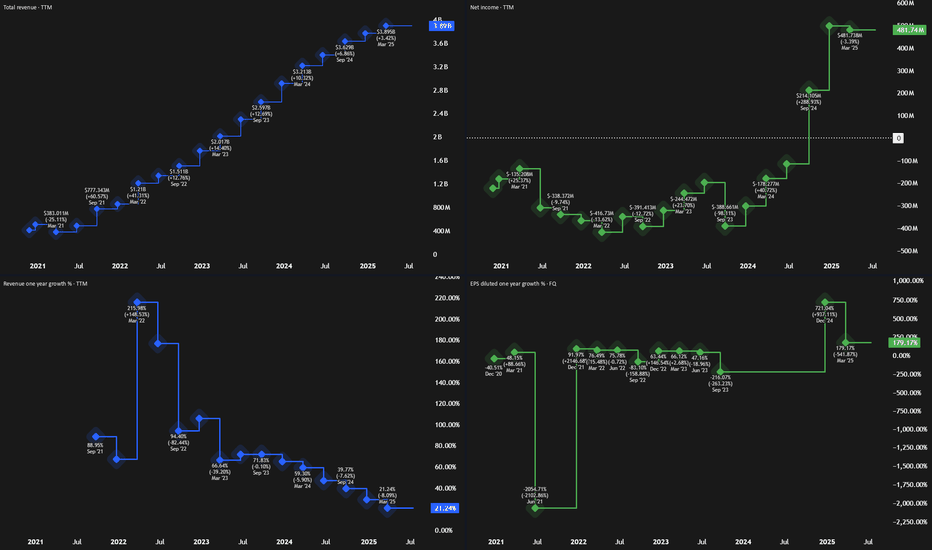

Why We See 100%+ Upside In SoFi Over The Next 3 YearsAfter soaring to nearly $28 per share during the SPAC-fueled fintech boom in 2021, SoFi Technologies (SOFI) crashed back to earth, trading under $5 as rising interest rates, regulatory headwinds, and lack of profitability dimmed investor optimism. But the tide has turned.

Over the past year, SoFi has reshaped its business and posted significant growth. Shares are now up 247% since our previous bullish call at $6. With the company now profitable and diversifying revenue, we'd argue there’s still upside ahead.

💼 A Stronger, Diversified Business

SoFi has evolved from a student loan-focused lender into a full-spectrum fintech platform. It now operates across:

Lending: $413M in Q1 revenue

Financial Services (consumer banking): $303M

Technology Platform (B2B): $103M

While lending still makes up the majority, the tech and services segments are growing fast—especially financial services, which doubled revenue YoY and tripled profit. SoFi's white-label platform also gives it a SaaS-like recurring revenue profile.

Q1 results showed:

Revenue: $770M (+33% YoY)

EPS: $0.06, with a $31M revenue beat

This business mix gives SoFi more stability and better scalability than many traditional financial firms.

💰 Valuation: Pricey vs. Banks, Cheap vs. Fintech

Critics point to SoFi’s rich valuation—trading at over 8x sales—as a concern. But when compared to other fintechs like NuBank (12x sales) and Robinhood (28x), SoFi looks much more reasonably priced.

On a forward earnings basis, SoFi trades at ~32x GAAP EPS, and if growth continues, this could drop below 30x. That’s appealing for a company expected to grow:

Revenue: ~25% annually

Net income: ~33% annually

By 2027, analysts project $1B in operating income, double today’s figure. If SoFi maintains current valuation multiples, this alone could double the stock in 3 years.

⚠️ Risks to Watch

Regulatory scrutiny in the financial sector

Cyclicality of consumer lending

Intense competition from firms like Robinhood, Chime, and Coinbase

Despite these challenges, SoFi’s expanding ecosystem and growing brand strength position it well.

✅ Final Take: Still a 'Strong Buy'

With accelerating revenue, expanding margins, and a scalable business model, SoFi has moved beyond its hype-fueled origins and is now a real fintech contender. Even after its rally, its valuation still leaves room for meaningful upside.

