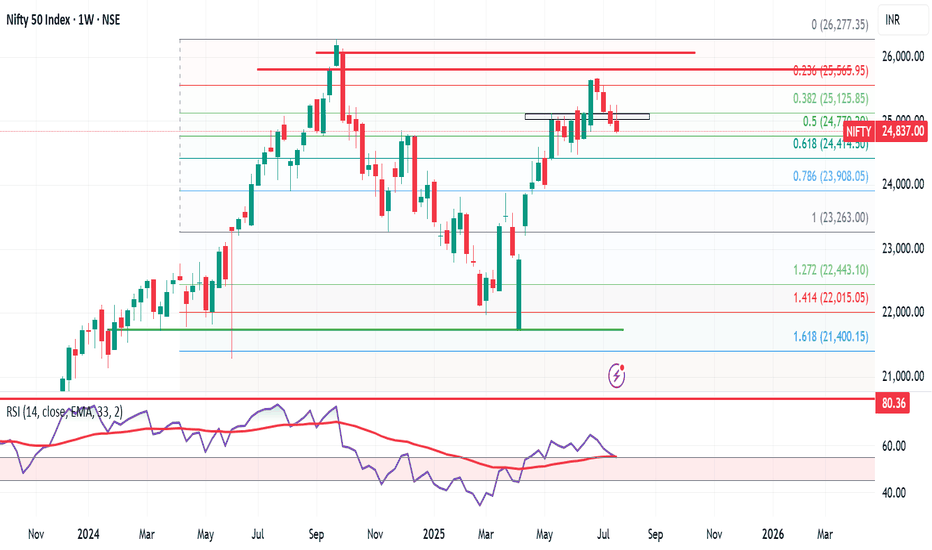

Nifty Weekly Market Update – Brace for Bearish Momentum? Nifty ended the week at 24,837, down 131 points from last week’s close. It made a high of 25,246 and a low of 24,806, staying perfectly within my projected range of 25,400–24,500.

As highlighted earlier, Nifty has now formed an inverted hammer on the weekly chart — a classic bearish reversal candlestick. 🔍

📅 Flashback: On 6th July, I mentioned giving bulls 10–15 days of playtime. That phase seems to be ending. The monthly time frame remains bearish, and now the weekly chart is aligning, indicating a stronger downside risk.

🔮 What’s Next?

👉 Expect Nifty to trade between 25,300–24,400 in the coming week.

👉 A break below 24,400 could open doors to 23,900.

👉 If 24,400 holds, bulls may still have a chance to regroup.

🧠 Pro Tip: Only Nifty Pharma is showing resilience. Those looking for long trades should focus on strong pharma stocks — the rest of the sectors are showing bearish signs.

Meanwhile in the US:

S&P 500 hits another all-time high, closing at 6,388, up 90 points from last week. My long-standing target of 6,568 now looks well within reach.

But here’s the catch — despite US strength, it’s not supporting Indian markets. If US markets correct, expect intensified selling pressure in India.

🎯 Strategy for Indian investors:

Let the bears rule till 7–8 August. Stay alert, and be ready to grab high-quality stocks at bargain prices. This is not the time to panic, but to prepare smartly.

Optionselling

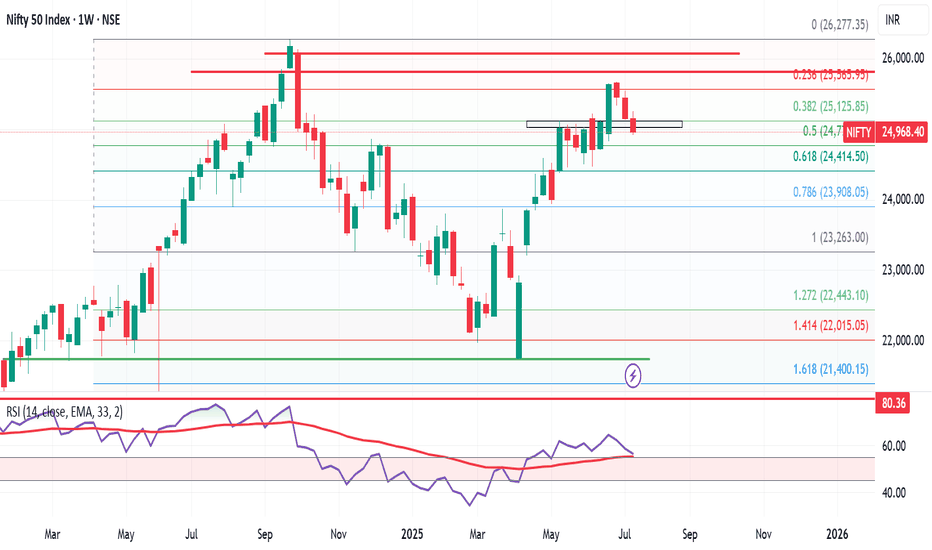

Wkly Market Wrap: Nifty Under Pressure, S&P 500 Hits Record HighThe Nifty 50 closed the week at 24,968, down 180 points from the previous week's close. It traded within a tight range, posting a high of 25,255 and a low of 24,918—perfectly aligning with the range I’ve been tracking between 25,600 and 24,700.

