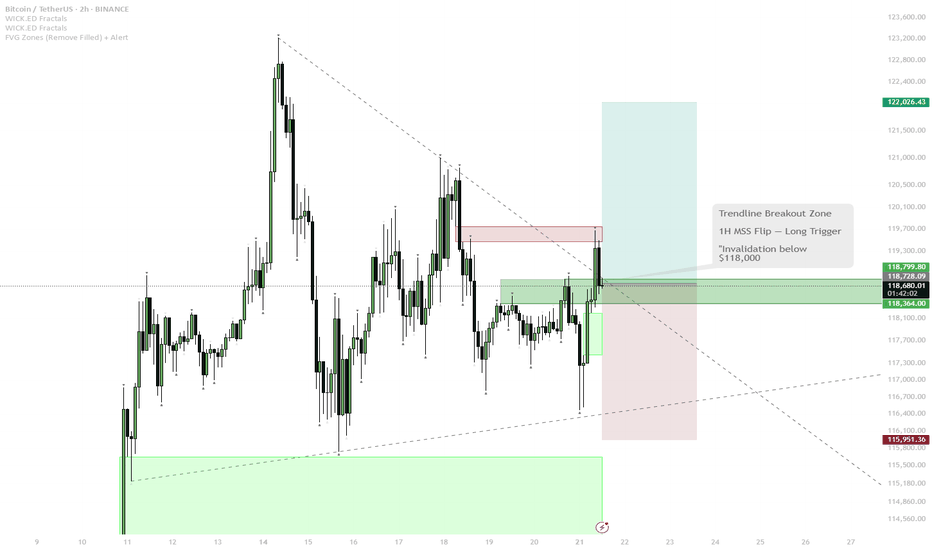

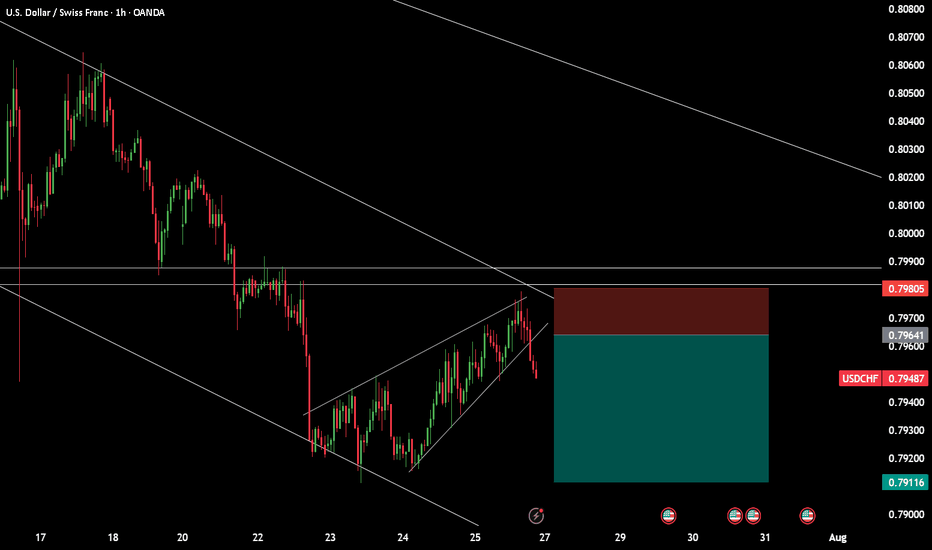

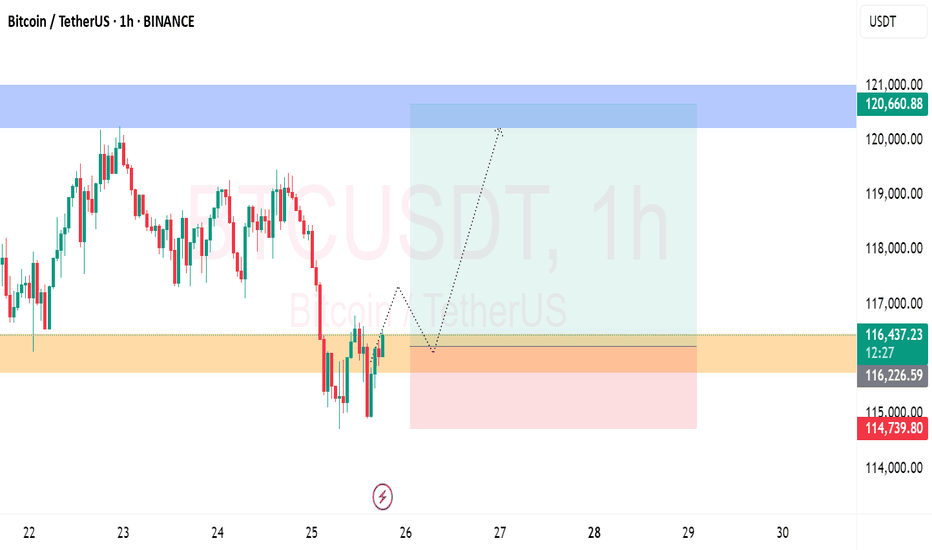

BTC Reloading for Breakout — Watching for 1H MSS Flip

BTC has bounced from local support (green zone) and is challenging the descending trendline.

The price is now testing the red resistance zone and the upper boundary of the 1H MSS (market structure shift) box.

Scenario A (Bullish):

— If BTC cleanly breaks the trendline and flips the 1H MSS box into support (with a strong close above), this is a trigger for a scalp long.

— Target for the move is the upper green box/previous high area near $122,000.

Scenario B (Bearish/Invalidation):

— If price is rejected at the red resistance and falls back below the green support box, risk of deeper pullback toward $116,000 increases.

BTC has shown resilience by quickly reclaiming support after a sweep lower, indicating strong demand. The market looks to be reloading for another push, with liquidity building up just below resistance. The setup favors a breakout if NY Open brings momentum. The flip of the 1H MSS box would confirm bullish intent. However, caution if the breakout fails — structure remains choppy and a failed breakout can trap late buyers.

