Why Your Orange Juice Costs More?The price of orange juice is surging, impacting consumers and the broader economy. This increase stems from a complex interplay of geopolitical tensions, macroeconomic pressures, and severe environmental challenges. Understanding these multifaceted drivers reveals a volatile global commodity market. Investors and consumers must recognize the interconnected factors that now influence everyday staples, such as orange juice.

Geopolitical shifts significantly contribute to the rising prices of orange juice. The United States recently announced a 50% tariff on all Brazilian imports, effective August 1, 2025. This politically charged move targets Brazil's stance on former President Jair Bolsonaro's prosecution and its growing alignment with BRICS nations. Brazil dominates the global orange juice supply, providing over 80% of the world's trade share and 81% of U.S. orange juice imports between October 2023 and January 2024. The new tariff directly increases import costs, squeezing margins for U.S. importers and creating potential supply shortages.

Beyond tariffs, a convergence of macroeconomic forces and adverse weather conditions amplify price pressures. Higher import costs fuel inflation, potentially compelling central banks to maintain tighter monetary policies. This broader inflationary environment impacts consumer purchasing power. Simultaneously, orange production faces severe threats. Citrus greening disease has devastated groves in both Florida and Brazil. Extreme weather events, including hurricanes and droughts, further reduce global orange yields. These environmental setbacks, coupled with geopolitical tariffs, create a robust bullish outlook for orange juice futures, suggesting continued price appreciation in the near term.

Orangejuice

OJ | Orange Juice | SHORT ICEUS:OJ1!

It's time to short orange juice. I expect it to return to its 2022–2023 price range. I have no idea why the price rose 500% in just three years, but this month it has already declined by almost 50% from the all-time high. Here are my targets:

TP1: $260

TP2: $200

TP3: $140

Timeframe: 2025

ORANGE JUICE Testing Key Support: Will Buyers Step In?FUSIONMARKETS:OJ has reached a significant demand area that has historically attracted buyers, leading to bullish momentum. This support level aligns with prior price reactions and represents a strong foundation for potential upward moves.

If the support holds and bullish confirmation appears, such as bullish engulfing candles or long lower wicks, I anticipate a move toward 502.70 level. Conversely, if the support is broken, the bullish outlook could weaken, paving the way for further declines.

This is not financial advice but rather how I approach support/resistance zones. Remember, always wait for confirmation, like a rejection candle or volume spike before jumping in.

Please boost this post, every like and comment drives me to bring you more ideas! I’d love to hear your perspective in the comments.

Best of luck , TrendDiva

The Orange Juice Crisis: A Climate-Induced Market ShiftOrange juice prices have hit record highs due to a confluence of climate-related challenges, including extreme weather events, rising temperatures, and altered rainfall patterns. These factors have decimated citrus crops, particularly in key production areas like Florida, leading to significant supply shortages and driving up prices. This crisis underscores the fragility of our food supply and highlights the urgent need for innovative solutions and international cooperation.

The orange juice industry faces a severe crisis driven by climate change, leading to soaring prices and dwindling supplies. Extreme weather events, rising temperatures, and altered rainfall patterns have devastated citrus crops, particularly in Florida, the heart of U.S. orange production. This has led to a bidding war for orange juice concentrate, exacerbated by inflationary pressures on fertilizers, pesticides, and labor costs.

Globally, major producers like Brazil, Mexico, and Spain also grapple with these climate-induced challenges, resulting in reduced yields and increased vulnerability. The economic toll extends beyond agriculture, affecting jobs and local economies.

Addressing climate change is crucial for the industry's future. Investing in research to combat diseases like citrus greening, improving water management practices, and adopting sustainable farming methods are essential steps. Diversifying crops and exploring alternative citrus products could also offer relief.

This crisis highlights the fragility of our food supply and the urgent need for global cooperation to ensure the long-term viability of the orange juice market. As climate change continues to impact agricultural production, innovative and sustainable solutions are imperative to stabilize prices and secure the future of this beloved beverage.

Orange Juice Crisis Prompts Search for Alternative FruitsThe global orange juice industry faces an unprecedented crisis due to bad weather and disease in Brazil, the world's largest orange exporter. Orange juice futures have surged to record highs, nearly doubling in price over the past year. This situation has led manufacturers to explore alternative fruits like mandarins for juice production.

Key Points:

- Record High Prices: Orange juice futures hit $4.92 a pound, reflecting concerns over supply shortages.

- Natural Disasters: A hurricane and cold snap in Florida, along with citrus greening disease, have devastated US orange groves.

- Brazil's Struggles: Brazil's orange production has fallen by 25% this year due to adverse weather and disease.

