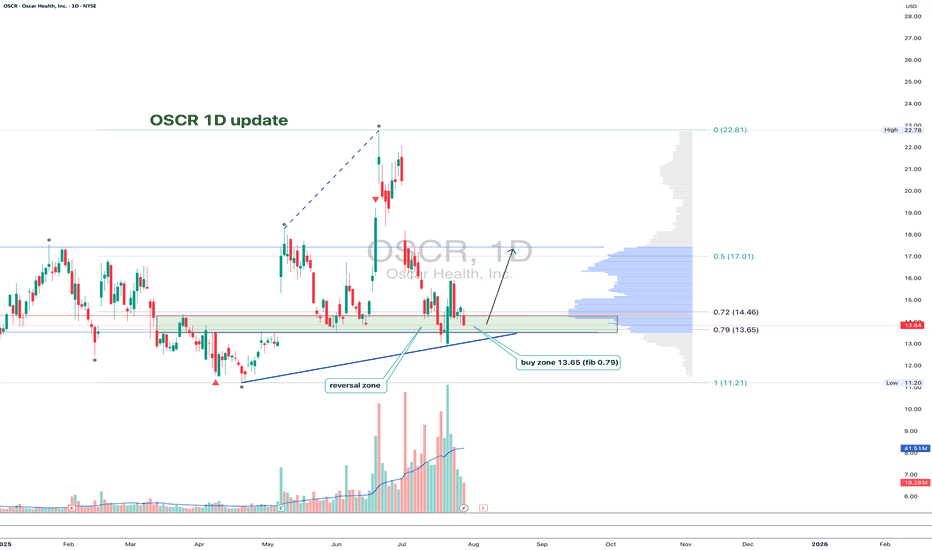

OSCR: back to support and now it’s decision timeAfter the recent impulse move, OSCR has pulled back to a key support zone around 13.65. That area aligns with the 0.79 Fib retracement, a horizontal level from spring, and a rising trendline that has already triggered reversals in the past. The structure is still intact, and buyers are testing the level again. If support holds and we get a bullish confirmation, the next target is 17.01, followed by a potential breakout toward the high at 22.81.

Volume remains elevated, the overall structure is healthy, and the correction is controlled. A break below 13.00 would invalidate the setup - until then, it’s a clean, high-reward zone with tight risk.

Fundamentally, Oscar Health has revised its 2025 guidance: revenue is expected in the $12–12.2B range, with operating losses projected between $200M and $300M. Despite softening topline growth, earnings per share are improving, and investor sentiment has been shifting. Technical strength is also reflected in the recent rise in RS Rating to 93, confirming that the stock is showing relative leadership even as the market cools.

This is one of those setups where both technicals and narrative are aligning - now we just need confirmation from the chart.

OSCR

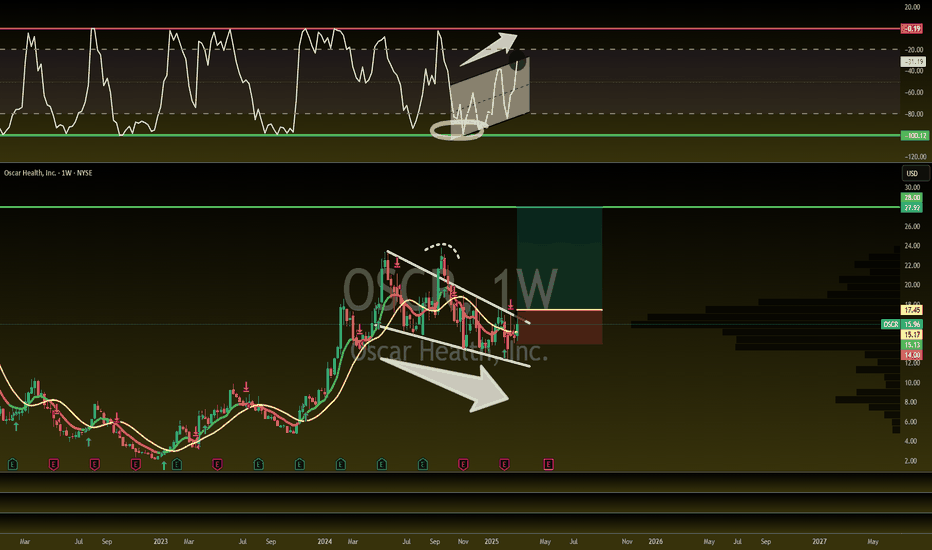

OSCR LONG IDEALooking at the weekly chart of OSCR stock, there's a long opportunity which can be taken advantage of to make some money provided that market follows the projection.