Rating: Strong Buy

Community ideas

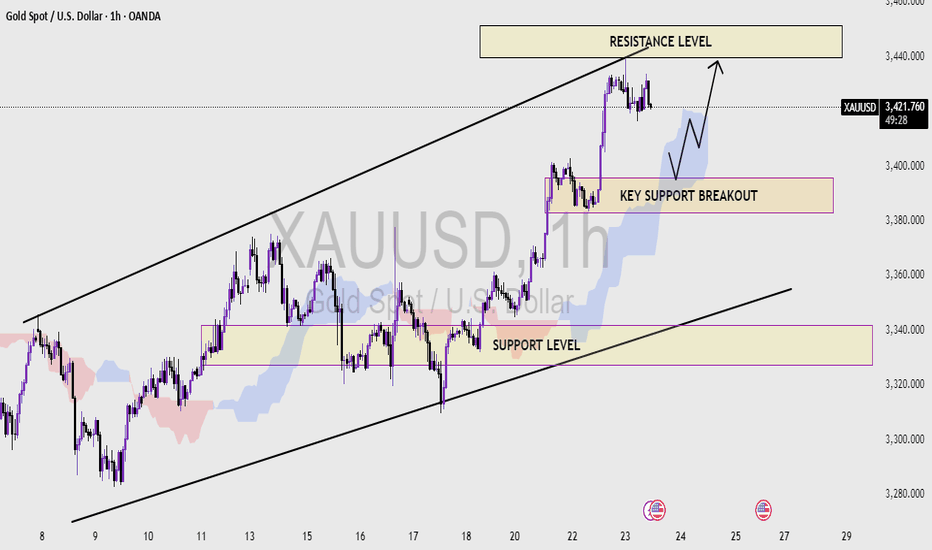

XAUUSD (1H Time frame) Read the captionXAU/USD Analysis (1H Timeframe )

This chart represents the XAU/USD (Gold vs US Dollar) price movement on a 1-hour timeframe, showcasing a well-defined ascending channel. The analysis highlights three critical zones:

1. Resistance Level (Upper Blue Zone):

This zone, located around the $3,440 - $3,450 range, marks the potential upper limit of the current bullish channel. A breakout above this level could indicate strong bullish momentum continuation.

2. Key Support Breakout Zone (Middle Purple Zone):

Around the $3,390 - $3,400 range, this area previously acted as resistance and now serves as a key support level. A price retest and bounce from this zone could confirm it as a new support base, potentially triggering a move toward the resistance zone again.

3. Support Level (Lower Purple Zone):

Found near the $3,320 level, this is the broader trendline and horizontal support zone that would be critical if the price breaks below the key support area. It acts as a major demand zone within the ascending channel.

Observations:

The price is currently in a strong uptrend within the rising channel.

A retest of the key support breakout zone is anticipated before potentially pushing higher toward resistance.

A breakdown below the key support could trigger a move toward the lower support level.

Technical Bias:

Bullish as long as the price remains above the key support level.

Bearish reversal may occur on a confirmed breakdown below the ascending channel and lower support zone.

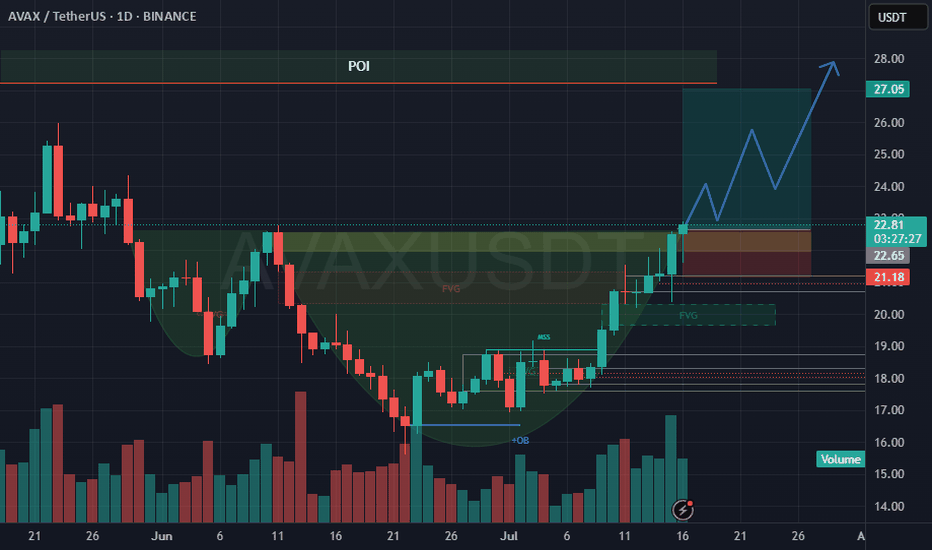

LONG ON $AVAXThe AVAX/USDT chart presents a bullish continuation setup supported by a completed cup formation, bullish market structure shift (MSS) and fair value gap (FVG) fills. With rising volume on the right side of the cup and a clean break above recent resistance, the market shows clear signs of institutional interest and buyer strength. The price is approaching a Point of Interest (POI) near $27, which is likely to serve as a target zone or temporary supply barrier.

A long trade setup is valid between $21.50 and $22.60 which aligns with the retest of the FVG zone, previous structure breakout and early handle development. Stop loss should be placed at $20.9, protecting the setup from invalidation while maintaining a strong risk-reward profile. Target levels include $24.50 (TP1) for an early exit, $26.80 (TP2) near the POI base and $27.05\$27.20 (TP3) at the top of the expected move. R:R range from 2:1 up to 5:1 depending on point of entry.

To execute, traders should watch for bullish confirmation on lower timeframes (1H–4H) within the entry zone, such as a bullish engulfing candle, BOS or a volume-backed rejection. A scaling entry strategy can improve average price and partial profit-taking at key levels ensures the position remains protected as the trade unfolds. Overall, the structure, volume, and Smart Money signals support a high-probability long from the $21.50\$22.60 range toward the $27 POI.

