$SOL Loses Key Support | Eyes on $140 & $95 Zones📉 CRYPTOCAP:SOL Loses Key Support | Eyes on $140 & $95 Zones

🕵️♂️ On the daily timeframe, #Solana has officially lost its key support near $140, which previously acted as a strong bounce zone. A failure to reclaim this level could open the gates for a deeper drop toward the $95–$100 support range.

📊 Indicators signal downside:

RSI is trending downward

MACD shows a bearish crossover

Stochastic RSI confirms continued selling pressure

⚠️ Macro pressure adds fuel to the fire: August 1st tariff tensions, with expected news from Trump on charging Paris, are weighing down global risk assets. Historically, August tends to be a bearish month for crypto markets.

🎯 Key Levels to Watch:

Immediate Resistance: $140

Major Support: $95–$100

🧠 Trade wisely and manage risk accordingly.

Community ideas

$USPCEPIMC -U.S PCE Prices Rise (June/2025)ECONOMICS:USPCEPIMC

June/2025

source: U.S. Bureau of Economic Analysis

- The US PCE price index rose by 0.3% mom in June, the largest increase in four months, and in line with expectations, led by prices for goods.

The core PCE index also went up 0.3%, aligning with forecasts.

However, both the headline and core annual inflation rates topped forecasts, reaching 2.6% and 2.8%, respectively.

Meanwhile, both personal income and spending edged up 0.3%.

Sell NATGAS into OCT/NOVNatalie has fromed a H&S and has broke through all of the supporting EMAs leading to most of the indicators turning bearish.

My approach for the forseeable is seeling bounces until the winter season approaches.

Of course Natalie is extremely susceptible to trend changes due to economical data and has to be monitored closely. Currenlty I'm a bear.

Only selling once it breaks and retests, where I will once again reasses based on economics such as storage, production, imports and demand.

Target around $2.5 where interestingly a gap (red rectangle) sits from Nov - 24.

Elliot Wave (although not a great fan) kind of aligns as well as the 0.786 fib level which began forming at the beginning of 2024.

Storage | Volatility | Price Outlook

U.S. natural gas markets are stabilizing as volatility trends back toward seasonal norms.

📉 Volatility has dropped from 81% in Q4 2024 to 69% in mid-2025

🏪 Storage is currently at 3,075 Bcf,

🔻 4.7% lower YoY

🔺 5.9% higher than the 5-year average

🚢 LNG exports remain strong—up 22% YoY and 74% above the 5-year average

🔌 Domestic demand is seasonally weaker but steady

➡️ Despite being below last year’s levels, storage surplus vs. the 5-year average acts as a soft ceiling on price.

➡️ Historical analogs suggest a fair value range between $2.50–$3.20/MMBtu in the short term.

📊 Current price action around $3.00–$3.40 looks slightly overheated unless a fresh catalyst emerges (heatwave, export spike, etc.).

🧭 Watching for:

