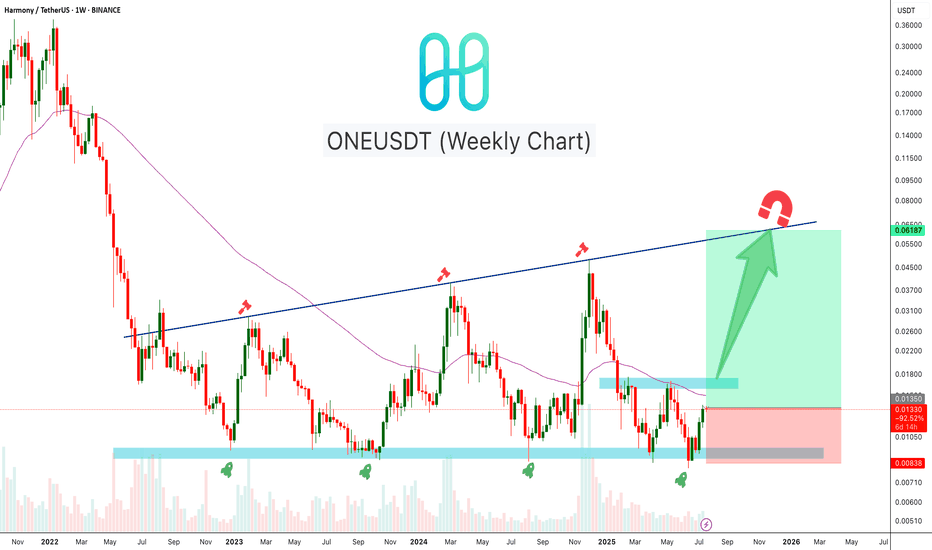

ONEUSDT Reversal BuildingONEUSDT is forming a strong base near the weekly demand zone around $0.009–$0.010, which has held multiple times over the past two years. The chart shows a clear accumulation pattern with higher lows forming. Price is now approaching the mid-range resistance near $0.017. If momentum continues, ONE may revisit the long-term trendline resistance near $0.065–$0.070.

Cheers

Hexa

Oneusdtidea

ONEUSDT at Make-or-Break Zone Major Reversal or Breakdown Ahead?📌 Overview:

ONEUSDT is currently sitting at a major historical support zone around $0.0080–$0.0093 (highlighted in yellow).

📉 This level has been tested multiple times since 2022, and continues to hold – signaling strong accumulation and potential for a major reversal.

🧠 Key Pattern in Focus:

✅ Triple Bottom Pattern

The Triple Bottom is a classic bullish reversal pattern, reflecting the strength of buyers after multiple failed attempts to break the support.

🔁 It’s typically followed by a surge in momentum if a breakout confirms the reversal.

🚀 Bullish Scenario (Reversal in Play):

🔸 Condition: Price holds above $0.0080 and begins forming higher lows.

🔸 Confirmation: A breakout and retest above the $0.01258 resistance level.

🎯 Upside Targets: 1️⃣ $0.01258 → Minor Resistance

2️⃣ $0.01644 → Previous structure high

3️⃣ $0.02285 → Major supply zone

4️⃣ $0.03530 → Psychological and technical target

🔍 With strong bullish momentum and volume support, a mid-term move toward $0.04900+ is possible.

🛑 Bearish Scenario (Breakdown Risk):

🔻 Condition: Price breaks down below $0.0080 with strong volume.

🔻 Risk: No clear support below this level → price could enter uncharted territory or set new All-Time Lows.

📉 Indicates complete seller dominance and failed demand structure.

🔍 Conclusion:

ONEUSDT is at a critical inflection point – a strong rebound opportunity or a breakdown toward new lows.

📌 Price action over the coming days will be key in determining the mid-term trend.

📈 Aggressive traders may look for early entries, while conservative traders should wait for breakout confirmation.

📢 Extra Notes:

🔔 Confirmation is key for this setup.

💡 Combine with indicators like RSI, MACD, or Volume Profile for added confluence.

⚠️ Risk management is essential — stop loss below $0.0080 recommended for long entries.

#ONEUSDT #HarmonyONE #CryptoBreakout #TripleBottomPattern #BullishSetup #AltcoinAnalysis #CryptoReversal #SupportZone #BreakoutZone #TechnicalAnalysis

#ONE/USDT#ONE

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower limit of the channel at 0.01147, acting as strong support from which the price can rebound.

