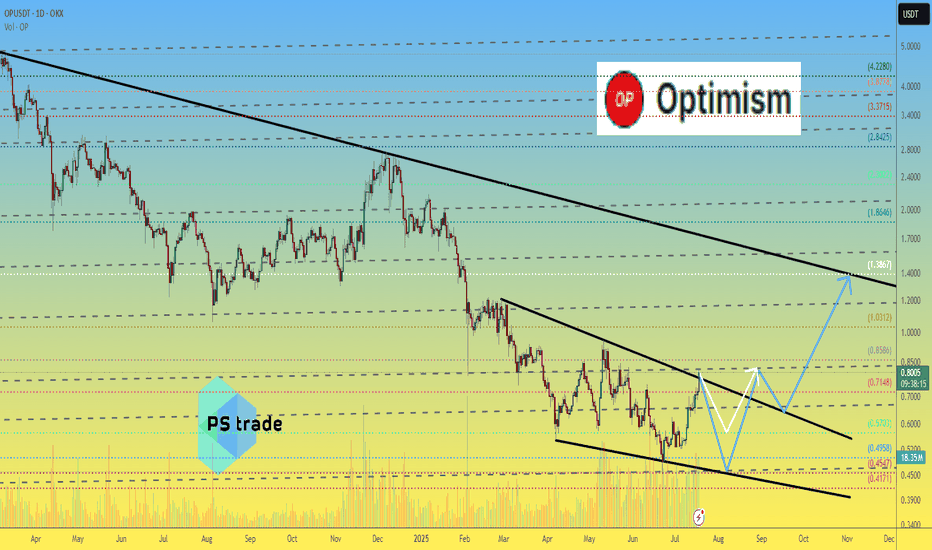

Optimism OP price analysisCurrently, the price of #OP does not look very optimistic (a little pun to start with )))

🟢 An optimistic forecast would be for the price of OKX:OPUSDT to rise to $1.40

🟡 But it looks like this growth will not happen now, but after a correction.

🔴 Correction: only to $0.57 or again to $0.45 — this is also an open question.

👌 Patience to holders and fans of the #Optimism project, the “microclimate” in the crypto market is improving — the time will come, and this coin will also be pumping...

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

OP

OPUSDT Forming Falling ChannelOPUSDT is currently exhibiting a promising setup that could lead to a significant bullish move. The chart shows that the price has broken out of a well-defined falling channel pattern, which often signals the end of a correction phase and the beginning of a potential uptrend. With the breakout confirmed and good volume supporting this move, there is a strong possibility of a 90% to 100% gain in the coming sessions, drawing the attention of traders looking for breakout plays.

Optimism (OP) has been a hot topic within the crypto community due to its role in scaling Ethereum through its layer 2 solution. The consistent development and growing adoption of the Optimism network have sparked investor interest, providing a fundamental backdrop that complements the bullish technical signals. Many traders see this breakout as an opportunity to get in early on a potential recovery rally.

The current price action suggests that OPUSDT may continue its upward trajectory if buying pressure remains strong and key resistance levels are cleared convincingly. Traders should watch for sustained volume spikes and possible retests of the breakout level, which can offer more confidence in the continuation of the bullish momentum. As always, risk management is essential when navigating such moves.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

Optimism Extreme BUY: Easy 1277% Profits Potential—Can Go HigherOptimism is now moving within a "extreme BUY" zone. This is a price zone that was active only once between June and July 2022, one month only and then OPUSDT went on a massive rally. Total growth amounting to more than 1,111% from bottom to top.

This zone has been activated again for a little over one month and I believe it won't remain valid much longer. There is room for a new wave of growth but this time much more than 1,111%.

The target shown on the chart is a good one but I believe this trading pair/Cryptocurrency project can go higher when all is said and done.

Technical analysis —Bullish based on price action

On the 16-June week, 22-June specifically, Optimism (OPUSDT) hit its lowest price yet. 0.457. This is just a bit higher compared to the all-time low June 2022 at 0.396. We can easily say the bottom is in as this week the action is back above its 7-April 2025 low.

Higher targets

The next high target sits at $12, giving us a 2,078% potential for profits from current price. 0.551 at the time of writing.

Previous cycle vs current cycle

Optimism's first bullish cycle lasted 630 days. The next cycle, the one that is about to start now, can last an entire year, eight months... We are entering uncharted territory so it is hard to say.

One thing I can say based on TA is that this new wave will be much more steep compared to the last one. The climb will be really fast, it will be hard to adapt.

How to trade to maximize profits

The best way to approach this pair for sure success is by buying when prices are low, now. This would secure a smooth ride and happy profits on the way up.

