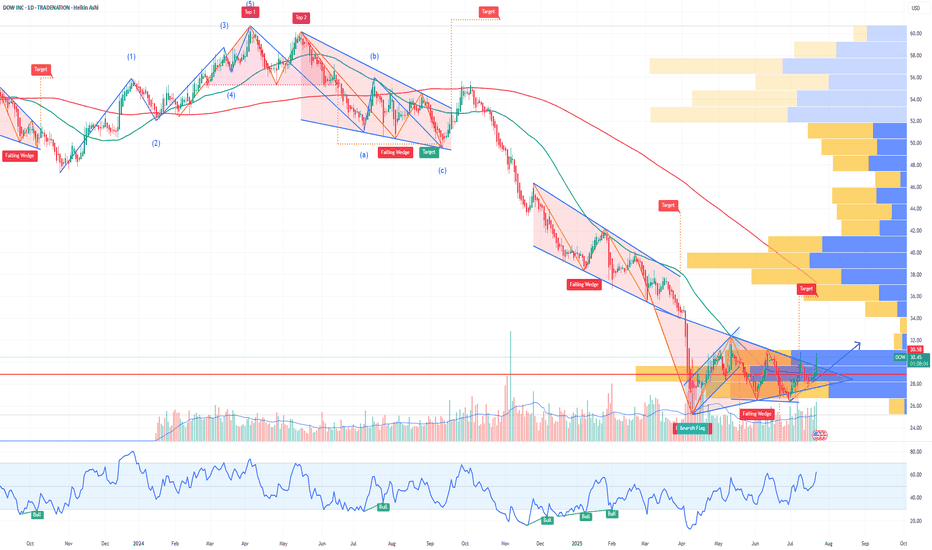

DOW Options Ahead of EarningsAnalyzing the options chain and the chart patterns of DOW prior to the earnings report this week,

I would consider purchasing the 30usd strike price Calls with

an expiration date of 2025-9-19,

for a premium of approximately $2.36.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Optiontrader

LCID: Could a Saudi Buyout Send This EV Stock Back to $10?If you haven`t sold LCID before the previous earnings:

Now you need to know that Lucid Motors (LCID) is one of the most polarizing EV stocks in the market — but it’s also one of the most interesting speculative turnarounds. Yes, the company faces production challenges, cash burn, and fierce competition from Tesla, BYD, and legacy automakers. But it has some unique wildcards that most other EV startups don’t:

1) The “Musk Factor”

Musk’s public comments about Lucid being “basically controlled by the Saudis” and that they make better-looking cars than Tesla might sound like trolling, but they highlight a real truth: Lucid isn’t just another budget EV player — it’s positioned as a luxury rival with design appeal that matters to high-end buyers.

2) Saudi PIF Is Deep In — Valuation Floor

The Saudi sovereign wealth fund has put billions into LCID already — and now owns around 60%+ of the shares. They’ve made no secret of their plans to expand the kingdom’s domestic EV production and see Lucid as a flagship partner.

Rumors have swirled for years about a possible full buyout to bring Lucid fully under the PIF umbrella — or merge it with other Middle East EV initiatives like the Ceer brand. Any credible news here could double or triple the stock overnight from these depressed levels.

3) Gravity SUV & Product Pipeline

The Lucid Air remains one of the few luxury EVs that truly competes with Tesla’s Model S in both design and range. The upcoming Gravity SUV could be the next big catalyst, especially as the luxury SUV segment has fatter margins and huge global demand.

Meanwhile, the new AMP-2 factory in Saudi Arabia will help Lucid localize production, get tax incentives, and serve the Middle East and Europe more cost-effectively.

4) Technical Setup: Double Bottom Pattern

Here’s what really makes this setup tradable: LCID is showing a clear double bottom on the daily chart around the $2–$2.20 zone. The stock tested that level twice and bounced, forming a W-shaped base that can signal a reversal.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

JEF Jefferies Financial Group Options Ahead of EarningsIf you haven`t bought JEF before the previous earnings:

Now analyzing the options chain and the chart patterns of JEF Jefferies Financial Group prior to the earnings report this week,

I would consider purchasing the 57.50usd strike price Calls with

an expiration date of 2025-7-18,

for a premium of approximately $1.40.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

24 June nifty breakout & breakdown levels 🔺 Bullish (Call Option / CE) Strategy:

✅ Buy CE (Call Option) when:

Above 24,710 → Entry for bullish trade

"Above 10m hold CE by buy level"

Above 24,870 → Stronger confirmation

"Above Opening S1 10M Hold CE By level"

Above 25,020 → Positive trade view

"Above 10M hold positive trade view"

Above 25,130 → Safer CE entry zone

"Above 10M hold CE by entry level"

Above 25,233 → Closing shot level

"Above 10M Closing Shot cover level"

🔻 Bearish (Put Option / PE) Strategy:

✅ Buy PE (Put Option) when:

Below 24,710 → Entry for bearish trade

"Below 10m hold PE By level"

Below 24,870 → Bearish confirmation

"Below Opening R1 10M Hold PE By level"

Below 25,020 → Negative trade view

"Below 10M hold nigeative trade view"

Below 25,130 → Risky PE zone

"Below 10M hold PE By Risky Zone"

Below 25,233 → Safer PE Zone

"Below 10M hold PE By Safe Zone"

19 june Nifty50 brekout and Breakdown leval

✅ Safe Buy Zone (Support Levels):

24,437.70 → Above 10M: Hold CE by Safe Zone Level

24,420.00 → Below 10M: Hold Unwinding Level

→ Breach below could trigger unwinding / profit booking.

🔴 Resistance & Bearish PE Zones:

25,070.00 – Above 10m closing: Short Cover Level

→ Strong resistance; if crossed and sustained, short covering possible.

24,970.00 – Above 10m: Hold CE by Entry Level

→ Bullish entry confirmation level.

24,838.00 – Above 10M: Hold Positive Trade View

→ Indicates shift to bullish bias if held above.

⚫ Opening Based Levels:

24,730.00

→ Above Opening S1: Hold CE by Level

Below Opening R1 (level not clearly marked with value but appears near 24,730)

→ Hold PE by Level

IOT Samsara Options Ahead of EarningsIf you haven`t sold IOT before the previous earnings:

Now analyzing the options chain and the chart patterns of IOT Samsara prior to the earnings report this week,

I would consider purchasing the 44usd strike price Puts with

an expiration date of 2025-6-6,

for a premium of approximately $1.90.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

PSTG Pure Storage Options Ahead of EarningsAnalyzing the options chain and the chart patterns of PSTG Pure Storage prior to the earnings report this week,

I would consider purchasing the 60usd strike price Calls with

an expiration date of 2025-6-20,

for a premium of approximately $2.55.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

12 may Nifty50 important levels trading zone #Nifty50 #option trading

🚀 If you like my trading plan and levels, don't forget to boost the post

99% working trading plan

👉Gap up open 24218 above & 15m hold after positive trade target 24323, 24522

👉Gap up open 24218 below 15m not break upside after nigetive trade target 23990, 23890

👉Gap down open 23990 above 15m hold after positive trade target 24218 , 23322

👉Gap down open 23990 below 15m not break upside after nigetive trade target 23890, 23790

📌 Trade plan for education purpose I'm not responsible your trade

More education follow social media and boost my idea

📌 koi bhi trade leval se 20 point ke sl ke bhina karan nahi hi

📌 koi trade app activate tabhi karana hota hi level pe 2 candle uper ya niche closing aati hai to

📌 leval par Ane pe turant trade plan na kare ...

📌 Full risk apaki hi hi meri na

AFRM Affirm Holdings Options Ahead of EarningsIf you haven`t bought AFRM before the last rally:

Now analyzing the options chain and the chart patterns of AFRM Affirm Holdings prior to the earnings report this week,

I would consider purchasing the 50usd strike price Puts with

an expiration date of 2025-9-19,

for a premium of approximately $8.65.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

MSTR Strategy Incorporated Options Ahead of EarningsAnalyzing the options chain and the chart patterns of MSTR Strategy Incorporated prior to the earnings report this week,

I would consider purchasing the 390usd strike price Calls with

an expiration date of 2025-9-19,

for a premium of approximately $81.30.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

ABNB Airbnb Options Ahead of EarningsIf you haven`t sold ABNB before the retracement:

Now analyzing the options chain and the chart patterns of ABNB Airbnb prior to the earnings report this week,

I would consider purchasing the 105usd strike price Puts with

an expiration date of 2026-1-16,

for a premium of approximately $8.10.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