As I’ve been highlighting over the past few weeks, the monthly chart continues to show weakness, and now even the weekly chart is starting to reflect bearish signals. This growing weakness is a notable concern.

What to Watch for Next Week:

If Nifty sustains above 25,100, we could see a potential rebound toward the 25,400–25,450 resistance zone.

However, a breakdown below this week's low of 24,918 opens the door to a retest of key support near 24,500.

What’s interesting is that, despite Nifty’s indecision, the number of bullish stocks on the monthly time frame has increased significantly. Last week, there were 18 such stocks on my radar; now that number has jumped to 26, even after excluding about 10 others that showed bullish patterns but had high volatility.

This divergence—index showing weakness while quality stocks turn bullish—could indicate a possible bear trap being set by institutional players. If true, we might see a sharp short-covering rally after a final shakeout.

Nifty Outlook:

For the upcoming week, I expect Nifty to remain range-bound between 25,400 and 24,500. A decisive breakout or breakdown from this range could lead to sharp directional movement, so traders should stay alert.

Global Markets: S&P 500 Soars to New Highs

The S&P 500 closed at a record high of 6,296, with a weekly high of 6,315 and low of 6,201. The index remains in strong uptrend mode.

A breakout above 6,315 could see it testing 6,376, 6,454, and potentially 6,500 in the coming sessions.

My next major Fibonacci target is 6,568.

As long as 6,149 holds on a weekly closing basis, I continue to view every dip as a buying opportunity.

Final Thoughts:

The Indian markets are sending mixed signals, with the broader index showing caution while individual stock strength is quietly building. This divergence warrants a tactical approach—stay nimble, respect levels, and be ready for sharp reversals or breakouts.

Next week could be crucial. Stay focused, stay disciplined.

Nifty at Make-or-Break Zone: What to Expect Next Week Markets eMarkets ended the week under pressure, with the Nifty 50 closing at 25,149, down 312 points from the previous week. The index traded within a tight band, hitting a high of 25,548 and a low of 25,129 — perfectly respecting the 25,900–25,000 range mentioned in last week’s analysis.

Now, Nifty finds itself at a crucial support level near 25,000. A rebound from this zone could trigger a short-term rally towards 25,500–25,600, which will act as immediate resistance. However, traders should proceed with caution, as the monthly chart remains neutral to bearish, indicating that this could just be a temporary bounce rather than a sustained uptrend.

Looking ahead, expect Nifty to trade within a range of 24,700 to 25,600. A breakdown below 24,700 could open the gates for deeper cuts, while a breakout above 25,600 needs to be backed by strong volume and participation to confirm a trend reversal.

Sector Watch: Reliance Shines Amidst Caution

Among the large caps, Reliance Industries stands out as the only stock showing strength on the monthly chart, while other heavyweights and key sectors continue to lack momentum. This narrow leadership is a red flag for broader market sustainability.

Global Markets: S&P 500 at a Crossroads

Globally, the S&P 500 closed at 6,259, down slightly from last week. What’s more important is the formation of a Doji candle — a classic sign of indecision. A move above 6,300 could lead to upside targets of 6,376 / 6,454 / 6,500, which would likely boost sentiment in global and Indian equities.

However, if the index slips below 6,150, it would mark a failed breakout, potentially triggering a global correction — a risk that Indian markets can't ignore.

Final Word

We’re at a critical juncture. While technicals suggest a potential bounce in Nifty from 25,000, the lack of confirmation on higher timeframes and uncertain global cues call for prudence over aggression.

👉 I’ll be staying out of the market this week. The setup doesn’t offer a favorable risk-reward, and in trading, patience is often the best position.

Let the charts speak. We’ll act accordingly.

Nifty Wkly Update: Market Cools Off,But Bulls May Regain ControlNifty closed the week at 25,461, down 176 points from last week's close. It touched a high of 25,669 and a low of 25,331—a clear sign of consolidation and short-term correction.

As I highlighted last week, it was a smart move to book partial profits or trail your stops, especially after the strong upmove. And here we are—a healthy pullback, exactly what we anticipated.

But things are about to get interesting...

Reliance, the heavyweight of Nifty, is turning bullish on the monthly chart—a strong signal for potential upside. As long as Reliance remains bullish, it's wise to focus on bullish opportunities only.

Nifty Outlook for Next Week:

Expected Range: 25,000 – 25,900

Strategy: Buy on dips while Reliance stays strong.

Sentiment: Cautiously bullish

Global Cue: S&P 500 Hits All-Time High!

The S&P 500 closed at a record 6,279, up nearly 100 points from last week. If it breaks above 6,284, we could see a rally toward:

6,376

6,454

6,500

6,568 (key level to watch)

However, a break below 6,177 could pull it back to 6,050/6,040.