Community ideas

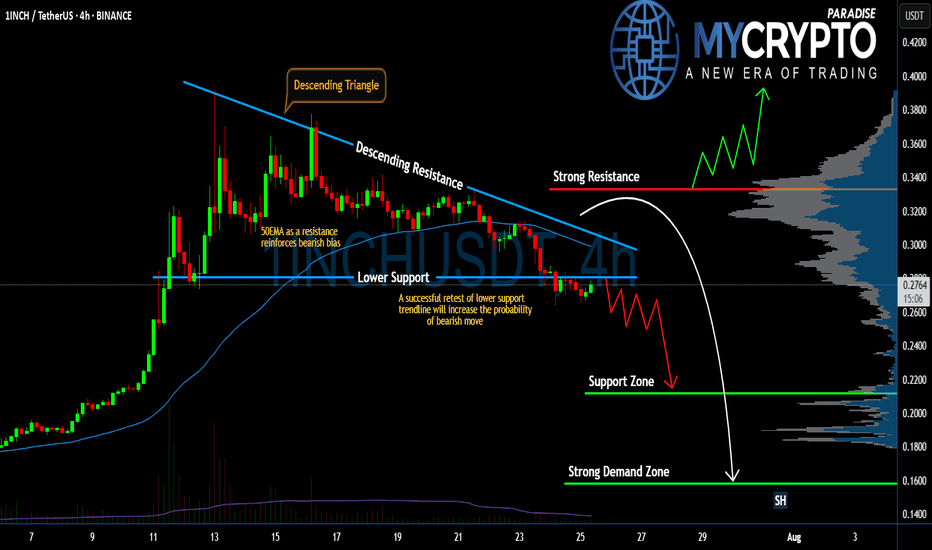

#1INCH Setup Favors Bears | Can Bears Pull it Down Further? Yello Paradisers! Are you prepared for what might be the next big move on #1INCHUSDT? The #1INCHNetwork is flashing clear warning signs:

💎#1INCH is currently trading inside a Descending Triangle, a pattern that historically favors bears. The price has broken down the lower support and is coming to retest it. If #INCHUSD retests the lower support and doesn't enter the descending triangle, the probability of the bearish pressure will increase.

💎The 50 EMA is acting as a strong dynamic resistance, reinforcing the bearish bias. Every attempt to reclaim higher levels has been rejected, and as long as we remain capped below the descending resistance, bulls are at a clear disadvantage.

💎A successful retest of the lower support trendline will significantly increase the probability of a breakdown. If this triangle finally breaks to the downside, we should be watching the $0.2116 support zone as the first key level to catch any temporary reaction.

💎But the real danger — and opportunity for patient traders — lies lower. If $0.2116 fails, the next strong demand zone sits at $0.1582, which could be the level where real buyers finally step back in. Until then, any bullish scenario remains invalid unless the price breaks and closes above the strong resistance at $0.3332.

Trade smart, Paradisers. This setup will reward only the disciplined.

MyCryptoParadise

iFeel the success🌴

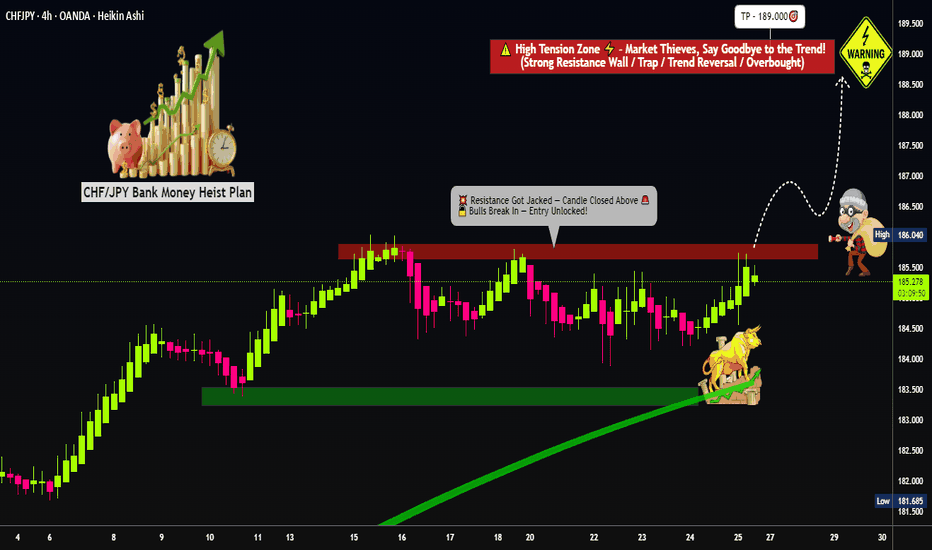

"Master Plan to Rob CHF/JPY – Breakout Trading Idea"💣CHF/JPY Forex Heist: Swiss vs Yen 🔥Master Robbery Plan Unfolded!

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers, Bandits & Chart Pirates 🤑💰💸✈️

It's time to reload your gear and lock in the blueprint. Based on our 🔥Thief Trader Technical + Fundamental Intelligence🔥, we’re all set to ambush the CHF/JPY "Swiss vs Yen" battlefield. This ain’t no casual walk—it’s a full-scale market operation targeting the High Voltage Reversal Trap Zone⚡. The pressure is real: Overbought, Tricky Consolidation, and Bears camping at resistance. Your job? Steal profits before they smell the breakout! 🏆💪💵

🎯 Entry Point — "Let the Heist Begin"

🗝 Entry Level: Wait for the Breakout @ 186.000. When price shatters the Moving Average ceiling—that's your greenlight!

🚀 Execution Choices:

Place Buy Stop above the breakout point

Or, use Buy Limit Orders near recent swing highs/lows on the 15/30-min chart using Layering/DCA tactics (that’s how the real thieves sneak in 🕶️).

🔔 Set an alert to stay sharp—don’t miss the vault crackin’ open!

🛑 Stop Loss — “Cover Your Escape”

🎯 SL Level: Just under the recent swing low on the 4H timeframe (around 184.000)

🚫 Never place the SL before the breakout confirms! Let the move prove itself first.

🧠 SL sizing depends on your capital, lot size, and number of entries stacked. You control the risk, not the other way around!

