RSI 101: Scalping Strategy with RSI DivergenceFX:XAUUSD

I'm an intraday trader, so I use the H1 timeframe to identify the main trend and the M5 timeframe for entry confirmation.

How to Determine the Trend

To determine the trend on a specific timeframe, I rely on one or more of the following factors:

1. Market Structure

We can determine the trend by analyzing price structure:

Uptrend: Identified when the market consistently forms higher highs and higher lows. This means price reaches new highs in successive cycles.

Downtrend: Identified when the market consistently forms lower highs and lower lows. Price gradually declines over time.

2. Moving Average

I typically use the EMA200 as the moving average to determine the trend. If price stays above the EMA200 and the EMA200 is sloping upwards, it's considered an uptrend. Conversely, if price is below the EMA200 and it’s sloping downwards, it signals a downtrend.

3. RSI

I'm almost use RSI in my trading system. RSI can also indicate the phase of the market:

If RSI in the 40–80 range, it's considered an uptrend.

If RSI in 20 -60 range, it's considered a downtrend.

In addition, the WMA45 of the RSI gives us additional trend confirmation:

Uptrend: WMA45 slopes upward or remains above the 50 level.

Downtrend: WMA45 slopes downward or stays below the 50 level.

Trading Strategy

With this RSI divergence trading strategy, we first identify the trend on the H1 timeframe:

Here, we can see that the H1 timeframe shows clear signs of a new uptrend:

Price is above the EMA200.

RSI is above 50.

WMA45 of RSI is sloping upward.

To confirm entries, move to the M5 timeframe and look for bullish RSI divergence, which aligns with the higher timeframe (H1) trend.

RSI Divergence, in case you're unfamiliar, happens when:

Price forms a higher high while RSI forms a lower high, or

Price forms a lower low while RSI forms a higher low.

RSI divergence is more reliable when the higher timeframe trend remains intact (as per the methods above), indicating that it’s only a pullback in the bigger trend, and we’re expecting the smaller timeframe to reverse back in line with the main trend.

Stop-loss:

Set your stop-loss 20–30 pips beyond the M5 swing high/low.

Or if H1 ends its uptrend and reverses.

Take-profit:

At a minimum 1R (risk:reward).

Or when M5 ends its trend.

You can take partial profits to optimize your gains:

Take partial profit at 1R.

Another part when M5 ends its trend.

The final part when H1 ends its trend.

My trading system is entirely based on RSI, feel free to follow me for technical analysis and discussions using RSI.

Oscillators

Class A/B RSI Bearish Divergence on SPY Futures?Really posting here to see if anyone would validate this for me but I was looking on the chart and this idea came about. On the weekly chart for ES1!, there seems to be class A or B Bearish Divergence developing on the Weekly timeframe.

Listen, of course we all know SPY trends upwards over time but is this an indicator of a larger sell the market needs to go higher every once in a blue moon? This is guarenteed a macro trend and I probably will have to wait a year for this analysis to play out but hey, at least we're here. (***ponders on how I charted Gamestop at $10 but never traded because of lack of knowledge***) Anyways, this is something I will of course monitor but let me highlight instances in history this has happened. Please feel free to give your input on this analysis!

Jan 1998 thru Apr 2001 (News Driver: Dot-Com Bubble)

Price makes higher highs from Jan 98' thru Mar 00'

From Mar 98' thru Mar 00', the 3 peaks formed on the RSI leading to price establishing a lower high (SMT) on Sep 00'. Fails to make new all-time high

From Sep 00' to Apr 01' price moves down as much as 30% over the next 224d

Jan 2013 thru Feb 2016

Price makes higher highs from Jan 13' thru May 15'

From May 13' thru Jun 14', the 3 peaks formed on the RSI leading to price establishing a lower high (SMT) Jul 15' and a following lower high on Nov 15'

From Jul 15' to Aug 15' (42d) (News Driver: Lagging China Market) price moves down as much as 14% and as much as 14% on the Nov '15 lower high to Jan 16' (78d) (News Driver: Oil Prices)

Current: Jan 24' thru Nov 24'

Price has been making higher highs all year

From Mar 24' thru , the RSI has been making lower highs while price is making higher highs

We are now at a point where price is pushing to go higher but what I would want to see based off of historical data is for price to consolidate or some type of Bearish Turtle Soup forming. If this happens and the RSI returns to Fair Value, we could be in for a sizeable sell of for at least a couple of weeks in the near future.

I will come back to this in the next few months. Happy Trading!

Example of how to draw a trend line using the StochRSI indicator

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

I have explained how to draw a trend line before, but I will take the time to explain it again so that it is easier to understand.

-

When drawing a trend line, it must be drawn on the 1M, 1W, and 1D charts.

However, since I focused on understanding the concept of drawing a trend line and the volatility period that can be seen with a trend line, I will explain it only with a trend line drawn on the 1D chart.

