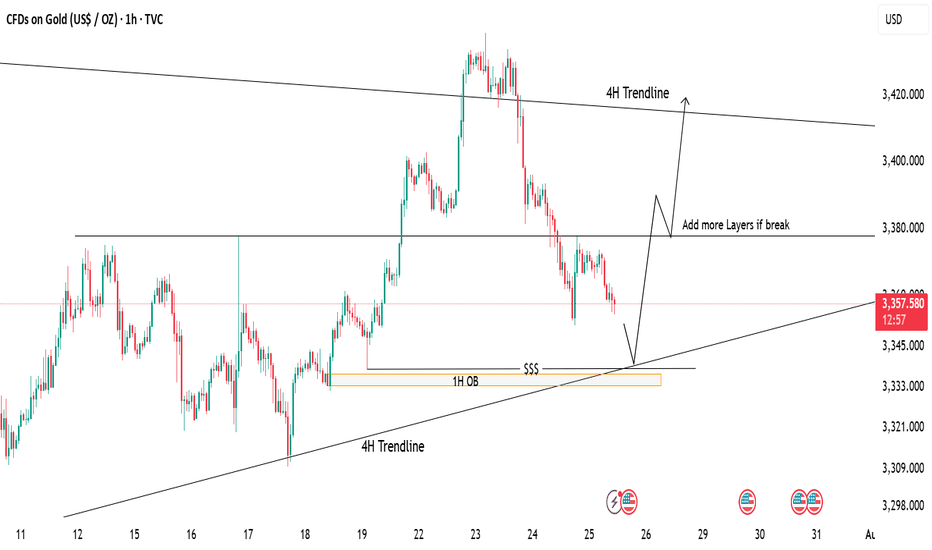

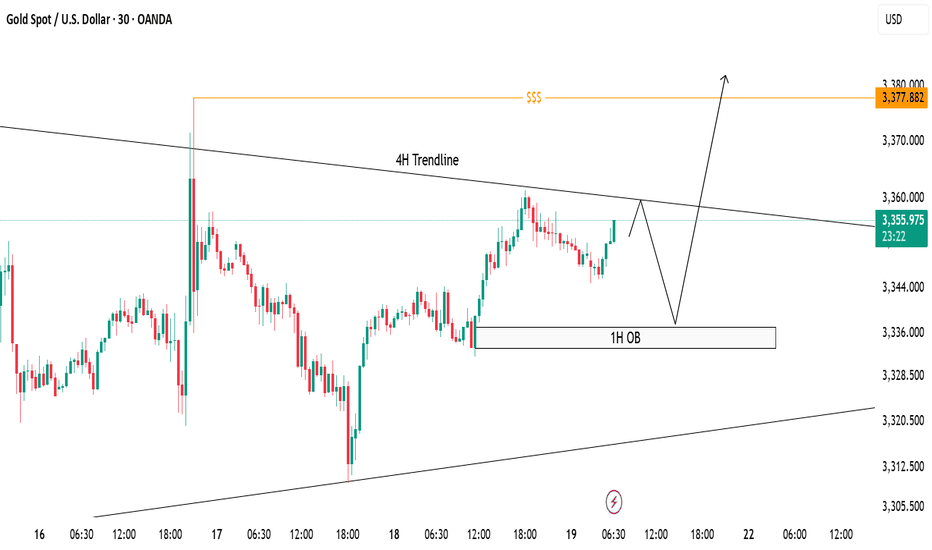

Gold Tapping Into Major Support – Eyes on Bullish ReversalPrice is currently retracing after a strong drop from recent highs. We're now approaching a key demand zone, aligning with:

📍 1H Order Block (OB)

📍 4H Trendline Support

📍 Liquidity Zone ($$$)

📉 If price taps into this area, it may offer a high-probability long setup.

📈 First target: 3380 (mid-range resistance)

🧱 If this breaks, we can look to scale in/add more positions, targeting the 4H trendline zone near 3420.

⚠️ Waiting for price reaction at support – patience is key!

Orderblocks

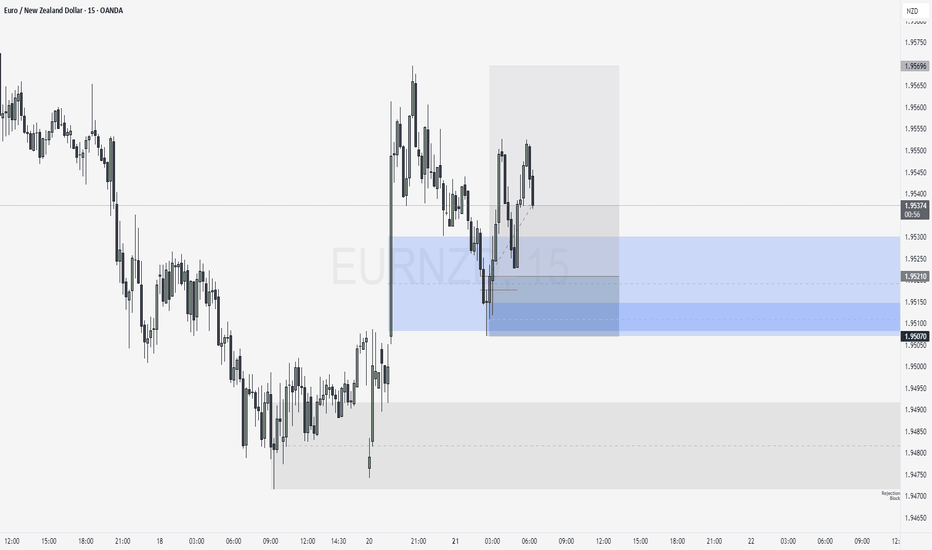

XAUUSD H1 BUYING SETUPScenario:

Gold is showing strong buying momentum 📈. The best entry points are around the H1 FVG (Fair Value Gap) and Order Block (OB) zones. Wait for confirmation signals in either of these areas.

Gold could take off 🚀 from the FVG or OB. Once you see confirmation in any of these zones, take the entry ✅.

