Silver's Two Scenarios, An Important TimeSilver is falling into Support Area, Two Scenarios:

Break the descending trend line, stand over it: Reverse

Being pressed by descending trend line, breakdown the support line, and keep falling.

For the current signals, 1st scenario has higher probability, let me say, 70%.

Indicators:

9 Seasons Rainbow Multiple Time Frames Pattern PRO

RSI

Signals:

Bullish Divergence (Oversold, Support, Blue) on 3H.

Failed Bullish Divergence ( Crazy Sold, Fuchsia) on 16H, which means the previous support was broken.

DISCLAIMER

This is only a personal opinion and does NOT serve as live trade call NOR trading advice.

Please make their own decisions, carefully assess risks and be responsible for your own investing and trading activities.

Oversold

Forex Divergence Watch: USD Pairs 20190419USDCAD: Resistance in 1D, Yellow, Range

USDAUD: Conflict Signals

Bullish Divergence (Blue) in 339m (5.6H), Support

Bearish Divergence (Yellow) in 4D-5D Resistance

USD Pairs being monitored:

USDAUD , USDCAD , USDCHF , USDGBP , USDJPY , USDEUR

Time Frame:

1H - 2D

DISCLAIMER

This is only a personal opinion and does NOT serve as investing advice NOR trading advice.

Please make their own decisions, carefully assess risks and be responsible for your own investing and trading activities.

Forex Divergence Watch: EURO Pairs 20190419Euro Pairs being monitored:

EURAUD, EURCAD, EURCHF, EURGBP, EURJPY, EURUSD

Time Frame:

30m - 1D

EURGBP: Bearish Divergence / Resistance on 170m (3H), Yellow

EURADU: Bullish Divergence / Support on 680m (11H), Blue

EURGBP 170m MACD, RSI

EURADU: 680m MACD, RSI

DISCLAIMER

This is only a personal opinion and does NOT serve as investing advice NOR trading advice.

Please make their own decisions, carefully assess risks and be responsible for your own investing and trading activities.

forexTrdr NZDUSD- DO KIWIS BOUNCE? ASKING A FRIENDGood afternoon traders,

Looking at a severely oversold New Zealand dollar versus US dollar on multiple time frames. Most appealing to us is the daily timeframe but almost all time frames confirm the oversold nature of this pair after the recent inflation print disappointed. 0.1% versus 0.3% expectation. This led for the New Zealand dollar breaching key levels around low 0.67.

The market appears to have a found support around levels dating back to January both on the headline number and on the subsequent short lived bounce after it. Now we currently see the pair in extreme oversold status on RSI and bollinger band analysis highlighted in our tradingview chart.

The bounce we are looking for may not start to trend until the New Zealand session begins overnight but we are looking for a sustained bounce into next week take New Zealand dollar back towards mid 67s.

Good luck trading

from the Team at forexTrdr

find us on instagram, twitter and Alexa flash briefings

Is Divergence Really Irresistible?Divergence is one of the best technical analysis theories. Although not 100%, a very high probability of profitability is well known.

This idea lists most of the instances of divergence on BTCUSD (Coinbase) since $19892 summit of December 2017 on 2H interval.

Indicators used:

RSI

MACD

9 Seasons Rainbow Multiple Time Frames Pattern PRO

Base Time Frame: 2H, most upper ribbon of "9 Seasons Rainbow"

Longest Time Frame: 90H (3D + 18H), most lower ribbon of "9 Seasons Rainbow"

Instances of Bullish Divergences (Green Arrows)

29 instances, probability of profitability > 85%

Signals:

Blue ascending arrows in RSI & MACD

Blue Ribbons in "9 Seasons Rainbow"

Instances of Bearish Divergences (Red Arrows)

17 instances, probability of profitability > 90%

Signals:

Yellow descending arrows in RSI & MACD

Yellow Ribbons in "9 Seasons Rainbow"

The value of divergence: it is not limited to fixed price and it happens on any Time Frame, when it encounters strong resistance or support.

The downside of divergence: high reward is coming with high risk, when the resistance or support being broken through, a breakout or breakdown may happen. Thus whales can use this to play with the market, with the recent case happened on April 1.

By using "9 Seasons Rainbow" Indicators, traders can monitor Divergence:

Visually

Cross Multiple Time Frames on a single screen, without necessary to change time intervals /sessions

Setting Alerts of divergence on All Time Frames on a click

DISCLAIMER

This is only a personal opinion and does NOT serve as investing advice NOR trading advice.

Please make their own decisions, carefully assess risks and be responsible for your own investing and trading activities.

The arrows and rectangles are added manually according to signals of the indicators.

Hidden Divergence is not included in this idea, because I feel the probability to win is not so high as normal Divergence. May be I don't find the right method to use hidden Divergence.

Is Divergence the King or Queen of Crypto Technical Analysis?Divergence is one of the best technical analysis theories. Although not 100%, a very high probability of profitability is well known.

This idea lists most of the instances of divergence on BTCUSD (Coinbase) since $19892 summit of December 2017 on 2H interval.