Please note that in order to calculate a somewhat accurate volatility period, support and resistance points drawn on the 1M, 1W, and 1D charts are required.

I hope this was helpful for understanding my thoughts on the concept of drawing trend lines and how to interpret them.

The main reason for drawing trend lines like this is so that anyone who sees it can immediately understand why such a trend line was drawn.

Then, there will be no unnecessary disagreements about the drawing, and each person will be able to share their opinions on the interpretation.

--------------------------

When drawing trend lines, the StochRSI indicator is used.

The reason is to secure objectivity.

When the StochRSI indicator touches the oversold zone and rises, the low corresponding to the peak is connected to draw a trend line between low points.

And, when the StochRSI indicator touches the overbought zone and falls, the Open of the downward candle corresponding to the peak is connected to draw a trend line between high points.

If the peak is not a downward candle, it moves to the right and is drawn with the Open of the first downward candle.

If you refer to the candlesticks of the arrows in the chart above, you will understand.

The trend line drawn as a dot is a high-point trend line, but it is a proper trend line because it does not touch the overbought zone between highs.

Therefore, you can draw a trend line corresponding to trend line 1.

Accordingly, around March 25-29, around April 8, and around April 14 correspond to the volatility period.

-

You can see how important the low-point trend line (2) is.

If the high-point trend line is properly created this time and the low-point trend line and the high-point trend line are displayed in the same direction, the trend is likely to continue along that channel.

If the StochRSI indicator rises and a peak is created in the overbought zone, you will draw a high-point trend line that connects to point A.

-

Thank you for reading to the end. I hope your transaction will be successful.

--------------------------------------------------

ETH Is Oversold Like Never Before !Hello Traders 🐺

In the recent week, we saw a massive long position wipeout, especially in the stock market.

However, despite all the rumors, BTC held itself at these levels and is still inside a falling wedge pattern.

If you don't know what I’m talking about, you can check my last idea about it.

But ETH!

In my opinion, this is a huge discounted price for ETH.

You know why?

1_ Monthly RSI is currently at 25, which means we’re in an extremely oversold situation, and this usually means bulls are about to come back.

Yes — we have all the signs of a reversal from here:

(A): BTC.D RSI is at an all-time high and forming a bearish divergence, meanwhile:

(B): ETH/BTC is extremely oversold right now.

(C): BTC itself has formed a falling wedge pattern right above the weekly Cup & Handle neckline support!

Guess what?

If you zoom in a little bit on the daily chart, you can see there’s a pattern to break, and price is currently too close to the edge of it —

which means time is ticking for ETH, and we are about to see an explosive move.

Probably to the upside, because of all the signs we’ve talked about above.

I hope you enjoyed this idea — and as always, don’t forget our goal:

🐺 Discipline is rarely enjoyable, But almost always profitable 🐺

🐺 KIU_COIN 🐺

TON USDT Buy Setup 1. Price Action and Trend Analysis

• Current Price and Movement: The current price of TONUSDT is 3.2440, down by 2.72% (as shown in the header). The chart shows a recent decline from a high of around 3.58777 (marked on the chart).

• Trend: The price appears to be in a downtrend after hitting a peak. However, the chart also shows a potential ascending triangle pattern (a bullish continuation pattern) with higher lows forming around the 2.35877 and 2.65256 levels and a resistance zone between 3.1010 and 3.24439 (highlighted in purple).

• Key Levels:

• Support: Around 2.35877 to 2.65256 (previous lows and the lower trendline of the ascending triangle).

• Resistance: The purple zone between 3.1010 and 3.24439, which the price is currently testing.

• Recent High: 3.58777 (a potential target if the price breaks above resistance).

• Recent Low: 2.35877 (a critical support level if the price continues to decline).

2. Volume Analysis

• The chart includes volume bars at the bottom, but they are not explicitly labeled. Generally, in a pattern like an ascending triangle, you’d want to see increasing volume on upward moves (indicating buying pressure) and decreasing volume on pullbacks (indicating lack of selling pressure). From the chart, volume appears relatively stable, with no significant spikes, suggesting a lack of strong momentum in either direction at the moment.

3. Indicators

• Relative Strength Index (RSI): The RSI is shown in the lower panel, currently at 41.01.

• RSI below 50 indicates bearish momentum, but it’s not yet in oversold territory (below 30). This suggests the price could still decline further before a potential reversal.

• The RSI has been trending downward recently, aligning with the price decline from the 3.58777 high.

4. Pattern Analysis: Ascending Triangle

• The chart shows an ascending triangle pattern, which is typically a bullish continuation pattern:

• Higher Lows: The price has formed higher lows at 2.35877, 2.65256, and 2.80841, indicating buyers stepping in at higher levels.

