Community ideas

Ranging? Not Really. The Big Guys’ Plan Is Already Set…Ever wondered what the crowd is really doing behind the candles?

This video breaks down how to read Cumulative Volume Delta (CVD)—

from retail behavior to sentiment charts, and why the market doesn’t always follow logic.

✅ When price moves one way but the crowd trades the other...

✅ When sideways markets aren’t as neutral as they look...

✅ When emotions take over—and how to spot it in advance.

We’re lifting the hood. The engine’s running. Let’s see what drives it.

The Charts Wall Street Watches – And Why Crypto Should Too📉 Crisis or Rotation? Understanding Bonds Before the Bitcoin Reveal 🔍

Hi everyone 👋

Before we dive into the next major Bitcoin post (the 'Bitcoin Reveal' is coming up, yes!), let's take a moment to unpack something critical most crypto traders overlook — the world of bonds .

Why does this matter? Because the bond market often signals risk... before crypto even reacts.

We're going to walk through 4 charts I've posted recently — not the usual BTC or altcoin setups, but key pieces of the credit puzzle . So here’s a simple breakdown:

1️⃣ BKLN – Leveraged Loans = Floating Risk 🟠

These are loans to risky companies with floating interest rates.

When rates go up and liquidity is flowing, these do well.

But when the economy weakens? They’re often the first to fall.

📌 Key level: $20.31

This level held in COVID (2020), the 2022 bank scare... and now again in 2025.

⚠️ Watch for a breakdown here = real credit stress.

Right now? Concerned, but no panic.

2️⃣ HYG – Junk Bonds = Risk Appetite Tracker 🔴

Junk bonds are fixed-rate debt from companies with poor credit.

They pay high interest — if they survive.

When HYG bounces, it means investors still want risk.

📌 Fear line: 75.72

Held in 2008, 2020 (COVID), and again now.

Price rebounded — suggesting risk appetite is trying to return .

3️⃣ LQD – Investment Grade = Quality Credit 💼

LQD holds bonds from blue-chip companies like Apple, Microsoft, Johnson & Johnson.

These are lower-risk and seen as safer during stress.

📊 Chart still shows an ascending structure since 2003, with recent pressure on support.

📌 Support: 103.81

Holding well. Rebound looks solid.

Unless we break 100, this says: "No panic here."

4️⃣ TLT – U.S. Treasuries = Trust in the Government 🇺🇸

This is the BIG one.

TLT = Long-term U.S. bonds (20+ yrs) = safe haven assets .

But since 2022, that trust has been visibly broken .

A key trendline going back to 2004 was lost — and is now resistance.

📉 Price is in a clear descending channel .

📌 My expectation: One final flush to $76 or even $71–68

…before a potential macro reversal toward $112–115

🔍 The Big Picture – What Are Bonds Telling Us?

| Chart | Risk Level | Signal |

|--------|------------|--------|

| BKLN | High | Credit stress rising, but support holding |

| HYG | High | Risk appetite bouncing at a key level |

| LQD | Medium | Rotation into quality, no panic |

| TLT | Low | Trust in Treasuries fading, support being tested |

If BKLN breaks $20...

If HYG fails to hold 75.72...

If LQD dips under 100...

If TLT falls to all-time lows...

That’s your crisis signal .

Until then — the system is still rotating, not collapsing.

So, Should We Panic? 🧠

Not yet.

But we’re watching closely.

Next: We add Bitcoin to the chart.

Because if the traditional system starts breaking... 🟧 Bitcoin is the alternative.

One Love,

The FXPROFESSOR 💙

📌 Next Post:

BTC vs Treasuries – The Inversion Nobody Saw Coming

Because if the system is shaking… Bitcoin is Plan B.

Stay ready.

Learning The Excess Phase Peak Pattern : How To Identify/Use ItThis new tutorial video is for all the new followers I have on TradingView who don't understand the Excess Phase Peak pattern (EPP) yet.

