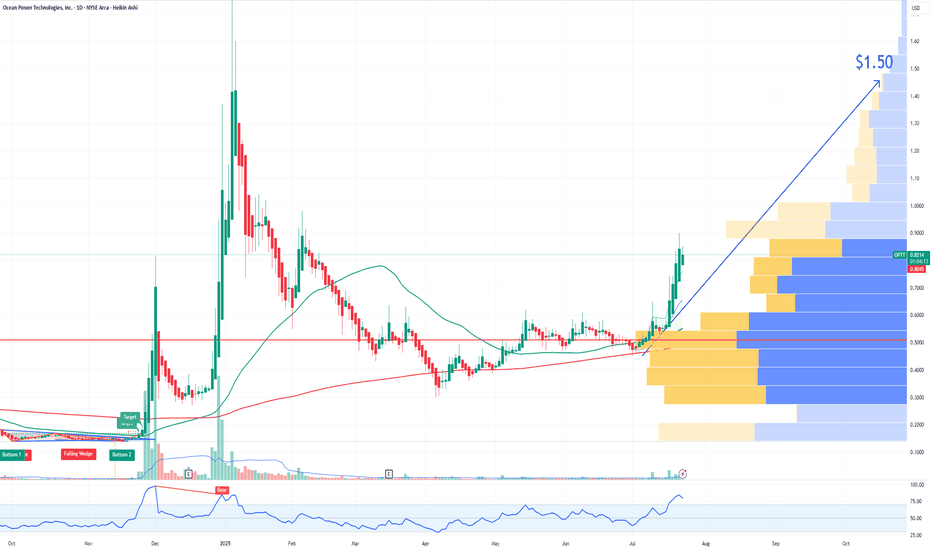

OPTT Ocean Power Technologies Options Ahead of EarningsAnalyzing the options chain and the chart patterns of OPTT Ocean Power Technologies prior to the earnings report this week,

I would consider purchasing the 1.50usd strike price Calls with

an expiration date of 2025-11-21,

for a premium of approximately $0.25.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Optionflow

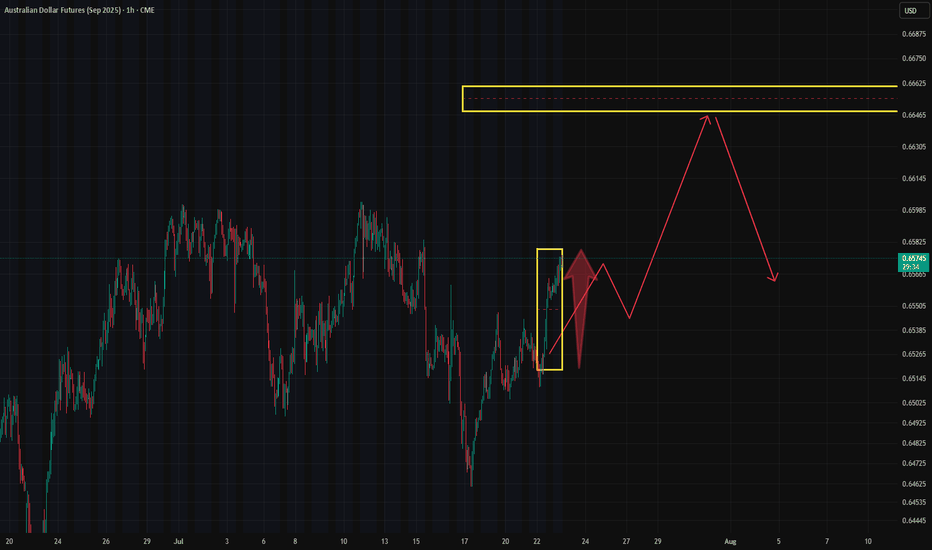

Australian dollar rose 0.8% but there is a "Wall" of naked callsAustralian dollar is up 0.8% in 24h — and almost eyeing the 0.66–0.665 zone .

That’s exactly where we’ve been seeing a systematic build-up of naked calls on the futures.

More “bricks” added to the wall yesterday.

Early, looking at the CME data , there’s been a meaningful inflow in deep-out-of-the-money call options at the 0.665 strike . And this has been happening for several days for now

We can’t say it’s one single player — CME reports don’t show that.

But the pattern is too consistent to ignore.

🧠 Why it matters:

As I’ve said before — these long call stacks can easily turn into zero-cost put spreads by selling futures at those levels.

🎯 Bottom line:

Seems the market isn’t betting on a rally in long term.