My take: S&P 500 is in beast mode, and as it climbs, it’s likely to drag Nifty higher too. The broader market is turning bullish—momentum is shifting in favor of the bulls.

Final Thought:

Bulls are loading their guns, and bears might want to take a nap for the next 10–15 days. The trend is your friend—for now, let the bulls enjoy the ride!

Market Recap: Nifty Breaks Out After 5 Weeks of Consolidation!The Indian stock market saw a strong bullish move this week, with Nifty 50 closing at 25,637, marking a significant gain of 525 points from the previous week's close. The index made a high of 25,654 and a low of 24,824, finally breaking out of the key resistance zone of 25,000–25,100 after five weeks of sideways consolidation.

This breakout is a critical technical development, signaling renewed strength in the broader market. However, to sustain this momentum and target the all-time high zone of 26,134–26,277, Nifty may need to either:

Consolidate within the previous week's range of 25,650–24,800, or

Retest the breakout level near 25,200 for confirmation.

Failing to do so could make this breakout a false one.

Weekly Outlook for Nifty:

For the coming week, the expected trading range is between 25,200 and 26,150. Price action around these levels will be key to watch.

On a broader sectoral view, out of 14 NSE indices, only Nifty Financial Services is showing relative strength on the monthly chart—a potential red flag for sustained bullish sentiment. When just one sector leads while others lag, it's often a sign to remain cautious.

Strategy Suggestion:

Consider booking partial profits and trailing stop losses on the remaining positions. Until the monthly time frame turns decisively bullish, it's wise to stay alert and manage risk actively.

Global Markets: S&P 500 Breaks Out!

In the U.S., the S&P 500 surged to close at 6,173, successfully breaking above its key resistance level at 6,013. This breakout, if sustained above 6,150 next week, opens up the path toward higher targets: 6,225 / 6,376 / 6,454 / 6,500.

However, traders should remain flexible. If the breakout fails, we could see a pullback to support zones near 6,013 or even 5,899.

Pro Tip:

Be ready to switch trading positions quickly if the breakout doesn’t hold—volatility is still very much in play in both Indian and U.S. markets.

Market Recap & Outlook – Nifty and S&P 500, Bulls coming?The Indian stock market witnessed a volatile week, with the Nifty 50 closing at 24,718, down nearly 300 points from the previous week's close. The index hit a high of 25,222 and a low of 24,473, moving precisely within the range of 25,500–24,500 that I highlighted last week. I hope some of you took advantage of the cautionary signal!

Key Support Zone in Focus

The 24,400 level continues to act as a strong support—bulls have fiercely defended this zone for the past five weeks. However, if this level cracks, we could see Nifty test deeper supports at 23,900 and 23,700.

Geopolitical Overhang

The ongoing Iran-Israel tensions remain a wildcard. Unless the situation escalates significantly, I expect Nifty to trade in the 24,400–25,200 range this week.

Short-Term Strategy

I believe the current selling pressure might persist for 2–3 more sessions before the bulls regain control. Historically, Nifty tends to stay under pressure until mid-June, followed by a bullish phase leading into mid-July. If we get more dips, I’ll be looking to accumulate quality mid-cap and small-cap stocks for potential short-term gains.

S&P 500 Update

The S&P 500 closed at 5,976, down just 25 points from the previous week. The index made a high of 6,059 and a low of 5,963, forming a bearish candle on the weekly chart.

Watch These Levels

If 5,963 breaks, expect further downside towards 5,899 and 5,875. On the flip side, a sustained move above 6,030 could ignite bullish momentum, targeting resistance zones at 6,090 and 6,142.

Final Take – Bulls Gearing Up?

The broader trend still favors bulls, especially if key support levels hold. Watch for a turnaround by mid-week—"Bulls may soon reclaim the throne!"

Market Outlook – Nifty Near Critical Levels! Caution Advised

Nifty Weekly Wrap-Up:

The Nifty 50 index closed the week at 25,003, posting a solid gain of +250 points from last week's close. It touched a high of 25,029 and a low of 24,502 during the week.

But here’s the twist—while the uptrend looks strong, we’re now at a crucial inflection point on the weekly chart.

Technical Outlook – Is a Bearish “M” Pattern Forming?

On the weekly timeframe, Nifty is at a level where a bearish M-pattern could potentially develop. To complete this pattern, the index could pull back towards support levels at:

24,414

24,200

24,000

If the selling deepens, the final support zone lies between 23,900–23,700, where a bounce-back is likely.

Bullish Scenario – Can Nifty Break Out?

If Nifty holds above 25,000 for at least 2 consecutive sessions, it could trigger a short-covering rally, paving the way for a move toward key resistance zones at:

25,400

25,565

26,100

Next Week’s Expected Range: 24,500 – 25,500

This range should see most of the action next week. If you're holding long positions, now is a great time to:

✔️ Lock in profits

✔️ Trail stop-losses

✔️ Prepare cash reserves for potential dip-buying opportunities

Global Watch – S&P 500 Hits Key Resistance

The S&P 500 closed near 6,000, up 100 points for the week. But heads up—it’s now testing a strong Fibonacci resistance at 6,013.

