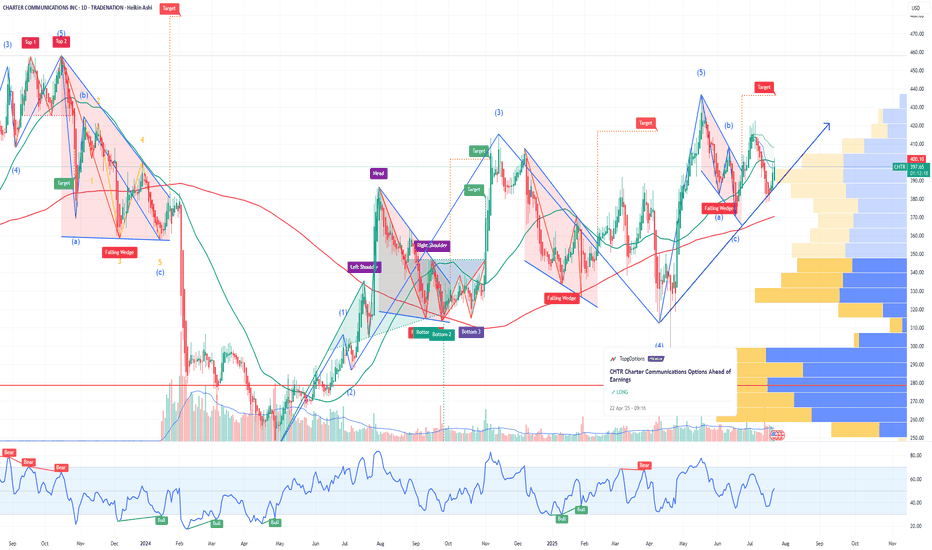

CHTR Charter Communications Options Ahead of EarningsIf you haven`t bought CHTR before the previous earnings:

Now analyzing the options chain and the chart patterns of CHTR Charter Communications prior to the earnings report this week,

I would consider purchasing the 387.5usd strike price Calls with

an expiration date of 2025-7-25,

for a premium of approximately $22.55.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Options-strategy

DG Trading Setup: Capitalizing on RangeDollar General has experienced a stabilization phase following its Q1 2025 results, with same-store sales increasing 2.4% and revenue growing 5.3% to $10.4 billion. The company has regained traction in the discount retail space, mitigating previous challenges related to shrink and operational inefficiencies.

Institutional Flow & Market Positioning

Recent institutional flow highlights large orders in DG’s 115 call and 110 put, signaling either:

- A range-bound setup, where smart money expects the stock to stay between $110-$115 in the near term.

- Potential volatility, with institutions hedging both directions ahead of an unexpected move.

Considering the ATR (18) and standard deviation (7.353), this aligns with a low-breakout probability, making range-based strategies the optimal play. The absence of earnings between now and July further supports sideways movement expectations.

Options Trade Setup: Iron Condor

To capitalize on premium decay and IV contraction, I’m structuring an iron condor:

- Sell 115 Call / Buy 120 Call

- Sell 110 Put / Buy 105 Put

This strategy ensures limited risk while collecting premium in a high-probability range trade.

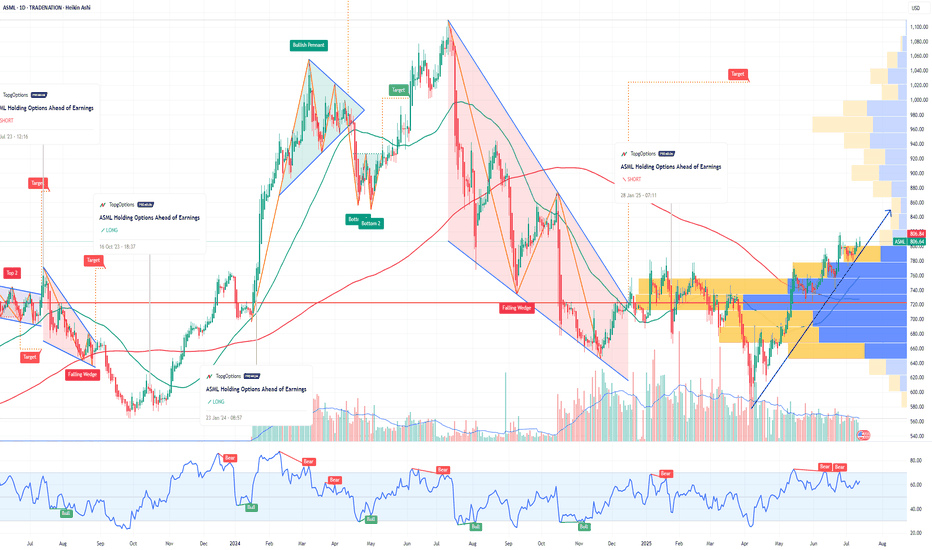

ASML Holding Options Ahead of EarningsIf you haven`t bought the dip on ASML:

Now analyzing the options chain and the chart patterns of ASML Holding prior to the earnings report this week,

I would consider purchasing the 800usd strike price Calls with

an expiration date of 2025-7-25,

for a premium of approximately $32.00.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

MP Materials Options Ahead of EarningsIf you haven`t bought MP before the previuos earnings:

Now analyzing the options chain and the chart patterns of MP Materials prior to the earnings report this week,

I would consider purchasing the 25usd strike price Calls with

an expiration date of 2025-6-20,

for a premium of approximately $2.97.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Carvana Leading Auto Retail – Outpacing LAD & AN-Financial Performance & Momentum:

Carvana reported a record-breaking adjusted EBITDA of $488M in Q1 2025, up $253M YoY, with an EBITDA margin of 11.5% (+3.8pp YoY). The company's strong operational efficiency positions it as a leader in the auto retail industry, nearly doubling the margins of competitors like Lithia Motors (LAD) and AutoNation (AN).

- Competitive Positioning & Growth Outlook:

Carvana’s EBITDA quality is superior due to lower non-cash expenses, enhancing long-term sustainability. The company expects sequential EBITDA growth in Q2 and targets 13.5% EBITDA margins within 5-10 years.

-Peer Comparison:

- Lithia Motors (LAD): EBITDA margin at 4.4% (up from 4% YoY), facing tariff-related headwinds that could impact pricing and demand.

- AutoNation (AN): SG&A as a percentage of gross profit rose to 67.5% in Q1, expected to stay between 66-67% in FY 2025, pressuring margins further.

-Options Flow & Institutional Activity - Key Levels: $350/$370

Recent institutional flow activity indicates strong positioning around $350/$370 strikes, potentially signaling a vertical spread in play rather than outright selling:

1️⃣ Momentum Confirmation:

- CVNA has strong upside momentum following its Q1 results, reinforcing a bullish outlook for near-term price action.

- Institutional traders may be accumulating bullish vertical spreads rather than unwinding positions.

Vertical Spread Setup ($350/$370 Strikes)

- Long Call ($350 Strike) → Signals expectations for further upside.

- Short Call ($370 Strike) → Caps max profit while reducing cost.

- Breakeven Price: $359 → CVNA must close above $359 for profitability.

Profit & Risk Zones

- Above $370: Maximum profit achieved.

- Between $359-$370: Partial profit zone (spread remains in play).

- Below $359: Spread loses value, making recovery dependent on extended upside momentum.

Why IonQ (IONQ) Could Be the NVDA of Quantum ComputingIf you haven`t bought IONQ before the rally:

Now you need to know that IonQ isn’t just another speculative quantum stock — The company is building a robust ecosystem around its best‑in‑class trapped‑ion architecture and targeting fault‑tolerant, networked quantum systems. With record bookings, major acquisitions, and a strong balance sheet, IonQ could emerge as the NVIDIA equivalent for quantum infrastructure.

Key Bullish Arguments

1) Superior Quantum Tech – Trapped‑Ion Advantage

IonQ’s trapped-ion processors boast 99.9% two-qubit fidelity, demonstrating higher accuracy and scalability than superconducting alternatives

These systems also operate at room temperature, meaning simpler deployment and lower costs

2) Ecosystem Strategy & Acquisitions

The $1.08B acquisition of Oxford Ionics (expected close in 2025) expands IonQ’s qubit control tech, pushing toward planned 80,000 logical‑qubit systems by decade’s end

Combined with ID Quantique and Lightsynq, IonQ is building a full-stack quantum and networking offering

3) Strong Revenue Growth & Cash Runway

Revenue soared from $22M in 2023 to $43.1M in 2024, with bookings of $95.6M

. Q1 2025 saw $7.6M revenue and EPS –$0.14, beating expectations; cash reserves near $697M provide years of runway

4) Real Commercial Deployments

IonQ sold its Forte Enterprise quantum system to EPB ($22M deal) for hybrid compute and networking, marking real-world commercial applications

5) AI & Quantum Synergy

Involvement in NVIDIA’s Quantum Day and hybrid quantum‑classical AI demos (e.g., blood pump simulation with Ansys, ~12 % faster) indicates strategic synergy and positions IonQ as a critical piece in the future AI stack

Recent Catalysts:

Texas Quantum Initiative passes – positions IonQ at forefront of U.S. state-backed innovation

Oxford Ionics acquisition pending – major expansion in qubit scale & tech

Barron’s analyst buys – industry analysts see long-term potential; IonQ among top quantum picks

