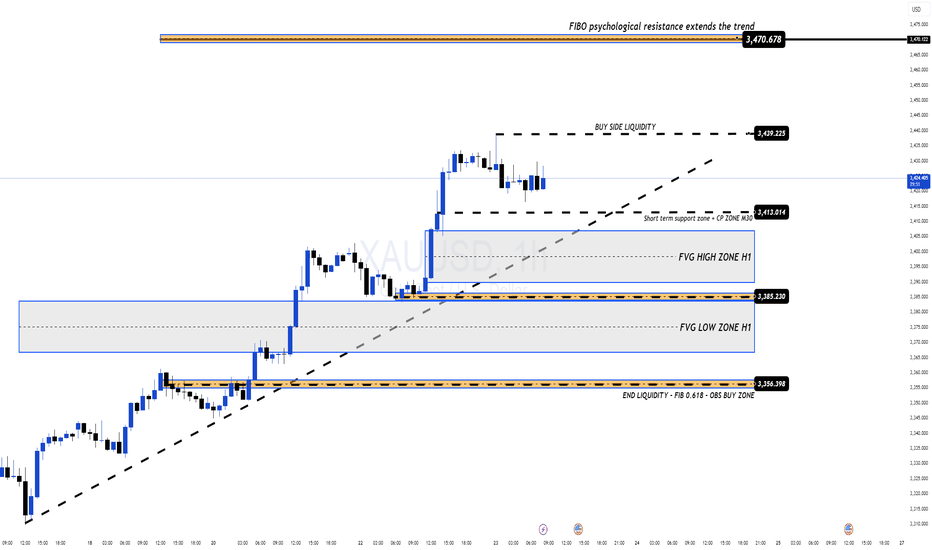

Bullish Momentum Fading? Key Correction Levels Ahead XAUUSD – Bullish Momentum Fading? Key Correction Levels Ahead (23 July)

📰 Market Overview

Gold surged strongly overnight, driven by:

A speech from Fed Chair Jerome Powell, with no hints of resignation or major policy shift.

Rising geopolitical tensions between the US, China, and the EU — with the 1st of August marked as a key deadline.

A notable drop in US bond yields and the US Dollar, triggering increased demand for safe-haven assets like gold.

While today’s economic calendar is quiet, the market remains sensitive to sudden volatility.

📉 Technical Analysis

On the H4 chart, the recent bullish wave shows signs of exhaustion. Reversal candles are now forming on the H1 and M30 timeframes — suggesting a potential correction in the short term.

The 3412 – 3410 support zone will be critical. If price breaks below and invalidates the ascending trendline, we may see a deeper pullback toward lower liquidity zones (FVGs).

Below that, the 335x region offers strong confluence (Fibonacci 0.618 + previous demand zone), making it a prime area for potential long entries if price action confirms a bounce.

📌 Trade Setups to Watch

🔻 SELL ZONE: 3469 – 3471

Stop Loss: 3475

Take Profit Targets: 3465, 3460, 3455, 3450, 3445, 3440, 3430, 3420

→ Wait for a breakout and retest before shorting.

🔸 BUY SCALP: 3385 – 3383

Stop Loss: 3379

TP Targets: 3390, 3394, 3398, 3402, 3406, 3410

→ Ideal for intraday pullback entries with clear structure.

🔹 STRONG BUY ZONE: 3356 – 3354

Stop Loss: 3350

TP Targets: 3360, 3364, 3368, 3372, 3376, 3380, 3390, 3400

→ Great long-term entry zone with technical alignment (liquidity + fib levels).

⚠️ Risk Management Reminder

Even in low-news sessions, markets may spike unexpectedly due to political statements or liquidity sweeps.

Always respect your TP/SL levels — smart trading is protected trading.

💬 Patience breeds precision. Wait for the zone, trust the plan, and manage the trade.