If you are reading this now, your timing is awesome because we are looking at a bottom catch, this type of opportunity is only seen once every several years. For example, the last time OPUSDT traded this low was in mid-2022, three years ago. Once the bullish wave takes off, there is no going back. Once the bulls are in, low prices will be forever gone.

Thanks a lot for your continued support.

Namaste.

OP Roadmap (3D)The OP token has entered a bearish phase after completing a triangle pattern. We are currently in this bearish phase.

Such large bearish phases typically require a sweep of liquidity from key levels before ending. It appears that OP, after sweeping the liquidity below support levels, may reverse and enter a bullish phase.

The targets have been marked on the chart.

A daily candle close below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

Everyone saw the drop. I saw the gapPrice nuked — but it didn’t break structure. It filled imbalance, paused, and now it's reloading beneath a stack of untouched FVGs. This isn't capitulation. It's orchestration.

The setup:

We’ve got layered 60-minute FVGs stacked from 0.61 to 0.66. That’s the destination — not the mystery. What matters is the origin. The rejection block around 0.58–0.59 has held clean, and we now have two bullish rejection wicks off that base.

Volume surged during the sweep — and fell on the retrace. That’s not distribution. That’s Smart Money filling.

Two entries — one outcome:

Entry 1: Tap into the red demand zone, wick the 0.58–0.579 region

Entry 2: Break and retest above minor FVG (0.60 reclaim confirmation)

Either way, the draw is the inefficiency stack above.

Execution Map:

Long from 0.579–0.583

SL: Below the base at 0.574

TP1: 0.615 (lower FVG)

TP2: 0.645 (full sweep)

Final: 0.660 liquidity run

Don’t fear the compression. That’s where the trap is set.

Final thought:

“Most traders fear price going sideways. I see it as silence before the algorithm speaks.”

The 2025 Bull Market: Do Not Sell Unless You See A New All-Time How long have you been in this market? You are about to embark on a journey; you are about to experience/enjoy the most sought after phase of the cryptocurrency market, the bull market.

If you've been around for less than four years, you've seen nothing like it. It will blow your mind.

You can see the numbers on the charts, past action and there you have your proof, but nothing can prepare you for the actual experience. Even if you've experienced previous bull markets, the actual event is mind-blowing. We are dying for you to try it. We cannot wait anymore... We just want you to earn, make money, share, have fun and enjoy. We, the Cryptocurrency family, deeply love you and wish for you amazing results.

Don't be shy. Do not be afraid. Buy everything up like it is the end of the world. Once bought, hold. Do not sell. I repeat, do not sell until prices are high, really high up. For example, looking at Optimism, OPUSDT, wait for a new all-time high before taking profits.

Thanks a lot for your continued support.

Leave a comment if you enjoyed the article, it will only take ten seconds.

Namaste.

OP/USDT Breakout Alert!!🚀 OP Breakout Alert – 100% Potential Incoming?! 👀🔥

Hey Traders! If you're all about high-conviction plays and real alpha, smash that 👍 and tap Follow for more setups that actually deliver! 💹💯

OP has successfully broken out from the falling wedge pattern on the daily timeframe, which historically signals a strong trend reversal. After retesting the breakout zone, price action looks ready for a fresh upside move!

🔹 Entry: CMP and add more up to $0.76

🎯 Targets:

→ $0.98

→ $1.21

→ $1.43

→ Final Target: $1.64

🛑 SL: $0.688

⚙️ Leverage: Low leverage (Max 5x)

📊 Structure:

Falling wedge breakout ✅

Retest holding strong ✅

Volume starting to pick up 📈

We’re watching closely—this setup has the potential to mimic the last 114% rally. Let's see how it unfolds! 🚀

💬 What’s your take on OP from here?

Optimism (OP) Falling WedgeBINANCE:OPUSDT is attempting a breakout from a 14 months long falling wedge.

A sustained break above the resistance in the near term would set the target at $3.80, just shy of the main $4.00-$4.80 supply zone.

Key Levels to Watch

• $0.55-$0.60: Main demand zone and invalidation point for the setup

• $1.00-$1.20: High Volume Node and key S/R dating back to June 2023.*

• $2.50-$2.80: High Volume Node and wedge high point.*

• $4.00-$4.80: Main supply zone.

* These could offer resistance and represent good levels for partial TPs.

Optimism Back Above Long-Term Support: Easy 480% PPI will base this entire analysis on a single signal, a break and recovery of support.

Optimism moved recently below its previous All-Time Low established October 2022. The break below this level only lasted a few days. A week closed below and immediately the next week a close happened above. This is a bullish signal. Support was tested and holds. It broke briefly but the fact that the action is back above it makes this situation a bullish one.

» As long as OPUSDT trades above 0.636, market conditions are strongly bullish.

This week we have a full green candle and the week closes today. This is a continuation of last week that closed at the top of the session, another bullish signal.