- Mandarins as Alternatives: Industry leaders are considering mandarins, which are more resilient to climate change, as a viable alternative for juice production.

- Regulatory Challenges: The International Fruit and Vegetable Juice Association is exploring legislative changes to include other citrus fruits in the definition of orange juice.

The long-term outlook remains uncertain as the industry adapts to these challenges, potentially leading to higher prices and new juice flavors for consumers.

OJ - Frozen Orange Juice Is DoneIn my YT Video Analysis I talked about, how OJ is at the Apex and has a high chance to fall down to the Center-Line.

On the daily chart (see the zoomed Screenshot), you see how price is struggling to get above the U-MLH.

Great signs of weakness.

But beware, OJ is super illiquid. This means that this market can get pushed in any direction, in any magnitude.

However, it's very cool to observe, how even such over-pumped markets react to my super tools, the Andrews Pitchfork aka. Medianlines.

Let's observe how this plays out.

We can learn a lot, and use this knowledge in the future for our own trading.

As for the Medianline-Framework, price falls down to the Center-Line when traded outside the U-MLH, and then comes back into the Fork.

Observation Mode ON!

Peace4TheWorld

Agricultural Commodities: On a Landscape of Market ManipulationThis Fib layout consists of the most important agricultural commodities. Beef, Pork, Soybean, Corn, Wheat, Rice, and Orange Juice Futures.

-Orange Juice is sold as a frozen concentrate which makes it a commodity.

Each Schematic is worked through by Large Institutions on behalf of the Fed.

Market Manipulation through inflation and destroying meat processing plants/Killing livestock shows its effects.

Orangejuice Strong Bullish long Hot Summer in EuropeAlongside apple juice, orange juice is one of the most popular juices in Central Europe. It is produced by pressing oranges and mandarins and has a sweet-sour taste. Use of the designation “juice” is defined in the Fruit Juice Regulation. According to this, drinks may only be labelled as juice if they are produced entirely from the juice or flesh of the relevant fruits.

Strategy: Strong Bullish

Use corrections to position size

RSI is giving permanent trend continuatoion signals, and the trend is becoiming more stronger

Orange Juice has broken the iportant resistance of 2.29 and reaching its first target at 4.80-5$

Agricultural Commodities: On a Landscape of Market ManipulationThis Fib layout consists of the most important agricultural commodities. Beef, Pork, Soybean, Corn, Wheat, Rice, and Orange Juice Futures.

-Orange Juice is sold as a frozen concentrate which makes it a commodity.

Each Schematic is worked through by Large Institutions on behalf of the Fed.

Market Manipulation through inflation and destroying meat processing plants/Killing livestock shows its effects.

Doubling Orangejuice? #OJ1! #Ojuice #orangejuice @stefanjbodeOrange juice is preparing for a breakout.

If this breakout is confirmed, then a doubling of the price in the next 3-4 years should not be surprising.

#FCOJ doubling orangejuice #OJ1! #Ojuice #orange

wkr from Hanover

@StefanJBode

#StefanBode

Sugar and FCOJ Take the Bullish BatonThe soft commodities sector of the commodity market can be highly volatile. Historically, sugar, coffee, cotton, cocoa, and frozen concentrated orange juice futures that trade on the Intercontinental Exchange have doubled, tripled, and halved in value over short periods. While clothing and other consumer goods depend on the cotton market, the other sector members are foods.

The soft commodity sector rose in 2021, and Q1 2022

Coffee and cotton rose to multi-year highs in 2022

FCOJ takes off on the upside in April and makes a new multi-year high

Sugar could be next for three reasons

Trading softs from the long side- Buy those dips

Brazil is the world’s leading producer and exporter of three of the soft commodities; sugar, coffee, and oranges. Sugar comes from two sources, sugar beets and sugarcane. Brazil’s tropical climate makes it the leading sugarcane producer. Arabica coffee beans are popular in the US and other areas, while Robusta beans produce espresso coffees. Brazil leads the world in Arabica production. While many people associate orange production with Florida and California, Brazil is the world’s top orange producer. Cocoa, the primary ingredient in chocolate confectionery products, comes mainly from West Africa, as the Ivory Coast and Ghana produce over 60% of the world’s annual supplies.

Soft commodities are agricultural products, so the weather in growing areas typically determines the prices each year. Since the 2020 pandemic, the price action has been anything but ordinary.

The two latest soft commodities to lead the sector on the upside have been sugar and FCOJ futures.

The soft commodity sector rose in 2021, and Q1 2022

In 2021, the composite of the five soft commodities that trade in the futures markets on the Intercontinental Exchange rose 31.57%. In Q1 2022, the softs added to gains, rising 6.58%, with all five members posting gains.

