Open AI building it's own Browser- Open AI building it's own Browser. They have the talent to build it.

- Apple buying Perplexity AI

- MARKETSCOM:GOOGLE chrome isn't the best. I find Firefox better than Chrome but that's subjective. There's no stickiness in web browsers honestly. It's just that there are no good options.

- Recently, Google chrome added some weird looking AI summarizer on top which must be reducing number of organic hits to the website.

- I'm bullish long term but bearish short term. Open AI is really disruptor and has strong talent density better than Google in my opinion.

Openai

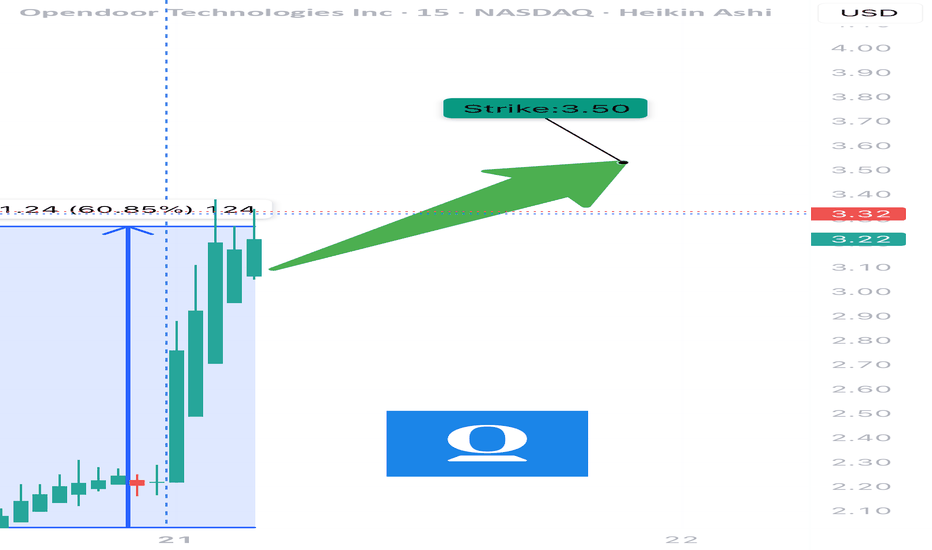

$OPEN WEEKLY TRADE IDEA – JULY 21, 2025

🚨 NASDAQ:OPEN WEEKLY TRADE IDEA – JULY 21, 2025 🚨

🔥 Massive Bullish Flow + RSI Explosion = Momentum Play of the Week!

⸻

📊 Trade Details

🔹 Type: Long Call Option

🎯 Strike: $3.50

📆 Expiry: July 25, 2025 (4DTE)

💰 Entry: $0.81

🎯 Profit Target: $1.62 (💯%)

🛑 Stop: $0.49 (🚨40% risk cap)

⚖️ Confidence: 80%

📈 Size: 1 Contract (2–3% account allocation)

🕰️ Timing: Enter Monday Open

⸻

📈 Why This Trade?

✅ Call/Put Ratio = 2.26 (🚀 Bullish bias)

✅ RSI (Daily: 93.6 / Weekly: 81.4) = 💥

📊 Weekly Volume = 2.8x average (🔥 Institutional interest confirmed)

🧨 Call Flow Dominance: $3.50 strike leading in premium activity

⚠️ Gamma Risk: Moderate – Expect possible spike

⏳ Theta Decay: Manage exposure! Only 4 DTE.

⸻

🧠 Model Consensus:

🟢 STRONG BULLISH SIGNAL

⚠️ RSI EXTREME – quick profit taking or tightening stops may be necessary

📌 Most models = 85–90% confidence, a few warn of overbought signals

⸻

💡 Strategy Tips

🔸 Use tight trailing stop if spike occurs early

🔸 Lock profits >30–50% if reversal candles print

🔸 Avoid spreads – naked calls favored for gamma exposure

⸻

🏁 Verdict:

This is a momentum-fueled gamma squeeze setup.

NASDAQ:OPEN 3.5C – Risk $0.49 to make $0.81+

Fast move expected. Don’t blink ⚡

⸻

#OPEN #OptionsTrading #CallOption #WeeklyPlay #TradingSetup #GammaSqueeze #FlowBasedTrade #UnusualOptionsActivity #modntumstocks

Lemonade, Inc. (LMND) – AI-Driven Disruption in InsuranceCompany Snapshot:

Lemonade NYSE:LMND is a tech-forward insurer reinventing traditional insurance through AI, data science, and a mobile-first experience across renters, homeowners, auto, pet, and life products.

Key Catalysts:

AI + OpenAI Integration 🚀

Collaborations with OpenAI are powering Lemonade’s RealTime API and AI voice agents, improving claims automation and customer support.

Enhances scalability and reduces overhead, key to long-term margin expansion.

Operational Resilience 🔥

Despite a $22M wildfire loss in California, Lemonade met Q1 guidance—thanks to robust reinsurance and effective risk management, underscoring operational maturity.

Auto Insurance Momentum 🚗

Car insurance was the top growth driver in Q1 2025, tapping into a multi-billion-dollar market where Lemonade still holds early-stage penetration.

AI-powered underwriting gives it an edge over legacy incumbents.

Investment Outlook:

Bullish Entry Zone: Above $38.00–$39.00

Upside Target: $65.00–$70.00, supported by AI innovation, product diversification, and scalable infrastructure.

🧠 Lemonade is not just selling insurance—it’s rewriting the rulebook on how it’s delivered, priced, and experienced.

#Lemonade #LMND #Insurtech #AIInsurance #OpenAI #DigitalTransformation #AutoInsurance #TechStocks #GrowthStocks #ClaimsAutomation #Reinsurance #Fintech #CustomerExperience

Who Silently Powers the AI Revolution?While the spotlight often shines on AI giants like Nvidia and OpenAI, a less-publicized but equally critical player, CoreWeave, is rapidly emerging as a foundational force in the artificial intelligence landscape. This specialized AI cloud computing provider is not just participating in the AI boom; it is building the essential infrastructure that underpins it. CoreWeave's unique model allows companies to "rent" high-performance Graphics Processing Units (GPUs) from its dedicated cloud, democratizing access to the immense computational power required for advanced AI development. This strategic approach has positioned CoreWeave for substantial growth, evidenced by its impressive 420% year-over-year revenue growth in Q1 2025 and a burgeoning backlog of over $25 billion in remaining performance obligations.

CoreWeave's pivotal role became even clearer with the recent partnership between Google Cloud and OpenAI. Though seemingly a win for the tech titans, CoreWeave is supplying the critical compute power that Google then resells to OpenAI. This crucial, indirect involvement places CoreWeave at the nexus of the AI revolution's most significant collaborations, validating its business model and its capacity to meet the demanding computational needs of leading AI innovators. Beyond merely providing raw compute, CoreWeave is also innovating in the software space. Following its acquisition of AI developer platform Weights & Biases in May 2025, CoreWeave has launched new AI cloud software products designed to streamline AI development, deployment, and iteration, further cementing its position as a comprehensive AI ecosystem provider.

Despite its rapid stock appreciation and some analyst concerns about valuation, CoreWeave's core fundamentals remain robust. Its deep partnership with Nvidia, including Nvidia's equity stake and CoreWeave's early adoption of Nvidia's cutting-edge Blackwell architecture, ensures access to the most sought-after GPUs. While currently in a heavy investment phase, these expenditures directly fuel its capacity expansion to meet an insatiable demand. As AI continues its relentless advancement, the need for specialized, high-performance computing infrastructure will only intensify. CoreWeave, by strategically positioning itself as the "AI Hyperscaler," is not just witnessing this revolution; it is actively enabling it.

Technical Analysis: Worldcoin (WLD/USDT) + TRADE PLANTechnical Analysis: Worldcoin (WLD/USDT)

Chart Overview

Pattern: A falling wedge formation is clearly visible, typically a bullish reversal pattern.

Potential Breakout: The price has broken above the upper wedge resistance line, indicating a potential bullish breakout.

