RIVN Rivian Automotive Options Ahead of EarningsIf you haven`t bought RIVN before the previous earnings:

Now analyzing the options chain and the chart patterns of RIVN Rivian Automotive prior to the earnings report this week,

I would consider purchasing the 10usd strike price Puts with

an expiration date of 2025-10-17,

for a premium of approximately $0.39.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Optionsstrategy

MA Mastercard Incorporated Options Ahead of EarningsIf you haven`t bought MA before the rally:

Now analyzing the options chain and the chart patterns of MA Mastercard Incorporated prior to the earnings report this week,

I would consider purchasing the 545usd strike price Puts with

an expiration date of 2025-8-8,

for a premium of approximately $4.45.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

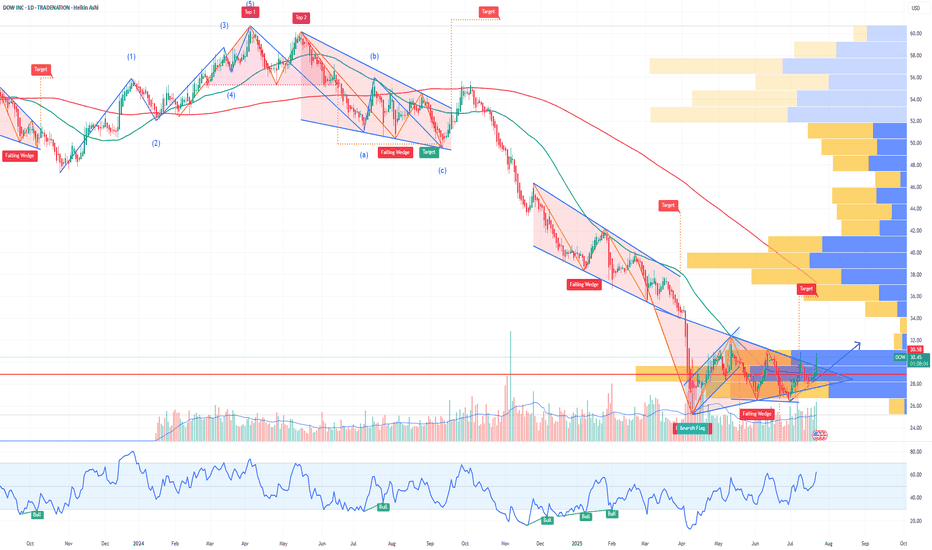

DOW Options Ahead of EarningsAnalyzing the options chain and the chart patterns of DOW prior to the earnings report this week,

I would consider purchasing the 30usd strike price Calls with

an expiration date of 2025-9-19,

for a premium of approximately $2.36.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

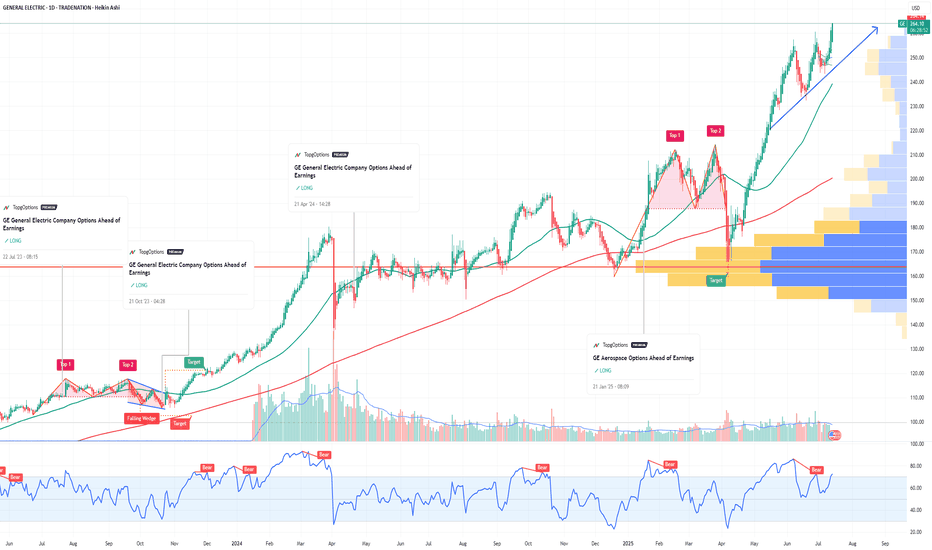

GE Aerospace Options Ahead of EarningsIf you haven`t bought GE before the rally:

Now analyzing the options chain and the chart patterns of GE Aerospace prior to the earnings report this week,

I would consider purchasing the 270usd strike price Calls with

an expiration date of 2025-8-15,

for a premium of approximately $8.60.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Why IonQ (IONQ) Could Be the NVDA of Quantum ComputingIf you haven`t bought IONQ before the rally:

Now you need to know that IonQ isn’t just another speculative quantum stock — The company is building a robust ecosystem around its best‑in‑class trapped‑ion architecture and targeting fault‑tolerant, networked quantum systems. With record bookings, major acquisitions, and a strong balance sheet, IonQ could emerge as the NVIDIA equivalent for quantum infrastructure.

Key Bullish Arguments

1) Superior Quantum Tech – Trapped‑Ion Advantage

IonQ’s trapped-ion processors boast 99.9% two-qubit fidelity, demonstrating higher accuracy and scalability than superconducting alternatives

These systems also operate at room temperature, meaning simpler deployment and lower costs

2) Ecosystem Strategy & Acquisitions

The $1.08B acquisition of Oxford Ionics (expected close in 2025) expands IonQ’s qubit control tech, pushing toward planned 80,000 logical‑qubit systems by decade’s end

Combined with ID Quantique and Lightsynq, IonQ is building a full-stack quantum and networking offering

3) Strong Revenue Growth & Cash Runway

Revenue soared from $22M in 2023 to $43.1M in 2024, with bookings of $95.6M

. Q1 2025 saw $7.6M revenue and EPS –$0.14, beating expectations; cash reserves near $697M provide years of runway

4) Real Commercial Deployments

IonQ sold its Forte Enterprise quantum system to EPB ($22M deal) for hybrid compute and networking, marking real-world commercial applications

5) AI & Quantum Synergy

Involvement in NVIDIA’s Quantum Day and hybrid quantum‑classical AI demos (e.g., blood pump simulation with Ansys, ~12 % faster) indicates strategic synergy and positions IonQ as a critical piece in the future AI stack

Recent Catalysts:

Texas Quantum Initiative passes – positions IonQ at forefront of U.S. state-backed innovation

Oxford Ionics acquisition pending – major expansion in qubit scale & tech

Barron’s analyst buys – industry analysts see long-term potential; IonQ among top quantum picks

Broader quantum optimism – McKinsey & Morgan Stanley forecasts highlight synergy between quantum and AI, benefiting IonQ

MU Micron Technology Options Ahead of EarningsIf you haven`t bought MU before the rally:

Now analyzing the options chain and the chart patterns of MU Micron Technology prior to the earnings report this week,

I would consider purchasing the 128usd strike price Calls with

an expiration date of 2025-6-27,

for a premium of approximately $5.52.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AAOI Applied Optoelectronics potential rally by EOYApplied Optoelectronics AAOI is well-positioned for a strong rally toward $24 per share by the end of 2025, supported by multiple operational and strategic catalysts. A key recent development—the warrant agreement with Amazon—adds a powerful endorsement and financial backing that enhances the bullish case.

1. Amazon’s Strategic Warrant Agreement: A Major Vote of Confidence

On March 13, 2025, AAOI issued a warrant to Amazon.com NV Investment Holdings LLC, granting Amazon the right to purchase up to approximately 7.95 million shares at an exercise price of $23.70 per share.

About 1.3 million shares vested immediately, with the remainder vesting based on Amazon’s discretionary purchases, potentially up to $4 billion in total purchases over time.

This agreement signals Amazon’s strong confidence in AAOI’s technology and its critical role as a supplier of high-speed optical transceivers for Amazon Web Services and AI data center infrastructure.

The warrant price near $24 effectively sets a floor and a valuation benchmark, supporting the thesis that AAOI’s stock could reach or exceed this level by year-end.

2. Major Data Center Wins and Hyperscale Customer Re-Engagement

AAOI recently resumed shipments to a major hyperscale customer, with volume shipments of high-speed data center transceivers expected to ramp significantly in the second half of 2025.

This re-engagement with a key customer aligns with the surging demand for AI-driven data center infrastructure, providing a strong revenue growth catalyst.

3. Robust Revenue Growth and Margin Expansion

Q1 2025 revenue doubled year-over-year to nearly $100 million, with gross margins expanding to over 30%, reflecting operational efficiencies and favorable product mix.