🎯 Target — "Cash Out or Vanish"

💎 First Take-Profit: 189.000

🚪Optional Escape: Secure the bag early if momentum fades. Better leave rich than be late!

👀 For Scalpers & Swing Robbers Alike

🔍 Scalpers: Only ride the Long wave.

💼 Big pockets? Hit straight entry.

👟 Small capital? Tag in with swing trades and trail that SL like a pro.

🎣 Use a Trailing SL to lock profits as price sprints toward resistance.

📰 The Bigger Picture: Why CHF/JPY?

The pair is pumped by:

📈 Macro Economics

📊 Quant Analysis

📰 COT Reports

📉 Intermarket Correlations

🧠 Sentiment Heatmaps

🔥 Future Price Dynamics

Don’t pull the trigger blind. Read the battlefield before charging in.

⚠️ Thief’s Caution Zone: News Traps Ahead

🛎 News = chaos.

📌 Avoid entering fresh trades during major data drops.

🔐 Use Trailing SLs to protect ongoing plays.

📉 Let the market dance, but you control the music.

💥Hit the Boost Button!💥

If this heist plan pumps your portfolio, smash that boost. That’s how we fund more blueprints, fuel the Thief Gang’s vault, and keep the robbery cycle alive.

🤑💵 Together, let’s rob this market clean—Thief Style.

New plan drops soon. Stay locked. Stay sharp. Stay profitable.

🧠💰🏴☠️

— Thief Trader Out 🐱👤🔓🚀

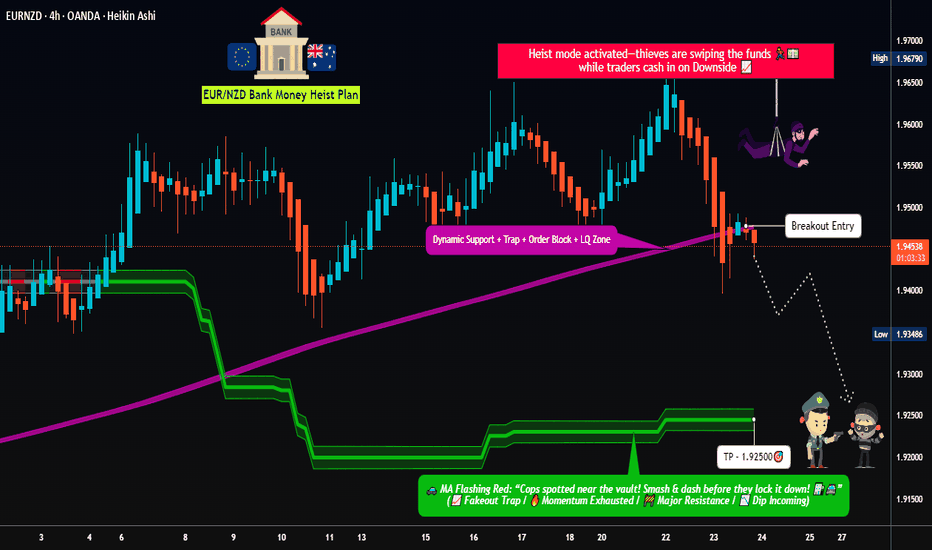

Dynamic Entry Alert – EUR/NZD Bearish Heist Execution!💣 EUR/NZD Robbery Blueprint: The Kiwi Vault Bearish Heist Plan 💰🕵️♂️

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

This ain't your usual trading tip — it’s a Thief Trading Masterstroke 🎯. We're gearing up for a high-stakes heist on the EUR/NZD forex market. Time to crack open the Kiwi vault and rob those bullish bandits blind! 😼💣

🧠 Strategic Mindset:

🔍 We're targeting the oversold consolidation zone. Bullish traders think they’re safe? Think again. This area is a trap — the perfect bait for our bearish ambush. Expect trend reversal vibes, layered with juicy liquidity grabs.

🕵️♂️ Entry Plan:

🎯 Sell Entry Trigger: Wait for a clean break below 1.94500.

💣 Setup:

Place Sell Stop Orders below the MA Support Breakout

Or... go stealth: Sell Limit Orders at nearest swing highs (15m or 30m timeframe)

Use DCA / Layering Method for multiple entries (scalp or swing tactics)

📌 Set your Alert 🚨 — no breakout, no entry. Patience pays.

🛑 Stop Loss Strategy (SL):

No premature moves! Don’t place that SL till we get the confirmed break.

🔥 SL Recommendation:

Just above 1.95700 (4H candle wick swing high)

Adjust based on lot size and number of layers

📍 Remember, the market’s a jungle — stay sharp or get sliced.

🎯 Take Profit (TP):

💵 Target Zone: 1.92500

(But hey, escape early if the vault starts shaking. Protect your gains like a pro.)

📊 Macro Intel – Why This Works:

This isn’t random — it's backed by our 🔥 combo of:

COT Reports

Sentiment Analysis

Quant/Algo Bias

Intermarket Correlation

Fundamental + Technical Confirmation

📌 You can dig deeper — but trust me, this setup’s been scouted like a pro job.

⚠️ Risk Protocols:

Avoid entries during high-impact news

Use Trailing SLs to lock in the loot

Adjust position size to suit your personal bankroll & risk appetite

🔥 Final Word from the Thief:

Smash that 💥Boost Button💥 if you're vibing with the heist plan!

Support the squad, stay profitable, and rob the market — legally, of course.

We don’t trade, we infiltrate.

We don’t predict, we execute.

📡 Stay tuned… More robbery blueprints coming soon!