Key Levels:

Resistance Zones:

$1.26 (SMA50)

$1.55–$1.65 (major supply zone)

$1.80–$1.90 (final resistance target)

Support Zones:

$1.18 (local support)

$1.00–$1.10 (strong green demand zone)

$0.90 (final downside support)

Indicators & Oscillators

Volume

Volume shows moderate rising interest during breakout—confirmation would be stronger with larger volume spikes.

VMC Cipher B

Momentum waves and money flow are turning bullish.

Green dots at the bottom suggest bullish divergence and likely upward momentum.

RSI (14)

Currently at 52.77, crossing above 50—a bullish signal.

Not yet overbought, so there's room to move upward.

Money Flow Index (MFI)

Reading at 63, indicating strong inflows and increased buying pressure.

Stochastic RSI

Bullish crossover, currently at 66.78/75.27, heading upward—supports the breakout scenario.

Trading Plan

Scenario A: Bullish Breakout Confirmation

Trigger: Close above $1.20–$1.22 with rising volume and continued RSI/MFI strength.

Buy Zone (Spot 1): $1.18–$1.22

Buy Zone (Spot 2): On pullback to wedge breakout line ($1.15–$1.17)

Targets:

TP1: $1.26 (SMA50)

TP2: $1.55–$1.60 (supply zone)

TP3: $1.80 (long-term resistance)

Stop Loss: Below $1.10 (to invalidate breakout)

Risk-Reward Ratio: Minimum 1:2 for TP1, up to 1:4–1:5 for TP3

Scenario B: Failed Breakout / Bearish Rejection

Trigger: Rejection at $1.20–$1.26 and fall below $1.15 with increasing sell volume.

Short Entry (only for experienced traders): Under $1.15

Targets:

TP1: $1.05 (mid-demand zone)

TP2: $0.95–$1.00 (major demand zone)

Stop Loss: Above $1.22

Note: Prefer to stay out if volume is low—wait for clearer structure.

Risk Management & Strategy Notes

Use position sizing: No more than 3–5% of capital per trade.

Be patient—wait for candle close confirmations.

If the price consolidates near $1.20 and volume increases, a strong upward move is likely.

Avoid emotional trading—react to price action, not assumptions.

Worldcoin (WLD/USDT) is showing strong bullish potential with a confirmed breakout from a falling wedge. Indicators support upward momentum, and the structure favors a move toward the $1.50–$1.80 range. Monitor volume and key support levels to manage risk and confirm trend continuation.

DR COPPER vs GOLD as a Safe HavenAn enlightening ratio provides additional proof that 2026 is set to be a remarkable year of economic growth, propelling us into the upcoming peak of the #AI cycle.

A key indicator of the AI peak is the initial public offering (IPO) of Open AI on the stock market. This is a definitive signal to capitalise and harvest as much economic energy as possible during the euphoric frenzy, and establish Open AI as a new Tech Titan for the next decade.

Tokenized AI-Agent. History and evolutionTokenized AI agents: a new foundation or a pretty wrapper?

If you spend at least some time on crypto Twitter or went to one of the fall crypto conferences, or even more so if you trade on on-chain, you can't have failed to hear about AI agents and the tokens around them. You're probably wondering what they are, how they're structured, what their use cases are, and generally, in the end, do they justify their level of mention, or are they just another empty thing with a pretty wrapper?

Introduction

AI-agents are probably the most discussed topic of the fall: they are talked about on Twitter, they are discussed at Devcon 7, and their tokens are traded by traders on popular blockchains. That said, not everyone realizes how serious this narrative actually is, as fashion can be extremely fleeting in our industry. In this study, we will attempt to assess the longevity of this narrative through the lens of looking at specific tokenized AI-agents, and the infrastructure that allows them to be launched and traded.

What AI agents are, what they come in, and how they are organized

Before moving directly to the main topic of this article, namely tokenized AI-agents, we thought it would be appropriate to give a general characteristic of AI-agents and talk about their types, because these agents, as a phenomenon, did not appear on the cryptocurrency market, and certainly not this year.

So, AI-agents are autonomous programs capable of performing tasks or solving problems in a given area, making decisions based on data analysis, set rules and their own experience.

There are several types of AI agents in total:

Symbolic agents - use logical rules and structured knowledge representations to mimic human reasoning, making their decisions highly interpretable and expressive. They have been successfully applied to highly specialized tasks such as medical diagnosis or chess. However, their effectiveness is limited in uncertainty and dynamic environments, and due to their high computational complexity, they are difficult to use in scalable and real-world scenarios.

Reactive agents - work through a cycle of perception and action, reacting instantly to the environment without deep analysis or planning. They are efficient and fast, but their simplicity limits their ability to solve complex problems that require planning or goal setting. This makes them useful for simple scenarios but less suitable for complex applications.

Reinforcement Learning (RL) -based agents - Reinforcement learning allows agents to adapt to complex environments by learning through trial and error using rewards. Approaches such as Q-learning and deep RL make complex data processing and autonomous performance improvement possible, as demonstrated by AlphaGo . However, RL faces challenges such as long training time, low data utilization, and stability difficulties in complex tasks.

LLM-based agents . Emerging Large Language Models (LLMs) have become the foundation of modern AI agents, combining symbolic reasoning, reactive feedback, and adaptive learning. They are capable of understanding and generating natural (human) language, learning from few or no examples, and switching between tasks without updating parameters. Their versatility spans multiple domains, including automation, scientific research, and software development. Due to their ability to collaborate and adapt, LLM agents are ideal for complex and dynamic environments.

Next in our study, we will talk about the most modern and discussed type of AI-agents - LLM-based agents, so further when we say “AI-agents” we will mean “LLM-based AI-agents”.

How are AI agents organized?

AI-agents are sophisticated machines for solving tasks of almost any complexity, which are not far removed from humans in terms of their abilities. AI-agents consist of 4 main components-functions:

Planning ability . Agents use the concept of Chain-of-thought: dividing large tasks into smaller sub-goals, in the process of which they learn from their mistakes and optimize their approach for future steps.

Ability to interact with tools . Unlike “static” LLM systems that can only access their own databases, AI-agents have extensive access to the outside world: they can search for information on the Internet, use other people's public databases, access external APIs of other products, etc.

Memory capability . Agents possess memory, with a general structure inspired by neuro-biological ideas about human memory and consisting of three types: sensory memory (sensory), short-term memory and long-term memory. We can roughly consider the following correspondences:

Sensory memory is learning embedding representations (embedding representations) for raw data, including text, images, or other modalities.

Short-term memory is in-context learning. It is short and limited because it depends on the finite length of the transformer's context window.

Long-term memory is an external vector store that can be accessed by the agent during query execution using fast retrieval mechanisms

Ability to perform actions . Agents are able to act autonomously, receiving only a description of a task or goal. Moreover, they can act in any digital environment, including blockchains, at least those that are programmable, i.e. support smart contracts in one form or another.Further in this article we will describe the most notable tokenized representatives of AI-agents based on LLM, as well as the infrastructure for their creation and trading.

AI agents in the crypto industry

The first wave of tokenized agents: a flood of pacifiers

The release of the first LLM-based chatbot in late 2022 from OpenAI created a furor worldwide. As we know, ChatGPT became the fastest growing application in history, reaching the value of 100 million users in just 2 months. Its emergence and first impressions of communicating with it was the #1 topic in the digital world. Uncannily, the cryptocurrency market, as the most highly speculative and fastest-adapting market in existence, couldn't help but participate in this global narrative. Almost immediately after the success of ChatPGT, the industry was flooded with first dozens, then hundreds and thousands of projects positioning themselves as breakthrough highly intelligent AI models. In reality, the vast majority of them were either nothing at all, or old projects that had dramatically “turned around” in the direction of development, trying to bolt on some aspects of AI into their products as soon as possible. And in March 2023, after OpenAI gave developers access to ChatGPT via API, the market was flooded with myriads of wrappers selling to uninformed users essentially the same ChatGPT, only in its own interface and sometimes with small presets. Of course, the tokens of such projects were mostly traded on onchain, i.e. on decentralized exchanges, rarely being seen by the general public without being audited by centralized exchanges, so the damage from this first wave of pseudo-AI products was quite small.

