve to keep interest rates high, making borrowing more expensive.

Energy costs impact corporate profits. Companies across multiple sectors will see shrinking profit margins as transportation and production costs rise.

Consumer spending takes a hit. Gasoline prices cut into disposable income, which weakens overall economic growth.

If Brent crude pushes above $100, expect increased market volatility and a potential selloff in equities.

4. Brent Crude Technicals: Price Targets for 2026

Current Setup

Price Holding Key Support (~$70-$74) – Brent is respecting major trendlines, signaling strong demand in this area.

Breakout Zone Around $80-$82 – If price moves above this level, it could trigger a rally to $100+.

Fibonacci Levels Align with $125 Target:

0.618 Fib retracement at $106 → First major resistance.

0.786 Fib extension at $119 → Likely next target.

1.272 Fib extension near $125 → Final upside target for 2026.

This technical setup aligns with macro fundamentals and historical oil cycles, making a move to $125 increasingly probable.

5. Investment & Trading Strategy

Long-Term Bullish Strategy

Accumulation Zone: $70-$74 (solid support).

Upside Targets: $106, $119, $125.

Stop Loss Consideration: Below $68 (invalidates thesis).

Hedging Against Market Risk

SPX Put Options / VIX Calls – If oil rises toward $100+, consider hedging against an equity downturn.

Energy Stocks (XLE, Exxon, Chevron) – These stocks tend to outperform during oil bull markets.

Gold & Commodities – Hard assets often rally when energy prices increase.

Conclusion: The Path to $125 Brent Oil

Geopolitical instability + supply cuts = higher prices.

AI, Bitcoin, and food production = rising demand.

If oil approaches $100, watch for an equities pullback.

While no forecast is perfect, all signs point to oil prices rising into 2026. If this trend plays out, investors should be prepared for higher inflation, tighter Fed policy, and increased market volatility.

Would love to hear your thoughts—do you think oil will hit $125, or are we headed lower? 🚀📊

Will Oil jump against Trump's requests?On a technical perspective, Oil could reverse from the current price and start to climb again targeting buyside, as we have seen a divergence between Brent and WTI. However, it looks like Brent is weaker and might not be able to validate higher prices.

Next week's OPEC meeting could clarify the direction, as I do not believe they will succumb to President Trump's requests of lowering Oil prices massively, and we could be looking for a volatile month.