Some Altcoins are now producing three digits green in a single day, real projects. This type of action is only present in a bullish cycle. At the beginning of a bullish wave, in-between or at the top, never within a bearish cycle or bearish wave.

Bullish action is confirmed. Bullish reversal is confirmed. Higher prices will happen next.

» I have an easy target for you mapped on the chart for OPUSDT, 480%.

Thank you for reading.

There will be more... This target on the chart is only the start, we are set to experience growth long-term. You have not seen how the Altcoins market looks and feels when it grows for six months straight, it will be awesome, and then the bull run.

Namaste.

OP/USDT Major trend. 07 2024Logarithm. Time Frame 1 week. After the listing there were 3 cyclical pumping of the “participation” phase. PR, hype, connection of the majority in mass media. The reversal occurred with a typical breakout in the secondary trend of a triangle (first pumping) or a wedge (second pumping). Now the third wedge is forming, the price is near the dynamic Gann support (reaction from it), but still in the range of the descending wedge pattern.

On a line chart (liquidity, no slippage) the declines are cyclical at -63% each time according to the algorithm. Each successive top +55% of the previous secondary trend.

It is quite possible that something similar will happen again this time (not necessarily), but only ideally after holding dynamic fan support and breaking wedge resistance. I have purposely shown only medium-term targets after a trend break.

Gann's trend fan is plotted on the chart, i.e. dynamic support/resistance areas for the future.

Optimism customization - L2's blockchain scaling solution ETH Crypto funds have invested a total of $267 million.

Secondary trend Time frame 3 days

OP/USDT Secondary trend. Wedge. Pivot zones. 27 07 2024OP/USDT Secondary trend. Wedge. Pivot zones. 27 07 2024

Logarithm. Time frame 3 days. A descending wedge is forming. The price is near the dynamic Gann support (reaction from it), but still in the range of the descending wedge pattern. The reaction in this resistance zone will determine the trend for the near future.

On the chart, I have specifically shown the minimum percentages of the two key reversal zones for the trend to local resistance levels, for the potential of option A and B.

Major trend.

OP/USDT Major trend. 07 2024 Time frame 1 week.

OP: Once in a Life-Time Chance?#Optimism may have completed its correction, showing a rare opportunity.

If the current low holds, it would mark the major bottom, completing a diagonal 1st wave followed by a WXY correction.

Passing $2.78 confirms targeting the ATH.

Breaking $0.39 invalidates the idea.

OP 1W (Optimism)NASDAQ:OP 1W;

OP has spent almost all of its time below the EQ level since its existence.

There is a noticeable mismatch on the RSI side. It is difficult to say how much time is left before the rise, but upward movements are experienced in the continuation of such incompatibilities.

#op #optimism

Optimism: The Optimistic ViewNASDAQ:OP

The all-time chart of #OP suggests a completed major diagonal first wave, followed by a double combo correction.

The recent bottom is either the final low or a last drop is needed to end the correction since March 2024.

Passing $2.78 confirms the correction’s end and signals a new all-time high.

Breaking the all-time low at $0.39 invalidates this idea.

#Optimism

OP (Y25.P1.E1). More lows to comeHi Traders,

Been on holidays for some time and now looking to come back with many videos and chart reads.

Optimism looks bearish as it loses a key level and now waiting to see if it can regain the weekly levels which I doubt.

Alts are likely to bleed a little more and with #OP, I'm looking for another 5 wave count.

Looking to short, like to see it get above current price and hit the weekly along with the 0.5 fib and find a nice daily rejection candle or even some reversal pattern on the smaller time frames.

Liquidity has been taken out but it might not be enough unless the ETH narrative gets a big boost but in the climate of today, tariffs of the USA have put doubt into the financial markets and so its likely to be very volatile in the coming months which will be good for trading but not for hodling.

All the best,

Regards SSAri.

OP/USD. It's time to RETURN! Technical analysis from 27.01.25Hello everyone, dear friends!

While bitcoin is holding in the phase of uncertainty, I suggest to consider the Op/Usd pair.

The price has been trading in a wedge structure for a long time, having formed a divergence. The spring is compressed for a long time and at the current moment I expect a breakdown on volume of the upper boundary of the triangle. Targets, entry point and stop loss are indicated on the chart.

From the recent:

Ldo from January 19:

Current picture:

Want more and, most importantly, for free, write in private messages, I will give access because here is forbidden advertising of third-party links.

Happy bidding!

Can #OP Bulls Defend this Key Levels or Not? Key Levels to WatchYello, Paradisers! Will #OPUSDT finally break free or are we about to see a deeper pullback? Let’s analyze the current #Optimism setup:

💎#OP is currently forming an ascending broadening wedge pattern, which often signals indecision but can result in a strong breakout or breakdown. The price is approaching a key resistance zone at $2.191, a level it must break decisively for bullish momentum to continue.

