DG Trading Setup: Capitalizing on RangeDollar General has experienced a stabilization phase following its Q1 2025 results, with same-store sales increasing 2.4% and revenue growing 5.3% to $10.4 billion. The company has regained traction in the discount retail space, mitigating previous challenges related to shrink and operational inefficiencies.

Institutional Flow & Market Positioning

Recent institutional flow highlights large orders in DG’s 115 call and 110 put, signaling either:

- A range-bound setup, where smart money expects the stock to stay between $110-$115 in the near term.

- Potential volatility, with institutions hedging both directions ahead of an unexpected move.

Considering the ATR (18) and standard deviation (7.353), this aligns with a low-breakout probability, making range-based strategies the optimal play. The absence of earnings between now and July further supports sideways movement expectations.

Options Trade Setup: Iron Condor

To capitalize on premium decay and IV contraction, I’m structuring an iron condor:

- Sell 115 Call / Buy 120 Call

- Sell 110 Put / Buy 105 Put

This strategy ensures limited risk while collecting premium in a high-probability range trade.

Optionstrategies

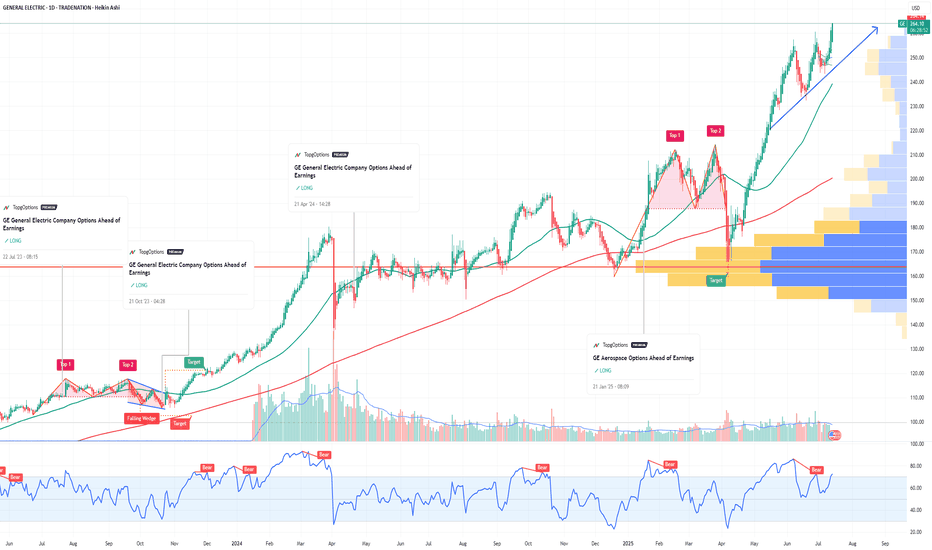

GE Aerospace Options Ahead of EarningsIf you haven`t bought GE before the rally:

Now analyzing the options chain and the chart patterns of GE Aerospace prior to the earnings report this week,

I would consider purchasing the 270usd strike price Calls with

an expiration date of 2025-8-15,

for a premium of approximately $8.60.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Why IonQ (IONQ) Could Be the NVDA of Quantum ComputingIf you haven`t bought IONQ before the rally:

Now you need to know that IonQ isn’t just another speculative quantum stock — The company is building a robust ecosystem around its best‑in‑class trapped‑ion architecture and targeting fault‑tolerant, networked quantum systems. With record bookings, major acquisitions, and a strong balance sheet, IonQ could emerge as the NVIDIA equivalent for quantum infrastructure.

Key Bullish Arguments

1) Superior Quantum Tech – Trapped‑Ion Advantage

IonQ’s trapped-ion processors boast 99.9% two-qubit fidelity, demonstrating higher accuracy and scalability than superconducting alternatives

These systems also operate at room temperature, meaning simpler deployment and lower costs

2) Ecosystem Strategy & Acquisitions

The $1.08B acquisition of Oxford Ionics (expected close in 2025) expands IonQ’s qubit control tech, pushing toward planned 80,000 logical‑qubit systems by decade’s end

Combined with ID Quantique and Lightsynq, IonQ is building a full-stack quantum and networking offering

3) Strong Revenue Growth & Cash Runway

Revenue soared from $22M in 2023 to $43.1M in 2024, with bookings of $95.6M

. Q1 2025 saw $7.6M revenue and EPS –$0.14, beating expectations; cash reserves near $697M provide years of runway

4) Real Commercial Deployments

IonQ sold its Forte Enterprise quantum system to EPB ($22M deal) for hybrid compute and networking, marking real-world commercial applications

5) AI & Quantum Synergy

Involvement in NVIDIA’s Quantum Day and hybrid quantum‑classical AI demos (e.g., blood pump simulation with Ansys, ~12 % faster) indicates strategic synergy and positions IonQ as a critical piece in the future AI stack

