AMD Advanced Micro Devices Options Ahead of EarningsIf you haven`t bought AMD before the previous earnings:

Now analyzing the options chain and the chart patterns of AMD Advanced Micro Devices prior to the earnings report this week,

I would consider purchasing the 220usd strike price Calls with

an expiration date of 2026-9-18,

for a premium of approximately $22.15.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Optionstrategy

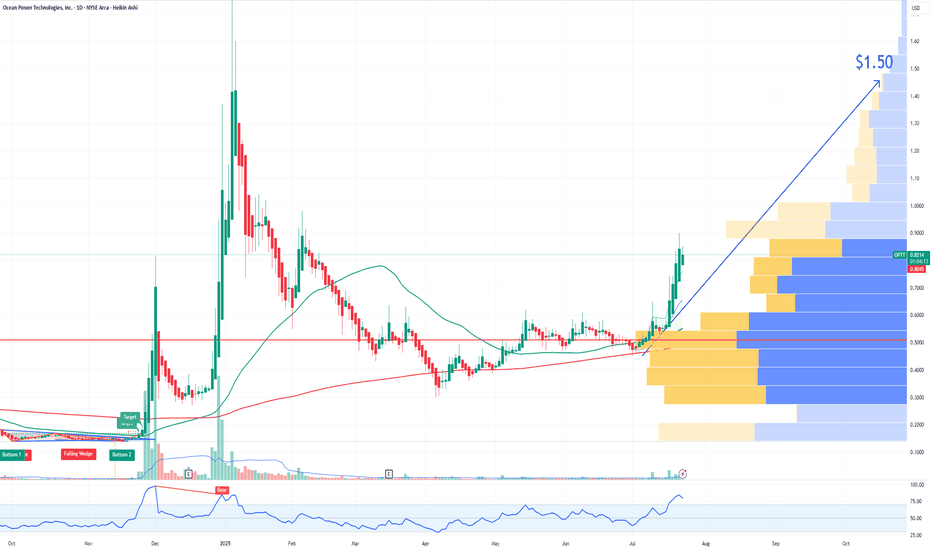

OPTT Ocean Power Technologies Options Ahead of EarningsAnalyzing the options chain and the chart patterns of OPTT Ocean Power Technologies prior to the earnings report this week,

I would consider purchasing the 1.50usd strike price Calls with

an expiration date of 2025-11-21,

for a premium of approximately $0.25.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

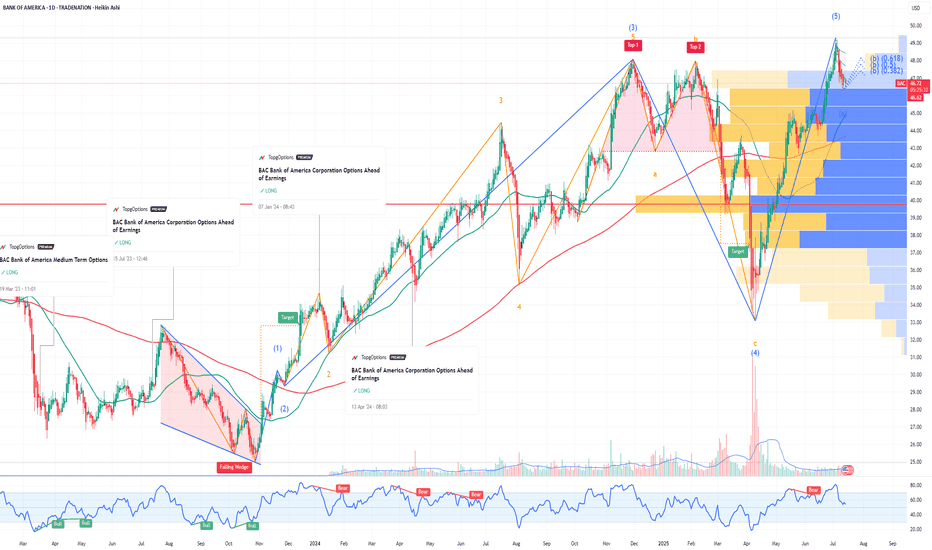

BAC Bank of America Corporation Options Ahead of EarningsIf you haven`t bought BAC before the rally:

Now analyzing the options chain and the chart patterns of BAC Bank of America Corporation prior to the earnings report this week,