💎A confirmed daily close above this resistance would open the door for a rally toward the major resistance area between $2.800 and $3.000, where significant selling pressure could emerge. For this move to sustain, watch for strong volume and momentum to validate the breakout.

💎On the downside, #OPUSD is leaning heavily on the ascending support near $1.791, with a broader support zone sitting between $1.584 and $1.300. This area has proven to be a reliable base during recent declines, providing the liquidity needed for buyers to defend the trend.

💎However, if NASDAQ:OP closes a daily candle below $1.300, the bullish structure will break down, likely leading to a deeper retracement toward $1.000 or lower levels, signaling a shift in market sentiment.

Stay focused, patient, and disciplined, Paradisers🥂

MyCryptoParadise

iFeel the success🌴

OPtimism At Its Best!📌Fundamental:

- Optimism (OP) is a Layer 2 scaling solution for Ethereum that enhances transaction speed and reduces costs through several distinctive features:

- Optimistic Rollups: Processes transactions off-chain and submits them to Ethereum in batches, increasing throughput and lowering fees.

USE THE BITCOIN

- EVM Compatibility: Fully compatible with the Ethereum Virtual Machine, allowing developers to deploy existing Ethereum smart contracts with minimal modifications.

USE THE BITCOIN

📌Technical:

OP rejected the lower bound of the rising broadening wedge pattern.

I am expecting a movement towards the upper bound of the wedge, targeting the $6 round number.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

OP Analysishello guys

We carefully analyzed this coin for you and determined the purchase areas and price targets.

If you are risk-taking, you can buy a step right here, otherwise, the two specified ranges in the case of a pullback are the ranges where we expect the price to move from there to the specified targets.

I am happy to support and follow us.

be successful and profitable

Opulous ($OPUSDT): Bullish Setup for a Strong Move

I spend time researching and finding the best entries and setups, so make sure to boost and follow for more.

Opulous ( BINANCE:OPUSDT BINANCE:OPUSDT ): Bullish Setup for a Strong Move

Trade Setup:

- Entry Price: $1.686 (Activated)

- Stop-Loss: $0.595

- Take-Profit Target:

- TP: $5.145

Fundamental Analysis:

Opulous ( BINANCE:OPUSDT BINANCE:OPUSDT ) is a revolutionary platform combining decentralized finance (DeFi) with the music industry. It enables artists to mint music as NFTs, allowing fans to invest directly in their favourite creators. This innovative approach to music rights and revenue sharing is gaining traction, with BINANCE:OPUSDT positioned as a key player in the growing MusicFi sector.

Recent partnerships and collaborations with global artists have further enhanced its visibility, making BINANCE:OPUSDT BINANCE:OPUSDT a token to watch in 2024.

Tokenomics Overview:

- Total Supply: 500 million BINANCE:OPUSDT tokens.

- Key Utility: Facilitates transactions for music NFTs and DeFi staking.

- Community Growth: Rapidly expanding user base with increasing NFT volume.

Technical Analysis (Daily Timeframe):

- Current Price: $1.898

- Moving Averages:

- 50-EMA: $1.700

- 200-EMA: $1.500

- Relative Strength Index (RSI): Currently at 65, reflecting bullish momentum nearing overbought levels.

- Support and Resistance Levels:

- Support: $1.600

- Resistance: $2.000

The price action indicates that BINANCE:OPUSDT BINANCE:OPUSDT is on a bullish trajectory, having already activated the entry level at $1.686. With strong support at $1.600, the token is poised for a breakout toward the take-profit target of $5.145.

Market Sentiment:

Community engagement around Opulous remains high, with significant interest in its MusicFi use cases. Social media chatter and increasing trading volume reflect growing confidence in its long-term potential.

Risk Management:

A stop-loss at $0.595 limits downside risk while allowing room for volatility. The take-profit target offers a massive **205% return** from the entry point, making this a high-reward setup for mid- to long-term traders.

Key Takeaways:

- BINANCE:OPUSDT ’s innovative approach to music rights through NFTs positions it as a leader in the emerging MusicFi sector.

- The trade setup offers an excellent risk-to-reward ratio, aligning with the token’s bullish momentum.

- Long-term holders could benefit significantly from this breakout opportunity.

When the Market’s Call, We Stand Tall. Bull or Bear, We’ll Brave It All!

*Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Traders should conduct their own due diligence before making investment decisions.*

Optimism OP price analysis#OP price has stopped before a strong mirror level of $2.85-3

📊 For confident growth to continue, the OKX:OPUSDT needs to consolidate above this mirror level.

1️⃣ Local target - $3.30

2️⃣ Medium-term - $4.20-4.30

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more