🤑🐱👤🚨💸💪 #ThiefTrader #ForexHeist #EURNZDShortPlan

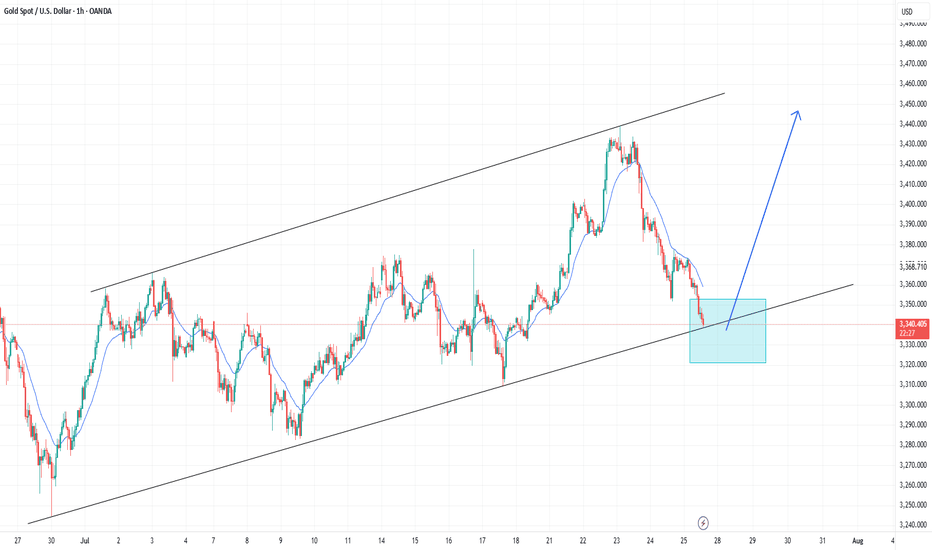

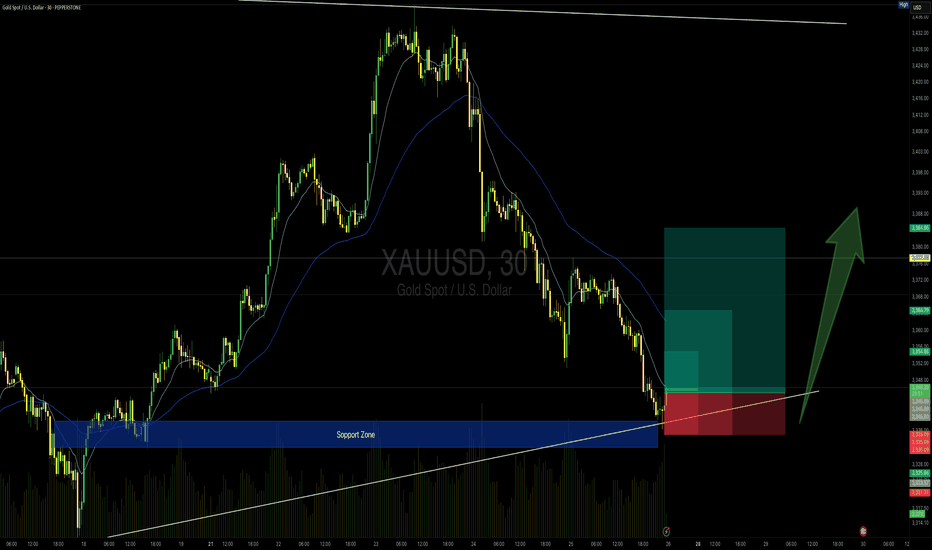

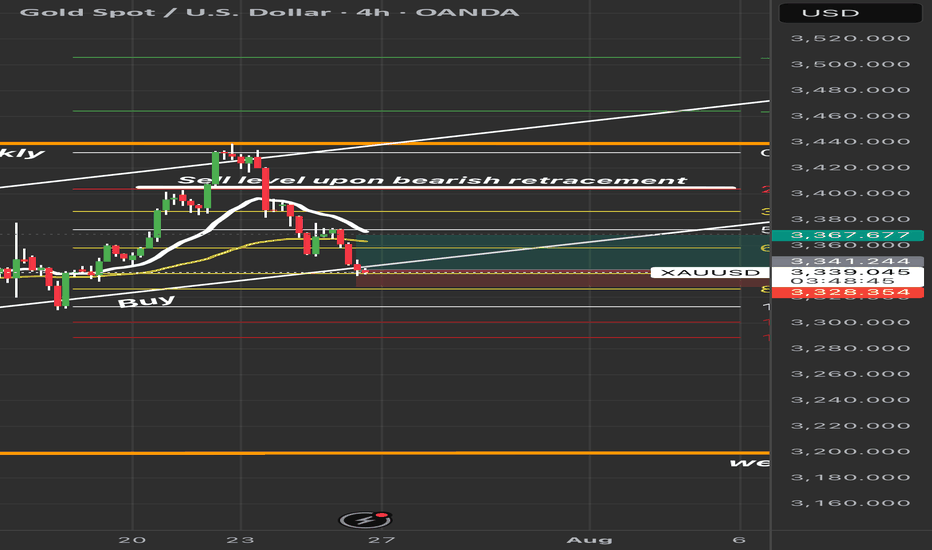

GOLD 30min Buy Setup (High Risk - High Reward)📍 TVC:GOLD 30min Buy Setup – MJTrading View

After an extended bearish leg, price has tapped into a strong support zone that previously acted as a launchpad. Also touching the main Uptrend...

We now see initial signs of absorption with potential reversal setup forming just above the ascending trendline.

🔹 Entry Zone: 3344–3346

🔹 SL: Below 3335 (under structure & wick base)

🔹 TP1: 3355

🔹 TP2: 3365

🔹 TP4: 3385+ (if momentum sustains)

🔸 RR: Up to 1:4 depending on target selected

🧠 Context:

– Still inside broader bullish structure (macro HL)

– Support zone coincides with rising trendline

– Potential for bullish reaccumulation after sharp drop

– Volume spike near zone suggests active buyers

Stay sharp and manage your risk please...

See the below Idea for full concept:

"Support isn't just a level — it’s a battlefield. If buyers win, they don’t look back."