Indicators used:

RSI

MACD

9 Seasons Rainbow Multiple Time Frames Pattern PRO

Base Time Frame: 2H, most upper ribbon of "9 Seasons Rainbow"

Longest Time Frame: 90H (3D + 18H), most lower ribbon of "9 Seasons Rainbow"

Instances of Bullish Divergences (Green Arrows)

29 instances, probability of profitability > 85%

Signals:

Blue ascending arrows in RSI & MACD

Blue Ribbons in "9 Seasons Rainbow"

Instances of Bearish Divergences (Red Arrows)

17 instances, probability of profitability > 90%

Signals:

Yellow descending arrows in RSI & MACD

Yellow Ribbons in "9 Seasons Rainbow"

The value of divergence: it is not limited to fixed price and it happens on any Time Frame, when it encounters strong resistance or support.

The downside of divergence: high reward is coming with high risk, when the resistance or support being broken through, a breakout or breakdown may happen. Thus whales can use this to play with the market, with the recent case happened on April 1.

By using "9 Seasons Rainbow" Indicators, traders can monitor Divergence:

Visually

Cross Multiple Time Frames on a single screen, without necessary to change time intervals /sessions

Setting Alerts of divergence on All Time Frames on a click

Poll: Is Divergence the King or Queen of Cryptocurrency / Cryptoasset Trading Technical Analysis?

Please leave your comments.

DISCLAIMER

This is only a personal opinion and does NOT serve as investing advice NOR trading advice.

Please make their own decisions, carefully assess risks and be responsible for your own investing and trading activities.

The arrows and rectangles are added manually according to signals of the indicators.

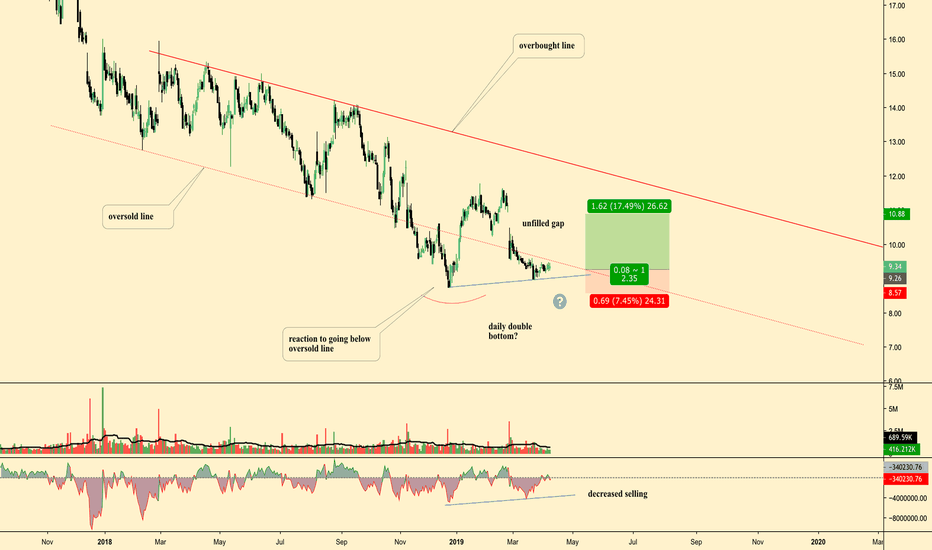

TIVO Long OppAnnotations and Ideas provided on chart

General Idea:

Possible Double Bottom, w/ second bottom forming higher low

decreased selling on second bottom

Price trading in oversold territory (below the channel)

Unfilled Gap that also coincides w/ local HVN (not marked)

EURJPY BULLISH TREND IN PLAY?Here we see the 4 hour eurjpy chart, with a few reasons to go long.

One is the bullish chart pattern that was printed.

Second is the double bottom that is circled in yellow.

Third is the 2 osc just leaving the oversold after giving them a quick kiss goodbye.

I am personally taking this trade, how ever its not a signal. Just an idea.

Thanks

Nokia potentially oversold on the alcatel lucent newsFundamentals:

Nokia took a big hit after stating that they are starting an internal investigation on alcatel lucent which they have bought. Investors reacted pretty hard to this and the stock was diving more that -8% during that day. It of course could be that there will be some negative facts to be found and in the worst case even some fines to be had. So there is of course a risk associated with longing the stock at this point.

However, let's consider this from a different perspective. The company decided willingly to start investigation and they contacted officials by themselves and they do not expect any concrete consequences on the company itself based on the investigation results. Of course this is their own statement and view on the matter and they would ideally always want to make it look like a minor thing even if it weren't. However, considering the other possibility that there won't be anything significant to be found on the investigations and there won't be any fines. The stock has dived more that -5% based on these news and the fear of the potential results. If nothing will be found this would suggest the stock was significantly oversold and should be looking to recover.