Cotton futures led the softs higher with a 20.51% gain. Cocoa futures moved 5.16% to the upside, with FCOJ posting a 3.86% gain. Sugar rallied 3.23%, and Arabica coffee futures eked out a 0.13% gain.

Meanwhile, coffee and cotton rose to new multi-year highs during the first three months of 2022.

Coffee and cotton rose to multi-year highs in 2022

In June 2020, coffee futures made a higher low under the $1 per pound level before taking off on the upside.

The weekly chart shows the bullish trend of higher lows and higher highs that took coffee futures to $2.6045 per pound in early February 2022. Coffee futures rose to the highest price since 2011.

Cotton futures also rose to the highest level since 2011, peaking at the $1.4614 per pound level in April 2022.

Coffee futures were over the $2.20 level, with cotton above $1.40 on April 14.

FCOJ takes off on the upside in April and makes a new multi-year high

Frozen concentrated orange juice futures are the least liquid of the five soft commodities, based on daily volume and open interest metrics. While the FCOJ futures arena rose to a new multi-year high in Q1 2022, the bullish price action continued in April with higher highs.

The chart shows that nearby FCOJ futures rose to $1.8660 per pound last week, the highest level since March 2017. The all-time high in the orange juice market came in 2016 at $2.35 per pound.

Brazil is the leading producer and exporter of oranges and Arabica coffee beans. The South American country also is the leader in free-market sugarcane production and exports.

Sugar could be next for three reasons

Sugar futures rose to 20.69 cents per pound in November 2021, the highest price since February 2017.

The weekly chart shows that sugar futures were above the 20 cents per pound level last week. Sugar is approaching the first technical resistance level at the November 2021 20.69 cents high. Above there, the next target is at the October 2016 23.90 high, which is a technical gateway to the 2011 36.08 cents per pound peak.

Three factors support sugar prices in April 2022:

Rising inflation is lifting all commodity prices, and the trend is always your best friend in markets across all asset classes.

Rising crude oil and natural gas prices support sugar. Crude oil is over the $100 per barrel level, and natural gas stopped just short of $7 per MMBtu last week. Multi-year highs in the energy market support sugar as it is the primary input in Brazilian ethanol production. As more sugarcane goes into ethanol production, less is available for exports.

Sugarcane production costs are increasing as they are labor-intensive. The rising Brazilian real makes sugar more expensive to produce.

The chart illustrates the technical breakout to the upside in the Brazilian currency against the US dollar. A higher real increases the cost of production, putting upside pressure on sugar’s price.

Trading softs from the long side- Buy those dips

Stocks and bonds have been shaky in 2022, and cryptocurrencies have not yet of the slump that took prices lower since the November 2021 highs. Commodities have been the place to be for investors and traders over the first four months of 2022. The latest inflation report will likely keep the bullish party in raw material markets going.

I remain bullish on soft commodities as they are highly volatile and can offer explosive returns. Sugar is my top choice as of April 15, as the sweet commodity loosed poised to eclipse the 2021 high on its way to higher ground. Meanwhile, I favor all soft commodities in the current environment. The optimal approach to the sector has been buying on price weakness, and I expect that to continue. Bull markets rarely move in straight lines, and corrections can be the best route to optimizing returns over the coming weeks and months.

--

Trading advice given in this communication, if any, is based on information taken from trades and statistical services and other sources that we believe are reliable. The author does not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects the author’s good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice the author provides will result in profitable trades. There is risk of loss in all futures and options trading. Any investment involves substantial risks, including, but not limited to, pricing volatility, inadequate liquidity, and the potential complete loss of principal. This article does not in any way constitute an offer or solicitation of an offer to buy or sell any investment, security, or commodity discussed herein, or any security in any jurisdiction in which such an offer would be unlawful under the securities laws of such jurisdiction.

OJUSD LONG - Buy Entry - D1 ChartOJUSD LONG - Buy Entry - D1 Chart

Buy @ Market

Symbol: OJUSD Orange Juice

Timeframe: D1

Type: BUY

Entry Price: Buy @ Market

Last High Resistance @ 170.38

Resistance @ 164.69

Resistance @ 154.11

Support @ 145.24

Pivot Point Yearly @ 134.5833

✅ If you liked this analysis, please consider Following and giving it a Thumbs Up 👍

✅ If you have any feedback or questions, please leave a comment below as I answer each comment 💬

✅ Wishing you enjoyable successful trading 🙏

Orange Juice heading towards a clear resistance OJ is moving in a channel up movement and unstoppable in the past few weeks.

It looks like it's moving to the resistance at the level 169, 170 level which is both historical horizontal resistance and channel upper boundary.

