OPUSDT Update

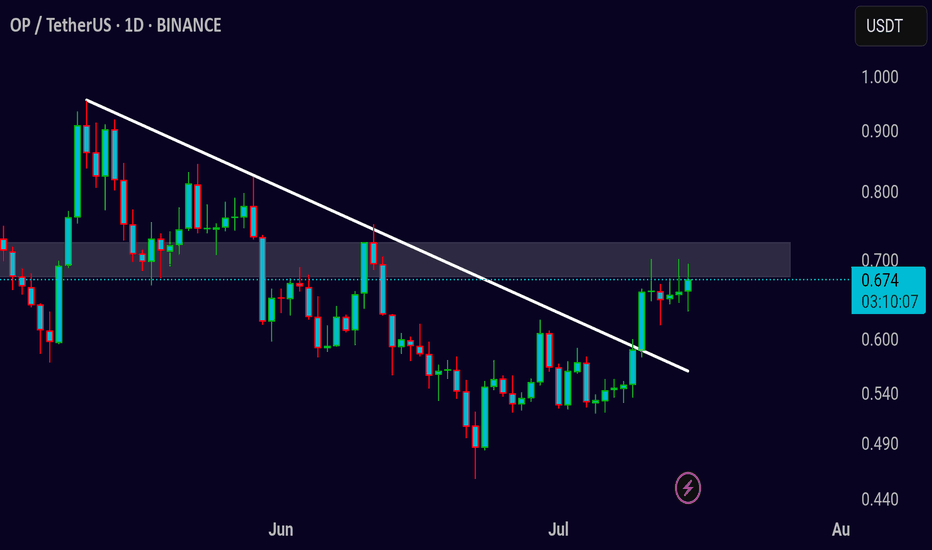

Symbol: OP/USDT

Timeframe: Daily

Chart Analysis:

The price is currently approaching a key resistance zone at around 0.673, as seen in the chart. A descending trendline from May to June has been acting as resistance. The price has recently made a strong move towards this resistance zone, showing a potential breakout pattern.

If the price successfully breaks above the 0.673 resistance, we could see a bullish continuation towards the next resistance levels, potentially up to 0.700 or higher. The breakout would suggest a reversal of the prior downtrend.

Key Levels:

* Resistance: 0.673 (current resistance zone)

* Support: 0.600 (lower support area)

Trade Strategy:

1. Long Entry: Consider entering a long position if the price breaks above the 0.673 resistance with strong volume.

2. Target: A reasonable target could be the 0.700 region. Keep an eye on price action as it approaches this level.

3. Stop Loss: Place a stop loss below the 0.600 support to manage risk in case of a failed breakout.

Risk-Reward: A potential reward-to-risk ratio of 2:1 or better, depending on entry and exit points.

Conclusion:

Monitor the price closely for a breakout above the 0.673 level. If it breaks and sustains, a bullish move could follow. Watch for volume confirmation and market momentum to gauge the strength of the breakout.

Opusdtlong

OPUSDT Forming Falling ChannelOPUSDT is currently exhibiting a promising setup that could lead to a significant bullish move. The chart shows that the price has broken out of a well-defined falling channel pattern, which often signals the end of a correction phase and the beginning of a potential uptrend. With the breakout confirmed and good volume supporting this move, there is a strong possibility of a 90% to 100% gain in the coming sessions, drawing the attention of traders looking for breakout plays.

Optimism (OP) has been a hot topic within the crypto community due to its role in scaling Ethereum through its layer 2 solution. The consistent development and growing adoption of the Optimism network have sparked investor interest, providing a fundamental backdrop that complements the bullish technical signals. Many traders see this breakout as an opportunity to get in early on a potential recovery rally.

The current price action suggests that OPUSDT may continue its upward trajectory if buying pressure remains strong and key resistance levels are cleared convincingly. Traders should watch for sustained volume spikes and possible retests of the breakout level, which can offer more confidence in the continuation of the bullish momentum. As always, risk management is essential when navigating such moves.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

OP/USDT Weekly Reversal Zone: Strong Bounce ExpectedThe OP/USDT pair is currently showing strong signs of a potential trend reversal from a major long-term demand zone.

📊 Timeframe: 1W (Weekly)

🟨 Key Support Zone: 0.396 – 0.542 USDT

The price has revisited a historically strong support area that previously served as an accumulation zone since mid-2022. The recent bounce from this level reinforces the likelihood of a bullish reversal.