Broader quantum optimism – McKinsey & Morgan Stanley forecasts highlight synergy between quantum and AI, benefiting IonQ

MKC McCormick & Company Options Ahead of EarningsAnalyzing the options chain and the chart patterns of MKC McCormick & Company prior to the earnings report this week,

I would consider purchasing the 85usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $1.40.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

RBRK Rubrik Options Ahead of EarningsAnalyzing the options chain and the chart patterns of RBRK Rubrik prior to the earnings report this week,

I would consider purchasing the 90usd strike price Calls with

an expiration date of 2025-6-20,

for a premium of approximately $5.60.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

ZS Zscaler Options Ahead of EarningsIf you haven`t bought the dip on ZS:

Now analyzing the options chain and the chart patterns of ZS Zscaler prior to the earnings report this week,

I would consider purchasing the 250usd strike price Puts with

an expiration date of 2026-1-16,

for a premium of approximately $29.30.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

[𝟬𝟱/𝟭𝟮] 𝗪𝗲𝗲𝗸𝗹𝘆 𝗦𝗣𝗫 𝗚𝗘𝗫 𝗣𝗹𝗮𝘆𝗯𝗼𝗼𝗸🔍 IF/THEN QUICK GAMMA PLAYBOOK

IF > 5825 THEN path to 5900 → stall/profit-taking likely

IF > 5900 THEN path to first 5950, then 6000 → gamma squeeze extension zone

IF < 5825 THEN path to 5700 → test of transition zone support

Chop Zone: — re-entry = short-term balance/testing zone

IF < 5700 THEN path to 5500 → gamma flush / dealer unwind risk

🧭 𝗘𝗫𝗧𝗘𝗡𝗗𝗘𝗗 𝗭𝗢𝗡𝗘 𝗠𝗔𝗣/b]

✅ Gamma Flip Level

5700 → This is the confirmed Gamma Flip level = High Volatility Zone = HVL. We are comfortably above it, confirming positive gamma environment.

🧱 Major Call Walls / Resistance to upside from here

5900 → Significant call resistance zone (highlighted across GEX, profile, and /matrix command). 5825–5900 = Current rally zone → expected stall at 5900 (Profit-taking zone)5950 → Next mid-large positive gamma wall to the upside, mid-station between mounts. Dealers short gamma, adding fuel to breakout.6000 → Positive Gamma squeeze continuation target. Gamma squeeze intensifies → likely extends to 6000.🟦 Transition / Chop Zone

5700–5825 → Previous chop range. Retrace could test this before renewed upside.Currently outside and breaking up from this zone, indicating trend initiation.

Balance zone from prior structure.

Expect fade setups if price dips back in.

Needs catalyst or strong sell flow to re-enter meaningfully.

🛡️ Major Put Supports to the downside

5700 → = HVL, also aligned with pTrans and Put support.Dealer unwind risk, downside opens.5500 → Key level if the 5700 zone fails — “total denial zone” of current FOMO.

-----------------------------

This week’s SPX setup remains decisively bullish from a gamma perspective. The GEX profile shows strong positive gamma, with institutional and dealer hedging flows firmly positioned to support continued upside—especially into Friday’s OPEX. The environment is ideal for a controlled melt-up: volatility is softening, implied volatility is trending lower, and there’s no sign of panic in the options market.

Put pricing skew is also declining, which suggests reduced fear and a shift toward more aggressive call buying—another sign of bullish sentiment. Dealer positioning implies that any upward momentum is likely to be chased and hedged into, reinforcing the trend.

However, traders should stay alert: if SPX slips back below 5825, we may see a pause or retracement back into the 5700–5825 transition zone. Only a decisive break below 5700 would flip the gamma regime back to negative and open the door to real downside volatility.

WULF TeraWulf Options Ahead of EarningsIf you haven`t bought WULF before the rally:

Now analyzing the options chain and the chart patterns of WULF TeraWulf prior to the earnings report this week,

I would consider purchasing the 2usd strike price Puts with

an expiration date of 2026-1-16,

for a premium of approximately $0.43.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

AMZN Amazon Options Ahead of EarningsIf you haven`t bought AMZN before the previous rally:

Now analyzing the options chain and the chart patterns of AMZN Amazon prior to the earnings report this week,

I would consider purchasing the 210usd strike price Calls with

an expiration date of 2025-6-20,

for a premium of approximately $3.75.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

$XYZ pullback would be a gift for longsNYSE:XYZ back in bull trend here since tapping the 50 psych level. The 100WMA showing some confluence here with bull flag + trendline break from last month's disaster.

Fibs also coincide with some of the idea here with us currently in the golden zone

Short term, I'd take a stop here below 52.50 as it can get ugly back to 50, and would consider taking another long there at 50.