Recent Catalysts:

Texas Quantum Initiative passes – positions IonQ at forefront of U.S. state-backed innovation

Oxford Ionics acquisition pending – major expansion in qubit scale & tech

Barron’s analyst buys – industry analysts see long-term potential; IonQ among top quantum picks

Broader quantum optimism – McKinsey & Morgan Stanley forecasts highlight synergy between quantum and AI, benefiting IonQ

MU Micron Technology Options Ahead of EarningsIf you haven`t bought MU before the rally:

Now analyzing the options chain and the chart patterns of MU Micron Technology prior to the earnings report this week,

I would consider purchasing the 128usd strike price Calls with

an expiration date of 2025-6-27,

for a premium of approximately $5.52.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AAOI Applied Optoelectronics potential rally by EOYApplied Optoelectronics AAOI is well-positioned for a strong rally toward $24 per share by the end of 2025, supported by multiple operational and strategic catalysts. A key recent development—the warrant agreement with Amazon—adds a powerful endorsement and financial backing that enhances the bullish case.

1. Amazon’s Strategic Warrant Agreement: A Major Vote of Confidence

On March 13, 2025, AAOI issued a warrant to Amazon.com NV Investment Holdings LLC, granting Amazon the right to purchase up to approximately 7.95 million shares at an exercise price of $23.70 per share.

About 1.3 million shares vested immediately, with the remainder vesting based on Amazon’s discretionary purchases, potentially up to $4 billion in total purchases over time.

This agreement signals Amazon’s strong confidence in AAOI’s technology and its critical role as a supplier of high-speed optical transceivers for Amazon Web Services and AI data center infrastructure.

The warrant price near $24 effectively sets a floor and a valuation benchmark, supporting the thesis that AAOI’s stock could reach or exceed this level by year-end.

2. Major Data Center Wins and Hyperscale Customer Re-Engagement

AAOI recently resumed shipments to a major hyperscale customer, with volume shipments of high-speed data center transceivers expected to ramp significantly in the second half of 2025.

This re-engagement with a key customer aligns with the surging demand for AI-driven data center infrastructure, providing a strong revenue growth catalyst.

3. Robust Revenue Growth and Margin Expansion

Q1 2025 revenue doubled year-over-year to nearly $100 million, with gross margins expanding to over 30%, reflecting operational efficiencies and favorable product mix.

The company expects to sustain strong quarterly revenue ($100–$110 million) and ramp production capacity to over 100,000 units of 800G transceivers per month by year-end, with 40% manufactured in the U.S.

4. Manufacturing Expansion and Supply Chain Resilience

AAOI is scaling manufacturing in the U.S. and Taiwan, enhancing supply chain robustness and positioning itself to benefit from potential government incentives for domestic production.

Its automated, largely in-house manufacturing capabilities provide a competitive edge in meeting hyperscale and AI data center demand.

In conclusion:

Amazon’s warrant agreement at a $23.70 strike price not only provides a direct valuation anchor near $24 but also serves as a powerful strategic endorsement of AAOI’s technology and growth prospects. Combined with robust revenue growth, expanding manufacturing capacity, and key customer re-engagement, AAOI has a compelling case to reach or exceed $24 per share by the end of 2025.

[06/09] [GEX] Weekly SPX OutlookLast week’s outlook played out quite well — as anticipated, SPX hit the 6000 level, closing exactly there on Friday. This was the realistic target we highlighted in last week's idea.

🔭 SPX: The Bigger Outlook

It's difficult to say whether the rising SPX trend will continue. We're still in the "90-day agreement period" set by the administration, and so far, the market has shown resilience, avoiding deeper pullbacks like the one we saw in April.

With VIX hovering around 17–18, we’ve reached a zone where further SPX upside would require volatility. For the index to continue rising meaningfully, it needs to reverse the current bearish macro environment, and that can only happen with strong buying momentum — not a slow grind.

The parallel downward channel drawn a few weeks ago is still technically valid. Even a short 100-point squeeze would fit within this structure before a larger move down unfolds.

GEX levels give us useful clues heading into Friday. We're currently in a net positive GEX zone across all expirations, giving bulls a structural advantage, just like last week.

As of Monday’s premarket, SPX spot is at 6009.The Gamma Flip zone is between 5975–5990, with a High Volume Level (HVL) at 5985.

🔍 Let’s zoom in with our GEX levels — this gives us a deeper view than our GEX Profile indicator for TradingView alone.

🐂 🟢 If SPX moves higher, the following are logical profit-taking zones:

6050 (Delta ≈ 33)

6075 (Delta ≈ 25)

6100 (Delta ≈ 17)

🎯 Targeting above 6100 currently feels irrational — for instance, the next major gamma squeeze zone is at 6150, but that corresponds to a delta 6 level (≈94% chance the price closes below it), so I won’t aim that high yet.