A rejection here could lead to a correction toward 5,900–5,850, a dip of 1.5–2.5%. If this unfolds alongside a Nifty pullback, it would align perfectly with our support targets around 24,400–24,500.

Final Takeaway:

Markets are looking stretched. While momentum remains positive, profit booking at higher levels is essential. Don’t get caught unprepared in case of a reversal. Stay tactical, stay liquid.

Smart money is already locking in gains. Are you?

Weekly Market Wrap: Nifty & S&P 500 Outlook The Nifty closed the week at 24,853, down 166 points from the previous week's close. It traded within a range of 25,062 (high) and 24,462 (low) — perfectly aligning with our forecasted zone of 24,450 – 25,600. On the weekly chart, the index formed an inside candle pattern, signaling consolidation.

Positives: Despite the dip, Nifty continues to hold above the critical support level of 23,800, keeping the medium-term bullish structure intact.

Key Levels to Watch for Next Week:

High/Low to mark: 25,116 – 24,378

Breakout above 25,116 can lead to tests of 25,329 and 25,500 (resistance zones).

Breakdown below 24,378 could retest 23,800 and 23,600.

A weekly close below 23,800 could spell trouble for bulls, opening doors for deeper correction towards 22,800 and 22,100.

Trend Analysis:

Monthly Timeframe: Bearish

Daily Timeframe: Turned Bearish

Weekly Timeframe: Still Bullish

Conclusion: Stay cautious below 24,378 — volatility may rise if this level is breached.

S&P 500 Weekly Snapshot:

The S&P 500 ended the week at 5,802, down 156 points. Once again, it faced stiff resistance around the 5,980 mark — a historically significant level where the index began its downward move in March 2025.

Geopolitical Impact: Markets remain jittery amid escalating global trade tensions and Trump’s tariff war, likely keeping volatility high over the next 2–3 weeks.

Key Support Zones:

Immediate support at 5,700

Close below 5,700 may trigger declines to 5,551, 5,458 (key Fibonacci support), and 5,392

Bullish Breakout Scenario:

Sustained close above 6,000 is required to resume bullish momentum

Upside targets: 6,013, 6,082, 6,147 (All-Time High), and potentially 6,225

Final Takeaway:

Both Nifty and S&P 500 are at critical junctures. With technical patterns pointing to mixed signals and geopolitical events adding fuel to volatility, traders should stay alert and focus on key breakout and breakdown levels.

Weekly Market Wrap: Nifty Dips 340 Points Amid Global TensionsThis week, the Nifty 50 ended on a cautious note, closing at 24,008, down 340 points from the previous week's close. The index traded within a tight range, hitting a high of 24,526 and a low of 23,935—well within my anticipated levels of 24,900 to 23,800.

Silver Lining: Despite ongoing geopolitical tensions and negative news flow—including war-related developments—bulls managed to defend the critical psychological support of 24,000. That’s a sign of resilience in an otherwise shaky environment.

What’s Ahead?

For the upcoming week, expect high volatility. I see Nifty moving between 24,600 and 23,200. A weekly close below 23,800 could spell trouble for bulls, potentially opening the door for a drop toward major support zones at 23,200 and 23,000.

Technical Outlook:

Monthly & Daily Timeframes: Weak

Weekly Timeframe: Still bullish

So, while long-term charts show vulnerability, the weekly trend gives hope. I'm staying cautiously bullish—but will only turn aggressive once the monthly chart flips positive. Until then, it’s time to stay vigilant, not impulsive.

Global Cues: S&P 500 Holding Up Amid Uncertainty

The S&P 500 closed at 5,659, just 30 points down from the previous week, forming a doji candle—a clear sign of indecision. As long as the index holds above 5,532, there's no major cause for concern.

Bearish Trigger: Below 5,532, expect downside pressure toward 5,458 and 5,392, which could spill over into already fragile emerging markets like India.

Bullish Breakout: Above 5,770, bulls gain momentum, with potential upside targets of 5,821, 5,850, and 5,900. A rally here could bring relief to global equities, including Indian markets.

Weekly Market Wrap Nifty, Mid & Small Caps, and S&P 500 OutlookNifty ended the week on a strong bullish note, closing at 24,346, up by 307 points from the previous week. The index traded within a tight range, hitting a high of 24,589 and a low of 24,054, aligning perfectly with my projected range of 24,650–23,400.

📌 Key Technical Levels to Watch:

Nifty closed just below a crucial Fibonacci resistance at 24,414.

A daily close above 24,414 next week could open the door for a sharp move towards the next major resistance at 24,770.

While my system suggests a broader range of 24,900–23,800, I personally hope for a healthy consolidation to cool off some momentum—paving the way for a stronger, faster rally in the coming weeks.

