OmiseGO (OMG) to breakoutI am not a financial advisor. The advice here given is not a financial advice even though my excitement might make it look like such. You trade at your own risk and nobody can guarantee you results. Even if someone could, I don't.

OMG

$OMG, Breaking from accumulation range under ~8670 sats...$OMG

Breaking from accumulation range under ~8670 sats resistance level..

Volume slowly starting to rise while UCTS showing buy signals on the 12H & 1D charts...

If gets traction, then aiming for ~9700 sats (10%+)

#OMG

OMG - not yet there ! ... but still looks promising !Positive divergence on RSI...

Maybe double bottom at 8400 satoshi holds...

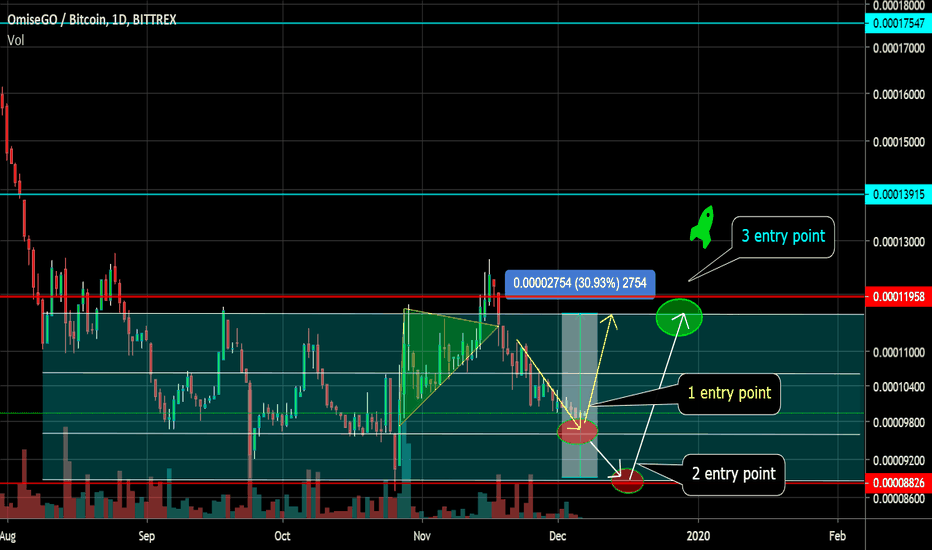

OMG / BTC Channel operation in 30% increments. Pivot points.After a false breakdown of the triangle, the price moved according to option 2 - trading in the channel.

OMG / BTC Operation in the horizontal accumulation channel in increments of 30%.

Pivot points breakthrough / retention of important support / resistance levels on which further movement I will depend on the chart.

I also showed various options for entering the market after confirming support for a certain local level.

The target are all on the chart depending on what price movement is confirmed.

A breakthrough of the channel and fixing the price above the resistance of the channel will open upside potential to higher targets than the potential of the channel.

Stop loss

Under key support levels during your entry into the market.

Do not forget to move Stop Loss during the price increase, but take into account the volatility of the coin.

BULLS ARE READY AND DEFENDING SUPPORT LINE-BEARS LOOSING POWEROmiseGo was one of the best investment's in middle 2017.

It hat an fake parabolic run up to 28$ range.

All coins are distributed.

140mn circulation versus 100mn$ marcetcap.

BUT 65mn$ dayli volume is huge.

PRoject is still alive and waiting for btc halving.

After that, bull's will take it to the moon, but higher than ever.

Buy and enjoy your ride.

