ONE/USDT — Breakout or Breakdown Ahead?📊 Complete Analysis of ONE/USDT (1D)

ONE is currently trading around $0.0111, sitting right at a critical junction between the major support zone ($0.0095–$0.0115) and a descending trendline that has been pressing price down since the December–January peak.

This setup forms a descending triangle pattern — typically a bearish continuation pattern, but under certain conditions it can flip into a strong bullish reversal if price breaks upward with volume.

---

🔍 Technical Details & Pattern

Primary Trend: Bearish since the late 2024 peak, with consistent lower highs.

Key Support Zone: $0.0095–$0.0115 (historical demand zone, tested multiple times since September 2024).

Dynamic Resistance: Descending trendline connecting lower highs.

Important Horizontal Levels:

$0.01375 → Nearest breakout confirmation resistance.

$0.01654, $0.02284, $0.03245, $0.04588 → Potential mid-term upside targets.

$0.00803 → Nearest low and first breakdown target.

Volume Factor: Breakout or breakdown must be confirmed by high trading volume.

---

🟢 Bullish Scenario (Breakout Upward)

If price breaks and closes daily above the descending trendline and clears $0.0138, the likelihood of a reversal increases.

Potential upside targets:

1. $0.0165 → Psychological resistance & minor supply zone.

2. $0.0228 → Major resistance and previous distribution area.

3. $0.0324–$0.0458 → If momentum extends further.

Strategy:

Enter after breakout + successful retest as new support.

Stop loss below $0.0095 to avoid fakeouts.

Watch for volume: without strong volume, risk of a bull trap is high.

---

🔴 Bearish Scenario (Breakdown Lower)

If price breaks and closes daily below $0.0095, the descending triangle pattern confirms as a bearish continuation.

Potential downside targets:

1. $0.00803 → Significant low and possible bounce area.

2. $0.0069 → Historical lowest level since 2023.

3. Below $0.0065 → Potential new lows if selling pressure escalates.

Strategy:

Enter after breakdown + failed retest above $0.0095.

Stop loss above $0.012–$0.013 to avoid short squeezes.

Adjust position size — volatility can spike sharply post-breakout.

---

📌 Key Points to Monitor

Convergence of Buyers & Sellers: The closer price moves toward the triangle’s apex, the higher the chance of a breakout in either direction.

Lengthy Consolidation: Post-breakout moves are often stronger after extended consolidation.

Risk Management: Avoid going all-in before confirmation; consider scaling entries.

Market Sentiment: Watch BTC & ETH — a bearish macro crypto environment increases the risk of a downside move.

---

📍 Conclusion

ONE/USDT is currently at a make-or-break zone.

📌 Bullish breakout → Potential rally toward $0.0165+

📌 Bearish breakdown → Likely drop toward $0.0080 or lower.

Traders should wait for daily close confirmation + strong volume to reduce false breakout risk.

The $0.0095–$0.0115 zone is the last major defense line for buyers in the medium term.

#ONEUSDT #HarmonyONE #CryptoAnalysis #TechnicalAnalysis #PriceAction #DescendingTriangle #Breakout #Breakdown #Altcoins #CryptoTrading

Oneusdtsignals

#ONE/USDT Reversal Building#ONE

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is poised to break it strongly upwards and retest it.

We have support from the lower boundary of the descending channel, at 0.01252.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward move.

There is a key support area (in green) at 0.01200, which represents a strong basis for the upward move.

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend of stability above the Moving Average 100.