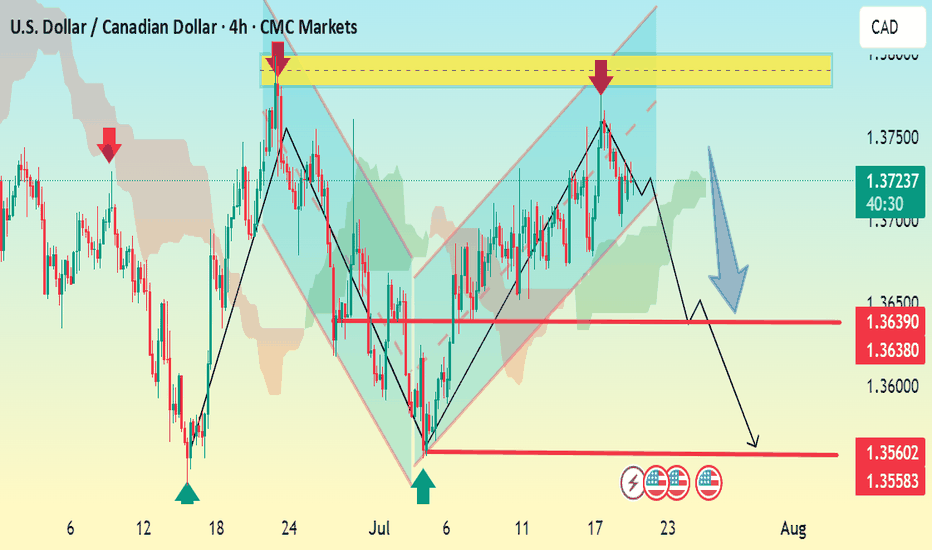

USDCAD 4H Bearish SetupThe USDCAD chart shows a clear bearish breakdown from the ascending channel. Price has broken below support near 1.3720, confirming a shift in structure.

Key Analysis:

Bearish Momentum: Break below the channel and current market structure signals downside pressure.

Immediate Resistance: 1.3725–1.3745 zone (yellow area) where price previously rejected.

Support Levels:

1.3639 / 1.3638: Short-term support — possible temporary bounce area.

1.3560: Main target — previous demand zone.

Trade Idea:

Sell below 1.3720

TP1: 1.3639

TP2: 1.3560

SL: Above 1.3750 (above resistance zone)

Summary:

Bias remains bearish as long as the price stays below 1.3725–1.3750 resistance zone. Confirmation of further downside expected on break below 1.3638.

Let me know if you want this as a signal format or turned into an image.

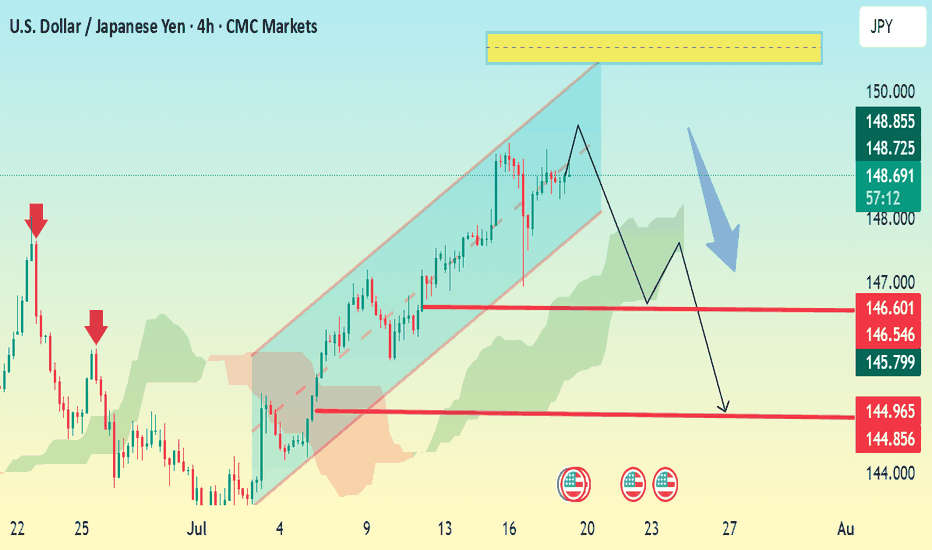

USD/JPY 4H Bearish Setup – Channel Breakdown ExpectedThe chart shows USD/JPY in a rising channel with a projected bearish reversal setup forming. Here’s a breakdown:

🔹 Current Price: 148.83

🔹 Pattern Observed:

The pair is trading inside a rising channel.

A potential double top or lower high formation near the top of the channel suggests weakening bullish momentum.

Price may break down through the channel support.

🔻 Bearish Scenario (as shown by the blue arrow):

1. Initial drop expected to the support zone around:

146.60 – 146.54

Minor consolidation possible at this level.

