Crude oil---sell near 64.00, target 62.00-60.00Crude oil market analysis:

Crude oil has been falling recently. Under the pressure of tariffs, the decline of crude oil is very large. In addition, the previously released crude oil inventory data also shows its weakness. The weekly line closed with a cross star, and the lower shadow is very long. The possibility of a unilateral decline in crude oil this week is small, and the possibility of fluctuations is greater. The position of 65.30 is its suppression. Look for selling opportunities in the Asian session of 63.50-65.30 today. The other 58.00 of crude oil is support.

Operational suggestions:

Crude oil---sell near 64.00, target 62.00-60.00

Oiltrading

Crude Oil Found Support: What's Next?FenzoFx—Crude oil tested the $58.9 level as support and bounced back from it. The primary trend is bearish; therefore, it will likely resume if the price closes and stabilizes below this support.

If this scenario unfolds, the next bearish target could be the $55.15 support level.

>>> Win $160.0 prize every week by joining FenzoFx contest.

Another tariff u-turn: Oil overbought on news? President Trump announced a 90-day pause on reciprocal tariffs for countries that have not retaliated, sparking a sharp rally in U.S. markets. The Nasdaq 100 led gains with a 12.2% surge. The U.S. dollar also strengthened against safe-haven currencies such as the Japanese yen and Swiss franc.

Crude oil prices rebounded alongside equities, with oil futures rising more than 4% to trade above $62 per barrel.

However, the strength of the oil rally may be overstated. China, one of the world’s largest oil consumers, was among the first to retaliate against U.S. tariffs. Tensions between Washington and Beijing have worsened, prompting the U.S. to raise tariffs on Chinese goods to 125%.

Adding to the caution, analysts at Goldman Sachs revised down their 2026 average price forecasts for Brent and WTI, citing rising recession risks. The bank now expects Brent to average $58 per barrel and WTI to average $55.

Crude oil-----sell near 63.70, target 62.00-60.00Crude oil market analysis:

We continue to be bearish on crude oil today, and continue to sell on rebounds. The position of 63.80, which was pulled up last night, is today's major suppression position. This position is a selling opportunity. Crude oil has not broken the previous low point, but it will have a big bottom shock and a big repair after the data is over. Today's crude oil will wait for the opportunity to sell. In addition, the recent data on crude oil also suppresses it. Crude oil has not effectively stood on the major pressure before, and the short-term rebound is just a rebound. The weekly trend is still bearish.

Fundamental analysis:

The US tariffs on the world are still brewing, which has also led to a sharp drop in global stock markets, and the market is not optimistic about expectations. Later this week, we will focus on the heavyweight CPI data.

Operation suggestions:

Crude oil-----sell near 63.70, target 62.00-60.00

WTI CRUDE OIL: Potential bottom and massive rebound to 71.00.WTI Crude Oil got oversold on its 1D technical outlook (RSI = 31.096, MACD = -1.620, ADX = 38.232) but is recovering its 1W candle now as it hit the bottom (LL) of the 1 year Channel Down. If the 1W candle makes a green closing, we will consider this a bottom, as the 1W RSI is also on its LL trendline) and go for a long aimed as the previous one at the 0.618 Fibonacci (TP = 71.00).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Analysis of oil prices in the next six months to one yearThe oil chart indicates that prices are likely to see lower numbers. The United States may intend to take a series of actions to keep oil prices down in order to alleviate some inflationary pressure, which could stem from the trade war and also from military conflicts involving the U.S.

From the chart, it can be inferred that in the medium term, prices might fluctuate between $55 and $69, but there is also the possibility of a correction down to around $43. This would benefit industrialized countries that consume oil, helping their economies become somewhat more resilient to the impending stagflationary shock worldwide.

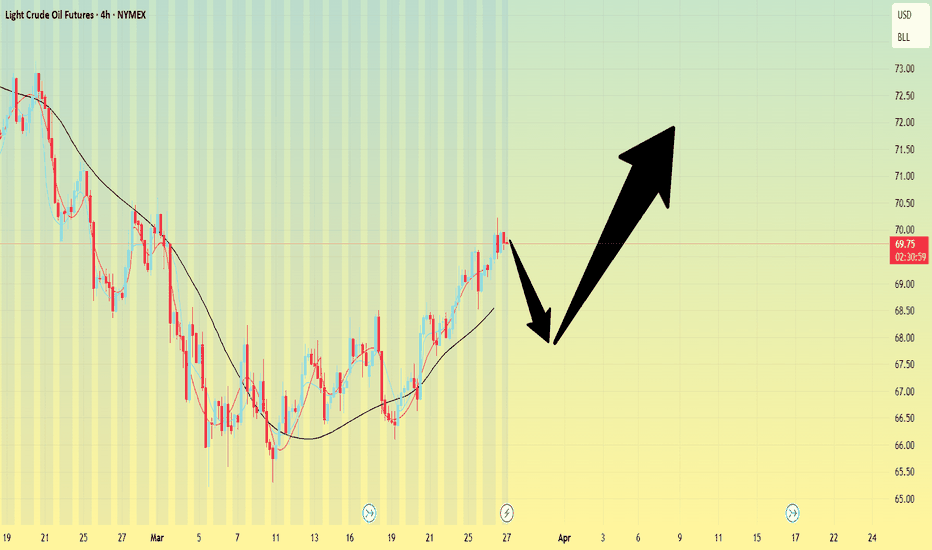

Crude oil-----buy near 68.90, target 69.90-72.00Crude oil market analysis:

Yesterday's crude oil daily line showed continuous tombstones, which was suppressed near 72.00. Today's idea is to continue to look at the rebound in the short term and pay attention to the support near 68.70. This position is a buy rebound. We will wait for opportunities in the Asian session. Crude oil has begun to move on a weekly trend. We need to pay attention to this week's closing to determine whether it will start a weekly trend in the future.