#MJTrading #Gold #BuySetup #PriceAction #SmartMoney #ChartDesigner #ReversalSetup #MarketStructure

Psychology Always Matters:

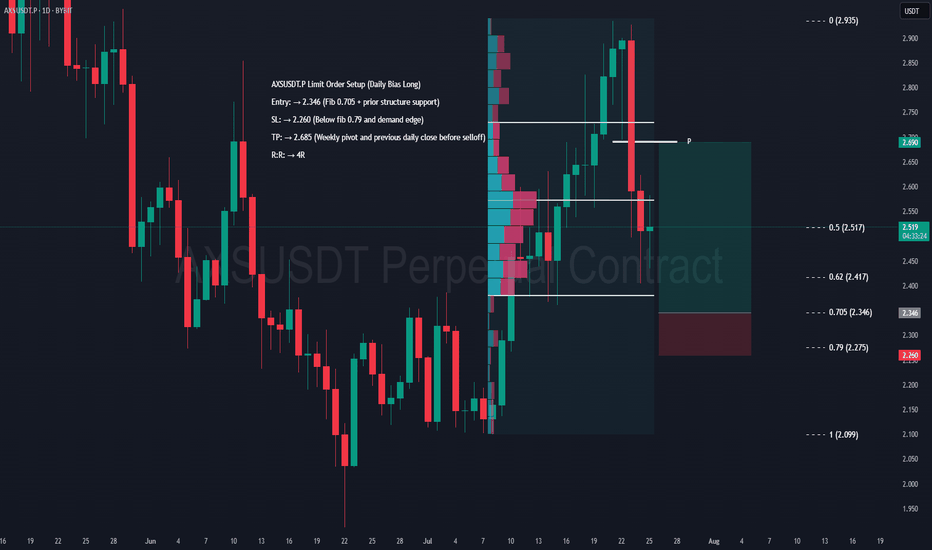

AXS Swing Long Setup – Daily Confluence TradeAXS Limit Order Setup (Daily Bias Long)

Entry: → 2.346 (Fib 0.705 + prior structure support)

SL: → 2.260 (Below fib 0.79 and demand edge)

TP: → 2.685 (Weekly pivot and previous daily low before selloff)

R:R: → 4R

DISCLAIMER: I am not providing trading signals or financial advice. The information shared here is solely for my own documentation and to demonstrate my trading journey. By openly sharing my process, I aim to put pressure on myself to stay focused and continually improve as a trader. If you choose to act on any of this information, you do so at your own risk, and I will not be held responsible for any outcomes. Please conduct your own research and make informed decisions.

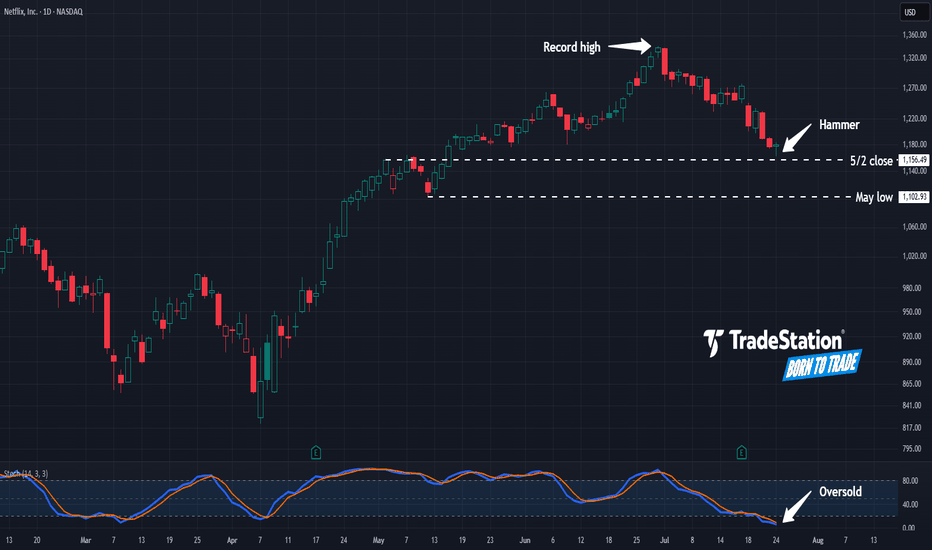

Hammer in NetflixNetflix has pulled back from record highs, and some traders may see potential opportunities in the streaming video giant.

The first pattern on today’s chart is the $1,156.49 level. It was a weekly close on May 2 and near the high the following week. NFLX is now showing signs of potential stabilization near that level. Is new support emerging?

Second, prices hit their lowest level in more than two months yesterday but rebounded. The resulting hammer candlestick pattern may be viewed as a bullish reversal pattern.

Third, stochastics have fallen to oversold territory.

Fourth, if the potential support at $1,156.49 breaks, traders may next eye the May low of $1,102.93.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

Options trading is not suitable for all investors. Your TradeStation Securities’ account application to trade options will be considered and approved or disapproved based on all relevant factors, including your trading experience. See www.TradeStation.com . Visit www.TradeStation.com for full details on the costs and fees associated with options.

Margin trading involves risks, and it is important that you fully understand those risks before trading on margin. The Margin Disclosure Statement outlines many of those risks, including that you can lose more funds than you deposit in your margin account; your brokerage firm can force the sale of securities in your account; your brokerage firm can sell your securities without contacting you; and you are not entitled to an extension of time on a margin call. Review the Margin Disclosure Statement at www.TradeStation.com .

