ORA.pa bullish scenario:ORA.pa bullish scenario:

We have technical figure Triangle in French company Orange S.A. (ORA.pa) at daily chart. Orange, formerly France Télécom S.A., is a French multinational telecommunications corporation. It has 266 million customers worldwide and employs 89,000 people in France, and 59,000 elsewhere. It is the tenth largest mobile network operator in the world and the fourth largest in Europe after Vodafone, Telefónica and VEON. The Triangle has broken through the resistance line at 30/10/2020, if the price holds above this level we can have possible bullish price movement with forecast for the next 24 days towards 10.09 EUR. Our stop loss order should be placed at 8.852 EUR if we decide to enter this position.

Fundamentals

- French telecoms group Orange ORAN.PA is considering a bid for Spanish competitor Euskaltel EKTL.MC, a move which would consolidate its market position as number two in Spain, according to a source with knowledge of the situation.

Orange

French companies are between islam boycott, the virus and crisisThe boycott topped the Arab and Islamic countries against French products, companies ... The share of France's exports to Islamic countries is about 37-100 of the total exports.

After the strongest Islamic economies in a province, there is fear of a drop in shares of French companies (Turkey, Saudi Arabia, Indonesia, Singapore, Egypt, Morocco, Malaysia, Iran, Qatar and Kuwait uae ... The GDP of these countries is $ 5 trillion annually, and France exports to these countries $ 57 billion annually per years . There are also branches of companies. Toyota, Carrefour stores, Orange Company and the General Company Bank

The boycott is widespread on social media, Facebook, YouTube, Instagram, and hashtag. The boycott is in first place, and many Islamic stores have replaced French products with the British, local and Russian, and they were banned from trading French products.

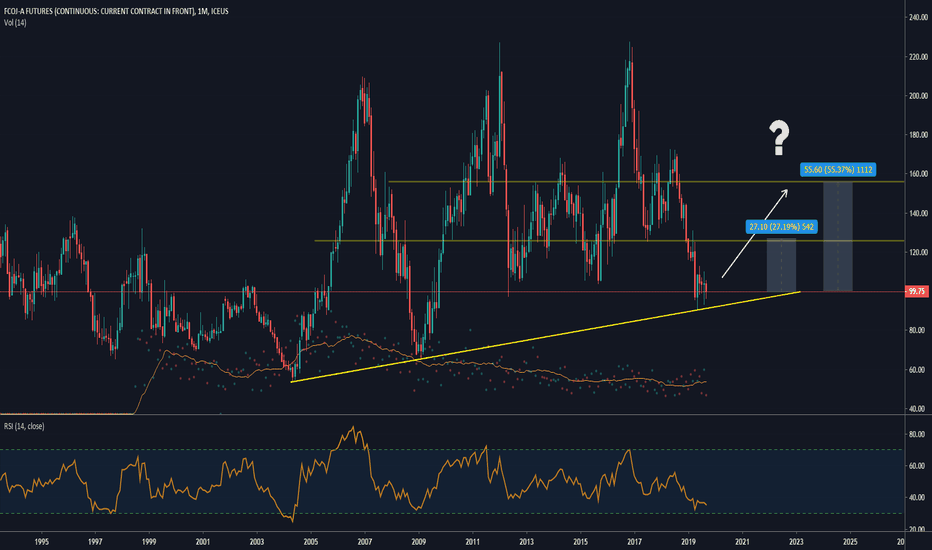

Orange Juice could get tasty over 110 Price LevelThere is a possible 3-Wave Move up coming. We have seen a 3-Wave move down I am expecting the whole Market to be corrective so I am only counting bigger 3-Waves. We can see in the COT DATA that the Commercials are strong on the Long side and we have come down to a technical Zone on the Weekly. A long position could be taken once we break the 110 Level to the Upside. Further we could see price Level Spikes because of Hurrican Season in in the South US, therefore Commercials should stay on the Long Side to hedge against harvest damage. This would be a seasonal position as markt with the Chance Risk ratio but of course this trade could also be played more short term with a tighter stop and just the end of the expected B Wave as target.

Orange Juice Idea Long JO1!Hi there ! The recent analysis is for Orange Juice JO1!, the most underestimated commodity i think because of low demand. As you see at the daily diagram a possible breakout is ahead the first possible resistance is at the price level of 106,8$ and the second target upward is 110,4$. This buy signal is possibly corfirmed also by Fisher transformation which tends to bouce to 1s above the mean of Gaussian bell. ADX also confirms that signal.

Hope you found this usefull.

This is not an investment advice. Invest with safety.

$JO1! Orange Juice Set-upwaiting patiently for breakout on RSI

long term support level

early bull div signs

Orange Juice - At critical levelI am going to wait for a signal to short this. This has been an incredibly powerful bull run. As you could see, OJ runs with force when it trends, so it's a very difficult market to capture unless you're way ahead.

Ultimately, level 3 should be established at some point and OJ will probably create a new range above 200. For now let's look at the signals and short this if we can.

Orange Juice: Intermediate Top OJ prices have gone up significantly very quickly since El Niño - probably the most among all commodities. Notice, last week price broke minor two month trend line followed by a .618 retracement into the trend line.

Below is a chart showing extreme lows in the US Dollar against orange juice prices. My yellow indicator at the bottom must correspond with price in the purple rectangle. We have that now.

Chart below shows the key levels OJ is up against (purple boxes). Additionally, a momentum shift may be coming (see blue line on the bottom). Price will likely be challenged here. If not, they will explode higher, but I think it will be short lived if they actually do. Probability is certainly on our side for price getting challenged.

Long term OJ Analysis I'm bearish for now. Don't see any reason to buy unless we go in the 70's. Will go short if there's a decisive break under 104