Entry price: 0.01183

First target: 0.01210

Second target: 0.01236

Third target: 0.01268

ONEUSDT likely to head towards 0.16 zoneONEUSDT is another one trading between weekly resistance WR1 and weekly support WS1.

The price has been retracing back to WS1 after hitting WR1. It is likely to hit WS1 before having a bounce.

WS1 is likely to provide a good bounce and the fuel for its upward journey in coming weeks and months.

The future of this one looks quite promising.

The price is likely to break WR1 on the next bounce from WS1 and likely to continue its journey towards monthly resistance MR1.

With some pullbacks here and there on various resistance milestones, the price is likely to aim for monthly resistance MR2.

ONEUSDT | Major Resistance Ahead at the Deep Red BoxI’ve shaded the red box extra dark because it really is a formidable barrier. Historically, price has stalled and reversed here, so if ONEUSDT manages to break through this zone, it could fuel a strong move higher. Until then, caution is essential.

Key Points to Watch

Red Box = Heavy Resistance

Sellers have been lining up in this area. Any rally into this zone could be met with aggressive selling pressure.

Confirmation Needed

I’ll wait for clear signs of a breakout on lower time frames—ideally a clean close above the red box followed by a successful retest. CDV shifts and rising volume must support that move before I even consider going long.

Flexible Bias

I will not insist on my short idea. If price breaks up through the red box without giving a proper downward break first, I’ll drop the bearish view. If instead that breakout holds with volume and retests as support, I’ll flip bias and look for longs.

This is one of those rare levels where preparation and patience pay off. Let the market prove its strength or weakness here, then act with confidence. Remember that well‑managed risk and strict confirmation criteria are your best allies in navigating tough resistance zones.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

📊 Simple Red Box, Extraordinary Results

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

ONE 900% potential BINANCE:ONEUSDT

Possible Targets and explanation idea

➡️Would like to see drop to 0.5 of M FVG

➡️After retest of FVG we can see uptrend to First M Bullish FVG around 900%

➡️On Monthly timeframe ADZ indicator in biggest accumulation stage ever

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

---

• Look at my ideas about interesting altcoins in the related section down below ↓

• For more ideas please hit "Like" and "Follow"!

ONEUSDT Analysis: Strategic Demand ZonesONEUSDT presents high-potential demand zones , highlighted by the blue boxes . I’ve intentionally placed these zones lower , considering the market's potential to reach these levels around the Christmas period . This approach provides an opportunity for well-positioned entries if market conditions align.

Key Points:

Strategic Positioning: Blue boxes set intentionally lower for better entries in expected market dips.

Market Timing: Potential price action around Christmas aligns with these zones.

Confirmation Indicators: I will use CDV, liquidity heatmaps, volume profiles, volume footprints, and upward market structure breaks on lower time frames for validation.

Learn With Me: If you want to master how to use CDV, liquidity heatmaps, volume profiles, and volume footprints to identify precise demand zones, just DM me. I’d be happy to guide you!

Reminder: Be aware of the market's current state and approach it with caution. Successful trading relies on meaningful levels and robust confirmations.

If you think this analysis helps you, please don't forget to boost and comment on this. These motivate me to share more insights with you! Wishing everyone success in their trades.

If you think this analysis helps you, please don't forget to boost and comment on this. These motivate me to share more insights with you!

I keep my charts clean and simple because I believe clarity leads to better decisions.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups.

If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

My Previous Analysis

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

ONEUSDT Delivers a Whopping 1,500% Gain and Still Running!ONEUSDT on the 1-Day timeframe has delivered an explosive long trade setup, exceeding all profit targets. The trade has achieved an extraordinary 1,500% profit so far and continues to show strength for further upside momentum.

Key Levels:

TP1: 0.01510 ✅

TP2: 0.01804 ✅

TP3: 0.02099 ✅

TP4: 0.02280 ✅

Technical Analysis:

The trade was perfectly caught using the Risological Swing Trading Indicator , which provided a clear entry at 0.01328 and an SL at 0.01181 for disciplined risk management.

Price action shows a strong uptrend, with consistent support from the Risological Trend Line, pushing ONEUSDT beyond all set targets. Profit-taking at higher levels remains ideal while monitoring for further gains.

