"ORDI/USDT: Pirate’s Treasure Trade! Bullish & Loaded"🚨 ORDI/USDT HEIST ALERT! 🚨 ORDI/USDT Bullish Raid Plan (Thief Trading Style) 💰🎯

🌟 Attention Market Pirates & Profit Raiders! 🌟

🔥 Thief Trading Strategy Activated! 🔥

📌 Mission Brief:

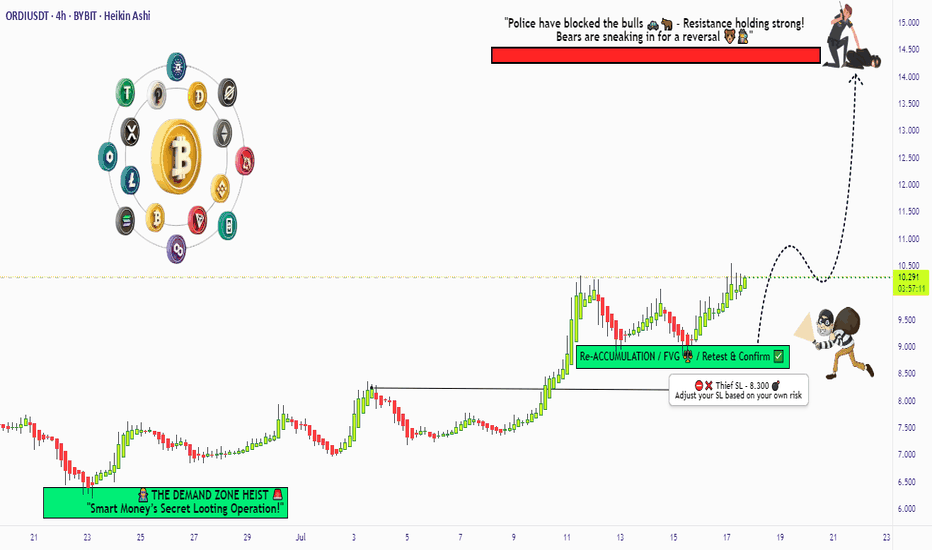

Based on our elite Thief Trading analysis (technical + fundamental heist intel), we’re plotting a bullish robbery on ORDI/USDT. Our goal? Loot profits near the high-risk resistance zone before the "Police Barricade" (bear traps & reversals) kicks in!

🚨 Trade Setup (Day/Swing Heist Plan):

Entry (📈): "The vault is open! Swipe bullish loot at any price!"

Pro Tip: Use buy limits near 15M/30M swing lows for safer pullback entries.

Advanced Thief Move: Layer multiple DCA limit orders for maximum stealth.

Stop Loss (🛑): 8.300 (Nearest 4H candle body swing low). Adjust based on your risk tolerance & lot size!

Target (🎯): 14.400 (or escape early if the market turns risky!).

⚡ Scalper’s Quick Loot Guide:

Only scalp LONG!

Rich thieves? Go all-in! Broke thieves? Join swing traders & execute the plan slowly.

Use trailing SL to lock profits & escape safely!

💎 Why ORDI/USDT? (Fundamental Heist Intel)

✅ Bullish momentum in play!

✅ Macro trends, & intermarket signals favor upside!

✅ News-driven volatility? Expect big moves!

⚠️ WARNING: Market Cops (News Events) Ahead!

Avoid new trades during high-impact news!

Trailing stops = Your best escape tool!

💥 BOOST THIS HEIST!

👉 Hit LIKE & FOLLOW to strengthen our robbery squad! More lucrative heists coming soon! 🚀💰

🎯 Final Note: This is NOT financial advice—just a thief’s masterplan! Adjust based on your risk & strategy!

🔥 Ready to Raid? Let’s STEAL Some Profits! 🏴☠️💸

👇 Drop a comment & boost the plan! 👇

(🔔 Stay tuned for the next heist!) 🚀🤫

ORDIUSD

ORDI (SPOT)BINANCE:ORDIUSDT

#ORDI/ USDT

Entry(6.450- 7.300)

SL 1D close below 6.100

T1 10.470

T2 17.000

T3 19.000

1 Extra Targets(optional) in chart, if you like to continue in the trade with making stoploss very high.

______________________________________________________________

Golden Advices.