Use a small lot size and follow strict risk management rules ⚠️💰.

Stay disciplined and trade smart! 🧠📊

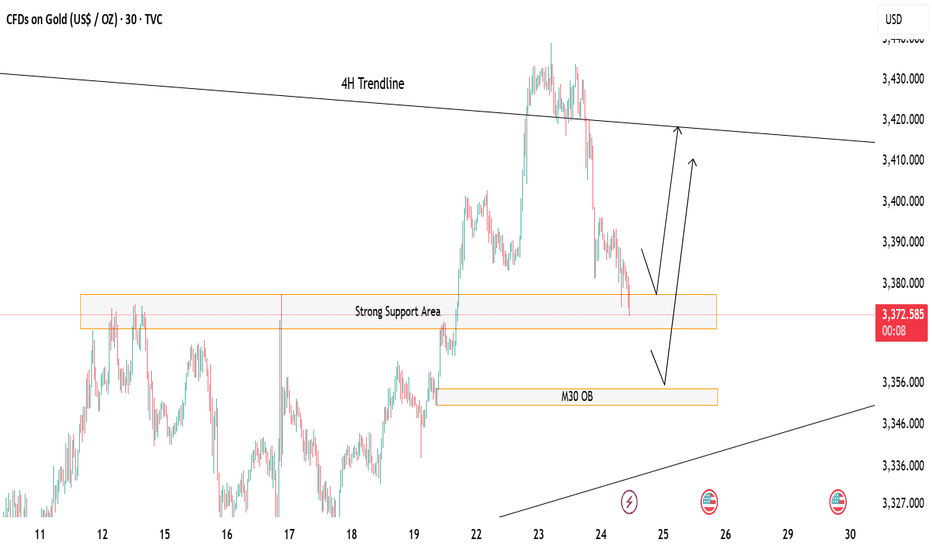

Gold at Key Decision Zone – Bounce or Break?Price is currently hovering above a strong support zone, showing potential for a short-term bounce. 🔁

If this zone holds, we could see a bullish reaction toward the 4H trendline resistance above. 📈

However, a break below may lead price to drop and tap into the M30 Order Block (OB) for a deeper mitigation before any move up. ⚠️

If this happen we could look for potential sell till the OB test otherwise the buying opportunity should focused more

🎯 Watch these key zones carefully – market is at a decision point!

Both buy and sell setups possible depending on how price reacts at these levels.

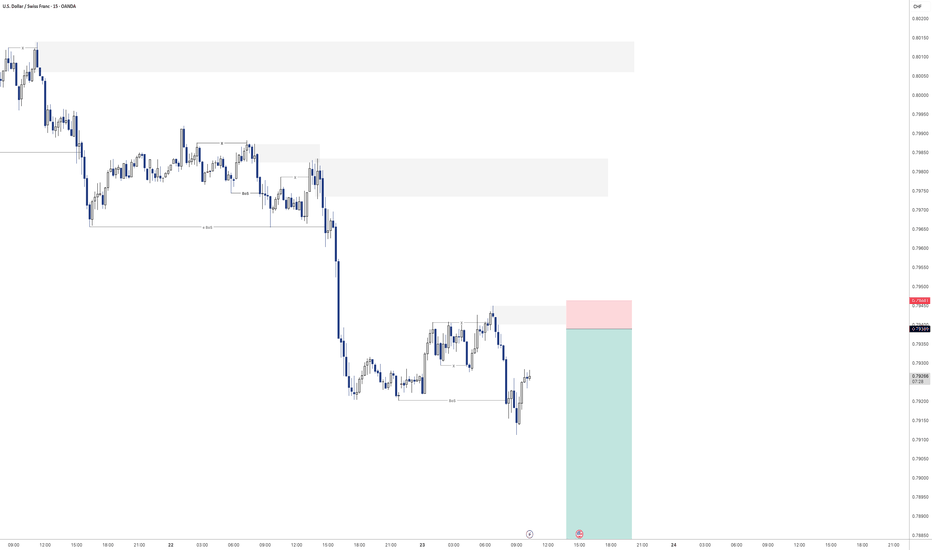

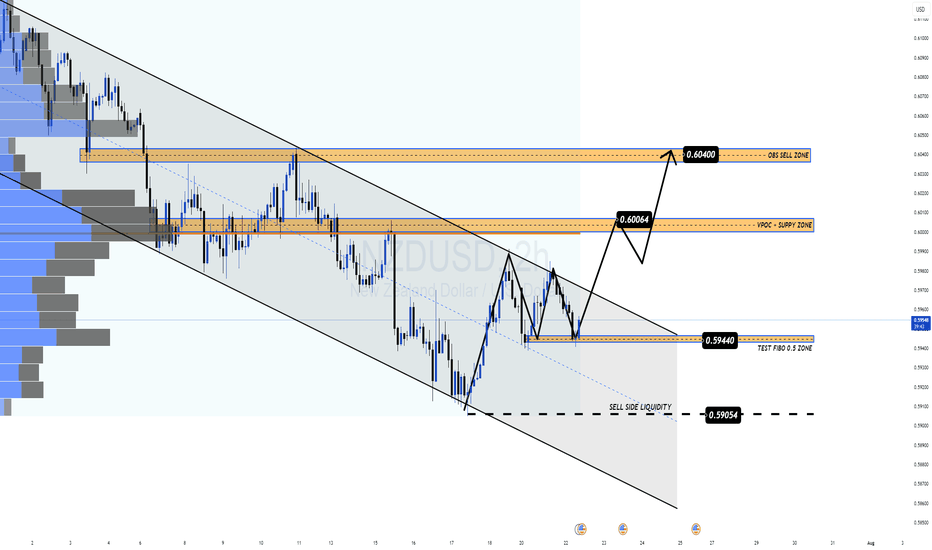

NZDUSD Is a Short-Term Rebound on the Table?NZD/USD is down nearly 0.4% in Tuesday’s European session, trading near the key support area of 0.5940 — a confluence of the 0.5 Fibonacci retracement and the midline of a descending channel. The pair is pressured by rising expectations that the RBNZ may cut rates in August, while the USD remains volatile amid uncertainty surrounding trade talks between the US and its key partners.