Caution Zone:

A break below 23,800 might signal the return of bears, potentially dragging the index down to test critical support at 23,200/23,100.

Midcap & Smallcap Watch:

I’ve received a lot of queries about Midcap and Smallcap indices, and here’s the honest truth—they remain in a 'no-trade' zone. Despite Nifty's strength, the rally hasn’t lifted most Mid & Small Cap stocks.

👉 Investors holding quality, fundamentally strong stocks in these segments should stay calm, but avoid high PE or overvalued stocks until we get a clear monthly buy signal on the charts.

🌍 Global Markets – S&P 500 Analysis:

The S&P 500 closed the week at 5,686, just above the strong Fibonacci level of 5,637. Sustaining above this level could lead to a rally toward 5,770/5,821. However, a failure to hold this support might trigger a 2–3% pullback, which could ripple across global markets, including India.

📣 Bottom Line:

Nifty bulls need a close above 24,414 to push higher.

Mid & Small Cap space remains tricky—stay selective.

Watch global cues, especially from the US, for broader market direction.

Stay nimble, stay informed. ✅

Nifty Wkly Market Outlook: Bulls Regain Momentum Amid key brkoutThe Indian benchmark index Nifty 50 ended the week on a strong note, closing at 24,039, marking a robust gain of nearly 200 points from last week's close. During the week, Nifty made a high of 24,365 and a low of 23,847, trading perfectly within the anticipated range of 24,414 – 23,200, as projected in our previous analysis.

Importantly, the index managed to secure a weekly close above the psychological resistance level of 24,000, signaling a possible continuation of bullish momentum. As we head into the next trading week, the bulls are expected to have the upper hand, provided Nifty stays above 23,700. A daily close below 23,700, however, could shift sentiment in favor of the bears, exposing key support zones at 23,400 and 23,200.

Looking ahead, traders and investors should watch for price action within the broader range of 24,650 to 23,400. If the bulls manage to break and sustain above the critical Fibonacci resistance level of 24,414, we could see an upside move toward 24,650 and even 24,770.

On the global front, the S&P 500 index also delivered a strong performance, closing at 5,525, up a significant 250 points from the previous week. As highlighted earlier, the bullish W pattern on the charts has played out well, driving momentum higher.

If the S&P 500 sustains above the key breakout level of 5,551, it could potentially rally further to test resistance at 5,638, 5,670, and 5,715. However, a break below 5,391 may invite selling pressure, dragging the index down to test supports at 5,368, 5,327, or even 5,246, which could trigger a negative ripple effect across global markets.

Key Takeaways:

Nifty bullish above 24,000; watch 24,414 for breakout confirmation.

S&P 500 bullish continuation above 5,551; potential to test 5,715.

Bearish reversal levels to monitor: 23,700 for Nifty and 5,391 for S&P 500.

TMC the metals company Options Ahead of EarningsIf you haven`t bought the dip on TMC:

Now analyzing the options chain and the chart patterns of TMC the metals company prior to the earnings report this week,

I would consider purchasing the 2.00usd strike price Calls with

an expiration date of 2025-5-16,

for a premium of approximately $0.20.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Nifty Closes 1000 Points Higher – Will It Catch Up with BNFIn a strong move, Nifty 50 surged by 1000 points to close at 23,851, compared to last week’s close. The index made a weekly high of 23,872 and a low of 23,207. As highlighted in last week's analysis, a breakout above 23,400 could push Nifty toward 23,900 — a target it missed by just 23 points.

However, an intriguing divergence has emerged between Nifty and Bank Nifty. While Bank Nifty has scaled a new all-time high, Nifty still trades significantly below its previous all-time high of 26,277. This sets the stage for an interesting dynamic: Will Nifty rally to close the gap, or will Bank Nifty face a correction?

What to Expect Next Week?

For the upcoming week, Nifty is expected to trade in a range between 23,200 and 24,414. Despite the bullish signals on the daily and weekly timeframes, the monthly chart remains weak, indicating that volatility is likely to persist until a broader trend confirmation.

S&P 500 Outlook: Bounce or Breakdown?

The S&P 500 index saw a mild pullback, closing around 80 points lower from the previous week’s close of 5,363. Our “sell on rise” strategy mentioned last week worked well, as the index dipped post-rally.

Now, things get technically interesting. On the weekly chart, the S&P 500 is forming a potential bullish W pattern and an inside bar. A breakout above the previous week's high of 5,481 could trigger upward targets of 5,551, 5,637, and 5,679.

However, on the downside, a break below 5,115 would reintroduce bearish pressure, which could have negative ripple effects across global markets.

Key Market Takeaways:

Nifty 50: Strong rally, but still below ATH. Watch 23,200–24,414 range next week.

Bank Nifty: At ATH, diverging from Nifty – crucial to monitor.

S&P 500: At a technical crossroads – potential for breakout or breakdown

NEULANDLAB short opportunityUpon the breakdown of the trendline NEULANDLAB has immense downside of 42 odd percentage. Next quarter results will be the catalyst, making or breaking the stock. Negative surprise in last two consecutive results declare us participants to beware of the liquidity present below this key level.