Injection trends over the next few weeks

Cooling demand in power sector

Resistance around $3.40

Support near $2.80

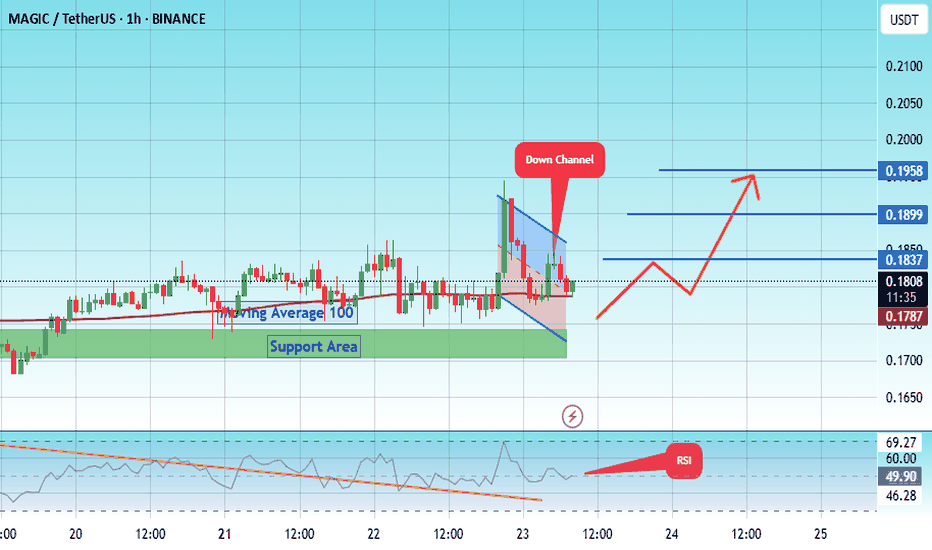

#MAGIC/USDT#MAGIC

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the descending channel, at 0.1474.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 0.1700, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.1800.

First target: 0.1837.

Second target: 0.1900.

Third target: 0.1958.

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

JD last correction is overSince fiscal stimulus announced by China, JD started to print an expanding diagonal which I labeled in black as 1-2-3-4-5. Currently, wave 4 is over (or will be over within a few days) and wave 5, the longest in such a type of diagonal, is set to unfold.

Which supportive evidence I found:

wave 4 is formed as a double three as (w)-(x)-(y) and (y) contains and ending diagonal - see green impulsive wave down. The diagonal's wave 5 reached the lower edge.

wave 4 retraced 61.8% of wave 3

wave can be seen as a bullish flag - it nicely fits into the channel (I showed in green)

both RSI and MACD show bullish divergence with price on daily

I believe JD will revert with strong impulse up in the coming days.

See divergences:

Ethereum Rejected from Supply - Bearish Shift in ProgressHello everybody!

Price has been rejected from a supply area.

The bullish trend has slowed down, and the market structure is slightly shifting bearish.

A polished upward trendline has been broken on the 1H timeframe.

We’re aiming for a target around the first untouched demand zone: 3437.

Manage your risk and trade safe!

SHORT | Gold | 4H Chart Direction: Bearish

Moving Average: Blue < Red

Pattern Impulse: Impulse correction

Fib Retracement: 38.2

MACD > 0

1st Target = 3302

2nd Target = 3290

Lots: 0.02

RISK: Economic instability still begs the question around whether commodities continue higher over the coming months.

Trade 1/20

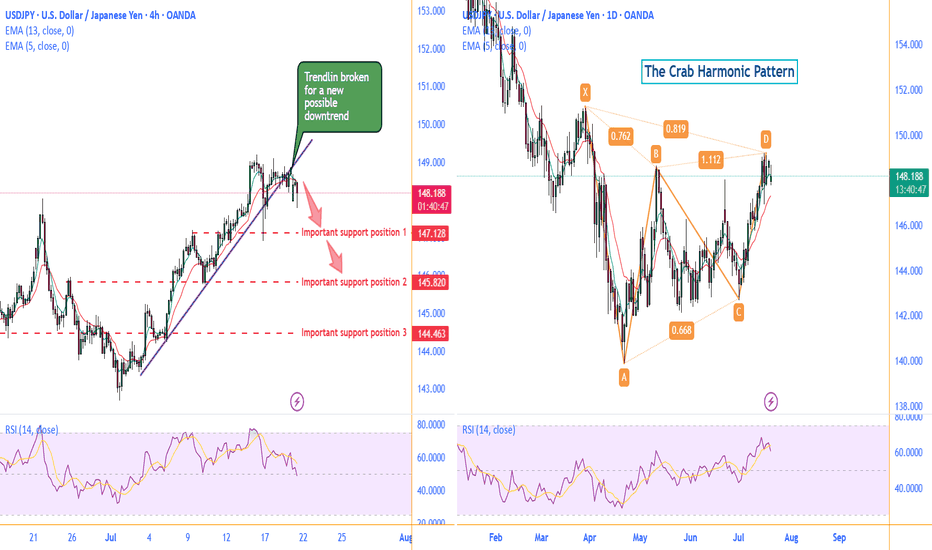

0721 Impact of Japanese Senate Elections on Yen Exchange Rate Hello traders,

1. I spent the entire weekend following the Japanese Senate elections, as they will determine the fluctuations of the world's largest financing currency—the yen exchange rate.