It’s preparing to defend the range .

Strategy: open shorts at "build-up" resistance zone

Crude Oil: Bulls vs. Bears — A Market at the Edge

Here’s what we’re seeing from the latest CME block trade data & CME report:

🐻 Confirmed & Detailed Bearish Sentiment

Big players are actively hedging and betting on a drop.

Block trades are targeting key downside levels:

$62.50 , $55.00 , and even as low as $45.00 .

This isn’t noise — it’s institutional conviction.

🐂 Strong Bullish Resistance

At the same time, there’s heavy buying in:

Long futures

Bullish call spreads (1,000+ contracts)

This tells us: there are serious buyers stepping in, targeting $67.50–$72.50 .

They don’t believe in the bear case — and they’re backing it with real money.

🧭 Market at a Bifurcation Point

The presence of massive, conflicting block trades is a clear sign:

The market is preparing for a big move — up or down.

“Smart money” isn’t betting on sideways action.

They’re positioning for breakout volatility .

📊 Final Forecast

Oil is under strong bearish pressure.

That makes a downward scenario more likely in the medium term .

BUT — there’s strong support from big buyers stepping in around $64–$65 .

So the most probable path?

A high-volatility phase , with attempts to test both:

Upper targets (bullish side)

Lower support zones (bearish side)

🔑 Key Battle Zone: $62 – $68

This range will be critical in the days ahead.

Break it — and we’ll know which side is in control.

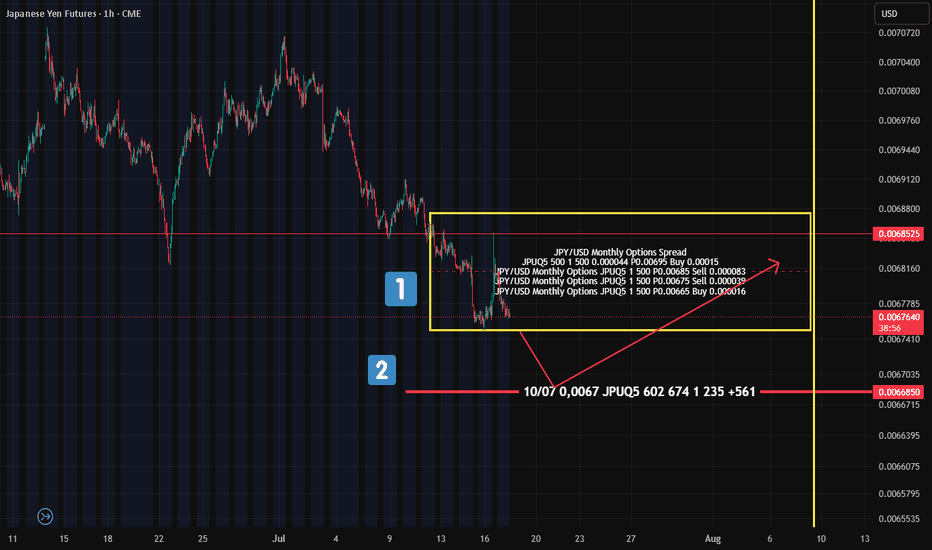

Yen Futures Options: What the "Put Condor" Tells Us About FutureA quick look at the options sentiment on Japanese Yen futures (not spot) — and there’s something interesting on the flow radar.

On July 10 , a "Put Condor" was placed — boundaries marked by the yellow rectangle on the chart (№1).

The goal of this setup? Price should expire within these boundaries — meaning the seller expects limited downside , but still allows for some controlled movement.

What’s notable?

This position was placed before the yen started to weaken — so someone was clearly preparing for this scenario in advance .

Also worth watching:

Further down (№2 on the chart), there’s another cluster of put options at 0.0067 — suggesting this level could act as a support zone if the futures contract drops that low.

📊 Bottom Line:

There are clear signs pointing to continued downside pressure in Yen futures.

The 0.006685 level is key — potential support for a bounce back into the 0.00675–0.00685 range .