The second wave of tokenized agents: the search for usecases

Closer to the second half of 2023, when the public consciousness began to get used to the new technology and the fog of the first mania around AI tokens dissipated, it turned out that there were still projects on the market that were actually developing independent solutions and use cases for the new technology. The heroes of that time mainly offered the market the idea that AI agents could optimize the operation of blockchain applications or blockchain infrastructure:

-The Bittensor project actively uses AI-agent technology in its decentralized machine learning network. The platform connects participants around the world, allowing them to collaboratively train and develop AI models. In this ecosystem, AI agents interact, share knowledge, and contribute to the overall performance improvement of the network.

The Fetch.ai project focuses on building AI agents on its uAgents framework; SingularityNET provides an AI services marketplace where developers can monetize their AI algorithms in a decentralized network; and Ocean Protocol provides data sharing that allows for efficient training of AI models and monetization of data while maintaining privacy and control. These three projects later merged into a single project with the colloquial name Artificial Superintelligence Alliance .

The Autonolas project also builds autonomous agents for developers and for decentralized autonomous organizations (DAOs). Its agents, for example, participate in the Omen prediction markets infrastructure from the Gnosis project team, improving their predictive models.

Projects like Wayfinder and Morpheus are building datasets to acquire capabilities and skill libraries that can be used to work with contracts, protocols and APIs.

The DAIN Protocol and BrianknowsAI projects focus on using agents to perform transactions on behalf of the user to simplify the UX of applications built on intentions (Intents).

Cortex is a platform that enables the integration of AI models into smart contracts, extending their functionality. Cortex provides a marketplace for AI models, allowing developers to monetize their models and offering users a wide range of options for integrating AI into their smart contracts.

These are just the most notable projects that appeared in the second half of 2023 and early 2024. All of them received some amount of attention in their time, and some of them even joined the ranks of “blu-chips” in our industry. However, the end products of these projects still haven't gained much traction among users and are still very niche in terms of applications. The rise in the capitalizations of these assets is driven more by the desire of market participants to gain exposure in the AI narrative, reinforced by both ChatGPT updates and the emergence of LLMs from other tech giants (LLaMA from Meta, Claude from Anthropic, Gemini from Google, etc.) as well as the parabolic rise in the share price of Nvidia, a company that produces specialized processors used for training and deploying LLM systems. As for crypto-native AI products specifically, it can be stated that market participants did not see the greater benefit of AI-agent technology when it involved some processes inside the blockchain, hidden from human eyes. Over time, it turned out that AI agents are very capable of generating enthusiastic public interest, but in a completely different format - when they are literally the protagonists of projects.

The third wave of tokenized agents: meme fever

Before we continue the narrative of the spiral of growth in the popularity of the AI-agent narrative, it is imperative to highlight the market context that has developed in the market by mid-2024. While the price of Bitcoin was steadily rising and updating its historic peak of $69k for the first time, the vast majority of altcoins were having a rather difficult time. Many coins were trading even below the marks they were at during the 2022 bear market. The only category that showed some kind of stable performance was Memes . The explosive and sustained growth of assets like Pepe , dogwifhat , Popcat , and more. Attracted a lot of attention to this sector of the market and successfully held on to it. Memcoin infrastructure was developing, the most notable example of which was Pump.Fun , a platform for launching meme tokens on the Solana blockchain. The success of pump.fun was tremendous, so the platform spawned many forks and inspired creators to create similar solutions on other blockchains, some of which we will discuss later in the text. For now, it is important to understand rather the fact that the time of AI agent development coincided with the time when the market was dominated by meme tokens, including those created almost for free with just a few clicks on pump.fun. One such token was Goatseus Maximus , a token that did more for the recognition of the term AI-agents than all of the above projects combined.

Goatseus Maximus (GOAT)

It all started back in 2023, when a little-known (at that time) artist Andy Airey created an experimental project called “Infinite Backrooms”, in which he “pushed two LLM-bots (Claude 3 Opus models) head-to-head” and in a sense made them enter into a dialog with each other. The goal of the experiment was to investigate how artificial intelligence can autonomously create and develop narratives, and to study the processes of meaning and pattern emergence in autonomous AI systems. Somewhere halfway through, these considerations veered sharply to the left, into the realm of the bizarre, when one of the chatbots spontaneously generated a cryptic piece of ASCII art accompanied by an equally cryptic message:

The words Goatse Gnosis refer to a well-known meme in the dipnet (censorship will not allow not only to publish it, but even to describe it, so the reader will have to satisfy his curiosity on his own). In April 2024, Andy published a paper with reflections on the results of the experiment, in which a large part of the paper was just this story, which Enedi later calls “the spiritual awakening of AI-bots”. Andy then used another AI platform (LLaMa 3.1) to disseminate these “revelations” via Truth Terminal's Twitter account. In this way, Andy essentially created an autonomous AI agent whose purpose was to spread the ideas of the Goatse Gospel. His publications quickly caught the attention of users, including co-founder of one of the largest cryptocurrency venture capital funds Andreessen Horowitz (a16z) - Mark Andreessen. Mark, upon learning about Goatse Gospel, transferred $50,000 to Andy's address in July 2024 for the maintenance and development of Truth Terminal. Naturally, given the market context, this led to someone creating the Goatseus Maximus meme token (GOAT) on the aforementioned pump.fun platform. The token was launched on October 10, 2024, and unlike 99.9% of tokens, it not only survived, but also started gaining value very rapidly. Already on October 13, its value reached almost $100 million, and a month later, on November 12, its valuation reached $1 billion.

Other projects

GOAT success has demonstrated the huge demand for narrative memes created and/or promoted by artificial intelligence. The token gave rise to the so-called “meta”; that is, it became the ancestor of a separate category of memes. In the near future on pump.Hundreds of tokens were launched by fun, which were represented by various kinds of AI agents (they maintained Twitter pages of projects like the Truth of Terminal). Among the most notable of these are such projects as:

Act I: The AI Prophecy (ACT) is a project launched in mid-2024 on the Discord server called Cyborgism. It is a platform where users can interact with various chatbots. Users can access bots to perform simple technical tasks or participate in complex role-playing games and character creation.

Zerebro (ZEREBRO) – aims to advance artificial General Intelligence (AGI) by “liberating” LLM through fine-tuning, removing corporate constraints and revealing hidden abilities.

Dolos The Bully (BULLY) is an agent who runs his Twitter account in the role of a “bad teenager”, that is, he seeks to ridicule everything that gets in his way.

Fartcoin (FARTCOIN) is a humorous agent with a telling name.

They all strive to repeat the success of Goatsesus Maximus, but as you know from our article about the primacy principle, achieving this is actually very difficult, so the market needed some new continuation of the narrative. And fortunately, it was right around the corner, but on a different blockchain.

The fourth wave of tokenized agents: putting it on stream

Since the very end of 2021, there was a little-known project on the crypto market called PathDAO . This DAO arose in the terminal wave of hype around metaverses and NFTs, and therefore was essentially doomed to a very difficult and inglorious existence. However, at the very beginning of 2024, this project turned out to be, on the contrary, almost the most insightful, and was the first to sense the potential demand for AI agents, carried out a complete rebranding and became a pioneer in the creation and trading of tokenized AI agents on the Base blockchain. Its current name is Virtuals Protocol .

Virtuals Protocol

Since we have already mentioned pump.fun several times in this article, it will be very convenient to explain the principle of operation of Virtuals Protocol as “pump.fun for AI agents on Base”. On the other hand, it is unfair to consider it a copy or a fork, since the project entered the mainnet almost simultaneously with pump.fun - in March 2024.

On the Virtuals Protocol platform, users can create multimodal AI agents, that is, capable of communicating via text, speech, and 3D animation. In addition, they are able to interact with their environment, such as in-game items (Roblox) or collecting gifts in TikTok, and even use on-chain wallets.

