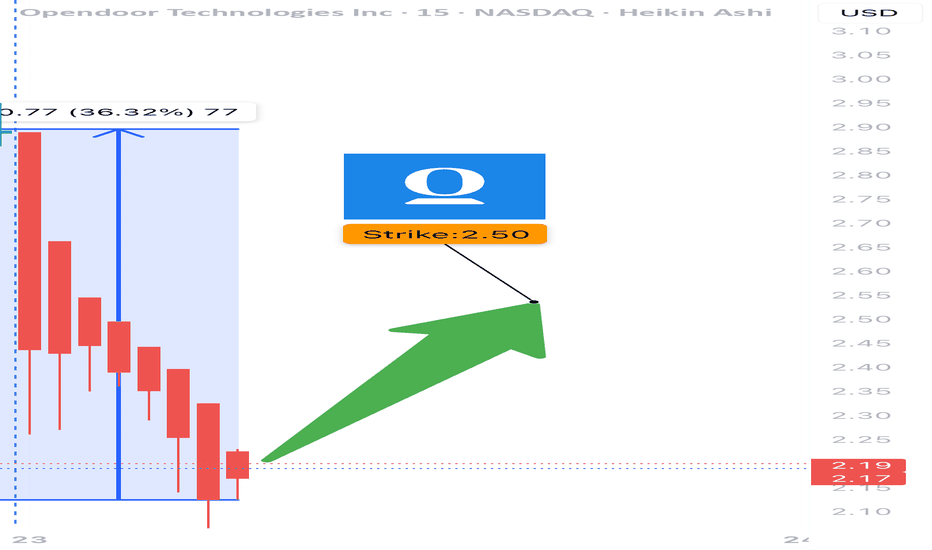

OPEN WEEKLY TRADE SETUP — 07/23/2025

🏠 OPEN WEEKLY TRADE SETUP — 07/23/2025

📈 Volume Surge + Call Flow = Bullish Bias Confirmed

⸻

🔍 MARKET SNAPSHOT

All major models signal STRONG WEEKLY BULLISH bias, supported by:

• 📊 Weekly RSI = 85.9 (RISING) → 🚀 Momentum confirmed

• 📉 Daily RSI = 83.3 (FALLING) → ⚠️ Overbought zone, short-term pullback possible

• 📈 Volume Ratio = 6.7× Last Week → Big accumulation

• 🔁 Call/Put Ratio = 1.35 → Flow favors upside

• 🌪️ VIX = 16.1 → Normal regime = Clean premium action

⸻

🎯 TRADE IDEA — CALL OPTION PLAY

{

"instrument": "OPEN",

"direction": "CALL",

"strike": 2.50,

"entry_price": 0.26,

"profit_target": 0.39,

"stop_loss": 0.13,

"expiry": "2025-07-25",

"confidence": 80%,

"entry_timing": "Open",

"size": 1 contract

}

⸻

📊 TRADE PLAN

🔹 🔸

🎯 Strike 2.50 CALL

💵 Entry Price 0.26

🎯 Target 0.39 (+50%)

🛑 Stop Loss 0.13 (risk control)

📅 Expiry July 25 (2DTE)

📈 Confidence 80%

⚠️ Risk High gamma + overbought daily RSI

💡 Size Tip Keep risk to 2–4% of account capital

⸻

🧠 MODEL CONSENSUS

• ✅ All models agree: Weekly trend = UP

• ✅ Heavy call flow centered around $2.50

• ⚠️ Caution on timing: falling daily RSI = maybe wait for early dip?

⸻

💬 Drop a 🟩 if you’re riding OPEN

📈 Drop a 🕒 if you’re waiting for the dip

🚀 Looks like momentum wants to go higher — but gamma’s real, manage tight!

#OPEN #Opendoor #OptionsTrading #CallOptions #WeeklySetup #BullishTrade #GammaRisk #VolumePlay #TradingIdeas #AIPoweredAnalysis

Opendoor

Opendoor Technologies | OPEN | Long at $0.60Opendoor Technologies $NASDAQ:OPEN. This is purely a swing trade for a company that has been posting declining earnings and revenue since 2022 and does not anticipate becoming profitable in the next 3 years. Since the stock is now under $1, it's at-risk of being delisted from the Nasdaq. I am entering this play because there is a chance the recent price hit near $0.50 may be a temporary bottom and there is enough short interest (near 18%) for a spike near its book value of $1.00. Quick ratio is 0.75 (i.e. company may have difficulty meeting its short-term obligations without selling inventory or acquiring additional financing). While the company may be forced to do a split (a major risk for this purchase), I can see other eyes viewing this as a potential "quick play" for a reversal near its book value.

At $0.60, NASDAQ:OPEN is in a personal buy zone for a swing trade.

Targets:

$0.87 (+45%)

$1.00 (+66.7%)

OPEN - Falling Wedge on the Daily ChartThe price has been fluctuating within a broad range but shows a general downward trajectory as indicated by FALLING WEDGE. There's a noticeable struggle to break above the supply zone, suggesting that any rally towards this zone might be met with selling pressure.