Channel boundaries have worked reliably in the past to dictate the movement, and I am hoping it will be the case at 170. In the long run, I still think OJ is moving to the 220 region which is the ultimate test and massive historic resistance.

MsgFW : 📧 #LDR 🧃On The Loose🔑🔐👼🏻Please ?🍊

Lana Del Rey

Florida Kilo's

White lines, pretty baby, tattoos

Don't know what they mean

They're special, just for you

White lines, baking powder on the stove

Cooking up a dream, turning diamonds into snow

I feel you, pretty baby, feel me

Turn it up hot, loving you is free

I like it down, like it down way low

But you already know that

You already know

(Fuck!)

Come on down to Florida

I got something for ya

We could see the kilos or the Keys, baby, oh yeah

Guns in the summertime

Chic-a-Cherry Cola lime

Prison isn't nothing to me if you'll be by my side

Yayo, yayo, yayo

And all the dope fiends

Yayo, yayo, yayo

(Fuck!)

Sun in my mouth and gold hoops

You like your little baby like you like your drinks--cool

White lines, pretty daddy, go skiing

You snort it like a champ, like the winter we're not in

(Fuck!)

Come on down to Florida

I got something for ya

We could see the kilos or the Keys, baby, oh yeah

Guns in the summertime

Chic-a-Cherry Cola lime

Prison isn't nothing to me if you'll be by my side

Yayo, yayo, yayo

And all the dope fiends

Yayo, yayo, yayo

We could get high in Miami

Ooh, ooh

Dance the night away

People never die in Miami

Ooh, ooh

That's what they all say (Yay)

(You believe me, don't you baby?)

Come on down to Florida

I got something for ya

We could see the kilos or the Keys, baby, oh yeah

Guns in the summertime

Chic-a-Cherry Cola lime

Prison don't mean nothing to me if you'll be by my

Yayo, yayo, yayo

All the Floridians like

Yayo, yayo, yayo

All the Colombians like

Yayo, yayo, yayo

And all my girlfriends

Yayo, yayo, yayo

That's how we do it, like

Mm-mm, pretty baby

White lines, pretty baby

Gold teeth, pretty baby

Yeah, yeah, yeah

Dance the night away

🍊

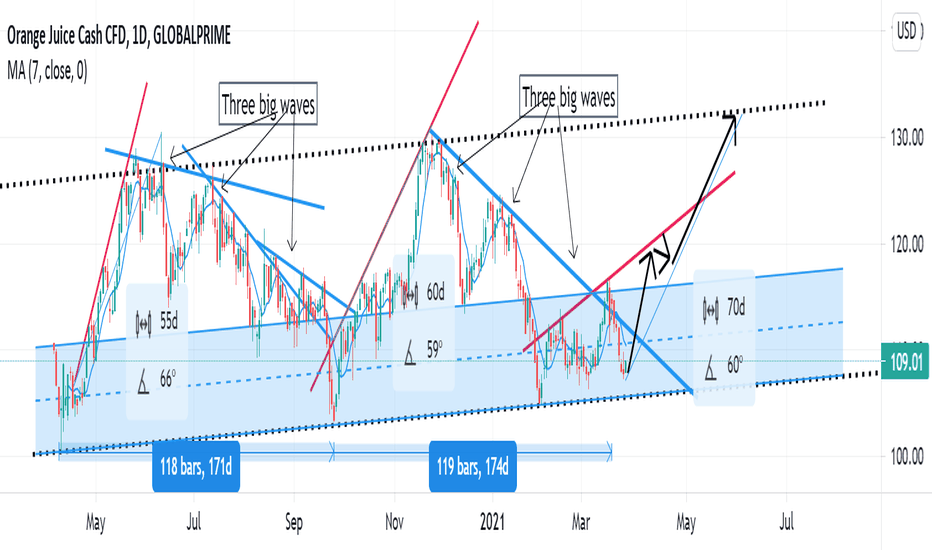

Best time to buy Orange Juice?Orange Juice demand/supply cycle frequency appears to be 170 days. Close to 25 weeks or 6 months.

When the price falls down, they come in three big waves. But the price increase happens fast. It takes about 2 months to increase the price to the maximum level.

Price falling happens slowly, takes about 4 months.

The last bull run in March couldn't break the resistance and fell back to the weekly support level. I can't see a reason for the price breaking weekly support.

A sharp price drop to key levels always shows a strong pullback. If the next bull run can break the resistance, the price could settle around $119 (or shoot past it to the previous high $130)

Can't think of a better time to buy Orange Juice. But wait until weekly support is confirmed by at least two consecutive days.

This is an idea only, not a financial advice.