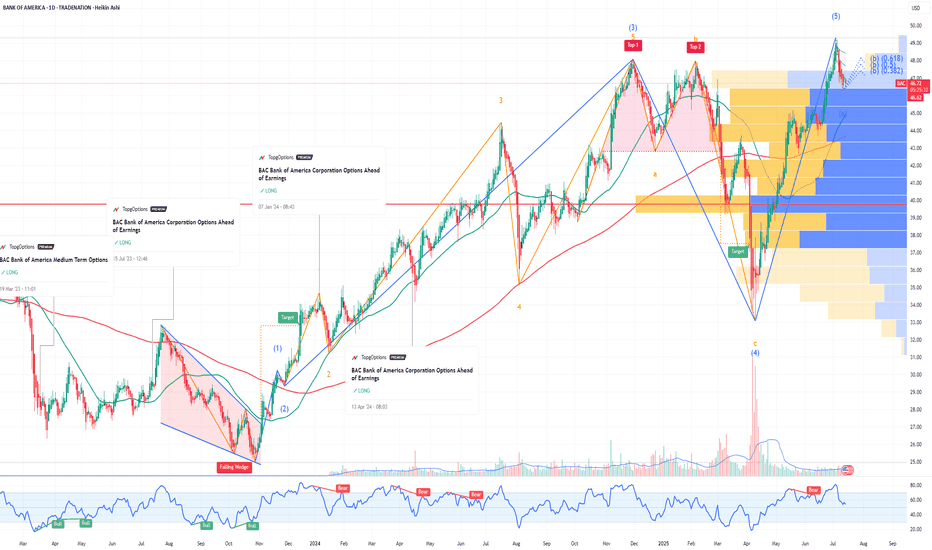

BAC Bank of America Corporation Options Ahead of EarningsIf you haven`t bought BAC before the rally:

Now analyzing the options chain and the chart patterns of BAC Bank of America Corporation prior to the earnings report this week,

I would consider purchasing the 48usd strike price Calls with

an expiration date of 2025-7-18,

for a premium of approximately $0.34.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

USD/CHF Weakness Alert: Retail Bulls vs. Smart Money FlowHere’s the latest aggregated data on the pair:

📊 4 out of 5 indicators suggest potential for further downside.

Sentiment - Bearish!

A quick note on sentiment in the table:

✅ It’s structured hierarchically — from the broadest view (COT reports) to specific entry points (algorithmic setups).

So, Retail traders are massively long USD/CHF — over 80% still buying , expecting strength.

But here’s the problem: the options flow tells a different story .

Looking at recent data from CME , we’re seeing fresh calls buying and growing open interest at key strikes upper current Swiss futures price — a sign that option traders are preparing for strong CHF

💡 Use this data in your trading OR quick check for market conditions at glance!

🎯 No Valuable Data, No Edge!

Quiet Before the Move — What AUD Options Are Telling UsThe AUD is stuck inside its recent range — trading has gone sideways, and trying to predict a breakout direction ahead of key moves would be premature (for more on the “Suffering Trader” concept, click here ).

Price is consolidating just below a cluster of previously opened retail longs. This "failure to achieve" undermines the case of shorting this level right now. So for the time being, I’ll stay in observation mode and watch which side ends up suffering the most.

Now, looking at the CME data , there’s been a meaningful inflow in deep-out-of-the-money call options at the 0.665 strike . That’s interesting.

Also worth noting: just above, at the 0.67 strike , we saw a similar inflow a couple of days ago — and that portfolio remains static. No repositioning or outflows so far.

That silence could mean something. Or nothing — yet.

We’re watching closely.

Contrarian Alert: Retail Is Buying, But Should You Sell?So far, there are no significant changes in the options flow suggesting a shift in sentiment or restructuring of previously established bullish positions. The market remains on watch, but interesting signals are coming from other sources.

According to the latest COT reports , institutional players continue to align with the current trend, reinforcing its stability.

However, retail positioning is starting to show signs of a potential reversal , with a noticeable increase in net-long positions and fresh buying activity over the past two days. This often indicates early countertrend interest.

The well-known contrarian principle — "do the opposite" — applies here, although it shouldn't be taken as an immediate signal to short.

For my part, I’ve identified the 0.6565–0.6570 zone as a key level where long positions are concentrated:

A rejection from this zone could offer a solid shorting opportunity.

A break above it would suggest the trend might resume higher.

By that point, updated options flow data and new positioning COT reports may provide further confirmation.

Quietly Building: A Major Options Position in August AUDEye-catching activity in August AUD options with a strike at 0.67 .

The break-even point for this portfolio sits slightly higher, at 0.674 — and judging by open interest, this is the largest position in play.

Quick reminder:

A break-even level like this could act as a synthetic put building zone by adding short futures to their positions. That means profit from downside moves — with limited risk .

But here’s the catch:

This setup alone doesn’t scream “buy” or suggest strong bullish conviction toward 0.674.

However, it’s definitely worth watching — especially if price starts moving in that direction.