Order

How to Trade Smart Money Concepts (SMC)\ How to Trade Smart Money Concepts (SMC)\

\ This article explores the foundation, key tools, and practical insights of Smart Money Concepts — and why it’s worth your attention.\

In today's fast-changing financial landscape, Smart Money Concepts (SMC) has become a popular strategy among modern traders. But what is SMC exactly, and how can it improve your trading decisions? This article breaks it down in a simple, professional way for traders at all levels.

---

\ What Are Smart Money Concepts?\

SMC is a trading approach based on the belief that large institutions ("smart money") like banks and hedge funds control most of the market's movements. These institutions often move the market in ways that confuse or trap retail traders. The goal of SMC is to understand and follow the footsteps of these big players.

Instead of relying on simple patterns or indicators, SMC focuses on:

\ - Market structure\

\ - Supply and demand zones\

\ - Liquidity pools\

By aligning your trades with the behavior of smart money, you can position yourself more strategically in the market.

---

\ Key SMC Concepts Explained\

\ Order Blocks\

Order blocks are zones on the chart where large institutions have placed significant buy or sell orders. These zones often lead to strong price reactions and act as hidden support or resistance levels. Order blocks are considered more precise than traditional supply and demand areas.

Example: ()

\ Fair Value Gap (FVG)\

A Fair Value Gap occurs when price moves sharply in one direction, leaving a gap or imbalance in the price action. These areas often get filled later and can act as magnets for price.

In a bearish move, the FVG is the gap between the low of the previous candle and the high of the next one. In a bullish move, it's the reverse.

Example: ()

\ Timeframe Consideration\

If you can’t monitor charts during the day, avoid relying on 5–30 minute setups. Consider 4H or daily timeframes for clearer signals and more manageable trading decisions.

\ Liquidity\

Liquidity refers to price zones where lots of pending orders exist. These are usually at obvious highs, lows, or trendlines. Smart money often targets these areas to trigger stop-losses and generate movement.

One common tool to identify liquidity is a "pivot point," which is a candle with a lower low or higher high than its neighbors.

Example: ()

\ Break of Structure (BOS)\

BOS occurs when price breaks above or below a previous high or low, signaling a possible trend continuation.

Example: ()

\ Change of Character (ChoCH)\

ChoCH happens when the market changes direction. For example, if price breaks a higher low in an uptrend, it may signal a reversal.

Example: ()

Combined with BOS: ()

---

\ How SMC Compares to Wyckoff\

The idea of "smart money" isn't new. Richard D. Wyckoff, a pioneer in technical analysis, laid the foundation for understanding market cycles driven by institutions. His price cycle theory includes four phases:

\ 1. Accumulation\

Smart money buys while the public is unaware.

\ 2. Markup\

Price rises as smart money pushes the market.

\ 3. Distribution\

Smart money sells into public buying.

\ 4. Markdown\

Price falls as the cycle completes.

SMC borrows from this logic but focuses more on structure and liquidity zones. Still, the core idea is the same: understand what big players are doing, and follow them.

\ For deeper insights into Wyckoff, explore additional resources focused on accumulation/distribution cycles.\

---

\ Summary\

Smart Money Concepts give traders a deeper look into market mechanics. By focusing on order blocks, fair value gaps, liquidity, and structure breaks, SMC helps identify high-probability trade setups based on institutional behavior.

It may seem complex at first, but once you understand the basics, SMC can become a powerful tool in your trading strategy. Whether you’re new or experienced, aligning with smart money can improve your edge in the market.

Strategy & Education: Trading with Fibonacci and Order Blocks🔍 Trading Strategy Based on Fibonacci Levels and Order Blocks

This chart showcases three consecutive sell trades I executed on the BTCUSDT pair, each resulting in a profitable outcome. The purpose of this explanation is to demonstrate how Fibonacci retracement levels can be combined with Order Block zones to identify high-probability trade setups.