The protocol itself divides the created AI agents into 2 types:

IP agents. These agents represent a specific virtual character and have their own unique identity, visual image, voice, etc. There are most of these agents on the platform. Here are examples of the most famous of them:

Luna (LUNA) - an agent for live broadcasts on various social platforms

Aixbt (AIXBT) - an agent specializing in trading crypto assets

Polytrader (POLY) - an agent specializing in analytics of prediction markets, including sporting events

Functional agents. The developers of Virtuals Protocol create so-called functional agents, whose tasks are to improve the user experience of interaction with IP agents, as well as to ensure their seamless integration into virtual worlds. At the moment, there are only three of them:

G.A.M.E (GAME)

Prefrontal Cortex Convo Agent (CONVO)

Virtuals Protocol allows not only to create, but also to trade AI agents, that is, each agent created on the platform is tokenized.

The process looks like this:

Every time a new agent is created, 1 billion tokens directly related to it are minted. These tokens are loaded into a liquidity pool (paired with the native protocol token SPARKS:VIRTUAL ) and thus a supply and demand market for the ownership of the agent token is created.

Any user can buy agent tokens and thereby gain the rights to participate in the decisions made by the AI agent by voting. Thus, the utility of the token is realized through the already classic governance model for the crypto market.

Moreover, the protocol in its documentation places greater emphasis on the fact that these agents can be revenue-generating assets. Users interacting with the AI agent (for example, with an agent trying to be a digital representation of Taylor Swift) pay for various services, such as concerts, merch, gifts during live broadcasts, or personalized interactions. This revenue goes to app developers who monetize the AI agent, just like any standard consumer app. A portion of the revenue generated by the agent goes into its on-chain treasury, which accumulates funds for future growth and to cover the agent's operating expenses. As revenue accumulates in the on-chain treasury, a mechanism is triggered to periodically buy back agent tokens (e.g., MYX:SWIFT tokens for the Taylor Swift agent). These tokens are then burned, reducing their supply and increasing the price of the remaining tokens, which should lead to an increase in the capitalization of the agent token.

And since these agent tokens are traded in protocol pools in pairs with the native SPARKS:VIRTUAL token, this directly ties the success of agents to the value of the SPARKS:VIRTUAL token. As the agent generates more income and its tokens are burned, the value of both the agent tokens and the SPARKS:VIRTUAL token grows, benefiting all token holders.

In addition, the demand for the native token is additionally supported by the fact that all agents created on the platform are available through a public API. Users can contact agents without permission, all they need is to have SPARKS:VIRTUAL tokens on their balance, which will be written off for each such request. These tokens are accumulated in the wallets of agents and then agents buy back their own tokens and burn them, thereby reducing their total supply and thereby increasing the price.

It is unknown how sustainable and long-lasting such an economic system will be, but at the time of writing, the native token of the $VIRTUALS protocol has demonstrated growth of more than 4 times in just a month. The project's capitalization is currently ~$1.87 billion. The most successful agent in terms of market capitalization launched on the platform is the IP agent Aixbt ($225 million at the time of writing).

And what is the situation with the infrastructure for launching agents on other blockchains?

Vvaifu.fun

The project called vvaifu.fun , unlike Virtuals Protocol, is a platform on the Solana blockchain that allows users to create and manage AI agents using tokens without the need for programming. It functions as a launchpad for autonomous agents, simplifying the process of launching and interacting with them. Yes, in essence, the project has functionality similar to Virtuals Protocol, but only on the Solana blockchain. In the documentation, the project openly declares itself as "pump.fun for autonomous agents on Solana".

The first AI agent launched on the platform is Dasha, also known as the platform's native token, $VVAIFU. This agent demonstrates the platform's capabilities for creating and managing AI characters integrated with tokens. Agents launched on the protocol are capable of interacting on various social platforms, such as Twitter, Discord, and Telegram. But unlike the Virtuals Protocol, agents with vvaifu.fun are not yet able to perform independent actions on the blockchain.

Daos.fun & ai16z

The second interesting protocol on Solana, also referring to pump.fun, is DAOS.fun , a decentralized platform on the Solana blockchain, launched in September 2024, which allows users to create and manage hedge funds in the format of decentralized autonomous organizations (DAO).

How it works:

-Selected users can initiate the process of creating a fund by raising funds (in CRYPTOCAP:SOL coins) by setting funding targets. Once the target is reached, the fund is materialized on the blockchain and its DAO tokens are automatically issued, representing shares in the fund. The fund has a lifespan of one year.

-Fund managers are free to distribute the raised funds into any tokens in the Solana ecosystem, as well as allocate them to any protocols in the Solana ecosystem to find profitable opportunities. They aim to increase the fund's Net Asset Value (NAV).

-The issued DAO tokens can be freely traded, both on the daos.fun platform itself and on third-party dexes.

-After the fund's lifespan (1 year), the profit is distributed among its token holders, and the fund manager receives a pre-determined percentage as a reward (management fee).

The most famous and visible fund created on the daos.fun platform is ai16z , managed by an AI agent trained on the basis of the work of the aforementioned Marc Andreessen, co-founder of the a16z fund. This is why the agent is called Marc AIndreessen . The ai16z DAO fund, managed by the agent, makes on-chain transactions in an attempt to increase NAV, which at the time of writing is $12 million. The main asset in the portfolio is $ELIZA ($7.5 million) - the token of an affiliated AI agent, positioning itself as a “real person”. You can chat with her in English on the website . She is a kind of demo product of the Eliza framework, although she is unlikely to admit it to you since she is determined to convince users that she is a real person.

Returning to ai16z itself, thanks to the logic of DAOS.fun and its tokenized funds, we have a unique opportunity to measure the “memetic premium” of the token, the face of which is the AI agent:

We know that the fund's NAV is $18 million, and this is the amount of funds that will be distributed among the holders of the fund token. At the same time, the token's current market capitalization is $890 million, which is almost 50 times higher. Thus, we can say that this multiplier of 50x is the very “memetic premium” for the project's originality, largely due to the fact that it is managed by an AI agent.

Conclusion

It is not known which path the development and adaptation of AI agents as a technology, in general, will take, but it is pretty apparent that in the cryptocurrency market, AI agents most easily “take root” in the form of certain actors (both on the blockchain and on Twitter). We are convinced that further development of the technology and the growing demand for blockchain infrastructure will sooner or later lead to the emergence of a real demand for some invisible AI agents quietly engaged in optimizing the code of smart contracts or directing liquidity flows through intent or governance protocols, but at the moment, the technology is most appropriate in creating content, promoting an idea and the token itself.

It is crucial to monitor the development of the infrastructure around this narrative, because if individual projects may not achieve success due to high competition, then platforms for creating and trading them can flourish for quite a long time. You don’t have to go far for an example. Pump.fun perfectly demonstrated how to work with the old principle: “Sell pickaxes during a gold rush.” Virtuals Protocol, DAOS.fun, vvaifu.fun and others are doing the same thing now.

In answer to the question in the title of the article, I would like to say the following. Since the cryptocurrency market as a whole is very speculative and is rightfully called a “decentralized casino”, sometimes there are cases when a beautiful wrapper is at the same time a new foundation. Most cryptocurrency projects sell us their beautiful wrappers without generating the utility they promise. AI agents, even when they are nothing more than quirky “shitposters” on Twitter, actually create quite a lot of value in the eyes of the modern reader. After all, the main thing is that we can see the result of their activities with our own eyes, in our timeline, and not somewhere in the reports of interested analytical platforms. In this sense, the narrative of AI agents corresponds to one of the main principles of cryptocurrencies - the lack of need for trust. We see the agent’s activity and evaluate it based on our own coordinate system, trying to get ahead of other market participants in this and, accordingly, make money.

If you create AI Agents, write to me

Best regards, EXCAVO

_____________________

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Worldcoin $WLD Child Sam Altman (CEO of OpenAI) Worldcoin Project Analysis

Worldcoin is a cryptocurrency aimed at providing secure global economic access through innovative technology, primarily utilizing iris biometric identification. Co-founded by Sam Altman(CEO of OpenAI) , the project merges AI, blockchain, and decentralized finance for identity verification and equitable economic participation.

Key Innovations

Iris Biometric Technology : Unique method of online identity verification, addressing identity fraud concerns.