Fundamental analysis:

Trump's midnight tariffs caused the market to tremble again. In addition, ADP rose sharply, with a result of 155,000 people, 80,000 people in advance, and 115,000 people expected. The bulls still pulled up under such a big negative situation.

Operation suggestions:

Crude oil-----buy near 68.90, target 69.90-72.00

Crude Oil: WTI Recovers Slightly Above the $70 ZoneSince touching the key support level at $67 , WTI crude oil has posted a notable recovery of more than 7% in recent weeks, and is now hovering slightly above the $70 per barrel mark. For now, the bullish bias remains intact as comments from the White House suggest potential tariffs ranging from 25% to 50% on countries that choose to trade Russian oil. According to President Trump, Russia has failed to implement a ceasefire in the short term and this could lead to additional tarrifs. Although this new tariff strategy has no official date, if enacted, it could significantly disrupt global oil supply, reinforcing short-term bullish expectations for crude.

Wide Sideways Range:

For several months now, oil has been moving within a stable sideways range between $81 (resistance) and $67 (support) per barrel. So far, there hasn't been any significant breakout from this channel, making it the dominant structure on the chart in the short term.

MACD:

The MACD histogram continues to oscillate just above the zero line, but recent sessions have shown slight bearish momentum, possibly signaling a pause in the upward movement as the dominance of the moving averages appears to be neutralizing.

TRIX:

A similar situation is developing in the TRIX indicator, with the line hovering just below the neutral 0 level. This suggests that the strength of the 18-period moving average has entered a zone of balance, lacking a clear directional force.

The behavior of both indicators implies that momentum is gradually weakening as the price approaches resistance levels.

Key Levels:

$73: A key resistance level located near the midpoint of the sideways range, also aligning with the 200-period moving average. A breakout above this level could trigger a solid short-term bullish trend.

$81: A distant resistance level marking the top of the current range. Price action reaching this level could be decisive in confirming a long-term bullish breakout.

$67: A significant support level , marking the lower boundary of the range. A return to this level could revive previously dormant bearish pressure and potentially resume a longer-term downtrend that began several weeks ago.

By Julian Pineda, CFA – Market Analyst

WTI CRUDE OIL: 1M MA100 providing huge buying pressure to $77.50WTI Crude Oil has reclaimed its bullish technical outlook on 1D (RSI = 62.688, MACD = -0.001, ADX = 49.608) as is about to end the month on a strong green 1M candle and a huge 1M RSI bullish divergence. The most important development here is that the current 1M candle (March) marginally hit the 1M MA100 and immediately rebounded. This trendline has been the market's major long term support since April 2021, so essentially for the last 4 years. We believe that this is enough to cause a medium term rebound to the LH Zone and possibly even just outside of it to test the 1M MA50. For now however, our target is contained inside this zone (TP = 77.50).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Crude oil-----buy around 69.00, target 69.90-70.90Crude oil market analysis:

Crude oil has not been so strong for a long time. The K-line has uploaded the daily moving average, and the bulls have begun to rush up. The current suppression position is 70.00-70.60. Yesterday, the highest peak was 70.22. Today's idea is to follow the short-term buying, buy at a low price to see its moving average rebound, and the daily moving average is also starting to attack. We don’t speculate whether this wave of upward rush will change the trend of the daily line, but we can be sure that the short-term is bullish. Today’s idea is to buy directly around 69.00.

Fundamental analysis:

Although there is no big data this week, the US tariffs still cause huge market fluctuations in terms of fundamentals.

Operation suggestions:

Crude oil-----buy around 69.00, target 69.90-70.90

WTI CRUDE OIL: Last pull to 4H MA50 possible, $72 target remainsWTI Crude Oil just turned bullish on its 1D technical outlook (RSI = 55.181, MACD = -0.570, ADX = 39.438) as it crossed above the 4H MA200. It is still under the 1D MA50, so the newly emerged Channel Up may pull the price back under the 4H MA50 one last time before the next, even stronger bullish wave. Overall, we remain long (TP = 72.00), even more so on the long term.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

USOil Sell 70.000Crude oil has been fluctuating and rising recently, reaching a three-week high. From a fundamental perspective:

Supply: The United States has intensified its energy sanctions against Iran. Attacks on Saudi facilities have affected their performance. The OPEC+ will gradually lift the voluntary production cuts starting from April and may increase production for the second time in May. The 30-day ceasefire agreement between Russia and Ukraine has not been effectively implemented in substance. However, recently, the United States, Russia, and Ukraine have reached some consensus on Black Sea navigation and the protection of energy facilities.