Techical side:

The technical side is quite simplistic. RSI9 shows that the stock is on the edge of being oversold and looking at the previous behavior the level 30 has often provided support and the price has bounced up. Sometimes of course this has been violated and can be the case here as well. However just considering the option that after the stock has been up and being valuated at the previous levels 5.25 - 5.6 after Q4 report it would be quite hard to believe the proper value would be below 5€ which is of course a very important support level.

Considering the both sides on this price crash I would suggest that Nokia is currently oversold and will be recovering when the investigations continue and if they show no concrete results suggesting significant fines to be had. I'd be looking to long Nokia now or at the fibonacci support at 5.065 which has been already tested briefly once. Stop loss should be placed below 5.065 support or 5.00 depending on your risk tolerance and personal view on how confident you are on these news.

Lastly considering the option that the investigations bring up skeletons in the closet and significant fines are had then the stop loss is still quite small and the potential reward in my opinion clearly out weights the risk.

BITCOIN GOT VALID SUPPORT, BULL MAY TEST 4050 RESISTANCE SOONBitcoin (CONBASE:BTCUSD) just got valid support.

Double Bottom Pattern is obvious.

Bull is showing strong desire to challenge 4050 resistance, which may happen within 72 hours.

Signals given by 9 Seasons Rainbow Multiple Time Frames Pattern PRO Indicator

Crazy Sold(Fuchsia) -> Oversold (Blue) indicates a failed breakdown and Price recovered to the support.

This happens on 42m, 1H, 2H Time Frames.

Overbought(Yellow) on 339m time frame indicates strong resistance at 4050 which was tested on March 21.

Some altcoins got support as well with the same signal:

LTCUSD

ETHUSD

$CRUUF is back in the buy zone. We could see Upside of +300%...=====================

CRUUF (Cameo Cobalt Corp.)

Alert Price: $0.0958

Investor Presentation

Company Website | Recent News

========================

Members,

Our top Cobalt play of 2019 is back in the buy zone!

it's time to put CRUUF (Cameo Cobalt Corp) back on your radar.

This energy metals explorer is back under 10-cents, and we're betting on an easy move of at least ten to fifteen percent tomorrow.

The Company just made another strategic acquisition that we believe will serve as an immediate catalyst for a major breakout in the days ahead.

Last week, the Company announced it has entered into an asset purchase agreement to acquire, from an arm’s length third party, three mineral claims adjacent to the Company’s Big Mac gold property. The Big Mac Gold Project shares more than 30 kilometres of contiguous claim boundaries on the east and west sides of Aben Resources Ltd.'s Forrest Kerr gold project. The Big Mac Gold Project is also located just north of properties owned by Garibaldi Resources Ltd. and Colorado Resources Ltd.

We view this as a very shrewd move by the management team over at CRUUF, as gold prices are expected to sky rocket this year.

Among those that are most bullish on the precious metal is Goldman Sachs. The investment bank maintained its overweight recommendation and raised its 12-month price forecast up from $1,350 an ounce to $1,425, a level last seen in August 2013. Goldman analysts contend that the gold price “will be supported primarily by growing demand for defensive assets, with a slower pace of Fed rate hikes in 2019 boosting demand only marginally.”

CRUUF is your key to capitalizing on the EV (Electric Vehicle) market for less than ten cents a share!

Companies like BMW, Nissan, Volvo, Tesla, GM, and Ford are all competing to become the leader in the electric vehicle space. Tesla CEO Elon Musk believes that more than half the new cars produced in America will be electric in ten years. Regardless of who comes out on top, all these automakers will need a supply of lithium to make car batteries.

There's a dire demand for cobalt to continue fueling the electric vehicle revolution.

Some have even said that cobalt may take over lithium as the star performer in the niche metals market. Cobalt is valued for its ability to withstand the crazy amount of heat that is generated by lithium-ion batteries.

CRUUF could be one of the most exciting cobalt plays in the market right now given the projects it has and these levels could be at the ground-floor!

CRUUF holds an option to acquire a 100% undivided, unencumbered legal and beneficial interest in the Montreal Cobalt Project, located 15 km southwest of Santiago in the past producing Metropolitan Region of Chile.

The company's Montreal Cobalt Project consists of 16 mineral claims and comprises a total of 4,500 hectares. It is less than 2 kilometres away from the past producing Merceditas mine.

The acquisition of the Montreal Cobalt Project has entrenched CRUUF in two of the three historic cobalt-producing regions of Chile!

CRUUF is the ultimate value play for those looking to cash in on the inevitable EV (Electric Vehicle) boom.

Here are just a few other reasons why we believe that CRUUF is due for a breakout of epic proportions

Cobalt demand is forecasted to triple in the next decade

Most of the world's cobalt production is concentrated in the Democratic Republic of Congo, where it has been revealed that children work in hazardous conditions mining the metal

It is now the 100% owner of 1 of only 2 molybdenum mines in Canada

61% increase molybdenum spot prices over the past year mean real feasibility of the Max Mine and Mill. Upward price movements are further amplified by Trump’s Trade War with China, affecting global molybdenum supply chains.

BMO Capital Markets has raised its price forecast for molybdenum on the back of expected limited output growth and rising demand from the oil and gas markets.