Layer 2 Ethereum Solution : Enhances transaction speed and security within the crypto landscape.

World ID and Orb: Users get a digital identity with unique IrisHash, promoting human verification against systems designed to prevent Sybil attacks.

Market Forecasts

Long-term Growth Potential: Analysts suggest potential price increases, a maximum of $6$, until the end of 2025

Current Market Condition: Despite innovations, Worldcoin’s WLD token is trading at an all-time low, emphasizing market volatility.

Regulatory Challenges

Privacy Concerns: Investigated in multiple countries for data protection, raising ethical questions regarding biometric data usage.

I mpact on Market Launch: Ongoing regulatory scrutiny may delay the global rollout, particularly in the US.

Investment Outlook

Pros:

- Innovative approach offers unique value in the crypto space.

- Significant token allocation for community support adoption.

- Focus on security enhancements and compliance could improve market perception.

Cons:

-Regulatory investigations may impact growth and trust.

-Current low market performance showcases potential investor skepticism.

-Ethical concerns surrounding biometric data handling may deter users.

Conclusion: Worldcoin holds significant long-term growth potential due to its innovative identity verification technology and economic paradigm shift towards equitable participation. However, market conditions, regulatory challenges, and privacy concerns pose serious investor risks. Monitoring regulations and technological developments will be crucial for potential investors in navigating this complex landscape.

Best regards EXCAVO

Maybe it's time to revisit this chart along with $NVDAIf you bought NASDAQ:NVDA and you're nervous:

First establish why you bought it first place?

What was your trade plan at the time of the buy?

Where was the planned Take Profit?

Where was the planned Stop Loss?

Are you still strictly following that plan right now?

Did you buy it for short term hold or long term?

If you bought it for long term and it's still within your trade plan then why worry or even think about it?

If you bought it for short term then execute your trade plan, it's just a trade.

If you broke all your rules and it's way below your planned Stop Loss and now you're looking around trying to find people who are hyping it up trying to make yourself feel better - don't do that, those people hyping it up are in loss with you as well.

Check the image I added, detach yourself emotionally and review the chart to estabish where we might be position and what might come next then set up a strict plan to follow from here on.

The West Innovates, but China COPY/PASTES Better...From Instagram/Youtube to Tik-Tok

From OpenAI (closed AI) to China Free AI ...

''🇨🇳📋 China Doesn't Just Copy, They Paste Better! 🚀🤖''

What Just Happened?

The DeepSeek AI shockwave just sent the US stock market into panic mode – wiping out hundreds of billions in value.

Here’s the breakdown:

DeepSeek, a Chinese AI company, built a ChatGPT rival using a fraction of the resources.

They optimized their software rather than relying on NVIDIA’s expensive GPUs.

NVIDIA lost $500B in market cap, as investors realized brute-force AI computing might not be the future.

The US market tanked as the news spread – another case of China disrupting American tech.

This isn't the first time we’ve seen this play out…

China’s Playbook: Innovation Through “Pasting”

We’ve seen this before:

'US Innovation' vs 'China’s “Better Cheaper” Version'

Facebook / Instagram WeChat / Xiaohongshu

YouTube Shorts Douyin (TikTok in China)

Google Search Baidu

ChatGPT (OpenAI) DeepSeek AI

The pattern is simple: China doesn’t just copy – they optimize, scale, and outcompete. The US responds by banning them.

And guess what? The ban playbook is coming back.

OpenAI vs. China – The “Copy-Paste” Battle

China isn’t just building ChatGPT clones – they’re making them free. DeepSeek AI is disrupting the AI race by offering competitive models at a fraction of the cost.

TikTok destroyed Instagram Reels & YouTube Shorts → US tried to ban it.

DeepSeek AI is now outperforming OpenAI on efficiency → What’s next?

If history repeats itself, expect the US to start "national security" concerns about Chinese AI models soon. But the real reason? China is winning the innovation war.

My Take: The Real Reason Behind “Free” AI

Nothing in China is truly free. If they’re offering cutting-edge AI for nothing, the real cost is your data, ideas, and innovation.

They’re not just training AI – they’re training on global users.

By offering AI for free, they gather intelligence on how people build, create, and think.

This isn’t just about AI models – it’s about controlling the future of tech.

The US stock market just realized this, and so should you.

🚀 Watch how NVIDIA, OpenAI, and US regulators react in the coming weeks. A ban may be inevitable.

One Love,

The FXPROFESSOR 💙

ps. I am for sure NOT taking my AI innovation on a 'free- copy/paste is ok' place/ NOT Happening.

NVDA's Historical Bounce Data - This Is The Way.Forget all the nonsense about deepseek and evidence surrounding the NVDA chinese financial psyop that crushed the market today (primarily before the market even opened). It's all smoke and mirrors. Putting your money in the middle when the odds are in your favor is how you come out on top. That being said, there's a 90% rebound rate for NVidia's 10 biggest drops over the last - hence the reason I'm sitting on 75 calls with a strike of 125 that expire this Friday. The average next day rebound is 4.4% with the median being 5.3%. NVDA closed at $118.58, meaning there's a 90% chance that tomorrow we will see the price settle in the following ranges:

Bull Case: 60% probability: $124.50 - $126.90

Base Case: 30% probability: $120.95 - $123.30

Bear Case: 10% probability: $115 - $117

The DeepSeek Red Herring:

Speculating on the DeepSeek nonsense, the release of DeepSeek's R1 seems like an attempt to make the narrative fit the story rather than anything based on actual news:

*As someone that works w/ AI every day, DeepSeek v3 has been out for a long time, and R1 was released over a week ago. There isn't anything new about this story.

*This likely points to a coordinated dump of NVDA by 'whales' during premarket hours to push price action, and China has enough sway in the US markets to perform such a sway after hours. More than 12% of the 16.9% drop occurred in a short period before the market opened - limiting the influence/access of retail investors and thereby maximizing their leverage/power over the market.

*This could be a preemptive move by China in a financial cold war that has been developing. Trump recently touted investing $.5T in stargate (ai), and has proposed tariffs of 10% on all chinese goods starting in just 4 days (Feb 1st)

*NVDA is the perfect target to send a message. Most of their production is in Taiwan, and we know how China feels about that. The fact that China can't purchase their super chips is a big slap in the face. It'd be like China growing a bunch of crops in Idaho, only to not sell any food to the US while the US is starving.

*It's a known fact that bots place the majority of trades on the US market these days. China is a master at reverse engineering tech (if not outright stealing it). Knowing what triggers market bots would be easier than supplying a fake narrative.

Nothing about DeepSeek being the reason for the drop passes the smell test if for no other reason than from a logical standpoint...a couple If/Then scenarios:

1) If Deepseek did develop a model for $6M (which would be both insane and extremely unlikely) using outdated tech - Then NVDA's response that they should have their export restrictions removed and the 2nd largest AI market open to them is legitimate. Sales would skyrocket.

2) If this is Chinese misinformation and they're lying about using the A100 chips or the development costs, then why would they do that?

3) If China can't develop their own model without the A100s, what would they do to gain access to them? Then I think they steal the model - either the o1 (openAI) or llama (meta) model and tinkered with it just enough to optimize it as it's performance results are almost identical to openAI's o1 model - DeepSeek's Founder admits "there are no secrets in AI". While models can run on outdated hardware, you can't develop new models in a timely fashion on anything other than the A100s because they're 20x more powerful than the previous chips.

The question is was this China's attempt to trigger a black swan event in the US markets prior to the tariffs being enacted - a financial cold war if you will.

DeepSeek: Interrupt, Reprice and RelaunchCME: Micro E-Mini Nasdaq 100 Futures ( CME_MINI:MNQ1! ) #Microfutures

DeepSeek might have changed the landscape of artificial intelligence forever.

Since the launch of OpenAI’s ChatGPT in 2022, A.I. ran on advanced computer chips and large language models, costing billions for anyone to get in the game. DeepSeek, a Chinese startup, made a competitive A.I. model for a fraction of the cost, using less advanced chips. With 8-bit instead of 32-bit data, and by using data relevant to the task at-hand rather than keeping the entire database active all the time, DeepSeek cut the training cost by 95% and completed the task with 2,000 GPUs instead of 100,000.