In order to take advantage of this long opportunity, a buy order limit can be placed at $12.38 while the exit can be at $11.09 and the final target can be at $22.80.

Confluences for this long idea are as follows:

1. Weekly break of structure

2. Valid Inducement (structural liquidity)

3. Orderflow

4. Sweep

5. Valid demand zone in the discount level

6. Imbalance

7. Pattern confirmation formed after mitigation of a demand zone indicating that there's a bullish change of trend.

Disclaimer: This is not a financial advice. The outcome maybe different from the projection. Don't take the signal if you're not willing to accept the risk.

Oscar (OSCR) – Tech-Enabled Healthcare with Margin Momentum Company Snapshot:

Oscar NYSE:OSCR Health is a technology-focused health insurer leveraging data and digital platforms to deliver affordable, personalized care. Its platform-centric model improves member experience, cost control, and care outcomes—setting it apart in a highly regulated sector.

Key Catalysts:

Steady Execution Under Proven Leadership 🧠

CEO Mark Bertolini (ex-Aetna) brings credibility and strategic clarity, reinforcing investor trust in Oscar’s long-term viability.

Focus remains on operational discipline, risk management, and scalable infrastructure.

2025 Guidance Reaffirmed 📊

Following a solid quarter, Oscar reaffirmed full-year 2025 guidance, projecting margin expansion and sustained growth despite sector headwinds.

Medical loss ratio (MLR) held steady at 75.4%, absorbing a $31M prior-period hit—showing resilience in cost containment.

Robust Financial Flexibility 💰

With $1B+ in free cash flow, Oscar is well-positioned for:

Organic growth in new markets

Potential share buybacks or dividends

Continued investment in digital infrastructure

Investment Outlook:

Bullish Entry Zone: Above $17.00–$17.50

Upside Target: $32.00–$33.00, supported by margin stability, capital strength, and smart execution.

🩺 Oscar is transforming health insurance from reactive to predictive—backed by tech, discipline, and capital strength.

#OscarHealth #OSCR #HealthTech #InsurTech #DigitalHealth #MarkBertolini #MedicalLossRatio #FreeCashFlow #TechEnabledCare #HealthcareStocks #Bullish #ValueDelivery #HealthInnovation

OSCR Weekly Trading Plan – June 20, 2025🟢 OSCR Weekly Trading Plan – June 20, 2025

🎯 Instrument: OSCR (Oscar Health)

📈 Direction: Long (Shares)

📊 Confidence Level: 72%

⏰ Time Horizon: 3–4 Weeks

⚠️ Market Condition: Volatile, meme-stock behavior, overbought risk

🧠 Model Consensus Snapshot

Model Direction Key Takeaways

DS 🔻 Short RSI 76, euphoric price surge, meme risk; targets $17.50

LM 🔼 Long Still bullish above $20.50, target $22.55, careful sizing

GK ⏸️ Watch Wait for dip to $19.25–$20.50, bullish bias if pullback

GM ⏸️ Watch Avoid for now, entry only if retesting $19.50

CD 🔼 Long Trade at open with $26.50 target; wide stop at $18.50

🧾 Summary & Final Decision

📌 Overall Market View:

Strong short-term uptrend is still active, but all models agree we are at overbought RSI levels. The price has surged ~50% in 5 days — historically unsustainable for "meme-like" setups.

