XLK Relative Strength – Leaders Extended, Rotation Risk BuildingXLK has been one of, if not the strongest sectors on a relative basis since bottoming at the end of March. Despite its relative strength, top SXLK holdings are into areas where profit-taking looks to be occurring, and a rotation out may be taking place (see Weekly Supply zone on RS chart 0.4157-0.4199).

This comes as NASDAQ:NVDA , NASDAQ:MSFT , NASDAQ:AVGO , and NASDAQ:INTU are into -0.236 fib. extensions. NYSE:ORCL and NASDAQ:PLTR show a similar picture, with NYSE:ORCL reaching the 1.618 extension, while NASDAQ:PLTR failed to reach its 1.618 extension at $162.05.

Weak:

$APPL, NYSE:CRM , NYSE:IBM , and NYSE:NOW are among the weakest performers. If $APPL doesn’t hold around $200.00, look for it to slump to the $170.00 area.

Trades:

Look for NASDAQ:AMAT to hold around $169.46 for a move to $205.06 (Weekly Supply) or $243.40 (Monthly supply). If NASDAQ:AMAT fails to hold the $169.46 print, expect a move to $156.75.

Look for NASDAQ:QCOM to hold $145.20 (Weekly) for a move to the $172.23 area (Weekly Supply).

Look for NASDAQ:ADBE to hold $329.30 for a move to $449.40 (could top out around $417.30 depending on buying volume).

Look for NYSE:ACN to hold $250.00 (Weekly), or I like it better a $218.32 (Monthly Demand).

Featured Chart:

Look for NYSE:APH to hold $100.71 (Daily close on 07/23) for a move up to $116.00-$116.50 area. If NYSE:APH fails to hold around the $100.00 mark, I’d expect a move below $95.00.

AMEX:XLK move down to $240.38?

Let me know your thoughts for or against any of these names in the comments.

XETR:AMEX :

ORCL

ORACLE Can you foresee it at $2000??Oracle (ORCL) is having perhaps the most dominant recovery from Trump's Tariff lows out of the high cap stocks, trading comfortable on new All Time Highs.

This is no surprise to us, as like we've mentioned countless times on our channel, we are currently at the start of the A.I. Bubble and heavy tech giants are expected to see massive gains until 2032, where we've calculated the end of this Bull Cycle and the start of a strong Bear.

As mentioned, this situation is extremely similar to the Dotcom Bubble of the 1990s. Of course Oracle is nearly impossible to repeat the +38637% gains of that Golden Decade after the 1990 Oil Crisis but in Fibonacci price and time terms, it can technically complete a +3411% rise and hit $2000 in the next 7 years.

If you have a long-term investor mindset like us, this is a must stock to buy and hold.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

ORCL A POTENTIAL PIGGYStock Overview: Looks like Oracle Corporation is on the chart! We’re seeing a wild ride with some key patterns popping up.

Recent Trend: The stock’s been climbing steadily, but that shaded triangle (a descending wedge?) suggests a potential reversal or breakout. Keep an eye on it!

Resistance Level: That red line around 130-140 looks like a tough ceiling. Price has bounced off it a few times—might struggle to break through without strong momentum.

Support Zone: The green line sloping down shows a support trend. If it dips below, watch for a bounce around 100-110.

Indicators: Those lower charts (RSI and TRENDS) are wiggling a lot. RSI might be hinting at overbought conditions lately, so a pullback could be due.

Volume Check: Hard to tell without clear volume bars, but if volume spikes with a breakout above resistance, that’s a bullish sign!

My Take: This could go either way—breakout to new highs or a slide back to support. I’d wait for a clear move past 140 with volume to jump in, or a dip to 110 for a safer entry.

Next Steps: Let’s watch how it behaves this week (June 16, 2025). Want me to edit the chart or dig deeper? Just ask!

Careful, very few top side numbers left with lots of downside targets showing.

Price targets and trends marked on chart.

Follow for more charts like this.

Oracle (ORCL) shares surge 24% in a week, hitting all-time highOracle (ORCL) shares surge 24% in a week, hitting an all-time high

Last week, Oracle (ORCL) shares:

→ rose by approximately 24% — marking the strongest weekly gain since 2001;

→ broke through the psychological level of $200 per share;

→ reached an all-time high, with Friday’s session closing above $215. It is possible that a new record may be set this week.