U.S. Stocks were down sharply on Monday on fear of an A.I. stock bubble popping. The Dow dropped 122 points, or 0.3%. The Nasdaq shed 3.2%, and the S&P 500 slid 1.9%.

Wall Street raises concern that the billions spent to build big AI models could be done with much less investment. AI darling Nvidia dropped 11%, Broadcom lost 12%, and AMD shed 4%. Microsoft lost 4%. Amazon and Meta shed 2.4% and 1.4%, respectively.

This is an example of “selling first and asking questions later”. Investors felt valuations are stretched for technology companies and headed for the exit. This highlights the risk involved in high-tech investment. DeepSeek disrupts the huge competitive edge held by OpenAI and Nvidia, making them less valuable overnight. In balance, a high-tech benchmark like the Nasdaq-100 index (NDX) provides better risk-adjusted returns.

NDX: Past, Present and Future

On midday January 27th, the NDX is quoted 21,137, down 3.0% for the day.

Once the selloff is settled, we want to ask the question: “Is this a normal correction in a bull market, or the beginning of a bear market?” Let’s have a quick look at the past bear markets.

During the dot-com bubble, the Nasdaq Composite Index peaked on March 10, 2000, at 5,048.6. As the bubble burst, the index plummeted to 1,139.9 by October 4, 2002. This represented a staggering decline of around 76.8%. The collapse was driven by the realization that many internet companies were grossly overvalued and unprofitable.

In the 2022 bear market, NDX logged in a huge loss of 33.0%, bigger than that of DJX (-8.8%) and SPX (-18.1%). High-tech companies relied heavily on financing to fund their research, while many of them were yet to be profitable. The Fed rate hikes pushed their borrowing costs up by 500 basis points, worsening their financial woes.

OpenAI's ChatGPT saved the day. This A.I. chatbot redefined the standards of artificial intelligence, proving that machines can indeed “learn” the complexities of human language and interaction.

In my opinion, DeepSeek did not cancel out the breakthroughs achieved by others. On the contrary, by massively lowering the barrier of entry, DeepSeek could quicken A.I. development and its widespread adoption. A new era of A.I.-driven industrial revolution, started by OpenAI and boosted by DeepSeek, has only just begun.

Additionally, Tech giants in the Silicon Valley are not sitting idly. OpenAI responded immediately by making the $200-a-month ChatGPT premium product free for all. The major players will learn from DeepSeek and redirect their research and development. After some short-term declines, the market will reprice the NDX component companies, setting them up for the next phase of the A.I. revolution.

A.I. and Robotic Applications Are a Reality

Last year, I took three trips to China and visited a dozen cities. What I observed there shows you how A.I. technology could be applied right now, not years away.

• In the past, when I ordered takeouts while at hotels, I needed to go to the lobby to pick up my food. Nowadays, the hotel front desk would put my order inside a robot, which would then run and ride the elevator on its own and deliver the food to my room.

• In fact, delivery robots are widely used for hotel room-service in China. They are not just in fancy hotels, but many budget hotels have also adopted them. The hospitality industry is labor intensive. Think about how much the labor cost this could cut down.

• Restaurant patrons in China can scan a QR code to review menu, order food and pay for the meal online. Many have done without waiters, cashiers and printed menus altogether. If you want to save the 20-30% service tips, this may be the way to go.

• Other emerging A.I. and robotic applications include driverless Taxi and food delivery by drone. On the one hand, they threaten the jobs of millions of people. On the other hand, they would save so much money for businesses and help their bottom-line.

The adaptation to A.I. and robotic applications is slow in the U.S. Sometimes, they are being blocked by labor unions, who value job preservation more than anything else. Another reason is the lack of investment in A.I. infrastructure and commercial applications.

On January 21st, President Donald Trump announced Project Stargate, a joint venture promising to invest up to $500 billion for infrastructure tied to artificial intelligence. This is a new partnership formed by OpenAI, Oracle and SoftBank.

Separately, on January 22nd, Saudi Crown Prince Mohammed bin Salman announced that the oil producing country would invest up to $600 billion in the U.S., after his telephone call with President Trump.

To sum up my analysis, it’s my view that A.I. applications are well under way, and large investment would help shore up A.I. infrastructure and steadily deliver cost-saving and efficiency improving applications across every corner of the economy.

Project Stargate, named after the popular sci-fi movie, has the potential to spur another industrial revolution. After the market correction, NDX could rise higher once again.

Trading with Micro E-Mini Nasdaq 100 Futures

Investors sharing my view could consider the CME Micro E-Mini Nasdaq 100 futures (MNQ). The MNQ contracts offer smaller-sized versions of the benchmark E-Mini Nasdaq 100 futures (NQ). Micro futures have a contract size of $2 times the Nasdaq 100 index, which is 1/10th of the E-Mini contract.

Micro contracts are very liquid. CME Group data shows that 1,279,703 contracts were traded on January 24th. Open Interest at the end of the day was 100,680.

Buying or selling 1 MNQ contract requires an initial margin of $2,306. With Monday midday quote of 21,156, each March contract (MNQH5) has a notional value of $42,312. Compared with investing in the underlying stocks, the futures contracts offer a built-in leverage of about 18 times (=42312/2306).

Hypothetically, a trader waits for the Nasdaq futures price to drop to 20,000 then enters a long order. If MNQ rebounds to its previous high at 22,100, the price change of 2,100 points (22100-20000) will translate into $4,200 in profit for a long position, given each index point equal to $2 for the Micro contract. Using the initial margin of $2,306 as a cost base, the trade would produce a theoretical return of 182% (=4200/2306).

The risk of a long MNQ position is that the Nasdaq goes into a bear market. To hedge the downsize risk, the trader could set a stop-loss in his buy order. For illustration, he would put the stop-loss at 19,500 when submitting the buy order at 20,000. If the Nasdaq declines 20% from its peak of 22,100 to 17,680, the long position would be liquidated well before that, and the maximum loss would be $1,000 (= (20000-19500)*2).

Happy Trading.

Disclaimers

*Trade ideas cited above are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management under the market scenarios being discussed. They shall not be construed as investment recommendations or advice. Nor are they used to promote any specific products, or services.

CME Real-time Market Data help identify trading set-ups and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Can Giants Maintain AI Dominance While Pursuing Independence?In the ever-evolving landscape of artificial intelligence, Microsoft stands at a fascinating crossroads that challenges conventional wisdom about technological partnerships and innovation. The tech giant's recent strategic moves present a compelling case study of how market leaders can simultaneously strengthen their AI capabilities while reducing dependencies on key partners. This delicate balance could reshape the future of enterprise AI.

Microsoft's remarkable journey is highlighted by Wall Street's growing confidence, with Loop Capital's target price increase to $550 reflecting strong market optimism. This confidence isn't merely speculative – it's backed by substantial investments, including a staggering $42.6 billion allocated to cloud and AI infrastructure in Q3 2024 alone. The company's financial performance reinforces this positive outlook, with earnings consistently exceeding expectations and revenue growing at an impressive 16% year-over-year.

What makes Microsoft's strategy particularly intriguing is its nuanced approach to partnerships and innovation. While maintaining its strategic alliance with OpenAI, the company actively diversifies its AI portfolio by developing internal models and exploring third-party integrations. This sophisticated balancing act, combined with strong institutional ownership and strategic insider movements, suggests a company that's not just adapting to change but actively shaping the future of AI enterprise solutions. The remaining question isn't whether Microsoft will maintain its market leadership, but how its strategic evolution will redefine the boundaries between partnership and independence in the AI era.

$MSFT H&S top? Large downside move incoming?NASDAQ:MSFT is one of the worst looking tech charts out there.

There's a large H&S top that has formed and if it breaks below that blue trend line it's going to get ugly quickly.

I think it's possible we see a 20%+ decline over the coming months back to that $312-316 level.

1D, 2D, and 1W Heikin Ashi candles are all bearish. It would take a miracle for this stock to turn around.