Entry price: 0.01257

First target: 0.01312

Second target: 0.01368

Third target: 0.01444

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

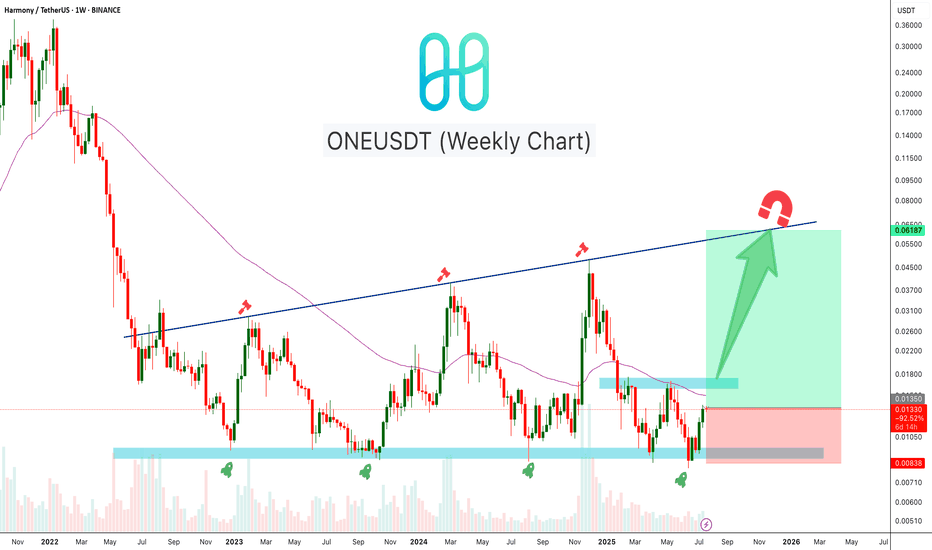

ONEUSDT Reversal BuildingONEUSDT is forming a strong base near the weekly demand zone around $0.009–$0.010, which has held multiple times over the past two years. The chart shows a clear accumulation pattern with higher lows forming. Price is now approaching the mid-range resistance near $0.017. If momentum continues, ONE may revisit the long-term trendline resistance near $0.065–$0.070.

Cheers

Hexa

ONEUSDT at Make-or-Break Zone Major Reversal or Breakdown Ahead?📌 Overview:

ONEUSDT is currently sitting at a major historical support zone around $0.0080–$0.0093 (highlighted in yellow).

📉 This level has been tested multiple times since 2022, and continues to hold – signaling strong accumulation and potential for a major reversal.

🧠 Key Pattern in Focus:

✅ Triple Bottom Pattern

The Triple Bottom is a classic bullish reversal pattern, reflecting the strength of buyers after multiple failed attempts to break the support.

🔁 It’s typically followed by a surge in momentum if a breakout confirms the reversal.

🚀 Bullish Scenario (Reversal in Play):

🔸 Condition: Price holds above $0.0080 and begins forming higher lows.

🔸 Confirmation: A breakout and retest above the $0.01258 resistance level.

🎯 Upside Targets: 1️⃣ $0.01258 → Minor Resistance

2️⃣ $0.01644 → Previous structure high

3️⃣ $0.02285 → Major supply zone

4️⃣ $0.03530 → Psychological and technical target

🔍 With strong bullish momentum and volume support, a mid-term move toward $0.04900+ is possible.

🛑 Bearish Scenario (Breakdown Risk):

🔻 Condition: Price breaks down below $0.0080 with strong volume.

🔻 Risk: No clear support below this level → price could enter uncharted territory or set new All-Time Lows.

📉 Indicates complete seller dominance and failed demand structure.

🔍 Conclusion:

ONEUSDT is at a critical inflection point – a strong rebound opportunity or a breakdown toward new lows.

📌 Price action over the coming days will be key in determining the mid-term trend.

📈 Aggressive traders may look for early entries, while conservative traders should wait for breakout confirmation.

📢 Extra Notes:

🔔 Confirmation is key for this setup.

💡 Combine with indicators like RSI, MACD, or Volume Profile for added confluence.

⚠️ Risk management is essential — stop loss below $0.0080 recommended for long entries.

#ONEUSDT #HarmonyONE #CryptoBreakout #TripleBottomPattern #BullishSetup #AltcoinAnalysis #CryptoReversal #SupportZone #BreakoutZone #TechnicalAnalysis

ONEUSDT | Major Resistance Ahead at the Deep Red BoxI’ve shaded the red box extra dark because it really is a formidable barrier. Historically, price has stalled and reversed here, so if ONEUSDT manages to break through this zone, it could fuel a strong move higher. Until then, caution is essential.

Key Points to Watch

Red Box = Heavy Resistance

Sellers have been lining up in this area. Any rally into this zone could be met with aggressive selling pressure.

Confirmation Needed

I’ll wait for clear signs of a breakout on lower time frames—ideally a clean close above the red box followed by a successful retest. CDV shifts and rising volume must support that move before I even consider going long.

Flexible Bias

I will not insist on my short idea. If price breaks up through the red box without giving a proper downward break first, I’ll drop the bearish view. If instead that breakout holds with volume and retests as support, I’ll flip bias and look for longs.

This is one of those rare levels where preparation and patience pay off. Let the market prove its strength or weakness here, then act with confidence. Remember that well‑managed risk and strict confirmation criteria are your best allies in navigating tough resistance zones.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

📊 Simple Red Box, Extraordinary Results

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

UniversOfSignals | ONE: Key Levels and Market AnalysisIn this analysis, I want to review ONE, the token of the Harmony project. Harmony is one of the layer-1 blockchain networks and is considered one of the older crypto projects.

✨ The token currently holds a market cap of $205 million, ranking 198th on CoinMarketCap.

📅 Daily Timeframe

On the daily timeframe, as you can see, there is a large consolidation box between $0.01033 and $0.032724. In the last bullish leg, the price started from the $0.01033 low and moved up to the main resistance at $0.032724.

✅ It even broke above this level, reaching $0.04532, but was rejected and fell back into the range, turning this bullish move into a fake breakout.