🔍 Technical Overview – Structure & Momentum

✅ Overall Trend: Bearish short-term (descending channel)

✅ Current Structure: Price is testing key technical support at 0.5940

✅ Volume Profile: VPOC and upper supply zones remain key targets on a bounce

NZD/USD continues to respect the bearish channel structure. However, the support zone at 0.5940 (Fibo 0.5 + recent demand) is showing signs of holding. If price sustains above this level, a bullish correction toward the 0.6006 and 0.6040 supply zones is a valid scenario.

🧭 Trade Scenarios

🔸 Bullish Short-Term Scenario (if 0.5940 holds):

Entry: Buy around 0.5940

TP1: 0.60064 (VPOC + supply zone)

TP2: 0.60400 (OBS sell zone)

SL: Below 0.5905 (sell-side liquidity break)

🔹 Bearish Continuation (if support breaks):

A clean break below 0.5905 confirms downside continuation

Look for retest and short entries targeting deeper channel lows (0.586x–0.583x)

⚠️ Macro Risk Drivers

Growing expectations of an RBNZ rate cut in August

Ongoing US trade negotiation uncertainty with key partners

Potential USD volatility around upcoming macroeconomic releases

📌 Key Price Levels to Watch

Technical Support 0.5940 Fibo 0.5 + mid-channel

Sell-Side Liquidity 0.5905 Bearish confirmation if broken

VPOC + Supply Zone 0.60064 First upside target

OBS Sell Zone 0.60400 Final bullish target / resistance

💬 The descending channel remains in control, but 0.5940 could be the key pivot. Wait for confirmation before entering, and watch volume closely.

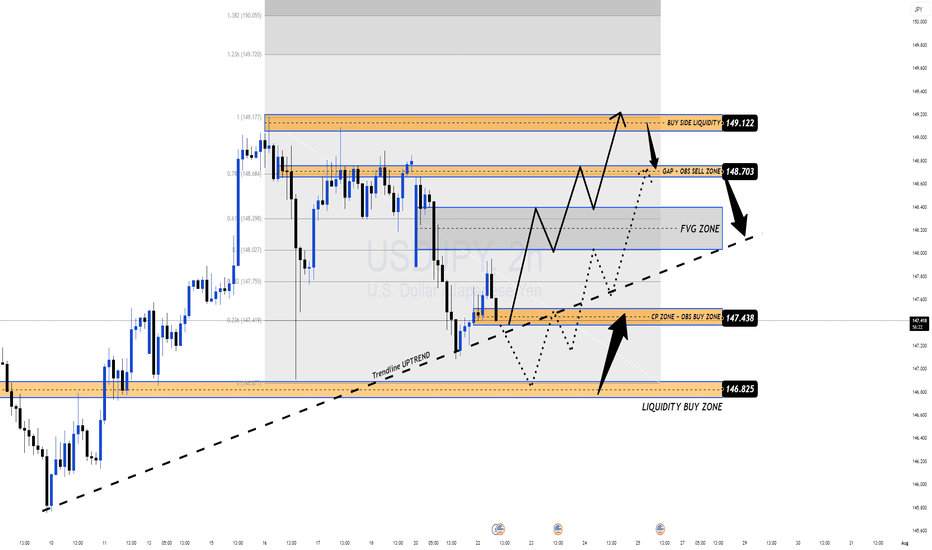

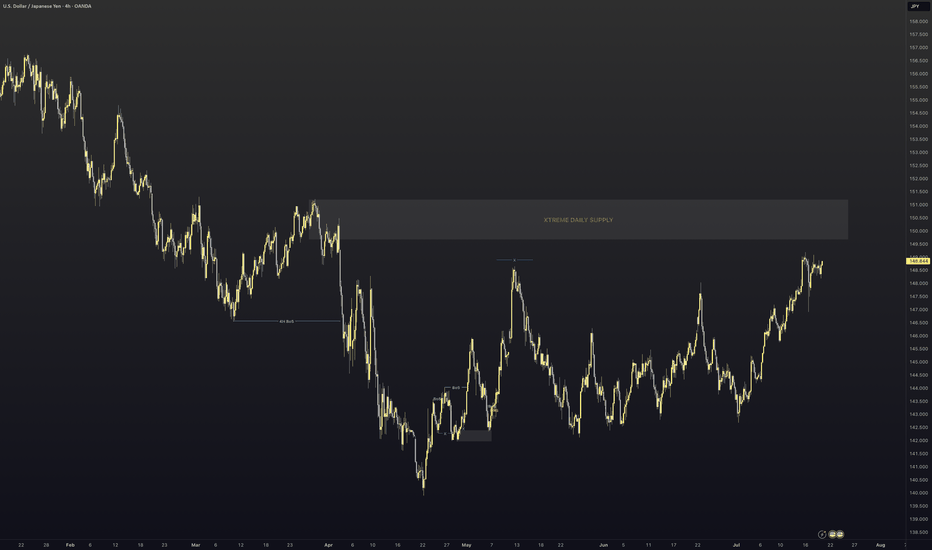

USDJPY Correction Complete, Is the Bullish Trend Back in play?After pulling back from the recent high near 149.17, USDJPY has shown signs of strength again, rebounding off the confluence support at the ascending trendline. The bullish narrative is supported by a hawkish FOMC tone and news that a U.S. federal court temporarily blocked Trump-era tariffs. The pair now awaits upcoming U.S. economic data for further directional clarity.

🔍 Technical Outlook – Structure & Momentum

✅ Primary trend: Bullish

✅ Correction phase: Completed near CP zone and trendline

✅ Key structural areas: FVG Zone, CP Zone, and trendline remain intact

Price has responded positively from the CP Zone + OBS Buy Zone around 147.438, aligning with the uptrend line. As long as this structure holds, buyers may push the market toward the next resistance zones.