What’s driving Oracle (ORCL) shares higher?

The main catalyst was the quarterly earnings report released last week:

→ Earnings per share ($1.70) exceeded analysts’ expectations ($1.64);

→ CEO Safra Catz projected revenue growth of 12–14% in upcoming quarters;

→ Company founder Larry Ellison highlighted “astronomical” demand for data centres, as well as Oracle’s competitive edge in building and servicing them.

Notably, Oracle provides infrastructure services for both OpenAI and Meta Platforms.

Technical analysis of ORCL shares

ORCL shares have shown high volatility throughout 2025, largely influenced by news surrounding Donald Trump. His promises to strengthen the US position in AI served as a bullish signal, while plans to impose international trade tariffs had a bearish impact.

As a result, a broad upward channel has formed on the chart, with the following key observations:

→ the price has repeatedly bounced sharply from the lower boundary (1), indicating strong demand;

→ by early June, the price had risen and stabilised near the channel’s median line (2).

Currently, the ORCL chart shows that the earnings-driven rally has pushed the price into the upper quartile (3) of the channel.

With the RSI indicator at extreme highs, it is reasonable to assume that ORCL may be vulnerable to a pullback. However, if a correction does occur, it is unlikely to be deep — perhaps testing the psychological $200 level — given the company’s strong fundamentals.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

An Internet Disaster - NET & GOOGL FallAs of Thursday, June 12, 2025, a significant internet outage has disrupted services across multiple major platforms, including Google, Amazon Web Services (AWS), Spotify, YouTube, Discord, and Shopify. Cloudflare acknowledged experiencing intermittent failures and noted that some services were beginning to recover, though users may continue to encounter errors as systems stabilize.

The root cause of the disruption has been identified as an issue with Google Cloud's Identity and Access Management (IAM) service, which affected various services globally. While Cloudflare's core services were not directly impacted, some of its services relying on Google Cloud experienced issues.

Imagine how far Net could've fallen if IGV / Cloud stocks weren't strong today.

ORCL Earnings Play – Riding AI Momentum (2025-06-11)📈 ORCL Earnings Play – Riding AI Momentum (2025-06-11)

Ticker: NYSE:ORCL (Oracle Corp)

Event: Earnings Report — 📆 June 11, After Market Close (AMC)

Bias: ✅ Moderately Bullish | Confidence: 70%

Strategy: Call Option | Expiry: June 13, 2025

🔍 Market Snapshot

📍 Price: Trading near recent highs

📈 RSI (Daily): 87.66 — Extremely overbought

📊 IV Rank: 0.75 → Implied volatility is high

📦 Options Market: Bullish skew; max pain at $170 suggests risk, but not dominant

🧠 Narrative Drivers: AI/cloud strength, institutional accumulation, strong uptrend

🧠 AI Model Consensus Summary

✅ Bullish (3/4 Models):

• Grok/xAI, Llama/Meta, Gemini/Google → all recommend a long call

• Favor upside potential due to strong trend + favorable sentiment

• Strike debate: $195 vs. $200 → $200 favored for cost/leverage

⚠️ Bearish (1/4 Models – DeepSeek):

• Flags overbought RSI + $170 max pain

• Recommends buying puts (contrarian sell-the-news play)

✅ Recommended Trade Setup

🎯 Direction: CALL

📍 Strike: $200

📅 Expiry: 2025-06-13

💵 Entry Price: $0.86

🎯 Profit Target: $1.00 (+16%)

🛑 Stop Loss: $0.25 (–71%)

📈 Confidence: 70%

⏰ Entry Timing: Before earnings close

📏 Size: 1 contract (limit to ~1% of capital)

⚠️ Risk Factors

• ❗ Binary Event: IV crush or weak results can kill premium

• 🧊 RSI > 87 → potential for short-term correction

• 🔁 If no move materializes, you may lose full premium

📣 Will NYSE:ORCL deliver an AI-fueled beat or flop on IV crush?

💬 Share your take ⬇ | Follow for daily earnings plays and AI-backed trade alerts.