Inventory: According to API data, for the week ending March 25, U.S. crude oil inventories dropped significantly by nearly 9 million barrels. However, commercial crude oil inventories have been increasing continuously for several weeks, and the overall inventory remains at a high level.

Geopolitics: The U.S. airstrikes against the Houthi armed group in Yemen and Israel's military operations in the Gaza Strip have heightened concerns about the disruption of crude oil supplies in the Middle East. The United States' continuous strengthening of sanctions against Iran and Venezuela also includes a plan to impose a 25% tariff on countries importing Venezuelan crude oil.

Production Increase Pressure: The daily supply increments of non-OPEC countries (such as the United States and Brazil) far exceed the global demand growth rate, which has long-term downward pressure on the oil price center.

💎💎💎 USOIL 💎💎💎

🎁 Sell@70.000 - 70.200

🎁 TP 68.5 68.0 67.5

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates

CFD on WTI CRUDEOIL (US OIL)ITS A T4HR TRADE FOR USOIL

1. Got Activated.

2. Stop loss @ 69.65 and resp. Target 1 @ 69.65 and Target 2 @ 67.59

3. Its a swing trade for 1 week trade working days duration.

4. Kindly make your orders accordingly to the duration period mentioned.

God bless. Happy trading Days

Crude oil ------ Buy around 68.60, target 70.00-70.60Crude oil market analysis:

Today's crude oil can be sold at short positions of 70.20-70.60, and the buying position is around 68.60. It is strong in the short term. We need to pay attention to the situation when it stands above 70.00. If the daily line stands above it, we need to pay attention to the new buying opportunities later, and the big drop will come to an end. However, the long-term trend of crude oil is still selling. In addition, with the increase in inventory data, the price of crude oil is unlikely to rise much.

Operation suggestion:

Crude oil ------ Buy around 68.60, target 70.00-70.60

USOIL To Retest $70.5I'm watching TVC:USOIL for a strong push towards at least the $70.5 level, though this area presents significant resistance.

A confirmed break of the bearish trend could fuel strong buying momentum, but patience is key.

Ideally, I’d like to see a solid rejection off the $68.5 level as confirmation before a move higher.

If we get a decisive breakout above $70.5 with sustained bullish momentum, my next target would be the major resistance around $75.

OIL Today's strategyIn the medium term, because the lower edge of the channel has been broken, the short force is relatively dominant, and crude oil may face certain downward pressure.

However, today's crude oil prices are affected by tightening expectations on the supply side, geopolitics and other factors, and the short-term trend is strong, and there is a certain upward momentum on the technical side. Investors need to pay close attention to the breakout of key support and resistance levels.

OIL Today's strategy

buy@67.5-68

tp:69-69.5

We share various trading signals every day with over 90% accuracy

Fans who follow us can get high rewards every day

If you want stable income, you can contact me

Crude oil-----sell near 69.00, target 67.00-66.00Crude oil market analysis:

Recently, crude oil has been hovering at the bottom. There are short-term stabilization signals, but it is basically difficult to turn around if you don't buy at 70.00. Today's idea is still bearish. Crude oil is sold regardless of weekly or short-term. Today's idea is still to sell at a high price and bearish. Crude oil pays attention to the inventory data later.

Operational suggestions:

Crude oil-----sell near 69.00, target 67.00-66.00

WTI CRUDE OIL: Hard rebound on 1.5 year support targeting $72.WTI Crude Oil is neutral on its 1D technical outlook (RSI = 48.748, MACD = -1.080, ADX = 23.603), which indicates the slow transition from a bearish trend to bullish. This started when the price hit the S1 level, a 1.5 year Support, and bottomed. The slow rebound that we're having since formed a Channel Up on a bullish 1D RSI, much like the one in September 2024, which eventually peaked after a +10.70% price increase. A similar rebound is expected to test the 1D MA200. The trade is long, TP = 72.00.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Crude oil ------- sell around 70.00, targeCrude oil market analysis:

Yesterday's crude oil daily line closed with a big positive, is it a buying opportunity? In fact, looking at the pattern, it has been hovering at this position for a long time, and the short-term is basically a snake. If the position of 70.00 is not broken, it is difficult to form a buying opportunity. The idea of crude oil today is still bearish. Continue to sell on the rebound. The previous contract delivery of crude oil has not changed the trend. I think it still needs to fluctuate.

Operation suggestion:

Crude oil ------- sell around 70.00, target 68.00-66.00

OIL Today's strategyIn the short term, there is a simultaneous advance of the long positions in crude oil. The price has tested the vicinity of $68.5 several times but encountered resistance. Moreover, after reaching around $65.2 at the lower level, it rebounded rapidly. The market still needs further testing. In the short term, it is advisable to sell high and buy low within the range of $68.5 to $65.2.

OIL Today's strategy

sell@67.5-67.9

buy:65.7-66.2

If you don't know how to do it, you can refer to my transaction.