🧭 Trade Scenarios

🔸 Bullish Bias (preferred scenario):

As long as price holds above 147.438, we expect continuation toward the FVG zone, with immediate targets at the GAP + OBS Sell Zone (148.703) and extended potential to the Buy-side Liquidity zone at 149.122.

A clean breakout above 149.122 opens the door to Fibonacci extensions: 149.72 and 150.05.

🔹 Bearish Scenario (if invalidated):

If price breaks below 147.438 and loses the trendline, we may see a deeper drop toward the Liquidity Buy Zone at 146.825, where strong buying interest is expected to re-enter the market.

⚠️ Macro Risk Drivers

Hawkish FOMC minutes continue to support USD strength

Paused trade tariffs reduce political headwinds, improving risk sentiment

Upcoming U.S. economic data could trigger sharp intraday moves → watch closely

📌 Key Price Zones

Liquidity Buy Zone 146.825 Major long re-entry zone

CP + OBS Buy Zone 147.438 Current active support

FVG Zone 148.20 – 148.68 Intraday bullish target

GAP + OBS Sell Zone 148.703 Short-term resistance

Buy-side Liquidity Zone 149.122 Final bullish objective

💬 Structure remains bullish unless the trendline breaks. Stay patient, wait for confirmations at key zones, and follow your plan with disciplined risk management.

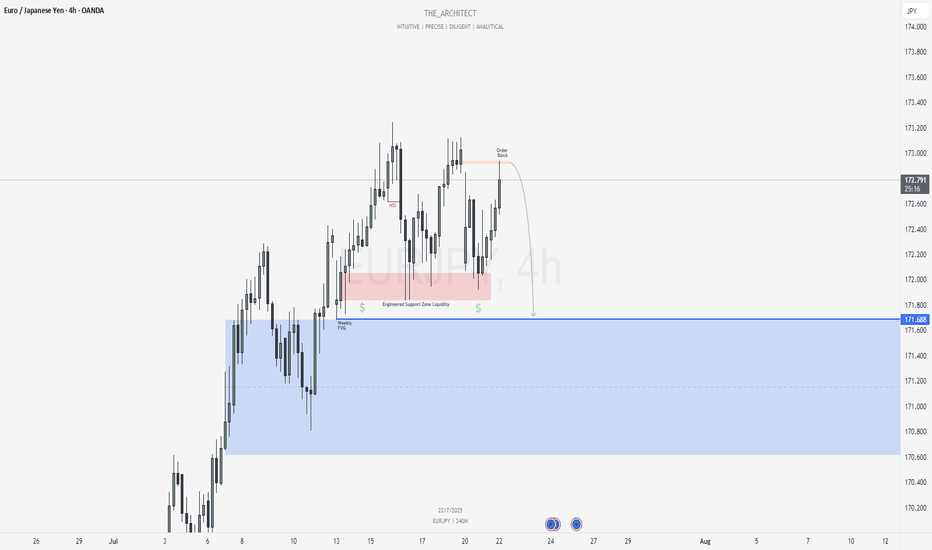

EURJPY: MSS on H4 Signals Bearish Shift Toward Weekly FVGGreetings Traders,

In today’s analysis of EURJPY, we observe that a Market Structure Shift (MSS) has recently occurred on the H4 timeframe, indicating a potential change in directional bias. This suggests that price may begin to draw toward the Weekly Fair Value Gap (FVG), presenting a favorable opportunity to align with bearish order flow.

Higher Timeframe Context:

The weekly timeframe currently shows an unfilled Fair Value Gap (FVG) to the downside, acting as the primary draw on liquidity. This macro bearish draw adds weight to the idea of shorting the pair from premium levels. On the H4—our intermediate timeframe—we now have structural confirmation via a bearish MSS, aligning the two timeframes toward downside targets.

Key Observations on H4:

Bearish Order Block in Premium: Price has recently retraced into an H4 bearish order block situated within premium pricing. This zone acts as institutional resistance and is currently showing signs of rejection.

Confirmation Zone: This H4 bearish order block is being monitored for M15 confirmation entries, as we look for price to break lower from this key institutional level.

Engineered Support & Resting Liquidity: Just above the weekly FVG lies an engineered support zone—characterized by equal lows—suggesting that liquidity has been pooled there. This area serves as a high-probability draw for institutional price delivery.

Trading Plan:

Entry Strategy: Seek lower timeframe (M15) confirmation around the H4 bearish order block before initiating short positions.

Targets: The first target lies at the H4 internal liquidity pool within discounted pricing. The longer-term objective is the weekly FVG, where liquidity is likely to be delivered next.

For a detailed analysis, please watch this weeks Forex Outlook:https://www.tradingview.com/chart/EURNZD/BZC9xW1L-July-21-Forex-Outlook-Don-t-Miss-These-High-Reward-Setups/

Maintain patience, follow your confirmation rules, and always adhere to sound risk management principles.

Kind Regards,

The_Architect 🏛️📉

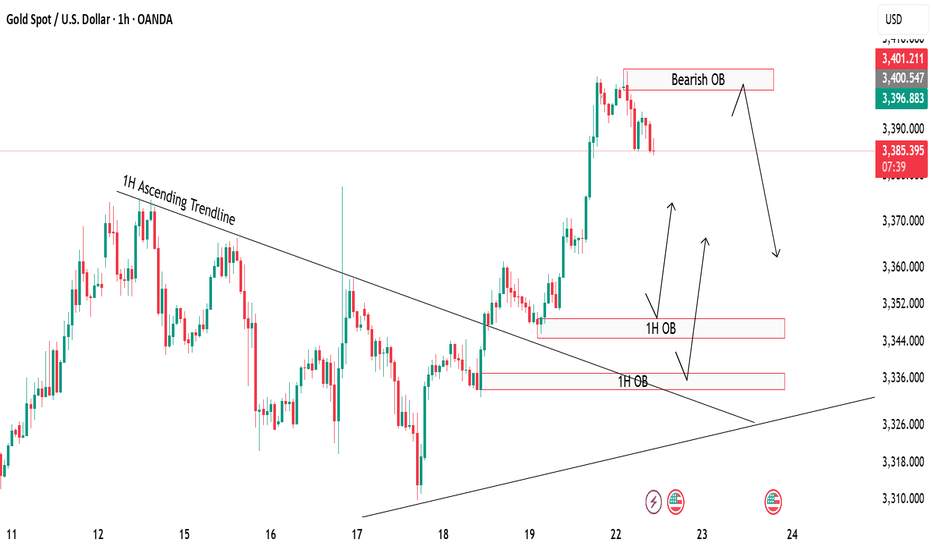

Gold Rejection & Retest Zones AnalysisGold has recently broken out of the 1H ascending trendline with a strong bullish push 🚀. After this breakout, we are now watching key supply and demand zones for the next move.