• Flat Resistance: The price has repeatedly tested the resistance zone around 3.1010 to 3.24439 but failed to break above it decisively.

• Implication: If the price breaks above the 3.24439 resistance with strong volume, it could target the recent high of 3.58777 or higher. The potential target for an ascending triangle breakout is often calculated by measuring the height of the triangle (from the base to the top) and projecting it upward from the breakout point:

• Height of triangle: Approximately 3.24439 - 2.35877 = 0.88562.

• Potential target if breakout occurs: 3.24439 + 0.88562 ≈ 4.13001.

5. Liquidity Levels

• The chart marks liquidity levels with numbers in parentheses, such as (3.58777), (2.80841), etc. These likely represent stop-loss or take-profit levels where liquidity might be clustered:

• Above the current price (e.g., 3.58777), there may be sell-stop orders or take-profit levels from short positions.

• Below the current price (e.g., 2.35877), there may be buy-stop orders or stop-loss levels from long positions.

• The price often moves toward these liquidity zones to “hunt” stops before reversing, so a drop below 3.1010 could target the 2.80841 or 2.65256 levels.

Mastering RSI Divergence: A Complete Guide to Trend ReversalsWhat Are Divergences?

In this guide, we will explore the concept of divergence and how it can be effectively utilized alongside the Relative Strength Index (RSI), one of the most popular momentum indicators in technical analysis. Divergence occurs when the price of an asset moves in the opposite direction of an indicator, such as the RSI. Understanding RSI divergence can be a powerful tool for identifying potential trend reversals or continuations. In this guide, we'll delve into the various types of divergence that can occur with the RSI and how to incorporate them into your trading strategy.

Types of Divergences?

There are three primary types of divergence: bullish, bearish, and hidden divergence. Each signals a distinct market condition and potential outcome, and understanding these nuances is key to using divergence effectively in your trading.

1. Bullish Divergence Bullish divergence happens when the price of an asset makes a lower low, while the RSI forms a higher low. This indicates that although the price is declining, momentum is weakening. The failure of the RSI to confirm the new low in price suggests that selling pressure is diminishing, potentially signaling that a reversal to the upside could occur. Essentially, the market is losing its downward momentum, setting the stage for a potential bullish move.

2. Bearish Divergence Bearish divergence occurs when the price forms a higher high, but the RSI forms a lower high. This indicates that although the price is rising, momentum is weakening. It suggests that the uptrend may be losing steam, signaling that a potential reversal to the downside could be on the horizon. As the price continues higher, but the RSI fails to confirm the new highs, it may indicate that the market is becoming overextended and ready for a correction.

3. Hidden Divergence Hidden divergence differs from regular divergence in that it signals a continuation of the existing trend, rather than a reversal. It typically occurs during pullbacks or retracements in a strong trend. Hidden divergence can appear in both uptrends and downtrends, providing traders with an indication that the prevailing trend is likely to continue after the short-term retracement is over. This type of divergence serves as a confirmation of trend strength and helps traders stay in profitable positions during market pullbacks.

Why Are RSI Divergences a Powerful Tool?

RSI divergence is a powerful tool in trading because it offers early insights into potential trend reversals or shifts in momentum before these changes are fully reflected in price movements. By recognizing divergence, traders can anticipate shifts in market sentiment and make timely decisions. One of the main reasons RSI divergence is so effective is that it serves as an early warning system. It signals when the momentum behind a price trend, whether up or down, is starting to weaken.

For example, in a strong uptrend, if prices continue to make new highs, but the RSI fails to reach new highs, this could signal that the buying momentum is losing strength, even though the price is still rising. This divergence indicates that a reversal or pullback might be imminent, allowing traders to exit their positions or prepare for a potential shift in market direction. Understanding this early warning can provide traders with an edge, helping them avoid being caught in the late stages of a trend and positioning themselves ahead of a change.

How to Trade RSI Divergences?

When the price makes a higher high but the RSI fails to confirm with a higher high, this is known as bearish divergence. While this situation suggests weakening momentum, it doesn’t necessarily mean a correction is imminent. The price may continue to rise for some time, and eventually, the RSI could catch up and make a higher high in line with the price action. Essentially, the market could remain in an uptrend, and the RSI could still align with the price over time.

This highlights the importance of not jumping to conclusions solely based on RSI divergence. Divergence can act as a useful warning, but it should not be relied upon as a definitive signal of a trend reversal. To increase the reliability of the signal, traders should wait for additional confirmation, such as a candlestick pattern indicating a potential trend reversal. Candlestick patterns like engulfing patterns, doji candles, or shooting stars at key support or resistance levels can provide stronger evidence that the trend may be about to change.

Therefore, it’s wise to wait for a more comprehensive confirmation from price action before making a move, rather than acting on divergence alone. Combining RSI divergence with other technical tools, such as candlestick patterns or chart patterns, can help increase the accuracy of your trade decisions.