⚡️ After returning to the range, the price first corrected to $0.02286. Once this level was broken, the next bearish leg pushed the price down to $0.01346. Currently, we are seeing a smaller consolidation box between $0.01346 and $0.01681.

🧩 Looking at the RSI oscillator, there is also a range between 37.05 and 50. A breakout in either direction could confirm the momentum for that direction. Naturally, a break below 37.05 would be a stronger confirmation for downside movement, as the market momentum is already bearish.

📊 If $0.01346 is broken, the price could move toward the bottom of the large range at 0.01033.If $0.01033 is broken, a new all-time low (ATL) is likely to be registered.

🔼 On the bullish side, if the $0.01346 support holds and the $0.01681 resistance is broken, we can expect the price to rally toward $0.02286 and possibly even $0.03274.

🛒 For spot buying, I prefer to wait until this coin shows strength against Bitcoin and Bitcoin dominance starts declining. My spot trigger is currently at $0.04532, and I will not enter a position before this level is broken.

⏳ 4-Hour Timeframe

On the 4-hour timeframe, the price remains within the same range as identified in the daily timeframe.

🔽 For a short position, if $0.01327 is broken, you can enter a short trade targeting the bottom of the range.

📈 For a high-risk long position, if $0.014825 is broken, you can target the top of the range, but this trade is very risky.The main long position will be confirmed if the price breaks above $0.01681.

🔑 Regarding indicators and oscillators, I don’t have much to say in this ranging market. Volume is also low, making it difficult to rely on momentum indicators in this sideways phase.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

#ONE/USDT#ONE

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.01300

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.01490

First target 0.01565

Second target 0.01641

Third target 0.01730

ONE 900% potential BINANCE:ONEUSDT

Possible Targets and explanation idea

➡️Would like to see drop to 0.5 of M FVG

➡️After retest of FVG we can see uptrend to First M Bullish FVG around 900%

➡️On Monthly timeframe ADZ indicator in biggest accumulation stage ever

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

---

• Look at my ideas about interesting altcoins in the related section down below ↓

• For more ideas please hit "Like" and "Follow"!

#ONE/USDT Ready to go higher#ONE

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 0.02100

We have a downtrend on the RSI indicator that is about to break, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.02130

First target 0.02200

Second target 0.02250

Third target 0.02350

ONEUSDT: Eyeing Weekly VWAP for Optimal Entry! ONEUSDT: Eyeing Weekly VWAP for Optimal Entry! 🌟📊

Key Points:

Price Check: ONEUSDT’s current price aligns well for a potential buy setup.

Weekly VWAP Opportunity: Aiming to catch an entry below the weekly VWAP for added confirmation and risk management. I would take half the risk I normally take.

Why This Setup?

Strategically buying below the weekly VWAP combines market sentiment and technical advantage. With indicators like CDV, liquidity heatmaps, volume profiles, and volume footprints, these demand zones offer high-value entry points.

Pro Tip: Confirm with low time frame market structure breaks and volume footprint support to maximize confidence in your trade.

If you find this analysis helpful, please boost, comment, and follow. Let’s make trading smarter, together!

Let me tell you, folks, this is amazing. Nobody does analysis like I do. Believe me. If this helps you, don't forget to boost and comment! It’s a big deal, motivates me to share even more winning insights with you. Tremendous insights.

I keep my charts the best, clean, simple, and clear. You know it, I know it, clarity leads to better decisions. No question about it. My approach? Built on years of tremendous experience. Incredible track record. I don’t claim to know it all, but I spot high-probability setups like nobody else. Trust me.

Want to learn how to use the heatmap, cumulative volume delta, and volume footprint techniques I use to determine demand regions with stunning accuracy? Send me a private message—totally free, folks. That’s right. I help anyone who wants it, absolutely no charge. Unbelievable value.

Here’s the list, long list, great list, of some of my previous incredible analyses. Each one, a winner:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

And that’s just the start. The list goes on and on, folks. It’s a tremendous list, the best. I stopped adding because, frankly, it’s tiring. So many wins. People are amazed. You can check my profile and see for yourself, winning moves, all the time. Believe me, nobody does it better.

ONEUSDT Analysis: Strategic Demand ZonesONEUSDT presents high-potential demand zones , highlighted by the blue boxes . I’ve intentionally placed these zones lower , considering the market's potential to reach these levels around the Christmas period . This approach provides an opportunity for well-positioned entries if market conditions align.

Key Points:

Strategic Positioning: Blue boxes set intentionally lower for better entries in expected market dips.

Market Timing: Potential price action around Christmas aligns with these zones.

Confirmation Indicators: I will use CDV, liquidity heatmaps, volume profiles, volume footprints, and upward market structure breaks on lower time frames for validation.