The company expects to sustain strong quarterly revenue ($100–$110 million) and ramp production capacity to over 100,000 units of 800G transceivers per month by year-end, with 40% manufactured in the U.S.

4. Manufacturing Expansion and Supply Chain Resilience

AAOI is scaling manufacturing in the U.S. and Taiwan, enhancing supply chain robustness and positioning itself to benefit from potential government incentives for domestic production.

Its automated, largely in-house manufacturing capabilities provide a competitive edge in meeting hyperscale and AI data center demand.

In conclusion:

Amazon’s warrant agreement at a $23.70 strike price not only provides a direct valuation anchor near $24 but also serves as a powerful strategic endorsement of AAOI’s technology and growth prospects. Combined with robust revenue growth, expanding manufacturing capacity, and key customer re-engagement, AAOI has a compelling case to reach or exceed $24 per share by the end of 2025.

Why Recursion Pharmaceuticals RXRX Could Be the NVDA of BiotechRecursion Pharmaceuticals RXRX is rapidly emerging as a transformative force in drug discovery, leveraging cutting-edge artificial intelligence and automation to industrialize and accelerate the development of new medicines. Here’s why RXRX could be the next NVIDIA (NVDA) of biotechnology and why its stock could soar by year-end:

1. AI-Powered Drug Discovery Platform with Unmatched Scale

Recursion integrates AI, machine learning, automation, and advanced data science to decode biology and chemistry, dramatically reducing the time and cost of drug discovery.

The company’s proprietary BioHive-2 supercomputer, built with NVIDIA’s DGX H100 systems, is the most powerful AI computing system wholly owned by any biopharma company, enabling Recursion to process biological data at unprecedented speeds.

By reducing the number of compounds needed for clinical candidates from thousands to just 136–200 and shrinking development timelines to under a year, RXRX is fundamentally changing the economics of pharmaceutical R&D.

2. Strategic Partnerships and Industry Validation

RXRX has forged high-profile partnerships with pharmaceutical giants such as Bayer, Roche/Genentech, Takeda, and Sanofi, validating its platform and unlocking milestone payments that could exceed $20 billion over time.

The company’s collaboration with AI biotech Exscientia in a $700 million deal further cements its leadership in the AI-driven drug discovery space, creating a pipeline of 10 clinical and preclinical programs with hundreds of millions in potential milestones.

NVIDIA itself holds over 7.7 million shares of RXRX, making it one of NVIDIA’s largest biotech investments and a strong endorsement of Recursion’s technology and long-term vision.

3. Explosive Revenue Growth and Strong Cash Position

Analysts forecast Recursion’s revenue to grow at a 65% CAGR from $58.8 million in 2024 to $263 million by 2027, far outpacing the broader biotech sector.

The company ended 2024 with over $600 million in cash, providing a solid runway for continued investment in R&D, platform expansion, and clinical trials.

Wall Street analysts expect more than 50% upside in RXRX stock over the next 12–24 months, with multiple clinical milestones and partnership announcements as near-term catalysts.

4. Disruptive Vision: The “Virtual Cell” and Beyond

RXRX is building toward a “virtual cell,” where AI models can simulate biological processes with such accuracy that wet lab experiments shift from data generation to validating computational predictions.

This approach could dramatically improve drug development success rates, addressing the industry’s notorious 95% failure rate and positioning Recursion as the go-to platform for next-generation drug discovery.

5. Market Sentiment and Institutional Support

RXRX has caught the attention of growth investors and major funds, including Cathie Wood’s ARK Invest, further boosting its profile and liquidity.

Recent stock surges and high trading volumes reflect growing investor confidence in Recursion’s disruptive potential and the broader AI-in-biotech trend.

RUM Rumble Options Ahead of EarningsIf you haven`t bought RUM before the recent rally:

Now analyzing the options chain and the chart patterns of RUM Rumble prior to the earnings report this week,

I would consider purchasing the 10usd strike price Calls with

an expiration date of 2025-11-21,

for a premium of approximately $1.20.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

SLB Schlumberger Limited Options Ahead of EarningsIf you haven`t sold SLB before the previous earnings:

Now analyzing the options chain and the chart patterns of SLB Schlumberger Limited prior to the earnings report this week,

I would consider purchasing the 27.50usd strike price Puts with

an expiration date of 2026-3-20,

for a premium of approximately $2.01.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

TMC the metals company Options Ahead of EarningsIf you haven`t bought the dip on TMC:

Now analyzing the options chain and the chart patterns of TMC the metals company prior to the earnings report this week,

I would consider purchasing the 2.00usd strike price Calls with

an expiration date of 2025-5-16,

for a premium of approximately $0.20.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

OUST Ouster Options Ahead of EarningsAnalyzing the options chain and the chart patterns of OUST Ouster prior to the earnings report this week,

I would consider purchasing the 20usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $0.75.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

HPE Hewlett Packard Enterprise Company Options Ahead of EarningsIf you haven`t bought HPE before the previous earnings:

Noe analyzing the options chain and the chart patterns of HPE Hewlett Packard Enterprise Company prior to the earnings report this week,

I would consider purchasing the 20usd strike price Calls with

an expiration date of 2025-3-21,

for a premium of approximately $0.52.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

RKLB Rocket Lab USA Options Ahead of EarningsIf you haven`t bought RKLB before the previous earnings:

Now analyzing the options chain and the chart patterns of RKLB Rocket Lab USA prior to the earnings report this week,

I would consider purchasing the 21.5usd strike price Calls with

an expiration date of 2025-3-7,

for a premium of approximately $1.62.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

GT The Goodyear Tire & Rubber Company Options Ahead of EarningsAnalyzing the options chain and the chart patterns of AGT The Goodyear Tire & Rubber Company prior to the earnings report this week,

I would consider purchasing the 8usd strike price Calls with

an expiration date of 2025-2-21,

for a premium of approximately $0.57.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

META Platforms Options Ahead of Earnings If you haven`t bought META before the rally:

Now analyzing the options chain and the chart patterns of META Platforms prior to the earnings report this week,

I would consider purchasing the 660usd strike price Calls with

an expiration date of 2025-2-21,

for a premium of approximately $32.20.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

CSX Corporation Options Ahead of EarningsIf you haven`t bought CSX before the previous rally:

Now analyzing the options chain and the chart patterns of CSX Corporation prior to the earnings report this week,

I would consider purchasing the 35usd strike price Calls with

an expiration date of 2025-6-20,

for a premium of approximately $1.10.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

GS The Goldman Sachs Group Options Ahead of EarningsIf you haven`t bought the dip on GS:

Now analyzing the options chain and the chart patterns of GS The Goldman Sachs Group prior to the earnings report this week,

I would consider purchasing the 555usd strike price Puts with

an expiration date of 2025-1-17,

for a premium of approximately $4.60.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

WBA Walgreens Boots Alliance Options Ahead of EarningsAnalyzing the options chain and the chart patterns of WBA Walgreens Boots Alliance prior to the earnings report this week,

I would consider purchasing the 9.50usd strike price Puts with

an expiration date of 2025-1-17,

for a premium of approximately $0.49.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

RH Options Ahead of EarningsIf you haven`t bought the dip on RH:

Now analyzing the options chain and the chart patterns of RH prior to the earnings report this week,

I would consider purchasing the 365usd strike price Puts with

an expiration date of 2024-12-20,

for a premium of approximately $16.30.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Bull & Bear Options for Week of 11/25 (184-210% Last Week)We are back after another banger week for SPY options. Last week's $590 Call 12/2 confirmed twice off $586 returning intraday gains of 48-67% on Tuesday & Wednesday and reaching highs on Monday 11/25 of 184-210%

Here are this week's options:

Range: $583-$598 ($590 mid-point)

$595 PUT 12/9

Entry: 15-min candle close BELOW $598.67

Targets: $595.50, White trendline

Stop: 15-min candle close ABOVE $598.67

$605 CALL 12/9

Entry: 15-min candle close ABOVE $598.67, 15-min retest and close ABOVE $598.67

Targets: $601, $605

Stop-loss: 15-min candle close UNDER $598.67

RKLB Rocket Lab USA Options Ahead of EarningsAnalyzing the options chain and the chart patterns of RKLB Rocket Lab USA prior to the earnings report this week,

I would consider purchasing the 13usd strike price Calls with

an expiration date of 2025-1-17,

for a premium of approximately $2.30.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

WMT Walmart Options Ahead of EarningsIf you haven`t bought the dip on WMT:

Now analyzing the options chain and the chart patterns of WMT Walmart prior to the earnings report this week,

I would consider purchasing the 80usd strike price Puts with

an expiration date of 2025-6-20,

for a premium of approximately $3.60.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.