Conclusion:

Divergence is a powerful tool that provides valuable insights into potential trend reversals or continuations. By understanding the different types of divergence and knowing how to identify them, traders can make more informed decisions. However, divergence should always be used in conjunction with other technical analysis tools to enhance the accuracy of your strategy. With practice, patience, and proper risk management, divergence trading can become a profitable strategy for identifying key market turning points. Whether you are seeking trend reversals or confirming ongoing trends, RSI divergence can be an essential component of your trading toolkit.

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

What Is Momentum – And Why It’s Not Just a Trend IndicatorMost traders follow price — candles, trendlines, support/resistance. But there’s another layer that often tells the story before the price moves: momentum.

⸻

🔍 In this post, you’ll learn:

• What momentum really measures

• Why it’s not the same as price direction

• How momentum can signal a shift before the chart confirms it

• Why combining momentum with structure improves timing

⸻

📈 Momentum ≠ Direction

Price can be rising while momentum is fading. That’s often a clue of an upcoming slowdown or reversal — long before the price turns. Similarly, price can be flat, while momentum builds in one direction. That’s tension… and tension leads to moves.

⸻

🔥 Why Momentum Matters:

• It reveals intensity, not just direction

• It can act as a leading indicator — not lagging

• Momentum divergences often hint at hidden accumulation or distribution

• Tracking it helps you avoid late entries or false breakouts

⸻

🔧 Takeaway for traders:

If you’re only watching price, you’re only seeing half the picture.

Momentum shows what’s driving the move, and when that drive starts weakening.

⸻

💬 What’s your favorite momentum indicator? RSI, %R, CCI, or something else?

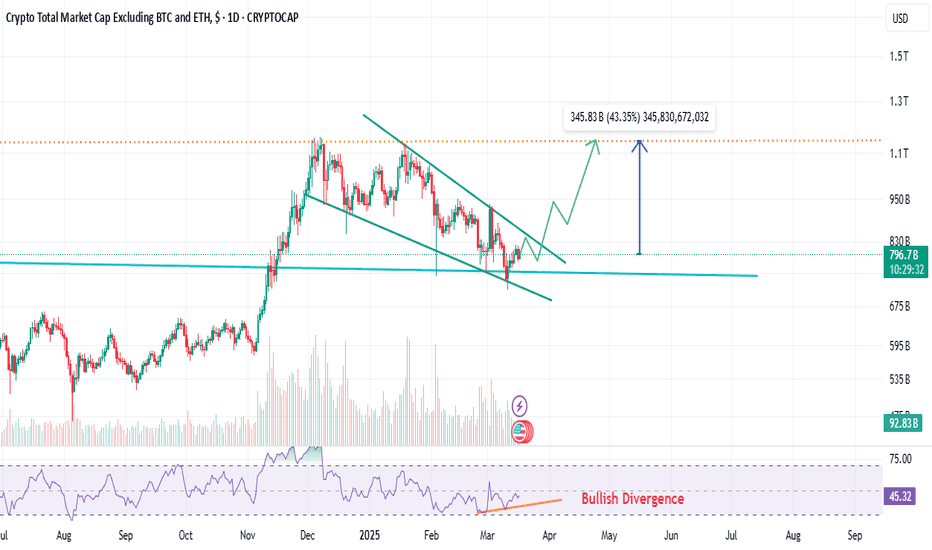

Altcoins' Market Cap is About to Reclaim $1 Trillion..!Hello Traders 🐺

In my last idea about Altcoins' total market cap, I talked about the midterm price targets. Now, in this idea, I want to focus on the short-term volatility. As you can see in the chart, the price is already in a falling wedge pattern, and the target of the falling wedge is the top of the wedge. This means we are about to see a nice bounce in Altcoins, which could break BTC.D's upward movement and lead to a bigger correction.

In my opinion, in this case, we can also treat this pattern as a bull flag, and the target will vary accordingly. If you want to know more about the price target for TOTAL3, you can check my previous idea, where I also mentioned my final price target for this Altcoin Season. I hope you enjoy this idea! Don’t forget to like and follow! 🚀🔥

🐺 KIU_COIN 🐺

Tesla to bounce from hereNASDAQ:TSLA

Tesla has reach and bonce from a key support level, as seen on the chart, in the Golden Pocket, between the 61.8% and the 78.6% Fibonacci Retracement, and it is shown two weekly hammer candlestick bar near each other, which is bullish. Odds that it has already found a mid-term bottom is high.

Now I expect a multi-week bounce from here, probably to the next Golden Pocket at the top, which is between $385 to $430 USD.

And yes, Elon Musk upset his customer base, and the stock is very expensive compared to other car manufacturers, and will probably see little to no growth in sales this year, or even a decline, insiders has sold big amounts of shares and it is all looking bad. And yes, we have probably already seen the top in Tesla in December last year for a long time.