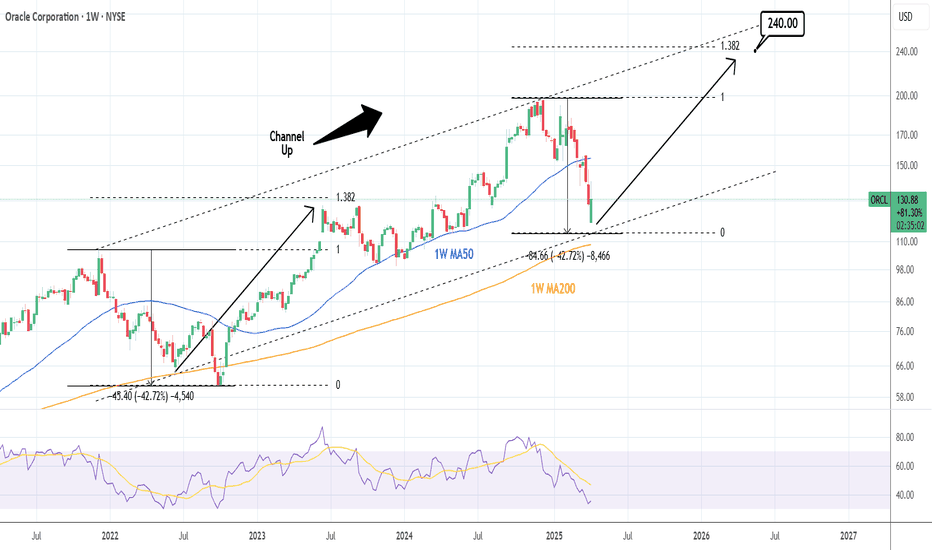

ORACLE: On a 3 year bottom. Buy opportunity for 240 long termOracle is bearish on its 1W technical outlook (RSI = 35.862, MACD = -4.360, ADX = 42.565) as this week it reached almost the same levels of correction as the 2022 Bear Market (-42.72%). This is also nearly a HL bottom for the 3 year Channel Up and as the 1W MA200 is right below, a great long term buy opportunity. The bullish wave after the 2022 bottom almost reached the 1.382 Fibonacci, so we have a technical level to target this time also (TP = 240).

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Oracle: Tilting Downward…After a sharp rebound from the $152.02 support following the steep drop from the peak of the beige wave II, Oracle is once again tilting downward as expected. The next step should see the price fall below $152.02 to reach the projected low of the beige wave III. After a countermovement of wave IV, the broader downward movement as part of the beige five-wave decline should extend further, ultimately driving the stock to the low of the overarching blue wave (A). If Oracle instead breaks above the $198.31 resistance in the short term, the macro-level light green wave alt. will rise to a new high. However, this alternative scenario holds only a 34% probability. Primarily, we assume that wave was completed with the December peak.

What Lies Beyond Stargate's Gates?In a bold move that redefines the intersection of technology and national policy, President Donald Trump has unveiled "Stargate," a colossal project aimed at advancing the United States' capabilities in artificial intelligence. This initiative, backed by tech titans Oracle, OpenAI, and SoftBank, is not merely an investment in infrastructure but a strategic leap towards securing America's future in the global AI race. With commitments reaching up to $500 billion, Stargate is set to transform not only how AI is developed but also how it integrates into the fabric of American society and economy.

The project's immediate impact is palpable; it involves constructing state-of-the-art data centers in Texas, with plans to scale significantly across the nation. This undertaking promises to generate around 100,000 jobs, showcasing the potential of AI to be a major economic driver. Beyond the economic implications, Stargate aims at a broader horizon — fostering innovations in fields like medical research, where AI could revolutionize treatments for diseases like cancer. The involvement of key players like NVIDIA, Microsoft, and Arm underscores a unified push towards not just business efficiency but also societal benefits, challenging us to envision a future where technology and humanity advance hand in hand.

However, the vision of Stargate also brings to mind the complexities of global tech dependencies, especially concerning AI chip manufacturing, which largely relies on foreign production. This initiative invites a deeper contemplation on how national security, economic growth, and technological advancement can be balanced in an era where AI's influence is ubiquitous. As we stand on the brink of this new chapter, Stargate challenges us to think critically about the future we are building — one where AI not only serves our immediate needs but also shapes our long-term destiny.