🐻🔴 In a bearish scenario:

5975 and 5950 are the first nearby support zones (Deltas 30 and 38).

If momentum picks up, 5900 becomes reachable quickly, even if it's technically a 17-delta distance — because that’s deep in the negative GEX zone.

📅 Don’t forget: On Wednesday premarket, we’ll get Core Inflation Rate data — a key macro risk that could shake things up, regardless of TSLA drama fading.

📌 SPX Weekly Trading Plan Conclusion

Whatever your bias, keep cheap downside hedges in place. We've been rising for a long time, and even if SPX breaks out of the descending channel temporarily, resistance and the gamma landscape may pull price back swiftly.

NVDA GEX Earnings Outlook by OptionsNVDA reports earnings this Wednesday, and it’s a big deal. A major move could impact both the indexes and broader tech sector.

The OTM 16 delta curve essentially overlaps with both the GEX profile and the expected probability zone — signaling strong confluence.

📈 Rising IV with falling call skew: Volatility is rising into earnings, while the call skew is dropping — a sign of growing interest in downside hedging/speculation.

🔷 Key inflection zone (129): Above 129, the market is unlikely to surprise. Below it, however, a domino effect could trigger increased volatility and put-side flows.

Implied move into earnings is 6.62%, reflecting binary risk expectations from the options market.

Strong gamma squeeze territory exists between 140–145, with significant call wall buildup around 140.

The nearest expiry shows a positive net GEX — supporting short-term mean-reversion or hedging flow stability above 129, at least until the earnings print.

🔴 Downside risk scenario:

In the event of a downward move, the market is most heavily hedged around the 125 level, which aligns with the deepest put support.

💡 Wheeling Opportunity Idea

ONLY IF you want to own NVDA long-term around the $130 level (even if it drops short/mid-term), this might be a great time to start the wheeling strategy.

Because earnings inflate volatility, you can sell a near-term cash-secured put (CSP) for solid premium — even on a 53DTE (July) option.

Based on current GEX levels, we’re seeing:

-Support (squeeze zone) around $125

-Call resistance around $140

-A potential upside squeeze extending to $145-$150

These align roughly with ~20 delta OTM options, so the premium is attractive.

How would I personally start this:

Sell a CSP for May 30 with the intention to get assigned if NVDA drops.

If I do get assigned, I’m happy to own shares.

Then, I sell a 60DTE covered call right after to collect another round of premium.

If I’m not assigned, I sell a new 45–60DTE put the following week — still benefiting from the relatively high IV.

👉 Remember: High IV = synthetic time value. With this two-step method, you can harvest premium twice in quick succession.

I used the same technique with NASDAQ:INTC , and it’s been performing well.

💥 ONLY IF you want to own NVDA long-term around the $130 level (even if it drops short/mid-term)!

PSTG Pure Storage Options Ahead of EarningsAnalyzing the options chain and the chart patterns of PSTG Pure Storage prior to the earnings report this week,

I would consider purchasing the 60usd strike price Calls with

an expiration date of 2025-6-20,

for a premium of approximately $2.55.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

RUM Rumble Options Ahead of EarningsIf you haven`t bought RUM before the recent rally:

Now analyzing the options chain and the chart patterns of RUM Rumble prior to the earnings report this week,

I would consider purchasing the 10usd strike price Calls with

an expiration date of 2025-11-21,

for a premium of approximately $1.20.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

SLB Schlumberger Limited Options Ahead of EarningsIf you haven`t sold SLB before the previous earnings:

Now analyzing the options chain and the chart patterns of SLB Schlumberger Limited prior to the earnings report this week,

I would consider purchasing the 27.50usd strike price Puts with

an expiration date of 2026-3-20,

for a premium of approximately $2.01.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

TMC the metals company Options Ahead of EarningsIf you haven`t bought the dip on TMC:

Now analyzing the options chain and the chart patterns of TMC the metals company prior to the earnings report this week,

I would consider purchasing the 2.00usd strike price Calls with

an expiration date of 2025-5-16,

for a premium of approximately $0.20.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

03/24 SPX Weekly GEX Outlook, Options FlowYou can see that every expiry has shifted into a stronger bullish stance heading into Friday, with GEX exposure moving upward across the board—though total net GEX is still in negative territory, while net DEX (delta exposure) is positive. This combination points toward a likely near-term rebound this week, which makes sense after testing the 5600 range last week….

Here’s a more detailed breakdown of the key zones and likely moves this week:

Bullish Target:

The current uptrend could reach 5750 on its first attempt (already reached in Monday, thx bullsh :) ). If a positive gamma squeeze emerges at that level, we might see an extension to 5800 or even 5850 as a final profit-taking zone for bulls this week.