However, stocks don’t generally go down in a straight line, the stock, as well as the stock market in general is oversold and do for a bounce, maybe a big bounce.

After the bounce, I will be looking for shorts, but now, I’m looking for longs.

Good luck to you

Skeptic | EUR/USD at a Crossroads: Breakout or Reversal?Welcome back, guys! 👋 I'm Skeptic.

Today, we're diving deep into EUR/USD , analyzing key levels and potential triggers.

🔍Recap & Current Structure:

As mentioned in our previous analysis , after the previous uptrend, EUR/USD entered a consolidation phase. Our short trigger at 1.07124 played out well, reaching an R/R of 2—if you followed the idea, you saw the results!

Now, we’ve formed a new structure , which is more visible on the 1H timeframe. After breaking the descending trendline and pulling back , we've now created a higher high , indicating a potential move toward the top of the box at 1.09453 .

With DXY weakening, the expectation leans towards an uptrend continuation, but we remain flexible—if our short trigger activates, we'll take it as well because we approach the market with a two-sided, skeptical view rather than a fixed bias.

📈 Bullish Scenario (Long Setup):

Trigger: Break & close above 1.08454

Confirmation: 7 SMA below the candle during the breakout + RSI entering overbought

]Invalidation: Rejection + close back below 1.07666

📉 Bearish Scenario (Short Setup):

Trigger: Rejection at 1.08278 + drop below 1.07666

Confirmation: RSI entering oversold

⚠️ Key Notes:

Fundamentals: This Friday is NFP day—a crucial event for the markets.

Given the recent uptrend in EUR/USD, a pullback is likely, so stay prepared for both triggers.

Risk Management: Avoid overleveraging—wait for confirmed breaks before entering.

Stay sharp, and I’ll see you in the next analysis!

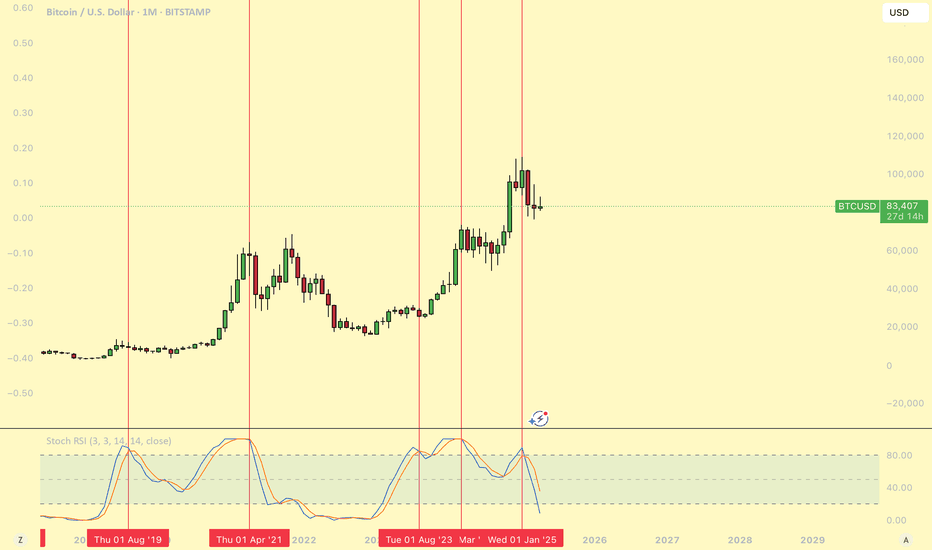

BTC - Analyzing monthly momentum shifts with the Stoch RSI!What is the stoch rsi?

The Stochastic RSI (Stoch RSI) is a momentum indicator that applies the stochastic oscillator to the RSI, making it more sensitive to price changes. The Stochastic RSI has two lines:

Blue line = the fast momentum line

Orange line = the slower momentum line

How It Works:

* Helps identify overbought (above 80) and oversold (below 20) conditions.

* Crossing above 20 signals possible bullish momentum.

* Crossing below 80 signals possible bearish momentum.

Why Use It?

* Reacts faster than regular RSI.

* Helps spot momentum shifts and reversals.

* Best used with other indicators for confirmation.

Analyzing the Monthly BTC Chart Through the Lens of Stochastic RSI: A Cycle Comparison

in this discussion, we’ll take a deep dive into the monthly Bitcoin (BTC) chart and examine how the Stochastic RSI aligns with previous market cycles, dating back to 2016. By comparing BTC’s historical price action with Stoch RSI signals, we aim to identify recurring patterns, overbought and oversold conditions, and how momentum shifts have played a role in past bull and bear markets. Understanding these correlations could provide valuable insights into where BTC currently stands in its broader cycle and what to expect next. Let’s break it down.