🔴 Bearish OB (3398-3404):

Price is currently hovering around the bearish order block, which could trigger some short-term rejection or pullback from this zone.

🟢 Bullish OB Zones (3350 & 3330):

If gold decides to correct lower, we have two important bullish OBs below, perfectly lining up with the previous trendline retest ✅. These zones can offer high-probability buy setups if price respects them.

🎯 Focus is on watching for possible rejections from the top OB, or waiting for a deeper retracement towards the bullish zones for buy confirmations

XAUUSD Trade Idea - 30m Structure with 4H ConfluenceCurrently, price is trading below the 4H descending trendline, respecting bearish structure on lower timeframe (30m).

✅ 1H Order Block (OB) marked between 3335-3340 remains a strong demand zone where price can bounce break the trendline to sweep liquidity above around 3377 to form bullish continuation.

📌 Scenarios I'm Watching:

Short-term rejection from the 4H trendline.

Potential reversal towards 1H OB.

Bullish reaction from OB could trigger a breakout above the 4H trendline.

Final upside target remains at the liquidity pool around 3377 zone ($$$).

🟣 Overall Bias: Bullish after liquidity sweep. Watching for bullish confirmation at OB before executing buys.

July 21, Forex Outlook : Don’t Miss These High-Reward Setups!Welcome back, traders!

In today’s video, we’ll be conducting a Forex Weekly Outlook, analyzing multiple currency pairs from a top-down perspective—starting from the higher timeframes and working our way down to the lower timeframes.

Pairs to focus on this Week:

EURUSD

USDJPY

AUDJPY

CADJPY

EURJPY

GBPCHF

USDCHF

NZDCHF

EURNZD

Our focus will be on identifying high-probability price action scenarios using clear market structure, institutional order flow, and key confirmation levels. This detailed breakdown is designed to give you a strategic edge and help you navigate this week’s trading opportunities with confidence.

📊 What to Expect in This Video:

1. Higher timeframe trend analysis

2. Key zones of interest and potential setups

3. High-precision confirmations on lower timeframes

4. Institutional insight into where price is likely to go next

Stay tuned, take notes, and be sure to like, comment, and subscribe so you don’t miss future trading insights!

Have a great week ahead, God bless you!

The Architect 🏛️📉

I'm currently long on EUR/GBPPrice is currently reacting to a retest of an order block located within the discount zone, following a Shift in Market Structure (SMS).

Additionally, on the weekly timeframe, price is also positioned in the discount zone, aligning with a weekly order block at the same level.

Disclaimer: This is not financial advice—just my personal analysis.

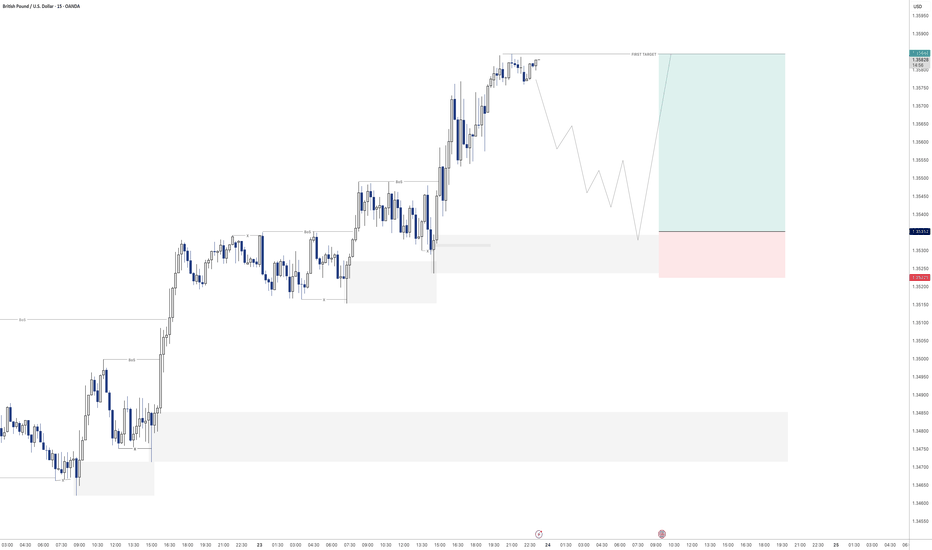

GBPUSD: Bearish > Bullish Order FlowAlright, we are approaching some Higher Timeframe Points of Interests. We got a Potential Bullish Bat Pattern Pattern this align with this Bullish H4 Order Block, that's right in the middle of an whole number 1.34. We could expect some spikes around the area, some complex pullbacks, but we must remain steady.

$RBCAA Looking to MoveNASDAQ:RBCAA was a pick from my July 1st, 2025 newsletter, along with $MCRI. They both had similar charts, and were both relatively flat since then. However, NASDAQ:MCRI had a single day 20% jump last week. I guess other folks are catching on. Its 50 day SMA has just recently crossed its 200 day SMA, giving us a golden cross. ROE has been increasing for 4 of the last the last 5 quarters, and the price seems to be bouncing off of it’s 50 day SMA and the baseline of its 3 year channel. Also, float has been decreasing since 2019.