★ The results are out, and we are currently in scenario two— the ruling coalition suffered a crushing defeat + Shigeru Ishiba refuses to resign. However, senior figures within the Liberal Democratic Party, such as Taro Aso, have publicly stated that they intend to demand Prime Minister Ishiba's resignation for accountability, increasing the pressure on Ishiba to step down. This means we might see "scenario three"—the USD/JPY exchange rate could potentially break through the 151-155 range.

★ Is this the worst-case scenario? Of course not. The worst-case scenario would be if the "far-right party" that campaigned on the slogan "Japan First" achieved a landslide victory in this election. The most notable winner is a marginal far-right party known as the "Reform Party."

The Reform Party originated from a YouTube channel during the pandemic, which spread conspiracy theories about vaccines and "global elite conspiracies." NHK estimates that the Reform Party will win up to 22 seats, whereas three years ago, they had only 1 seat in the Senate and currently have only 3 seats in the House of Representatives.

✔ Let's take a look at this big winner's political proposals—stricter immigration restrictions + opposition to globalism + opposition to radical gender policies + reassessment of decarbonization and vaccine policies + massive tax cuts + increased social welfare spending. This means Japan may implement more "radical tax cuts" combined with aggressive economic stimulus through quantitative easing, leading to a more severe depreciation of the yen, increasing the likelihood of the USD/JPY exchange rate rising to the 160 range.

★ What are the risks of a sharp depreciation of the yen?

For Asia, the depreciation of the yen typically drags down other Asian currencies collectively, especially under U.S. tariff pressures, where Asian currencies are already under devaluation pressure. A strong depreciation of the yen would mean Japan is taking other Asian countries along with it off a cliff. We need to pay attention to the "passive" depreciation of the renminbi.

Asia will feel the pain, but Europe and the U.S. will also suffer. Theoretically, if the USD/JPY exchange rate surges (indicating a sharp depreciation of the yen), it is very advantageous for arbitrage trading with leverage (because the yen becomes cheaper). However, when the yen experiences a severe depreciation, the situation changes.

Let me give you a classic example: After Shinzo Abe returned to power at the end of 2012, he launched the "three arrows" economic policy: unlimited quantitative easing monetary policy + fiscal stimulus + structural reform = artificially lowering the yen exchange rate to stimulate exports (the clear goal was to increase the USD/JPY exchange rate) = rapid depreciation of the yen (from 80 in 2012 to 125 in 2015).

So what happened then? — A large number of Japanese institutions sold off U.S. bonds, European bonds, and REITs to cash out. The reason is simple:

✔ Japanese financial institutions (such as GPIF, insurance companies, and banks) hold a large amount of dollar/euro assets. When the yen depreciates, the yen-denominated market value of these foreign currency assets skyrockets. Selling off overseas assets is equivalent to cashing out foreign exchange gains in advance.

✔ The proportion of foreign currency assets is too high → must rebalance. Due to the yen depreciation, a large institution that originally allocated 20% of its total assets to foreign currency assets might see that proportion swell to 30% or 40%. This triggers asset allocation restrictions within pension and insurance funds (ALM principles), necessitating the sale of overseas assets and reallocation to yen-denominated assets.

✔ The yen depreciation phase is usually accompanied by an expansion of the U.S.-Japan interest rate differential. If Japanese institutions hedge their dollar assets, the hedging costs become very high (the costs of hedging through FX swaps and forwards rise), so they must also sell off some assets to reduce exposure. Therefore, in 2013, there was a collective sell-off of U.S. and European bonds.

Technically:

Daily chart, there is a possible Crab Harmonic Pattern.

The Crab Harmonic Pattern

From the chart, we can see:

The upward move from A to B is labeled as 0.762, which falls within the Fibonacci ratio range of 0.618-0.786 for the A-B leg of the Crab pattern.

The downward move from B to C is labeled as 0.668, which also falls within the Fibonacci ratio range of 0.382-0.886 for the B-C leg of the Crab pattern.

The upward move from C to D is labeled as 1.112, which corresponds to the Fibonacci ratio range of 1.13-1.272 for the C-D leg of the Crab pattern.

Based on these Fibonacci ratio relationships, we can identify this price action pattern as a typical Crab harmonic pattern. This type of pattern often suggests that the price may be about to reverse.