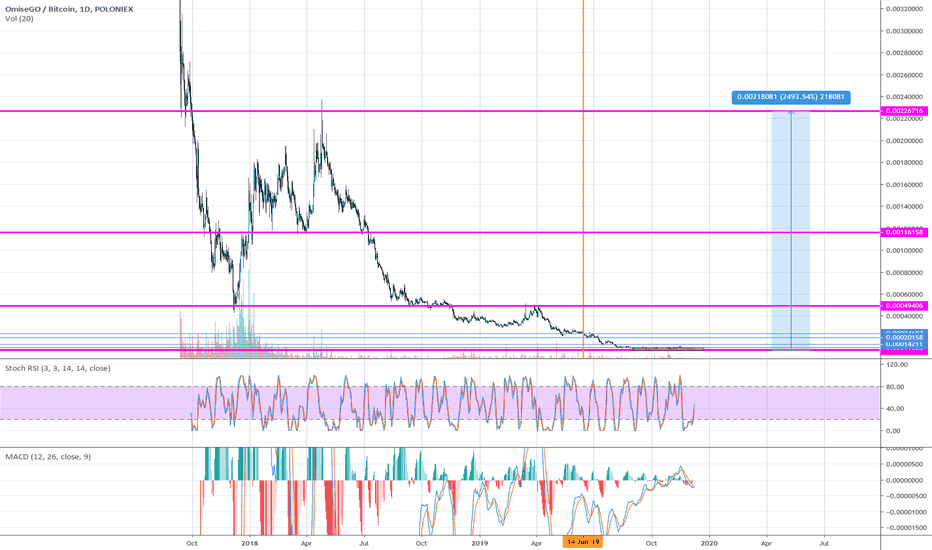

OMG - Second Chance at Near Bottom PricesOMG has a very nice setup here. Looking at the daily chart, it is bouncing off its all-time low and testing overhead resistance. The MACD looks very bullish. It's curving support, showing a bullish cross, and is showing good bullish divergence. In fact, OMG is giving us a second chance to load up before its next move upward. This is a low marketcap alt so it can really fly if volume flows in.

Massive pump opp. for OmiseGo detected! 2020 is Layer2 and PayWe will see in 2020 crazy growing industries in Layer 2, Games and Payment industries.

OmiseGo will lead this.

Don't pass this one!

OMG/USDT Good Entry PointChart has strong daily support and high credit ratings. You can buy at a loss.

SydTechnical - December 2019

LONG - OMG - Trading OpportunityAfter a harsh fall, a bullish divergence seems to have formed on BINANCE:OMGBTC after finding support at the MA200, the R/R is quite good on this play, as we can expect a bounce back to formed highs with a tight stop-loss.

Entry: 0.0001075

Target 1: 0.0001130

Target 2: 0.0001183

Target 3: 0.0001266

SL: 0.0001035

CryptoCue is not providing investment advice and is not taking subscribers’ personal circumstances into consideration when discussing investments. Investment involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire position.

CryptoCue is not registered, licensed or authorized to provide investment advice and is simply providing an opinion, which is given without any liability or reliance whatsoever. The information contained here is not an offer or solicitation or recommendation or advice to buy, hold, or sell any security. CryptoCue makes no representation as to the completeness, accuracy or timeliness of the material provided and all information and opinions provided by CryptoCue are subject to change without notice and provided on a non-reliance basis and without acceptance of any liability or responsibility whatsoever or howsoever arising. You hereby irrevocably and unconditionally waive, release and discharge: (a) any and all accrued rights and/or benefits you may have against CryptoCue in respect of any opinion expressed or information conveyed by CryptoCue at any time; (b) any and all Claims you may have against CryptoCue arising out of any opinion expressed or information conveyed by CryptoCue at any time; (c) CryptoCue from all and any claims (whether actual or contingent and whether as an employee, office holder or in any other capacity whatsoever) including, without limitation, Claims you may have against CryptoCue arising out of any opinion expressed or information conveyed by CryptoCue at any time. ("Claims" shall include any action, proceeding, claim, demand, judgment or judgment sum of whatsoever nature or howsoever arising.) You hereby agree to indemnify and hold harmless CryptoCue in respect of any and all Losses paid, discharged, sustained or incurred by CryptoCue in the event of bringing any Claim against CryptoCue. (“Losses” shall include any and all liabilities, costs, expenses, damages, fines, impositions or losses (including but not limited to any direct, indirect or consequential losses, loss of profit, loss of earnings , loss of reputation and all interest, penalties and legal costs (calculated on a full indemnity basis) and all other reasonable professional costs and expenses and any associated value-added tax) of whatsoever nature and/or judgement sums (including interest thereon).)

OMGBTC BUY OPPORTUNITYI have been following this coin for a couple of weeks now. The weekly chart shows it is very bullish, and the daily chart shows it has broken out from the triple bottom pattern as well.

Do you agree?

OMG Ascending Triangle. + 21% Channel + 30%. Entry points.OMG Ascending Triangle. Earnings with different price movements.

Rising triangles mostly work up. Perhaps this upward triangle will become a reversal pattern of a downtrend. A break of the triangle up and working it out to the widest part + 21% will mean a break of the channel. Just at a height of + 21% is the first resistance. If this happens and the price consolidates above the accumulation channel, a trend reversal may occur.

1 entry option.