I received a question from a new follower yesterday about the EPP patterns. He/She could not understand what they were or how to use/identify them.

This video should help you understand what the EPP patterns are, how to identify them, how to trade with them, and how to identify/use proper expectations with them.

I hope this video is informative and clear. Remember, price only does two things...

FLAG or TREND - NOTHING ELSE

And the EPP pattern is the CORE STRUCTURE of price that happens on all charts, all intervals, and all the time.

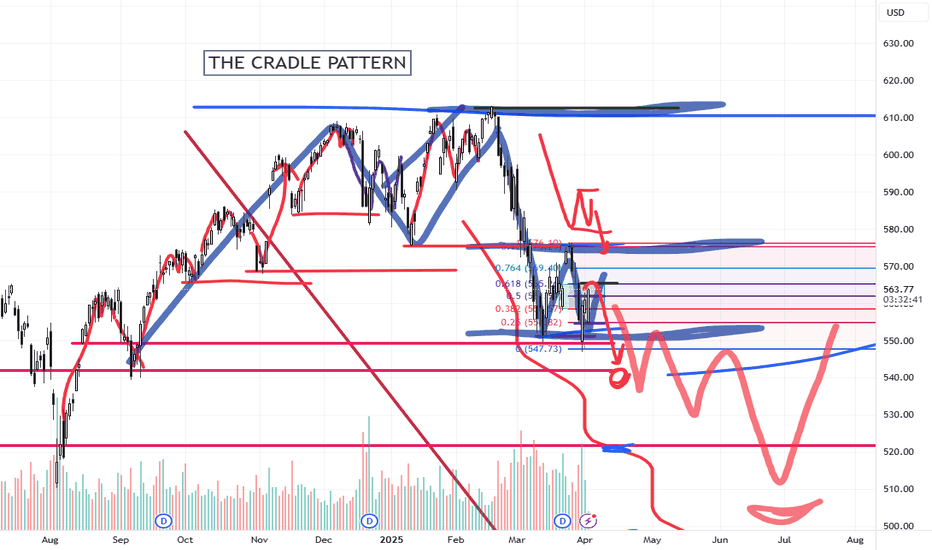

The second pattern, the Cradle pattern, is part of the EPP pattern, but it acts as another price construct related to how to identify opportunities in price action.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

Trading A Divergence Trade (Breakdown) with Pivots and LiquidityTrading divergences was always a problem for me in the past. I did the same thing you did and got it wrong every time. I was trading divergences when i saw them instead of realizing a divergence is a flip of support and resistance levels. I just needed to know where they are.

In this video:

Internal vs External Pivot divergence confirmation:

You can have two types of pivots on your chart. One for long term and one for short term.

Using them to confirm short and long term price action is intuitive as youll be able to see the market squeezing on the short term while knowing where your long term price structure exists.

Price action to Divergence Confirmation:

A divergence on a short term pivot is an indication of short term loss of trend or reversal.

If the short term has no divergence but the long term does, you are about to end up with some pretty large price moves.

Youll be confirming the divergence by looking for highs, lows, and closes moving the wrong way from current price action.

This video will give you a method you can use to draw out your support zone / resistance zone / divergence zone and use them to your advantage.

The "Divergence Zone" that you draw out is the very reason why so many people fail at divergences.

Bare in mind that when you have a divergence, support and resistance are on the WRONG sides as their normally are so you'll learn here how to find those zones as well.

Then in the end of the video ill show you how to use lower timeframes to confirm the new move of the market.

Thanks, everyone. For coming through to the CoffeeShop.

Connecting Your Tickmill Account to TradingView: A Step-by-Step In this step-by-step guide, we’ll show you exactly how to connect your Tickmill account to TradingView in just a few seconds.