Max Mine and Mill’s past operator, Roca Mining had a market capitalization of more than $400 million with this asset.

Exposure to the looming gold bull market, by way of its 100% owned Big Mac Gold Project in the prolific Golden Triangle.

Currently rated as a "Buy" by the analysts at barchart.com

Has entered into an asset purchase agreement to acquire, from an arm’s length third party, three mineral claims adjacent to the Company’s Big Mac gold property. The Big Mac Gold Project shares more than 30 kilometres of contiguous claim boundaries on the east and west sides of Aben Resources Ltd.'s Forrest Kerr gold project. The Big Mac Gold Project is also located just north of properties owned by Garibaldi Resources Ltd. and Colorado Resources Ltd.

CRUUF closed Friday's session out strong, up over four percent, and just below session highs.

It has also closed in the green the past three sessions, while continuing to trade on higher than average volume.

This is a major bullish indicator....

We see limited downside risk, and almost unlimited upside potential from this alert price.

That being said, we ask that all members read our full profile, start their research now, and consider grabbing up a position in CRUUF tomorrow morning at 9:30AM EST!

About Cameo Cobalt Corp.

Cameo Cobalt Corp. (OTC: CRUUF) Invests in rare earth and precious metals projects. It has been garnering attention lately and has some notable lithium projects in the works.

They include: the Big Mac Gold Project, the Will Gold Project, the Carrizal Cobalt Project, the Montreal Cobalt Project, and now the with yesterday's acquisition, the MAX Mill and Molybdenum Project.

Big Projects = Big Revenue

Three weeks ago, CRUUF announced the completion of their acquisition of the Max Mine and Mill, Willa Property.

Acquisition Overview:

The acquisition of the Max Mine and Mill is a major development and a catalyst for growth as CRUUF only has a $5,000,000 market cap and these assets represent an opportunity of drastic growth in the valuation of the firm by 5x – 10x conservatively in the near term.

The deal is a combination of $203,982 in cash considerations, 5 million common shares and a grant of 50% net profit interest in the two mining properties going forward. The net profit grant is active only after Cameo has recouped its capital investment and pre-production cost.

Roca Mines Inc., the previous operator of the Max Mine and Mill traded at a market capitalization of more than $400,000,000. This highlights the management teams acquisition prowess and can give investors confidence in further growth of CRUUF.

While Energy Metals are forecasted to be the future of the automotive and energy storage industries, this company has built a dominant position in the booming gold market and holds claim to the most lucrative molybdenum call option on the board.

It looks like the management team over at CRUUF read President Trump's "The Art of the Deal" because this acquisition is shaping up to be the steal of a lifetime.

CRUUF is proving itself to be an acquisition powerhouse having grown its portfolio significantly in recent quarters. The company just completed 3 major acquisitions and is in the process of completing a $2 million dollar private placement that will assist with advancing their exploration programs this year.

The company is now in two out of three historic cobalt producing regions in Chile and has projects in 3 provinces in Canada. Its flagship asset is a 456-hectare project in the Carrizal Alto region that is adjacent to a historical high-grade cobalt deposit.

MAX Mine/Mill Overview

The Max Mine and Mill includes an underground molybdenum mine, crushing, milling and concentrating facilities, tailings storage facilities, mineral claims, mining leases, licenses. other The project is located near Trout Lake in the Revelstoke mining division of British Columbia.

The Max Project is turnkey and permitted with investments exceeding $80 million. The property is 5,489 hectares and consists of 59 mineral claims. The mine holds 22 million tons of 0.5% molybdenum and is one of the top 2 richest molybdenum deposits in Canada.

What is Molybdenum used for?

Molybdenum is used to make alloys and the mineral is able to increase the strength, hardness, electrical conductivity and resistance to corrosion. It is used for the creation of engines, heating elements, drills, circuit boards and electrodes.

Molybendum prices are currently affected by the Trade War between the US and China. This means turmoil for their industry represented by China’s leading Molybdenum producer’s stock being down over 35% in the last six months. China is responsible for nearly half the world’s industrial metal demand and two-thirds of the world’s seaborne trade in steel-making raw materials.

US will need to look to its neighbors for production and the MAX mine is one of only two options in close proximity to America. Molybdenum spot prices are up 61% over the past year and this rare earth element is certainly poised for another bull cycle.

In fact, BMO Capital Markets has raised its price forecast for molybdenum on the back of expected limited output growth and rising demand from the oil and gas markets.

MAX Mine/Mill Project Highlights

1 of 2 molybdenum mines in Canada

59 mineral claims totaling approximately 5,489 hectares

Total investment to date exceeds $80m

MAX Mine complex is turnkey operation and is fully permitted

Big Mac Gold Project Overview

The Big Mac gold project consists of 12 mineral claims situated in the Golden Triangle of British Columbia and represents the largest claim package in proximity of Aben Resources’ Forrest Kerr gold project. The Big Mac gold project is notable as it not only surrounds much of the Forrest Kerr gold project, but also contains significant tenure historically held by Barrick Gold. Aben Resources recently provided an update, announcing discovery of 62.4 grams per tonne gold over 6.0 metres within 38.7 grams per tonne gold over 10.0 metres.