2. If broken, next target zone is:

144.96 – 144.85

🔑 Key Levels:

Resistance Zone: 149.80–150.00 (highlighted in yellow)

Support Levels:

First: 146.60

Second: 144.96

✅ Bearish Confirmation:

A 4H candle close below 146.60 would confirm the bearish move.

Watch Ichimoku cloud — if price breaks and closes below the cloud, it will strengthen the downtrend.

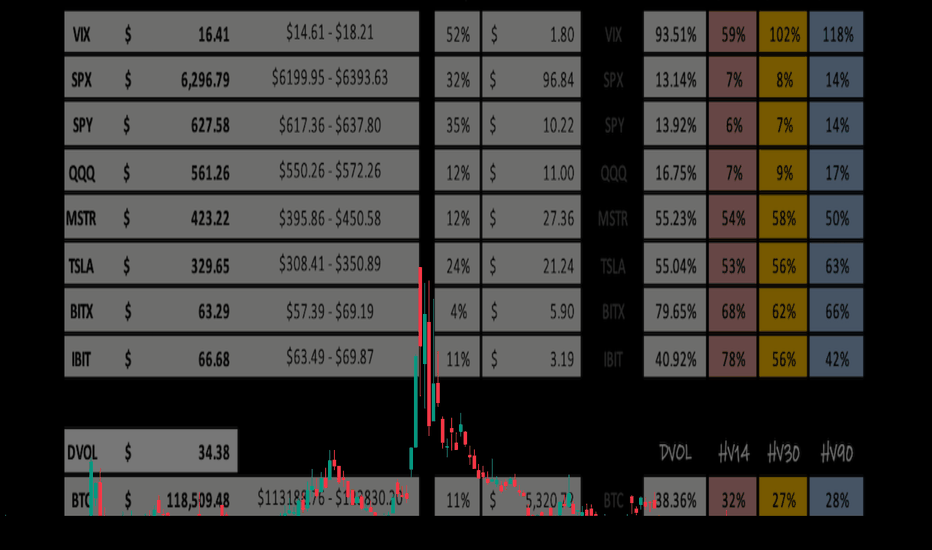

Weekly Volatility ReadGood Evening --🌗 🌕🌓

I hope everyone is having a relaxing weekend with friends and family alike because soon we will be in the thick of the price action again -- and it may get spicy! Let't us dive in as we review what happened last week and we look towards the next to trade range or observe.

The CBOE:SPX opened the week fairly slow at $6,193.18 and increased throughout the week wicking up to a new ATH of $6,315.61 only to close the week off at $6,267.28 -- This leaves the IM on the week +$83.10. This closest respects the quarterly implied range that was a 'strength of IV' of 129.30%.

Now looking towards this next week we have extremely low HV across the board in the broader markets. CBOE:SPX IV (13.14%) is trending 32% IV percentile on the year -- premium is seemingly cheap. HV10 (6.97%) is coiled within 97.67% of it's sliding yearly lows, showing a need for short-term volatility to consolidate. HV21 (7.78%) is even more coiled to it's yearly low at 98.76% respectively. Both are roughly mid 50% 'strength to IV' as IV predicts twice the potential move next week.

Lastly, HV63 our quarterly trending values is showing a 'strength of IV' at only 108% but, could be supporting the thesis IV is projecting, as we do need a TVC:VIX pop OR time-wise consolidation. 📈📉

I hope everyone has a great week trading ranges and I will see you next weekend!