✅ Easy walkthrough

✅ Real-time trading from charts

✅ Tips for a smooth connection

Don’t forget to like, comment, and subscribe for more trading tutorials!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

Why you should WAIT for trades to come to YOU!In this video, we dive deep into one of the most underrated but powerful habits that separates consistently profitable traders from the rest: waiting for the trade to come to you.

It sounds simple, even obvious. But in reality, most traders—especially newer ones—feel the constant urge to do something. They scan for setups all day, jump in at the first sign of movement, and confuse activity with progress. That mindset usually leads to emotional trading, overtrading, and eventually burnout.

If you've ever felt the pressure to chase price, force trades, or trade just because you're bored… this video is for you.

I’ll walk you through:

1. Why chasing trades destroys your edge—even when the setup “kind of” looks right

2. How waiting allows you to trade from a position of strength, not desperation

3. The psychological shift that happens when you stop trading to feel busy and start trading to feel precise

4. How the pros use waiting as a weapon, not a weakness

The truth is, trading is a game of probabilities and precision. And that means you don’t need 10 trades a day—you need a few good ones a week that truly align with your plan.

Patience doesn’t mean doing nothing, it means doing the right thing at the right time. And when you develop the skill to sit back, trust your process, and wait for price to come to your level… everything changes. Your confidence grows. Your equity curve smooths out. And most importantly, your decision-making gets sharper.

So if you're tired of overtrading, feeling frustrated, or constantly second-guessing your entries—take a breath, slow it down, and start thinking like a sniper instead of a machine gun.

Let the market come to you. That’s where the real edge is.

Trump's Tariff Wars : Why It Is Critical To Address Global TradeThis video, a continuation of the Trump's Tariff Wars video I created last week, tries to show you why it is critically important that we, as a nation, address the gross imbalances related to US trade to global markets that are resulting in a $1.5-$1.8 TRILLION deficit every fiscal year.

There has been almost NOTHING done about this since Trump's last term as President.

Our politicians are happy to spend - spend - spend - but none of them are worries about the long-term fiscal health of the US. (Well, some of them are worried about it - but the others seem to be completely ignorant of the risks related to the US).

Trump is raising this issue very early into his second term as president to protect ALL AMERICANS. He is trying to bring the issue into the news to highlight the imbalances related to US trade throughout the world.

When some other nation is taking $300B a year from the us with an unfair tariff rate - guess what, we need to make that known to the American consumer because we are the ones that continue to pay that nation the EXTRA every year.

Do you want to keep paying these other nations a grossly inefficient amount for cheap trinkets, or do you want our politicians and leaders to take steps to balance the trade deficits more efficiently so we don't pass on incredible debt levels to our children and grandchildren?

So many people simply don't understand what is at risk.

Short-term - the pain may seem excessive, but it may only last 30, 60, 90 days.

Long-term - if we don't address this issue and resolve it by negotiating better trade rates, this issue will destroy the strength of the US economy, US Dollar, and your children's future.

Simply put, we can't keep going into debt without a plan to attempt to grow our GDP.

The solution to this imbalance is to grow our economy and to raise taxes on the uber-wealthy.

We have to grow our revenues and rebalance our global trade in an effort to support the growth of the US economy.

And, our politicians (till now) have been more than happy to ignore this issue and hide it from the American people. They simply didn't care to discuss it or deal with it.

Trump brought this to the table because it is important.

I hope you now see HOW important it really is.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

How to Build a Super Pitchfork with Reaction & Trigger LinesIn this educational video tutorial, I guide you through the process of setting up a Super Pitchfork using the Bitcoin daily chart. This method is inspired by Patrick Mikula’s work in " The Best Trendline Methods of Alan Andrews. "

I demonstrate how to:

- Create and project reaction lines

- Generate bullish and bearish trigger lines

- Apply a personal timing technique for pitchforks based on Michael Jenkins’ methods by squaring significant pivots to the median line, reaction lines, and upper parallel to produce time-based reaction points anticipating potential market turns.