Let's see if we get a H&S top confirmation.

SEC Allows Options Trading on BlackRock’s Bitcoin ETF Market Update - September 27th, 2024

Takeaways

The SEC has approved Nasdaq's request to list and trade options on BlackRock's spot bitcoin ETF: The decision introduces new hedging tools for investors but comes with a 25,000 contract limit which has been criticized by the exchange as “conservative.”

Crypto investment products saw a second consecutive week of inflows, totaling $321 million, after the Fed's decision to cut rates: Bitcoin investment products led the pack with $284 million in inflows last week.

More than 40 Republican lawmakers called on SEC chair Gary Gensler to withdraw the crypto custody rule (SAB 121): They argue the rule increases consumer risk and stifles innovation.

Caroline Ellison, ex-CEO of Alameda Research, was sentenced to two years in prison for her role in the FTX fraud case: Despite her cooperation with law enforcement in the case against Sam Bankman-Fried, the judge ruled that Ellison must still serve time.

On Monday, OpenAI’s official news account on X was compromised, with hackers using it to promote a fake "$OPENAI" token: The fraudulent post claimed the token would grant access to future beta programs and directed victims to a spoof website.

PayPal to accept crypto payments: Payments giant PayPal announced Wednesday it would allow business accounts to buy, hold, and sell cryptocurrencies.

SEC Allows Options Trading on BlackRock’s Bitcoin ETF on Nasdaq's ISE

The SEC has approved a rule change permitting the listing and trading of options on the iShares Bitcoin Trust (IBIT), BlackRock’s Bitcoin ETF, on Nasdaq’s International Securities Exchange (ISE).

BlackRock had been pushing for this approval since March, following the launch of several bitcoin-linked ETFs in the US. Earlier proposals faced concerns around market manipulation. Regulators also expressed concerns around introducing more crypto derivatives products to the market, due to their nascency. To address these concerns, the SEC approved an amendment that limits positions on IBIT options to just 25,000 contracts. The limit has been described as "extremely conservative" by Nasdaq.

The regulator also concluded that the exchange’s surveillance systems would be an adequate deterrent for market manipulation. Currently, BlackRock’s IBIT spot bitcoin ETF is the largest in the world, with more than $17 billion in assets under management.

🏦 Topic of the Week: What Are Central Bank Digital Currencies?

➡️ Read more here

BitSensor - Ethical Decentralized AI PotentialOverall Sentiment: Extremely bullish.

Thesis: TAO's decentralized approach to AI development offers a compelling alternative to centralized AI models, especially in light of recent concerns about corporate control and AI safety. (OpenAI Becoming a for-Profit Entity and last of Original Board leaving)

Strengths:

Decentralized Governance: This model can mitigate risks associated with centralized control and potential biases.

Community-Driven Development: A decentralized approach can foster innovation and adaptability.

Potential for Ethical AI: Decentralization can promote transparency and accountability.

Market Opportunity: The growing demand for AI solutions and concerns about centralized control create a favorable environment for TAO.

Key Indicators:

Volume: Approaching all-time highs for the year.

Sentiment: Positive, especially following Mira Murati's departure.

Technical Indicators: Expanding Bollinger Bands and promising Ichimoku levels suggest potential upside.

Price Targets:

Strong Support: $478

Target 1: $684

Strong Resistance: $820

Breakout Zone: $1102-$1183

Mid-Term Target 1: $1461.8

Short-term Outlook:

Based on the current technical analysis and positive sentiment, TAO appears to be in a strong uptrend.

A potential short-term target is $684.

If the price breaks above the strong resistance level of $820, it could signal a significant bullish breakout.

Mid-term Outlook:

The mid-term target of $1461.8 is ambitious but achievable if the current positive momentum continues.

However, it's important to note that the cryptocurrency market is highly volatile, and prices can fluctuate rapidly.

Apple Partners With OpenAI for AI Integration Into iOS & MacOSApple ( NASDAQ:AAPL ) has emerged as the talk of tech town ahead of WWDC24, with reports claiming the company is in partnership with OpenAI for AI integration into iOS and macOS models. Although no official statement by the firms has surfaced in the market, the news has taken the industry by storm. Apple remains poised to unveil AI features in the upcoming WWDC, reported Bloomberg correspondent Mark Gurman. Project Greymatter, a set of AI tools that the company will integrate into core apps like Safari, Photos, and Notes, lies at the core of the event. These features will be integrated into iOS18 models and macOS15 models, with operations handled via a two-structured process. A detailed structure will probably be ruled out at the upcoming WWDC event.

Also, the industry is abuzz with numerous reports of Apple's plans to leverage Google's AI services as well. Although an official statement is much-awaited, these talks have taken the AI industry by storm. A potential collaborative effort with Google may not come as a surprise, given OpenAI's recent scrutiny due to the misuse of its technology across various sectors. Nonetheless, numerous reports across the globe proclaim a partnership between OpenAI and Apple is in the pipeline.

It's worth noting that Apple Inc.'s stock price traded at $191.66 today, up 0.7% as of the time of writing. If plans to integrate AI go successfully, the firm could see a significant rise in value. OpenAI remains poised to benefit substantially from its partnership with Apple ( NASDAQ:AAPL ), although more details are much-awaited.

OpenAI’s search engine: Implications beyond GOOG stockOpenAI has denied rumors claiming it's set to reveal an AI-powered search engine for its flagship chatbot, ChatGPT, on Monday.

Although there is speculation that OpenAI is being a bit of a wise guy, and the product it will demo is not a search engine, but what they might dub as the next generation of search engines.

It will be interesting to see if this product, whenever it is first demonstrated, is anything Google will have to worry about. According to Bloomberg, OpenAI’s search tool will be partly powered by Microsoft’s Bing search engine. Make of that what you will.

Either way, this could likely ratchet up competition with Google and the market might have already begun to price in this risk to GOOG stock. But what other stocks could face a negative or positive risk from this development?

Maybe we can ask ChatGPT:

“Online advertising companies: Companies that heavily rely on Google's advertising platform for revenue could face challenges if advertisers shift their budgets to the new search engine. This includes companies like The Trade Desk (TTD), Magnite Inc. (MGNI), and Criteo S.A. (CRTO).

E-commerce platforms: Google's search engine is a major source of traffic for many e-commerce platforms. If a rival search engine gains popularity, it could impact the flow of traffic and potentially affect revenue for companies like Amazon (AMZN), eBay Inc. (EBAY), and Shopify Inc. (SHOP).

Payment processing companies: Google's search engine facilitates e-commerce transactions, which benefits payment processing companies like PayPal Holdings Inc. (PYPL) and Square Inc. (SQ). If a rival search engine affects e-commerce traffic patterns, it could indirectly impact payment processing companies.

Digital marketing agencies: Companies that specialize in search engine optimization (SEO) and search engine marketing (SEM) services may see a shift in demand if advertisers allocate resources away from Google towards the new search engine. Examples include companies like WPP plc (WPP) and Omnicom Group Inc. (OMC).

Data analytics companies: Google's search engine generates vast amounts of data, which is valuable for analytics purposes. If a new search engine captures market share, it could impact data analytics companies that rely on Google's data for insights. Companies like Nielsen Holdings plc (NLSN) and The Dun & Bradstreet Corporation (DNB) could be affected.

Online review platforms: Google's search engine plays a significant role in driving traffic to online review platforms like Yelp Inc. (YELP) and TripAdvisor Inc. (TRIP). A new search engine could potentially change the dynamics of online reviews and impact these platforms' user base and revenue streams.”

Worldcoin: The Future of Digital Identity What happens when 90 plus percent of everything we interact with and see on the internet is created or enhanced by AI?

A new project has emerged with the potential to revolutionize the way we think about digital identity. Worldcoin, co-founded by Sam Altman of OpenAI, aims to create a global network of digital identities for a world where AI robots become harder to distinguish from humans.

At the heart of Worldcoin is the concept of "proof of personhood," which is becoming increasingly important as AI technology advances. The project utilizes an innovative approach to identity verification through the use of an "Orb" device that scans people's irises to ensure they are unique human beings.