Oracle Stock (ORCL) Surges Amid Trump’s InitiativeOracle Stock (ORCL) Surges Amid Trump’s Initiative

Stargate – an initiative unveiled by Donald Trump on his second day as president – represents a collaborative project between OpenAI, SoftBank, and Oracle to advance artificial intelligence infrastructure in the United States. The project’s partners also include Microsoft, MGX, Arm, and NVIDIA.

The initiative involves an initial $100 billion investment to construct a data centre in Texas, with total funding potentially increasing to $500 billion over four years. Additionally, President Trump has revoked an executive order from his predecessor, Joe Biden, issued in 2023, which aimed to mitigate risks associated with AI development.

Financial markets responded with a rally in tech stocks, with Oracle’s stock (ORCL) gaining over 7% in a single day.

Technical analysis of the ORCL chart shows:

→ Price fluctuations are forming an ascending channel, and yesterday’s rally lifted the price from the lower half of the channel to its median line.

→ The price is approaching a bearish gap created on December 10 following disappointing quarterly results. This gap may act as resistance – similar to the inverse situation earlier in 2025, where the price found support at the upper boundary of a bullish gap formed after the September earnings report.

However, with support from the new administration, bulls might manage to sustain levels above $180, paving the way for a potential climb to a new all-time high around the psychological mark of $200 per ORCL share.

According to TipRanks:

→ 15 out of 27 analysts recommend buying ORCL stock.

→ The average 12-month price target for ORCL is $197.

Trade on TradingView with FXOpen. Consider opening an account and access over 700 markets with tight spreads from 0.0 pips and low commissions from $1.50 per lot.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

ORACLE Slowly turning into a long-term Buy again.Oracle (ORCL) gave us an excellent buy signal on our last call (September 18 2024, see chart below):

For the past 30 days it has been on a technical decline, which based on its +2 year pattern, is nothing but the Bearish Leg of the Channel Up. The 1W MA50 (blue trend-line) is the natural Support of this trend but the September - October 2023 Bearish Leg bottomed a little over the 0.382 Fibonacci retracement level.

As a result we expect the stock to turn into a buy by the end of the month or if the 1W RSI hits its 42.70 Support first and initiate the new Bullish Leg, which at first shouldn't be that aggressive.

Our Target is a little below the -0.236 Fib extension at $220.00.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Oracle: Correction Started!Although ORCL is currently still trading above the $147.50 support level, we believe the green wave has reached its peak. This implies that the overall upward trend has concluded, and we anticipate a significant correction moving forward. This correction should unfold in five parts, with the beige wave I extending well below the $147.50 level. Afterward, we foresee a corrective counter-movement back above $147.50 during wave II before the price resumes its downward trajectory.

Digital Dreams, Nuclear Reality: Is AI Sparking a Revolution?In an unprecedented fusion of cutting-edge technology and atomic power, Oracle's latest venture illuminates the extraordinary energy demands reshaping our digital landscape. The tech giant's bold decision to power its next-generation AI facilities with nuclear reactors signals more than just an infrastructure upgrade – it represents a fundamental shift in how we approach the intersection of computational power and energy resources.

The numbers tell a compelling story: with data centers already consuming more electricity than entire nations and AI operations demanding exponentially growing power supplies, traditional energy solutions are proving insufficient. Oracle's gigawatt-scale ambitions, powered by small modular reactors, showcase an innovative response to this challenge, potentially revolutionizing how we fuel our digital future.

As tech titans race to build increasingly powerful AI systems, Oracle's nuclear gambit raises fascinating questions about the future of technological progress. Will this marriage of nuclear power and artificial intelligence unlock unprecedented computational capabilities, or are we witnessing the dawn of a new era where the limits of power generation become the primary constraint on digital innovation? The answer may reshape not just the tech industry, but the very framework of our energy infrastructure for generations to come.

ORACLE Channel Up targeting $200.Oracle (ORCL) broke above its previous High last week and even though the current one is under a certain degree of volatility (reasonable due to the Fed), this confirmed the upward continuation of the trend.

Technically, the stock has been trading within a long-term Channel Up since the September 2022 market bottom and after a prolonged test this year of the 1W MA50 (blue trend-line) as Support, it has started the new Bullish Leg with the current phase being the last one.

An ideal 1W RSI symmetry suggests that we might be printing a sequence similar to March - June 2023, which peaked after a +110% rise from its bottom.