This walkthrough is for traders who already have a foundational understanding of pitchforks.

Inspired by the work of Patrick Mikula, this is how I personally apply and expand on the Super Pitchfork method in my own charting.

OptionsMastery: This is the "h" DayTrading Pattern.This is the "h" pattern. A highly successful daytrading pattern!

🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

Clear DayTrading strategy video. The "Inside Bar"🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

Understanding the ICT Venom ModelIn this video I break down the ICT Venom Model as recently described by the man himself on his YouTube channel. I am sure he has more details on the model he has not released, but I basically attempt to give my two cents on NQ and the model itself.

I hope you find the video useful in your endeavours regarding learning ICT concepts as well as trading in general.

- R2F Trading

Using Fibonacci/Measured Moves To Understand Price TargetThis video is really an answer to a question from a subscriber.

Can the SPY/QQQ move downward to touch COVID levels (pre-COVID High or COVID Low).

The answer is YES, it could move down far enough to touch the pre-COVID highs or COVID lows, but that would represent a very big BREAKDOWN of Fibonacci/ElliotWave price structure.

In other words, a breakdown of that magnitude would mean the markets have moved into a decidedly BEARISH trend and have broken the opportunity to potentially move substantially higher in 2025-2026 and beyond (at least for a while).

Price structure if very important to understand.

Measured moves happen all the time. They are part of Fibonacci Price Theory, Elliot Wave, and many of my proprietary price patterns.

Think of Measured Moves like waves on a beach. There are bigger waves, middle waves, smaller waves, and minute waves. They are all waves. But their size, magnitude, strength vary.

That is kind of what we are trying to measure using Fibonacci and Measured Move structures.

Watch this video. Tell me if you can see how these Measured Moves work and how to apply Fibonacci structure to them.

This is really the BASICS of price structure.

Get Some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

FXAN & Heikin Ashi TradeOANDA:AUDCHF

In this video, I’ll be sharing my analysis of AUDCHF, using FXAN's proprietary algo indicators with my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

EDUCATION: The $5 Drop: How Trump’s Tariffs Sent Oil TumblingOil markets don’t move in a vacuum. Politics, trade wars, and global economic shifts all play a role in price action. Case in point: the recent $5 drop in oil prices following Trump’s latest tariff announcement.

What Happened?

Markets reacted swiftly to Trump’s renewed push for tariffs, targeting key trading partners. The result? A ripple effect that sent oil prices tumbling as traders anticipated lower global demand. The logic is simple—higher tariffs slow trade, slowing trade weakens economies, and weaker economies use less oil.

Why It Matters to Traders

For traders, this kind of volatility is both an opportunity and a risk. Sharp price drops like this shake out weak hands while rewarding those who position themselves with clear strategies. If you trade crude oil, understanding the macro picture—beyond just supply and demand—can make or break your positions.

The Next Move

Is this just a knee-jerk reaction, or the start of a larger trend? Smart traders are watching key levels, tracking institutional order flow, and looking for confirmation before making their next move.

How do you react when headlines move the market? Do you panic, or do you position yourself with a plan? Drop a comment and let’s talk strategy.

Trump's Tariff Wars : What To Expect And How To Trade Them.I promised all of you I would create a Trump's Tariff Wars video and try to relate that is happening through the global economy into a rational explanation of HOW and WHY you need to be keenly away of the opportunities presented by the new Trump administration.

Like Trump or not. I don't care.

He is going to try to enact policies and efforts to move in a direction to support the US consumer, worker, business, and economy.

He made that very clear while campaigning and while running for office (again).

This video looks at the "free and fair" global tariffs imposed on US manufacturers and exports by global nations over the past 3+ decades.

For more than 30+ years, global nations have imposed extreme tariffs on US goods/exports in order to try to protect and grow their economies. The purpose of these tariffs on US good was to protect THEIR workers/population, to protect THEIR business/economy, to protect THEIR manufacturing/products.