Will it get a big bounce like NASDAQ:MCRI did last week? That remains to be seen, but I might be adding a little bit more to my current position.

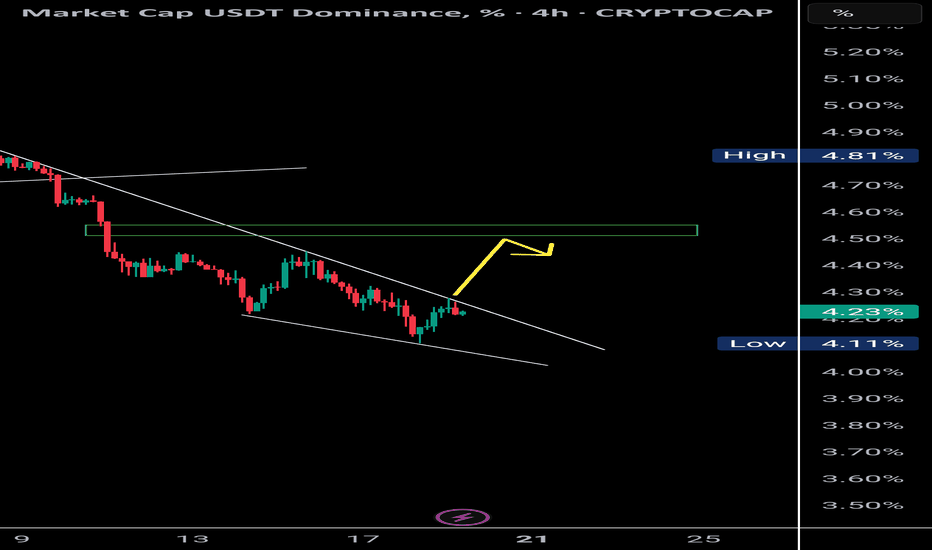

USDT Dominance Forming Bullish Divergence | Altcoins May Retest 📉 USDT Dominance (4H):

Currently forming a bullish divergence with RSI, supported by a falling wedge structure. Price is respecting a clear supply OB (resistance zone) and might retest the 4.55% level.

🔁 Historically, a rise in USDT.D signals short-term corrections in BTC and altcoins, creating opportunities for OB/supply fills and long setups.

📊 This could be the retest phase for major crypto assets before resuming upward momentum.

🧠 Use this phase wisely — it’s where strong setups begin to form.

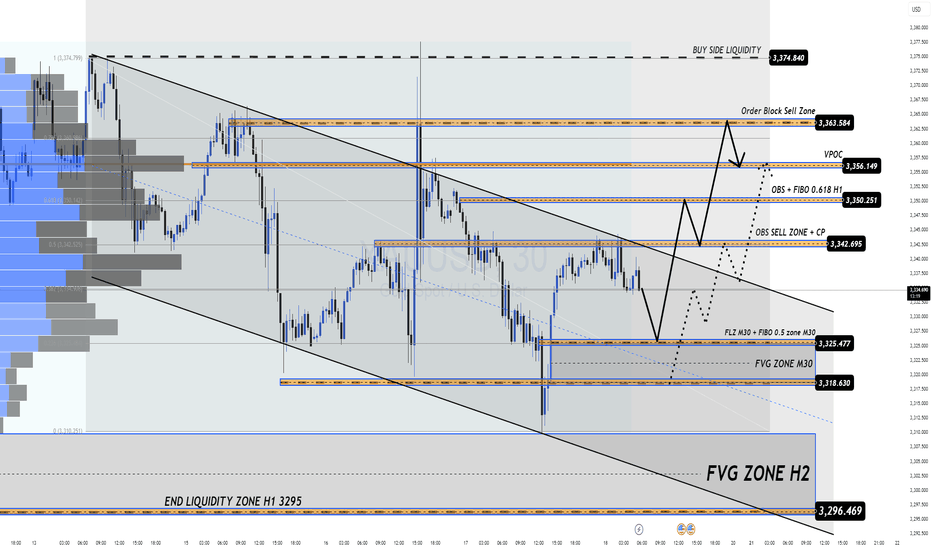

18/07 Gold Outlook Market Tensions Mount Liquidity Zones in Play Gold Outlook – Market Tensions Mount, Liquidity Zones in Play

Price action heats up as we enter the final trading day of the week. Are you ready to ride the wave or get caught in the liquidity sweep?

🔍 Market Sentiment & Global Highlights

Gold rebounded strongly after dropping on better-than-expected US data. However, several macro risks are keeping gold buyers in the game:

Buy-the-dip activity emerged amid concerns that Trump’s tariff policies may fuel inflation.

Rate cut expectations remain strong as US core inflation shows no signs of cooling.

Geopolitical risks intensified as Israel conducted fresh airstrikes on Syria.

EU threatens $84B in tariffs on US goods should trade talks break down.

💡 These tensions are giving gold strong support — especially as traders prepare for potential volatility into the weekend.

📈 Technical Overview – Liquidity Zones at Play

Yesterday's bounce from FLZ H2 (3310) — a critical demand and liquidity zone — triggered a clean reversal. Sellers took profit, volume shifted, and buyers regained control. Price has since pushed up to retest the OBS SELL ZONE + CP Pattern near the 334x area with a sharp reaction.

For today, price is likely to revisit lower liquidity pockets (M30–H2) before making the next directional move.

🔑 Key Levels to Watch

🟢 BUY ZONE: 3318 – 3316

Stop Loss: 3312

Take Profits: 3322 – 3326 – 3330 – 3335 – 3340 – 3345 – 3350 – 3360+

⚡ BUY SCALP ZONE: 3326 – 3324

Stop Loss: 3320

Take Profits: 3330 – 3335 – 3340 – 3345 – 3350 – 3360

🔴 SELL ZONE: 3363 – 3365

Stop Loss: 3370

Take Profits: 3360 – 3355 – 3350 – 3346 – 3342 – 3338 – 3335 – 3330

⚠️ Final Notes

Today’s session has no major news releases, but as it’s the end of the week, we may see liquidity grabs and unexpected volatility. Stay disciplined, stick to your plan, and always respect TP/SL.