Also keep an eye on option unwinds or roll-overs — they often tell us more about how big players see the future path of the asset.

📈 Bottom line:

Not a clear signal yet — but definitely a pattern forming. Stay tuned.

Follow for more edge-driven breakdowns!

JEF Jefferies Financial Group Options Ahead of EarningsIf you haven`t bought JEF before the previous earnings:

Now analyzing the options chain and the chart patterns of JEF Jefferies Financial Group prior to the earnings report this week,

I would consider purchasing the 57.50usd strike price Calls with

an expiration date of 2025-7-18,

for a premium of approximately $1.40.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

CAD Option Flow Positive Sentiment. It's worth taking a closer Based on the analysis of yesterday's trading on CME, we have captured an excellent portfolio in the lens.

The trader methodically formed this position in a 5-minute period of time, which is a good sign.

Сonfirmation - the market is already moving in his direction

But, reasonable entry level - above 0.7339.

Don't rush it. The risk/profit ratio is still at acceptable levels, but it's worth waiting for the resistance to be overcome.

Why CSX Corporation CSX Could Reach $37.50 by the End of 2025If you haven`t bought CSX ahead of the previous earnings:

Now CSX Corporation CSX, a leading North American rail freight operator, is positioned for a meaningful upside in 2025, with a realistic price target of $37.50. This target is supported not only by strong fundamentals and industry tailwinds but also by recent options market activity showing significant call option interest at the $37 strike price, indicating growing investor conviction around this level.

1. Strong Options Market Signals at $37.50

Recent options data reveals a notable concentration of call open interest and volume at the $37 strike price in the CSX options chain, especially for near- and mid-term expirations.

This elevated activity suggests that institutional and retail investors are positioning for a rally toward $37–$38, reflecting confidence that the stock will surpass $35 and approach $37.50 by year-end.

The options market’s pricing and demand at this level provide a real-time, market-driven validation of the $37.50 target, adding weight to the fundamental bullish case.

2. Analyst Price Targets and Upward Revisions Support $37.50+

Several analysts have price targets ranging from $35 up to $38–$39, with recent upward revisions reflecting improving operational metrics and resilient demand.

Bank of America and Goldman Sachs, among others, have raised targets closer to or above $35, and the options market activity suggests investors expect further upside beyond these levels.

3. Operational Improvements and Network Optimization

CSX continues to address past network challenges, improving service reliability and operational efficiency, which are expected to drive volume growth in key sectors such as agriculture, minerals, and intermodal freight.

These improvements are critical for margin expansion and revenue growth, underpinning the stock’s appreciation potential.

4. Favorable Macroeconomic and Industry Tailwinds

The resilient U.S. economy and ongoing federal infrastructure investments support sustained freight demand.

Rail’s environmental advantages and cost efficiency over trucking position CSX to capture increased market share as companies seek sustainable logistics solutions.

5. Financial Strength and Shareholder Returns

CSX boasts strong free cash flow generation, enabling consistent dividend growth and share repurchases.

The company’s valuation remains attractive relative to peers, with a P/E around 15.5 and a dividend yield near 1.4%, making it appealing for both growth and income investors.

6. Technical Support and Market Sentiment

The stock has held solid support near $30–$31 and is trading near $34.60 as of mid-June 2025, showing resilience amid market volatility.

Positive sentiment from institutional investors and steady trading volumes reinforce the potential for a breakout toward $37.50.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

DOCU DocuSign Options Ahead of EarningsIf you haven`t bought DOCU before the previous earnings:

Now analyzing the options chain and the chart patterns of DOCU DocuSign prior to the earnings report this week,

I would consider purchasing the 93usd strike price Calls with

an expiration date of 2025-6-6,

for a premium of approximately $4.80.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

COST Costco Wholesale Corporation Options Ahead of EarningsIf you haven`t bought COST before the rally:

Now analyzing the options chain of COST Costco prior to the earnings report this week,

I would consider purchasing the 800usd strike price Puts with

an expiration date of 2027-1-15,

for a premium of approximately $42

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

ETH : What the Options Are Saying (Hint: Big Move Ahead)Right now, Ethereum’s key players are positioning themselves to make some money on the rise.

And guess what? The market's already whispering where it’s headed next — but only if you know how to listen. And the loudest voice right now? Options flow on Deribit.

Let me break it down for you…

---

We caught some serious heat in the options pit lately. On Deribit, someone — or maybe a few someones — started stacking **Call options on ETH at 1,800 and 2,200 strike prices**, all under one portfolio. That’s not random. That’s a classic **Call Spread** setup, expiring June 27, 2025.