On the left 4H chart, the broken trendline is suggesting a new possible downtrend to begin .

Make a good use of those support positions, sellers of UJ could find a great trade deal.

Follow me to get more update on UJ.

GOOD LUCK!

LESS IS MORE!

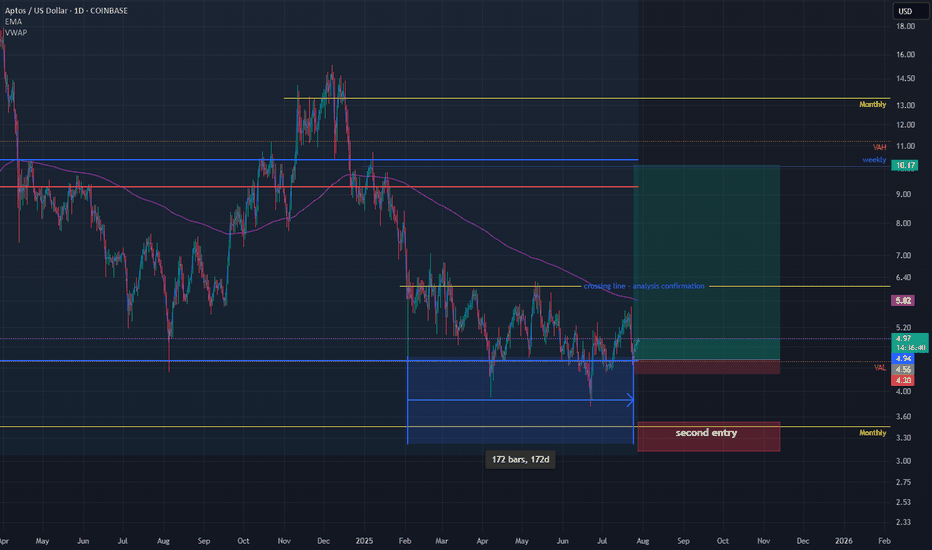

APT - HUGE POTENTIAL (130+% SPOT) You probably forgot about this altcoin but it is justified. Downtrend since 2023 and lower highs, lower lows but....

If we look more close and use tool fixed price volume we can see that price is above VAL (Value area low), we had break through but price returns..Also good reaction of FVG (Fair value gap).

Now, we can try buy this coin and have some stop lose. Price is in range 172 days and all people forget abut this coin. Analysis is right only if we close daily candlestick about 6$.

Stop lose can be below 4.4$ which is 6-7% of losing.

Second entry is monthly level at 3.3 and stop lose should be below the lowest low 3$.

For me is great opportunity because risk reward is excellent.