We trade a triangle. Entrance on the breakthrough of the triangle or on the rollback after the breakthrough, depending on your strategy. The potential is from + 21% and the target is above the channel if the price can consolidate above the accumulation channel. And a trend reversal will occur.

2 entry option.

We trade channel potential. This is if a triangle is struck down. (Low probability). Entrance at the bottom of the horizontal channel, with confirmation of support. The potential to the upper boundary of the horizontal channel + 30%.

The pivot points of the price, on which this or that movement will depend, I showed on the chart.

____________________________________

Ascending triangle.

The ascending triangle is a figure of growth. This means that no matter what movements were in front of the figur, after the completion and confirmation of the figure, the price on the trading instrument goes up in 90% of cases. You need to understand that if one person (or group by conspiracy) controls a fully defined instrument (coin), then there is a high probability of fraudulent movements against logic and rules. But in 90% of cases it works up.

An ascending triangle is a bullish pattern and is formed on an uptrend as a figure of the continuation of the trend. It should be noted that in some fairly rare cases, the upward triangle may complete the downtrend (bearish) trend and act as a reversal pattern. However, regardless of whether it was formed on an uptrend or downtrend, its appearance is an indicator of accumulation, preceding the upward movement of prices. Very rarely there are exceptions.

Unlike neutral figures, an ascending triangle can be identified until the upper resistance line is broken.

In fact, the bulls encounter a strong level of resistance and make a number of attempts to break through it, forming approximately the same maximums on the chart. However, each subsequent correction will be less and less deep, which indicates a weakening bear pressure on the market and an upcoming continuation of the bull trend. Everything has its own reasons. You need to understand for what reasons and how one or the other figures are formed.

___________________________________________

Target

To determine the purpose of the price movement, it is necessary to measure the distance of the widest part of the figure and put it up at the breakpoint of the triangle. If we take the entire width as 100%, then we must leave the position at a distance of about 80% of the planned movement. It’s better to get out before everyone else. I always do that, especially when the position is big.

___________________________________________

Rules for all shapes of Triangles.

1) Price breaking is likely to occur in the direction of the previous trend.

2) An odd number of vibrations (waves) usually occurs inside a triangle. It is desirable that their number be at least five (three down and two up or vice versa). The more waves, the stronger the signal.

3) It is believed that if the last wave of the triangle did not touch the border and developed earlier, then this will lead to a sharp price movement when one of the parties breaks through.

4) It is not recommended to trade inside the triangle figure.

5) During the movement of the price inside the triangle, the volume indicators should decrease, and during the break through of one of the sides increase. If the price after a breakthrough of the border is trying to return, then for the model to be successful this return should occur on a declining volume.

6) If, after breaking through one of the sides of the triangle, the price “tries” to return, then this should happen with decreasing volume indicators (otherwise this serves as a “not good” signal).

7) To confirm the opening of a position, when a triangle is broken, it is advisable to wait until the closing price of the Japanese candlestick is outside the triangle and only then open the position.

8) It is desirable that the price breakout occurs at a distance from 1/5 to 3/4 of the horizontal length of the triangle. If this happened later, then the triangle loses its breakthrough momentum and further price movement may be uncertain.

9) If the angle of inclination of the triangle is more directed upwards, then most likely the price will go up and vice versa, if the angle of inclination of the triangle is more directed downwards, then most likely the price will also go down.

10) It is believed that the fastest way out of a triangle occurs when the last wave of the triangle does not touch its border, but unfolds earlier.

11) After breaking through one of the sides of the triangle, very often this side becomes the level of support / resistance (depending on where the price broke up or down).

12) After breaking through, the price will go towards breaking through at a distance equal to at least the height of the triangle in its largest part.

OMG - Bullish Breakout! Lots of Upside PotentialOMG had a strong breakout beyond resistance. The MACD also looks very bullish. This is a good entry point with lots of potential for positive gains.

OmiseGO / Bitcoin OMGBTC

Good buy opportunity as it have daily bullish MA cross.

Buy at 1100-1110

Sell

1202

1249

1300

1360

Stop loss at 1020 daily close.

Omisego Hidden BullThis coin will resemble something like the ZRX pump price action, for the upcoming weeks.

Be aware and act accordingly

Trade safe, hedge or use stops.

OMG/BTC - TODAY (TIME TO BUY)Hello!

We see great opportunities to buy OMG.

XXX growth for altcoins coming soon ^_^

OMISEGO/OMG - LONG SETUPOmiseGo looks good for the long entry.

Everything you can find by this chart here.

Enjoy!