Learn With Me: If you want to master how to use CDV, liquidity heatmaps, volume profiles, and volume footprints to identify precise demand zones, just DM me. I’d be happy to guide you!

Reminder: Be aware of the market's current state and approach it with caution. Successful trading relies on meaningful levels and robust confirmations.

If you think this analysis helps you, please don't forget to boost and comment on this. These motivate me to share more insights with you! Wishing everyone success in their trades.

If you think this analysis helps you, please don't forget to boost and comment on this. These motivate me to share more insights with you!

I keep my charts clean and simple because I believe clarity leads to better decisions.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups.

If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

My Previous Analysis

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

#ONE/USDT#ONE

The price is moving in a descending channel on the 4-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 0.02226

Entry price 0.02512

First target 0.02973

Second target 0.03367

Third target 0.3865

ONEUSDT Delivers a Whopping 1,500% Gain and Still Running!ONEUSDT on the 1-Day timeframe has delivered an explosive long trade setup, exceeding all profit targets. The trade has achieved an extraordinary 1,500% profit so far and continues to show strength for further upside momentum.

Key Levels:

TP1: 0.01510 ✅

TP2: 0.01804 ✅

TP3: 0.02099 ✅

TP4: 0.02280 ✅

Technical Analysis:

The trade was perfectly caught using the Risological Swing Trading Indicator , which provided a clear entry at 0.01328 and an SL at 0.01181 for disciplined risk management.

Price action shows a strong uptrend, with consistent support from the Risological Trend Line, pushing ONEUSDT beyond all set targets. Profit-taking at higher levels remains ideal while monitoring for further gains.

ONEUSDT: Analysis of Key Buying AreasThe blue and green boxes on this chart represent critical buying zones, identified using a blend of advanced technical analysis techniques. These zones indicate areas where strong buying pressure is expected, making them ideal for potential long positions. Below is a detailed breakdown of their significance and trading approach:

1. The Concept of Buying Zones

Buying zones are price regions where a reversal or bounce to the upside is likely. These zones are derived from significant support levels and historical price reactions.

Blue Boxes: These are primary buying zones , indicating areas with the highest confidence of support. They are often identified from higher timeframes, such as daily or 4-hour charts, and reflect strong confluence levels like Fibonacci retracements or key order blocks.

Green Boxes: These are secondary buying zones , providing additional opportunities but with slightly lower confidence. These zones typically stem from intraday price action and minor structural support levels.

2. How Are These Zones Determined?

The buying zones are meticulously drawn using the following methods:

Fibonacci Levels: Focused on 0.618–0.786 retracement areas for strong support.

Order Blocks: Highlighting the last bullish or bearish candle before an impulsive price move.

Volume Profile: Identifying high-volume nodes, which often act as significant price magnets.

Market Structure: Analyzing higher highs and higher lows to define areas of structural support.

3. How to Trade the Zones

When the price enters these buying zones, here’s how to approach it:

Blue Box – High-Confidence Trade:

Monitor for confirmation signals such as bullish candlestick patterns (e.g., engulfing or pin bars).

Place stop-loss orders just below the zone’s boundary to minimize risk.

Green Box – Lower Priority Trade:

Use tighter stop-losses and wait for stronger intraday confirmations, like breakouts from local resistance.

Be mindful of higher risks as these zones are not as robust as blue boxes.

4. Additional Confirmation Signals

Strengthen your entries by combining these signals:

Bullish Divergences: Look for RSI or MACD divergences aligning with the zones.

Volume Spikes: A sharp increase in volume near the zones indicates institutional interest.

Reclaim of Key Levels: A break above nearby resistance after bouncing from the zone confirms upward momentum.

5. Example Scenarios

Scenario 1: Price enters the blue box and forms a bullish engulfing candle. Enter a long position, set a stop-loss below the zone, and target the next resistance level.

Scenario 2: Price dips into the green box but holds above the lower boundary. Wait for consolidation and a breakout before entering.

I keep my charts clean and simple because I believe clarity leads to better decisions.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups.

My Previous Analysis

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

ONEUSDT Signals Trend ReversalONEUSDT Technical analysis update

ONEUSDT has been trading within a channel for the last 150 days, which is considered an accumulation stage. We can see high volume as the price moves toward a breakout, and today, the price has crossed the 200 EMA. This is considered a strong bullish signal, indicating a potential trend change to bullish.

Regards

Hexa

ONE / ONEUSDTWe have two scenarios for the price, the first is that we are in an upward correction wave and then the price falls again. Second, the price is in a fourth corrective wave and still has more to fall, then the price rises again.

Good Luck >>

• Warning •

Any deal I share does not mean that I am forcing you to enter into it, you enter in with your full risk, because I'll not gain any profits with you in the end.

The risk management of the position must comply with the stop loss.

(I am not sharing financial or investment advice, you should do your own research for your money.)