Translation? Someone’s betting hard on ETH heading north — straight toward **$2,200**.

But here's where it gets spicy. The **Max pain** for this contract sits right at **$2,000** — currently above spot price. Yeah, we’ve seen mixed stats on whether "price gravitates" to max pain like magic. But from experience? Right before expiry, price tends to *flirt* with that level.

So here's our read:

- There's **bullish sentiment** building.

- Eyes are locked on the **$2,200 zone** — likely within the next **30–50 days**.

- BTC’s playing the same game — big interest around **$100K–$110K strikes**, same expiry.

This isn’t noise. This is signal.

---

If you're tired of FOMO and want to catch the real setups before they blow up — follow. We turn complex flows into simple edge. Just actionable insights.

---

📈 *Trade smart. Stay sharp.

Join the crew that reads the market — not the hype.

AFRM Affirm Holdings Options Ahead of EarningsIf you haven`t bought AFRM before the last rally:

Now analyzing the options chain and the chart patterns of AFRM Affirm Holdings prior to the earnings report this week,

I would consider purchasing the 50usd strike price Puts with

an expiration date of 2025-9-19,

for a premium of approximately $8.65.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

ABNB Airbnb Options Ahead of EarningsIf you haven`t sold ABNB before the retracement:

Now analyzing the options chain and the chart patterns of ABNB Airbnb prior to the earnings report this week,

I would consider purchasing the 105usd strike price Puts with

an expiration date of 2026-1-16,

for a premium of approximately $8.10.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Game-changing analysis technique that will elevate your strategyAs many of my loyal followers know, my analysis toolkit goes beyond just the standard fare of CME options data and COT reports. I dive deeper, utilizing additional filters like the average long and short positions of retail traders. These insights are publicly available, and while I won’t name specific sources to avoid any hint of hidden promotion, I’ll give you a clue: look for a website with the word "book" in its title. 📚

For years, I’ve relied on this data, and it has proven to be both reliable and insightful. The average positions of market participants serve as both filters and indicators. But what do I mean by indicators?

Let’s break it down. When the price interacts with these levels, it reveals the market sentiment. For instance, if the price is below the average long position and breaks through easily, it’s a bullish sentiment. Conversely, if it hovers below the level and struggles to break through, that’s still bullish, as it indicates buyers are being drawn into profitable territory.

Now, let’s flip the script for the bears: if the price breaks down from above or struggles below the average short position, that’s a bearish sentiment. The price isn’t responding to sellers, dragging them into a profit land.

There’s more. Often, you’ll notice different behaviors near these key levels, allowing you to enter positions with an incredible risk/reward ratio of 3:1, 5:1, or even better! This clarity gives you insight into the current market mood—who’s being punished and who’s favored at that moment.

Now, let’s take a look at the screenshot of the British Pound futures chart. Here’s what you’ll see:

- A green line representing the average long position of retail traders.

- A red line for the average short position.

- The breakeven point of a put option contract for the June futures expiring on May 22, with 1,320 contracts at a strike of 1.295.

Take a moment to study the chart. What do you observe? 🤓

Ok, breathe in, breathe out. Tomorrow, we’ll dive deeper into this analysis. Don’t forget to subscribe so you won’t miss the continuation of this story! The insights I’ll share are definitely worth your time, as I aim to shift your perspective on the market by demonstrating a clear methodology without relying on indicators or technical patterns.

Stay tuned; it’s going to be incredibly valuable! 🚀✨

Targeting 1.185: Strategies for Navigating Euro Volatility!A few thoughts on the results of the analysis of Friday's stock exchange reports on the euro/dollar pair

We noticed a portfolio that has entered the market with a target of 1.185, and only have 12 days until expiration. With the current volatility at 10.23, the future price at expiration is expected to be in the range of 1.0993 to 1.1849 — a 95% probability. Interesting, right?

Now, let’s consider two possible scenarios.

The first option : if the price is rapidly moving towards 1.185, it might be wise to think about selling the asset. Why? Because this price will act as a strong resistance level. Two reasons:

First , the expected price range is based on a mathematical formula and statistical data. Second , using leverage embedded in options that are deep out of the money (i.e., far from the current price) presents an excellent opportunity to create a synthetic short position without any risk, even if the market continues to move upward! Sounds unreal? Start learning about options, and a new world of opportunities will open up for you. Your perspective on risk and opportunities will change dramatically!