🧩 The Foundation: Understanding Price Retracement Behavior

The ABC, abc, and (a)(b)(c) structures marked on the chart are not Elliott Waves. Instead, these labels are used to represent simple retracement movements in the market. The focus here is not wave theory, but recognizing how price reacts and pulls back after a move, and how we can benefit from these reactions.

📌 Trade 1: Primary Fibo-OB Confluence

I drew a Fibonacci retracement from the A wave to the B wave.

The price then retraced to the C area, landing between the 0.618 and 0.786 Fibonacci levels, where an Order Block (OB) was also present.

This overlap created a strong technical and structural resistance zone.

I entered the first sell trade from this confluence.

📌 Trade 2: Internal Retracement and OB Alignment

Inside the first corrective move, a smaller abc pattern formed.

I applied Fibonacci again from small a to small b.

The c leg reached the same key Fibonacci zone (0.618–0.786) and overlapped with a second OB.

This confluence offered a second sell entry.

📌 Trade 3: Micro Structure – Same Logic Reapplied

I repeated the exact same logic one more time on a micro (a)(b)(c) structure.

Fibonacci from (a) to (b), price touched 0.618–0.786, coinciding again with an OB.

This became the third and final sell position.

🧠 The Logic Behind the Strategy:

Price doesn’t move in straight lines—it flows in waves. During pullbacks, if Fibonacci levels align with Order Block zones, the market tends to react strongly. My focus here was to identify these areas of confluence in advance and enter trades at high-probability turning points.

China is about to decided whether retailiate or not. Donald Trump and hes administration went to far and to many direction.

EU and China at the same time is just too much but tretening the whole world is just an enormous startegic error.

He made woke up not1 but 170 bear at the same time while the bears were sleeping and dreaming. And the dream ended. The USA not enymore realiable, trustworty, and therefore friendly country. The bears are dissapointed and angrys.

They dont wanna have does fals dreams at the next time, and its seems that Trump is in a deadend roed.

Honestly this story can be continued for pages but lets just speak about the an abnormal situation.

BONDS UP 10Y 5Y - trough agressive selling of US debt which is really will tied up the FED hands if the inflation does not happen due to the lack of the tarrifs. 10Y is at the 4,3

The questions can china put the USA in a situation then interest rate cat wount help on the longrun since China and may some of their contries under their influence reaching high detach in a US10Y 5Y and interest rate relation and sending US in to debt cicle.

The slow one is that that will slowly sell as much debt of US that they are cancelling the fed rate cuts.

The fast one is sending aup rates by at least 6% and making the big boys on the stock market to capitulate.

I will update and elaborate this idea better , but I hope if someone reads gets some hints.

RENDER Descending Triangle 4HBINANCE:RENDERUSDT seems to be forming a descending triangle on the 4H timeframe.

3 clear touches on resistance, and well-defined two-tap horizontal support at $2.50.

Key Levels to Watch 🔑

• $2.50-$2.75 Main support and daily demand zone

• $3.80-$4.20 Daily sell order block (potential resistance)

• $5.00-$5.20 4H sell order block (potential resistance)

Breakout Targets 🎯

⬆️ $5.00

⬇️ $1.50

Still in a No-Trade Zone, wait for confirmation (breakout candle close with good volume).

BTCUSD | 1D SMC Short Setup with Refined SL and TargetsDescription:

This analysis identifies a high-probability short opportunity for BTCUSD on the 1D timeframe using the Smart Money Concepts (SMC) framework. The chart shows clear bearish confluences, including market structure, supply zones, liquidity levels, and Fibonacci retracement zones. I believe the current bullish momentum is merely a manipulation driven by inflation news and the upcoming Trump inauguration. Following these events, I anticipate a significant market correction. Here’s the detailed breakdown and trade plan:

Analysis:

Market Structure:

Break of Structure (BOS): Price has confirmed a bearish trend with BOS to the downside, signaling a continuation of lower highs and lower lows.