Cheers! 🍻🍻🍻

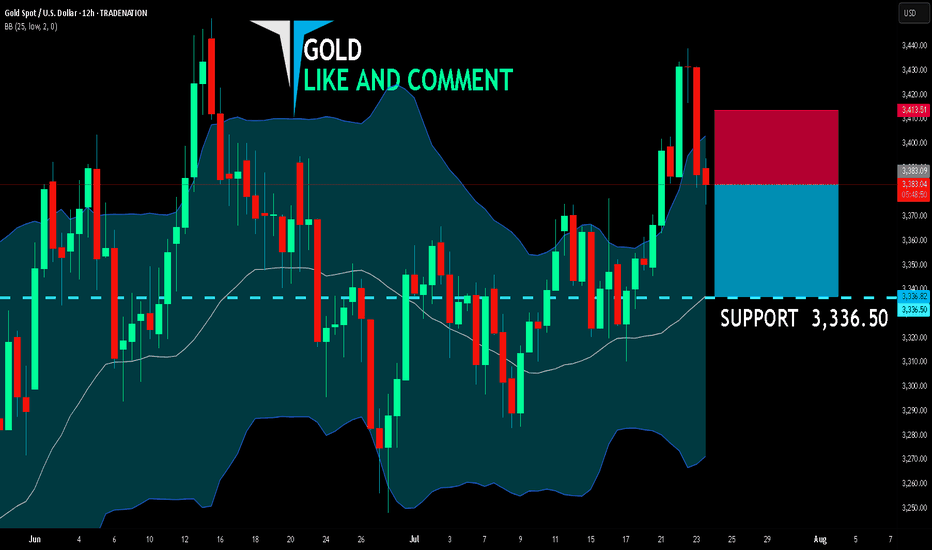

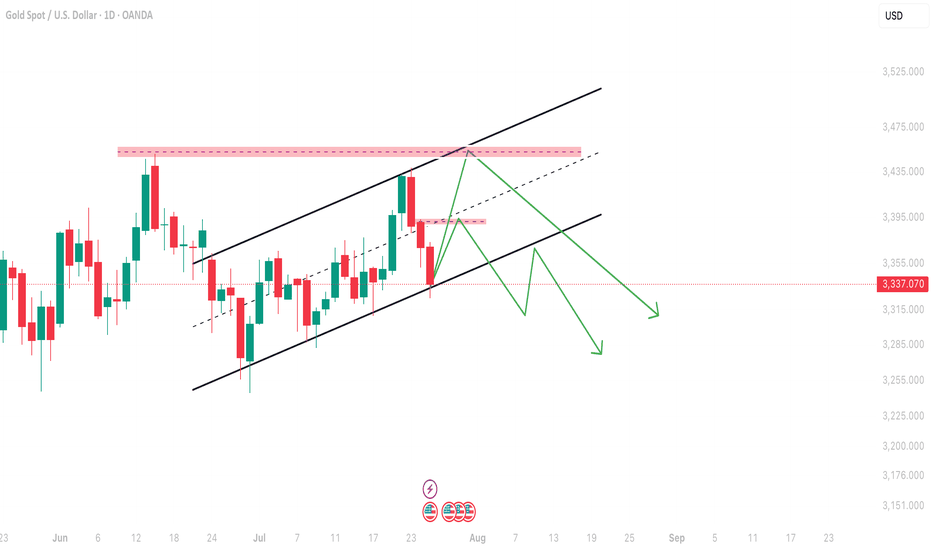

GOLD BEARS ARE STRONG HERE|SHORT

GOLD SIGNAL

Trade Direction: short

Entry Level: 3,383.09

Target Level: 3,336.50

Stop Loss: 3,413.51

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 12h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

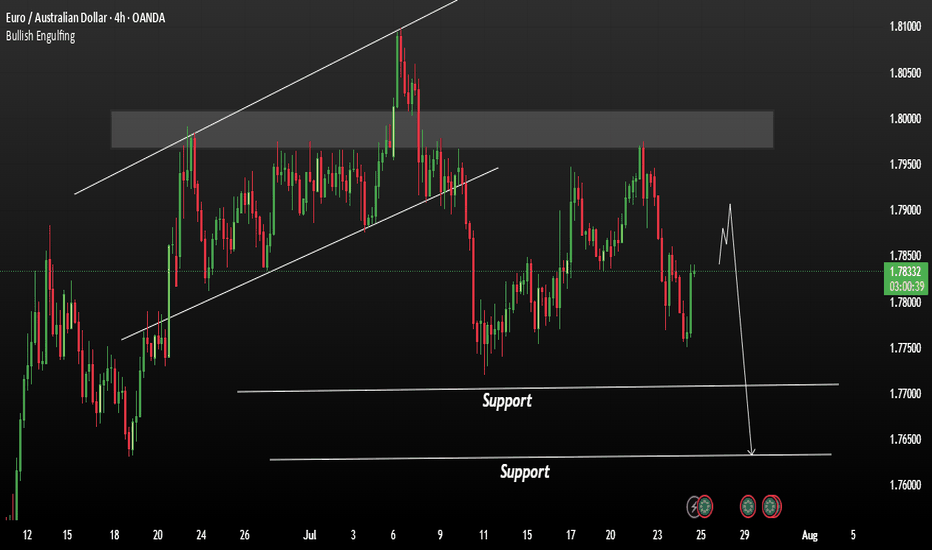

EURAUD is currently showing signs of a bearishEURAUD is currently showing signs of a bearish trend continuation. Despite short-term upward movement driven by optimism around the ECB, the overall structure remains vulnerable to downside pressure.

The European Central Bank (ECB) is expected to keep interest rates unchanged, potentially ending a seven-year streak of cuts. While this could bring temporary strength to the Euro, the technical setup still favours the bears.

Watch for a Break Below the Neckline

If price manages to break below the neckline of the current pattern, it could trigger a strong bearish move. First support: 1.77100 Second support: 1.76300

You May find more details in the chart.

Ps: Support with like and comments for more analysis.

FLOKI - Oki Doki PumpJust one of many coins that I am picking in this area.

But these meme coins can have some pop - and so this is one I share with TradingView.

It had once nice push up (arrow) - signalling it has plenty of bullish potential.

The low time frame is choppy but the candles are both narrowing and shallowing -

I think this may be building pressure for a next wave up.

This analysis is shared for educational purposes only and does not constitute financial advice. Please conduct your own research before making any trading decisions.

