Where Can We Rebuy OM? (1W)After the heavy drop, it became evident that a bearish trend had started, and the price is now seeking high-liquidity (buy) zones.

Based on the chart, the green zone stands out as the best area for a potential rebuy — it could launch the price upward by 100% to 500%.

Reaching this zone may take several weeks or even months.

A weekly candle closing below the invalidation level would invalidate this outlook.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

Omusd

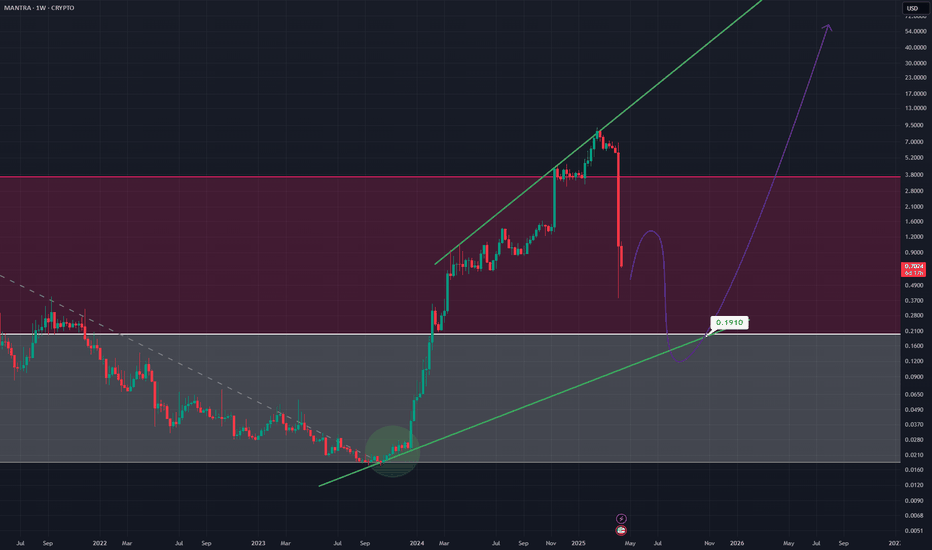

Is Mantra OM The Next Luna?Hello, Skyrexians!

This Monday was calm until the huge drop on BINANCE:OMUSDT has not interrupted us. In 1 hour price dropped more than 80% and now Mantra's holders are panicking is this coin scam or not. It's almost useless to have any strong technical analysis, but as we know this coin dropped because of rug pull. In case of Luna scam we have seen the infinite coins printing, so its price became 0. OM only has the negative news without any algorithmic issues.

We can only apply Fibonacci levels on the log scale and we can see that there is a chance that this is only the wave A inside 2. If $0.2 will be held we can have a chance for the scenario on the chart, otherwise it's scam!

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

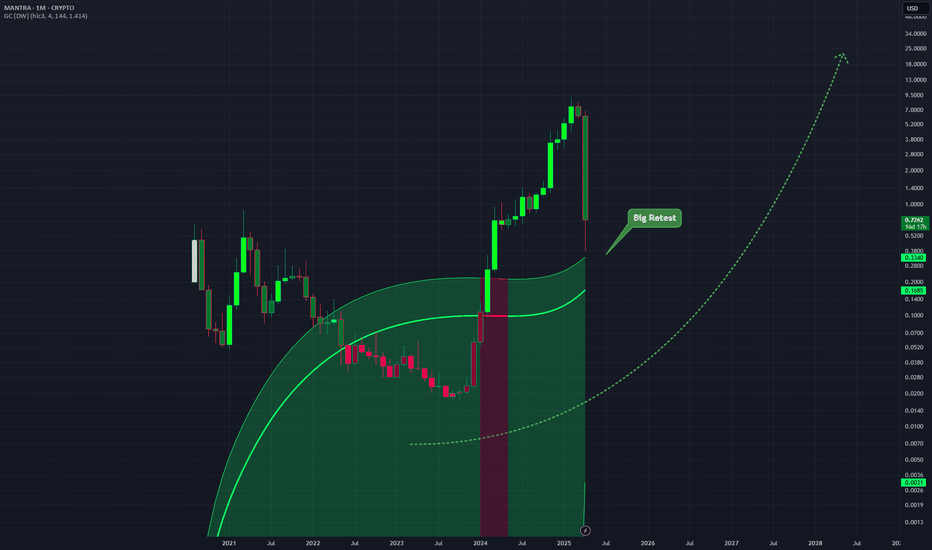

OMUSD - Monthly Channel IndicatorOn the monthly chart this dump is shown as just a retest of the Gaussian Channel indicator which price is still above.

Very big move which could shake a lot out.