Short below daily close of 11,100

Stoploss - 8%

TP - Trail the 50 DMA close above

Nifty Market Update: Bears Are in Control – A Rough Ride Ahead?The Nifty closed at 22,795 this week, down by 134 points from the previous week’s close, with a high of 23,049 and a low of 22,720. The formation of a Gravestone Doji candle indicates that the market is firmly under the control of the bears, signaling potential weakness ahead. As forecasted last week, Nifty moved within the range of 23,450 to 22,400, aligning perfectly with my predictions.

Looking ahead to next week, I expect Nifty to trade between the 23,300 to 22,250 range. While 22,300-22,400 offers a strong support zone, if the index slips below 22,250, it could test the WEMA100 at 22,050, which could offer some relief.

Digging deeper, I analyzed the Nifty50 monthly chart from 2004 onwards and noticed a recurring pattern: whenever Nifty closes below the monthly EMA21, it tends to test the EMA50, which currently stands at 19,450. If this month’s close is below 22,400, we could be heading toward 19,450, so brace yourselves for what could be a bumpy ride ahead.

On the international front, the S&P 500 is showing signs of forming a bearish M-pattern, a negative signal for the broader market. This is troubling news for Indian markets, which are already under pressure. From the current level of 6,013, a 1.5% correction could see the index testing support levels around 5,900.

The battle between bears and bulls continues, but for now, I believe the bears still have the upper hand. Stay cautious and keep a close watch on market movements – volatility is here to stay!

#nifty50 Week ahead, 3-7th Feb 2025The Nifty ended the week at 23,482, up nearly 400 points from last Friday’s close, with a high of 23,632 and a low of 22,786. With Saturday's budget announcement and tax break news, all eyes will be on Monday, which could be a game-changer. The new tax slabs will bring relief to many in the middle class, but institutional investors are carefully assessing its impact on the broader market. Monday’s closing could give us a clearer picture of how they’re positioning themselves, making it a critical day to watch.

Looking ahead, I anticipate Nifty may trade within the range of 24,000 to 22,950 next week. However, the weekly and monthly charts are still in a bearish phase, and until we see a shift toward a bullish trend on at least a weekly timeframe, the best approach remains to "sell on rallies."

Meanwhile, the S&P 500 closed at 6,040, about 60 points lower than last week. It tried to break through the strong resistance at 6,100 but couldn’t manage it. The weekly chart suggests a potential "W" pattern, but for that to play out, the index may need to drop and test support levels of 5,880-5,850. If that happens, it could trigger selling pressure on global markets, including India.

It’s going to be a crucial week ahead—prepare for a potentially volatile market environment!

#Nifty50 Market Update: A Week of Weakness and What Lies Ahead

This week, Nifty closed at 23,203, down by 228 points from the previous week's close. It touched a high of 23,391 and a low of 23,047, reflecting a volatile yet cautious market sentiment. The candlestick pattern for the week is indicative of weak market sentiment, signaling growing bearish pressure.

As highlighted last week, the market saw a bounce used by institutional players to offload their positions, leading to a sharp pullback. The Nifty was confined within the range of 23,950 to 22,900, as anticipated. Looking ahead, I expect Nifty to continue oscillating between 23,750 and 22,700 in the coming week.

From a monthly perspective, the market remains in a selling phase, and until either the monthly or weekly timeframes shift into the buying zone, or Nifty tests key support levels near 22,400/22,300, the bears will likely maintain control.

S&P500 Update: Recovery with Caution

Over in the US, the S&P 500 has bounced back from the lows of 5,773 and closed just below the critical Fibonacci resistance level of 6,013. If the index manages to stay above 6,013 next week, we could see it testing higher resistance levels around 6,100.

However, expect potential selling pressure to kick in on Monday, and if the index dips below 5,900, it could test key support levels at 5,821, 5,773, or even 5,700.

Bottom Line: Brace for Volatility Ahead

In conclusion, selling pressure is expected to persist in the markets for the time being. Traders should prepare for a bumpy ride as we navigate through these volatile conditions. Stay alert, manage risk, and keep an eye on critical support and resistance levels.

#Nifty50 What Lies Ahead for Nifty & S&p500,13-17th Jan 2025The Nifty Index experienced a sharp decline this week, closing at 23,431, a significant 570 points below the previous week's close. While the index reached a high of 24,089, it ultimately succumbed to selling pressure, finding support at 23,344. As forecasted, the Nifty traded within the predicted range of 24,500 to 23,300. For the upcoming week, I anticipate the index to remain confined within a range of 23,950 to 22,900 .

Given the prevailing bearish sentiment, a potential short-term bounce could unfold next week to lure in unsuspecting buyers before a renewed downward move. Historically, whenever the Nifty has breached the support of the 50-week Exponential Moving Average (WEMA50), it has typically undergone a 5-6% correction. Based on the current level of 23,431, the Nifty may find crucial support near the 22,200-22,400 zone.