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

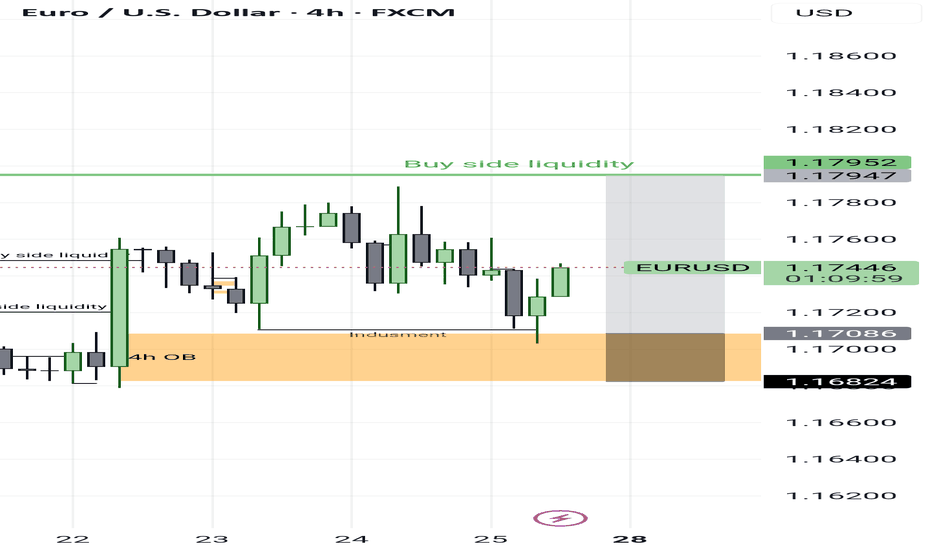

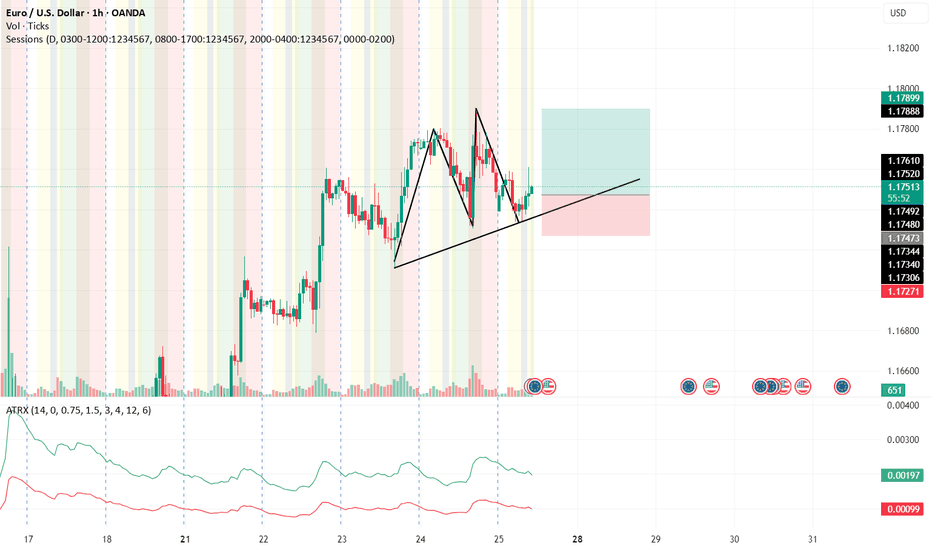

EUR USD longas trend suggest and as today is Friday everything should settle this trade can be viable but the question that the target will hit would not be answered today

Please note: This is for educational purposes only and not a trading signal. These ideas are shared purely for back testing and to exchange views. The goal is to inspire ideas and encourage discussion. If you notice anything wrong, feel free to share your thoughts. In the end, to learn is to share !

GBP USD long as the price approaching the trend line we may have a rejection to the top so this trade is so viable ....

Please note: This is for educational purposes only and not a trading signal. These ideas are shared purely for back testing and to exchange views. The goal is to inspire ideas and encourage discussion. If you notice anything wrong, feel free to share your thoughts. In the end, to learn is to share !

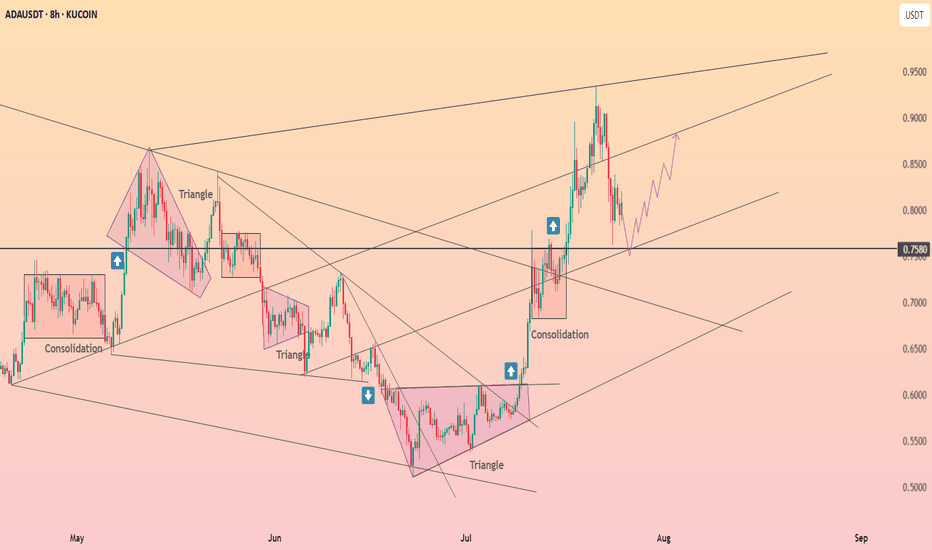

Now We WaitTrading Fam,

In my last video, I mentioned how I had been learning to trade more patiently, giving myself those high-quality, high-probability winning trades. This is a perfect time to illustrate that strategy.

With our altcoin market overheated, I am expecting more rest, accumulation, and pullback in many of our alts. The selection of even decent entries is very slim. It's time for us to sit back, wait, and let the trades come to us again.

The TOTAL chart shows us more clearly what may occur. Let's discuss a few important indicators on this chart.

First of all, we see my indicator popped a BUY signal right around 3T. We had a safe bet at that point; we were going to see quite a bit of buying action in the altcoin space. Indeed, we did. The altcoin market increased by about 25 percent and went all the way to 4T, at which point the sellers came back in. Now, we are in the middle of a little bit of a pullback, and I think there could be more to come. I am expecting at least a touch of that rising 50-day SMA, currently at 3.4T.

Supporting my thesis here are the crossover of the RSI to the downside of its 14-day MA, the MACD cross, the Chalkin money flow decrease, and the HMV indicating high volume during these sell-offs. Leverage is being liquidated. This is healthy!

It is possible that the total market cap could drop even further, all the way down to that 3.24T PoC on the VRVP. That is where we see most of our volume in alts has occurred. Keep these two targets in mind. Once hit, I will begin looking for more trade entries once again.