HVL (Gamma Slip Zone):

Placed at 5680, this threshold currently supports a low-volatility environment. A drop below 5680, however, could reignite fear and fuel bearish momentum.

Put Floors & Net OI:

The largest net negative open interest (OI) cluster is at 5650, with the next key level near 5600. At 5600, net DEX reads fully positive, suggesting strong buying support if the market tests that lower boundary.

Opening (IRA): PLTR May 16th 90 Covered Call... for a 76.56 debit.

Comments: After taking off my iron condor for a loss, structuring a covered call such that the max profit potential is greater than the loss experienced by the nondirectional of 13.11.

Metrics:

Buying Power Effect/Break Even: 76.56

Max Profit: 13.44

ROC at Max: 17.55%

Will generally look to roll out the short call out and/or down and out at intervals to increase profit potential and/or reduce downside break even ... .

OUST Ouster Options Ahead of EarningsAnalyzing the options chain and the chart patterns of OUST Ouster prior to the earnings report this week,

I would consider purchasing the 20usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $0.75.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Educated Gambling!! LOL. Call Options that go $POWW or OW!! Were in a Double Bottom and a Bearish Pennant on the daily so who knows, and the chart doesn't look great either. This one is at the top of my degenerate list, pure speculation. My idea is either a big bang or a misfire. I've been buying NASDAQ:POWW $2.50 calls expiring 1/17/25. Started off buying at $15 then $10 and now $5 per call. And sometimes no one is even selling these options when they list for .01 (actually cost $5 min) My thought is NASDAQ:POWW could either run in the next 3 weeks or all the way up to Inauguration Day on January 20, 2025, hope to at least fill the gap at 2.46 and then get back to June 3rd high of $2.86. Most of us can figure out why it could possibly go parabolic so close to the Election. I hope for God's sake and love of country I'm actually wrong about this and pray for peace. But at the same time, as some of the corrupt powers to be say "never let a crisis go to waste"... Safe Trading Everyone!!

HPE Hewlett Packard Enterprise Company Options Ahead of EarningsIf you haven`t bought HPE before the previous earnings:

Noe analyzing the options chain and the chart patterns of HPE Hewlett Packard Enterprise Company prior to the earnings report this week,

I would consider purchasing the 20usd strike price Calls with

an expiration date of 2025-3-21,

for a premium of approximately $0.52.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

RKLB Rocket Lab USA Options Ahead of EarningsIf you haven`t bought RKLB before the previous earnings:

Now analyzing the options chain and the chart patterns of RKLB Rocket Lab USA prior to the earnings report this week,

I would consider purchasing the 21.5usd strike price Calls with

an expiration date of 2025-3-7,

for a premium of approximately $1.62.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

GEO The GEO Group Options Ahead of Earnings If you haven`t bought the dip on GEO:

Now analyzing the options chain and the chart patterns of GEO The GEO Group prior to the earnings report this week,

I would consider purchasing the 26usd strike price Calls with

an expiration date of 2025-4-17,

for a premium of approximately $3.10.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

RIVN Rivian Automotive Options Ahead of EarningsIf you haven`t sold RIVN after the recalls:

Now analyzing the options chain and the chart patterns of RIVN Rivian Automotive prior to the earnings report this week,

I would consider purchasing the 16usd strike price Calls with

an expiration date of 2025-4-17,

for a premium of approximately $0.93.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

GT The Goodyear Tire & Rubber Company Options Ahead of EarningsAnalyzing the options chain and the chart patterns of AGT The Goodyear Tire & Rubber Company prior to the earnings report this week,

I would consider purchasing the 8usd strike price Calls with

an expiration date of 2025-2-21,

for a premium of approximately $0.57.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Update: TLT March 21st 95 Covered CallsA "refresh" of a fairly long-running cash flow setup, with the cash flow emanating from (a) short call premium and (b) dividends.

As of the 12/18/24 dividend, my break even is at 85.81 (including dividends). (See Post Below).

One of my New Year's resolutions is to be a little more patient and roll out the short call on approaching worthless, targeting the short call strike paying around 1% of the strike price in credit, but my mouse hand occasionally seems to have a mind of its own ... .

GOOGL Alphabet Options Ahead of EarningsIf you haven`t bought the dip on GOOGL:

Now analyzing the options chain and the chart patterns of GOOGL Alphabet prior to the earnings report this week,

I would consider purchasing the 200usd strike price Calls with

an expiration date of 2025-2-7,

for a premium of approximately $7.20.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

META Platforms Options Ahead of Earnings If you haven`t bought META before the rally:

Now analyzing the options chain and the chart patterns of META Platforms prior to the earnings report this week,

I would consider purchasing the 660usd strike price Calls with

an expiration date of 2025-2-21,

for a premium of approximately $32.20.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.