Turning to the US markets, the S&P 500 found support at the 100-day Exponential Moving Average (DEMA100) level of 5,817 and closed at 5,827. The upcoming week will be pivotal. If the S&P 500 successfully defends the 5,807 low, a potential rally towards the 5,926-5,944 range could materialize. However, a weekly close below the 5,800 mark would signal a significant bearish turn for global markets, potentially triggering a deeper correction towards the 5,637 or even 5,504 levels.

Wishing readers a very happy Lohri and Makar Sakranti.

#nifty50 What Lies Ahead for Nifty & S&p500, 6-10th Jan 2025The Nifty Index this week staged a rally, closing at 24,004, a 200-point surge from the previous week. This bullish move, driven by a classic "W" pattern as predicted, saw highs of 24,226 and lows of 23,460. However, profit-taking by large players triggered a decline, confining the index within my anticipated range of 24,300-23,400.

For the upcoming week, I expect a trading range of 24,500-23,400 . A breach below 23,400 could find support at the 23,200-23,300 zone. A weekly close below this level would be a significant bearish signal, potentially triggering further selling pressure towards the 22,250 level. Conversely, a sustained move above 24,770 would signal a resumption of the uptrend, though this scenario currently appears challenging.

The S&P 500 also exhibited resilience this week, closing at 5,942 despite breaching the crucial support of 5,850. This formed a long-legged candle, indicating strong demand at lower levels. To reignite its upward momentum, the S&P 500 needs to close consecutively above 6,093. This bullish confirmation could propel it towards 6,142, 6,225, and even 6,376, providing a much-needed boost to global markets

Nifty Index about to witness Quarterly Bearish Engulfing4 and a half years from April 2020, it has been a euphoric ride for India's Nifty and Sensex.

If prices remain more or less unchanged by New Year's Eve, we're about to witness a once in 5 year event on the charts. A "quarterly bearish engulfing" at all time highs. In simpler terms, quarterly prices closing below the lowest price of previous quarter.

What has happened in the past when this happened?

This happened last in 2020 (the deep red pandemic candle) - where 15 quarters or nearly 4 years of gain was wiped out in a single quarter.

Before that, it happened in 2015 - where it took 3 quarters to wipe out 4 quarters or 1 year worth of gain. (Indicating more of a systemic sell-off, than a knee-jerk news based panic. Something similar is happening now, after a long long time.)

2015, then 2020, and now 2024-25. For those who understand time cycles in nature and its inevitable influence on our nature, and thus the markets, you'd appreciate this is no co-incidence.

There is no reason to panic, as this, just like any other event, presents an opportunity to grow wealth.

Before you read further, I intend to keep this idea beginner friendly on how to potentially benefit from this opportunity. It can form a base for you to navigate your personal finance journey further. Intermediate and advanced traders/investors may benefit from my other (future) posts. Kindly note that this published note is only my opinion, solely for educational purposes, and not investment advice.

Through the remainder of this piece, I will waltz you through the most probable outcomes and the possible decisions one may take, all assuming that you're relatively new to witnessing a systematic sell-offs.

Understanding the logic of a bearish engulfing pattern:

First - What a bearish engulfing candlestick pattern on a quarterly time frame means is that

for 1 whole quarter, there was a net gain (July-Sept2024 = +7.5%) and the lowest price was 23893.7; whilst immediately for next 1 whole quarter (Oct- 30Dec2024 = -8.49%) we can see a net loss. Not only do we see a net loss, but also most importantly, we see quarter price "closing" lower than the "lowest" price of previous quarter . This is powerful information as it indicates that buyers have "failed to remain in strength" even at the lowest price of the previous quarter (Understand that the lowest price of previous quarter is where the buyers were the most powerful in that quarter, that is why it was the "lowest" price of that quarter because the price went up from there). For reference, see the feature image of this post again.

What does this mean for the next few weeks/months/quarters: (The most probably outcomes)

1) Normally, a bearish engulfing pattern at the top of the charts indicates end of an existing up-trend. When this happens in a higher time frame (weekly/monthly/quarterly), it is more reliable.

2) End of an existing up-trend indicates beginning of a new opposite trend. An opposite trend can either be sideways or downside. This depends on further reaction from market forces in the coming days. We can see that after the pandemic quarterly crash, we had no opposite trend, in fact, there was an immediate rebound. This was an exception as pandemic market crash was a 1 time panic-led sell-off rather than a systemic sell off (which is more sustainable time-wise).

3) We are highly likely in a systemic sell off now, if this quarter's low is taken out in January. This is the highest likely scenario after a 4.5 years of euphoric uptrend in the market.

How to benefit in the following weeks/months:

The simplest way with minimal to moderate time investment, is to begin SIP in fundamentally strong "value" stocks, or the index itself, or both - in a "pyramid" fashion.

Once you select the stocks, pyramiding your investment amount - that is, starting small at current levels and scaling up your investment as you get better prices when Nifty (or your cherry picked stocks) fall further.