On January 28th the company announced it has purchased a drill ready large land position in the Golden Triangle. This part of British Columbia has seen $100 million in exploration expenditures in 2017 and offers power generation, road infrastructure and abundant resources. The Big Mac project consists of 12 mineral claims across 9,264 hectares close to projects with sizable gold reserves.

Big Mac Exploration Plans

Cameo completed a helicopter-borne magnetic survey in early September 2018, comprising 901 line kilometers over the entire property. This study defined important structures branching east off the regional-scale Forest Kerr Fault Structure.

These second and potentially third order fault splays are interpreted as important controls on the emplacement of high-grade gold and silver veins in the region.

Cameo is currently preparing for an aggressive exploration program on this property that will include ground-based geophysical surveying, soil sampling, mapping and prospecting. This work is going to be done across the Forest Kerr splay structures defined by the 2018 airborne survey as well as zones of known mineralization previously defined by Barrick Gold Corp.

The Company is going to use the results of the Phase I exploration program to generate drill targets on the Big Mac. They will prepare a Notice of Work application for drilling with the BC Ministry of Energy, Mines and Petroleum Resources in 2019.

The potential of a significant discovery in the Golden Triangle has historically offered spectacular results for investors. GT Gold stock gained 646% in 2017, Garibaldi Resources gained 822% in three months and Metallis Resources gained 450% inside of two months.

The company’s $2,000,000 private placement, strong geological team and raising gold metals environment successful drill targets could mean big gains for Cameo Cobalt in the near term.

Big Mac Gold Project Highlights

12 mineral claims across 9,264 hectares

The largest claim package adjacent Aben Resources’ Forrest Kerr Gold Project that has indicated 62.4 grams per tonne gold over 6.0 metres within 38.7 grams per tonne gold over 10.0 metres

Recent Developments

Cameo to Acquire Additional Claims Adjacent to Its Big Mac Gold Project in British Columbia's Golden Triangle

The Company announced it has entered into an asset purchase agreement (the “Asset Purchase Agreement”) to acquire, from an arm’s length third party, three mineral claims (the “Claims”) adjacent to the Company’s Big Mac gold property. The Big Mac Gold Project shares more than 30 kilometres of contiguous claim boundaries on the east and west sides of Aben Resources Ltd.'s Forrest Kerr gold project. The Big Mac Gold Project is also located just north of properties owned by Garibaldi Resources Ltd. and Colorado Resources Ltd.

Under the terms of the Asset Purchase Agreement, Cameo has agreed to purchase the Claims for consideration of 20,000 common shares of the Company. The Asset Purchase Agreement and the purchase of the Claims by the Company are subject to the approval of the TSX Venture Exchange. Once issued, the common shares will be subject to a hold period of four months and a day from the date of issuance.

Big Mac Exploration Campaign

The Company is also pleased to announce that it finalizing its geochemistry survey and soil sampling initiatives for the 2019 summer exploration season. Cameo expects to engage Ridgeline Exploration Services Inc. (“Ridgeline”) to manage its summer exploration campaign in the Golden Triangle.

Cameo also reports that Campbell & Walker Geophysics Ltd. (“Campbell & Walker”) is concluding its 3-D modelling of a strong magnetic anomaly stretching more than five kilometres in a generally north-northeast trend across the Big Mac East block claims (see Cameo news release dated February 7, 2019). This anomaly appears to be up to approximately one kilometre wide and is interpreted to hold the potential to record a buried back-arc spreading centre.

The anomaly occurs within Hazelton Group basalts, mapped as Eskay rift fill by government geologists, on a prominent topographic feature referred to as Pillow Ridge entirely within the Big Mac East block and located 16 kilometres northwest of the historical gold- and silver-producing Eskay Creek mine site.

The Company plans to leverage the completed 3-D model of the Big Mac anomaly to locate one or two drill holes with the objective of establishing the stratigraphic context.

About the Big Mac Gold Project

The Big Mac gold project consists of 12 mineral claims structured into three tenure blocks and is the largest claim package contiguous with Aben Resources' Forrest Kerr gold project. The Big Mac West Block is located approximately 3 to 4 kms to the west of the East Block, across the Forrest Kerr Creek valley. As many as twenty mineral showings and prospects from the B.C. government’s MINFILE website occur between the Big Mac East and West Blocks.

Cameo completed a helicopter-borne magnetic survey over the property in September 2018, comprising 773 line kilometres at 150-metre spacing. Interpretation of the airborne magnetic data identifies a strong magnetic anomaly stretching more than five kilometers in a generally north-northeast trend within the Big Mac East Block, as well as cross faults extending from the regionally significant north-south Forrest Kerr fault. This strong magnetic anomaly occurs within Hazelton Group basalts, mapped as Eskay rift fill by government geologists.