Let's dive into the bullmarket of 2016/2017:

In 2016 and 2017, the Stochastic RSI on the monthly BTC chart stayed consistently above the 80 level, often fluctuating between 80 and 100. During this period, the blue line occasionally crossed below the orange line, signaling a short-term pullback. When this cross occurred, it was typically followed by a red candle in the next month, indicating a brief dip before the price continued its upward movement. This pattern appeared multiple times throughout the bull market, allowing BTC to make higher highs and pushing the price further up.

However, the key turning point came when both the blue and orange lines crossed below the 80 level. This marked a shift in momentum, often leading to a significant drop in price or even a bear market phase. When the Stochastic RSI fell below 80 and remained there, it indicated that bullish momentum had stalled, and a potential reversal or prolonged downtrend was likely to follow. This was a critical signal for traders to watch during the bull cycle.

What happened in 2019-2021?

In 2019, the Stochastic RSI on the monthly BTC chart quickly moved from the oversold region to the overbought area, reflecting a rapid surge in BTC’s price during that time. This sharp movement in the Stochastic RSI mirrored the fast-paced price increase. However, once the Stochastic RSI entered the overbought zone, the blue line crossed below the orange line, signaling a potential reversal. When this happened, the Stochastic RSI fell below the 80 level, indicating that bullish momentum was weakening.

This crossover was a critical signal of potential downside, suggesting that BTC could experience a correction or even an extended period of bearish pressure. The decline in the Stochastic RSI below 80 marked the beginning of a phase where BTC faced increased downside momentum, leading to a correction in price for months.

Later in the cycle BTC and the Stoch RSI went up to the overbought area ones again. When the Stoch RSI with the blue and orange line crossed below the 80 was the start of a prolonged bear market.

What occured in this cycle?

In the current cycle of Bitcoin (BTC), there have been three notable crosses on the Stochastic RSI, which offer important insights into market conditions. The first cross stayed above the 80 level, which typically signals an overbought condition. When the Stochastic RSI is above 80, it indicates that the market may be experiencing strong bullish momentum, but it's also at risk of becoming overextended, potentially signaling a reversal.

However, the other two crosses occurred as the Stochastic RSI moved below the 80 level, which is generally interpreted as a sign that the bullish momentum is weakening and that further downside could be in play. The fact that these two crosses occurred below the 80 level suggests that the overbought conditions are being worked off, and momentum may be shifting to the downside.

The last cross is still in play. The momentum is quickly turning to the downside while BTC is facing downside pressure

How can we compare this cycle with the last ones?

In the last cycle of BTC, there were two key crosses of the Stochastic RSI below the 80 level, both of which marked important turning points for the market.

The first cross below the 80 level triggered a significant crash of around 70%, which was a sharp correction from the bull market's peak. This steep drop signified a clear shift in market sentiment, with the bearish trend beginning to take hold. The second cross below 80 marked the official start of the bear market, though it wasn’t as dramatic as the first crash.

An interesting aspect of the second cross was that Bitcoin briefly made a slightly higher high before the decline, which might have seemed like a potential sign of recovery or a continuation of the bullish trend. However, this higher high was not sustainable, and the bearish momentum quickly took over, confirming that the market had turned decisively to the downside. This higher high can often be seen as a bull trap, where traders were temporarily lured into thinking the market was rebounding, only for the price to reverse sharply.

In contrast, the cycle before this one was marked by Bitcoin staying consistently above the 80 level for the entire duration of the bull market. The Stochastic RSI remained elevated, reflecting strong bullish momentum and a prolonged uptrend. Once the Stochastic RSI crossed below the 80 level, it signaled the official start of the bear market. This transition from above to below 80 is often seen as a clear indication that the overbought conditions had been worked off, and the market was beginning to lose its bullish steam.

In both cycles, the Stochastic RSI's behavior has been crucial in identifying key points where the market shifted from bullish to bearish. In the most recent cycle, the sharp crash following the first cross below 80 and the subsequent bear market beginning with the second cross below 80 highlight the significance of this indicator in forecasting major market changes. Meanwhile, in the previous cycle, the sustained time spent above 80 helped to keep the bullish momentum intact until the market finally reversed with that pivotal cross below 80.

These patterns suggest that once Bitcoin’s Stochastic RSI starts crossing below the 80 level after an extended period of bullish movement, it’s a strong signal that the market is entering a phase of weakness and may eventually lead to a bear market.

Conclusion:

The current cycle shows similarities to the 2019/2021 cycle, particularly with the second cross down on the Stochastic RSI, which previously marked a local top. There is a strong possibility that this could signal a cycle top.