A simple way to apply it is to buy whenever price is near the Moving Averages (MA) of 55 weeks, 89 weeks and 233 weeks - as the index continues in a down trend in the following weeks/months. You can plot these on Tradingview with ease. Remember to plot on weekly time frame. Buy lower multiples at 55 MA, higher at 89 MA and even higher at 233 MA.

This is a simple, more optimised way of buying the index fund which can help you get higher ROI as compared to someone making SIP on a fixed date every month. This is because your average buy price will be lower than someone buying the same quantity at random prices every month.

Yet another way is to learn the skill of selling index call options by hedging them. Even though this is a slightly advance way of generating extra income, it is great to learn in downtrending markets - as you will be able to generate profits from a decline in the price of index (remember it is a lot more difficult to generate profits from individual stocks and investments in a broader down-trending market). A realistic expectation for beginners can be making 1-3% a month with this technique (average annualised) - thus helping offset the loss in the existing stocks/MF portfolio.

If this sounds difficult, yet another way is assessing the hygiene of your portfolio and rejig the holdings if needed. Without proper knowledge, it is best to let a qualified financial advisor/expert review your holdings/portfolio and see if they want to re-shuffle the portfolio. This could even mean reducing exposure to equity for a period of 1 year, and increase exposure to debt funds or other fixed income avenues, or simply sitting on some % cash to buy at a later, better value. Whilst this sounds too much work, remember that a mere 4-5% extra gain for the entire year, every year, compounds to a large number over the years. So entrusting a reliable financial advisor to do this could be worth your time and resources. Now is a good time to do that.

Disclaimer:

This is my personal opinion and is only for educational purposes. Please consult your financial advisor before making any decision. Stock Market investments are subject to market risk. Past performances are no guarantee of future returns.

This content above is solely for educational purposes only and to provide information and is not intended to give any advice. Information shared is personal opinions only. Wherever any stock or mutual fund name is mentioned, this is only for educational and informational purposes. Share market and investment can be risky, please take professional advice before making any decision.

#Nifty50 Outlook for upcoming week 30-3rd Jan 2025The Nifty roared this week, gaining a solid 226 points, closing at a strong 23813! It reached a peak of 23938 before dipping to 23647. As predicted, the Nifty stayed within the 24100-23000 range, forming an interesting inside candle pattern. Excitingly, a bullish "W" pattern has emerged on the weekly chart!

If the Nifty can hold above the crucial 23900 level next week, we could see it trading between 24300 and 23400 . However, while a bounce is expected, the bearish Monthly chart might tempt big players to unload their positions. Stay alert!

Across the pond, the S&P500 took a 2.5% hit, closing at 5970 after reaching a high of 6049. The 5870-5850 support zone is critical. A breach could trigger a faster selloff, potentially testing the 5637/5551 support levels. For an upward move, the S&P500 needs to conquer 6050, paving the way for resistance levels at 6094/6142/6225.

Bottom line: Use any bounce next week as an opportunity to lock in profits. Stay informed and trade wisely!"

Wishing everyone a very happy & prosperous New Year.

Risk-Managed Option Selling Strategy: Nifty50 23900 CallMarket Outlook:

I hold a highly bearish view on the Nifty50 23900 Call Option with an expiry date of 26th December 2024. This outlook is based on a detailed analysis of market trends and proprietary indicators.

Entry and Stop-Loss Levels:

Entry Level: Ready to sell the 23900 Call option at or above ₹142.40.

Stop-Loss: Maintain a strict stop-loss at ₹202.10 to manage risk effectively.

Additional Criteria:

This strategy involves a specific criterion that is integral to trade execution but will not be disclosed openly.

Risk Management:

This strategy is designed with a focus on controlling potential losses through predefined stop-loss levels.

Option selling involves substantial risk, including the possibility of unlimited losses. Therefore, ensure appropriate margin and capital allocation based on individual risk tolerance.

Disclaimer:

This strategy is shared for informational purposes only and does not constitute financial advice. Options trading involves high risk and may not be suitable for all investors. Always conduct your own research or consult a certified financial advisor before executing trades. Past performance is not indicative of future results.

#NIfty50 Outlook for upcoming week 9-13th Dec, Nifty Rallies, Bu

The Nifty 50 index concluded the week on a high note, closing at 24,677, a significant 550-point surge from the previous week. The index oscillated wildly, touching a high of 24,857 and a low of 24,008. As predicted, the index faced selling pressure around the 25,000 level, a critical resistance zone that triggered a downward trend in late October.

For the upcoming week, the Nifty is expected to trade within a range of 24,100 to 25,000. A sustained break above 25,000 could propel the index towards 25,250. However, a pullback to retest support levels is likely before the next upward move.

Meanwhile, the S&P 500 index gained 1% to close at 6,090. Key resistance levels for the S&P 500 are 6,142 and 6,225, while support levels are 6,013 and 5,963.let's see if US market this week also support world market or not.