📈 Upside Targets (Resistance Levels):

1. Minor Resistances:

0.699

0.844

2. Mid-Term Target:

1.190 (key breakout confirmation level)

3. Long-Term Bullish Targets:

2.168

2.400

2.700

2.991

3.725

4.020

4.538

4.865 (Previous major high)

🛡️ Critical Demand Zone:

As long as price holds above the 0.396–0.542 range, bullish structure remains intact. A breakdown below this range could invalidate the setup.

🔄 Outlook:

The chart pattern suggests the formation of a higher low and a potential breakout in stages, supported by volume and positive sentiment. Watch the 0.699 and 0.844 levels for initial confirmation of buyer strength.

📌 Note:

This setup offers an attractive risk-reward ratio for mid to long-term traders watching for a trend reversal.

#OP/USDT#OP

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading toward a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 0.544.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are heading toward stability above the 100 moving average.

Entry price: 0.564

First target: 0.581

Second target: 0.602

Third target: 0.626

#OP/USDT#OP

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.653.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.702

First target: 0.757

Second target: 0.805

Third target: 0.865

#OP/USDT#OP

The price is moving within a descending channel on the 1-hour frame and is expected to continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator, which supports the upward move by breaking it upward.

We have a support area at the lower limit of the channel at 0.817.

Entry price: 0.860

First target: 0.891

Second target: 0.916

Third target: 0.950

#OP/USDT#OP

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.834

We have a downtrend on the RSI indicator that is about to be broken and retested, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.909

First target 0.939

Second target 0.992

Third target 1.054

OP / USDT: Gearing up for a breakout above Trendline resistance OP/USDT: Gearing Up for a Breakout Above Trendline Resistance

OP/USDT is shaping up for an exciting move 📈 as it approaches a critical trendline resistance zone 📊. The price has been consolidating tightly, creating the perfect setup for a potential breakout 💥. If the breakout happens, we could see a strong bullish trend unfold 🚀. Keep a close eye 👀 on this pair and wait for confirmation before acting.

Key insights:

1. Trendline resistance: OP/USDT is approaching a long-standing trendline that has previously acted as a barrier. A break above this could mark the start of a strong upward move.

2. Volume surge: Watch for a significant increase in trading volume during the breakout to confirm buyer strength 🔥.

3. Bullish signals: Momentum indicators like RSI and MACD are trending positively ⚡, supporting the case for a bullish breakout.

Steps to confirm the breakout:

Look for a clear 4H or daily candle closing above the trendline 📍.

A noticeable spike in volume during the breakout can signal strong buying activity 📊.

A retest of the broken resistance as a new support zone adds credibility to the move ✅.

Be cautious of fake breakouts, such as sharp reversals or wicks above the trendline ⚠️.

Risk management strategies:

Use stop-loss orders to manage your risk effectively 🔒.

Ensure position sizing aligns with your overall trading strategy 🎯.

This analysis is for educational purposes only and not financial advice. Always conduct your own research (DYOR) 🔍 before making investment decisions.

Analysis of OPUSDT Perpetual Swap (4H - OKX)Analysis of OPUSDT Perpetual Swap (4H - OKX)

1. Trend Analysis

Bearish Momentum Continues:

Price remains below EMA 50, EMA 100, and EMA 200, indicating a strong downtrend.

Multiple sell signals confirm continued selling pressure.

The price is hovering near the lower part of the structure, meaning it is still searching for strong support.

Potential Oversold Conditions:

The Stochastic RSI is at an extreme level, suggesting the market could be oversold and a short-term bounce may occur.

However, until a clear reversal pattern forms, the trend remains bearish.

2. Key Resistance Levels (Supply Zones)

🔴 Major Resistance Areas:

1.5030 USDT (EMA 50 Resistance & Fib 0.500 Zone):

If price bounces, this is the first major test for buyers.

1.6139 - 1.7025 USDT (EMA 100 & Fib 0.618 Zone):

A stronger resistance zone; if price reaches this level, expect potential selling pressure.

1.8999 - 1.9419 USDT (Fib 0.786 - 0.886 & EMA 200 Zone):

A critical area; breaking this would indicate a shift toward a bullish structure.

3. Key Support Levels (Demand Zones)

🟢 Crucial Support Areas:

1.4225 - 1.4335 USDT: Local support area; if this breaks, price could drop further.