I would consider purchasing the 48usd strike price Calls with

an expiration date of 2025-7-18,

for a premium of approximately $0.34.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

JEF Jefferies Financial Group Options Ahead of EarningsIf you haven`t bought JEF before the previous earnings:

Now analyzing the options chain and the chart patterns of JEF Jefferies Financial Group prior to the earnings report this week,

I would consider purchasing the 57.50usd strike price Calls with

an expiration date of 2025-7-18,

for a premium of approximately $1.40.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Why CSX Corporation CSX Could Reach $37.50 by the End of 2025If you haven`t bought CSX ahead of the previous earnings:

Now CSX Corporation CSX, a leading North American rail freight operator, is positioned for a meaningful upside in 2025, with a realistic price target of $37.50. This target is supported not only by strong fundamentals and industry tailwinds but also by recent options market activity showing significant call option interest at the $37 strike price, indicating growing investor conviction around this level.

1. Strong Options Market Signals at $37.50

Recent options data reveals a notable concentration of call open interest and volume at the $37 strike price in the CSX options chain, especially for near- and mid-term expirations.

This elevated activity suggests that institutional and retail investors are positioning for a rally toward $37–$38, reflecting confidence that the stock will surpass $35 and approach $37.50 by year-end.

The options market’s pricing and demand at this level provide a real-time, market-driven validation of the $37.50 target, adding weight to the fundamental bullish case.

2. Analyst Price Targets and Upward Revisions Support $37.50+

Several analysts have price targets ranging from $35 up to $38–$39, with recent upward revisions reflecting improving operational metrics and resilient demand.

Bank of America and Goldman Sachs, among others, have raised targets closer to or above $35, and the options market activity suggests investors expect further upside beyond these levels.

3. Operational Improvements and Network Optimization

CSX continues to address past network challenges, improving service reliability and operational efficiency, which are expected to drive volume growth in key sectors such as agriculture, minerals, and intermodal freight.

These improvements are critical for margin expansion and revenue growth, underpinning the stock’s appreciation potential.

4. Favorable Macroeconomic and Industry Tailwinds

The resilient U.S. economy and ongoing federal infrastructure investments support sustained freight demand.

Rail’s environmental advantages and cost efficiency over trucking position CSX to capture increased market share as companies seek sustainable logistics solutions.

5. Financial Strength and Shareholder Returns

CSX boasts strong free cash flow generation, enabling consistent dividend growth and share repurchases.

The company’s valuation remains attractive relative to peers, with a P/E around 15.5 and a dividend yield near 1.4%, making it appealing for both growth and income investors.

6. Technical Support and Market Sentiment

The stock has held solid support near $30–$31 and is trading near $34.60 as of mid-June 2025, showing resilience amid market volatility.

Positive sentiment from institutional investors and steady trading volumes reinforce the potential for a breakout toward $37.50.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

DOCU DocuSign Options Ahead of EarningsIf you haven`t bought DOCU before the previous earnings:

Now analyzing the options chain and the chart patterns of DOCU DocuSign prior to the earnings report this week,

I would consider purchasing the 93usd strike price Calls with

an expiration date of 2025-6-6,

for a premium of approximately $4.80.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

COST Costco Wholesale Corporation Options Ahead of EarningsIf you haven`t bought COST before the rally:

Now analyzing the options chain of COST Costco prior to the earnings report this week,

I would consider purchasing the 800usd strike price Puts with

an expiration date of 2027-1-15,

for a premium of approximately $42

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

24000PE Nifty Intraday Analysis for May 12, 202524000PE Outlook:

The 24000PE is currently in the sell zone. As I maintain a bearish view on Nifty for tomorrow, I will wait for a buy confirmation on the 24000PE before considering any entry.

Based on my analysis (excluding gap considerations), I estimate the support zone around 141 and resistance near 451. However, please note that these zones may shift if price action begins to factor in gap areas on either side.

Disclaimer: This is my personal view and not a trading recommendation. All traders are advised to conduct their own technical analysis and trade with strict stop-loss and risk management.