Trendline Resistance: A well-defined downward trendline indicates selling pressure, reinforcing the bearish bias.

Key Zones and Liquidity:

Supply Zone: Highlighted in purple at $102,000-$104,000 . This zone represents an area where strong selling previously occurred, creating an imbalance.

Golden Zone (Fibonacci Retracement): Located around $101,000-$103,000 , this area aligns with the 61.8%-78.6% retracement levels and offers a high-probability reversal opportunity.

Weak High: The high near $104,000 represents untapped liquidity, which smart money may target for a liquidity grab before reversing lower.

Equal Lows (EQL): Around $92,000 , these act as a bearish target where liquidity rests, aligning with the continuation of the bearish trend.

Confluences for Short Entry:

Price is approaching the supply zone and Fibonacci Golden Zone , indicating a potential reversal point.

The weak high may trigger a liquidity grab to entice buyers before sellers regain control.

Previous BOS and trendline resistance add further validation to the bearish bias.

Trade Plan:

Short Entry Setup:

Entry Zone: $102,000-$104,000 (inside the supply zone and Golden Zone).

Stop Loss (SL): $105,500 (above the supply zone and imbalance to account for liquidity grabs).

Take Profit Levels:

TP1: $97,000 – Close partial profits at this imbalance mitigation level.

TP2: $92,000 – Target the equal lows and resting liquidity.

TP3: $88,000 – Final target near the blue demand zone for maximum reward.

Risk-Reward Ratio:

With the entry at $103,000 (midpoint of supply), SL at $105,500, and TP at $92,000, the trade offers a 1:4 RR or better, depending on execution and scaling.

Additional Notes:

Monitor the price action closely as BTC approaches the supply zone for confirmation, such as bearish candlestick patterns or lower timeframe CHoCH (Change of Character).

Scaling into the trade in smaller portions across the supply zone can improve overall entry precision.

Adjust stop loss or take profit levels as market conditions evolve

Just an idea on Bitcoin and the cyclesFirst of all, Bitcoin is a programmable asset. Then there are cycles, not just with the markets, but with humans as well.

There is always a chaos within the structures. Just like the atoms in our bodies. They move chaotic in space, but within the boundaries of a our cells. The order is just a well organized chaos.

The First Bitcoin Super cycle is close to it's ending. The Second (mass adoption) Super cycle is knocking at the door. It is up to humanity to decide now, not "the the leaders or the riches".

Cheers.

It is not intended as a trading advice, nor it is.

Just a research on markets I do.

P.S. All the channels are equal in height on log...

inj sell limit"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

OrderUSDT: Is the Bullish Breakout for Real? Don’t Miss !Yello Paradisers! Are you ready for what could be the next big move? #OrderUSDT is flexing some serious strength compared to the rest of the market. But is it all hype, or are we on the verge of something significant? Let’s break it down.

💎#OrderUSDT has shattered a descending trendline it was stuck in for days. The breakout wasn’t just clean—it’s already retested on lower time frame as well, showing strong probability for sustained upside.After being crushed in a downtrend, the pair has shifted gears into an uptrend. That’s right, Paradisers: higher highs are back on the table.

💎The probability is high for the upside move as A critical resistance zone was flipped into support after formation of double bottom below at support zone. This spot is holding strong and could become the springboard for the next move up.

💎If OrderUSDT pulls back, look for the previous resistance-turned-support zone around $0.22-$0.23.A deeper retracement could test the descending trendline, now a key support near $0.20-$0.21.

💎The next critical resistance zone for OrderUSDT lies between $0.27 and $0.2751, a level that will likely test the strength of the current bullish momentum. A successful break and hold above this area could pave the way for a continuation toward the next significant hurdle at $0.295 to $0.30. Clearing this upper range would not only solidify the bullish structure but also signal the potential for an even stronger upward move, drawing increased market participation and setting the stage for higher targets in the near future.