As described in the NI 43-101 report, the Big Mac gold project is in British Columbia’s prolific golden triangle, covering 9171 hectares in two separate claims blocks. The Big Mac East Block (larger of the two blocks) is located between the past-producing Eskay Creek gold and silver mine (16 kms southeast), and Aben Resources’ 2018 drilling (9 kms to the north) which reportedly intersected multiple high-grade gold zones, including 38.7 grams per tonne gold over 10.0 metres.

Cameo Closes Acquisition of Max Mine and Mill, Willa Property

Cameo Cobalt Completes Big Mac 43-101

Market Outlook

Cobalt demand remains strong due to the electric vehicle EV boom.

Each new electric vehicle (EV) uses about 10kg (22 lbs) of cobalt.

The recent nickel shortage has attracted a lot of attention. What is less known is that molybdenum too is in ever greater demand, with tightening supplies and soaring prices. A world-wide boom in infrastructure projects, especially those which have critical applications, has fuelled demand for this versatile metal. Stainless Steel World asked Nicole Kinsman and Hans Imgrund of the International Molybdenum Association to explain the background and indicate what the future may hold. Their findings suggest that supplies will remain tight in the short term, but that the long-term supply prospects are looking good.

Healthy demand for molybdenum rich stainless steel, especially from the oil and gas industry, plus sluggish supply growth are expected to keep the price of this minor metal riding high.

Technical Analysis

From a technical standpoint, CRUUF looks like a no brainer.

But don't just take our word for it....the analysts at barchart.com are also bullish on this ticker, and have rated it a "Buy" based on several key technical indicators.

Shares of CRUUF were trading over forty-cents just last summer.

A run back to those highs from today's alert price would show traders well over +300% in real profit.

CRUUF closed Friday's trading session strong, up over four percent, and just below session highs.

It has also closed in the green the past three sessions, while continuing to trade on higher than average volume.

This is a major bullish indicator, and it means that momentum is on our side....

In our very own modest/unlicensed opinion, we are betting on at least a ten to fifteen percent move from CRUUF tomorrow

We see limited downside risk, and almost unlimited upside potential from this alert price.

As such, we are urging all members to start their research now, and consider grabbing up a position in CRUUF tomorrow morning at 9:30AM EST!

(*Remember to use a basic Stop-Loss Order or more advanced Stop-limit Order to protect your gains, as well as limit possible losses.)

Best Regards,

The TopMarketGainers Team

Don't Miss Our Next Huge Winner...

Text 'GAINS' to '67076'

to have our Trade Alerts

Delivered Direct

to your Cell Phone.

(There is no charge.

Msg&data rates may apply.)

DISCLAIMER

This newsletter is a paid advertisement, not a recommendation nor an offer to buy or sell securities. This newsletter is owned, operated and edited by both MJ Capital, LLC and PennyStockLocks, LLC. Any wording found in this e-mail or disclaimer referencing to “I” or “we” or “our” refers to MJ Capital, LLC and PennyStockLocks, LLC. Our business model is to be financially compensated to market and promote small public companies. By reading our newsletter and our website you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature, and are therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis of making investment decisions, and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our newsletters or on our website.

We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website and newsletter are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our newsletter and on our website may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. MJ Capital does NOT own any shares of the companies mentioned herewithin, nor intends to buy any in the future.

MJ Capital’s business model is to receive financial compensation to promote public companies. We have been compensated ten thousand dollars by World Wide Media Group to conduct investor relations advertising and marketing for CRUUF. Any compensation is a major conflict of interest in our ability to be unbiased. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the hiring third party or parties. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. The investor relations marketing may be as brief as one day, after which a large decrease in volume and share price is likely to occur. Our emails may contain forward looking statements, which are not guaranteed to materialize due to a variety of factors.

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our email newsletters and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, MJ Capital often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice.

WRK LONG - (WEEKLY)Westrock CO (WRK) are at a discount and looking to make it's new bullish swing. Parabolc SAR and MACD are both indicating this!!

We're LOVING <3 the Technical Setup on NYSE: $SDPI!We're LOVING <3 the Technical Setup on NYSE: $SDPI!

As such, I've added 2,500 shares here & submitted a BUY order to

BUY an additional 2,000 shares @ $1.39! We are sitting just below

the GOLDEN POCKET @ precisely the 0.7 fib area! There is likely

no better time to buy shares of #SuperiorDrillingProducts!

EOSUSD Completed Adjustment, Time to LongEOSUSD has completed Adjustment, the Support works, Time to buy.

Signals by 9 Seasons Rainbow PRO

OverSold(Blue) in 15m, 21m, 30m, 1H

DISCLAIM

This is only a personal opinion and does NOT serve as investing NOR trading advice.

Please make their own decisions, carefully assess risks and be responsible for your own investing and trading activities.

#BHTG on high alert. This Nasdaq listed company looks ready...=====================

BHTG (BioHiTech Global Inc.)

Current Price: $2.95

Analyst Price Target: $7.00

Chart Analysis

Float: 6.63M

Investor Presentation

Website | Recent News

========================

Members,

One of our biggest winners of 2019 is back in the buy zone.