OK, now let's get back to the point of the post. The second option : if the price consolidates above 1.1436 on the futures, this could signal a buying opportunity.

Taking into account other factors (you can dig deeper using our website's data), the current sentiment is quite bullish and the continuation of the uptrend seems more likely than a correction.

Which path will you choose? Share your thoughts in the comments!

That’s where our market research comes in. Think of it as your “bias detector.” We’ve developed and use it daily to get a second opinion on trades. It’s like having a pro trader whisper, “Hey, this isn’t looking good— think twice.”.

P.S. No pressure, just a chance to trade smarter! No Valuable Data, No Edge!

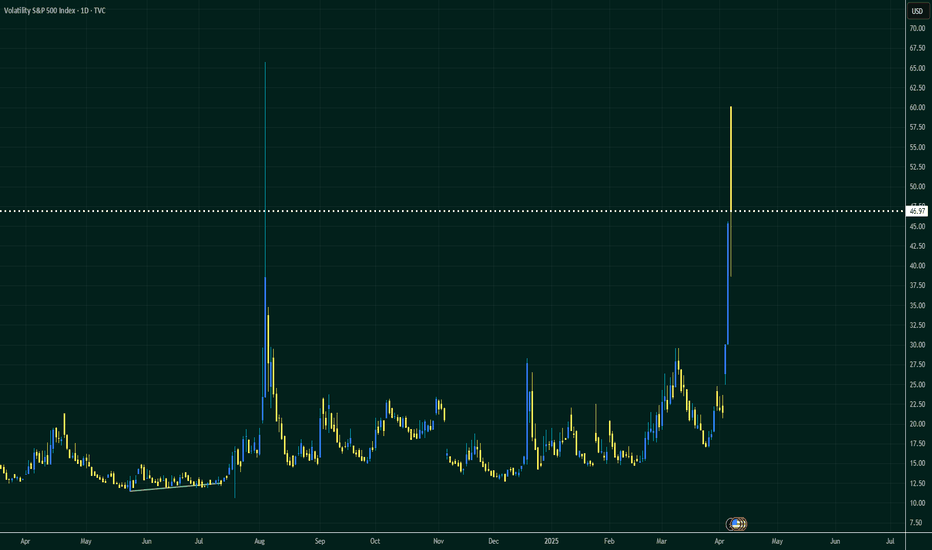

VIX Option Flow Signals Volatility Spike A massive wave of institutional option activity is pointing toward an upcoming surge in volatility—and likely a pullback in equities even more. Here's what the VIX flow is telling us:

🧠 Key Takeaways:

🔺 Aggressive Call Buying on VIX

Heavy blocks on VIX 22–42.5 calls, with most trading at the ask, signaling urgency.

Standout trades include:

1,407x April 22C @ $10.73 – $1.51M

2,535x May 60C @ $1.55 – $394K

5,770x April 40C @ $2.95 – $1.7M

📅 Short- to Mid-Term Focus

Expiries are clustered around April 16 and May 21, suggesting a volatility spike is expected within the next 1–6 weeks.

💵 Big Premiums Paid

Multiple trades between $500K and $1.7M, indicating strong conviction or heavy portfolio hedging.

📉 Minimal Put Activity

Very few puts being bought on VIX, signaling no expectations for volatility to fall.

📊 What This Means for Markets (SPY/QQQ)

This type of flow usually precedes a market correction, a macro catalyst, or event risk. Whether it's CPI, earnings season, or geopolitical flare-ups—institutions are bracing for turbulence.

🔮 Prediction:

Expect a spike in the VIX and downward pressure on major indices like SPY and QQQ in the coming 1–3 weeks.

This flow doesn’t lie—smart money is prepping for a move.

KULR Technology Group Options Ahead of EarningsAnalyzing the options chain and the chart patterns of KULR Technology Group prior to the earnings report this week,

I would consider purchasing the 1.50usd strike price Calls with

an expiration date of 2025-5-2,

for a premium of approximately $0.35.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

LAZR Luminar Technologies Options Ahead of EarningsAnalyzing the options chain and the chart patterns of LAZR Luminar Technologies prior to the earnings report this week,

I would consider purchasing the 7usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $1.40.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

SWBI Smith & Wesson Brands Options Ahead of EarningsIf you haven`t sold SWBI before the previous earnings:

Now analyzing the options chain and the chart patterns of SWBI Smith & Wesson Brands prior to the earnings report this week,

I would consider purchasing the 11usd strike price Calls with

an expiration date of 2025-3-21,

for a premium of approximately $0.52.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.