🔔 Follow the key zones carefully – volatility loves indecision.

Volume Gaps and Liquidity Zones: Finding Where Price Wants to GoDifficulty: 🐳🐳🐳🐋🐋 (Intermediate+)

This article is best suited for traders familiar with volume profile, liquidity concepts, and price structure. It blends practical trading setups with deeper insights into how price seeks inefficiency and liquidity.

🔵 INTRODUCTION

Ever wonder why price suddenly accelerates toward a level — like it's being magnetized? It’s not magic. It’s liquidity . Markets move toward areas where orders are easiest to fill, and they often avoid areas with little interest.

In this article, you’ll learn how to identify volume gaps and liquidity zones using volume profiles and price action. These tools help you anticipate where price wants to go next — before it gets there.

🔵 WHAT ARE VOLUME GAPS?

A volume gap is a price region with unusually low traded volume . When price enters these areas, it often moves quickly — there’s less resistance.

Think of a volume gap as a thin patch of ice on a frozen lake. Once the market steps on it, it slides across rapidly.

Volume gaps usually show up on:

Volume Profile

Fixed Range Volume tools

Session or custom volume zones

They’re often created during impulsive moves or news events — when price skips levels without building interest.

🔵 WHAT ARE LIQUIDITY ZONES?

Liquidity zones are price areas where a large number of orders are likely to be sitting — stop losses, limit entries, or liquidation levels.

These zones often form around:

Swing highs and lows

Order blocks or fair value gaps

Consolidation breakouts

Psychological round numbers

When price approaches these areas, volume often spikes as those orders get filled — causing sharp rejections or breakouts.

🔵 WHY THIS MATTERS TO TRADERS

Markets are driven by liquidity.

Price doesn’t just move randomly — it hunts liquidity, clears inefficiencies, and fills orders.

Your edge: By combining volume gaps (low resistance) with liquidity zones (target areas), you can forecast where price wants to go .

Volume gap = acceleration path

Liquidity zone = destination / reversal point

🔵 HOW TO TRADE THIS CONCEPT

1️⃣ Identify Volume Gaps

Use a visible range volume profile or session volume. Look for tall bars (high interest) and valleys (low interest).

2️⃣ Mark Liquidity Zones

Use swing highs/lows, OBs, or EQH/EQL (equal highs/lows). These are magnet areas for price.

3️⃣ Watch for Reactions

When price enters a gap, expect speed.

When it nears a liquidity zone, watch for:

Volume spike

Wick rejections

S/R flip or OB retest

🔵 EXAMPLE SCENARIO

A strong bearish move creates a volume gap between 103 000 – 96 000

Below 96 000 sits bullish order blocks — clear liquidity

Price enters the gap and slides fast toward 96 000

A wick forms as buyers step in, volume spikes — the reversal begins

That’s price filling inefficiency and tapping liquidity .

🔵 TIPS FOR ADVANCED TRADERS

Use higher timeframes (4H/1D) to define major gaps

Look for overlapping gaps across sessions (Asia → London → NY)

Align your trades with trend: gap-fills against trend are riskier

Add OB or VWAP as confirmation near liquidity zones

🔵 CONCLUSION

Understanding volume gaps and liquidity zones is like reading the market’s intention map . Instead of reacting, you start predicting. Instead of chasing, you’re waiting for price to come to your zone — with a plan.

Price always seeks balance and liquidity . Your job is to spot where those forces are hiding.

Have you ever traded a volume gap into liquidity? Share your setup below

Gold 15-Min Chart Analysis Alert!Gold has successfully broken above the descending trendline, showing early signs of bullish momentum. Price has reclaimed structure and is now trading above the breakout level.

📌 Retest Zone:

We can expect a possible pullback towards the marked zone for a healthy retest before continuing the upward move.

🎯 Bullish Target:

As long as price holds above the support area, the bullish bias remains intact with targets around 3351+.

FDAX Today 1. Wave (3) likely near completion:

Price hit the 1.618 extension of Wave 1, which is textbook for a Wave 3 target.

There’s also confluence with the 23.6% retracement from the previous swing high (24,703), and we're near a Bearish FVG + Order Block zone.

High-probability zone for a short-term rejection or distribution top.

2. Wave (4) could start today

If Wave 3 is topping into OpEx, dealers might unwind long gamma hedges, contributing to volatility + pullback.