✌️Stew

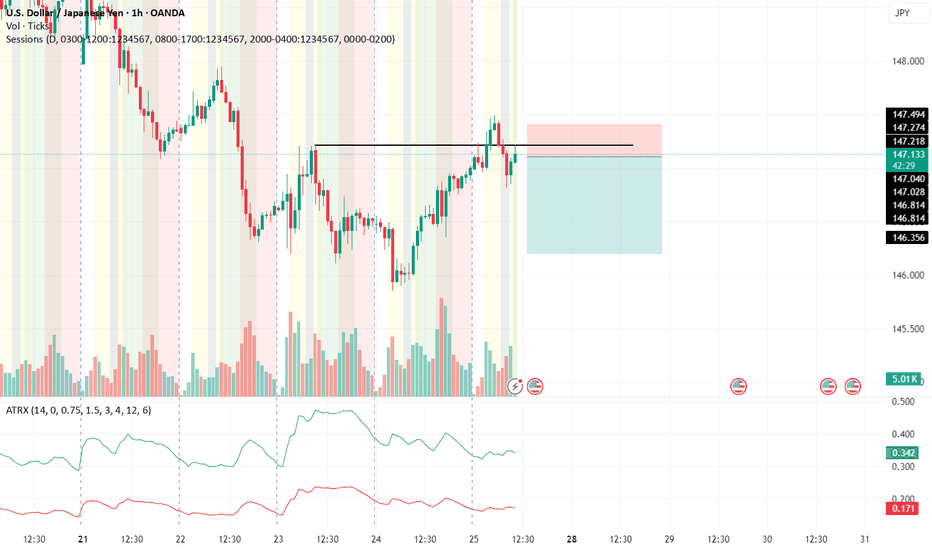

USD JPY shortthe sl is a bit short and narrow but yet lets see the rr is very good 1 to 3 lets see

Please note: This is for educational purposes only and not a trading signal. These ideas are shared purely for back testing and to exchange views. The goal is to inspire ideas and encourage discussion. If you notice anything wrong, feel free to share your thoughts. In the end, to learn is to share !

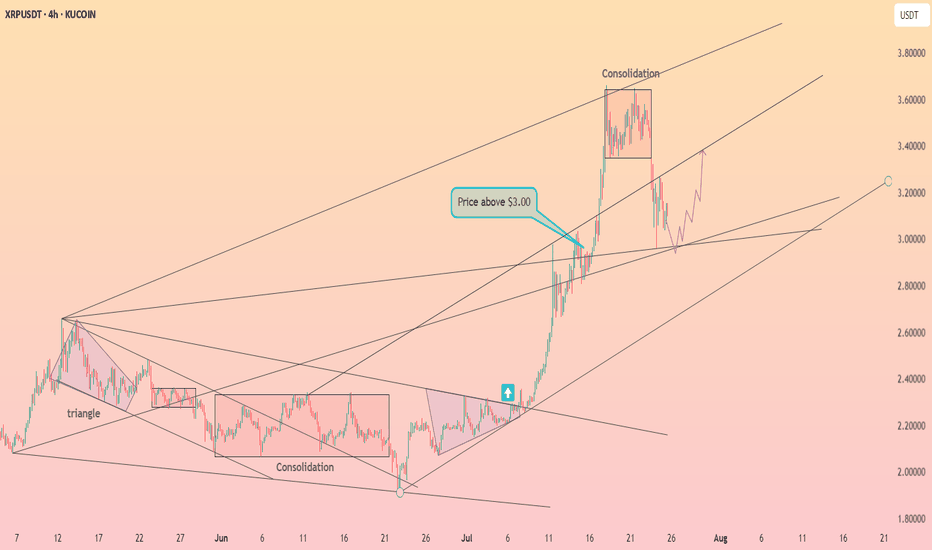

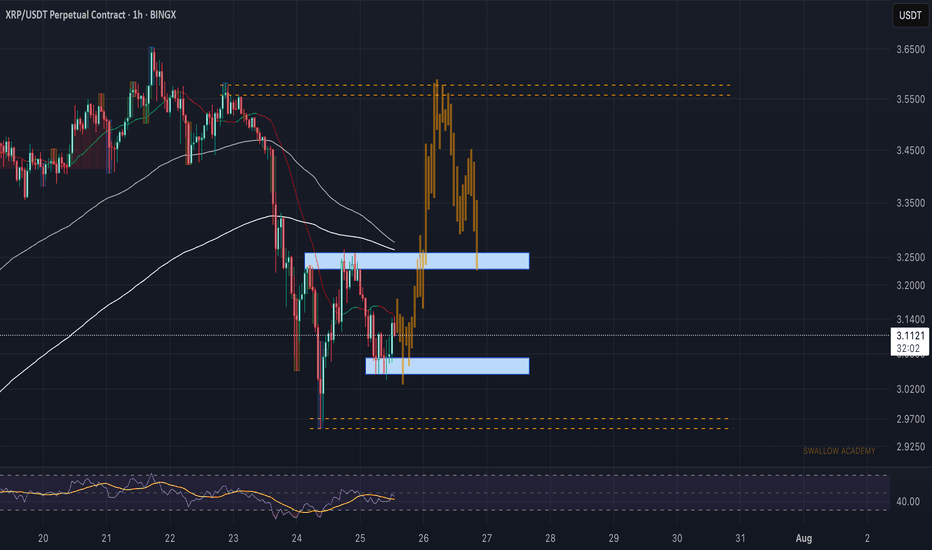

Ripple (XRP): Looking For Breakout and Smaller 10% PumpRipple coin has established some kind of local support zone, where we had a potential MSB to form but failed to break the area near $3.25.

Now price has cooled down and most likely will head again for another attempt to form the market structure break, so we are looking for a 10% gain right here.