Yes, the tariffs they imposed on US goods was directly responsible for THEIR economic growth over the past 30-50+ years and helped them build new manufacturing, distribution, consumer engagement, banking, wealth, and more.

The entire purpose of their tariffs on US goods was to create an unfair advantage for their population to BUILD, MANUFACTURE, and BUY locally made products - avoiding US products as much as possible.

As I suggested, that is why Apple, and many other US manufacturers moved to Asia and overseas. They could not compete in the US with China charging 67% tariffs on US goods. So they had to move to China to manufacture products because importing Chinese-made products into the US was cheaper than importing US-made products into China.

Get it?

The current foreign Tariffs create an incredibly unfair global marketplace/economy - and that has to STOP (or at least be re-negotiated so it is more fair for everyone).

And I believe THAT is why Trump is raising tariffs on foreign nations.

Ultimately, this will likely be resolved as I suggest in this video (unless many foreign nations continue to raise tariff levels trying to combat US tariffs).

If other foreign nation simply say, "I won't stand for this, I'm raising my tariff levels to combat the new US tariffs", then we end up where we started - a grossly unfair global marketplace.

This is the 21st century, not the 18th century.

Step up to the table and realize we are not in the 1850s or 1950s any longer.

We are in 2025. Many global economies are competing at levels nearly equal to the US economy in terms of population, GDP, manufacturing, and more.

It's time to create a FREE and FAIR global economy, not some tariff-driven false economy on the backs of the US consumers. That has to end.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

Using The CRADLE Pattern To Time/Execute TradesThis simple video highlights one of my newest pattern definitions - the Cradle Pattern.

In addition to the many other patterns my technology identified, this Cradle Pattern seems to be a constant type of price construct.

I'm sharing it with all of you so you can learn how to identify it and use it for your trading.

Ideally, this pattern represents FLAGGING after a trend phase.

It is a consolidation of price within a flag after a broad trending phase.

It usually resolves in the direction of the major trend, but can present a very solid reversal trigger if the upper/lower pullback range is broken (see the examples in this video).

Learn it. Use it.

Price is the ultimate indicator.

Learn to read price data more efficiently to become a better trader.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

Trend Changing Pattern (TCP) ExplainedIntroduction

One of the most important skills in forex trading is learning how to read price action and understand what the market is telling you. Price is not just numbers — it’s the collective perception of traders, making it the most reliable leading indicator available.

Today, I want to explain a powerful concept known as the Trend Changing Pattern (TCP) — a crucial tool for identifying potential market reversals and shifts in trend direction.

📈 What Is a Trend Changing Pattern?

In any trending market, whether it's an uptrend or downtrend, the trend won’t change easily. The strength of the trend and the timeframe you're trading on will determine how long it takes for a true reversal to occur.

One key signal of a trend change is a shift in momentum:

In an uptrend, when a momentum low forms during a pullback, it can be a sign that the trend is beginning to reverse.

In a downtrend, a momentum high during a pullback can signal a potential bullish reversal.

These are what we refer to as Trend Changing Patterns (TCPs) — moments where the structure of the market starts to shift.

⚠️ Watch for Manipulation After the TCP

After a TCP appears, it's common to see price manipulation before the new trend fully takes hold:

In an uptrend, price may return to manipulate the previous high before continuing down.

In a downtrend, price often dips to manipulate the previous low before reversing higher.

Being aware of this common liquidity grab helps traders avoid being trapped and instead position themselves in alignment with the new trend.

🧠 Final Thoughts

Understanding how to spot and interpret a Trend Changing Pattern gives you a major edge in forex trading. It helps you stay ahead of the market and make informed decisions based on price action, not emotion.

🎥 In the video, I go into more detail about momentum highs and lows, and how to recognize these key patterns in real time. Be sure to check it out if you want to sharpen your trend reversal strategy.

Wishing you success on your trading journey! 🚀