Ivan

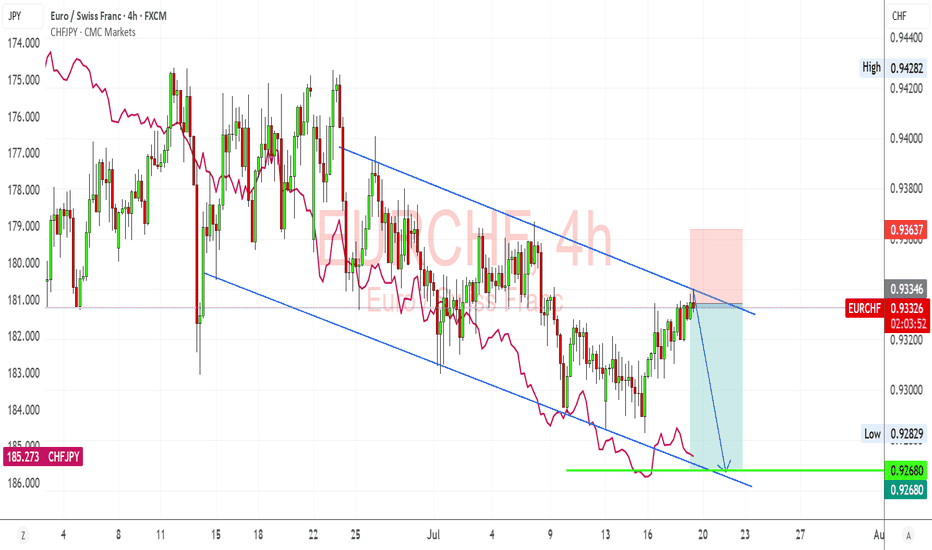

EURCHF – Bearish Channel Holds Firm, CHF Strength Set to ResumeEURCHF just tapped into the descending channel resistance again and is showing signs of rejecting. I'm expecting a bearish continuation here, especially given the strong CHF momentum recently, supported by safe-haven flows and Swiss inflation stability. If the pair fails to break above 0.9340, I’m watching for a downside push back toward 0.9270–0.9265, completing another leg within the structure.

🔍 Technical Setup (4H):

Channel Structure: EURCHF remains firmly within a downward-sloping parallel channel since mid-June.

Resistance Rejection: Price recently tested upper channel resistance (~0.9335–0.9340 zone), aligning with trendline rejection.

Target Support: 0.9270–0.9265 (channel base and key horizontal level).

Confluence: CHFJPY overlay (pink line) is rising again, suggesting renewed CHF strength—this usually weighs on EURCHF.

💡 Fundamental Insight:

EUR Side:

ECB officials remain cautious, but with recent EU data showing weaker growth (especially PMIs and sentiment), euro upside is capped.

The ECB is likely to pause further tightening, while other central banks like SNB remain firm on inflation risks.

CHF Strength:

The Swiss National Bank (SNB) still leans hawkish, with stable inflation giving room to hold rates steady or tighten if needed.

CHF benefits from risk-off flows amid global tariff headlines, China slowdown, and Middle East tensions.

Rising CHFJPY = clear CHF strength across the board.

⚠️ Risks:

If eurozone data surprises to the upside (e.g., inflation rebounds), EURCHF could break out of the channel.

A sudden drop in geopolitical tension or strong risk-on rally could weaken CHF as safe-haven demand falls.

SNB jawboning or FX intervention is always a wildcard.

🧭 Summary:

I’m bearish on EURCHF while it respects this well-defined descending channel. The technicals show consistent lower highs and lower lows, while the fundamentals continue to support CHF strength due to risk aversion, stable inflation, and a resilient SNB. My short bias is valid as long as price remains below 0.9340, with downside targets at 0.9270–0.9265. CHFJPY rising confirms franc leadership across FX markets, and EURCHF is likely a lagger following broader CHF strength.