ONEUSDT: Analysis of Key Buying AreasThe blue and green boxes on this chart represent critical buying zones, identified using a blend of advanced technical analysis techniques. These zones indicate areas where strong buying pressure is expected, making them ideal for potential long positions. Below is a detailed breakdown of their significance and trading approach:

1. The Concept of Buying Zones

Buying zones are price regions where a reversal or bounce to the upside is likely. These zones are derived from significant support levels and historical price reactions.

Blue Boxes: These are primary buying zones , indicating areas with the highest confidence of support. They are often identified from higher timeframes, such as daily or 4-hour charts, and reflect strong confluence levels like Fibonacci retracements or key order blocks.

Green Boxes: These are secondary buying zones , providing additional opportunities but with slightly lower confidence. These zones typically stem from intraday price action and minor structural support levels.

2. How Are These Zones Determined?

The buying zones are meticulously drawn using the following methods:

Fibonacci Levels: Focused on 0.618–0.786 retracement areas for strong support.

Order Blocks: Highlighting the last bullish or bearish candle before an impulsive price move.

Volume Profile: Identifying high-volume nodes, which often act as significant price magnets.

Market Structure: Analyzing higher highs and higher lows to define areas of structural support.

3. How to Trade the Zones

When the price enters these buying zones, here’s how to approach it:

Blue Box – High-Confidence Trade:

Monitor for confirmation signals such as bullish candlestick patterns (e.g., engulfing or pin bars).

Place stop-loss orders just below the zone’s boundary to minimize risk.

Green Box – Lower Priority Trade:

Use tighter stop-losses and wait for stronger intraday confirmations, like breakouts from local resistance.

Be mindful of higher risks as these zones are not as robust as blue boxes.

4. Additional Confirmation Signals

Strengthen your entries by combining these signals:

Bullish Divergences: Look for RSI or MACD divergences aligning with the zones.

Volume Spikes: A sharp increase in volume near the zones indicates institutional interest.

Reclaim of Key Levels: A break above nearby resistance after bouncing from the zone confirms upward momentum.

5. Example Scenarios

Scenario 1: Price enters the blue box and forms a bullish engulfing candle. Enter a long position, set a stop-loss below the zone, and target the next resistance level.

Scenario 2: Price dips into the green box but holds above the lower boundary. Wait for consolidation and a breakout before entering.

I keep my charts clean and simple because I believe clarity leads to better decisions.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups.

My Previous Analysis

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

ONE / ONEUSDTWe have two scenarios for the price, the first is that we are in an upward correction wave and then the price falls again. Second, the price is in a fourth corrective wave and still has more to fall, then the price rises again.

Good Luck >>

• Warning •

Any deal I share does not mean that I am forcing you to enter into it, you enter in with your full risk, because I'll not gain any profits with you in the end.

The risk management of the position must comply with the stop loss.

(I am not sharing financial or investment advice, you should do your own research for your money.)

ONEUSDT 280% Will it Happen?DCA LL Longing oneusdt from here.

Under 0.03160.

Hold and send will have a massive move towards upside.

Currently on this trade putting stoploss too tight at local lows.

Highly Risky but worthit if I catch the initial move.

Targeting 0.074(400% with 3x)

Targeting 0.12 (850% with 3x)

Unbelievable targets but lets give it a try.

Drop a comment if you like my Ideas and work.

Note: Not a Financial Advice.

ONE target 0.024 $ 0.051D time frame

-

ONE is consolidating under the long-term downtrend, and retesting the 0.618 Fibonacci Retracement, so here is a good timing to set up a perpetual trading plan with 3.6 RR. Also, there is a strong support on higher time frame around 0.008~0.010, this is a great zone to accumulate spot if ONE come back again in future. Therefore, I provide two trading plans for perpetual and spot.

-

Perpetual:

TP: 0.024 / 0.031

SL: 0.0119

Spot:

TP: 0.05

SL: 0.0079

ONE target 0.051D time frame

-

ONE is breaking out the long-term downtrend with an obvious bottom zone around 0.009. What it need is more volume to push price higher, that would be a perfect breakout. Also, we use Fibonacci Extension and structural resistance to set targets as below.

-

TP: 0.038~0.04 / 0.05

SL: 0.01612