As a result, we remain bullish on Oracle, targeting $200.00 by the end of the year.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Oracle Corporation | ORCL & Ai If there is one person that you can compare it with Tony Stark aka IRON MAN is Larry Ellison

the ruthless entrepreneur who is born to win and be the number 1. Since the close of trading Friday, Ellison’s net worth has pumped 8 billion dollar to reach $ 206 billion

Oracle’s stock has reached new highs following its earnings report last week, which exceeded expectations and raised its revenue forecast for fiscal 2026.

Orcl have risen 20% this month and If this upward trend holds, it would mark their best performance since October 2022, when the stock jumped 28%, and the second best month since October 2002, nearly two decades ago.

The company’s stock success is partly driven by its involvement in the booming artificial intelligence sector. Ellison, Oracle’s founder since 1977, mentioned in last week’s earnings call that the company is building data centers to meet the growing demand for generative AI.

“We are literally building the smallest, most portable, most affordable cloud data centers all the way up to 200 megawatt data centers, ideal for training very large language models and keeping them up to date,” Larry said during the call

also he recently mentioned that Elon Musk and I ‘begged’ Jensen Huang for GPUs over dinner!We need you to take more of our money please!! It went ok. I mean, it worked!

Oracle also announced last week a partnership with Amazon’s cloud computing division to run its database services on dedicated hardware. Over the past year, it has formed similar alliances with Microsoft and Google, two other major cloud infrastructure providers

Oracle's cloud services are a key driver of their success, with revenue from this division growing 21% year over year, reaching $5.6 billion in quarterly earnings

Oracle is becoming a crucial provider, acting like a foundational layer for AI-focused companies. Their database systems are now critical to supporting businesses like OpenAI, AWS, and Google Cloud in building the infrastructure for future AI advancements. Despite AWS and Google Cloud being direct competitors, Oracle’s software remains essential to AI’s future.

Oracle's technology plays a foundational role, much like GPUs have in AI development. As companies seek efficient cloud-database solutions for AI workloads, Oracle is well-positioned to fulfill this demand.

Considering their strong Q1 performance and the central role of their database software in this field, I now view Oracle as a strong buy. The company's AI-powered cloud solutions, strategic partnerships, and growing database market make their technology indispensable for the future of AI

Oracle’s fiscal Q1 for FY 2025 exceeded expectations, with non GAAP earnings per share (EPS) of $1.39, surpassing estimates by $0.06, and revenue hitting $13.3 billion, outperforming projections by $60 million. The cloud segment, which includes their AI database software, remains a significant growth driver, generating $5.6 billion in revenue.

Most of Oracle’s revenue came from the Americas, contributing $8.3 billion, a 6.9% year-over-year increase. The AI revolution, gaining momentum in the US, aligns with their strong revenue growth in this region.

During the Q1 earnings call, management emphasized their expanded partnerships with major tech companies like Google Cloud (Alphabet Inc) and AWS (Amazon), which are notable given that they are also competitors. Oracle highlighted its success in the AI training space, pointing to the construction of large data centers equipped with ultra-high-performance RDMA networks and 32,000-node NVIDIA GPU clusters.

In the EMEA region, crucial to Oracle’s growth due to rising demand for cloud infrastructure and AI solutions among European enterprises and governments (sovereign AI), the company reported $3.3 billion in revenue.

Oracle’s earnings per share aka EPS is projected to grow at a compound annual rate of 13.5% for FY 2025, increasing to 14.41% in FY 2026, and continuing to compound at a modest double-digit rate in the coming years.

While these projections show strong potential for Oracle to be a compounder, I believe they may be somewhat conservative. The company’s remaining performance obligations (RPO) jumped 53% year-over-year to $99 billion by the end of the first fiscal quarter, indicating that their pipeline of signed work is growing faster than revenue. Once Oracle scales its solutions and workforce to match this RPO growth, we could see both revenue and EPS accelerate further.

In fact, while Oracle’s forward revenue growth is projected at just 8.86% for the next 12 months, their backlog is growing by over 50%. This suggests a notable gap between revenue expectations and actual demand.

I believe the current revenue growth projections are too low, and once revised upward, they could become a key growth catalyst for the company.

As for Oracle’s valuation, its forward price-to-earnings (P/E) ratio stands at 24.74, which is just 6.76% above the sector median of 23.17. However, given Oracle’s growth potential, I think it warrants a P/E ratio closer to 30.12, which is roughly 30% above the sector median. This would imply an additional 21.75% upside for the stock, excluding dividends.