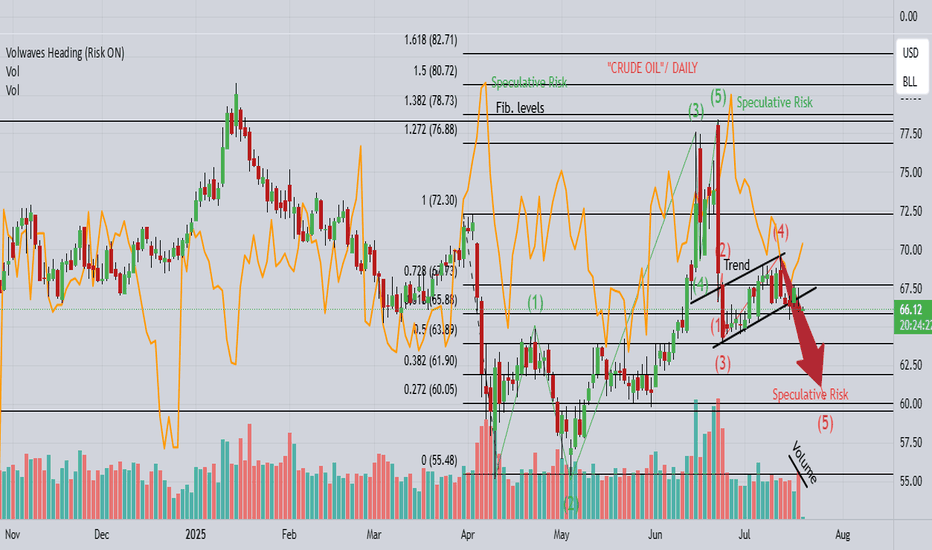

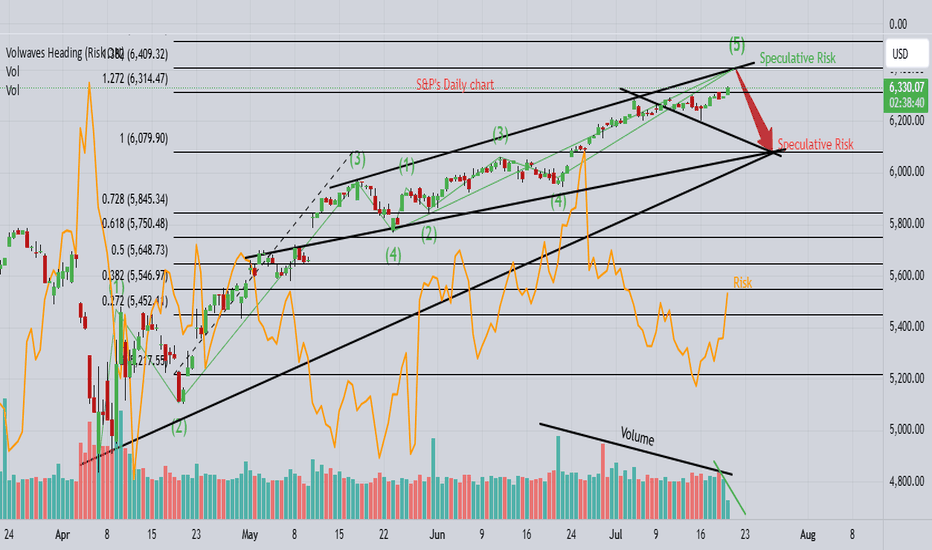

S&P's "hugely overbought" towards 6375!1). Position Volume dropping! 2). Big institutions (Banks & Insurance) have backed off on higher Risk positions! 3). Huge resistance at .728 fib & trend! 4). Trump tariff talk is likely adding to a fall as well! 5). We're looking for a "SELL" trade @ 6375, since buying is too risky at the moment...Good Luck!

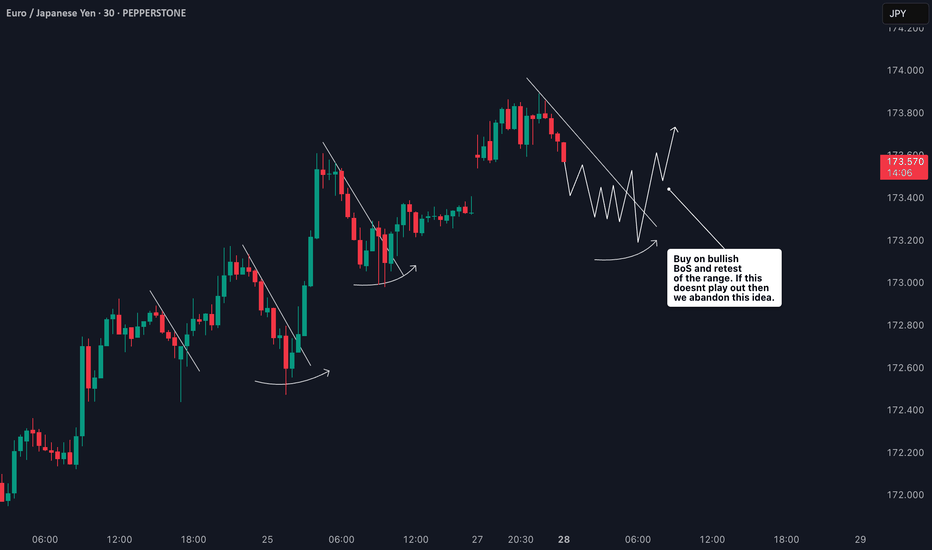

Trading the Pullback on EURJPY My Trade PlanThe EURJPY is clearly in a strong bullish trend 📈, as shown by a consistent pattern of higher highs and higher lows on the 1H timeframe ⏱️. In this video, I’m looking to capitalize on a pullback as a potential buy opportunity 🎯.

We dive into my entry strategy, explore how to align with the prevailing trend, and break down key concepts such as price action, market structure, and smart pullback zones 🧠📊.