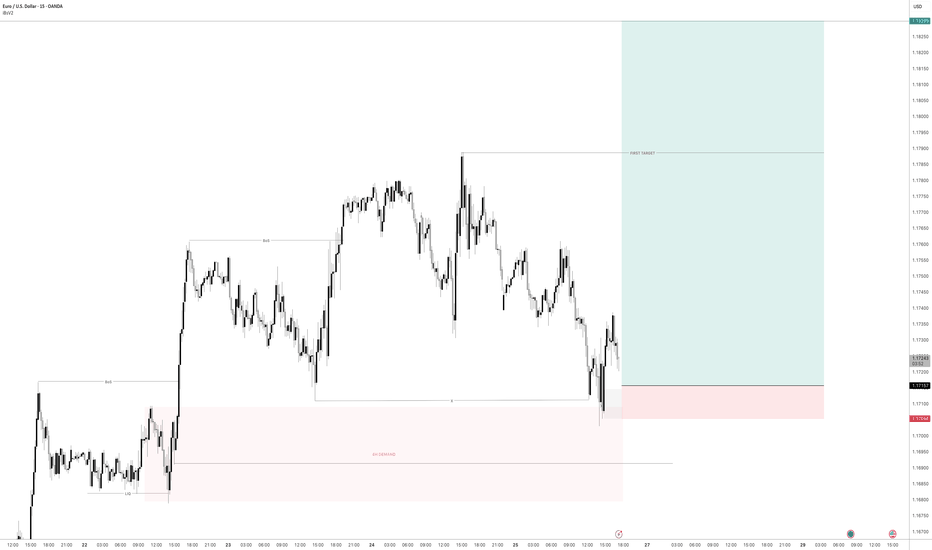

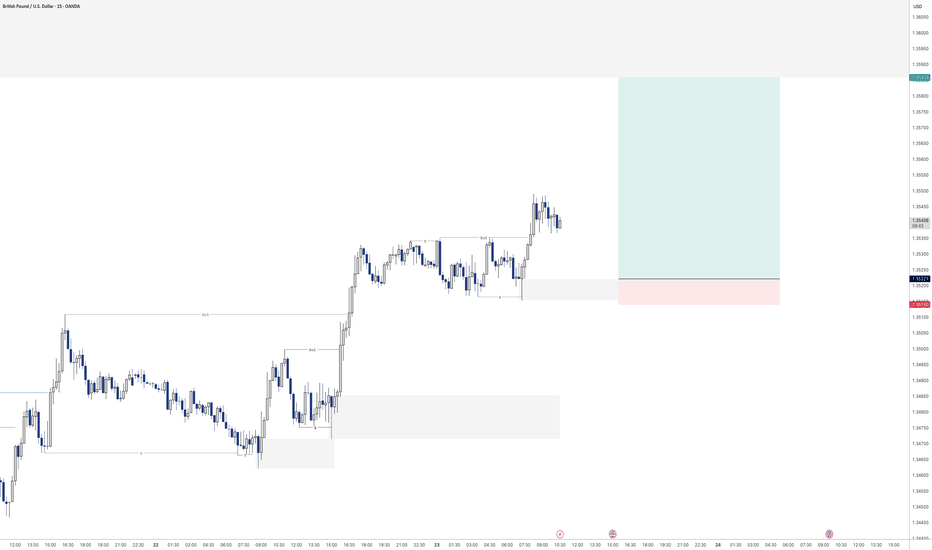

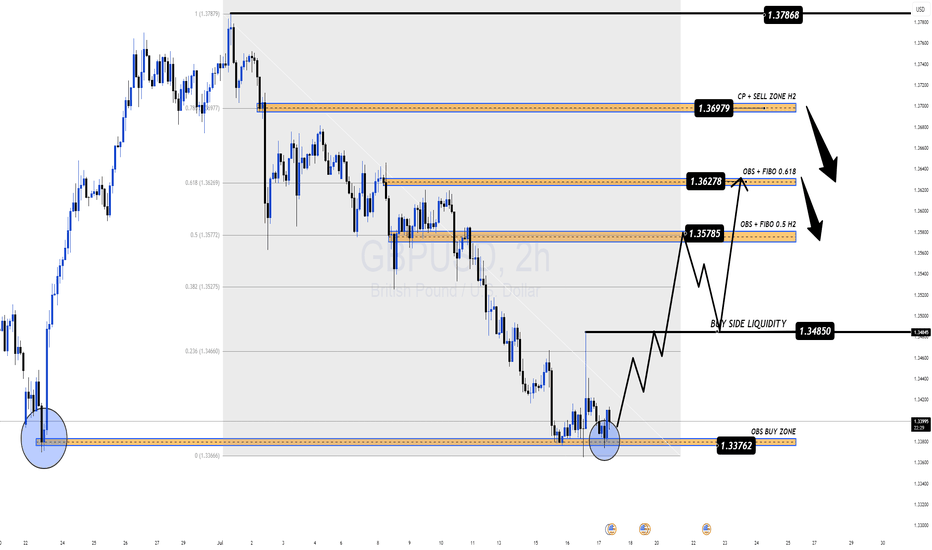

Sterling Rebounds But Faces Heavy Resistance Ahead GBP/USD Outlook – Sterling Rebounds But Faces Heavy Resistance Ahead

🌐 Macro Insight – UK Labour Data Mixed, Trump Headlines Stir Market

The British Pound (GBP) regained some lost ground against the U.S. Dollar after the UK labour market data revealed mixed signals:

Wage growth cooled as expected, suggesting a potential easing in inflationary pressures.

UK ILO Unemployment ticked up to 4.7%, raising concerns about labour market fragility.

Meanwhile, in the U.S., President Trump denied reports about firing Fed Chair Powell, briefly easing tensions and stabilizing USD demand.

With both currencies facing mixed narratives, GBP/USD is set for a pivotal move, and traders should stay alert to key liquidity zones and order blocks.

🔍 Technical Setup – MMF + Smart Money Framework

On the H2 chart, GBP/USD has reacted from the OBS BUY ZONE at 1.3376, bouncing with a bullish structure and forming a potential continuation pattern. Price is now expected to target key zones above, where significant order blocks and Fibonacci confluence reside.

⚙️ Key Resistance Zones:

1.3578 – 0.5 Fibonacci Retracement + OBS

1.3627 – 0.618 Fibonacci + Supply Zone

1.3697 – CP Continuation Pattern + H2 Order Block

These areas represent institutional interest for potential sell setups.

✅ Trade Plan for GBP/USD

🟢 BUY ZONE: 1.3376 – 1.3398

SL: 1.3360

TP: 1.3450 → 1.3485 → 1.3530 → 1.3578 → 1.3627

Look for bullish structure confirmation before entering. Target the next liquidity highs and imbalance zones.

🔴 SELL ZONE: 1.3627 – 1.3697

SL: 1.3735

TP: 1.3580 → 1.3530 → 1.3480

Watch for rejection and bearish divergence at supply areas to time potential swing shorts.

🧠 Strategy Notes

This setup combines MMF zones with institutional volume and price action concepts. The pair is currently reacting to a deep discount zone and may climb toward premium levels where selling pressure awaits. Be cautious during New York session volatility, especially with potential U.S. policy headlines and upcoming global inflation data.

🗨 What’s Next?

Are bulls ready to reclaim control or will resistance zones cap this recovery? Drop your ideas below and don’t forget to follow for more institutional-grade insights powered by MMF methodology.