For now, 53-54 range looks good for long pullback. 54.60 is the 333SMA on the 1HR chart here. Looks like a great spot for starter entries. If the pullback does not come, a break above 57 (pm highs TODAY, 4/23) should see a nice push towards 60 psych level which could see some strong resistance. Targeting 62 if we break 60.

Leaps look great here with all this confluence. Easy stop below that 50 psych.

Targets on chart are assuming we do not get a pullback tomorrow. If we do, the r/r becomes much better to the long side. This chart does not look good for bears. Options flow

Thoughts on XYZ?

MRK Merck Options Ahead of EarningsAnalyzing the options chain and the chart patterns of MRK Merck prior to the earnings report this week,

I would consider purchasing the 80usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $8.50.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

CHTR Charter Communications Options Ahead of EarningsAnalyzing the options chain and the chart patterns of CHTR Charter Communications prior to the earnings report this week,

I would consider purchasing the 360usd strike price Calls with

an expiration date of 2025-9-19,

for a premium of approximately $22.35.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Nifty50 Wkly Anlysis – Strong Reversal, But Volatility AheadThe Indian stock market closed the week on an interesting note. The Nifty 50 index ended at 22,828, just 70 points lower than last week's close, after forming a significant bullish reversal from a low of 21,743 to a high of 22,923.

As we mentioned in last week's market outlook, a base formation was underway—and this week's price action confirmed it. With the next week being truncated due to market holidays on Monday and Friday, traders should expect increased volatility and sideways movement.

Key Technical Levels:

Support: 22,200 – This is 50% of this week's candle; a break may bring bearish momentum.

Resistance: 23,400 – A close above this could ignite a rally toward 23,900, 24,100, and possibly 24,414.

On the global front, the S&P 500 respected the 4,800 support level, rebounding sharply to close at 5,363. However, underlying market weakness remains, so it's a sell-on-rise situation in U.S. equities.

Pro Tip:

Indian investors should keep an eye out for quality, fundamentally strong stocks. Any correction in the market may offer excellent long-term buying opportunities.

HUMA Humacyte Options Ahead of EarningsIf you haven`t bought HUMA before the previous rally:

Now analyzing the options chain and the chart patterns of HUMA Humacyte prior to the earnings report this week,

I would consider purchasing the 2.5usd strike price Puts with

an expiration date of 2025-4-17,

for a premium of approximately $0.62.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

NIO Options Ahead of EarningsIf you haven`t bought NIO before the previous earnings:

Now analyzing the options chain and the chart patterns of NIO prior to the earnings report this week,

I would consider purchasing the 6usd strike price Calls with

an expiration date of 2025-6-20,

for a premium of approximately $0.47.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

LFWD Lifeward Options Ahead of EarningsAnalyzing the options chain and the chart patterns of LFWD Lifeward prior to the earnings report this week,

I would consider purchasing the 2.50usd strike price Calls with

an expiration date of 2025-7-18,

for a premium of approximately $0.50.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

[03/03] SPY GEX Analysis (Until Friday Expiration)Overall Sentiment:

Currently, there’s a positive GEX sentiment, suggesting an optimistic start to the week following Friday’s bounce. However, the key Call resistance appears at 600, and it may not break on the first attempt. If optimism remains strong, there’s a chance SPY 0.09%↑ could still push above that zone after some initial back-and-forth.

🟢Upside Levels:

600–605 Zone: This is a major resistance area. Should SPY move decisively through 600/605, the next potential target could be 610.

610: This is currently the largest positive GEX zone for the week. Current option pricing suggests only about a 9% chance of closing at or above 610 by Friday, so it might require a particularly strong move to break through.

🔵 Transition Zone: Roughly 592–599. The gamma flip level is near 592, and staying above that keeps the market in a positive gamma range for now.

🔴 Downside Risk:

If 592 Fails (or HVL climbing up during the week, and after that HVL fails…): A drop could accelerate toward 585, which may act as the first take-profit zone for bears. Below that, 580 could be in play if selling intensifies.

Lower Support: 575 is the last strong support mentioned, but current option probabilities suggest about an 88% chance of finishing above that level, making a move below 575 less likely—though still possible given the higher put skew.

🟣Volatility & Skew:

IVR (Implied Volatility Rank) is quite high on SPY, with a notable put pricing skew (around 173.1%).

This heightened put skew indicates the market is pricing in faster, more volatile downward moves compared to upside.

GEO The GEO Group Options Ahead of Earnings If you haven`t bought the dip on GEO:

Now analyzing the options chain and the chart patterns of GEO The GEO Group prior to the earnings report this week,

I would consider purchasing the 26usd strike price Calls with

an expiration date of 2025-4-17,

for a premium of approximately $3.10.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.