⚠️ As always, this is for educational purposes only — not financial advice.

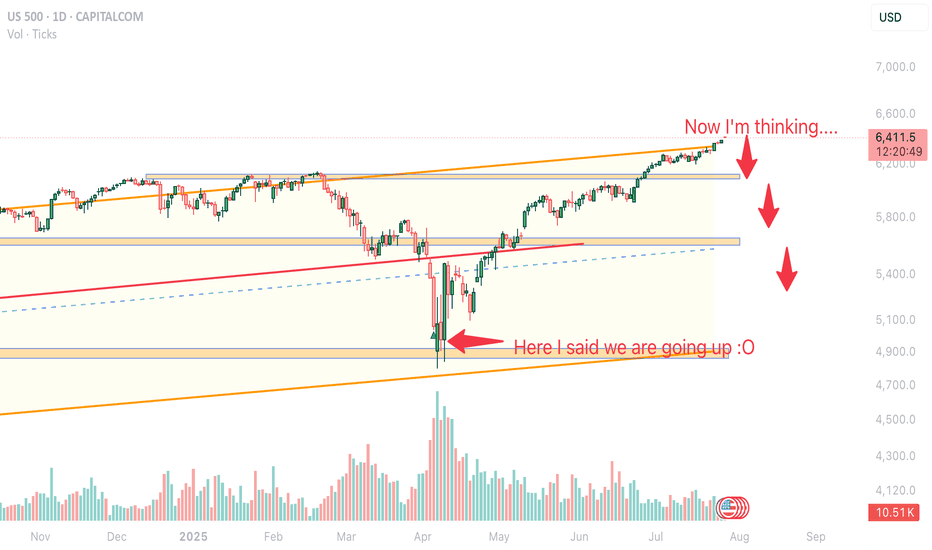

US500 SP500 Sell the news- ShortHello fellow traders, what do you think? Am I predicting FUTURE? This is my early entry, cautious, but holding steady, checking from time to time but general rule- what went up will eventually fall. The price is just a Wave of coincidance and events, trade carefully! Protect capital! don't copy my idea it's an idea NOT A TRADING ADVISE

Gold Price Target: 3380-3400+, Set a Trailing StopGold Price Target: 3380-3400+, Set a Trailing Stop

As shown in Figure 4h:

Gold finally rallied this weekend.

Despite recent heavy losses for long positions, the past two days have been encouraging.

We ultimately managed to successfully buy the dip in the 3280-3300 range and recover all our losses.

Gold prices continue to rise, and everyone is asking if it's time to sell.

Now is the critical time to exit.

We must acknowledge one fact:

Gold currently presents a huge opportunity.

Of course, the risks are also increasing.

At times like these, I always emphasize that the best approach is to set a 10-point trailing stop.

Even if gold prices soar, we can move with them.

This non-farm payroll data was a huge disappointment.

It was a truly positive surprise for gold.

The market expected 110,000 new jobs, but the result was a disappointing 73,000, a decrease of half from the previous month.

The market went into a tizzy after the outperformance. But even more shocking news is yet to come: Non-farm payrolls for May and June were revised downward by a combined 258,000.

This means the June gain was revised downward from 140,000 to 14,000.

The May gain was abruptly revised downward from 140,000 to 19,000.

The strong data of the past two months was completely false.

Market followers have become the "clowns" of the Fed and Trump.

Now you understand why everyone praised Powell's hawkish speech two days ago.

Because Powell said: "Only if there is a severe decline in employment will we consider cutting interest rates."

Just this Wednesday, some good non-farm payroll data was released.

This undoubtedly gave the market a false impression.

Everyone believed that a rate cut was impossible, and the probability of a September cut had dropped to 40%.

However, today's poor non-farm payroll data, combined with revisions to May and June data, revealed the truth.

The job market has been dismal over the past quarter.

The market reacted quickly, and gold prices soared on this sentiment.

My advice is to buy gold at a low price and hold on.

For investors who have successfully bought in the 3280-3300 level in recent days, I recommend setting a 10-15 pip trailing stop-loss.

Gold prices are likely to continue their upward trend next Monday.

Our next target is above 3380-3400 points.