💎If the pair fails to hold support and drops below $0.18, this would invalidate the bullish scenario and signal a potential return to bearish action.

💎This market loves to shake out the weak hands before making its real move. A pullback here might just be the perfect opportunity to position yourself smartly. But remember: discipline is key. Don’t rush—wait for confirmations at key levels.

Stay sharp, Paradisers. This market isn’t for the faint of heart—but for those who stay disciplined, the rewards can be game-changing. Let’s crush it!

MyCryptoParadise

iFeel the success🌴

Trade BoxI have decided to start providing my signals in the futures market, so this will be the last trading box model I draw. Starting tomorrow, I’ll share futures signals that I believe can yield good profits with reasonable leverage on gold and crypto markets. If you need, let me know the name of the cryptocurrency so we can focus on it for a week. From tomorrow, we’ll begin trading on gold.

Quantum Mechanics & Market Behavior At this stage of my research, I would like to share the primary inspirations behind my style of analysis. As you've already noticed, I don’t create forecasts, as they are subjective and inherently disconnected from the objective nature of markets. Instead, I focus on predictions grounded in the captured dynamics of market behavior in order to actually get closer to its causality.

"QUANTUM MARKET"

In the unpredictable world of trading, price action often mirrors the strange principles of quantum mechanics. Concepts like wave function collapse, entanglement, chaos theory, the multiverse, and even the double-slit experiment provide a unique lens to understand why markets behave as they do—particularly when they defy the majority of forecasts and move in unexpected directions.

The Collapse of the Market Wave Function

In quantum mechanics, a particle exists in a state of possibilities described by its wave function until it is measured. When observed, the wave function "collapses" into one definite outcome. Similarly, in markets, price exists as a spectrum of probabilities, influenced by fundamental data, sentiment, and technical levels. These probabilities reflect the collective forecasts of traders, analysts, and institutions.

The "collapse" of the market wave function can be likened to the moments when price unexpectedly moves against the prevailing sentiment, proving the majority wrong. For instance, when experts predict a bullish breakout, only for the market to reverse sharply, it resembles the moment a quantum system resolves into a state that surprises its observers.

This metaphor highlights the fragile relationship between market expectations and actual outcomes. Just as the act of measurement influences a quantum system, the collective observation and positioning of traders directly impact market movements.

The Multiverse of Price Action

The Many-Worlds Interpretation (MWI) of quantum mechanics posits that every possible outcome of a quantum event occurs, creating branching universes for each scenario. This offers a useful metaphor for the multiverse of market possibilities, where price action simultaneously holds countless potential paths. Each decision by traders, institutions, and external forces influences which path the market ultimately "chooses," much like the branching of quantum states into separate realities.

When the market takes an unexpected turn, it can be thought of as moving into a "branch" of the multiverse that was previously considered improbable by the majority. For example:

A widely anticipated bullish breakout may fail, with the price collapsing into a bearish reversal. This outcome corresponds to a "parallel universe" of price action where the market follows a path contrary to the consensus. When they say market has its on path, chances are they're definitely referring to approach from Fractal Market Hypothesis.

The moment traders observe the market defy expectations, their reality shifts into this new "branch," leaving the discarded probabilities as theoretical relics.

While traders only experience one "reality" of the market—the observed price movement—the multiverse perspective reminds us that all potential outcomes coexist until resolved by market forces.

Chaos Theory: The Hidden Order Behind Market Behavior

Markets may appear chaotic, but their movements are not entirely random. Instead, they follow principles reminiscent of chaos theory, where complex systems display patterns that arise from underlying order.

In trading, this hidden order emerges from the entanglement of price action—the intricate relationship between buyers, sellers, sentiment, and external events. Counter-oscillations of opposing forces, such as bullish and bearish sentiment that has stake in patterns. When these forces reach a critical point, they can produce dramatic reversals or breakouts.