If you are long on this Monthly you should not be very worried. Unless the intensity of the downward move is too much.

Monthly chart.

OMUSD - Big DumpA massive move downwards on this Weekly timeframe

I think still however support can be found and the overall upward phase on the longer term trend line can resume

Could be a massive buy the dip scenario

Reminds me in some ways of the LUNA crash however

I would wait till the the price label point is hit before entering on this long timeframe

OM/USDT : Do you know what is going to happen?hello guys

As you can see, this currency has strong spikes...

Now, according to the latest spike, we have identified good support ranges for you to buy step by step and move with it until the specified goals, of course, with capital management...

*Trade safely with us*

OM | MANTRA | Bullish Cycle OVER?MANTRA has made leaps and strides towards a new ATH, whilst the rets of the market was trading lower for the past few weeks.

But it seems the buying pressure has run out, if we take a look at the technical indicators.

Interestingly enough, if we take a look at OM through the Weekly timeframe and we pull up the Fibonacci extension, the current cycle ended at exactly 2.618 - a significant marker in the Fib zones.

It is said that, after reaching 2.618, a retracement to 0.786 is probable. This would put us roughly at the major previous resistance zone before the ATH breakout:

The Moving Averages is another great place to watch for possible bounce zones:

After this correction (which could go even lower) the price could potentially bounce back, as it gears up for a new ATH. I'd be looking to buy from the 0.786 and lower, possibly as low as the $2 mark.

________________________

OKX:OMUSDT

Can #OM Bulls Save the Day or Not? Bears Ready For a Showdown Yello, Paradisers! Is #OM gearing up for a massive breakdown, or will the bulls step in to save the day? Let's analyze the #Mantra's latest trade setup:

💎#OMUSDT is flashing clear warning signs of weakness after forming a classic bearish divergence on the 8H timeframe. While price made higher highs, the oscillator showed lower highs, signaling a loss of bullish momentum. This is a textbook setup for an impending reversal unless buyers step in aggressively.

💎The key level to watch is the $7.48 support zone—a critical area that bulls must defend. If OM closes a candle below this level, expect a sharp drop toward the $5.00 support, with an ultimate downside target of $3.17 if the selling pressure intensifies.

💎On the flip side, the bearish setup gets invalidated above $9.26. If bulls manage to break this resistance with strong volume, we could see #OM pushing higher. However, until that happens, the bias remains bearish, and lower levels look far more likely.

The market is at a crucial tipping point—will #OMUSD crash or bounce? Let us know your thoughts in the comments. Are you shorting, or do you see a surprise rally coming? Let’s discuss.

MyCryptoParadise

iFeel the success🌴

The key is whether the price can be maintained above 5.7948

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

(OMUSDT 1M chart)

The chart was broken by a sharp rise.

The point to watch is whether the BW(100) indicator or HA-High indicator is formed on the 1M chart.

-

(1D chart)

It formed an important support and resistance zone by moving sideways in the Fibonacci ratio range of 0(3.1730) ~ 0.382(4.4436).

Therefore, if it falls below this range, I think it would be better to stop trading and wait and see.

-

The high boundary zone is formed in the 4.8752-5.3288 range.

Accordingly, if it falls without support near 5.7948, the key is whether it will be supported near 4.8752-5.3288.

-

The strong support zone is near 3.7312.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- Big picture

I used TradingView's INDEX chart to check the entire range of BTC.

(BTCUSD 12M chart)

Looking at the big picture, it seems to have been maintaining an upward trend following a pattern since 2015.

That is, it is a pattern that maintains a 3-year uptrend and faces a 1-year downtrend.

Accordingly, the uptrend is expected to continue until 2025.

-

(LOG chart)

As you can see from the LOG chart, the uptrend is decreasing.

Accordingly, the 46K-48K range is expected to be a very important support and resistance range from a long-term perspective.

Therefore, we expect that we will not see prices below 44K-48K in the future.

-

The Fibonacci ratio on the left is the Fibonacci ratio of the uptrend that started in 2015.

In other words, it is the Fibonacci ratio of the first wave of the uptrend.

The Fibonacci ratio on the right is the Fibonacci ratio of the uptrend that started in 2019.

Therefore, this Fibonacci ratio is expected to be used until 2026.

-

No matter what anyone says, the chart has already been created and is already moving.

How to view and respond to this is up to you.

When the ATH is updated, there are no support and resistance points, so the Fibonacci ratio can be used appropriately.

However, although the Fibonacci ratio is useful for chart analysis, it is ambiguous when used as support and resistance.

This is because the user must directly select the important selection points required to create Fibonacci.

Therefore, since it is expressed differently depending on how the user specifies the selection points, it can be useful for chart analysis, but it can be seen as ambiguous when used for trading strategies.

1st : 44234.54

2nd : 61383.23

3rd : 89126.41

101875.70-106275.10 (Overshooting)

4th : 134018.28

151166.97-157451.83 (Overshooting)

5th : 178910.15

-----------------

MANTRA OM Bullish IdeaOM has been flat for 40 days now, drawing nice bull flag and currently has bullish divergence on 12H, RSI about to cross mid line 50 and enter into bullish zone, BBWP was congested on many time frames and currently started expansion with 4H pointing North, If that's the case, it will continue expansion on higher frames. MACD does look nice for bullish scenario.

I havent check perps and liquidity pools, it totally can drop down to scare normies and kill late longs, you know the drill.

#OMUSDT Bulls Losing Steam | Can It Slide Downward or Not?Yello, Paradisers! Are you ready for a potential shake-up in #MANTRA’s price action or not? Let's look at the latest analysis of #OMUSDT:

💎#OM is retesting the ascending support level within its rising wedge formation—a pattern known for triggering significant volatility. A downward breakdown at this point would confirm a bearish bias, potentially paving the way for a deeper decline.

💎A significant volume divergence further reinforces this bearish case: although prices have been making higher highs, volume is noticeably declining, suggesting weakening momentum. On top of that, the EMA20 and EMA50 are aligned to support the bearish outlook, effectively doubling the likelihood of a downward move.

💎If the breakdown materializes, our first bearish target would be the weak support zone around $1.09. Hitting this level could signal intensified selling pressure as the market searches for stability. But the bearish scenario doesn’t stop there. If the struggle continues, the next significant target lies at a stronger demand area of around $0.835, where we could see some relief. The final target for this downward move would be major support in the $0.63-$0.708 range, indicating a substantial shift in sentiment.

💎However, there's still a glimmer of hope for the bulls. If #OMUSDT manages to close above $1.64 on the daily chart, it would weaken the bearish outlook, possibly triggering a new rally and reigniting the uptrend.

Smart and disciplined trading will keep you ahead of others in this volatile market.

MyCryptoParadise

iFeel the success🌴

OM ROADMAP (12H)OM is building a large liquidity pool.

The price is reaching the premium range of the previous wave.

With the signs we have on the chart, we are looking for sell/short positions in the supply range.

The price can be rejected downwards for several months.

Closing a daily candle above the invalidation level will violate the analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

Cage Cycle Values for OmusdtCage Cycle Values: If the price is above 0.67647 (Buy Point), the price target is 1.13913, and if it is below 0.66245 (Sell Point), the price target is 0.19979. You can find the details of the Cage Cycle strategy attached. (MAKE SURE TO FOLLOW THE NEW TAKE PROFIT POINTS PUBLISHED AS TAKE PROFIT POINTS ARE INCREASED ACCORDING TO THE TRADING CYCLE)

Long Position:

Entry: 0.67647

Profit: 1.13913 (Will be updated if necessary in the positive direction)

Stop: 0.66245

Short Position:

Entry: 0.66245

Profit: 0.19979 (Will be updated if necessary in the positive direction)

Stop: 0.67647

The Cage Cycle Strategy is a model that emerges from analyzing approximately 2 over 20 data points (1,000,000 and above tick data). The price definitely reaches one of the specified Take Profit Points as a price target. It is not possible to determine the direction with a hundred percent certainty in financial markets. Therefore, success rates are attempted to be increased by using certain models. The Cage Cycles end when the price reaches the price target in any direction in the Cage Cycle Strategy. Although it is not an investment advice, an example of use is as follows: A Long position is opened at the price level of 0.67647, the Stop Loss is 0.66245, and the Take Profit is 1.13913. When the price reaches 0.66245, instead of the Long position that was stopped, a Short Position is opened, with the Stop Loss of the Short Position being 0.67647 and the Take Profit being 0.19979. Transactions are monitored by stopping until the market direction is determined. Considering the number of stopped transactions and the expected time, Take Profit points are updated to increase profits (Updated Take Profit Points will never be lower than the initially specified Take Profit points). By recalculating the Take Profit points to increase profits, the aim is to compensate for the losses of the stopped transactions when the Cage Cycle ends. In the data analysis of the last 10 years, the average number of stops is 12, and the highest number of stops is calculated as 83 (These figures may vary in the future). Although it is not an investment advice, in the Cage Cycle, if the amount to be stopped is set at $1, by increasing the position by half of the initial lot amount for every 10 stops (0.5 $ for every 10 stops), a higher profit can be targeted along with the increased Take Profit point. Using the Cage Cycle data provided above as an example for Peopleusdt, after 15 stops, when the cycle ends, the profit-loss calculation (Initial Stop Amount to be stopped is $1): For the first 10 stops, the loss will be 10$*1=10$, and between 10 and 15 stops, the loss will be 5*1.5$= 7.5$, resulting in a total loss of 17.5$. The profit to be obtained with the updated Take Profit points will be 1.5*27= 40.5$. The net profit, excluding commission, will be 40.5-17.5= 23$. The Cage Cycle helps you determine the Take Profit point in your own trades as well, as it is known that the price will definitely reach one of the Take Profit points. Enjoy and Good luck with your trades.