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

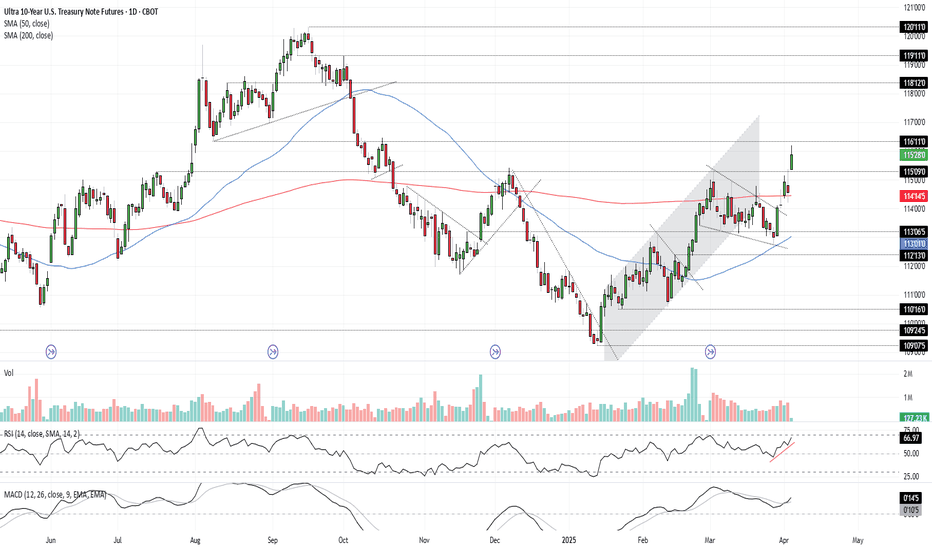

Bonds Don’t Lie: The Signal is ClearU.S. 10-year Treasuries are a crucial cog in the global financial machine, serving as a benchmark borrowing rate, a tool for asset valuation, and a gauge of the longer-term outlook for U.S. economic growth and inflation.

As such, I keep a close eye on 10-year note futures, as they can offer clues on directional risks for bond prices and yields. The price action over the past few days has sent a clear and obvious signal as to where the risks lie: prices higher, yields lower.

Futures had been grinding lower within a falling wedge for several weeks but broke higher last Friday on decent volumes following soft U.S. household spending data. It has since extended bullish the move, reclaiming the 200-day moving average before surging above key resistance at 115’09’0 after Trump’s reciprocal tariff announcement on Wednesday.

RSI (14) is trending higher but isn’t yet overbought, while MACD has crossed the signal line above 0, confirming the bullish momentum signal. That favours further upside, putting resistance at 116’11’0 and 118’12’0 on the immediate radar. For those who prefer it expressed in yield terms, that’s around 4% and 3.8% respectively.

Good luck!

DS

GOLD - Day Trading with RSI 04/03/2025FX:XAUUSD

Daily Timeframe (D1): Still in a strong uptrend, with RSI and both moving averages are pointing upwards. The WMA45 is above 60.

4-Hour Timeframe (H4): RSI is positioned between the resistance created by WMA45 (current price around 3152) and the RSI 60 support level (current price around 3121).

1-Hour Timeframe (H1): The WMA45 is trending upward, supporting the bullish trend.

Trading Plan: BUY

Entry Zone:

When the RSI on the M15 timeframe is supported at the 50 or 60 levels.

Entry Confirmation:

When M5 completes a wave, or a divergence appears.

Or even when M1 shows divergence.

Stop Loss:

20–30 pips below the M5 low.

Take Profit:

100 pips or R:R ≥ 1:1.

Or when M5 completes its own uptrend.

But be careful when RSI on H4 reaches its own WMA45.

You can check out the indicators I use here: tradingview.com/u/dangtunglam14/

EURNZD Wave Analysis – 2 April 2025

- EURNZD reversed from resistance area

- Likely to fall to support level 1.8700

EURNZD currency pair recently reversed down from the resistance area located between the resistance level 1.9100 (which stopped the earlier sharp upward impulse wave I at the start of March) and the upper daily Bollinger Band.

The downward reversal from this resistance area stopped the earlier short-term impulse wave iii of the upward impulse wave 3 from the end of February.

Given the strength of the resistance level 1.9100, EURNZD currency pair can be expected to fall to the next support level 1.8700.

GOLD - Day Trading with RSI 04/02/2025

Weekly and Daily Timeframes (W & D):

GOLD is still in an uptrend, as the RSI's WMA45 is still hovering near the 70 level, and RSI remains above both of its moving averages.

H4 Timeframe:

This timeframe is currently showing a correction. However, it's not yet considered a downtrend because the WMA45 is still in the high region, close to the 70 level. But, RSI has dropped below the WMA45.

At present, the RSI on H4 is facing dynamic resistance from the WMA45 above and has support around the 4x level (43-48). The corresponding temporary price levels are approximately 3128 (resistance) and 3088 (support).

This end-of-uptrend correction on H4 could lead to high price volatility. GOLD may move within a 300–400 pip range (between the resistance from WMA45 and the RSI support around the 4x zone).