With a forward P/E ratio only slightly above the sector median, despite Oracle’s impressive growth, the company’s performance suggests the stock should be trading at a higher valuation.

Larry Ellison is the man that I always can trust his vision and always bullish on his spirit and his ambitious. Oracle expanding influence in AI, coupled with robust revenue growth, positions the stock for significant upside. AI is like a modern day Gold Rush, and Oracle, much like GPU makers, is providing the essential tools the "pickaxe" for AI companies so That’s a space I’m eager to invest in

the chart looks insane and if there will be pullback I consider it as a buy opportunity

Oracle’s Earnings Growth & Amazon Deal Propel Stock to New HighsOracle Corporation ( NYSE:ORCL ) is riding a wave of investor optimism after posting impressive fiscal first-quarter results and announcing a strategic multicloud partnership with Amazon Web Services (AWS). This combination of strong financial performance and a game-changing collaboration has driven Oracle’s stock up nearly 9% in extended trading, marking a significant milestone in the company’s journey as a leading enterprise software and cloud services provider.

Key Highlights

- Earnings Beat Expectations: Oracle reported first-quarter revenue of $13.3 billion, up 7% year-over-year, surpassing analysts' expectations. Earnings per share climbed to $1.03, beating the previous year’s 86 cents.

- AI-Driven Cloud Growth: Oracle’s cloud services, its largest business segment, saw a 21% revenue increase to $5.6 billion, fueled by heightened demand for AI training models. The company’s Oracle Cloud Infrastructure (OCI) surged 45% year-over-year to $2.2 billion, a testament to the robust growth driven by AI applications.

- Amazon Partnership: Oracle announced a multicloud partnership with AWS, allowing customers to leverage Oracle database technology within AWS cloud data centers. This collaboration is expected to accelerate cloud adoption and drive further revenue growth.

Why Oracle is Soaring

Oracle’s financial strength is closely tied to its strategic focus on AI and cloud computing. With the rapid rise of AI large language models, Oracle’s cloud infrastructure has become a vital resource for companies looking to train these models efficiently. CEO Safra Catz highlighted a strong contract backlog, emphasizing the potential for sustained revenue growth throughout fiscal year 2025.

Additionally, Oracle’s partnership with AWS underscores its commitment to becoming a central player in the multicloud environment. By integrating with one of the world’s largest cloud providers, Oracle not only expands its market reach but also solidifies its position as a versatile and reliable cloud service provider, giving clients more flexibility and options for their data management needs.

The combination of AI-fueled demand and strategic alliances makes Oracle a compelling investment opportunity. Its impressive earnings growth and market adaptability suggest that the company is well-positioned to capitalize on the expanding cloud market, especially as enterprises increasingly look towards multicloud solutions.

Technical Analysis:

Oracle’s stock has been on a bullish trajectory, gaining over 34% year-to-date before Monday’s after-hours surge. The recent price action suggests a continuation of this upward trend, particularly with the stock breaking out of a well-defined trading range in mid-June.

- Short-Term Price Targets: Following the breakout, Oracle shares ( NYSE:ORCL ) defended a key level in early August before rallying over 11% from last month’s low. Technical analysis suggests a short-term price target of $154, calculated using the measuring principle that involves adding the height of the prior trading range to the breakout point.

- Critical Retracement Levels: Investors should watch for potential retracements to the $145 level, which previously served as resistance and may now act as support. This level will be crucial in determining whether Oracle ( NYSE:ORCL ) can maintain its upward momentum or if profit-taking could lead to a temporary pullback.

Future Outlook

Oracle’s recent performance and its expanding cloud business provide strong tailwinds. However, it’s important to consider potential risks, such as overbought market conditions and the possibility of a cooling-off period. The current rally has been fueled by euphoria around AI and partnerships, but extended upward trends without consolidation can lead to volatility.

The technical outlook remains positive, but investors should be mindful of the broader market environment and Oracle’s valuation. With the stock up significantly in recent months, any signs of slowing growth or competitive pressures could prompt a retracement.

Conclusion

Oracle’s blend of AI-driven earnings growth, strategic cloud partnerships, and technical breakout positions it as a standout performer in the tech sector. The multicloud deal with AWS is a game-changer that not only broadens Oracle’s market reach but also underscores its adaptability in a rapidly evolving industry.