GBP/USD (1H) – SMC Outlook & Price Pathways🔍 Structure Overview:

Price has tapped into a key intraday demand zone (Pivot Point region) after a clean drop from the bearish breaker area. The market is at a critical decision point, and we’re watching for either a short-term retracement rally or a deeper liquidity hunt into the major POI below.

🧠 Key SMC Concepts Applied:

✅ Clean BOS (Break of Structure)

✅ Well-mapped OB zones (above & below)

✅ Liquidity Traps: SSL & BSL identified

✅ Bear Zone Retracement mapped for short-sellers

✅ RSI + MACD divergence signals are building quietly

📍 Key Zones on Chart:

🔴 Bearish Zone Retracement (Short Area): 1.3511 – 1.3517

🔵 Pivot Point / Minor Demand: 1.3480 – 1.3490

🟦 Deep POI: 1.3380 – 1.3400

🟩 Strong OB: 1.3365 – 1.3385

🟪 Day High/BSL Target: 1.3588

❌ SSL (Sell-Side Liquidity): ~1.3360

📈 Scenario A – Short-Term Bullish Reversal (Purple Path):

Price may bounce from the pivot zone

Target 1: Bear Zone (1.3515)

Target 2: BSL @ 1.3588

✅ Bias flips bullish if 1.3515 is cleanly broken

📉 Scenario B – Liquidity Sweep (Yellow Path):

If the current zone fails, watch for a drop into the deep OB / POI

Potential long from 1.3365 – 1.3385, targeting full bullish swing toward BSL 1.3588

🎯 Trade Example (Scenario B):

Buy Limit: 1.3375

SL: 1.3345

TP1: 1.3485

TP2: 1.3588

Risk-Reward: 1:3+

✅ Suggested Caption for TradingView:

GBP/USD (1H): Decision Point Active!

Price has reacted off a local demand near the pivot. Watching for bullish momentum to target 1.3515 → 1.3588. If price dips into the deeper POI below 1.3400, I’ll be looking for a liquidity sweep and reversal. RSI + MACD divergence are hinting at strength building.

🔹 This is educational content – not financial advice.

Crypto market review [UPD]: set-ups in BTC and alt-coinsMade a quick video going over some of the setups I see developing in Bitcoin and a few altcoins I personally track and trade.

Thank you for your attention and I wish you successful trading decisions!

If you’d like to hear my take on any other coin you’re following — feel free to ask in the comments (just don’t forget to boost the idea first 😉).

Bullish potential detected for MTSEntry conditions:

(i) higher share price for ASX:MTS along with swing up of indicators such as DMI/RSI.

Stop loss for the trade would be:

(i) below the recent swing low of 6th May (i.e.: below $3.21), or

(ii) a close below the 50 day moving average (currently $3.16), or

(ii) below the support level from the open of 11th April (i.e.: below $3.12), depending on risk tolerance.

