Orderblocks

XAUUSD Weekly AnalysisAccording to latest Gold Weekly analysis ,the price had entered an important Bullish Order Block. By this movement we expected this range to prevent Gold from Downward trend further.. In the last two weeks , When the price entered the 1690$ range , it faced a positive reaction and this order block was finally able to stop the heavier Fall! during this week ,If the weekly candle closes above 1730$, we can expect a new upward trend in the price , whose mid-term target can be in the range of 1800$ to 1830$! Hope this analysis was useful to all the traders.

Nasdaq Setup 4hr: Bullish momentum, as we can see price creating HH and HL's.

1hr: We can see price moving bullish. We do see change of price from around 12300 moving bullish.

30min: We can see price suddenly shot to the upside. Price is being induced into the market therefore leaving an Order Block.

15min: A refined Order Block, clearly showing how price has reacted from that area of interest.

5min: On this chart we can see an Order Block has been created inside of our 15min Order Block. This is a confirmation that this Order Block could serve it's purpose. We just need to wait for price to return to these areas before we take trades.

Overall, I will be waiting to see how price reacts to my significant areas and levels before deciding to take trades.

We are ideally looking for Bearish opportunities , but Should price decide to move in the opposite direction... We are ready to take part in that opportunity.

Sandbox - Long playWhat I want for a long on Sand - especially given the relative strength were seeing now in the market today.

A retest of demand (grey box) where we broke previous MS and have triggered a micro trend reversal for now would be my entry. This grey box lines up with the break of MS and also the 618 fib level of the recent move off the local bottom (the sweet spot).

Then want to see a strong reaction to punch above resistance from prior bearish consolidation and back INTO the range. If we don't get a strong reaction I will start to debate if this momentum is real or not (what we're seeing on other coins atm).

Tight SL would be set below the low or just below where we broke the market structure.

Or we punch sooner and I don't get filled, have to keep this in mind as well.

V

Topglove. Where is its orderblock & CHoCH lvl? 9/Sept/22Topglove “Conservative” traders may wait price to break RM1.140 which is CHoCH level ( subwave wave B (yellow) of last impulsive wave 5 ( Cyan Circled) to “ confirm the “long term” downtrend is “game over “ and waiting to buy at “pullback “ after the “ break out.”

Gold. Its OB, And more importantly where its CHoCH? 9/Sept/22Gold. As a “contribution” to tradingview ( many thanks to tradingview for providing such a good free charting platform) community ( Today I’m going to share my own interpretation of OB ( order blocks), and most importantly where is the “exact “ location/pivot/level of CHoCH ( change of character)?. A concept with BOS ( break of structure) which has been used by advanced naked/ Price action trading traders without any indicators. . It will cut “novice traders” learning curve from 3-5 years even 10 years where they are searching for “holy grail “ trading system/indicators..The biggest question for this concept of trading will be “where” is the exact location of CHoCH? ( change of character = change of “previous underlying trend” )..The “ANSWER” is! = at subwave b of any last leg of impulsive wave which is wave 5. < p/s unlike conventional Elliottwave rule there is ONLY abc subwaves “inside” any impulsive wave..> Last but least many thanks to @makuchaku and @Efe for coding the such a great “super OrderBlock..” script/ indicator which help us/traders to “visualize “ where is OB, FVG Although we still need to find where is “CHoCH” “manually”..

EURUSD to the Ground, DXY to the Moon!I've called out stronger Dollar for months, and all targets have been reached. Go through my old posts to see previous markets being called out. And now, lets do it again... :)

DXY ANALYSIS:

Interest Rates:

The FED just raised the Interest Rates from 1,750 % up to 2,500 %. That gives us a Long-Term view on how Banks and Institutions are positioned in the marketplace.

The Interest Rates Market is the biggest and most important market, so that's why we follow it. It's like the father of all markets, whereas the forex market, stock market, futures market, crypto markets are its kids.

Bonds & Yields:

The Bond Market is inversely correlated with DXY.

Bonds just rebalanced and fully filled its Monthly Premium FVG. The Monthly candle also closed below a Bullish candle, and that Bullish candle should act as an OB for price to remain below.

If Bonds are poised to go Lower, Yields will increase. And price chases yield. I'm seeing the US30Y Yield reach up to 4,0 % and then potentially up to the equal highs at 4,852 %.

So in short:

I'm Bearish on the Bonds, and Bullish on the Yield - which both indicate that DXY will go higher.