While the stock’s current momentum is promising, careful monitoring of key technical levels and fundamental developments will be essential in navigating Oracle’s next move. As the company continues to innovate and expand its cloud offerings, it stands well-positioned to capitalize on the growing demand for AI and multicloud solutions, potentially driving further gains for investors in the months ahead.

Oracle Liquidation - Short or Sell | Yellowstone Bubble Anyone?Awhile back I posted a chart, where I referred to this current market as the "Yellowstone Bubble".

Lol at the time, I was simply teasing about how ever since roughly season 4 of the show Yellowstone , it seems like everyone thinks they are some kind of tough-guy money-making, all-powerful market wizard.

Google: "Yellowstone Oracle".

Anyway, there's not much else to say here. The internet is a commodity.

Oracle (ORCL): Bullish Outlook Ahead of EarningsToday, we’re getting the earnings report on ORCL, and we’ve had to adjust our last analysis accordingly. We are now looking at a more bullish scenario after our previous bearish outlook was invalidated. If Oracle holds the desired level, we believe our current wave count is accurate.

The count is pretty straightforward, and we think we’re now in the intra wave (ii) of the larger wave 3. This wave (ii) might touch the trend channel again, though it doesn’t necessarily have to. The channel seems accurate as waves ((i)), ((ii)), and ((iii)) are all tagging it. It would have been ideal if wave ((iv)) had touched it as well, but perfection is rare in markets.

We’re focusing on the area between $133.43 and $129 to hold. We’re not setting any limit orders for ourselves just yet, as we want to see if our new count proves correct before making any moves.

Oracle (ORCL): Bearish Scenario with Long-Term PotentialSince our last analysis of Oracle on the daily chart, there has been little significant change. The stock moved into our Wave (B) zone between $128 and $138, and after reaching a high of $132.77, it was rejected. A trendline was broken but quickly reclaimed, suggesting a potential push upward.

We anticipate Wave 3, the subordinate wave, to find support around $91 to $86. Currently, everything indicates a falling trend, and unless the price rises above the recent high of $132.77, we expect continued downward movement.

However, our primary scenario remains bearish, expecting a further sell-off down to the range between $80 and $50. This range is broad but suitable for long-term entries. We see no issue with the size of this target zone, as it offers good long-term potential.

Elon Musk's xAI Set to Rent Oracle's AI Servers for $10 Bln Oracle Corp. ( NYSE:ORCL ) is close to a $10 billion cloud contract with Elon Musk's artificial intelligence startup, xAI. Oracle Chairman Larry Ellison announced last September that the company had a deal to provide cloud infrastructure to xAI to train artificial intelligence models. The talks are ongoing and there is no guarantee that the two companies will reach an agreement. XAI was set to close a $6 billion funding round, valuing the company at about $18 billion. The shares gained 3.7% to $120.68 in New York after earlier hitting $122.55. The stock has increased 10% this year through Monday's close.

The deal would make xAI one of Oracle's largest customers, as Musk looks to raise funds for xAI in an attempt to rival the AI offerings of OpenAI and Google. The cloud negotiations are ongoing and there is no guarantee that the two companies will sign a deal. XAI was reportedly in talks to raise $3 billion in a round last month, which would have valued the company at $18 billion. Oracle and Elon Musk did not immediately respond to Reuters requests for comment.

Oracle ( NYSE:ORCL ) released an update to its database technology earlier this month intended to make it more useful with AI. XAI is the largest H100 customer at Oracle, using more than 15,000 of the AI chips, which are made by Nvidia. Last month, Musk said xAI would launch an enhanced version of its chatbot Grok to early testers and existing users on his social media platform X.

Michael Burry is Wrong on This One!!! SELL ORCL!I love Michael Burry. He has some amazing calls and I'm always curious to see what he is up to, but obviously we're all human and make mistakes. His company Scion Asset Management started buying in the last quarter of last year as we're going into a 5th wave breakout. We have met three different objectives for a 5th wave target including divergence on the monthly chart. It's possible for an extended 5th wave, but more than likely not. My target is at least $82-$59, which is the .382 fib level of the entire move or bottom of wave 4. However, we will need to save a wave A unfold to determine a further target.