📉 Bearish Risks:

RSI > 75

Elevated VIX = increased whipsaw risk

Meme-stock volatility

Potential for profit-taking or rug-pull behavior

📈 Bullish Catalysts:

Technical breakout confirmed above key EMAs

High volume + news momentum

Heavy interest from social media channels

✅ Final Trade Recommendation

Parameter Value

📉 Direction LONG (Shares)

💵 Entry Price $21.00 (limit open)

🛑 Stop Loss $18.50

🎯 Target Profit $26.50

🔢 Size 12 shares (based on $10K acct, ~2.5% risk)

📅 Holding Period 3–4 weeks

📈 Confidence 72%

📌 NOTE: Reduce size and tighten stops if market volatility continues rising next week.

📊 TRADE_DETAILS (JSON Format)

json

Copy

Edit

{

"instrument": "OSCR",

"direction": "long",

"entry_price": 21.00,

"stop_loss": 18.50,

"take_profit": 26.50,

"size": 12,

"confidence": 0.72,

"entry_timing": "open"

}

⚠️ Risk Considerations

Overbought RSI: Expect choppiness and high risk of short-term reversal.

Meme stock volatility: News, Reddit chatter, or influencer tweets may spike/dump price irrationally.

VIX > 20: Use limit orders to avoid bad fills on open.

💡 This is a high-risk, high-reward momentum play. Stick to your stop-loss and use small sizing.

Bullish Thesis: Why Oscar Health OSCR Could Rally Strong in 2025Oscar Health, OSCR, a technology-driven health insurance company, is positioned for a significant stock price appreciation in 2025. Despite some mixed short-term sentiment, the long-term outlook and recent analyst forecasts suggest a potential rally that could more than double the current share price. Here’s why OSCR could be a compelling bullish opportunity this year:

1. Strong Analyst Price Targets Indicate Upside of Over 125%

According to recent forecasts, OSCR is expected to reach an average price of $31.40 in 2025, with some analysts projecting highs as much as $41.31—a potential upside exceeding 125% from the current price near $13.95.

Monthly forecasts show a steady upward trajectory, with July 2025 targets around $37.24 and December 2025 targets near $34.67, highlighting sustained bullish momentum throughout the year.

The average 12-month price target is around $34.40, representing a 146% upside, signaling strong confidence in OSCR’s growth prospects.

2. Innovative Business Model and Growth Potential

Oscar Health leverages technology and data analytics to offer user-friendly, transparent health insurance plans, differentiating itself in a traditionally complex industry.

Its focus on member engagement, telemedicine, and cost-effective care management positions it well to capture market share as healthcare consumers increasingly demand digital-first solutions.

The company’s expanding footprint in both individual and Medicare Advantage markets provides multiple growth avenues.

3. Long-Term Vision and Market Opportunity

Beyond 2025, forecasts remain highly bullish, with OSCR projected to reach $53.77 by 2027 and nearly $100 by 2030, reflecting strong secular growth potential in the health insurance and digital health sectors.

Analysts see Oscar as a disruptive force with the potential to reshape healthcare delivery, driving substantial long-term shareholder value.

4. Improving Financial Metrics and Operational Execution

Oscar has been improving its loss ratios and operating efficiencies, which are critical for sustainable profitability.

The company’s investments in technology infrastructure and data-driven care management are expected to translate into better margins and revenue growth over time.

5. Market Sentiment and Analyst Ratings

While some platforms show mixed short-term sentiment, the dominant analyst consensus is a "Buy" or "Moderate Buy," supported by strong price targets and growth forecasts.

The stock’s current undervaluation relative to its growth potential creates a favorable risk-reward profile for investors.

What's going on with $OSCR? Let's break it down!🚨 What's going on with NYSE:OSCR ? Let's break it down! 👇

📌 Long-term investors: Every dip = buy/add opportunity

📌 Traders: Short term, we may fill the $13.31 GAP

🔹 Massive volume shelf & consolidation between $11-$17 for nearly 2 years—the bigger the base, the bigger the breakout!

🔹 Rising trendline since April lows—if this breaks, expect a move to $13.31 GAP, possibly $11-$12. Strong support here unless bad news or a market correction hits.

🔹 Break above $18.27 (earnings pop) = 🚀 $20+ short term

🔹 200DMA rejection after retest from below = bearish short term

🔹 WR% is making a lower low instead of swinging higher—watching this closely.

🧐 Overall: We’re in a consolidation phase—when it moves, expect it to be quick & explosive 🔥 Best strategy: DCA & wait for the inevitable surge to $20+ (barring major setbacks).

Stay patient. Stay focused. NYSE:OSCR ’s move is coming! 💪

$OSCR 190% Upside! The MASSIVE move is already in MOTION! The MASSIVE move on NYSE:OSCR is already in MOTION! 🚀

🎯 Targets:

2025 = $28+

2026 = $35+

2027 = $45+

Falling Wedge Breakout

Approaching CupnHandle breakout

WR% Is swinging from green to red

MACD is about to flip bullish

Massive Volume Shelf launch

Fundamentals are next level

Massively undervalued

What else could you want?!

📈 Breakout confirmed. Momentum building. Smart money positioning. Are you ready?! 👇

OSCR 1W — When the Chart Speaks Before the FundamentalsThe Oscar Health chart is currently forming a textbook cup and handle — a long-term reversal structure that has completed its base and is now breaking out of the consolidation zone. The bullish structure is confirmed through price action, volume, and positioning relative to key moving averages.

The price has broken through the upper boundary of the handle, shaped as a descending wedge. The breakout is accompanied by increased volume — a clear sign of capital rotation out of accumulation. All major moving averages (EMA, MA50, MA200, WMA) are trending upward, and the price is holding above them all, confirming the bullish momentum.

According to Fibonacci extension levels, drawn from the historical low of $1.50 to the peak near $23.26, the first wave target stands at $36.71 (1.618 level), with an extended target at $45.02 (2.0 level).

Structurally, the setup suggests a medium-term scenario pointing from current levels toward the $36–45 range, with the potential to repeat the kind of explosive move seen during the 2023 phase, when the price increased more than sixfold.

On the fundamental side, Oscar Health is actively recovering: in 2024, revenue grew by more than 50%, net losses were cut nearly in half, and the client base continued to expand. The company is strengthening its share in the digital insurance market and gaining support from institutional investors, including Morgan Stanley and Capital Group. The latest quarterly report was positively received.

The breakout is technically clean and fundamentally supported. The immediate pullback zones sit at $14.95 and $13.40. Below that, moving averages may act as control zones for reaction.

$OSCR is BREAKING OUT! 82% UPSIDENYSE:OSCR is BREAKING OUT! 82% UPSIDE

Oscar crushed recent earnings and now is getting the attention then deserve!

They are massively undervalued and a disruptor of the health insurance industry.

$15 Falling Wedge Breakout =

$28 Measured Move (MM)

Not financial advice

$OPFI ABOUT TO RUN 108%?! MASSIVE PotentialNYSE:OPFI ABOUT TO RUN 108%?!!! 🤯

Rounded Bottom with a Hammer Candle as a Cherry on Top! 🍒

My Price Targets are ATHs and $22 🎯

- Rounded bottom on daily repeating last move

- Rounded bottom on Monthly Chart with a breakout/ Retest/ now a confirmation of higher if we hold this week higher!

- About to make a Bullish Cross on the - H5_S Indicator (Still Bullish on H5_M Indicator)

- Volume Shelf Gap fill to 12 then 14

- Consistent buying volume. Sellers may be exhausted here

- Daily WCB formed giving us added insurance against the downside

Most of all MASSIVE Buying Volume today which eclipses the last 2 weeks of volume!

Not Financial Advice

$OSCR - 77% Upside if we HODOR!!NYSE:OSCR - HODOR!!!

Strong Support has been created at $12.15-$13.25 throughout the last two years.

It's held every time, if we hold again and market plays ball then...

🎯$16.50 & $23 are INBOUND!

- All indicators curling up

- At key support

- Name has a lot of big names behind it.

- Extremely undervalued

Not financial advice

60% Upside - H5 Trade of the Week!H5 Trade of the Week!

In this video, we are talking about a phenomenal potential trade that allows us to take action if we get some key items.

Everything is lining up for this one. We just need a few more items, and it will be time to enter!