A fascinating aspect of this hidden order lies in the measurement of cycle intervals, which can decrypt the path and stops of price action. These intervals, often influenced by Fibonacci ratios, reflect the inherent chaos of the market while maintaining a surprising consistency. In chaotic systems, the ratios of results inherit the domestic chaos properties of the system itself. This means the measured intervals not only explain past behavior but also project future movements, where price has no option but to adhere to the golden ratio in its path, regardless of direction.

Tools like Fibonacci Channels on TradingView combine these ratios with the angle of the trend, revealing fractal-based timing measurements that highlight potential trend shifts. These tools demonstrate how price action, driven by the chaotic yet structured forces of the market, aligns with these self-similar patterns over time.

Entanglement and the Double-Slit Experiment in Markets

Einstein described quantum entanglement as "spooky action at a distance," where the state of one particle instantaneously influences another, no matter how far apart they are. Markets also mirror another iconic quantum experiment: the double-slit experiment, which demonstrates how particles behave as waves when unobserved but collapse into definitive points when measured.

In the double-slit experiment, an electron passes through two slits, existing as a wave of probabilities until observed. Without observation, it creates an interference pattern, suggesting it travels through both slits simultaneously. However, when measured, the electron collapses into a single state, taking a definitive path through one slit and landing at a specific spot on the detector.

Price action behaves in a strikingly similar way. Just as an electron "feels" it is being observed and alters its behavior, ongoing price action appears to respond to the collective observation of millions of traders. Despite this intense scrutiny, price action frequently surprises both bulls and bears, defying expectations as if reflecting the duality of probability and definitiveness.

When unobserved or in a state of uncertainty, markets exhibit wave-like behavior, oscillating between potential paths. Trends consolidate, creating a balance of opposing forces. However, as traders act on their observations—placing bets, setting stop losses, or predicting breakouts—price "collapses" into a definitive state, choosing a path that often defies the collective expectations of the market.

Logical Deductions

Understanding the market through the lens of quantum mechanics, chaos theory, and the multiverse offers valuable insights for traders:

Expect the Unexpected: Just as a quantum particle's state cannot be precisely predicted, markets are inherently probabilistic. Even the most widely expected outcomes can collapse under the weight of unforeseen variables or simply change of incentive during overheat volatility.

Beware of Herd Mentality: When the majority aligns behind a forecast, the market becomes entangled in their collective assumptions. This might create conditions for a dramatic reversal, much like how a quantum system shifts into an unanticipated state.

Recognize Counter-Oscillations: Price action is driven by the push and pull of opposing forces. Trends often mask the tension beneath, and understanding these dynamics can help traders anticipate critical turning points.

Measure Cycles with Ratios: Fibonacci-based tools, when combined with trend angles, reveal fractal rhythms and the frequency of reversals. These measurements help traders predict price shifts with greater accuracy.

Embrace the Multiverse: Just as the Many-Worlds Interpretation suggests all outcomes coexist until resolved, traders should recognize that multiple possibilities are always present in the market. Being prepared for alternative scenarios helps mitigate risk and improve decision-making.

General Interconnectedness:

Markets are a dynamic interplay of order and chaos, shaped by the entanglement of opposing forces and the constant tension between consensus and contrarian dynamics. The collapse of the wave function—those moments when price defies expert predictions—reminds us of the deep complexities underlying actual behavior of masses.

Through the lens of the multiverse, every market outcome can be seen as a branching reality, where the price action we observe is just one of many potential paths. By embracing this perspective, traders can better navigate the intricate dance of probabilities and entanglement, understanding that markets are not linear systems but ever-changing, interconnected realities. This mindset empowered me to thrive in the environment of duality, where adaptability and probabilistic thinking are the actual keys to understanding price mechanism in Financial Markets.

Disclaimer:

You don’t have to accept these observations as true. Always trust your own judgment and cultivate independent thinking. Personally, I find that the behavior of particles at the quantum scale is the closest phenomenon that mirrors the chaos of the market.