Please turn your immediate attention back to BHTG (BioHiTech Global Inc.).

The last time we brought BHTG to your attention, shares of this innovative waste management company ran from $2.26 all the way to a 3-month high of $3.30.

Those who acted on our buy call had the opportunity to secure up to +46% in realistic gains.

Since then we've been keeping a close eye on BHTG, and once again this low-float Nasdaq listed company appears to primed and ready for another run past $3.00 and beyond.

Not only has BHTG seen a significant decrease in its short interest since our last alert, but it has also released some market friendly news that we feel hasn't received the full attention of the Street as of yet.

With its cutting edge technology, BHTG appears to be well on its way to changing the game in this multi-billion dollar Waste Management industry.

Trading at a forty-seven percent discount from its 52-week high, BHTG once again looks like one of the biggest steals on the Nasdaq.

For one, its client list already reads like a veritable "Who's Who" in the service industry:

The Cheese Cake Factory

Costco

Dunkin Donuts

Golden Corral

Hilton

Marriott

The Hard Rock Cafe

These are all global household names whose growth could be considered an immediate catalyst for BHTG's bottom line.

If that wasn't enough, you'll be happy to know that BHTG:

Targeting a Q4 2020 completion date for a facility that is expected to generate $12 million of high margin annual revenue.

Has initiated operations at the nation's first HEBioT™ renewable resource recovery facility located in Martinsburg, West Virginia

Announced the installation of BioHiTech Revolution Series™ Digester technology at Sprouts Farmers Market's first store in Philadelphia, Pa., located at 1000 S Broad Street.

Installed BioHiTech Revolution Series™ Digester technology at two hospital locations for a major operator of more than 25 hospitals and primary care facilities in the New York metropolitan area.

Witnessed Q3 2018 revenues increase by 65.8% with gross profit increasing by 282.8%!

Has a tight float of 6.63M.

Analyst price target of $7.00, giving it an Immediate upside of over +137% from today's alert price of $2.95.

Witnessed 11 insider open market buys over the last 12-months, and ZERO insider sells.

Reported a decrease of 8.81% in short interest.

Total Annual Potential Revenue of $2.75B.

Has a management team is committed to long-term growth.

All the above bullish catalysts have us confident that BHTG will once again be a significant winner for our members in both the short, and long term.

All signs are pointing to a blowout quarter, leaving us excited for the future of BHTG.

If you missed out on BHTG's last +46% multi-day rally, you may want to consider jumping on board this time around.

That being said, we are asking all members to read our full profile on BHTG, start their research, and consider taking action tomorrow morning at 9:30AM EST.

About BioHiTech Global

BioHiTech Global, Inc. (BHTG), is changing the way we think about managing waste. Our innovative waste management services combined with our disruptive technologies provide sustainable waste disposal and supply chain management solutions for businesses and municipalities of all sizes. Our cost-effective technology platforms can virtually eliminate landfill usage through real-time data analytics to reduce waste generation, biological disposal of food waste at the point of generation, and the processing of municipal solid waste into a valuable renewable fuel. For more information, please visit www.biohitech.com.

BHTG Provides Cost-Effective Technology and Management Solutions for Sustainable Waste Disposal

BHTG integrates proprietary technology solutions into the traditional disposal services model that are designed to:

Reduce waste volume.

Lower transportation costs.

Minimize landfill usage to achieve Zero Waste.

Their sustainable technology solutions include:

Mixed municipal waste processing/conversion facilities - utilizes proven patented technology to reduce weight and convert waste into an EPA recognized renewable solid recovered fuel.

On-site food waste disposal technology - converts food waste into a liquid that is safely discharged to any standard sewer line, eliminating transportation costs while reducing odors and pest problems.

Cloud-based data analytics platform - patented technology that collects food waste disposal data and converts it into actionable real-time supply chain management information to help change behavior and reduce food waste generation.

BHTG controls the exclusive U.S. development rights to deploy facilities using a patented High Efficiency Biological Treatment (“HEBioT”) process in 11 Northeast states and DC.

HEBioT® Facility Benefits:

Aesthetically pleasing.

Waste is unloaded and processed inside facility

Outside environment is not exposed to waste.

Filtration system contains all odors and contaminants.

Fully automated process.

No worker exposure to waste.

Reduces landfill usage by up to 80%.

Produces an EPA recognized solid recovered fuel (SRF).

Generates high EBITDA margins.

BioHiTech’s Martinsburg facility is the first mixed municipal waste processing facility in the U.S. to utilize the patented HEBioT process.

First full year of operations in 2019.

Financed through $33 million in bond issuances by the West Virginia Economic Development Authority.

10 year contracts for input and off-take guarantees strong EBITDA margins.

BioHiTech’s majority owned subsidiary owns a 78% equity stake (partners include Kinderhook Industries and Entsorga).

BHTG's patented IoT software platform leverages AWS and Slack to empower low-tech industrial machinery with high-tech data analytics capabilities and communication tools.

BioHiTech Cirrus™ & BioHiTech Alto™

Provides frictionless two-way natural language communication through chatbot technology.