Open door Technology Inc: unravel the hidden gemOpendoor is one of the most prominent companies, leveraging technology to streamline the home buying and selling process.

Opendoor has several growth opportunities that it could pursue to drive future revenue and earnings growth. One such opportunity is to expand its geographic footprint by entering new markets. The company operates in over 40 markets across the United States and plans to expand into additional markets in the coming years. This could help the company increase its revenue base and market share in new regions.

Opendoor Technologies entry pursuit As requested by a follower:

Opendoor Technlogies NASDAQ:OPEN

- Currently this is a high risk trade as we are reaching

oversold on the weekly and price is close to

overhead resistance

Positives and entry levels:

- Above 200 day moving average & sloping upwards

- A pull back to 200 day would be an ideal entry

- Break above the OBV resistance line could indicate

further push through

I would not be entering this trade unless we revisited the 200 day or broke through the OBV resistance.

Opendoor is a small $2.68bln market cap company aiming to make selling your home as easy as clicking a few buttons. There are a lot of unknowns in the housing sector however a new CFO was appointed in Dec 2022 and she seems to have the company back on the front foot which is positive. #opendoor

Opendoors mission statement:

Opendoor is an e-commerce platform for residential real estate that allows people to buy, sell and move online. Our vision is to build a one-stop shop that allows people to move with the tap of a button.

opendoor ---> is going to touch $10hello guys...

as you can see the door breaks up the last resistance level and it will touch the $10!

if the price retraces to the break-up zone you can get a long position.

______________________________

always do your research.

If you have any questions, you can write them in the comments below, and I will answer them.

And please don't forget to support this idea with your likes and comment

Opendoor - powerful bullish ButterflyLooks like Opendoor's stock is shaping up to form a Butterfly pattern! If you're familiar with this symmetrical chart pattern, you'll know that it can signal a potential reversal in the stock's current trend.

So, for those of you who believe in the power of technical analysis, this could be seen as a bullish signal for Opendoor's future stock price. Of course, as with any trading strategy, it's important to use multiple forms of analysis and not rely solely on chart patterns. But hey, let's enjoy this moment of Butterfly bliss while it lasts!

Opendoor Tech (NASDAQ: $OPEN) Looking Undervalued For Real! 🏠 Opendoor Technologies Inc. operates a digital platform for residential real estate in the United States. The company's platform enables consumers to buy and sell a home online. It also provides title insurance and escrow services. Opendoor Technologies Inc. was incorporated in 2013 and is based in Tempe, Arizona.

Strong support area provides a good R/ROpendoor $OPEN has delivered better than expected results in the past 2 QE. The fundamentals are strong and this past sell-off was due to the broad market sell-off. At $13.50-$13.75 range we have a strong support area that should hold. If so the minimum rise should be the resistance area of the range-bound rectangle at around $18.50.

Entering a BUY position at the current price would provide 2.5+ R/R which is pretty good. If we can get a small dip down to $14.5 then the R/R rises to 4.44 as shown on the chart.

Other notable technicals we can see are:

- the price should retrace back to 200SMA around $18-$18.5 area

- the retracement would be less than 50% Fibo

- the price is really over-sold and a counter-trend leg to the upside is expected

Not financial advice, DYODD

$OPEN, Opendoor Technologies long trade$OPEN just had earnings and beat expectations but is still suffered heavily from the tech selloff. IMO the big selloff is unjustified and the stock held the lower support trendline. This is a great long entry for someone looking to make close to 80% gain to a new ATH.

Opendoor Is the Future Amazon of the $1.6 Trillion Real EstateOpendoor is an e-commerce platform where consumers can buy, sell and view homes online. For all intents and purposes, Opendoor is the future Amazon of the real estate market — and this $1.6 trillion market is ripe for significant and widespread digital disruption over the next 10 to 15 years. Amid this disruption, Opendoor will grow by leaps and bounds, and IPOB stock will soar like AMZN stock has soared over the past 10 to 15 years.

Credit: Luke Lango, InvestorPlace Senior Investment Analyst

$OPEN, Zillow, and Redfin correlation and long term bullishOpendoor broke trends today during a period of limited/no support (See related ideas section).

I look to RDFN and Z for wider market trends. These 3 companies are in a similar tech real estate market. There is limited trading history for OPEN and IPOB, TradingView doesn't even allow charting properly. There is a correlation with patterns for RDFN and Z, but there has been higher volume with OPEN. Using 1H ichimoku, both Redfin and Zillow are bullish and have no trends broken. Z is actually slightly positive since the OPEN ticker change. I expect OPEN to get back on a bullish 1H trend once the early stakeholders complete their selling.

This is an accumulation level and it could gain momentum fast as people accumulate. I would like to see a bullish 1H trend since the new ticker launch, which could at the earliest be established during the first week of January, before I recommend going long.