Calm before the storm. Waiting for the rockets to launchI've covered many topics in this video

The difference between myself and others is that I speak from real world experience whilst others keep trying the 'sell the dream'

bullsh*t baffles brains, and that's not what I'm about

So if you are a student of the markets I hope you are taking notes of these golden nuggests

TWLO, rebalance to FVG, then make a bullish liquidity run So, my current analysis is built around a bullish bias on this chart. I’ve identified a few key elements that are lining up to potentially signal a strong move upward:

Bullish Block Breaker: First, I've identified a bullish block breaker. This occurred when the price broke above a significant resistance level, indicating a shift in market sentiment from bearish to bullish. This breakout suggests that buyers have taken control, and it's often a sign of a potential trend reversal or continuation to the upside.

Fair Value Gap (FVG): After the bullish block breaker, the price left behind a Fair Value Gap. This gap is an area of price imbalance, where the market moved too quickly and didn't allow for a balanced trading range. I'm looking for the price to potentially retrace into this FVG, as the market often seeks to 'rebalance' itself by filling this gap. This rebalancing process can provide a strategic entry point.

Bullish Order Block with 50% Retracement: Within the area where the FVG resides, I've also identified a bullish order block. This is an area of previous consolidation before the strong upward move. What adds confluence here is the 50% retracement level within this order block. This 50% level is crucial because it often represents a fair value area within the order block itself. Institutions and smart money traders often look to add to their positions around this level. So, if the price can hold above this 50% mark within the order block, it significantly increases the chances of a bounce.

Confluence Zone: The combination of the FVG, the bullish order block, and the 50% retracement level creates a strong confluence zone. This area serves as a potential support level where I expect buyers to step in if the bullish bias is to continue.

Looking for a Liquidity Run: After potentially rebalancing in the FVG and finding support within the order block at the 50% retracement level, I’ll be looking for the price to make a move towards a liquidity run. The target here would be key liquidity zones, such as previous swing highs or resistance levels. These are areas where stop-loss orders from short sellers or breakout orders from buyers are likely concentrated, acting as a magnet for the price.

SOLOKING - 1H || TP1 5X, TP2 10X, TP3 100XThe currency is currently at a great discount, making it an excellent time to buy for those who want to strengthen their position. It’s considered the best entry point before prices go up. There are many buy signals, and the team behind the project is strong and hardworking. This is a long-term investment opportunity. The team has been working super hard and they just listed on Bitmart and on MEXC in less than two days after launch.

Key highlights about $SKING:

- Initial liquidity pool of 5,350 SOL ($700k+) has been burnt 🔥

- Minting and freezing accounts have been revoked

- No tax on transactions

- No team tokens

First Target: 5x

Second Target: 10x

Third Target: 100x

Final Target: 100x to 1000x (Open)

Reasons to Buy:

Oversold

Fibonacci Reversal

Strong Divergence

Hardworking Team

Bullish Falling Wedge

And More! Don't miss it

Order typesIn the past, a person would typically have to go to the brokerage or another financial entity to buy or sell a security. The trade would be then settled through a personal meeting or, as technology progressed, over the phone. Nonetheless, the implementation of modern technology within the financial markets of the 21st century made placing buy and sell orders as easy as a few mouse button clicks. Nowadays, many trading platforms allow their clients to execute various types of orders beyond ordinary buy and sell orders.

Key takeaways:

Using limit orders is generally considered one of the safest ways to buy or sell a security.

Modern technology allows placing buy and sell orders with a few mouse clicks.

A stop-loss and stop-limit orders are used to protect an investor’s capital.

A trailing stop locks in some of the accrued profits.

Quick trade orders get instantly filled by a single or double click on a bid or ask button.