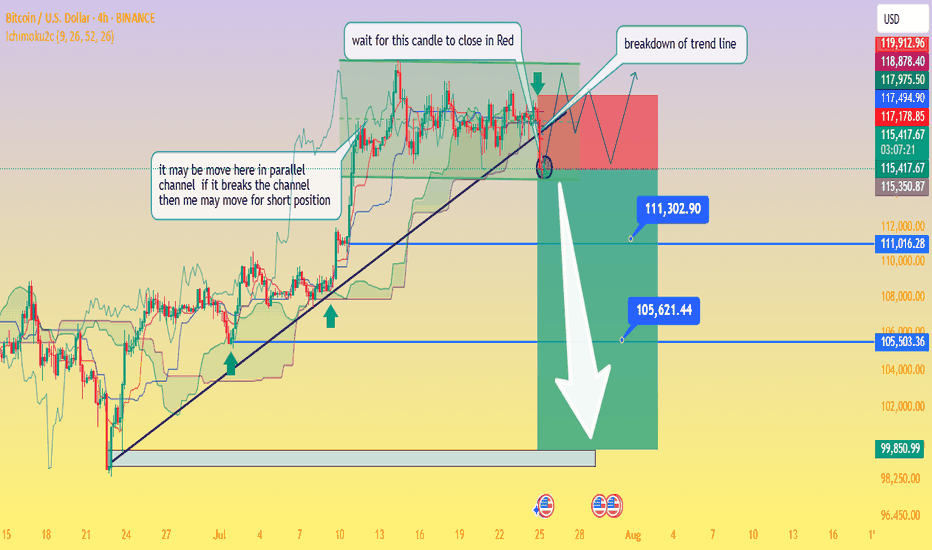

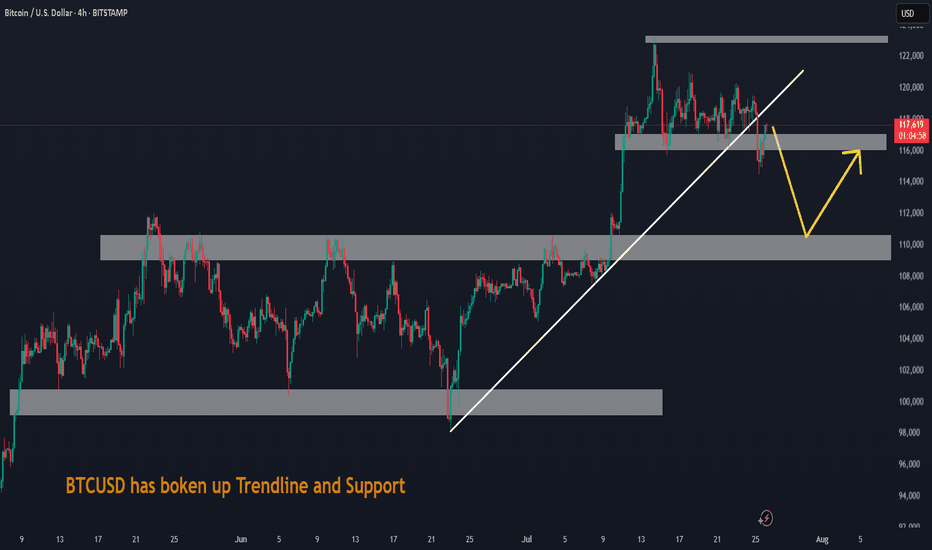

Critical Breakdown: BTC/USD Poised to Fall — Waiting on H4 CloseAnalysis of the BTC/USD 4‑Hour Chart

From the chart you provided, here's how the technical situation looks:

Ascending trendline support has been tested multiple times and was recently breached this afternoon, signaling a possible shift from the bullish setup to a bearish continuation.

The price is now trapped within a descending triangle formation beneath a well‑defined swing high resistance zone. This reflects indecision in the market, with neither buyers nor sellers in clear control

Business Insider

+15

Fxglory Ltd

+15

Bitcoin News

+15

.

Key levels to monitor:

Support zone: ~$115,500, extending down to ~$111,300 and ~$105,600 as deeper targets if bearish momentum strengthens.

Resistance zone: ~$119,000–120,000 area, forming strong overhead supply

Economies.com

DailyForex

Bitcoin News

.

The chart’s annotations align with a classic breakout strategy—with the caveat: wait for a confirmed close below the trendline before considering short positions (as noted in your “wait for this candle to close in red” comment).

Breakout confirmation would likely pave the way toward your indicated profit zones near ~$111k and ~$105k, with a larger potential down to ~$99.8k if further downside pressure builds.

🔍 What the Broader Market Signals

Technical sentiment from sources covering today’s analysis shows BTC/USD hovering just under $120,000, stuck within the defined range of $115.5k support to $120k resistance

Economies.com

.

While there’s still neutral momentum in indicators like RSI and MACD, the short-term direction leans bearish if the breakdown is confirmed on the H4 timeframe

Fxglory Ltd

.

Analysts emphasize that sustained movement above $116.5k could retarget resistance near $119–120k. A failure there and a move below $115.5k may thrust price deeper toward your downside zones

DailyForex

.

✅ Trading Strategy Overview

Scenario Trigger Target Levels

Bearish Breakdown H4 candle closes below trendline ~$115.5k $111.3k → $105.6k → possible $99.8k zone

Bullish Rejection Bounce back above ~$116.5k and trending above resistance $119k–120k retest, potential breakout if sustained

Neutral / Wait-and-see No decisive candle close yet Hold for confirmation

⛳ Final Thoughts

chart highlights a critical point: don’t act prematurely. Wait for a decisive H4 candle close below the trendline before committing to shorts. Confirmed bearish action around the breakout could open the path to the lower targets you identified. However, if price rebounds above support and climbs above $116.5k, a short-term retest of $119k–120k is still in range.

Traders should maintain prudent risk management—watching the unfolding price action around these pivot points without overreaching. Let me know if you'd like help crafting entry/exit zones or risk profiles for this setup!