********************

* collect the coin slowly in the entry range.

* Please calculate your losses before the entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

ORDIUSDT Hanging by a Thread Before the Next Leg Down?Yello Paradisers! Are you ready for the next big move on #ORDIUSDT? Because if you’re not already positioned or thinking three steps ahead, this structure could catch you off guard. We’re seeing signs of exhaustion, and the market is setting up for another potential drop. Here’s what you need to know before it's too late.

💎#ORDIUSDT remains in a clear downtrend, printing consistent lower highs and lower lows. Each rally is weaker than the last, and buyers have failed to break above key resistance zones. After the most recent failed bounce into the 7.28–7.51 area—where support has now flipped to resistance—sellers regained control and pushed price back below the 21 EMA. This confirms the

bearish momentum remains dominant and is high probability to go further down.

💎The structure continues to print classic breakdown signals. Multiple breaks of structure (BOS) further validate the downtrend. As long as price remains under the 8.47 invalidation level, there's no technical reason to consider a bullish scenario. Any short-term bounce into resistance is more likely to be a selling opportunity rather than a reversal signal.

💎If price continues lower from here, we’re watching the support levels at 6.46 and then the major support level between 5.79–5.53. A sweep of those levels could trap late shorts, but until we see a confirmed shift in market structure, our bias remains bearish. Patience will be rewarded here.

💎This is a classic scenario where retail traders often get chopped up. The real move comes after both sides get squeezed. Don't be part of the noise.

Strive for consistency, not quick profits. Treat the market as a businessman, not as a gambler. The downtrend is clear, but only disciplined traders will be able to extract profits here without emotional mistakes. Stay sharp, stay strategic, and above all—stay safe, Paradisers.

MyCryptoParadise

iFeel the success🌴

ORDIUSDT heading to weekly supportORDIUSDT is currently trending down after hitting the weekly resistance WR1.

The price is likely to head to weekly support WS1. This support is going to hold the price and provide the bounce.

I believe, the price is very likely to bounce from WS1 and then move upward and on this attempt it may break weekly resistance WR1.

I will share the update once we have the price bounce from WS1 and trading around WR1.

ORDI buy/long setup (2H)Notice: This coin is highly volatile and somewhat risky—trade with caution.

After a sharp drop, it has formed a ranging zone. As long as no candle closes below the previous low, we can look for buy/long positions in the lower order blocks, as there are sell orders in the swap zone and above, aiming to push the price lower.

Note: Enter positions only within the demand zone, not higher.

Targets are marked on the image.

A daily candle closing below the invalidation level will invalidate this analysis.

Do not enter the position without capital management and stop setting

Comment if you have any questions

thank you

ORDI roadmap (1D)From the point where we placed the red arrow on the chart, it seems that ORDI's correction has begun.

This correction appears to be a diametric pattern, and we are currently in wave E of this diametric, which is a bearish wave.

The green zone represents a low-risk area for buy/long positions.

If the price reaches the green zone during wave E, we can enter buy/long positions. However, if it reaches this zone after completing wave F, we will not proceed with buy/long.

The closure of a daily candle below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

Can #ORDIUSDT Bulls Sustain this Bullish Momentum or Not?Yello, Paradisers! Can #ORDIUSDT bulls sustain the current bullish momentum or not? Let's look at the latest analysis of #ORDI to see what's happening:

💎#ORDI is trading within a descending channel formation, a clear technical pattern indicating a persistent downtrend over the past months. With the price breaching descending resistance near the channel, the upcoming movements will be decisive in shaping ORDI’s trajectory for the foreseeable future.

💎The immediate resistance to watch is $66.20, which aligns with the descending channel’s upper boundary. A daily close above this resistance level would confirm a breakout, signaling the potential beginning of a bullish trend reversal. Such a move could drive the price toward the major resistance zone near $100, attracting fresh buyers and sparking renewed market confidence.

💎On the other hand, failure to break above $66.20 could result in the price retracing toward the $35.85 support level, which has previously acted as a strong demand zone. A bounce from this level would provide bulls another opportunity to reclaim momentum and challenge the resistance once again.

💎However, if ORDI closes below the $29.19 demand zone, it would invalidate any bullish case, paving the way for further downside. In this scenario, we could witness an extended drop toward lower levels around $18, reinforcing the bearish outlook and shaking out weak hands.

