InvestMate|EUR/GBP fall season💶💷EUR/GBP fall season

💶💷Quick play

💶💷A play to continue the trend and reach the 1:1 range of the last downward wave in the trend.

💶💷Breaking out at current levels.

💶💷Stop order above today's downtrend candle

💶💷Take profit at 0.8492 i.e. 1:1 fall wave.

🚀If you appreciate my work and effort put into this post I encourage you to leave a like and give a follow on my profile.🚀

Onetoone

SILVER, M30 - Market geometryClear uptrend on Silver on this time interval. Possible support level at 23.94. There is OneToOne geometry, 61.8 Fibo and potential another trendline touch

GOLD, H1 - Geometry 1:1 and harmonic patternOn H1 chart possible demand zone in the area 1750$. There is geometry 1:1 and harmonic pattern. Price reacted on 61.8 level, so possible bullish reaction on 78.6 or 88.6.

LONG with a beautiful 1:1 pattern on both extension and pullbackWe can see a 1:1 pattern on the extensions (Labelled 'A'). Identical in length and gives a good tend. The pullbacks are equally 1:1 (Labelled 'B') and interestingly have stopped at a level of support. By looking at the 4hr we can see that should the trend continue, the only structural support above is the all time highs of BNBGBP. This will be a strong stopping force for the Bears however, breaking this could once again lead to new highs. Overall my analysis for Bulls remains strong.

EURUSD Update, approaching buy zone Hello everyone, this is next update on eurusd as it's apporaching our buy zone which ~40 pips away. I will be looking at price action at this levels to get into long position.

We have 50% fib, onetoone formation and retest of previous high. This indicate that we may see a stron support at those levels.

This information is not a recommendation to buy or sell. It is to be used for educational purposes only.

"A is for my attitude working through the patience

Money comes and goes so the M is for motivation

Gotta stay consistent, the P is to persevere..."

USDPLN - the near end of the correction?After the zloty's sharp appreciation against the US dollar on 26 May, the market seems to be able to complete the full corrective structure labeled as abc. This is a typical simple correction, where wave c may be equal to wave a. One to one pattern is at 3.99 PLN.

Also in this region the previous tops and the lower limit in the trend channel are located, which could also be treated as a support area.

If this area is defended and the USD/PLN exchange rate remained above 4.00, it could be possible to return of the exchange rate to the upper limit in the trend channel.

________

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Nasdaq Update: still some room into climactic topShort-term weakness quickly overcome again, yet long-term trend analysis shows signs of climactic run

WYCKOFF STORY

SHORT TERM WEAKNESS INTO THE END OF THE LAST WEEK NEVER MATERIALIZED INTO AN ACTUAL SIGNAL

AND MARKET REMINDED US AGAIN THAT WE ARE IN A RUNAWAY MOMENTUM PHASE OF ADVANCE

DEMAND IS NOW OF SPECULATIVE NATURE AND A LOT OF INSTITUTIONS ARE RIDING MOMENTUM

WHICH THEY WILL ABANDON AT FAST RATE ONCE THIS MOMENTUM BUBBLE BURST

ONE-TO-ONE PROJECTION OFF THE BASE (2064 POINTS, 17 WEEKS) SUGGESTS A TOUCH OF 9500 BY JAN 27-31

BUT CLIMACTIC RUN COULD COME ON WEDNESDAY'S SIGNING OF THE TARIFF'S PHASE ONE AS "SELL ON NEWS" EVENT

possible cypher pattern usdjpypossible cypher pattern on usdjpy....one to one measured move and 161.8 confluence completion at the cypher completion (113.145). Target 1 at 111.642 target 2 110.727 as you can see these are not the conventional targets of being exactly at the 38.2 or 61.8. I have adjusted them based of the market structure. This pattern is pretty big and will take time to play out. Entry reasons have to be met for me to enter. Really looking for a 4 hr double top with rsi divergence before entering or evening star pattern w/ rsi oversold conditions on 4 hr. Stops for this trade are interesting because of how large it is. But conventional stops would be above x(starting point of cypher) hopefully out of reach. Also if the market does continue upward after I enter and I am not stopped out. Once the market turns to the downside I will adjust my tp's by pulling fib retracement from c to where the market completed and use those new 38.2 and 61.8 retracments as my targets.

NZD/USD 30min measured move and 240 min CypherPrice is starting to break down 240 min chart. On the 30 min we have a potential measured move. I'm looking for price to retrace back to the .382 fib (.70451) and then continue to the 1.618 fib ext to .6980. The measured move from the .382 to the 1.618 ext is exactly the same length. Also, the .382 fib level has acted as former support. I would have my stop just above the .618 at .7070 to give the trade some room to develop. The Cypher on the 240 min chart is still valid has well. If price closes on the 240 min above .69843, the Bearish Bat is still valid too. Good luck trading out there.

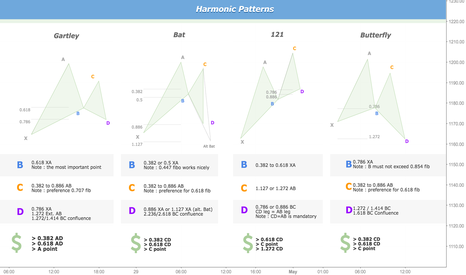

Harmonic Patterns ratio and examplesHi,

Above, some harmonic patterns that i often look for (bullish ones)

These patterns, when identified, have a good risk/reward ratio. They allow traders to enter into the market with minimal risk. Obviously, you need some other confirmations before taking the trade on the pattern completion.

If the point D occurs with some divergence on classic oscillators (RSI / Macd, Sto), on a bottom (or top, if pattern is bearish) of a trendline / channel, previous support/resistance levels, supply/demand zone...then there are good probabilities to see price react on the completion of the pattern.

There are plenty of patterns, but this selection, from my side, is a good start for those who want to learn harmonic pattern.

Below some examples that have worked nicely (this don't work each time, this would be too easy ;)

EUR/USD 30min Bearish Gartley patternThere is bearish Gartley setting up on the 30 min time frame for all of you pattern traders.(Completes at .786 around 1.1245 depending on how you trade patterns). Even if you don't trade patterns, there is a 1.272 extension and .886 fib confluence right into a double topping formation. Along with a one-to-one extension. On the 4 hour time frame we made a lower low/lower close. I'm looking to go short around 1.1252, stop above the swing high at 1.1270, and my target down to 1.1200 even. Price really rejected that 1.1200 area, so this could even be a potential buying opportunity. Good luck trading out there.

EUR/USD Bullish Continuation Zone 60minThis pair has been bullish in the wake of the ECB's rate cut and the increase in QE. We have nice zone (1.1215-1.1225) where we have a one-to-one confluence, a 1.618 inversion, and a .886 Fib retracement. This could be a potential zone to get long in the underlying trend. Look for price to reject this zone first before getting long. I would have my stops just below the swing low, but be aware of the 1.1200 even handle. It has acted as resistance before and could act as support if price blows through this level. I would look to take profits at the swing high's around 1.1325. Good luck trading out there.