GBP/USD in terminal phase? This zone could flip everything!📊 Technical Analysis

Price is currently trading in a strong weekly/monthly resistance zone around 1.3390–1.3400, marked by a dense multi-layer supply area. Historically, this level has caused sharp rejections.

From the lows, price completed a steep bullish leg, breaking through several structures. However:

Momentum seems overstretched.

RSI shows potential overbought signals.

There's a likely bearish target zone between 1.2950 and 1.2850, which is a key demand area.

📌 Trade Setup:

I’m watching for exhaustion signals or bearish confirmations on H1 to short from the current resistance, targeting the grey and turquoise zones below 1.30.

🧾 COT Report – GBP

Large Speculators (Asset Managers) still hold a net short position, although they've reduced exposure in recent months.

Leverage Funds remain slightly long, but without strong conviction.

💵 COT Report – USD

Leverage Funds have turned significantly net long on the dollar (strong green line upward since March).

This supports a bearish view on GBP/USD, as USD strength returns.

📉 Summary:

Price is at a key decision zone. A technical correction is possible. COT data supports this view:

GBP remains weak on the institutional side.

USD is regaining strength.

Opec

EUR/NZD About to Explode? Traders Are Watching THIS Level!📊 General Analysis of EUR/NZD (Higher Timeframe)

1. 📌 Price Context

The price had a strong bounce from a demand zone (highlighted in light blue) around 1.85.

It then broke through multiple supply zones (gray and maroon) to the upside and is currently hovering near 1.91874.

🔍 Key Zones

🔵 Demand Zone (Support)

Range: 1.8430 – 1.8712

This zone has been tested multiple times, with long wicks to the downside → indicating strong buying interest.

A powerful bullish move originated from this area.

🔴 Supply Zone (Resistance)

Current resistance: 1.9187 – 1.9450

This is where the price is currently paused → potential rejection area.

Monthly upper zone (1M): 1.96 – 2.00

A strong long-term resistance. If reached, we might see profit-taking or even a reversal.

🕯️ Candles & Momentum

The large green candle represents a strong bullish breakout.

The weekly candle (labeled "1W") shows indecision → this could be a pause before continuation or the beginning of a pullback.

🔮 Possible Future Scenarios

✅ Bullish Scenario

If the price decisively breaks above 1.9187, the next target is 1.9600 – 2.0000.

⚠️ Bearish Scenario

If price gets rejected at current levels, it may fall back into the support zone 1.8712 – 1.8500, which has previously shown strength.

📈 Lower Indicator (Likely RSI or Wavetrend)

Currently bouncing from an oversold area.

No clear overbought signals → there’s room for more upside.

🧭 Conclusion

Current trend: Bullish (especially in the short to mid term).

Key levels to watch:

Resistance: 1.9187 and 1.96–2.00

Support: 1.8712 and 1.85

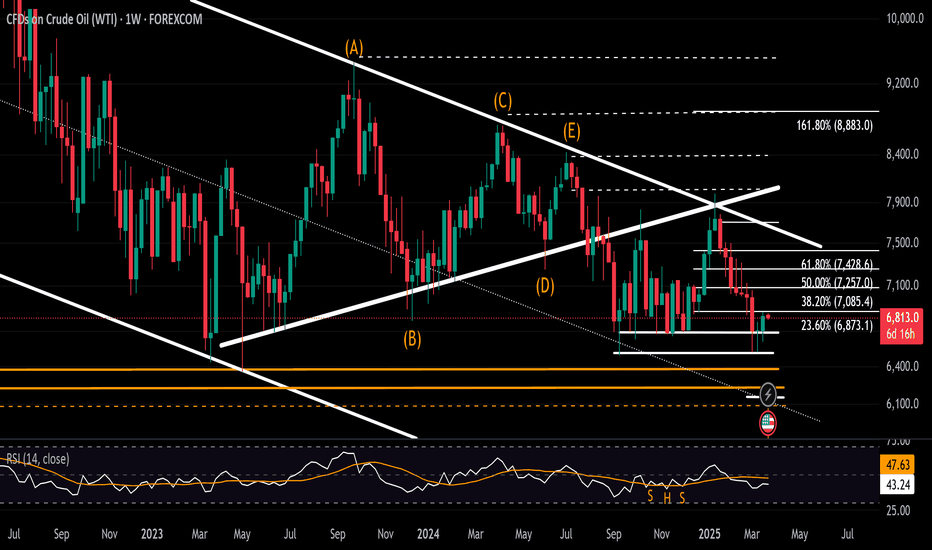

Crude Oil Holds at Key ResistanceFollowing a sharp rebound from the $55 low—mirroring broader market strength and gains in U.S. indices—oil is now hovering near a key resistance level at $64. Meanwhile, major U.S. indices remain below their respective resistance zones, awaiting confirmation of further uptrends.