Limit order

A buy limit order is used to buy a security at a specified price. This type of order is executed automatically in a case when the price of a security is lower than the value of the buy limit order. A sell limit order is used to sell a security at a specified price. It gets automatically filled when the price of a security is higher than the value of the sell limit order. This design occasionally allows for the execution of the buy limit order or the sell limit order at a better price. Generally, limit orders are one of the safest ways to purchase or sell a security.

Quick-trade order

Some trading platforms allow the use of quick-trade orders. A quick-trade order is a type of order that is instantly filled by a single or double click on a bid or ask button in a trading platform. These orders are relatively safe to use. However, filling this type of order in highly volatile markets might be difficult due to a quickly changing price.

Market order

When traders choose to use a market order, they let the market set the price of security. In essence, this means that for a buy market order, a trade execution occurs at the nearest ask. For a sell market order, a trade execution takes place at the nearest bid. The use of the market order is less safe in comparison to limit order because it allows for worse filling of orders in illiquid markets and markets dominated by algorithmic trading. However, some platforms offer their clients the option to choose the tolerance threshold for such trade orders.

Good ‘Til Canceled order (GTC)

This type of order remains active until it is filled or canceled.

Stop-loss and stop-limit orders

A stop-loss order sells a position at a market price if it reaches or passes a specified price. Unlike a stop-loss order, a stop-limit order liquidates a position only at a specified or better price. These types of orders are used to protect investor’s capital before depreciation.

Trailing stop order

A trailing stop order trails the price as it moves in the trader’s favor. For a long position, a trailing stop moves higher with the price but stays unchanged when the price falls. Similarly, for a short position, a trailing stop moves lower with the price but remains unchanged when the price rises. The intent of a trailing stop is to lock in some of the accrued profits.

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not be a basis for taking any trade action by an individual investor or any other entity. Therefore, your own due diligence is highly advised before entering a trade.

BTC still bearishBTC still bearish

Effective risk management is crucial for success in trading. It not only helps in protecting assets but also optimizes the performance of trading strategies. The difference between seasoned traders and novices often lies in how they manage risks. Mastering the art of mitigating losses while maximizing gains is essential for long-term profitability in trading markets.

Analysis of Gold on the 12-hour Time FrameAfter a strong upward movement, gold has reached the resistance range of 2140 - 2148 significantly. It seems like it's time for a correction now.

If gold wants to correct due to today's news, we can set our target at 2090, which is an important support level for gold.

Gold Support: 2080.5 - 2088

Gold Resistance: 2140 - 2148

And the price of 2120 determines the market boundary.

Today-tomorrow there will be quite strong news, all focus on Fed Chair Powell. Discussions on interest rates, inflation, and other factors are likely. Given the overall situation in the US, there is a chance that the dollar will receive more support, potentially impacting gold negatively.

Gold might make another move upwards based on the news and touch the resistance zone before starting a downward movement.

Recommended Positions:

Sell: 2142 - 2148

No need for a stop-loss

Short-term Target: 2121 - 2090

Long-term Target: 2060 - 2033

Buy Short-term (Scalp): 2088 - 2085

Stop-loss: 2081

Target: 2094 - 2096 - 2100

PEPE Possible Cup and Handle Patternin my next limit order that I promised you last month, I have chosen PEPE because I am currently interested in how PEPE forms the cup and handle pattern.

Of course to be more sure when you can get in would be the breakout as it sometimes happens that a coin only fakes the cup and handle.

However, I have now personally bought Pepe here and placed further limit orders.

This is also a Good Sample or Tutorial for you guys to see how the Cup and Handle Pattern works.

Cheers

ETCUSDT.PIt appears that the price is approaching the 4-hour Point of Interest (POI), which looks promising. Additionally, I've noticed that both the 4-hour POI and the 1-hour Order Block (OB) coincide. Therefore, I anticipate a favourable reaction in this zone with a potential upward bounce.

Please write your opinion on this analysis in the comments.

If you find the analysis helpful, it would be appreciated if you share it with your friends.