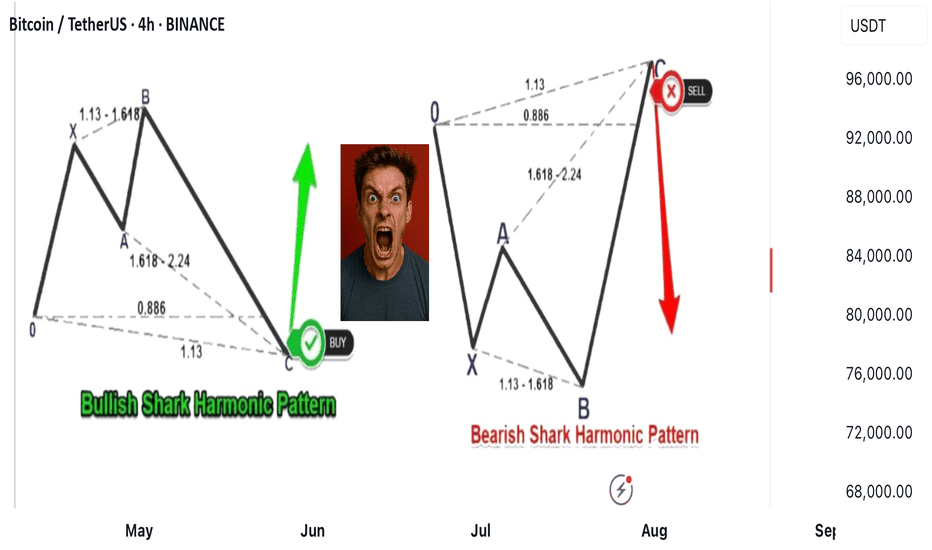

Shark harmonic pattern

---

### 🦈 What Is the Shark Harmonic Pattern?

- **Discovered by**: Scott Carney in 2011

- **Foundation**: Combines **Fibonacci ratios** with **Elliott Wave Theory**

- **Purpose**: Identifies potential **trend reversals** using precise geometric price structures

- **Structure**: Five points labeled **O, X, A, B, C** (not the usual XABCD)

- **Key Feature**: Relies heavily on the **88.6% Fibonacci retracement** and **113% extension**

---

### 📐 Pattern Geometry & Ratios

| Leg | Description | Fibonacci Ratio Range |

|------------|--------------------------------------------------|-------------------------------|

| XA | Initial impulse leg | No specific ratio |

| AB | Extension beyond X | 113% to 161.8% of XA |

| BC | Completion leg | 88.6% to 113% of OX |

| | | 161.8% to 224% of AB |

- **Point B** must **exceed point X**, forming an **Extreme Harmonic Impulse Wave**

- **Point C** is the **Potential Reversal Zone (PRZ)**

---

### 🛒 Buy Setup (Bullish Shark)

1. **No fixed retracement for A**

2. **B extends 113%–161.8% of XA**

3. **C completes at**:

- 88.6%–113% of OX

- 161.8%–224% of AB

📍 **Entry**: Near point C

📍 **Stop Loss**: Below point C

📍 **Target**: Retracement levels of BC (e.g., 50%, 61.8%), or back to point A/B

---

### 📉 Sell Setup (Bearish Shark)

1. **No fixed retracement for A**

2. **B extends 113%–161.8% of XA**

3. **C completes at**:

- 88.6%–113% of OX

- 161.8%–224% of AB

📍 **Entry**: Near point C

📍 **Stop Loss**: Above point C

📍 **Target**: Retracement levels of BC, or back to point A/B

---

### 📊 Real Trade Example & Educational Resources

In the comment

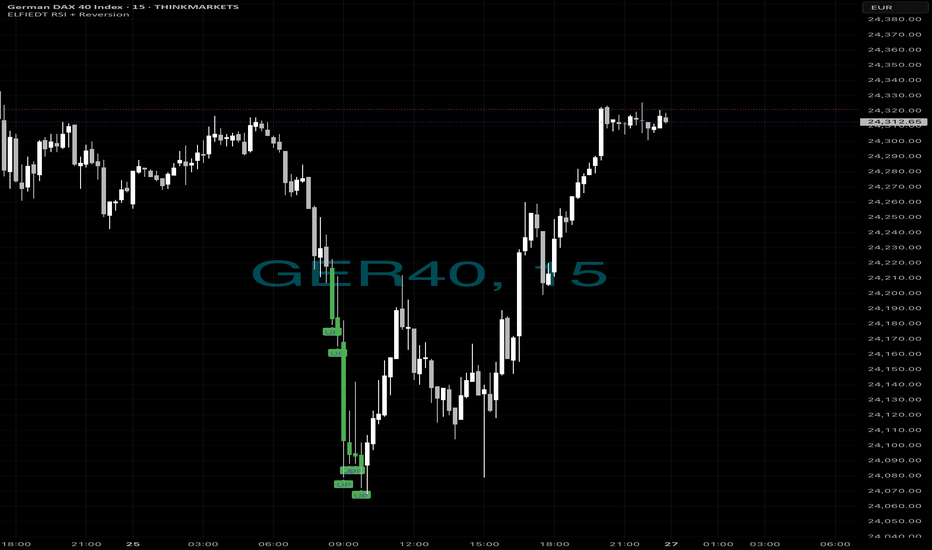

Same as always….📈 The Market Crashed. We Bought the Bottom. Again. 💥

Just another 15-minute chart… or is it?

While panic hit the DAX this morning, ELFIEDT RSI + Reversion was calmly printing BUY after BUY at the dead low. No guessing. No hype. Just precision.

✅ 5 Buy signals within minutes

✅ Picture-perfect mean reversion

✅ Price soared right after

✅ ZERO lag. ZERO repaint.

If you missed this move, don’t worry — this is what my system does.

🧠 Want to learn the logic behind this?

💰 Want to use it live on your own charts?

👉 Drop a 🔥 below if you want access.

👉 DM me “ELFIEDT” to test it out.

👉 Follow for real, repeatable setups.