A sustained break and hold above $64 could open the door for additional upside toward $66 and $70.

On the downside, if gains fail to hold and prices slip back below $64, support levels to watch are $60, $58, and $55.

A decisive break below $55 may trigger a steeper decline, potentially driving oil prices back toward the $49 per barrel region.

Written by Razan Hilal, CMT

GBP/CAD at a crossroads: this key level could trigger the drop!My visual analysis highlights a strong multi-timeframe resistance zone (weekly and monthly) between 1.8662 and 1.8779, where price has reacted sharply multiple times. This area, marked in dark burgundy, signals a significant supply zone.

Currently, price is trading back in the 1.8350–1.8400 region. Based on my note on the chart ("Looking for a short opportunity on H1"), I’m anticipating a potential short entry from lower timeframes—likely triggered by a structural break or bearish candlestick confirmation.

🔻 Bearish Scenario:

If I get a short confirmation around the current area, I’ll be targeting the 1.7900–1.7677 demand zone (highlighted in deep blue), which has previously shown strong bullish reactions.

The RSI is also showing signs of potential divergence or overextension, adding weight to the bearish thesis.

🟢 Alternative Scenario:

If price decisively breaks above the 1.8780 monthly resistance, we could see an extended bullish move towards levels not currently visible on this chart.

📌 Operational Note:

I’ll be looking for entry confirmations on lower timeframes (like H1), with valid reversal patterns or price action triggers, and will manage the position dynamically depending on how price behaves around the 1.79 zone.

EUR/USD at Key Decision Zone – Breakout or Smart Money Trap?🟢 Current Context

Price: 1.13820 USD

Trend: Strong bullish structure, with impulsive moves especially in April.

Main timeframe: Appears to be daily or weekly, with multi-timeframe zones (1W, 1M marked).

🧱 Key Zones

🔴 Supply Zone (1.13000–1.15000)

Well-defined area of historic selling pressure. Price reacted with a temporary drop but bounced right back into it.

🟦 Demand Zone (1.08500–1.10000)

Major order block where the current rally was initiated. Price used this as a base to launch higher.

⚫ Lower Supports

1.03600: Weekly support

1.02838: Monthly support

Broad accumulation zone (grey box) from which this trend began.

📈 Price Structure

Strong breakout above 1.10–1.11 resistance.

Currently pulling back inside the supply zone – the dashed arrows hint at potential liquidity sweeps before a continuation to 1.15+.

🔍 Momentum Indicator (likely RSI/CCI)

Currently elevated, but not yet in extreme overbought. No clear divergence. Momentum favors bulls.

📊 Scenarios

✅ Bullish:

Clean break above 1.14500–1.15000 opens the door to 1.1600 and 1.1800. Wait for a structural retest for safer long entries.

⚠️ Bearish (corrective):

Strong rejection from the supply zone → potential pullback to 1.10–1.0850 (blue zone).

Only below 1.0850 would a deeper bearish structure toward 1.03600 be confirmed.

🧠 Strategic Note

This is a zone of clear smart money activity: liquidity grabs on both ends.

Watch how this weekly candle closes – we’re either validating above 1.13 or setting up a trap for late longs.

SILVER at a CROSSROADS: Bounce or CRASH to $28?🔹 General Context

Silver has shown a strong bullish reaction from the lows around $28, later reaching a key monthly supply area between $34 and $35. However, this zone has once again been firmly rejected, leaving room for a potential deep retracement.

🟥 Key Zones

🔴 Monthly Supply Zone (34.00 - 35.00 USD): Strong resistance already tested multiple times. Candlesticks show strong rejections and long upper wicks.

🟥 Weekly Supply Zone (33.00 - 34.00 USD): Breaker block or mitigation area that triggered a strong bearish move.

⬛ Current Weekly Support Zone (32.00 - 31.90 USD): Price is currently testing this area. A new impulse could arise here — or we may witness a breakdown.

🟦 Monthly Demand Zone (28.20 - 29.20 USD): The last area defended by buyers in the mid-term. A realistic target in case of breakdown.

📊 Price Structure

The short- to medium-term trend remains bearish, with lower highs and strong rejection candles.

Current price action shows indecision, with lower wicks on recent weekly candles but smaller bullish bodies — a sign of potential accumulation... or just a pullback?

📉 RSI (Relative Strength Index)

RSI is in the neutral-high zone, not yet overbought, but in a downward phase → more room for downside if buyers don’t step in soon.

No clear divergences visible, but watch for signals on the daily timeframe.

🧭 Possible Scenarios

✅ BULLISH Scenario:

Condition: Support holds between 32.50 and 31.90 USD with a clear reversal candle.

Target: Move back toward the supply zone at 33.80 – 34.90 USD.

Confirmation: Break above 33.00 USD with increasing volume.

❌ BEARISH Scenario:

Condition: Weekly close below 31.90 USD → sign of weakness.

Target: Zone between 29.20 – 28.20 USD, a potential new institutional buy area.

Confirmation: Strong bearish break with follow-through and lack of buying reaction.

🧠 Operational Conclusion

Silver is at a critical decision point: bearish pressure from the monthly zones is evident, but as long as the 31.90/32.00 zone holds, buyers may still defend. A clean breakdown would open the door for a drop below $30.

OPEC Cuts Oil Demand Forecast While Increasing SupplyOil prices are feeling bearish pressure. OPEC was unable to increase production significantly last year to stabilize prices. High interest rates have kept global economies cool enough. However, starting in May, OPEC will begin unwinding its voluntary production cuts. The timing of this decision is questionable. Tariffs are expected to hit global economies hard, while the Fed is likely to hold rates steady for a few more months. Recession risks in the world’s two largest economies, the U.S. and China are rising.

OPEC has acknowledged this trend by lowering its oil demand forecast for 2025 and 2026 by nearly 10%.

If summarized:

Oil demand is expected to fall 10%, possibly more if the U.S. and/or China enter recession.

Trump is expected to boost U.S. drilling, increasing supply.

OPEC will start to unwind supply cuts, increasing supply.

Brent is likely to remain under bearish pressure throughout the year because of rising supply and falling demand. As long as the current fundamental outlook remains unchanged, upward moves should be viewed as selling opportunities. A downtrend channel has formed since mid-2023, with the lower boundary recently tested. There is now an upward reaction. If this continues toward the 68.25–70.70 zone—previously a demand zone, now a potential supply zone—traders may look for short entry setups, provided this zone holds, with nearby stop-loss levels.

Crude Oil Holds Rebound Above $55Crude oil's sharp rebound from the $55 support—aligned with the 0.618 Fibonacci retracement of the 2020–2022 uptrend—faced immediate resistance at the long-standing support-turned-resistance zone around $63.80, established in 2021.

A decisive move above $63.80 may clear the way for further gains toward $66, $68, $69.60, and ultimately $73. On the downside, a drop below $58 would bring $55 back into focus.

A clean break below that level could trigger further downside toward $49 per barrel, which aligns with the lower boundary of crude oil's long-term uptrend.

With global powers competing for oil, key events this week include:

🔹 OPEC report amid tariffs and efforts to regain market share

🔹 US–China trade talks

🔹 Chinese GDP, IP, Retail Sales (Wed)

Written by Razan Hilal, CMT

XOM Analysis: Oil's Next Move & Policy ShiftsNYSE:XOM currently piques my interest, particularly with oil prices potentially stabilizing or rising further. Recent geopolitical developments and policy shifts under Trump’s administration—such as rolling back Biden-era energy regulations, reducing methane fees, and easing LNG export permits—could significantly influence the energy landscape.

My intuition suggests Trump’s "Mar-a-Lago Accord" might involve major global economies reducing holdings of US dollar assets, swapping short-term treasuries for century bonds. Such currency shifts and reduced drilling activity could lead to a tighter oil supply, benefiting prices. Additionally, a weakening US dollar could positively impact technology stocks, as investors rotate towards sectors less affected by traditional commodities.

Technical Analysis (Daily & Hourly Chart)

Current Price: Approximately $103.00

Key Resistance Levels:

Immediate resistance: $103.93 (L.Vol ST 1b)

Important resistance zone: $104.74 (118 AVWAP)

Critical resistance (Last week's high): ~$106.46

Key Support Levels:

Near-term support: $101.13 (Weeks Low Long)

Major support: $97.92 (Best Price Short)

Trading Scenarios

Bullish Scenario (Continued oil strength & supportive policy shifts):

Entry Trigger: Sustained breakout and close above immediate resistance at $103.93.

Profit Targets:

Target 1: $104.74 (AVWAP resistance)

Target 2: $106.46 (recent swing high)

Stop Loss: Below recent pivot around $101.00, limiting risk effectively.

Bearish Scenario (Oil price weakness or production surge):

Entry Trigger: Failure to sustain the above resistance at $103.93 or a breakdown below near-term support at $101.13.

Profit Targets:

Target 1: $99.00 (psychological & short-term support)

Target 2: $97.92 (strong support, ideal short target)

Stop Loss: Above $104.75 to control risk in case of a reversal.

Thought Process & Final Thoughts

Given the current geopolitical and regulatory environment, XOM appears poised for potential upside if oil prices remain strong and policy shifts materialize. However, caution is warranted, as oil companies seem hesitant to increase production due to profitability concerns. Clearly defined technical levels will help navigate trade entries and exits effectively around these evolving macroeconomic conditions.

Earnings Date: May 2nd—Keep positions nimble as earnings can significantly impact short-term volatility.

GBP/USD at a Crossroads: Imminent Breakout or Bull Trap?The weekly chart of GBP/USD shows a strong recovery following the late-April correction, which brought the price down to a key demand zone between 1.2550 and 1.2600. The bounce was sharp and decisive, but the pair is now facing resistance between 1.3000 and 1.3150 — a previously sold area marked by a visible supply block in red.

The current weekly candle reflects a bullish reaction, but the overall structure suggests a potential exhaustion zone for upward momentum. Price action reveals a series of lower highs in the short term, and while the RSI is bouncing, it remains far from overbought, hinting that this move may be just a technical rebound.

From a trading perspective, a confirmed weakness around the 1.3000–1.3150 zone could offer short opportunities with an initial target near 1.2700 and, if extended, down to 1.2550 — a key dynamic support area. On the flip side, a clean breakout above 1.3150 with strong volume and a weekly close would open the door for a new bullish leg toward 1.3300–1.3400.

Conclusion: GBP/USD is currently at a critical juncture. The next directional move will depend on how price reacts to this resistance zone: a confirmed rejection could trigger renewed selling pressure, while a confirmed breakout may reignite the bullish trend.

EUR/GBP: Monthly Resistance Test, Rising Risk of PullbackEUR/GBP has recently shown a strong bullish acceleration, breaking decisively above the consolidation zone between 0.8285 and 0.8480, and reaching the monthly resistance area around 0.8580–0.8600. This zone, highlighted on the chart with a marked red and grey band, represents a historically significant selling area—already tested earlier this month and revisited again today. The strong upward expansion has been accompanied by an RSI nearing extreme levels, indicating a possible and imminent loss of bullish momentum.

From a technical perspective, the current setup reveals an active supply zone that could trigger a pullback, especially if the price fails to close decisively above the weekly and monthly highs. Potential profit-taking may drive the pair back toward the intermediate balance zone around 0.8450–0.8480, which would serve as the first dynamic support level. Only a clear and confirmed breakout above 0.8600 would open the door for further bullish continuation, with targets toward 0.8650 and beyond.

Strategically, caution is advised at this stage: traders already long may consider scaling out near resistance, while those eyeing short entries could find opportunities on reversal signals or confirmation of rejection from the current zone.

Crude Oil: Volatility and Key Levels in FocusThe Crude Oil (CL1!) chart shows a recent phase of high volatility, with a sharp decline followed by a recovery attempt. After reaching the recent high around 80.77, the price underwent a significant correction, returning to the key support zone between 60.97 and 62.43. This price range represents an important accumulation level, previously tested multiple times in recent months and defended by buyers.

From a technical perspective, the area between 65.27 and 69.00 represents a dynamic resistance zone, whose breakout could pave the way for a recovery towards the critical 73.00 area. However, the recent bearish impulse has pressured lower levels, and a weekly close below 60.97 could indicate a structural trend change, with potential bearish targets around 57.00.

The RSI is currently in an oversold zone, suggesting a potential consolidation phase or a technical rebound attempt. However, selling pressure remains high, and sentiment is negative, partly driven by global economic uncertainties and concerns about oil demand.

From an operational perspective, a move back above 65.27 could indicate a recovery phase, with targets at 69.00 and subsequently 73.00. Conversely, a break below 60.97 would open negative scenarios with a possible extension towards the lower support at 57.00. Investors remain focused on macroeconomic data and OPEC+ decisions, as potential production cuts could trigger a new rally, while an unfavorable macro environment could increase selling pressure.

Crude Oil Week AheadFrom a weekly time frame perspective, oil prices have continued to respect the boundaries of a declining channel since the 2022 highs, reaching three-year lows in 2025, in alignment with the long-standing support zone between $64 and $66 that has held since 2021.

After recently rebounding from the $65 level, a decisive close below $63.80 would confirm further downside potential, opening the way toward key support levels at $60, $55, and, in more extreme scenarios, $49.

If the support zone holds, resistance levels within the declining channel may come into play at $70.80, $72.60, $74.30, and $76. A breakout above the channel’s upper boundary and a sustained hold above $78 could shift the outlook to bullish, with potential resistance at $80, $84, $89, and the $93–$95 range.

Despite a complex mix of OPEC quotas, U.S. policy shifts, Chinese economic dynamics, global growth uncertainty, renewable energy demand, and escalating geopolitical tensions, oil remains bearish and range-bound—awaiting a decisive breakout.

Written by Razan Hilal, CMT

USD/CAD: Rebound Above 1.4265 or Imminent Drop?📊 Market Context

The USD/CAD exchange rate has shown recent volatility with a significant surge followed by a retracement phase. The market is reacting to expectations regarding decisions from the Federal Reserve and the Bank of Canada (BoC), as well as fluctuations in oil prices, a key factor for the Canadian dollar.

🔍 Technical Analysis

The chart analysis highlights the following key levels:

Main Resistance: 1.4521 → Located in the upper zone of the chart, this level could act as a barrier to further bullish movements.

Key Supports: 1.4333 - 1.4265 - 1.4239 → These levels have previously acted as bounce points and could provide a base for price recovery.

Market Structure: The price reacted with a strong green candle after testing the lower support area, followed by a correction phase.

Bullish Momentum: If the price holds above 1.4265, it could attempt another push towards 1.4521.

📌 Potential Bullish Scenario: If the price remains above 1.4265, we could see another push towards 1.45 and beyond.

📌 Bearish Scenario: A break below 1.4239 could trigger a sharper decline towards the 1.41 - 1.40 range.

🌍 Fundamental Analysis

Federal Reserve: The Fed is assessing the impact of its monetary policies, with markets speculating on a potential rate cut by mid-year.

Bank of Canada: The BoC maintains a cautious approach, monitoring inflation and the labor market.

Oil Prices: The CAD is correlated with oil prices, so an increase in crude oil could strengthen the Canadian dollar and push USD/CAD lower.

🎯 Conclusion

Main Bias: Bullish above 1.4265, targeting 1.45.

Trend Invalidation: Below 1.4239, a potential downward correction could occur.

Will Mixed Geopolitical News Limit the Downside of Oil Prices?Macro:

- Oil prices continued their decline following an agreement between the US and Russia to halt attacks on energy infrastructure, though without implementing a complete ceasefire.

- The market turned bearish amid expectations that Russian sanctions may be eased, potentially increasing the oil supply surplus.

- Uncertainty lingered as geopolitical tensions in the Middle East sent mixed signals. While the possibility of increased supply pushed prices down, fears of conflict disrupting oil production kept some upward pressure.

Technical:

- USOIL retested its descending channel's upper bound before rejecting the boundary and forming a bearish Engulfing Candlestick, which may provide a hint that bears are in control. The price is below both EMAs, indicating persistent bearish momentum.

- Breaking below the support at 65.80 may prompt another plunge to the 100% Fibonacci Extension at 64.00.

- Closing above 68.40 and breaking the descending channel's upper bound may shift the current structure sideways before retesting the following resistance at 70.20.

Analysis by: Dat Tong, Senior Financial Markets Strategist at Exness

USD/JPY Direction 151 After the BoJ📊 Market Context

As of March 18, 2025, the USD/JPY exchange rate stands around 149.38, reaching its highest level since March 5. This movement is driven by expectations regarding upcoming monetary policy decisions from both the Bank of Japan (BoJ) and the U.S. Federal Reserve.

🔍 Technical Analysis

The technical analysis of USD/JPY highlights the following key points:

Current Trend: USD/JPY shows a moderate recovery, with a 0.49% increase on March 17.

Key Resistance: The area between 150.00 and 151.00 represents a significant resistance level. A decisive breakout above this zone could pave the way for further gains.

Important Supports: Support levels are found at 148.00 and 146.50. A drop below these levels could indicate a deeper correction.

Technical Indicators: Moving averages and key oscillators suggest a short-term bullish trend.

🌍 Fundamental Analysis

Several fundamental factors are influencing the USD/JPY exchange rate:

BoJ Decision: The Bank of Japan recently raised its key interest rate from 0.25% to 0.5%, citing higher wages and rising inflation. However, for today's meeting, the BoJ is expected to keep rates unchanged while assessing the impact of global trade tensions on the Japanese economy.

U.S. Monetary Policy: The Federal Reserve is expected to keep interest rates stable in the upcoming meeting, with the Fed Funds rate projected to remain between 4.25% and 4.5%.

Trade Tensions: U.S. trade policies under the Trump administration are creating economic uncertainties, influencing central bank decisions and currency markets.

🎯 Conclusion

USD/JPY is currently in a consolidation phase near recent highs. If the BoJ maintains an accommodative monetary policy and the Fed keeps rates stable, the dollar could continue strengthening against the yen, targeting the key resistance level of 151.00. However, uncertainties related to trade tensions and future central bank actions require close monitoring by investors.

EUR/USD Direction 1.10 - Technical and Fundamental Analysis📊 Market Context

As of March 18, 2025, EUR/USD is in a strong bullish expansion phase, with the price testing significant resistance levels. The US dollar remains solid, but market attention is focused on the Federal Reserve and the ECB, with expectations of more accommodative monetary policies in the coming months.

🔍 Technical Analysis

The chart analysis reveals a bullish trend with the following key points:

Main Resistance: 1.0912 - 1.10 area (potential reversal zone highlighted in red on the chart).

Key Supports: 1.0822 (former resistance now acting as support), 1.0360, and 1.0283 (deeper support levels highlighted in yellow).

Market Structure: The price has tested the monthly resistance around 1.0912 and entered a potential reversal zone where significant price reactions are expected.

Bullish Momentum: The trend shows strong bullish candles, indicating a possible continuation toward 1.10.

📌 Possible Scenario: If EUR/USD decisively breaks 1.0912 and closes above 1.10, there could be room for a further rally toward 1.12.

📌 Alternative Scenario: A rejection at resistance and a close below 1.0822 could trigger a bearish correction toward 1.0360.

🌍 Fundamental Analysis

US Data: Consumer confidence in the United States has dropped to its lowest level since November 2022, increasing the likelihood of a Fed rate cut by June.

Monetary Policy: The ECB is maintaining a more neutral stance, while the Fed may be forced to cut rates faster to support the economy.

Capital Flow: The market is anticipating US dollar weakness due to the outlook for rate cuts, supporting a possible euro appreciation.

🎯 Conclusion

Main Bias: Bullish above 1.0822, targeting 1.10 and beyond.

Trend Invalidation: Below 1.0360, the bullish trend would weaken.

EUR/USD could consolidate in this area before breaking above 1.10. The future direction will depend on upcoming central bank statements and macroeconomic data.

Nasdaq 100 (NQ1!) - Key Levels and Market Outlook 📌 Market Structure

🔹 Key Support Zone (~19,170 USD)

The price recently bounced off this level, which has acted as a significant support area.

The highlighted gray-blue zone represents a demand area where buyers stepped in.

🔹 Intermediate Resistance (~19,800 - 20,200 USD)

The price is currently testing this zone, which was previously a key breakdown area.

A strong rejection here could push the index back towards the 19,170 USD support.

🔹 Major Supply Zone (~21,500 - 22,400 USD)

The previous peak around 22,400 USD saw strong selling pressure, leading to a sharp drop.

The red-shaded area represents a heavy supply zone where sellers were dominant.

📉 Bearish Scenario

A rejection at 19,800 - 20,200 USD could lead to another retest of 19,170 USD.

A break below 19,170 USD would expose the index to further downside, possibly towards 18,500 - 18,200 USD.

📈 Bullish Scenario

A break and close above 19,800 - 20,200 USD could trigger a move towards 21,000 - 21,500 USD.

A sustained breakout above 22,400 USD would invalidate the bearish structure and signal a continuation of the uptrend.

🔎 Conclusion:

The Nasdaq is at a pivotal moment, hovering around key resistance at 19,800 - 20,200 USD.

A breakout or rejection from this zone will determine the short-term direction.

Key factors to watch include economic data, Fed policy, and overall market sentiment.

USOIL Market Outlook – Key Levels and Scenarios📌 Market Structure

🔹 Key Support Zone (~64.50 - 65.30 USD)

The price has tested this area multiple times, highlighted by the red dashed line at the bottom.

A pronounced lower wick suggests a possible exhaustion of bearish pressure.

🔹 Intermediate Resistance (~68.20 - 70.00 USD)

The price has reacted to this zone, which appears to be a former support turned resistance.

Caution is needed for potential rejections in this range.

🔹 Liquidity and Wider Supply Zone (~75.00 - 80.00 USD)

This area, marked with red/purple gradients, represents a selling zone with a high concentration of orders.

The price could be drawn to this level if the bullish phase continues.

📉 Bearish Scenario

Failure to break above 68.20 - 70.00 USD could lead to a retest of 64.50 - 65.30 USD.

A breakdown below this level could open the way toward 62.40 - 60.00 USD.

📈 Bullish Scenario

A weekly close above 68.20 - 70.00 USD could trigger a recovery toward 75.00 - 77.00 USD.

A breakout above 80.00 USD would invalidate the long-term bearish structure.

🔎 Conclusion:

The price is currently at a critical stage around 68 USD, with potential for a pullback.

Monitoring the reaction between 65.30 - 68.20 USD will be key in determining the next direction.

Volume and macroeconomic factors (OPEC, oil inventories, Fed policies) will be crucial in confirming the trend.

Crude Oil: Is There More Downside?Following crude oil’s rebound from its September 2024 low of $65.20, the risk of a reversal remains uncertain amid ongoing bearish pressures.

Key Events This Week:

Chinese deflation risks

OPEC monthly report

US CPI data

Trade war developments

Potential Scenarios:

🔻 Bearish Scenario:

A clean break below $65 could extend losses toward $63.80, a key level that may determine whether the market holds neutral and rebounds or breaks further into a steeper bearish trend towards $62, $60, and $55 (the 0.618 Fibonacci retracement of the 2020–2022 uptrend).

🔺 Bullish Scenario:

If the rebound sustains above $67, resistance levels at $68.70, $70.80, and $72.50 could come back into play.

- Razan Hilal, CMT

CAD/JPY Analysis – Key Levels & Market Drivers📉 Bearish Context & Key Resistance Levels:

Major Resistance at 108.32

Price previously rejected from this strong supply zone.

Moving averages (yellow & red lines) are acting as dynamic resistance.

Short-term Resistance at 106.00-107.00

Failed bullish attempt, leading to a strong reversal.

A break above this area is needed to shift momentum bullishly.

📈 Bullish Context & Key Support Levels:

Support at 102.00-101.50 (Demand Zone)

Significant buyer interest in this area.

If the price reaches this zone, a potential bounce could occur.

Deeper Support at 99.00-100.00

If 102.00 fails, the next demand level is in the high 90s, marking a critical long-term support.

📉 Current Market Outlook:

CAD/JPY is in a strong downtrend, consistently making lower highs and lower lows.

The price is testing key support areas, and further movement depends on upcoming economic events.