1.3581 - 1.3150 USDT (Demand Zone & Entry Point):

This is a strong historical demand zone; if price reaches here, buyers might step in.

1.2850 USDT: A deeper support level, marking the last known major buying area before a potential larger breakdown.

4. Risks & Concerns

⚠️ Bearish Signals & Potential Risks:

Trend Still Bearish: Price is trading below all major EMAs, meaning any bounce could be a short-term retracement.

Weak Buying Volume: Without strong volume, even if price bounces, it may fail to sustain upward movement.

Possible Breakdown Below Support: If price breaks below 1.3150 USDT, further declines toward 1.2850 USDT are likely.

5. Trading Strategy

✅ Long Scenario (If Price Holds Support & Shows Strength):

Entry: If price bounces from 1.3150 - 1.3581 USDT (Demand Zone).

Target 1: 1.4335 - 1.5030 USDT (EMA 50 Resistance).

Target 2: 1.6139 - 1.7025 USDT (EMA 100 Resistance).

Stop-Loss: Below 1.2850 USDT to minimize downside risk.

✅ Short Scenario (If Price Rejected at Resistance):

Entry: If price reaches 1.5030 - 1.6139 USDT and shows weakness or rejection.

Target 1: 1.4225 USDT (Local Support).

Target 2: 1.3581 - 1.3150 USDT (Demand Zone Retest).

Stop-Loss: Above 1.7500 USDT to avoid getting trapped in a breakout.

6. Summary & Outlook

📌 OPUSDT remains in a strong downtrend, with support at 1.3150 - 1.3581 USDT.

📌 Key resistance levels are 1.5030 - 1.7025 USDT. If the price fails to break, expect continued downside.

📌 A bounce could lead to a short-term recovery, but bearish sentiment dominates.

📌 Trading Strategy: Wait for a confirmed bounce from support for long entries or short at key resistance levels.

🔎 Recommendation:

Monitor price action near 1.3150 USDT for a potential bounce.

If rejection happens at 1.5030 - 1.6139 USDT, consider shorting opportunities.

💬 Would you like a deeper breakdown of any specific area? 🚀📊

My strong BUY plan for OPUSDT in SPOT assetOP is a good altcoin on the top.

My Plan for BUY BINANCE:OPUSDT

I saw Confirm Uptrend signal on H6 timeframe

I saw Break Up cloud - Buy signal (follow uptrend )

After a Correction in Uptrend, now I can make another plan for this Altcoin.

Entry Zone: 2.01 - 2.1

Stoploss: 1.73

Target : from 1R to 3R

#OP/USDT Ready to launch upwards#OP

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 2.10

We have a downtrend on the RSI indicator that is about to break, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 2.17

First target 2.28

Second target 2.40

Third target 2.60

op idea"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

OPUSDTPOP price action has played within a descending channel for 115 days now. Twice has it tried to break out of it to the upside, with failure as sellers promptly send price crashing to the floor of the channel the 1st time, and an adjacent support trendline the second time. However, there have been 2 wicked breakouts to the downside, suggesting a demand liquidity pool that has been induced but not mitigated just yet.

With BTC likely to test the 15k and 14ks to tap demand liquidity, I expect OP to drop in for a liquidity tap as well, buoyed by the support right there (so pA does't fall off), and then a subsequent retest of the strong resistance at $1.4.

My money is on bulls flipping that resistance to support this 3rd time of asking, for price to go on to test the $2.2 ATH region and likely, price discovery.

#OP/USDT#OP

The price is moving in a descending channel on the 1-hour frame upwards and is expected to continue.

We have a trend to stabilize above the 100 moving average again.

We have a downtrend on the RSI indicator that supports the rise by breaking it upwards.

We have a support area at the lower limit of the channel at a price of 1.57.

Entry price 1.64.

First target 1.67.

Second target 1.74.

Third target 1.80.

#OP/USDT#OP

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel and we are now touching this support at a price of 1.53

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 1.57

First target 1.63

Second target 1.70

Third target 1.77

#OP/USDT#OP

The price is moving in a descending channel on the 4-hour frame and it was broken upwards

We have a trend to stabilize above the moving average 100

We have an upward trend on the RSI indicator that supports the rise by breaking it upwards

We have a major support area in green at a price of 1.10

Entry price 1.30

First target 1.50

Second target 1.65

Third target 1.83