Functions as as a virtual assistant at your fingertips.

Smart Mode Technology

Drives equipment performance through cloud-connected machine learning capabilities.

Automated optimization to reduce water usage and lower energy consumption.

Three Complimentary Revenue Streams to Fuel Growth in 2019 and Beyond

HEBioT Facilities

Martinsburg W.Va facility expected to generate $7 million in high margin annual revenue starting in 2019.

Rensselaer facility expected to commence operations in Q4 2020 – Q1 2021 expected $12 million in high margin annual revenue.

Anticipates having 2-3 projects in various stages of development each year.

Revolution Series and Eco-Safe Digesters

Recurring revenue model with growing customer base to target 30%+ year over year unit growth.

Consistent international product sales.

Gold Medal Management Services

High margin revenue expected to be approximately $1 million in 2019 for oversight of Gold Medal’s operations leveraging it’s existing management team.

Gold Medal/Kinderhook partnership creates significant opportunities to accelerate the growth of our other businesses.

Recent Developments for BHTG

BioHiTech Global Initiates Operations at the Nation's First HEBioT Renewable Resource Recovery Facility in Martinsburg West Virginia

Initial phase of mechanical testing at the facility has been completed

Facility has received its first deliveries of waste and is expected to begin next phase of processing for production of its EPA recognized Solid Recovered Fuel in March

Company expects the facility to run at or near full capacity early in Q2 2019

Company sees the facility's operations adding $7 million of annual high margin revenue

Market Outlook:

According to a new report published by Allied Market Research, titled,"Waste Management Market by Waste Type and Service: Global Opportunity Analysis and Industry Forecast, 2018 - 2025,"the global waste management market accounted for $303.6 billion in 2017, and is expected to reach $484.9 billion by 2025, growing at a CAGR of 6.0% from 2018 to 2025".

Multi-Billion Dollar Market Opportunity for BHTG Solutions

Recurring Revenue Model for Digesters

Multi-year leasing model creates dependable recurring revenue stream

Eco-Safe Digester Market

Annual Potential Revenue: $1.5B

Revolution Digest Market

Annual Potential Revenue: $1.01B

HEBioT Technology Potential Market

Initial U.S. Target Area

11 Northeast States + DC

Annual Potential Revenue: $500-$600M

Total Annual Potential Revenue: $2.75B

Technical Analysis:

As we mentioned before, BHTG has a well recorded history of running up for big gains..

On June 11th shares ran-up over 48% from $3.88 to $5.76!

On September 21st shares ran-up over +25% from $3.50 to $4.40!

On November 29th shares ran-up over 33% from $2.59 to $3.45!

On January 7th shares ran-up over 33% from $2.08 to $2.78!

And let's not forget...

The last time we brought BHTG to your attention, it ran from $2.26 all the way to a 3-month high of $3.30 over the course of seven trading sessions.

Those who acted on our buy call had the opportunity to secure up to +46% in realistic gains

BHTG is trading at a nearly forty-seven percent discount from its 52-week high of $5.76

A run back to those highs from today's alert price would show traders gains of up to +95.5%!

We've done our own chart analysis, and see the potential for a move of nearly +82% for BHTG.

With a strong revenue growth, big-name clients, and plenty of room to the upside, BHTG looks like it could be massive winner in both the short, and long-term.

As such, we are urging all members to start their research on BHTG, and to add it to the top of their watchlist!

Best Regards,

The TopMarketGainers Team

Don't Miss Our Next Huge Winner...

Text 'GAINS' to '67076'

to have our Trade Alerts

Delivered Direct

to your Cell Phone.

(There is no charge.

Msg&data rates may apply.)

Follow Us On Twitter:

DISCLAIMER

This newsletter is a paid advertisement, not a recommendation nor an offer to buy or sell securities. This newsletter is owned, operated and edited by both MJ Capital, LLC and PennyStockLocks, LLC. Any wording found in this e-mail or disclaimer referencing to “I” or “we” or “our” refers to MJ Capital, LLC and PennyStockLocks, LLC. Our business model is to be financially compensated to market and promote small public companies. By reading our newsletter and our website you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature, and are therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis of making investment decisions, and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our newsletters or on our website.

We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website and newsletter are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our newsletter and on our website may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. MJ Capital does NOT own any shares of the companies mentioned herewithin, nor intends to buy any in the future.

MJ Capital’s business model is to receive financial compensation to promote public companies. We have been compensated ten thousand dollars by World Wide Holdings dba Invictus Resources to conduct investor relations advertising and marketing for BHTG. We have been previously compensated ten thousand dollars by World Wide Holdings dba Invictus Resources to conduct investor relations advertising and marketing for BHTG on two seperate occacions -which have expired. Any compensation is a major conflict of interest in our ability to be unbiased. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the hiring third party or parties. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. The investor relations marketing may be as brief as one day, after which a large decrease in volume and share price is likely to occur. Our emails may contain forward looking statements, which are not guaranteed to materialize due to a variety of factors.

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our email newsletters and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, MJ Capital often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice.