KSHB off bottomRecent news has led to an increase in volume off a higher low. Has potential to break 1.94, then 2. Enter below 1.94, risk under newly formed "base," approx 1.80. Target 2.15+. Volume isn't crazy high relatively, but with a breakout it could begin a parabolic move. I could be too early, but I'm willing to take the small risk.

Weed stocks could get a boost very soon with new voting in November and rollouts from last year's voting results initiating in November and launching January 1, 2018. Start watching closely for volume increases.

OTC

OSCI ready to mine gold?It has been a long road and you can see part of that under the $PYHH idea I previously published. $OSCI has filed a large number of financials in the past 2 days and I'm expecting them to go current on OTCMarkets.com followed by some news and hopefully production ramping up. We've seen a lot of activity over the past few months on the property, mostly posted to www.facebook.com

ENVV HARMONIC PATTERN COMPLETED: ONE MORE WAVE UP?ENVV is in the middle of a correction. It has completed an harmonic pattern and i'm looking to the price action for a potential breakout to the upside. A strong breakdown under the D point invalidates this setup.

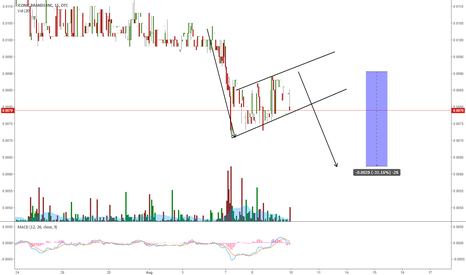

OMVS: SMALL DEGREE FLAG AND A DEEPER CORRECTION?OMVS seems in the middle of a correction. I'm expecting one more wave up and a deeper correction.

$PLFX is a truck of tinder waiting to catch on fire!The .45 closing for PLFX caused the stock to tap resistance for a 4th time while prepping for a golden cross right when there was a squeeze. Support held at .31 since June 29th. MACD has a large upward alligator mouth, RSI is slightly overbought, STO overbought and CCI has shown a steady upward movement since June 29th. Hopefully news releases and the CCI can stay above the 0 line when the market opens again. PSAR should be flipped next opening day as well. Last note... the stock has only been lower one time back in 2015 so the support is exponential.

(GNTY) - Strong Fundamentals / Solid TechnicalsThis company just launched it's IPO. Already you have technicals forming. In addition, the earnings are strong and with volume at the support line and small candles, I can tell that someone on the inside is convinced it will continue upward.

Also, doing extensive research into the kind of operations this company has made in the past. They would not have gone public if they didn't think they had something to show. They have yet to release their most recent earnings which I think, will be positive and will lead to a good profit.

Price targets around ($36 and $40)

$PLFX beyond TA, notes from the June 22nd Shareholder CCBLUF: PLFX will be making some huge PR notification in July as Jordan Fiksenbaum establishes his position as the CEO and Pulse Evolution takes on Las Vegas with its holographic live performances. Expect move up to QB then big boards.

PLFX CC June 22, 2017

Caveat – finances, expenses cab be different when audited – GAAP or non—GAAP

Revenue activity has commenced!

Alpha Test of Michael Jackson showed, the process needed better technology. Much better today than in 2014. We are among global leaders in this technology.

Why the CC now?

We feel we are at the Inflection Point. From a Start-up to a Global Entertainment Company.

From a developer to a monetizer of our technology.

The hire of Jordan NOW confirms the point of inflection has arrived.

Working together with AR, VR and AI. PLFX entertainment applications include:

On stage ( concert tours / theatrical exhibitions)

Games

VR

Rev’s will come in bunches. Series of announcements coming in coming quarter.

Our raising of financials has been successful. Since 2014 about $40 mil. Mostly from shareholders – including favourable shareholder debt. Cash-bur rate has been reduced.

Now, ready to start productions w/repeatable revenues in mind.

July 1 to Sept. 30, 2016 $3.5 mil deficit and 2 mil/mo. Cash burn rate.

2nt Quarter 2017:

1.8 mil cash receipts.

1.25 mil were producer fees, a very efficient way of sharing fees and responsibilities with co-producers, who bring a great deal of experience in live entertainment.

$400k in animation, Fantasy Popstars in Korea. Our first Animation.

$270k from living celebrity – can’t mention name, but TOP in the world today – eager to have his “digital likeness” established by us.

No rev. in current quarter – still more efficient cash deficit.

Focus on next month. (Mentioned here Pulse Biologic, a Subsidiary)

Expecting small profit starting July, which will help with overhead.

Our issue is sustainability and monetization of our technology.

Michael Jackson (Estate) Production activity was visible in 2017. We have a powerful, long-term relationship with them re: digital rights. The estate has the option to buy the digital rights in the future.

MJ = Global Distribution.

Elvis is still in negotiations. Working on contracts – hoping it will be similar to MJ Estate, with fixed revenue sharing, instead of % of rev’s.

Response to questions about ABBA – Let Simon Fuller build that property. PLFX still has proprietary rights, but traditionally (as we did with Cameron during film Titanic), Tech. Co.’s stay in background and do not get ahead of celebrities. We defer to Fuller and Universal Co. re: announcements. Relationship still important.

Large scale celebrity-based production (July) will be global ( again the inflection point). In House Production, goal is to push the evolution of our Technology.

Management – we have become active in recruiting top talent-

Jordan had over $5 bil. in sales – the fact that he is joining us NOW underlines the inflection point. HE was a long-time Non-Fiduciary Board of Advisors Member – now becoming active. He will have a broad mandate, stressing timeliness of reports.

Our principle currency will be the US Market.

Since Jan. 2015, focused on Big Productions. Had disadvantages – lots of work, development – didn’t always lead to delivery of product.

Co-production helps to eliminate these disadvantages. PLFX will have multiple “small pieces” of many pies. (Compare to franchising?)

Move up to QB next goal, then onward after that.

Up till now, we have been rather quiet, but now it’s time to talk. Shareholders will be hearing from us (Jordan) over the next weeks.

Debt is almost 100% shareholder. 8.9 million, of which 2.5 presently converting at $1.

PLFX has $600l in secured debt.

$TNTY breaches lower bolliesThe candles breached the lower bollie yesterday by more than 50% signaling a 85% likelyhood for a correction with the MACD and STO supporting my idea.

PLFX Sharehold Webcast at 11AM ESTLooks like the prices of $PLFX jumped up over the middle bollie and the PSAR is in support of a run in anticipation for the Shareholder webcast this morning. They've been very quiet for a long time, lets see what they've been keeping quiet about.

Shareholder Webcast Call Details – Thursday, June 22, 2017 at 11:00am ET: Webcast Link: www.investor

news.morningstar.com

6-16-17 1:15 PM EDT | Email Article

JUPITER, FL and SAN RAFAEL, CA / ACCESSWIRE / June 16, 2017 / Pulse Evolution Corporation (the "Company" or "Pulse Evolution") (OTC PINK: PLFX), a recognized pioneer and leading developer of hyper-realistic digital humans, today announced that the Company will host a shareholder webcast call on Thursday, June 22, 2017 at 11:00am ET, hosted by John Textor, Pulse Evolution's Executive Chairman, who intends to discuss the following topics:

- Financial Highlights: The Company will discuss the unaudited financial highlights of fiscal 2016, ended June 30, 2016, and the first two fiscal quarters of fiscal year 2017, including an important 'first revenue' milestone achieved in the quarter ended December 31, 2016. Please see note below regarding unaudited financial information.

Such revenues represent the first revenues realized by the Company, since its marketing launch of Virtual Michael Jackson at the 2014 Billboard Music Awards. While the Company's revenue model remains inconsistent, the 2nd fiscal quarter revenues represent an important milestone in the transformation of the Company from a technology development model to a rights exploitation and producer model. The Company will discuss in detail its plan to continue this transformation, while reporting on projects in development through Pulse Evolution's previously announced strategic entertainment partnerships.

- Project Update and Revenue Outlook: Management will report on projects and shows in development through Pulse Evolution's previously announced strategic entertainment partnerships, including a discussion of celebrity estate relationships, as well as non-theatrical projects in development.

- Management and Leadership Initiatives: The Company has been active in the recruitment of senior leadership candidates and prospective board members to strengthen our team in advance of key projects and corporate initiatives, including having been involved in negotiations with members of our Advisory Board to assume greater leadership roles in the Company and in connection with specific productions. The Company will provide a comprehensive update of this process and the expected timing of the addition of key hires.

- Business Model: The Company will discuss plans to become more efficient in its use of human capital and financial capital in its pursuit of the highest and best uses of its proprietary technology and its technical and creative know-how. This represents a change in strategy from the direct development of specific entertainment projects, which take significant time and expense to plan and launch, to the accumulation of rights contracts, made possible by the Company's technology leadership, which have the potential to produce more consistent revenues in the near-term and more value in the long-term.

- Strategic Review of Up-listing Alternatives: The Company will discuss its ongoing review of stock listing alternatives and report its priority intention to pursue an up-listing via the United States exchange markets, while still evaluating international opportunities.

- Capital Resources & Funding Strategy: The Company intends to review past methods of raising capital, as well as strategies going forward. The Company is currently reviewing several offers, that are either strategic in nature or that relate to specific productions. The shareholder call will include a discussion of these options.

ECOS $ECOS Setup to reverse

www.ecolocap.com Invest in the ecosystem!

www.sec.gov SEC Filings

.0012

charts.stocktwits.com

$ABHI MASSIVE DD Uncovered Current ChartALERTING $ABHI: NEW CEO, GOING CURRENT, POSSIBLE WIN OF RECENT LAWSUIT WORTH MILLIONS, REDUCTION OF DEBT, KILLER LICENSING AGREEMENT SIGNED.

Could gain some traction with massive revenue growth.300%+ Revenue growth from 2014 to 2015. I have a feeling something is brewing here, waiting patiently for a nice run.

stocktwits.com

charts.stocktwits.com

charts.stocktwits.com

charts.stocktwits.com

VTCQ Ready for a breakout, Bar chart analyst say 60% buyVTCQ is coming off a great day despite the markets getting hammered. It's in a nice consolidation phase and looks ready to breakout. Bar Chart analyst rate it a 60% short term buy. The company just signed a huge distribution deal earlier in the week as well.