AFRM Affirm Holdings Options Ahead of EarningsIf you haven`t bought AFRM before the last rally:

Now analyzing the options chain and the chart patterns of AFRM Affirm Holdings prior to the earnings report this week,

I would consider purchasing the 50usd strike price Puts with

an expiration date of 2025-9-19,

for a premium of approximately $8.65.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

ABNB Airbnb Options Ahead of EarningsIf you haven`t sold ABNB before the retracement:

Now analyzing the options chain and the chart patterns of ABNB Airbnb prior to the earnings report this week,

I would consider purchasing the 105usd strike price Puts with

an expiration date of 2026-1-16,

for a premium of approximately $8.10.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

KULR Technology Group Options Ahead of EarningsAnalyzing the options chain and the chart patterns of KULR Technology Group prior to the earnings report this week,

I would consider purchasing the 1.50usd strike price Calls with

an expiration date of 2025-5-2,

for a premium of approximately $0.35.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

LAZR Luminar Technologies Options Ahead of EarningsAnalyzing the options chain and the chart patterns of LAZR Luminar Technologies prior to the earnings report this week,

I would consider purchasing the 7usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $1.40.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

SWBI Smith & Wesson Brands Options Ahead of EarningsIf you haven`t sold SWBI before the previous earnings:

Now analyzing the options chain and the chart patterns of SWBI Smith & Wesson Brands prior to the earnings report this week,

I would consider purchasing the 11usd strike price Calls with

an expiration date of 2025-3-21,

for a premium of approximately $0.52.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

PENN Entertainment Options Ahead of EarningsAnalyzing the options chain and the chart patterns of OXY PENN Entertainment prior to the earnings report this week,

I would consider purchasing the $22.5usd strike price Calls with

an expiration date of 2025-4-17,

for a premium of approximately $0.88.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

WMT Walmart Options Ahead of EarningsIf you haven`t bought WMT before the previous earnings:

Now analyzing the options chain and the chart patterns of WMT Walmart prior to the earnings report this week,

I would consider purchasing the 110usd strike price Calls with

an expiration date of 2025-4-17,

for a premium of approximately $2.33.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

DXCM DexCom Options Ahead of EarningsAnalyzing the options chain and the chart patterns of DXCM DexCom prior to the earnings report this week,

I would consider purchasing the 90usd strike price Calls with

an expiration date of 2025-2-21,

for a premium of approximately $1.65.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

WDC Western Digital Corporation Options Ahead of EarningsIf you haven`t bought WDC before the previous earnings:

Now analyzing the options chain and the chart patterns of WDC Western Digital Corporation prior to the earnings report this week,

I would consider purchasing the 65usd strike price Calls with

an expiration date of 2025-3-21,

for a premium of approximately $4.35.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

DAL Delta Air Lines Options Ahead of EarningsIf you haven`t bought the dip on DAL:

Now analyzing the options chain and the chart patterns of DAL Delta Air Lines prior to the earnings report this week,

I would consider purchasing the 60usd strike price Calls with

an expiration date of 2025-2-21,

for a premium of approximately $3.80.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

ISRG Intuitive Surgical Options Ahead of EarningsIf you haven`t bought ISRG before the rally:

Now analyzing the options chain and the chart patterns of ISRG Intuitive Surgical prior to the earnings report this week,

I would consider purchasing the 595usd strike price Calls with

an expiration date of 2025-2-21,

for a premium of approximately $19.15.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

BLK BlackRock Options Ahead of EarningsIf you haven`t bought BLK before the breakout:

Now analyzing the options chain and the chart patterns of BLK BlackRock prior to the earnings report this week,

I would consider purchasing the 850usd strike price Puts with

an expiration date of 2025-3-21,

for a premium of approximately $6.50.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

ADBE Adobe Options Ahead of EarningsIf you haven`t bought the dip on ADBE:

Now analyzing the options chain and the chart patterns of ADBE Adobe prior to the earnings report this week,

I would consider purchasing the 560usd strike price Calls with

an expiration date of 2025-1-17,

for a premium of approximately $24.35.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

VEEV Veeva Systems Options Ahead of EarningsAnalyzing the options chain and the chart patterns of VEEV Veeva Systems prior to the earnings report this week,

I would consider purchasing the 220usd strike price Puts with

an expiration date of 2025-1-17,

for a premium of approximately $7.45.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

XPEV XPeng Options Ahead of EarningsIf you haven`t bought XPEV before the breakout:

Now analyzing the options chain and the chart patterns of XPEV XPeng prior to the earnings report this week,

I would consider purchasing the 13usd strike price Calls with

an expiration date of 2024-12-20,

for a premium of approximately $1.16.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.