Swallow Academy

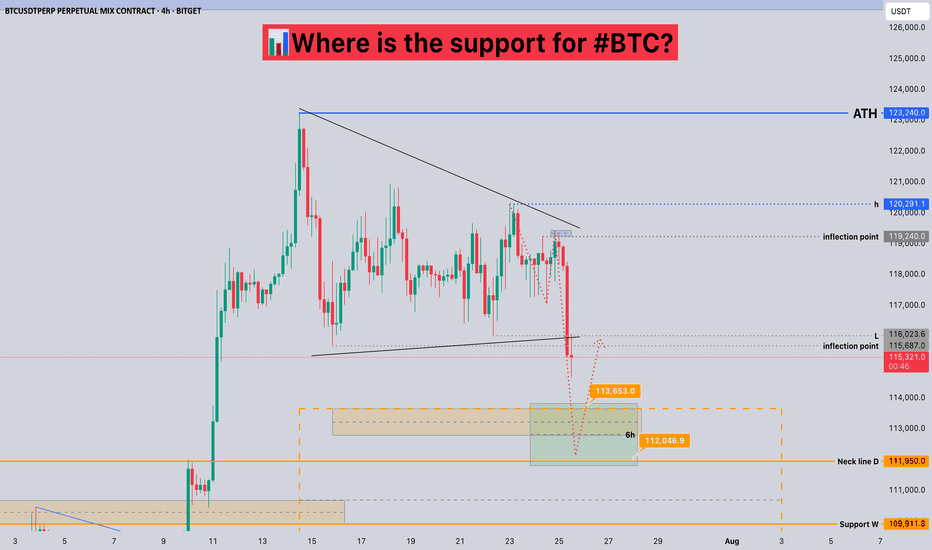

Where is the support for #BTC?📊Where is the support for #BTC?

🧠From a structural perspective, we did not stabilize after breaking through the inflection point of 119240, but broke down quickly. According to the current structure, the short-term support area is 112000-113700.

➡️From a morphological perspective, we failed to successfully break through the h point, but chose to break down, so we need to be vigilant about further pullbacks!

🤜If you like my analysis, please like 💖 and share 💬

BITGET:BTCUSDT.P

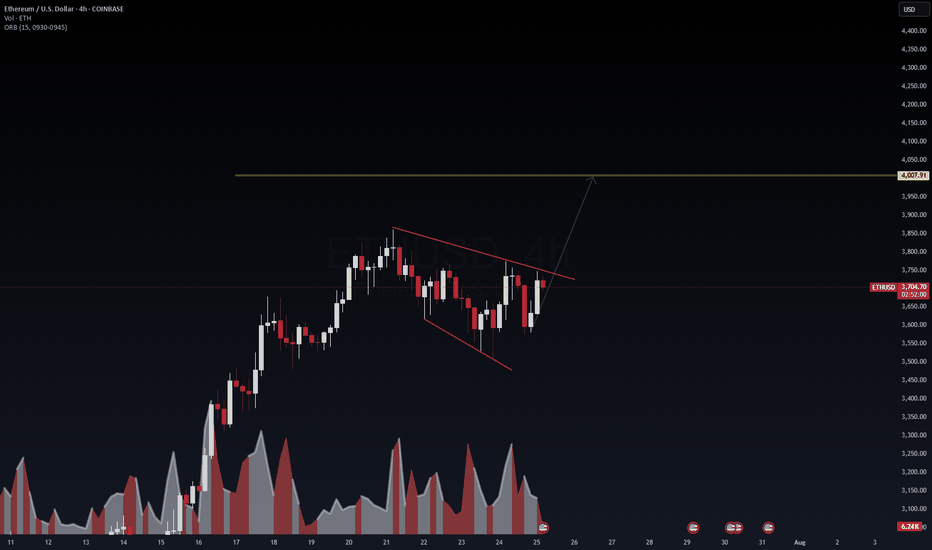

ETHUSD: Road to 4K today after a breakout. ETH/USD – 4H Outlook: Targeting $4,000+

Ethereum is coiling within a descending wedge, signaling potential breakout momentum. Volume compression indicates that once ETH breaks above the wedge resistance (~$3,750), it could accelerate toward the $4,000–$4,050 supply zone.

Key Levels:

Resistance: $3,750 → $4,000

Support: $3,650 → $3,550

Breakout Target: $4,007 (mid-term)

VolanX Protocol Insight:

Institutional liquidity clusters sit above $3,800. A clean breakout with strong volume could trigger stop runs and a swift rally to 4K.

Risk Management:

Entry after breakout retest above $3,750.

Stop-loss: Below $3,640.

Take-profit: $3,980–$4,050.

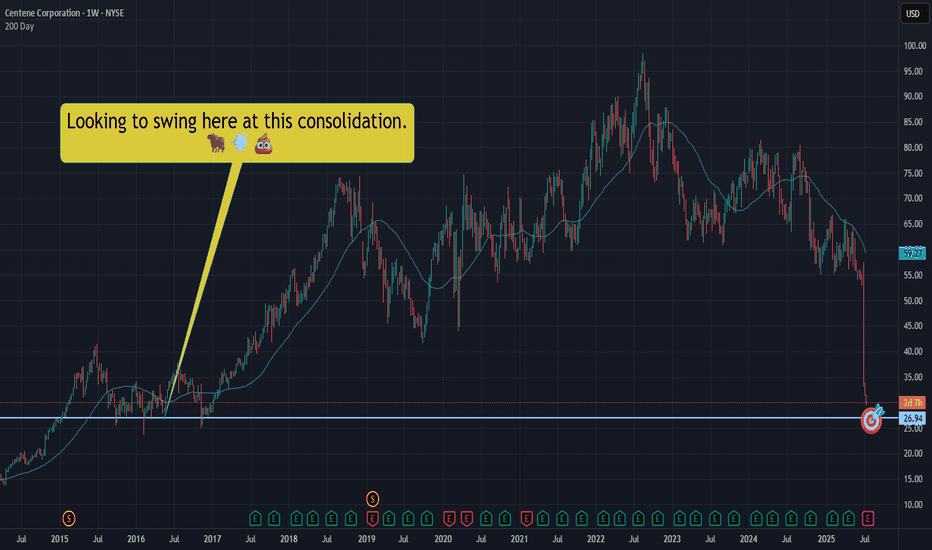

CNC|Let's take a swing at a falling dagger! NYSE:CNC slicing through the void, well.... like a falling dagger through a void.

Not trying to catch this bad boi, but we should expect a bounce at some point. Let's swing for a bounce in that $26.90ish area.

This is NOT a YOLO and I hope it's not an "oh no!" Let's keep our wits about us - starter position only. We can add if we need to, but let's just hope we sell and make some quick Christmas money.

THANK YOU FOR YOUR ATTENTION ON THIS MATTER