ONDOUSDT

$ONDO Time to show the cardsI found the $ODNO pretty early on.

I knew right away it was a gem.

Now it's a leader in the RWA industry and although the industry is moving fast. We are still too young and the biggest thing is yet to come.

If I tell you now that ONDO will make x7 more from this price you will think I'm crazy, so I won't say it:).

If you're seeing this, share & pass the alpha about Ondo to someone else.

It's time we put the King of RWAs on the map👑

Setting the stage for ONDO Tokenization

Tokenized RWA's by Leaders in RWA

Investors

WEB2 TradFI WEB3 DEFI

The answer to RWA is in front of you

Ondo Team

Thank you Kyren

Best regards, EXCAVO

ONDO finance price analysis Today we're talking about #ONDO, which we took into copytrading according to our preliminary analysis, although the price has been pushed lower than we would like over the past 1.5 months.

Now the critical zone for OKX:ONDOUSDT is $1.10 - $1.20

Fixing above this zone can give a quick rise to $1.50 and medium-term to $2.70

👀 By the way, #ONDOfinance is made in the USA, is in the Trump Foundation's portfolio and is directly related to #Ethereum

Is this 🆒 promising or a red flag 🚩 ?)

ONDO ANALYSIS 🔮 #ONDO Analysis 💰💰

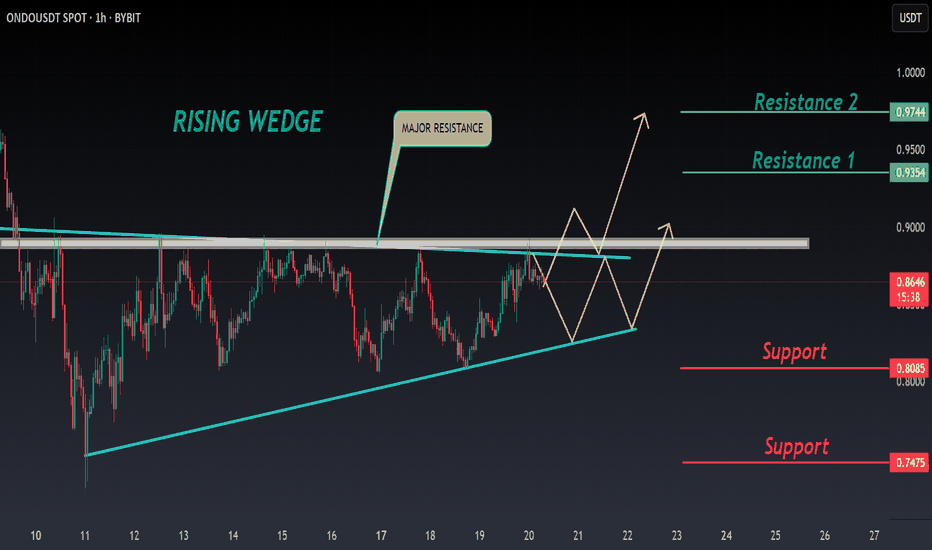

🌟🚀In 1hr chart we can see a formation "Rising Wedge Pattern in #ONDO. There is a strong resistance zone near at $0.8840 and we could see a rejection from that level but if the price breaks the resistance zone then we would see a bullish move 💲💲

🔖 Current Price: $0.8640

⏳ Target Price: $0.9350

⁉️ What to do?

- We have marked some crucial levels in the chart. We can trade according to the chart and make some profits in #ONDO. 🚀💸

#ONDO #Cryptocurrency #DYOR #PotentialBreakout

ONDO Trade Setup: EMA Break ConfirmationWe're monitoring the EMAs for a breakout, which will trigger this trade. RWA (Real-World Assets) remains a strong narrative, and if the market turns bullish, ONDO could see a significant pump.

🛠 Trade Details:

Entry: Around $0.88

Take Profit Targets:

$0.98 (First TP - Key Resistance Level)

$1.12 (Second TP - Upside Expansion Zone)

Stop Loss: Below $0.79

Waiting for EMA confirmation and market momentum shift before execution. 🚀

Tradecitypro | Ondo: Key Levels to Watch for Trend Reversal 👋 Welcome to TradeCity Pro!

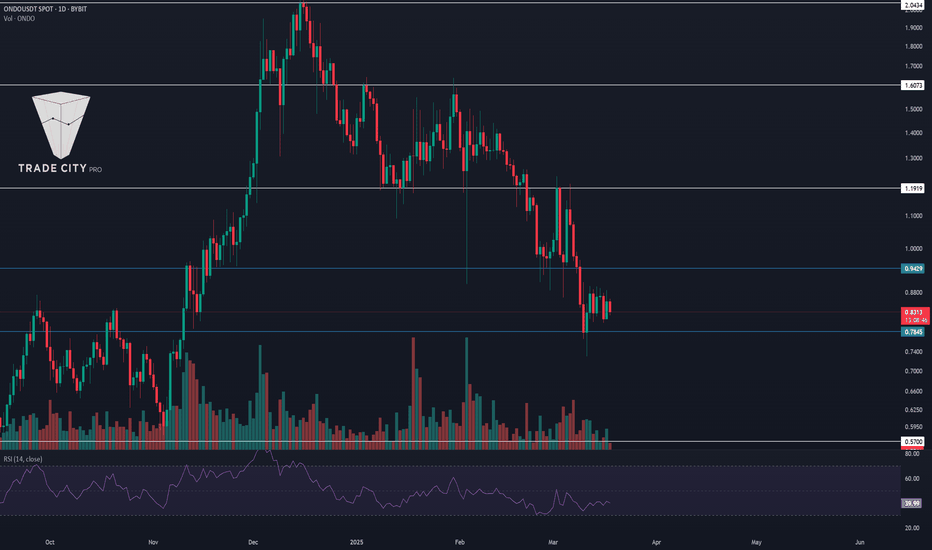

In this analysis, I’ll be reviewing Ondo, one of the RWA projects, currently ranked 32nd on CoinMarketCap with a market cap of $3.04 billion.

📅 Daily Timeframe

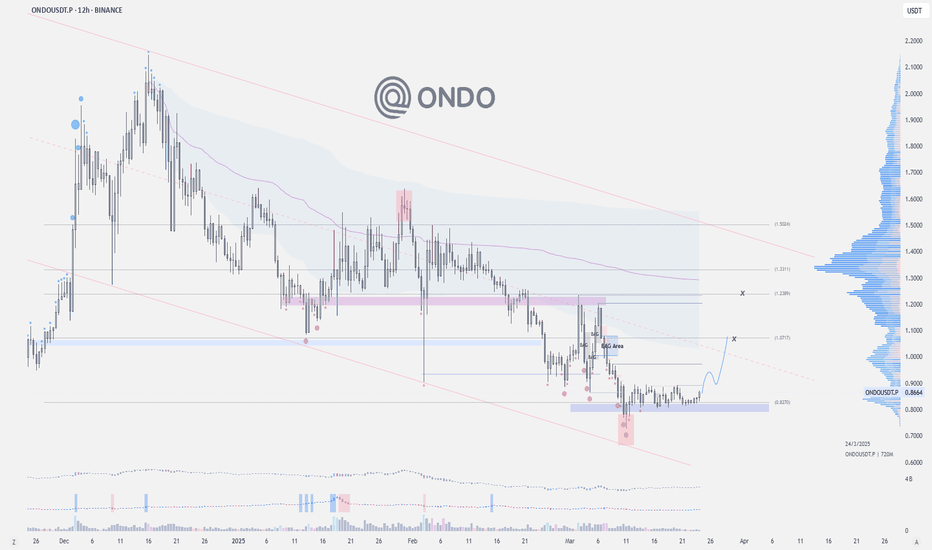

As seen in the daily timeframe, a downtrend has formed, extending down to the $0.7845 low. Currently, with declining volume, the price has entered a consolidation and corrective phase.

💥 If the price manages to stabilize below $0.7845, the next bearish leg could begin. Therefore, upon breaking this level and confirming a trigger in lower timeframes, we can enter a position.

✨ In case of an upward correction, the first resistance zone will be at $0.9429, and if the price corrects further, breaking $1.1919 could confirm a trend reversal.

🛒 For spot buying, the risky trigger is $1.1919, while the main triggers are $1.6073 and $2.0434. If you have already purchased this coin, you can set your stop loss at $0.7845 in case of a breakdown. The RSI entering the oversold zone could serve as a momentum confirmation.

⌛️ 4-Hour Timeframe

In the 4-hour timeframe, a range box has formed between the $0.7845 and $0.8875 levels.

✔️ Buyers have shown stronger volume and momentum within this range. If $0.8875 is broken, you can enter a long position.

🔽 For a short position, if $0.7845—a significant level on the daily timeframe as well—breaks, you can enter. As mentioned earlier, breaking this level could trigger the next bearish leg.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

ONDO | ALTS | Lower Price LikelyONDO could be a good hold, if a lower entry presents itself.

It's worrisome that the opening prices have not yet been retested, and the next immediate support zone is approaching fast:

I'd be willing to start accumulating from anywhere under the next immediate support zone.

____________________________

BYBIT:ONDOUSDT

#ONDO/USDT#ONDO

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a rebound from the lower limit of the descending channel, this support is at a price of 0.7550

We have a downtrend on the RSI indicator that is about to be broken and retested, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.8180

First target 0.8890

Second target 0.9588

Third target 1.034

#ONDO/USDT #ONDO

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at a price of 1.25

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 1.42

First target 1.51

Second target 1.64

Third target 1.76

Breaking: $ONDO Tanks 13% Today- What Next? Standing as a beacon in the realm of decentralized finance Ondo (ONDO) aiming to democratize access to institutional-grade financial services. Founded in 2022 and based in the Cayman Islands, Ondo operates through a unique ecosystem that bridges traditional finance with blockchain technology. The Ondo Foundation collaborates closely with Ondo Finance, its commercial partner, to support decentralized protocols and the tokenization of real-world assets.

Earlier today, the native token CRYPTOCAP:ONDO tanked 13% placing the coin on the cusp of a selling spree. However, CRYPTOCAP:ONDO faded a breakdown in the $0.866 pivot- a pivot that turned out to be the support point. If Selling pressure should increase, a break below the $0.866 point for CRYPTOCAP:ONDO would pose a serious threat for CRYPTOCAP:ONDO as the RSI is already weak at 41.82.

As indicated by the chart, a break above the $1.27 pivot could send CRYPTOCAP:ONDO on a bullish voyage with a breakout above the 1-month high as confirmation.

Ondo Price Live Data

The live Ondo price today is $0.973556 USD with a 24-hour trading volume of $462,035,194 USD. Ondo is down 13.67% in the last 24 hours, with a live market cap of $3,075,569,399 USD. It has a circulating supply of 3,159,107,529 ONDO coins and the max. supply is not available.

BlackRock and ONDO Pioneer Real World AssetsBlackRock has initiated strategic expansion into the Real World Assets (RWA) sector, with preliminary allocations to its BUIDL fund signaling active preparation for tokenization initiatives. Supporting evidence includes documented transactions, which underscore early-stage operational readiness for asset digitization. A detailed analysis of these deals can be found below.

Concurrently, the upcoming crypto summit, featuring participation from a White House representative of ONDO, highlights growing institutional and governmental engagement with digital asset frameworks. This development suggests alignment between public-sector policy and private-sector innovation, reinforcing the potential for regulatory advancements in tokenization.

Such coordinated activity underscores a broader trend toward integrating blockchain-enabled solutions into traditional financial infrastructure, with industry leaders and policymakers collaboratively exploring scalable applications of decentralized technologies.

Alex Kostenich,

Horban Brothers.

ONDO appears to have a bright future ahead!ONDO is a favorite cryptocurrency of many investors and traders alike. The entire crypto market has been dragged down since December after the massive gains from the "Trump election pump" caused many cryptos to go ballistic. However, the future looks bright for ONDO, as the current weekly chart suggests it's setting up for another leg up.

Good luck, and always use a stop-loss!

ONDO : one of the RWA crypto projects | Univers Of SignalsLet's take a quick look at ONDO, one of the RWA crypto projects, which ranks 32nd on CoinMarketCap with a market cap of $3.08 billion.

✨ In the 4-hour timeframe, we see a parabolic downtrend that started from the $1.4340 peak. In the first leg, the price reached the $1.0972 support. In the next leg, after breaking $1.0972, it dropped to $0.9255. After numerous red candles with high volume, the price has now entered a correction phase, forming a few green candles.

💫 The RSI oscillator is currently pulling back to the 30 zone, and if it gets rejected from this level, we might see the next bearish wave. However, if it moves back above the 30 zone, the price could form a new ranging box.

📊 If the $0.9255 zone is broken, you can open a short position. For a long position, wait for the price to form a new structure to create a long trigger.

$ONDO Back In Buying Territory - NEW ATHs on Q2ONDO is back in this buying zone.

I’ve been waiting to fill the wick, and it’s in the process—at least for 50%.

Stronger bids are sitting around 95 all the way down to 92, where I expect the price to trade above.

Should have plenty of time, as I see this consolidating until the end of April, so no rush.

LSE:ONDO BYBIT:ONDOUSDT

ONDO is the brainchild of BlackRockONDO is the top-1 tokenization platform for Real World Assets. I have already spoken at May 2024 where I talked about the relevance of the RWA sector and its aspirations for widespread adoption in blockchain. Specifically ONDO is a very progressive project that is launching its ONDO Chain! I think we will see strong upside in the asset over the near term and approach the 1.618 Fibonacci level. More globally, I would expect much higher values.

Horban Brothers.

ONDO target $2.654h time frame

-

Entry: $1.1

TP: $2.65

SL: $0.897

RR: 7.64

-

(1) ONDO is building a continuation structure with a triangle pattern.

(2) Triangle bottom is around $1.1, which is our entry opportunity.

(3) Fibonacci provides first target at $2.65 and final target at $3.7

(4) Stop loss once going below $0.897

HBAR & ONDO Give Us A Buy SignalTrading Fam,

My portfolio is all in rn. But that’s not going to stop me from helping you if you still have some cash on the sideline to throw at a trade or two. Here are two trades you may be interested in. I received a buy signal from my indicator at candle close last night on both.

The first is HBAR.

Hedera Hashgraph ( CRYPTOCAP:HBAR ) is one of the top alts currently being considered for a future ETF. I’ve received not one but two green dot signals within that large liquidity block. This tells me that institutional money and whales are accumulating this gem here. And it is on good support which I don’t see us breaking. If you entered at the time of this post (not fin advice), I could see holding to at least that recent high for a potential profit of 84% plus. If it were me, I’d set my stop out just below that recent pivot low.

The second trade opportunity I have spotted here is ONDO.

The chart here looks similar and once again I’d be targeting that last pivot high for around 75% profit potential. I’d also set my stop limit below our most recent pivot low.

These are both great coins with great opportunities for entry here! Let me know if you enter.

Best!✌️ Stew