24 April Nifty50 trading zone prediction #Nifty50 #option trading

99% working trading plan

👉Gap up open 24382 above & 15m hold after positive trade target 24483, 24570

👉Gap up open 24382 below 15 m not break upside after nigetive trade target 24233, 24120

👉Gap down open 24233 above 15m hold after positive trade target 24382, 24480

👉Gap down open 24233 below 15 m not break upside after nigetive trade target 24120, 24000

💫big gapdown open 24120 above hold 1st positive trade view

💫big Gapup opening 24483 below nigetive trade view

Trade plan for education purpose I'm not responsible your trade

More education follow & support me

MRK Merck Options Ahead of EarningsAnalyzing the options chain and the chart patterns of MRK Merck prior to the earnings report this week,

I would consider purchasing the 80usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $8.50.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

MBLY Mobileye Global Options Ahead of EarningsAnalyzing the options chain and the chart patterns of MBLY Mobileye Global prior to the earnings report this week,

I would consider purchasing the 14usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $2.12.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

FFAI Faraday Future Options Ahead of EarningsAnalyzing the options chain and the chart patterns of FFAI Faraday Future Intelligent Electric prior to the earnings report this week,

I would consider purchasing the 1.50usd strike price Puts with

an expiration date of 2025-4-17,

for a premium of approximately $0.20.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

KULR Technology Group Options Ahead of EarningsAnalyzing the options chain and the chart patterns of KULR Technology Group prior to the earnings report this week,

I would consider purchasing the 1.50usd strike price Calls with

an expiration date of 2025-5-2,

for a premium of approximately $0.35.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

GAP Options Ahead of EarningsAnalyzing the options chain and the chart patterns of GAP prior to the earnings report this week,

I would consider purchasing the 19.50usd strike price Puts with

an expiration date of 2025-3-7,

for a premium of approximately $1.02.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

RKT Rocket Companies Options Ahead of EarningsAnalyzing the options chain and the chart patterns of RKT Rocket Companies prior to the earnings report this week,

I would consider purchasing the 13usd strike price Calls with

an expiration date of 2025-4-17,

for a premium of approximately $1.25.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

XYZ Block Options Ahead of EarningsIf you haven`t sold XYZ before the previous earnings:

Now analyzing the options chain and the chart patterns of XYZ Block prior to the earnings report this week,

I would consider purchasing the 82usd strike price Puts with

an expiration date of 2025-2-21,

for a premium of approximately $3.50.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

UBER Technologies Options Ahead of EarningsIf you haven`t sold the top on UBER:

Now analyzing the options chain and the chart patterns of UBER Technologies prior to the earnings report this week,

I would consider purchasing the 68usd strike price Calls with

an expiration date of 2025-2-14,

for a premium of approximately $3.95.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

DAL Delta Air Lines Options Ahead of EarningsIf you haven`t bought the dip on DAL:

Now analyzing the options chain and the chart patterns of DAL Delta Air Lines prior to the earnings report this week,

I would consider purchasing the 60usd strike price Calls with

an expiration date of 2025-2-21,

for a premium of approximately $3.80.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

[01/20] GEX Outlook: Decision, Key Levels and Looming VolatilityLooking at the GEX levels through Friday, we can see that since mid-December, the market has been moving in a slightly downward channel.

Above 6000–6025: A call gamma squeeze is expected.

Between 5925 and 6000: A sideways “chop zone.”

Below 5925: The high-volatility zone begins, with 5800–5850 acting as our major support/resistance level characterized by heavy put dominance.

Below that level lies a “total denial zone.” We’ve seen this scenario before—think back to the red candle on December 18, when the price broke below that threshold. This “red zone” is currently around 5800, so below 5925 we can anticipate large-amplitude moves.

At this point, the market still does not seem worried about significant volatility. Until Friday, all NETGEX values for every expiration are positive , so market participants are pricing in more of a sideways movement. We haven’t yet seen a big pickup in volatility.

I’m not pessimistic, but keep in mind that Trump’s inauguration might usher in a high-volatility period—something the market and many retail traders haven’t experienced in a while. Better safe than sorry.

BLK BlackRock Options Ahead of EarningsIf you haven`t bought BLK before the breakout:

Now analyzing the options chain and the chart patterns of BLK BlackRock prior to the earnings report this week,

I would consider purchasing the 850usd strike price Puts with

an expiration date of 2025-3-21,

for a premium of approximately $6.50.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.