Commodities :

Using the Gold Futures chart (GC1!), I'm expecting the Equal Lows to get taken out to at least around 1680.

If Golds go DOWN, DXY will then go UP...

(I didn't include the Bond Market/Yield, nor Golds in this chart as it took up too much space on the chart. Go to your own chart yourself and you'll see what I'm pointing at in these markets).

DXY :

On DXY chart, next target is a FVG where we might see some sensitivity, and should it get breached to the upside - the next target for DXY is the Equal Highs (they also have a LRLR signature, meaning itæs easy to go to and through them).

123.00 looks like a good area to sweep. I'd be content with that.

-------

EURUSD:

Obviously, EURUSD and DXY are inversely correlated. So when one goes up the other one goes down.

So again, I have a strong bias for DXY to go UP, which means EURUSD should go DOWN...

Nice Sellside Liquidity Pool at 0.83540. I wanna see it sweep and reach down into 0,8000.

As of from today where price currently is, I have a 2100+ pip target for EURUSD.

...

So travel to USA before it's too late when the Dollar is super expensive lol

EURUSD: No Man's Land 🔄From a swing trader perspective, price is currently in no man's land. ⚠️

I would advise not looking for long-term swing opportunities until the price has either:

1 ) Swept liquidity from the un-mitigated supply and last swing high. (Sell Opportunity)

2) Swept liquidity from the mayor monthly order block low. (Buy Opportunity)

With the majority of the market sentiment buying, I assume price will just continue to drop to gather more and more likely, but whatever comes first I will take with my team.

Until then we must sit on our hands and make the most of some intra-day scalps.

Good luck trading this week guys! ✅

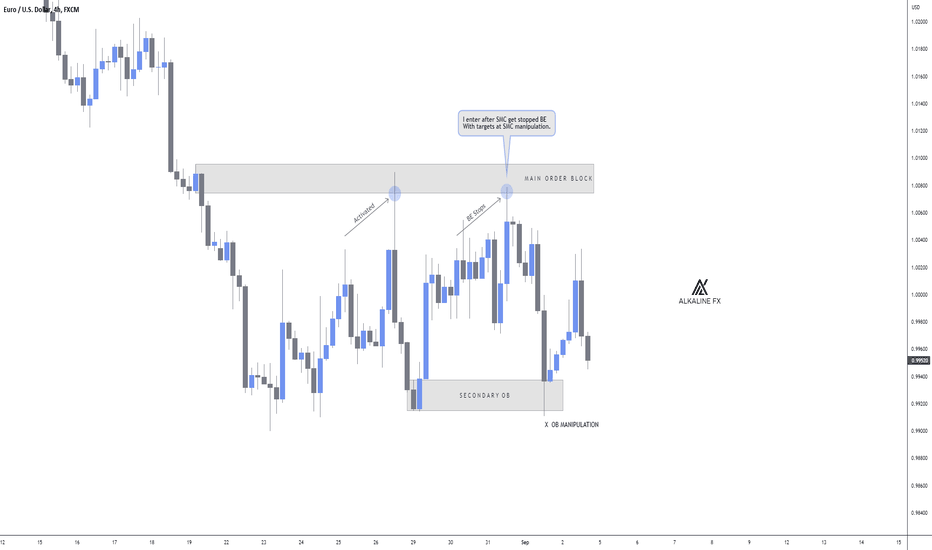

Smart Money Manipulation 🥊Alkaline is back baby! 💣

As smart money concepts gain popularity, liquidity increases.

I have taken a month away from trading to study the new forms of market manipulation and have been pleasantly surprised by what I have found.

Here is my discovery:

1) The market is currently focusing on taking liquidity from breakeven positions over fixed stop losses.

This is because emotional traders put their stops to BE quickly to avoid pain, especially during indecisive markets.

2) Order blocks are the perfect manipulation areas.

If you take time out to backtest significant order blocks, you will notice price will tap and lure or simply sweep above/below the zone before going in the intended direction.

3) That tight stop loss you are using is doing more damage than good.

Scale into your positions, trust me when I say this will reduce your emotions and give you a more relaxed trading style.

4) Use your brain, even if you are in denial.

If the majority of traders lose money, and the majority of traders now use smart money concepts, do the maths.

It feels good to be back after a long month of studying, I have lots of new things to teach and share.

I will be taking on new students shortly, have a great weekend everyone 👋