THIS IS NOT AN INVESTMENT ADVICE. Made by Yourcages

Is OMUSDT Primed for a Bullish Reversal? What nextYello, Paradisers! Is #OMUSDT on the verge of a massive bullish reversal?

💎#OM is showing a high probability of bullish continuation from a strong support zone. We've seen #OM consistently respect the descending resistance, recently breaking upward and completing a retest phase. Currently, it’s approaching support at $0.7422, raising the probability of holding momentum at this key level and planning a bullish reversal.

💎If #OMUSD can successfully sustain momentum, there is a high probability it will break above the resistance at $0.9011 and make a robust bullish move, targeting levels above this resistance zone. The price has already tapped this support level and made a significant upward move. We're expecting a repetition of the same reaction at this support level.

💎However, as sagacious traders, we must consider all probabilities. What if the price fails to take an upward ride from the support at $0.7422 and loses momentum? In such a scenario, we are looking for a bullish rebound from the lower support at $0.6953. Breaking this support would clearly indicate that seller sentiment is in control, and #OM could drop significantly

Strive for consistency, not quick profits. Treat the market as a businessman, not as a gambler.

MyCryptoParadise

iFeel the success🌴

OM sell/short setupThe price is within a large range.

Now the price is approaching the upper part of the range.

At the bottom of the chart, we have a large liquidity pool that is expected to be swept away soon.

The targets are clear on the chart.

If it reaches the supply range, we will look for sell/short positions.

Closing a daily candle above the invalidation level will violate the analysis

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

OMUSD Breaking out. Catch it if you can!Mantra (OMUSD) broke today above the top of its Rectangle, which has been the pattern it consolidated in since late March. The recent low of May 30 was supported just above the 1D MA100 (green trend-line) and that initiated the current rebound.

This is not very different than the March 04 break-out, which after holding its 0.5 Fibonacci retracement level, it started an aggressive rally towards the 5.0 Fibonacci extension, registering a +360% rise. This gives us our current Target at 2.800.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

OM - this altcoin can 37x this year, here is whyOM looks very bullish. We can see that the previous downtrend ended with a descending parallel channel on the weekly chart. Now the price is finally breaking out! What is important is to always take a look at the volume indicator. Bullish volume is absolutely very high and at record levels, which confirms the breakout. Whales are buying it, and they cannot hide it. From the Elliott Wave perspective, the complex correction WXYXZ is complete, which is another sign of strength. Let me know what you think about my analysis, and please hit boost and follow for more ideas. Trading is not hard if you have a good coach! Thank you, and I wish you successful trades.

MANTRA (OM) is a first of its kind, vertically-integrated and regulatory compliant blockchain ecosystem. The MANTRA OMniverse encompasses the DAO; MANTRA Nodes: a blockchain infrastructure-as-a-service business that includes retail staking, institutional delegation, node management and white-label validator operations; MANTRA Chain: a protocol for regulated assets for the Cosmos ecosystem; and MANTRA Finance: a globally-regulated DeFi platform that brings the speed and transparency of DeFi to the world of traditional finance.

OMUSDT: Falling Wedge with RSI Bullish Divergence at SupportOMUSDT is trading within a Falling Wedge, holding onto a congestion zone at support with heavy amounts of Bullish Divergence on the RSI. If this level holds, I think we might get somewhat of a Bull Flag type of move which would take it up to around $0.40 and also happens to align with the 1.618 Fibonacci Extension from here.

OM can 12x in a few weeks. Buy now?Technical analysis

Since my last technical analysis on OM, this coin made 190%. I believe this trend will continue in the next few weeks and month and soon we will hit a new all time high. We can see that the volume is extremely strong and whales are buying. There is absolutely no sign of weakness at this moment and the price action looks absolutely unstoppable.

Let me know what you think about my analysis, and please hit boost and follow for more ideas. Trading is not hard if you have a good coach! Thank you, and I wish you successful trades.

About MANTRA

MANTRA is on a mission to build the world’s preeminent and most-trusted decentralized finance ecosystem by bringing security, compliance and democratized access to DeFi. Through its flagship projects including MANTRA Finance and MANTRA Chain, MANTRA addresses key challenges that have held back institutional adoption of DeFi.