NYSE:OSCR Breakout = $24/ $28

Not financial advice

OSCR - This could be MASSIVE!NYSE:OSCR

Still doing my DD on this name but here are my thoughts on the technical side of the house.

Monthly Chart Analysis:

CupnHandle Breakout = $45 🎯

Bullish:

- CupnHandle forming

- At the first Volume Shelf with a GAP above

- In a bullish up trend

- Michael Burry bought at current prices

Bearish:

- S/R zone range is $10-$13.50

- Volume GAP down to $10ish

- Bottom of Bullish channel is $10ish

- Wr% is down-trending

My Opinion:

- I believe we will more than likely form a deeper handle due to the fact that the Wr% is down-trending. I've found that when we break above -20 and then start a bearish channel descent we get to -80 or to the green support beam before we bottom out and then bounce to the opposite end of the spectrum.

- This would bring us into the $10-12 range before we see a bounce.

- I believe this to be the case as we now have a red H5 Indicator that is almost making a bearish cross as well.

As I said I'm still doing my Fundamental DD on this name but if it does turn out to be fundamentally undervalued with a bright future then I would welcome this to fall further in order to buy more.

Not financial advice

🏥💡 Oscar Health (OSCR) Analysis 📈🔍Market Disruption:

Oscar Health NYSE:OSCR is at the forefront of revolutionizing the health insurance industry through technological innovation, significantly enhancing market reach and member experience.

Expansion Plans:

In 2024, Oscar Health aims to introduce new technology-enabled plans across 165 new counties spanning 11 states. These initiatives prioritize accessibility, affordability, and personalized member experiences, aimed at driving premium growth.

Innovative Programs:

The company's +Oscar program, catering to 500,000 lives, fosters improved healthcare access and quality through innovative partnerships, such as the collaboration with Stanford Health Plan.

Investor Sentiment:

Bullish sentiment surrounds OSCR, with long positions taken by sell-side firms and institutional investors like The Vanguard Group and Millennium Management LLC. Upgraded price targets from Bank of America Securities and Wells Fargo further bolster this positive sentiment.

Robust Performance:

OSCR's performance demonstrates strength, including a remarkable 40% year-over-year increase in total health plan membership, reaching 1.44 million, and a substantial 46% revenue growth to $2.1 billion in the latest quarter.

CEO Endorsement:

CEO Mark Bertolini highlighted strong membership retention, an increased Net Promoter Score (NPS) of 60%, and improved core ratios during the latest earnings call, further affirming OSCR's positive trajectory.

Investment Outlook:

Bullish Outlook: Given these positive indicators, a bullish stance on OSCR above $16.50-$17.00 appears justified.

Upside Potential: With an upside target set at $34.00-$35.00, OSCR's growth potential in the health insurance market is poised for significant expansion.

📊🔍 Stay attuned to Oscar Health's progress for potential investment opportunities! #OSCR #HealthInsurance 🏥💼

UNH on watch for continuation after pullback LONGUNH after earnings with a mild beat in mid July, price shot up for one week then went

sideways and then pulled back in the past week. Price is now at 497 and under

the dynamic resistance of the first deviation line above the mean VWAP. The dual

time frame shows a good pattern with the shorter TF of 3 minutes in green above the

longer TF of 45 minutes in black. The short TF is above the 50 level.

Overall, I think the pullback is about over. I will take a long trade with a buy stop of

500.25 setting the stop loss below what will become dynamic support of the blue

line at 499.5. This is a tight stop and low risk owing to the positioning of the trade

about a support level. I will target 515.00 for a risk to reward ratio of 0.75 to 15

or 1:20 which is outstanding. I may take a call option striking $510 out a couple of months

if it would not draw down by the cash portion of my overall portfolio more than 3%. This

option premium is about $9000 but I think the potential profit is about the same.

OSCR : incertitude phaseOSCR in Daily still bearish but we just begun an incertitude phase. It is preferable to wait before to identify the new direction.

Positifs signals we are waiting for:

• Break the range by superior limit

• Ichimoku composant cross the cloud (Price, chninkou and tenken

In the other hand we have Two supports to see : 16.42 and 15.40