H1 Timeframe:

Currently in a downtrend, as RSI is moving below both of its MAs, and the WMA45 has a noticeable downward slope.

H1 also has RSI support at the 30 level (temporary price ~3086) and resistance at WMA45 above (temporary price ~3130).

Since we’re focusing on intraday trading, priority is given to the H1 trend.

Figure 1

Trading Plan: SELL

Entry Zone:

When RSI on M15 approaches upper resistance: levels 50–55 or 65–70.

Confirm Entry:

Conservative/Safe approach: when M5 ends its uptrend and reverses (see example in Figure 1 – M5 ends uptrend when RSI crosses below both MAs).

Or when bearish divergence appears on M5.

Or even earlier, when there’s divergence on M1 and M5's WMA45 flattens out.

Stoploss:

20–30 pips above M5’s recent peak.

Or if RSI on M5/M15 breaks through its previous high.

Take Profit:

100 pips or R:R >= 1:1.

Or when M5’s downtrend ends (when RSI crosses above both MAs).

You can check out the indicators I use here: www.tradingview.com

Russell 2000: Squeeze Potential BuildsWith uncertainty surrounding U.S. trade policy about to be resolved and price signals turning bullish, the ingredients for a squeeze in Russell 2000 futures are now in place.

Unlike other stock indices with far larger constituents, U.S. small caps have lagged this week’s rebound—potentially due to recession concerns, which wouldn’t help unprofitable cyclical firms tied to the broader economy.

However, while fundamentals point to downside risks, recent price signals have been more constructive. Monday’s hammer candle formed after a reversal from known support. While Tuesday’s doji signaled indecision, it still closed slightly higher, with strong volumes going through.

While signals like RSI (14) and MACD remain in negative territory, bearish momentum is starting to ebb, suggesting we may be in the early stages of a turn.

Those considering bullish positions could look to establish entries above 1994.8 with a stop beneath for protection. Rallies over the past two sessions have fizzled around 2040, making that an initial focal point. If sellers there are overrun, it could encourage others to join the move, looking for a retest of horizontal resistance at 2132.5.

Good luck!

DS

GBPAUD Wave Analysis – 1 April 2025

- GBPAUD reversed from long-term resistance level 2.0820

- Likely to fall to support level 2.030

GBPAUD currency pair recently reversed from the resistance area located between the long-term resistance level 2.0820 (former multiyear high from 2020), resistance trendline of the weekly up channel from 2024 and the upper weekly Bollinger Band.

The downward reversal from this resistance area stopped the earlier short-term impulse wave 3 of the weekly upward impulse sequence (3) from the start of 2024.

Given the strength of the resistance level 2.0820 and the overbought weekly Stochastic, GBPAUD currency pair can be expected to fall to the next support level 2.030.

GOLD - Day Trading with RSI 04/01/2025FOREXCOM:XAUUSD

D and H4 Timeframes:

GOLD is in a strong uptrend.

RSI is operating around the 80 level, indicating that buying pressure is 4 times stronger than selling pressure.

Priority: Trade in the direction of the trend on higher timeframes.

H1 Timeframe:

GOLD is showing signs of a correction: EMA9 has crossed below WMA45, and RSI is positioned below the two MA lines.

Given the current slope of WMA45 on the H4 RSI, this correction is considered minor for now.

Intraday Trading Plan:

Entry Strategy:

If H1 continues to correct: Look for buy entries when RSI H1 reaches previous RSI lows (zones 44, 55).

If H1 breaks the current high (level 3128): Look for buy entries when RSI M15 reaches previous RSI lows (zones 30–40).

At these levels, RSI M5 should end its downward wave (e.g., forming a double-bottom pattern on RSI) or show a price-RSI divergence before entering a buy trade.

Stop Loss (SL):

Set SL 20–30 pips below the entry point's low on the M5 timeframe.

Take Profit (TP):

Follow an R:R ratio of at least 1:1.

Or, take profit when M5 ends its bullish wave:

If RSI M5 forms a double-top pattern or

If RSI M5 crosses below WMA45.

Partial profit-taking is recommended at different stages to optimize returns.

📌 Refer to my scripts for pre-configured RSI indicators. 🚀

How To Trade Forex-Part1In this chart i show you my frustration as i am trying to find a better way to scan for Forex trades but at the end of the chart we can see the light at the end of the tunnel.

Because i am now able to scan for Forex trading using:

1-Candle stick patterns

2-Directional Movement indicator

3-Moving Averages.

Study this chart in order

to see how i have really broken it down to

a simple science

I will try to make a video to demonstrate this

system.

Rocket boost this content to learn more.

Disclaimer:Trading is risky please

learn risk management and profit taking

strategies.Also feel free to use a simulation trading

account before you trade with real money.