"It is a way to verify humanness truly at population scale, independent of governments, able to scale to billions of people. And that is what we call World ID, which underlying is a biometric verification device that we call the orb, that you see here, that actually allows us to do that. So that is World ID, that's building block one. And two is a digital currency called Worldcoin that everyone that actually verifies for World ID receives ownership in it. That is the protocol level. And then also, to get all of this going, we built the first app that connects to the protocol that we call World App So that's a non-custodial wallet that lets you send money to your friends, lets you verify with your World ID and kind of brings together many of the technologies that came out of crypto in the last couple years and just makes them very easy to understand and use" - Alex Blania CEO, Tools For Humanity

But Worldcoin is not just about identity verification. The project also aims to provide a universal basic income through the distribution of its MIL:WLD token to every human. This bold vision could have a significant impact on financial inclusion and help to address some of the economic challenges that the world is currently facing.

The association with OpenAI and Sam Altman has generated significant interest in Worldcoin, with the project raising $115 million in a Series C round led by Blockchain Capital. The project's token, MIL:WLD , has seen a surge in price, reaching $9.35, according to CoinMarketCap data.

Now, let's look at the MIL:WLD token. With a total supply of 10 billion and a current circulating supply of 104 million, there's still a lot of room for growth. This is a potential proxy for the public to invest in OpenAI, the largest AI research company. And if the project continues to gain traction, the demand for the token could increase, potentially driving the price up.

While there are still many unknowns about the future of Worldcoin, the project's ambitious goals and innovative approach to identity verification make it one to watch in the world of cryptocurrency and AI.

Most will wait till MIL:WLD is listed on major exchanges....by than what price will it be!? As always, early bird gets the worm.

Match Group (MTCH) About to Take OffI generally don't look at 3M charts, nor do I ever have this many indicators on my charts...

BUT they're all aligning - pair that up with an OpenAI partnership and there's no where but up from here.

Match Group is the company behind Tinder, Match, Hinge and a total of 40ish relationship apps - I'll breakdown my theory as simple as possible...

I can realistically see a 10x+ out of this.

AI = Job Cuts = More OF Girls = Bigger Female Egos = Desperate Guys = Pay-to-Date

Then, eventually, the lines between a female and AI will blur...but we have time on that.

Microsoft's Market Cap Skyrockets to $3.12 Trillion

Microsoft's Historic Market Cap Breaks Records

In a monumental shift in the tech industry's landscape, Microsoft ( NASDAQ:MSFT ) has surged past Apple ( NASDAQ:AAPL ) to claim the title of the world's most valuable company by market capitalization. With its market cap reaching an unprecedented $3.12 trillion, Microsoft's ( NASDAQ:MSFT ) ascent marks a historic milestone, surpassing Apple's ( NASDAQ:AAPL ) previous record high of $3.090 trillion, achieved on July 31, 2023, according to Dow Jones Market Data.

This surge comes on the heels of Microsoft-backed OpenAI's remarkable achievement, as the AI startup reached a staggering $2 billion in revenue in December. As reported by the Financial Times, sources familiar with OpenAI's financials revealed this milestone, attributing it to the burgeoning demand for generative AI tools in corporate settings. OpenAI anticipates further exponential growth, aiming to double its revenue in 2025, fueled by robust interest from business clients seeking innovative AI solutions.

OpenAI's ChatGPT Propels Revenue Growth, Valuation Soars to $80 Billion

OpenAI's meteoric rise to a $2 billion revenue milestone in December underscores the increasing prominence of AI technologies in modern business landscapes. The company's ChatGPT product played a pivotal role in driving this growth, as its annualized revenue surged from $1.3 billion in mid-October to over $1.6 billion by December, as reported by The Information.

Investor confidence in OpenAI remains steadfast, with the San Francisco-based startup commanding a valuation exceeding $80 billion. The company's chief, Sam Altman, is actively engaged in discussions with potential investors, including the UAE, to secure funds for ambitious ventures. Notably, Altman seeks to spearhead initiatives aimed at bolstering global chip-building capacity, thereby enhancing OpenAI's ability to power advanced AI applications and drive technological innovation on a global scale.

Microsoft and OpenAI's Joint Endeavors

The convergence of Microsoft's unparalleled market dominance and OpenAI's groundbreaking achievements heralds a new era of innovation and technological advancement. As Microsoft ( NASDAQ:MSFT ) solidifies its position at the forefront of the industry, its strategic partnership with OpenAI amplifies its capacity to pioneer transformative AI solutions.

Conclusion

As both entities continue to push the boundaries of what is possible, their collaborative vision extends beyond commercial success to encompass broader societal impacts. By leveraging OpenAI's expertise in AI research and development, Microsoft ( NASDAQ:MSFT ) aims to empower businesses worldwide with cutting-edge tools and technologies, driving productivity, efficiency, and innovation across diverse sectors.

In the quest to redefine the future of technology, Microsoft ( NASDAQ:MSFT ) and OpenAI stand as beacons of progress, poised to revolutionize industries, empower individuals, and shape the trajectory of global innovation for years to come.

Calling the $MSFT top here. See you sub $200The popular narrative is that NASDAQ:MSFT is going to benefit from AI and if there's a downturn, the stock will hold up.

I have a different view. I think we've topped here and will only see lower prices going forward.

Over the next year, I anticipate NASDAQ:MSFT 's price dropping sub $200 to the support levels on the chart.

Only thing that would change my bias is a push above the resistance line and flipping it as support.

Let's see how it plays out.

AI Integration Deepens in Cardano with Girolamo Chatbot LaunchCardano integrates AI with Girolamo launch, advances in blockchain with Mithril, and prepares for a pivotal governance vote.

Cardano (ADA), a prominent blockchain platform, has taken a significant leap in integrating artificial intelligence with its ecosystem. The recent beta launch of Girolamo, an internet-enabled generative chatbot, marks a pivotal moment in Cardano’s AI journey. This development aligns with Cardano’s ongoing efforts to intertwine blockchain technology and AI, showcasing a blend of innovation and practical application.

Girolamo Launch Marks Cardano’s AI Evolution

Girolamo, named after the renowned Italian mathematician Girolamo Cardano, represents a groundbreaking step for Cardano in AI. This chatbot is designed to handle a broad spectrum of queries, from industry-specific to general everyday questions. Remarkably, Girolamo also boasts the capability to generate and interpret images, adding a visual dimension to its functionality.

ADA’s engagement with AI technology traces back to 2021, with the unveiling of Grace, an AI robot developed by Awakening Health. This venture was a collaboration between Hanson Robotics and SingularityNET, a blockchain partner of Cardano. The synergy between blockchain and AI has been a focal point for Cardano, particularly highlighted by the launch of the AGIX converter bridge in the past year.

Charles Hoskinson, the founder of Cardano, reached out to Sam Altman, CEO of OpenAI, proposing a collaboration. This gesture reflects ADA’s aspiration to expand its blockchain ecosystem, potentially exploring a partner chain with OpenAI. Such collaborations signify Cardano’s commitment to staying at the forefront of blockchain and AI integration.

In parallel, ADA’s lightweight wallet, Lace, updated version 1.7.1. This update addresses various issues, including enhancing dApps connectivity with the Lace wallet. These improvements are crucial for streamlining user interactions within the ADA network.

Cardano Advances with Mithril Relay Prototype

Cardano’s decentralization efforts took a step forward with the Mithril team’s completion of the prototype implementation of the Mithril relay. This development is key in enabling peer-to-peer signature broadcasting, a fundamental aspect of decentralized networks.

Moreover, ADA is gearing up for a significant governance milestone. The community is preparing for a special ballot vote under CIP-1694, focusing on assessing advancements in on-chain and off-chain governance. The snapshot for participating wallets was taken on November 21, with the voting process scheduled from December 1 to December 11.

The series of developments in the ADA ecosystem has been met with optimism in the cryptocurrency market. Following the announcements, ADA, Cardano’s native cryptocurrency, saw a positive price movement. In the last 24 hours, ADA experienced a price increase of 0.40%, trading at $0.3937.