A potential bounce could occur at 102.00, but failure to hold could trigger further declines toward 99.00.

📰 Fundamental Analysis & Market Drivers

🔹 Bank of Canada (BoC) Interest Rate Decision – March 12, 2025

Expected rate cut from 3.00% to 2.75% → Bearish for CAD.

A dovish stance signals weakness in the Canadian economy, potentially pushing CAD/JPY lower.

If the BoC provides an aggressive rate cut or hints at further easing, the downtrend could continue.

🔹 Japan Current Account (January) – March 7, 2025

Expected at 370B JPY (significantly lower than previous 1077.3B JPY).

A lower-than-expected surplus may weaken JPY, slightly offsetting CAD weakness.

If JPY remains strong despite this data, CAD/JPY could fall further toward 101.50-100.00.

📈 Potential Trading Setups:

🔻 Short Setup (Bearish Bias):

Entry: Below 103.00, confirming further weakness.

Target 1: 102.00

Target 2: 100.00

Stop Loss: Above 104.50 to avoid volatility spikes.

🔼 Long Setup (Bullish Scenario - Retracement Play):

Entry: Strong bullish rejection from 102.00

Target 1: 105.00

Target 2: 108.00

Stop Loss: Below 101.50 to limit downside risk.

📌 Final Thoughts:

The BoC rate decision will likely be bearish for CAD, increasing downward pressure on CAD/JPY.

The Japan Current Account data could provide temporary support for JPY but is unlikely to fully reverse the trend.

102.00-101.50 is a key buying zone, while failure to hold could drive the pair toward 99.00-100.00.

🚨 Key Watch Zones: 102.00 Support & 108.00 Resistance – Strong moves expected!

XAU/USD Analysis & Market Insights📉 Bearish Context & Key Resistance Levels:

Major Resistance at 2,934.00

Strong supply zone where price has previously rejected.

Multiple tests of this area indicate seller pressure.

Short-term Resistance at 2,920-2,925

Price is consolidating near this zone.

A rejection could lead to a downward move.

📈 Bullish Context & Key Support Levels:

Support at 2,846.88 - 2,832.72 (Demand Zone)

Strong reaction zone where buyers stepped in.

Previous price action suggests liquidity in this area.

Deeper Support at 2,720-2,680

If 2,832 breaks, this is the next key demand area.

Aligned with moving averages, adding confluence.

📉 Current Market Outlook:

Price recently bounced from the 2,846-2,832 support, showing buyers’ presence.

However, the 2,920-2,925 area is acting as resistance.

If the price fails to break higher, a move back toward 2,846 or even 2,720 is possible.

📈 Potential Trading Setups:

🔻 Short Setup (Bearish Bias):

Entry: Below 2,920 after a clear rejection.

Target 1: 2,846

Target 2: 2,832, with possible extension to 2,720.

Stop Loss: Above 2,935 to avoid fakeouts.

🔼 Long Setup (Bullish Scenario):

Entry: Break and hold above 2,934.00 with confirmation.

Target 1: 2,960

Target 2: 3,000+

Stop Loss: Below 2,915 to minimize risk.

📰 Fundamental Analysis & Market Drivers

1️⃣ US ISM Services PMI & ADP Jobs Report:

The ISM Services PMI increased to 53.5, signaling stronger services inflation and employment.

However, the ADP Employment Report showed a disappointing 77K jobs, far below the expected 140K, weighing on the USD.

2️⃣ Trump’s Tariffs & USD Weakness:

Trump announced massive tariffs on trade partners, affecting risk sentiment.

While he downplayed negative effects, US Commerce Secretary Howard Lutnick hinted at potential tariff rollbacks, boosting risk appetite.

This weakened the USD, allowing gold to rise.

3️⃣ Upcoming ECB Decision:

The ECB is expected to cut rates by 25 bps on Thursday, which could further impact market sentiment and gold’s direction.

If the rate cut weakens the EUR, gold could see more upside.

📌 Final Thoughts:

2,920-2,925 remains a key resistance for short-term direction.

A break above 2,934 could signal bullish continuation.

A rejection from current levels could push price back toward 2,846 or lower.

Fundamentals favor gold's strength as the USD weakens due to poor job data and trade uncertainty.

🚀 Key Decision Zone: Watch price action near 2,920-2,925!