Stay focused, patient, and disciplined, Paradisers🥂

MyCryptoParadise

iFeel the success🌴

ORDI potential ORDI / USDT

This coin is belonging to BTC ecosystem !

In last BTC surge just before the 7 months sideway this coin was pumping hard along with BTC and other BRC20 coins

Its possible that when BTC start flying hard above 100k this coins to pump hard again if that scenario happens

Best of wishes

#ORDI (SPOT) entry range (22.00- 30.20) T.(70.27) SL (20.72)BINANCE:ORDIUSDT

Keep the order in entry range & waiting for the price to come to fill your order

entry range (22.00 -30.20 )

Target1 (40.50)- Target2 (58.5) - Target3 (70.27)

SL .1D close below (20.72)

*** Collect slowly in the entry range ****

*** This trade is short time investment ****

**** #Manta ,#OMNI, #DYM, #AI, #IO, #XAI , #ACE #NFP #RAD #WLD #ORDI #BLUR #SUI #Voxel #AEVO #VITE #APE #RDNT #FLUX #NMR #VANRY #TRB #HBAR #DGB #XEC #ERN #ALT #IO #ACA ****

ORDI price has started to growToday, CRYPTO:ORDIUSD price has broken out quite nicely.

Considering that before that, OKX:ORDIUSDT price came and traded well in the $25-28 purchase zone, which was written about 5 months ago:

🛍 Those who are cautious can keep an eye on this asset and wait for a confident consolidation above $33

🍿 And the brave can take and wait for happiness in growth to $70)

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

Buy ORDI Technical Analysis of ORDIUSDT 📈

Key Price Levels:

- $40.65: Starting point of the downward trend.

- $32.42: Support level where the price bounced back after a decline.

- $34.54: Entry point for buyers to enter the market.

Entry and Exit Points:

- Entry Point: $34.54. This level can act as a strong support zone. Buying at this level may reduce risk and increase the potential for price growth. 🚀

- Exit Points:

- $36: First price target. 🎯

- $38.47: Second price target.

- $40.10: Third target, which may serve as a strong selling point.

- Stop Loss: $32.98. This level can be used as a stop-loss to manage risk effectively. ⚠️

Price Patterns:

In the ORDIUSDT chart, various patterns can be observed:

- Fork Pattern: Indicates a potential reversal move. 🔄

Support and Resistance:

- $32.42: Support level.

- $38.47 and $40.10: Resistance levels. ⬆️⬇️

This analysis can help traders make informed decisions regarding buying and selling ORDIUSDT and capitalize on market fluctuations. For further details, you can refer to platforms like TradingView or specialized cryptocurrency analysis websites.

#ORDI entry range ( 26.73 - 28.19) for 20% profit (34.22)#ORDI

entry range ( 26.73 - 28.19)

20% Target (34.22)

SL .4H close below 25.66

#ORDI

SEED_DONKEYDAN_MARKET_CAP:ORDI

#ORDIUSDT

#ORDIUSD

#swingtrade

#shortterminvestment

#ALTCOIN

#Cryptotading

#cryptoinvesting

#investment

##trading

#cryptocurrencytrading

#bitcoininvestments

#Investing_Coins

#Investingcoins

#Crypto_investing

#Cryptoinvesting

**** #Manta ,#OMNI, #DYM, #AI, #IO, #XAI , #ACE #NFP #RAD #WLD #ORDI ****

#bitcoin

#BTC

#BTCUSDT

BINANCE:ORDIUSDT

ORDI buy/long setupThe ORDI symbol has a bearish structure and the price is expected to reach the main demand.

A good demand range is ahead and above the price, in which we look for buy/long positions.

Closing a daily candle below the invalidation level will violate the analysis

Note that the financial market is risky, so:

Do not enter a position without setting a stop and capital management and confirmation and trigger.

When we reach the first TP, save some profit and try to move the stop continuously in the direction of your profit.

If you have any comments please post them, comments will help us improve our performance

Thanks

ORDI analysis (12H)From where we placed the red arrow on the chart, it seems that ORDI's correction has started.

This correction appears to be a diametric as we now appear to be in wave e.

From the supply range, it can be rejected downwards.

We are looking for buy/long positions on the green range.

Closing a daily candle below the invalidation level will violate the analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You